Government

Market Surges As Election Turns Into Optimal Outcome

Market Surges As Election Turns Into Optimal Outcome

Authored by Lance Roberts via RealInvestmentAdvice.com,

After reducing equity risk in portfolios over the last few weeks, we suggested last week the “selling” was likely overdone.

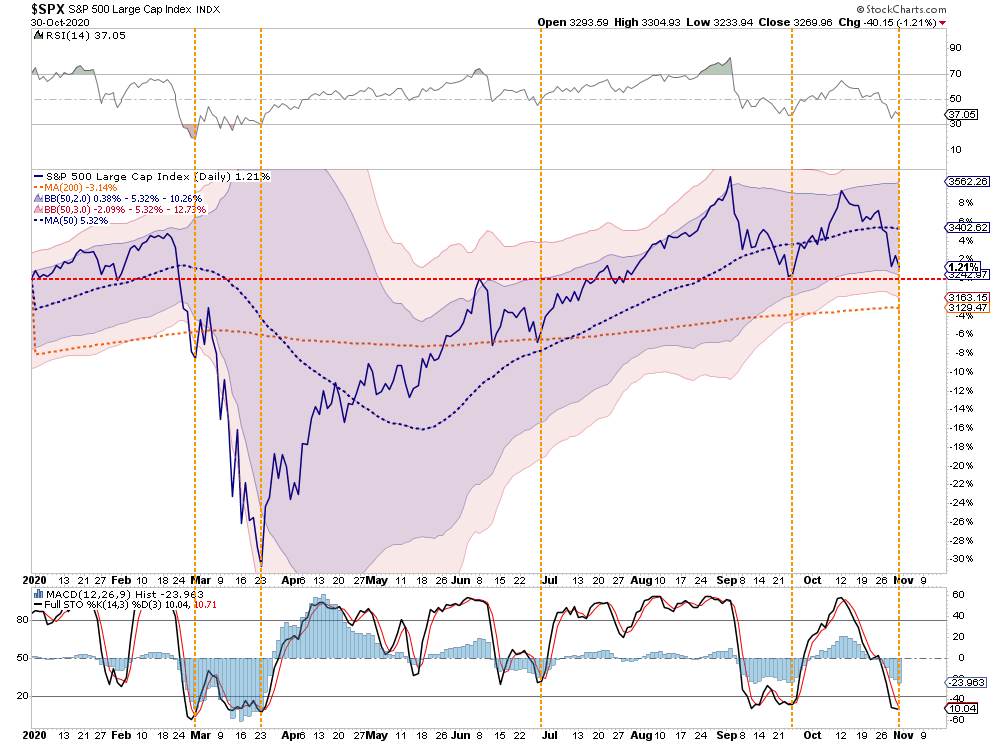

“All of our “sell signals” have been intact for the last few weeks suggesting more downside risk near term. Those signals have now reversed to the point where we are likely to see a decent reflex rally starting as early as Monday. As noted in the year-to-date performance chart below, the market is 2-standard deviations below its 50-dma and is close to the September low support.”

Just for comparison purposes, here is the chart from last week.

And it is updated through Friday’s close.

It was quite the reversal. The rally pushed the market back above the 50-dma and lower highs’ previous downtrend. Such sets the market up for a retest of all-time highs next week.

Not Out Of The Woods

However, before you get all excited and go throwing your money into the market, you may want to step back and re-evaluate your risk. If you haven’t liked the ups and downs in the market over the last couple of months, you have too much “risk” in your portfolio.

The volatility isn’t over. Particularly as we head into 2021.

Furthermore, while we did expect this rally and added exposure in our portfolios, the previous “oversold” condition has now been largely reversed. As shown below, the market is now back to more “overbought” conditions, which suggests limited upside from current levels. Also, the deviation from the 200-dma is now back to levels that have previously led to mild, short-term corrections.

Still A Sellable Rally

“Such a rally will provide an opportunity to rebalance portfolio risks accordingly. As we will discuss momentarily, the markets will begin to process the election’s impact on various sectors and the market itself.

However, the economy’s disconnect remains longer-term, which can not last as earnings come from economic activity. While the very short-term trading environment is conducive for a rally, the longer-term ‘investing’ environment is still problematic with weakening relative strength, participation, and fundamental issues.

Keep a watch on the Advance-Decline line. Over the last few trading days, the rapid surge in prices pushed that indicator back to more extreme overbought conditions, typically denote short- to intermediate-term tops.

For all of these reasons, aggressively positioned investors can use any rally to adjust portfolio volatility and risk.

Remember, investing isn’t a competition for who can say they “beat the market.” There are no “trophies.” However, there is a heavy penalty to your retirement goals if you are wrong.

Gridlock Is Best For Markets

On Thursday, in our daily “3-Minutes” video, I discussed why the markets were rallying despite a hotly contested election.

As noted, it doesn’t matter who the President is. With the GOP potentially maintaining control of the Senate and narrowing the majority in the House, such vastly reduces significant policy changes such as:

-

Higher taxes

-

Massive stimulus packages

-

Extreme regulation on the oil and gas industry

-

Large spending packages on “green energy.”

-

Major reform or socialization of health care.

-

An inflationary spike.

Such bodes well for the markets as noted by MarketWatch:

“The likely reason that Wall Street likes gridlock is that it reduces the possibility that any major policy changes will take effect. Sam Stovall, chief investment strategist at CFRA, noted in an email to clients that the increasingly likely gridlock ‘lessens the prospects for an increase in regulations and taxes.’ In addition, he added, the gridlock reduces the likelihood of ‘additional fiscal stimulus’ — and that reduced likelihood in turn eases potential inflationary pressures down the road.”

As noted last week, such also aligns with historical Presidential election years. The weakness in September and October turns to strength in November and December.

A Continuation Of The Rally Into Year-End

My colleague Doug Kass confirms our view of a rally into year-end.

“With the perception, in part, of election uncertainty and the quicker spread of Covid-19, market participants have been positioned defensively and cautiously. We have exited the weakest period of the calendar (August to October) and are entering a two-month period where stocks are seasonally strong.

The evolving market structure change, in which the market is dominated by products and strategies chasing price and momentum, could catapult the markets higher rather swiftly. In ‘risk parity’ and other quant strategies, ‘buyers live higher and sellers live lower.’ They are and might continue to buy high.”

He is correct.

Combine his thesis with a lack of significant policy changes from Washington, and it is likely money will continue to chase “risk assets” given no other alternative currently. With yield spreads compressed, interest rates at zero, the “T.I.N.A” (There Is No Alternative) narrative continues to reign.

However, as noted, beware 2021.

The Focus Turns Back To The Fed

Once we start to analyze what “Gridlock” will mean for policy, it should become apparent what the “risks” are.

As we have noted previously, earnings growth rates continue to drop as we head into next year. With stock prices back near all-time highs, this continues to be a market that is driven solely by valuation expansion.

The majority of that “price chase” has been based solely on the premise of more liquidity coming from the Federal Reserve. The hope, of course, is that eventually, earnings will play “catchup” with valuations. Historically, such has never been the case.

As we head into 2021, a “gridlocked” Congress potentially means less stimulus, less infrastructure spending, and more battles over the debt and deficit. The regular “debt ceiling” fights will return, and smaller stimulus packages will compound time delays.

Such translates into three critical factors for the financial markets:

-

Less direct stimulus to households means reduced spending and lower rates of economic growth.

-

Less stimulus means there is less debt issued, which keeps the Federal Reserve trapped with interest rates at zero.

-

The combination of less stimulus and Fed monetization will lead to increased deflationary pressures.

In 2021, the odds of another recessionary bought will increase, putting downward pressure on stocks. The only question will be if the Federal Reserve can bail it out again as the “effective benefit” continues to decline.

The Fed Remains Stuck At Zero

This past week, the Federal Open Market Committee (FOMC) concluded their meeting. Not surprisingly, given the embattled election and lack of stimulus, they provided “happy talk” to the markets.

In other words, they said “nothing.” As Mish Shedlock noted in his post:

“The Fed is stuck in glue. It did not change interest rates. Nor did it change much of its announcement.”

However, it is more important to understand their dilemma.

“The Fed is stuck and will not lower rates below zero nor can it raise them without killing housing. Meanwhile, the bubbles keep getting bigger increasing the odds of a deflationary collapse.”

Such is indeed the most significant risk to both the economy and the markets. As we noted in yesterday’s “Rescues Are Ruining Capitalism.”

“The rest of the world followed the Fed. As interest rates fell toward zero, the world’s debts—including households, governments and nonfinancial companies—more than tripled between 1980 and 2007 to more than three times the size of the global economy.

It was taking more debt to fuel the same amount of growth, because more debt was going to unproductive borrowers. Capitalism was bogging down.” – Sharma

Each successive round of stimulus pulls forward future consumption, which leaves a void. That void then has to be filled with more stimulus, which leaves a larger void in the future.

Eventually, the void will become too large to fill.

“The continuous bailouts continue to distort the market’s price signals, which makes the markets less efficient in allocating capital. Such has led to the rising number of “zombies” and monopolies, the widening of wealth inequality, and lower productivity and growth.

The deformation of capitalism will be an economic plague that continues to lead to further dysfunction alienating younger generations. Social unrest and revolt will be the eventual result.”

Portfolio Positioning Update

Over the last few weeks, we discussed that we had gradually raised cash and rebalanced portfolio risks ahead of the Presidential election. After the election passed, and we could see where the markets were positioning themselves, we reallocated that cash and took our equity exposure back to target weightings.

There were two primary reasons for the reversal. The first was that the sell-off had removed short-term risk over the last few weeks. The second was the outcome of the election perceived as favorable to the markets, as discussed above. There are still risks to that view until the election is officially over. Therefore, we will keep a close watch on holdings and tighten up our stops.

As we discussed recently in “Policies Over Politics,” what matters most long-term are taxes, debt, and deficits. Unfortunately, we will probably head the wrong way on all three.

Last week, I stated that we would “not buy the market’s low.” We did wait for the market to “tell us,” what it was going to do, and then we acted quickly to put capital to work. We are currently near full exposure to equities, are slightly underweight in bonds with a shortened-duration, and have tightened current stop-losses.

While the next two months tend to be positively biased, there is still a considerable risk to the markets. Markets remain deviated from long-term means, economic growth remains weak, and further stimulus will remain elusive.

As such, it is worth remaining vigilant over portfolios and using rallies to rebalance portfolio risks as needed.

To win the “investing war,” it is essential to pick and choose our “battles” wisely. If you aren’t sure about the battleground, it is always better to retreat and “live to fight another day.”

Government

Low Iron Levels In Blood Could Trigger Long COVID: Study

Low Iron Levels In Blood Could Trigger Long COVID: Study

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate…

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate iron levels in their blood due to a COVID-19 infection could be at greater risk of long COVID.

A new study indicates that problems with iron levels in the bloodstream likely trigger chronic inflammation and other conditions associated with the post-COVID phenomenon. The findings, published on March 1 in Nature Immunology, could offer new ways to treat or prevent the condition.

Long COVID Patients Have Low Iron Levels

Researchers at the University of Cambridge pinpointed low iron as a potential link to long-COVID symptoms thanks to a study they initiated shortly after the start of the pandemic. They recruited people who tested positive for the virus to provide blood samples for analysis over a year, which allowed the researchers to look for post-infection changes in the blood. The researchers looked at 214 samples and found that 45 percent of patients reported symptoms of long COVID that lasted between three and 10 months.

In analyzing the blood samples, the research team noticed that people experiencing long COVID had low iron levels, contributing to anemia and low red blood cell production, just two weeks after they were diagnosed with COVID-19. This was true for patients regardless of age, sex, or the initial severity of their infection.

According to one of the study co-authors, the removal of iron from the bloodstream is a natural process and defense mechanism of the body.

But it can jeopardize a person’s recovery.

“When the body has an infection, it responds by removing iron from the bloodstream. This protects us from potentially lethal bacteria that capture the iron in the bloodstream and grow rapidly. It’s an evolutionary response that redistributes iron in the body, and the blood plasma becomes an iron desert,” University of Oxford professor Hal Drakesmith said in a press release. “However, if this goes on for a long time, there is less iron for red blood cells, so oxygen is transported less efficiently affecting metabolism and energy production, and for white blood cells, which need iron to work properly. The protective mechanism ends up becoming a problem.”

The research team believes that consistently low iron levels could explain why individuals with long COVID continue to experience fatigue and difficulty exercising. As such, the researchers suggested iron supplementation to help regulate and prevent the often debilitating symptoms associated with long COVID.

“It isn’t necessarily the case that individuals don’t have enough iron in their body, it’s just that it’s trapped in the wrong place,” Aimee Hanson, a postdoctoral researcher at the University of Cambridge who worked on the study, said in the press release. “What we need is a way to remobilize the iron and pull it back into the bloodstream, where it becomes more useful to the red blood cells.”

The research team pointed out that iron supplementation isn’t always straightforward. Achieving the right level of iron varies from person to person. Too much iron can cause stomach issues, ranging from constipation, nausea, and abdominal pain to gastritis and gastric lesions.

1 in 5 Still Affected by Long COVID

COVID-19 has affected nearly 40 percent of Americans, with one in five of those still suffering from symptoms of long COVID, according to the U.S. Centers for Disease Control and Prevention (CDC). Long COVID is marked by health issues that continue at least four weeks after an individual was initially diagnosed with COVID-19. Symptoms can last for days, weeks, months, or years and may include fatigue, cough or chest pain, headache, brain fog, depression or anxiety, digestive issues, and joint or muscle pain.

Government

Walmart joins Costco in sharing key pricing news

The massive retailers have both shared information that some retailers keep very close to the vest.

As we head toward a presidential election, the presumed candidates for both parties will look for issues that rally undecided voters.

The economy will be a key issue, with Democrats pointing to job creation and lowering prices while Republicans will cite the layoffs at Big Tech companies, high housing prices, and of course, sticky inflation.

The covid pandemic created a perfect storm for inflation and higher prices. It became harder to get many items because people getting sick slowed down, or even stopped, production at some factories.

Related: Popular mall retailer shuts down abruptly after bankruptcy filing

It was also a period where demand increased while shipping, trucking and delivery systems were all strained or thrown out of whack. The combination led to product shortages and higher prices.

You might have gone to the grocery store and not been able to buy your favorite paper towel brand or find toilet paper at all. That happened partly because of the supply chain and partly due to increased demand, but at the end of the day, it led to higher prices, which some consumers blamed on President Joe Biden's administration.

Biden, of course, was blamed for the price increases, but as inflation has dropped and grocery prices have fallen, few companies have been up front about it. That's probably not a political choice in most cases. Instead, some companies have chosen to lower prices more slowly than they raised them.

However, two major retailers, Walmart (WMT) and Costco, have been very honest about inflation. Walmart Chief Executive Doug McMillon's most recent comments validate what Biden's administration has been saying about the state of the economy. And they contrast with the economic picture being painted by Republicans who support their presumptive nominee, Donald Trump.

Image source: Joe Raedle/Getty Images

Walmart sees lower prices

McMillon does not talk about lower prices to make a political statement. He's communicating with customers and potential customers through the analysts who cover the company's quarterly-earnings calls.

During Walmart's fiscal-fourth-quarter-earnings call, McMillon was clear that prices are going down.

"I'm excited about the omnichannel net promoter score trends the team is driving. Across countries, we continue to see a customer that's resilient but looking for value. As always, we're working hard to deliver that for them, including through our rollbacks on food pricing in Walmart U.S. Those were up significantly in Q4 versus last year, following a big increase in Q3," he said.

He was specific about where the chain has seen prices go down.

"Our general merchandise prices are lower than a year ago and even two years ago in some categories, which means our customers are finding value in areas like apparel and hard lines," he said. "In food, prices are lower than a year ago in places like eggs, apples, and deli snacks, but higher in other places like asparagus and blackberries."

McMillon said that in other areas prices were still up but have been falling.

"Dry grocery and consumables categories like paper goods and cleaning supplies are up mid-single digits versus last year and high teens versus two years ago. Private-brand penetration is up in many of the countries where we operate, including the United States," he said.

Costco sees almost no inflation impact

McMillon avoided the word inflation in his comments. Costco (COST) Chief Financial Officer Richard Galanti, who steps down on March 15, has been very transparent on the topic.

The CFO commented on inflation during his company's fiscal-first-quarter-earnings call.

"Most recently, in the last fourth-quarter discussion, we had estimated that year-over-year inflation was in the 1% to 2% range. Our estimate for the quarter just ended, that inflation was in the 0% to 1% range," he said.

Galanti made clear that inflation (and even deflation) varied by category.

"A bigger deflation in some big and bulky items like furniture sets due to lower freight costs year over year, as well as on things like domestics, bulky lower-priced items, again, where the freight cost is significant. Some deflationary items were as much as 20% to 30% and, again, mostly freight-related," he added.

bankruptcy pandemic trumpGovernment

Walmart has really good news for shoppers (and Joe Biden)

The giant retailer joins Costco in making a statement that has political overtones, even if that’s not the intent.

As we head toward a presidential election, the presumed candidates for both parties will look for issues that rally undecided voters.

The economy will be a key issue, with Democrats pointing to job creation and lowering prices while Republicans will cite the layoffs at Big Tech companies, high housing prices, and of course, sticky inflation.

The covid pandemic created a perfect storm for inflation and higher prices. It became harder to get many items because people getting sick slowed down, or even stopped, production at some factories.

Related: Popular mall retailer shuts down abruptly after bankruptcy filing

It was also a period where demand increased while shipping, trucking and delivery systems were all strained or thrown out of whack. The combination led to product shortages and higher prices.

You might have gone to the grocery store and not been able to buy your favorite paper towel brand or find toilet paper at all. That happened partly because of the supply chain and partly due to increased demand, but at the end of the day, it led to higher prices, which some consumers blamed on President Joe Biden's administration.

Biden, of course, was blamed for the price increases, but as inflation has dropped and grocery prices have fallen, few companies have been up front about it. That's probably not a political choice in most cases. Instead, some companies have chosen to lower prices more slowly than they raised them.

However, two major retailers, Walmart (WMT) and Costco, have been very honest about inflation. Walmart Chief Executive Doug McMillon's most recent comments validate what Biden's administration has been saying about the state of the economy. And they contrast with the economic picture being painted by Republicans who support their presumptive nominee, Donald Trump.

Image source: Joe Raedle/Getty Images

Walmart sees lower prices

McMillon does not talk about lower prices to make a political statement. He's communicating with customers and potential customers through the analysts who cover the company's quarterly-earnings calls.

During Walmart's fiscal-fourth-quarter-earnings call, McMillon was clear that prices are going down.

"I'm excited about the omnichannel net promoter score trends the team is driving. Across countries, we continue to see a customer that's resilient but looking for value. As always, we're working hard to deliver that for them, including through our rollbacks on food pricing in Walmart U.S. Those were up significantly in Q4 versus last year, following a big increase in Q3," he said.

He was specific about where the chain has seen prices go down.

"Our general merchandise prices are lower than a year ago and even two years ago in some categories, which means our customers are finding value in areas like apparel and hard lines," he said. "In food, prices are lower than a year ago in places like eggs, apples, and deli snacks, but higher in other places like asparagus and blackberries."

McMillon said that in other areas prices were still up but have been falling.

"Dry grocery and consumables categories like paper goods and cleaning supplies are up mid-single digits versus last year and high teens versus two years ago. Private-brand penetration is up in many of the countries where we operate, including the United States," he said.

Costco sees almost no inflation impact

McMillon avoided the word inflation in his comments. Costco (COST) Chief Financial Officer Richard Galanti, who steps down on March 15, has been very transparent on the topic.

The CFO commented on inflation during his company's fiscal-first-quarter-earnings call.

"Most recently, in the last fourth-quarter discussion, we had estimated that year-over-year inflation was in the 1% to 2% range. Our estimate for the quarter just ended, that inflation was in the 0% to 1% range," he said.

Galanti made clear that inflation (and even deflation) varied by category.

"A bigger deflation in some big and bulky items like furniture sets due to lower freight costs year over year, as well as on things like domestics, bulky lower-priced items, again, where the freight cost is significant. Some deflationary items were as much as 20% to 30% and, again, mostly freight-related," he added.

bankruptcy pandemic trump-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 day ago

International1 day agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges