A research team has discovered antibodies that could lead to a new approach to treating acute and chronic infections with the bacterium Pseudomonas aeruginosa. Due to its numerous resistance mechanisms, P. aeruginosa is associated with high morbidity and mortality and can cause complicated infections and dangerous cases of sepsis in severely ill patients. The team of scientists from the University of Cologne, University Hospital Cologne, the Helmholtz Centre for Infection Research in Braunschweig and University Hospital Hamburg-Eppendorf isolated the antibodies from immune cells of chronically ill patients and described their binding mechanisms. The study ‘Discovery of highly neutralizing human antibodies targeting Pseudomonas aeruginosa’ was published in the renowned scientific journal Cell.

Antibiotic-resistant bacteria are a crucial health concern worldwide not only to infected people, but also to our healthcare systems in general. Infections with the bacterium P. aeruginosa in particular are a threat due to numerous resistance mechanisms, often leading to complicated infections of the lungs and dangerous sepsis, especially in severely ill patients. In addition, the pathogen can permanently colonize organs such as the lungs, where it promotes progressive tissue damage. Often, so-called last-resort antibiotics must be used to treat infected patients, as the standard treatments no longer work. New therapeutic approaches are therefore urgently needed to ensure effective treatment for infections with multi-resistant pathogens such as P. aeruginosa in the future.

In their study, the researchers therefore investigated whether the approach of isolating broadly neutralizing human antibodies, which has been successful for viral infections, could also be used for the development of new therapies against bacterial infections. “Many of the therapeutic antibodies that are already being used against viruses have been isolated and developed from infected, recovered or vaccinated individuals,” said lead author Dr Alexander Simonis, resident physician at the Infectiology Department of Department I of Internal Medicine and head of the BMBF-funded junior research group ‘Immunotherapies against bacterial infections’ at the UoC’s Center for Molecular Medicine Cologne.

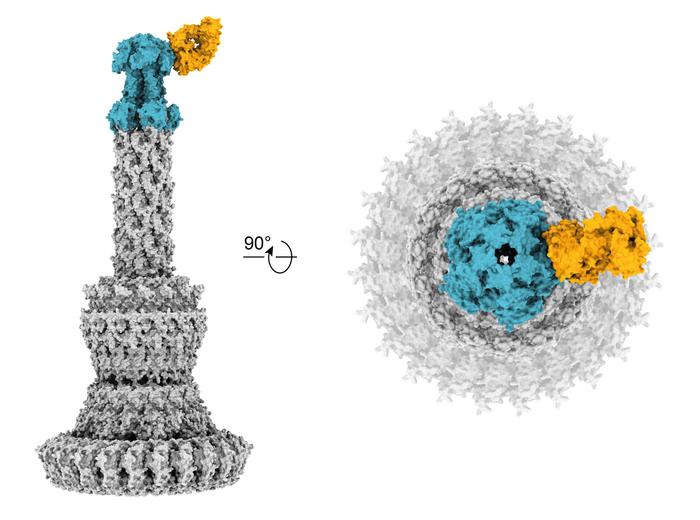

The research team isolated highly effective antibodies against this pathogen from immune cells of patients with cystic fibrosis who were chronically infected with P. aeruginosa. These antibodies block an important virulence factor of the bacterium, the so-called type III secretion system, which plays an important role especially in severe infections with P. aeruginosa. In extensive experiments using cell cultures and animal models, the researchers were able to show that the newly developed antibodies are as effective against the bacterium as conventional antibiotics. However, since the activity of these antibodies is independent of the mechanisms of action and resistance of antibiotics, these so-called pathoblockers can also – in contrast to many conventional antibiotics – work on highly resistant bacteria.

“The findings and the experimental approaches can also be transferred to other bacterial pathogens and thus represent a promising new approach for the treatment of infections with multi-resistant bacteria,” concluded the last author of the study, lecturer (Privatdozent) Dr Jan Rybniker, physician at the Infectiology Department of Department I for Internal Medicine and head of the ‘Translational Research Unit – Infectious Diseases’ at University Hospital Cologne and the UoC’s Center for Molecular Medicine Cologne.

The study was conducted with funding from the Clinician Scientist Programme of the UoC’S Faculty of Medicine, the Career Advancement Program of the Center for Molecular Medicine Cologne as well as from the funding measure ‘Young Researchers Groups in Infection Research’ by the Federal Ministry of Education and Research, which has supported Dr Simonis since May 2022 with a junior research group.

The scientists are now planning to further develop the antibodies and to test them in clinical trials. In the long term, they plan to use the antibodies as part of a new therapeutic approach, especially in acute and severe infections with P. aeruginosa. According to the researchers, the antibodies also offer the possibility to protect patients with an increased risk of P. aeruginosa infections – especially in intensive care units or in the case of cancer – by means of passive immunization.

Journal

Cell

DOI

10.1016/j.cell.2023.10.002

Method of Research

Experimental study

Subject of Research

Animals

Article Title

Discovery of highly neutralizing human antibodies targeting Pseudomonas aeruginosa

Article Publication Date

1-Nov-2023