Market Rout Extends With Futures Tumbling To Verge Of Bear Market

Market Rout Extends With Futures Tumbling To Verge Of Bear Market

US stock futures slumped again, extending yesterday’s brutal selloff that…

US stock futures slumped again, extending yesterday’s brutal selloff that erased $1.5 trillion in market value on concerns about everything from slowing growth, to Chinese lockdowns, to soaring inflation and tightening monetary policy. Contracts on the S&P 500 were down 1.2% 7:30 a.m. in New York, having earlier dropped to 3,856, one point away sliding 20% from January's all time highs, and triggering a bear market. The underlying index tumbled 4% on Wednesday, the most since June 2020, as consumer shares cratered after Target slashed its profit forecast due to a surge in costs. Nasdaq 100 futures were down 1.2%. 10Y TSY Yields slumped about 7bps, dropping to 2.833, while the dollar also dropped after yesterday's surge; bitcoin was flat around $29K.

The retail rout continued on Thursday: shares of US retailers again tumbled in premarket trading amid growing worries over the impact of rising inflation and the ability of companies to pass on higher costs to consumers; with Bath & Body Works becoming the latest retailer to cut its guidance. Major technology and internet stocks were also down, pointing to further losses in major technology and internet stocks a day after the tech-heavy Nasdaq slumped to its lowest since November 2020. Apple (AAPL US) -1.2%, Microsoft (MSFT US) -1.2%, Meta Platforms (FB US) -1.1%, Netflix (NFLX US) -0.9% and Nvidia (NVDA US) -2.2% in premarket trading. US rail stocks may be in focus as Citi cuts ratings on Norfolk Southern (NSC US), Union Pacific (UNP US) and US Xpress Enterprises (USX US) to neutral from buy, while lowering 2023 estimates “across the board.”Here are some other notable movers:

- Cisco Systems (CSCO US) plunged 13% in premarket trading after the network-gear maker spooked investors with a warning that Chinese lockdowns and other supply disruptions would wipe out sales growth in the current quarter. Shares of networking equipment makers drop after Cisco cuts outlook, with Broadcom (AVGO US) -3.6% and Juniper Networks (JNPR US) -5.9% in premarket trading.

- Synopsys (SNPS US) rises 3.8% in premarket trading after the supplier of software used to design semiconductors boosted its profit and revenue guidance for the full year.

- Target (TGT US) shares fall 2.2% in premarket trading, Walmart (WMT US) -0.3%; Kohl’s (KSS US) is in focus after two senior executives depart

- Under Armour (UAA US) shares dropped as much as 6% in US premarket trading, with analysts saying that the departure of the sportswear maker’s CEO Patrik Frisk is a surprise and adds uncertainty.

- Bath & Body Works’s (BBWI US) outlook cut was a little greater than expected, though analysts noted that it was due to higher costs and investment. The company’s shares fell almost 4% in premarket trading.

- United Wholesale Mortgage (UWMC US) will struggle to main its 1Q earnings level in coming quarters, Piper Sandler says in a note downgrading the stock to underweight from neutral. Shares drop as much as 7% in US premarket trading.

The S&P 500 is on track for its longest weekly losing streak since 2001 as traders flee risk assets over fears that the Federal Reserve will push the economy into a recession as it tries to curb inflation. The benchmark is close to falling into a bear market, after dropping 18% from a record high in January.

"The US selloff was rather orderly and the market isn’t oversold, yet. That tells us that we are likely not at the bottom yet,” said Joachim Klement, head of strategy, accounting and sustainability at Liberum Capital. “Consumer sentiment remains depressed and we are seeing consumers retrenching on some discretionary spending.”

Speaking on Tuesday in his most hawkish remarks to date, Fed Chair Jerome Powell said the US central bank will keep raising interest rates until there is “clear and convincing” evidence that inflation is in retreat. JPMorgan's Marko Kolanovic, meanwhile, said - what else - that things can get better for US stocks. “There will be no recession this year, some summer increase in consumer activity on the back of reopening, China increasing monetary and fiscal measures,” he said. Bolstering his opinion is a conviction that US inflation has probably peaked, or is about to do so, paving the way for a pullback in price pressures that will eventually allow the Federal Reserve to moderate the pace of monetary tightening.

"Since we are pricing in a growth scare but not yet a recession, we could see further downside in the coming weeks, but we are starting to price in a very negative picture already, suggesting we should, at some point, be closer to the bottom,” said Esty Dwek, chief investment officer at Flowbank SA. US stock investors are pricing in stronger odds of a recession than are evident from positive macroeconomic indicators, according to Goldman Sachs strategists.

"A recession is not inevitable,” Goldman strategists led by David J. Kostin wrote in a note. “Rotations within the US equity market indicate that investors are pricing elevated odds of a downturn compared with the strength of recent economic data.”

Bets that robust earnings can help investors weather this year’s turbulence were thrown in doubt after US consumer titans signaled growing impact of high inflation on margins and consumer spending. Meanwhile, Federal Reserve officials reaffirmed that tighter monetary policy lies ahead, and investors fretted over stagflation risks.

“We are pricing in a growth scare,” Lori Calvasina, the head of US equity strategy at RBC Capital Markets, told Bloomberg TV. “There is a lot of uncertainty in this market right now about whether or not that recession is going to come through or if it’s going to be another near-death experience.”

There was some more good news on the China covid lockdown front: Shanghai Vice Mayor said Shanghai port throughput recovered to around 90% of the levels a year ago and that Shanghai will expand work resumption in areas with no COVID risk in early June. Furthermore, Shanghai is to gradually restore inter-district public transport from May 22nd and will require residents to show negative PCR tests taken within 48 hours before using public transport, while an economy official said Shanghai will reduce rents for small and medium-sized enterprises by more than CNY 10bln and the city extended CNY 72.3bln of loans to over 10,000 firms since March, according to Reuters.

In Europe, the Stoxx 600 retreated 1.8%, after sliding more than 2% earlier, with all industry sectors in the red and personal care and financial services leading the decline as Wednesday’s retailer trouble in the U.S. spills over into Europe. FTSE 100 lags regional peers, dropping 2%. Here are some of the biggest European movers today:

- HomeServe shares jump as much as 12% after Brookfield agrees to buy the home emergency and repair services company for GBP4.1b.

- Societe Generale shares rise as much as 1.5%, as it was raised to outperform from market perform at KBW, with the broker saying the sale of Russian activities removes a key overhang for the bank and should result in a re-rating.

- Generali shares rose as much as 1.4% after 1Q profit beats analyst estimates as EU136m impairments on Russian investments were more than offset by higher operating income.

- PGNiG shares rise as much as 6.2% after reporting 1Q results that, according to analysts, support Polish gas company’s outlook.

- Nestle shares drop as much as 5.3% after Bernstein downgraded the stock to market perform from outperform, saying the shares will “struggle” if market sentiment improves and investors exit havens.

- Royal Mail shares fall as much as 14% after the postal group’s FY results slightly missed estimates and analysts said its outlook is “disappointing.”

- National Grid shares fall as much as 2.5%, erasing gains from yesterday’s record high, after the utility company reported full-year results.

Earlier in the session, shares of Asian retailers follow their US counterparts lower after Target became the second big retailer in two days to trim its profit forecast.

- Australia: JB Hi-Fi retreats 6.6%, Wesfarmers -7.8%, Harvey Norman -5.5%, Woolworths -5.6%

- South Korea: E-Mart - 3.4%; apparel makers Hansae -9.4%, F&F -4.2%, Youngone -8.2%

- Japan: Fast Retailing - 3.1%, MatsukiyoCocokara -1.4%, Ryohin Keikaku -1.7%, Nitori -3%

- Singapore: Grocery chain operator Sheng Siong slips as much as 1.3%

- Hong Kong: Sun Art Retail down as much as 4.1%

In China, Tencent Holdings Ltd. plunged 6.6% after warning it will take time for Beijing to act on promises to prop up the Chinese tech sector. Cisco Systems Inc. slid in extended US trading on a disappointing revenue outlook.

Japan's Nikkei 225 suffered firm losses amid reports the ruling coalition is considering increasing the corporate tax rate and after several data releases in which Machinery Orders topped estimates but Exports missed as China-bound exports declined by the fastest pace since March 2020.

Indian stocks declined to a ten-month low, tracking a sell-off across Asia, on concerns the US Fed’s hawkish stance on inflation may cool economic activity and hurt consumer demand. The S&P BSE Sensex plunged 2.6% to 52,792.23, its lowest level since July 30, in Mumbai, while the NSE Nifty 50 Index slipped 2.7% to 15,809.40 Software exporter Infosys Ltd. fell 5.4% to a 11-month low and was the biggest drag on the Sensex, which had 27 of 30 member stocks trading lower. All 19 sector indexes compiled by BSE Ltd. declined, led by S&P BSE Information Technology index, that dropped the most in over two years. “Deteriorating macro sentiment such as soaring inflation, recession fears, and the prospect of the Federal Reserve getting even more hawkish will continue to keep benchmarks on the edge,” Prashanth Tapse, an analyst at Mehta Equities Ltd., wrote in a note. In earnings, of the 36 Nifty 50 firms that have announced results so far, 21 have either met or exceeded analyst estimates, while 15 have missed forecasts.

In Australia, the S&P/ASX 200 index fell 1.7% to close at 7,064.50, tumbling with global shares as concerns over inflation, interest-rate hikes and Ukraine piled up. All sectors dropped, except for health. Consumer shares were among the worst performers, following their US peers lower after Target became the second big retailer in two days to trim its profit forecast. Aristocrat rose after it released its 1H results and unveiled buyback plans. In New Zealand, the S&P/NZX 50 index fell 0.5% to 11,206.93

And in emerging markets, Sri Lanka fell into default for the first time in its history as the government struggles to halt an economic meltdown that prompted mass protests and a political crisis. An index of developing-nation stocks slumped more than 2%.

In FX, the Bloomberg dollar spot index declines, with all G-10 majors rising against the greenback. CHF is the strongest G-10 performer with USD/CHF snapping lower on to a 0.97 handle and EUR/CHF slumping below 1.03. The Swiss franc diverged from Japanese yen and dollar after hawkish comments from SNB’s Thomas Jordan Wednesday, which assured traders CHF rates could follow EUR higher. Options trades may also be behind the latest move in the spot market.

In rates, Treasury yields dropped about seven basis points as investors sought insurance against further declines in risk assets. Treasury yields richer by up to 6bp across belly of the curve, richening the 2s5s30s fly by 2.2bp on the day; 10-year yields around 2.83% with German 10-year outperforming by 2.5bps. Treasuries extended Wednesday’s rally as stocks resume slide with S&P 500 futures dropping under 3,900 to lowest level in a year; on the curve, the belly led the advance while bunds outperform in a more aggressive bull-flattening move as European stocks tumble. US session highlights include 10-year TIPS reopening at 1pm ET. Flurry of block trades during London session follows a spate of trades Wednesday; five blocks worth a combined cash-equivalent $1.2m/DV01 between 3:38am and 5:35am similarly entailed price action consistent with sales. Most European bonds also gained, with the yield on German 10-year securities falling more than basis points. German yield curve bull-flattens: 30-year yield drops ~9bps before stalling near 1.05% which has acted as support for much of May so far.

The Dollar issuance slate empty so far; eight borrowers priced $8.5b Wednesday, and new issue activity is expected to be muted during remainder of the week. Three-month dollar Libor +2.69bp to 1.50486%. Economic data slate includes May Philadelphia Fed business outlook and initial jobless claims (8:30am), April existing homes sales and leading index (10am).

In commodities, crude oil extended declines, while most industrial metals were in the red as global growth fears damped the demand outlook. WTI reverses Asia’s gains, dropping back below $110 but holding above Wednesday’s lows. Spot gold is comparatively quiet, holding above $1,810/oz. Most base metals trade in the green; LME tin rises 2.1%, outperforming peers while copper held near a seven-month low and zinc extended losses.

Bitcoin is modestly softer in a relatively contained range that lies just shy of the USD 30k mark. Crypto exchange FTX to start rollout of new stock-trading service on Thursday, WSJ reports; will not accept payment for order flow on stock trades.

Looking to the day ahead now, and data releases from the US include the weekly initial jobless claims, along with April’s existing home sales and the Philadelphia Fed’s business outlook survey for May. Central bank speakers include ECB Vice President de Guindos, the ECB’s Holzmann and the Fed’s Kashkari. Finally, the ECB will be publishing the minutes from their April meeting.

Market Snapshot

- S&P 500 futures down 1.1% to 3,879.25

- STOXX Europe 600 down 1.7% to 426.41

- MXAP down 1.8% to 161.60

- MXAPJ down 2.2% to 527.30

- Nikkei down 1.9% to 26,402.84

- Topix down 1.3% to 1,860.08

- Hang Seng Index down 2.5% to 20,120.68

- Shanghai Composite up 0.4% to 3,096.97

- Sensex down 2.4% to 52,926.71

- Australia S&P/ASX 200 down 1.6% to 7,064.46

- Kospi down 1.3% to 2,592.34

- Gold spot down 0.1% to $1,814.49

- U.S. Dollar Index down 0.28% to 103.52

- German 10Y yield little changed at 0.96%

- Euro up 0.3% to $1.0496

- Brent Futures down 0.1% to $109.00/bbl

Top Overnight News from Bloomberg

- President Joe Biden is set to meet on Thursday with Finland’s President Sauli Niinisto and Swedish Prime Minister Magdalena Andersson at the White House to discuss the Nordic nations’ NATO bids.

- China’s top diplomat again warned the US over its increased support for Taiwan, showing the island democracy remains a major sticking point between the world’s biggest economies as Beijing sent more military aircraft toward the island

- Sri Lanka fell into default for the first time in its history as the government struggles to halt an economic meltdown that prompted mass protests and a political crisis

- The yuan’s outlook is finally looking more balanced after a 6.5% dive versus its major trading partner currencies since March.

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were pressured on spillover selling after the worst day on Wall St in almost two years. ASX 200 was led lower by consumer staples following the retailer woes stateside and mixed Australian jobs data. Nikkei 225 suffered firm losses amid reports the ruling coalition is considering increasing the corporate tax rate and after several data releases in which Machinery Orders topped estimates but Exports missed as China-bound exports declined by the fastest pace since March 2020. Hang Seng and Shanghai Comp initially weakened with the Hong Kong benchmark dragged lower by heavy losses in tech after Tencent’s profit declined by more than 50% and with the mainland pressured as Beijing conducts a fresh round of mass COVID testing, although the mainland bourse recovered most of its losses after Shanghai announced a further gradual easing of restrictions. Xiaomi (1810 HK) Q1 adj. net profit CNY 2.859bln (vs 6.069bln Y/Y), Q1 revenue CNY 73.4bln (vs. 76.9bln Y/Y); global smartphone shipments -10.5% Y/Y at 38.5mln units.

Top Asian News

- Shanghai Vice Mayor said Shanghai port throughput recovered to around 90% of the levels a year ago and that Shanghai will expand work resumption in areas with no COVID risk in early June. Furthermore, Shanghai is to gradually restore inter-district public transport from May 22nd and will require residents to show negative PCR tests taken within 48 hours before using public transport, while an economy official said Shanghai will reduce rents for small and medium-sized enterprises by more than CNY 10bln and the city extended CNY 72.3bln of loans to over 10,000 firms since March, according to Reuters.

- Japanese MOF official said China's COVID curbs are among the factors that caused a decline in China-bound exports from Japan which fell by the fastest pace since March 2020, while Japan's April imports reached the largest amount on record, according to Reuters.

- Japan's ruling coalition is reportedly considering increasing the corporate tax rate, according to Jiji.

- New Zealand sees 2021/22 OBEGAL at NZD -18.98bln (prev. forecast -20.44bln), 2021/22 net debt at 36.9% of GDP (prev. forecast 37.6%) and Cash Balance at NZD -31.78bln (prev. forecast -34.10bln), while Finance Minister Robertson said the economy is expected to be robust in the near term and they see a return to OBEGAL surplus in 2024/25, according to Reuters.

European bourses are pressured across the board in a broader risk-off moves after yesterday's Wall St. sell off, as European players look past the brief respite seen overnight on Shanghai's reopening; Euro Stoxx 50 -2.3%. Stateside, the magnitude of the downside is somewhat more contained given newsflow has been limited since Wednesday's downside commenced, ES -1.2%.

Top European News

- EU is reportedly considering a targeted trade war on troublesome Brexiteer MPs and Tory ministers to force UK PM Johnson to do a U-turn on the Northern Ireland protocol, according to The Telegraph.

- Top UK Economist Defends BOE’s Handling of Inflation Crisis

- EasyJet Bookings Pick Up Ahead of Uncertain Summer Season

- Apax-Owned Rodenstock Acquires Spanish Rival Indo

- European Gas Slips With LNG Imports Helping Boost Stockpiles

In FX

- Franc resurgence and re-emergence as a safe haven currency continues; USD/CHF touches 0.9750 vs 1.0060+ peak on Monday, EUR/CHF sub-1.0250 vs circa 1.0500 at one stage only yesterday.

- Dollar loses momentum as US Treasury yields retreat further and curve re-flattens amidst ongoing risk rout, DXY ducks under 103.500 after peaking just shy of 104.000 on Wednesday.

- Kiwi and Aussie find positives via fiscal and fundamental factors to evade aversion; NZD/USD back above 0.6300 after NZ budget and AUD/USD hovering around 0.7000 post- Aussie jobs data.

- Yen retains underlying bid irrespective of mixed Japanese data, USD/JPY below 128.00 again.

- Euro firmer beyond EUR/CHF cross ahead of ECB minutes and Sterling off UK inflation data lows awaiting retail sales on Friday, EUR/USD retains sight of 1.0500 and Cable near 1.2400.

- Rand meandering ahead of SARB in anticipation of 50 bp rate hike, USD/ZAR around 16.0000, irrespective of Gold taking firmer hold of USD 1800/oz handle.

Fixed Income

- Debt resumes safe-haven rally as market mood continues to sour.

- Bunds top 154.00, Gilts get close to 120.00 and 10 year T-note even nearer the same psychological level.

- BTPs lag amidst the ongoing aversion to risk, while OATs and Bonos reflect on somewhat mixed auction results.

Commodities

- WTI and Brent are pressured in-fitting with broader sentiment as initial resilience on demand-side positives re. China/COVID were overpowered by the risk move.

- However, the benchmarks are around USD 1.00/bbl off lows of USD 104.36/bbl and USD 106.76/bbl respectively, following reports that China is discussing the purchase of Russian crude.

- China is said to be in talks with Russia to purchase oil for strategic reserves, according to Bloomberg sources; detailed on terms and volume reportedly not decided yet

- Qatar Energy was reportedly selling July Al-Shaheen crude at premiums of USD 5.80-6.40/bbl above Dubai quotes which is the highest in 2 months, according to Reuters sources.

- Spot gold is bid as it draws haven allure, with the yellow metal marginally surpassing USD 1830/oz.

US Event Calendar

- 08:30: May Initial Jobless Claims, est. 200,000, prior 203,000; Continuing Claims, est. 1.32m, prior 1.34m

- 08:30: May Philadelphia Fed Business Outl, est. 15.0, prior 17.6

- 10:00: April Existing Home Sales MoM, est. -2.2%, prior -2.7%; Home Resales with Condos, est. 5.64m, prior 5.77m

- 10:00: April Leading Index, est. 0%, prior 0.3%

DB's Jim Reid concludes the overnight wrap

Today is my last day at work this week before I head up to Cambridge tomorrow for my Masters’ graduation. Before you send in a flood of congratulations though, I didn’t actually do any work for this qualification, with not even a single hour of revision. Now at this point you’re probably thinking I’m either a genius or guilty of some serious academic malpractice. I’m hoping the former. But the truth is that I’m benefiting from a quirky tradition that somehow means Cambridge, Oxford and Dublin will upgrade your Bachelors into a Masters after a few years. With the wedding two months away, it appears as though I’m losing all my bachelor status at once.

Markets seem ready for a holiday too after the last 24 hours, with the selloff resuming at pace after the brief respite on Tuesday. In fact it was nothing short of a rout with the S&P 500 ending the day down -4.04%, marking its worst daily performance since June 2020, and leaving the index at a fresh one-year low. There wasn’t a single catalyst behind the slump, but weak housing data out of the US along with Target’s move to cut its profit outlook helped feed investor concern that the consumer might not be in as strong a position as previously thought. And that’s on top of all the other worries of late that the global economy is heading in a stagflationary direction amidst various supply-chain issues, alongside the prospect that tighter central bank policy is going to further dent growth and risks tipping various economies into recession.

In terms of the specific moves, the S&P 500 gradually tumbled as the day went on, with its -4.04% decline more than reversing its +2.02% bounceback on Tuesday. The decline was an incredibly broad-based one, with just 8 constituents in the index ending the day higher, which is the lowest number since November. That earnings report we mentioned at the top meant that Target (-24.93%) saw the worst performance in the entire S&P 500, after saying they now expected their full-year operating income margin rate to be around 6%. That follows a disappointing report from Walmart the previous day, and meant that consumer staples (-6.38%) and consumer discretionary (-6.60%) were the worst-performing sectors in the S&P yesterday. The latest declines also mean that the S&P is back on track for a 7th consecutive weekly decline, having shed -2.49% since the start of the week, and S&P 500 futures are only up by +0.18% this morning. If the S&P 500 does see a 7th week in negative territory, then that would be the longest run of weekly declines for the index since 2001. Other indices lost ground too given the risk-off move, with the Dow Jones (-3.57%), the NASDAQ (-4.73%), and the small-cap Russell 2000 (-3.56%) all experiencing sizeable declines of their own. European indices had a better performance after closing before the worst of the US declines, and the STOXX 600 was “only” down -1.14% to just remain in positive territory for the week.

With recessionary concerns back in focus, sovereign bonds rallied on both sides of the Atlantic as investors sought out safe havens. Yields on 10yr US Treasuries fell by -10.2bps to 2.88%, with the decline mostly led by a -9.6bps move lower in real yields, and nominal yields are only back up +2.5bps this morning. The yield curve also continued to flatten and the 2s10s slope (-6.9ps) fell to its lowest in over two weeks, at 21.0bps, although it’s been over 6 weeks now since the curve last traded in inversion territory. We did get some Fedspeak but to be honest there weren’t any major headlines relative to what we already knew, with Chicago Fed President Evans saying it was “quite likely” the Fed would be at a neutral setting by year-end, whilst Philadelphia Fed President Harker was making the case for more gradual rate hikes after the next few 50bp hikes are delivered. More important for the outlook was the release of various housing data yesterday, where housing starts fell to an annualised rate of 1.724m in April (vs. 1.756m expected), and that was from a downwardly revised 1.728m in March. That comes against the backdrop of rising mortgage rates, and the MBA reported that mortgage purchase applications fell -11.9% in the week ending May 13, leaving them at their lowest levels since May 2020 when the numbers were still recovering from the pandemic slump.

Over in Europe, sovereign bond curves also became flatter as investors became increasingly aggressive on the near-term ECB rate path. Indeed the amount of ECB rate hikes priced in by the December meeting hit a fresh high of 108bps, or equivalent to at least four rate hikes of 25bps by year-end. That came amidst further ECB speakers over the last 24 hours, including Finnish central bank governor Rehn, who had already endorsed a July hike and said yesterday that the initial hike was “likely to take place in the summer”. Furthermore, he said that it seemed “necessary that in our policy rates we move relatively quickly out of negative territory”. We also heard from Estonian central bank governor Muller, who also endorsed a July hike and said he “wouldn’t be surprised” if the deposit rate were in positive territory by year-end. However, Spanish central bank governor De Cos said that rate hikes should be gradual as he called for APP purchases to end at the start of Q3, with rate hikes to follow shortly afterwards.

Those growing expectations of tighter policy saw shorter-dated yields move higher in Europe once again, with 2yr German yields hitting their highest level since 2011 despite only a marginal +0.1bps move to 0.36%. However, the broader risk-off tone meant it was a different story for their longer-dated counterparts, and yields on 10yr bunds (-1.6bps) and OATs (-2.2bps) both moved lower on the day. Peripheral spreads widened as well, whilst iTraxx Crossover neared its recent highs with a +26.2bps move to 468bps.

In terms of the fight against inflation, there was a potential boost on the trade side yesterday as US Treasury Secretary Yellen confirmed ahead of a meeting of G7 finance ministers and central bank governments that the she favoured removing some tariffs on goods that are not considered strategic. Separately the risk-off move also saw oil prices move lower for a 2nd day running yesterday, with Brent crude down -2.52%, although it’s since taken back a decent chunk of that loss this morning with a +1.51% move higher to $110.76/bbl.

Over in Asia, equity markets have tracked those steep overnight losses on Wall Street to move sharply lower this morning. Among the key indices, the Hang Seng (-2.25%) is the largest underperformer amidst a broad weakness in tech stocks as the Hang Seng Tech index fell by an even larger -3.40%. Mainland Chinese stocks have performed relatively better however, even if the Shanghai Composite (-0.08%) and CSI (-0.25%) have both moved slightly lower, while the Nikkei (-1.91%) and the Kospi (-1.29%) have seen more substantial losses. Finally there was some important employment data out of Australia this morning ahead of their election on Saturday, with the unemployment rate falling to its lowest since 1974, at 3.9%. The employment gain was a bit softer than expected with just a +4.0k gain (vs. +30.0k expected), but that included a +92.4k gain in full-time employment, offset by a -88.4k decline in part-time employment.

Elsewhere on the data side, there were fresh signs of inflationary pressure in the UK after CPI inflation rose to a 40-year high of +9.0% in April. But in spite of the 40-year high, that was actually slightly beneath the +9.1% reading expected by the consensus, which marked the first time in over 6 months that the reading hasn’t been higher than expected. Gilts outperformed following the release as it was also beneath the BoE’s staff projection of +9.1%, and 10yr gilt yields closed down -1.6bps on the day, whilst sterling underperformed the other major currencies leave it -1.28% weaker against the US Dollar.

To the day ahead now, and data releases from the US include the weekly initial jobless claims, along with April’s existing home sales and the Philadelphia Fed’s business outlook survey for May. Central bank speakers include ECB Vice President de Guindos, the ECB’s Holzmann and the Fed’s Kashkari. Finally, the ECB will be publishing the minutes from their April meeting.

Government

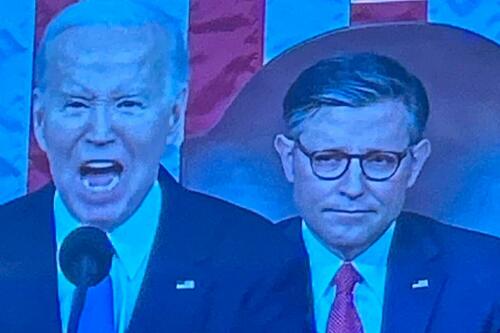

Angry Shouting Aside, Here’s What Biden Is Running On

Angry Shouting Aside, Here’s What Biden Is Running On

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union…

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union address - in which he insisted that the American economy is doing better than ever, blamed inflation on 'corporate greed,' and warned that Donald Trump poses an existential threat to the republic.

But in between the angry rhetoric, he also laid out his 2024 election platform - for which additional details will be released on March 11, when the White House sends its proposed budget to Congress.

To that end, Goldman Sachs' Alec Phillips and Tim Krupa have summarized the key points:

Taxes

While railing against billionaires (nothing new there), Biden repeated the claim that anyone making under $400,000 per year won't see an increase in their taxes. He also proposed a 21% corporate minimum tax, up from 15% on book income outlined in the Inflation Reduction Act (IRA), as well as raising the corporate tax rate from 21% to 28% (which would promptly be passed along to consumers in the form of more inflation). Goldman notes that "Congress is unlikely to consider any of these proposals this year, they would only come into play in a second Biden term, if Democrats also won House and Senate majorities."

Biden once again tells the complete lie that "nobody earning less than $400,000/year will pay additional penny in federal taxes."

— RNC Research (@RNCResearch) March 8, 2024

FACT: Biden has *already* raised the tax burden on Americans making as little as $20,000 per year. pic.twitter.com/VrZ1m0rzG3

Biden also called on Congress to restore the pandemic-era child tax credit.

Immigration

Instead of simply passing a slew of border security Executive Orders like the Trump ones he shredded on day one, Biden repeated the lie that Congress 'needs to act' before he can (translation: send money to Ukraine or the US border will continue to be a sieve).

As immigration comes into even greater focus heading into the election, we continue to expect the Administration to tighten policy (e.g., immigration has surged 20pp the last 7 months to first place with 28% in Gallup’s “most important problem” survey). As such, we estimate the foreign-born contribution to monthly labor force growth will moderate from 110k/month in 2023 to around 70-90k/month in 2024. -GS

SEE IT: Biden gets boo-ed while talking about his immigration bill. WATCH pic.twitter.com/O5FmkYx3xM

— Simon Ateba (@simonateba) March 8, 2024

Ukraine

Biden, with House Speaker Mike Johnson doing his best impression of a bobble-head, urged Congress to pass additional assistance for Ukraine based entirely on the premise that Russia 'won't stop' there (and would what, trigger article 5 and WW3 no matter what?), despite the fact that Putin explicitly told Tucker Carlson he has no further ambitions, and in fact seeks a settlement.

‼️ Breaking: Putin wants a negotiated settlement to what’s happening in Ukraine.

— Ed (@EdMagari) February 9, 2024

In a surprising turn of events, Tucker Carlson could be the key to peace, potentially playing a crucial role in ending the current conflict????️ pic.twitter.com/IKN8ajlEUX

As Goldman estimates, "While there is still a clear chance that such a deal could come together, for now there is no clear path forward for Ukraine aid in Congress."

China

Biden, forgetting about all the aggressive tariffs, suggested that Trump had been soft on China, and that he will stand up "against China's unfair economic practices" and "for peace and stability across the Taiwan Strait."

SOTU FACT CHECK:

— Wesley Hunt (@WesleyHuntTX) March 8, 2024

Biden claims we’re in a strong position to take on China.

No president in our lifetime has been WEAKER on China than Biden. pic.twitter.com/Y73JsIzmM3

Healthcare

Lastly, Biden proposed to expand drug price negotiations to 50 additional drugs each year (an increase from 20 outlined in the IRA), which Goldman said would likely require bipartisan support "even if Democrats controlled Congress and the White House," as such policies would likely be ineligible for the budget "reconciliation" process which has been used in previous years to pass the IRA and other major fiscal party when Congressional margins are just too thin.

So there you have it. With no actual accomplishments to speak of, Biden can only attack Trump, lie, and make empty promises.

Government

Jack Smith Says Trump Retention Of Documents “Starkly Different” From Biden

Jack Smith Says Trump Retention Of Documents "Starkly Different" From Biden

Authored by Catherine Yang via The Epoch Times (emphasis ours),

Special…

Authored by Catherine Yang via The Epoch Times (emphasis ours),

Special counsel Jack Smith has argued the case he is prosecuting against former President Donald Trump for allegedly mishandling classified information is “starkly different” from the case the Department of Justice declined to bring against President Joe Biden over retention of classified documents.

Prosecutors, in responding to a motion President Trump filed to dismiss the case based on selective and vindictive prosecution, said on Thursday this is not the case of “two men ‘commit[ting] the same basic crime in substantially the same manner.”

They argue the similarities are only “superficial,” and that there are two main differences: that President Trump allegedly “engaged in extensive and repeated efforts to obstruct justice and thwart the return of documents” and the “evidence concerning the two men’s intent.”

Special counsel Robert Hur’s report found that there was evidence that President Biden “willfully” retained classified Afghanistan documents, but that evidence “fell short” of concluding guilt of willful retention beyond reasonable doubt.

Prosecutors argue the “strength of the evidence” is a crucial element showing these cases are not “similarly situated.”

“Trump may dispute the Hur Report’s conclusions but he should not be allowed to misrepresent them,” prosecutors wrote, arguing that the defense’s argument to dismiss the case fell short of legal standards.

They point to volume as another distinction: President Biden had 88 classified documents and President Trump had 337. Prosecutors also argued that while President Biden’s Delaware garage “was plainly an unsecured location ... whatever risks are posed by storing documents in a private garage” were “dwarfed” by President Trump storing documents at an “active social club” with 150 staff members and hundreds of visitors.

Defense attorneys had also cited a New York Times report where President Biden was reported to have held the view that President Trump should be prosecuted, expressing concern about his retention of documents at Mar-a-lago.

Prosecutors argued that this case was not “foisted” upon the special counsel, who had not been appointed at the time of these comments.

“Trump appears to contend that it was President Biden who actually made the decision to seek the charges in this case; that Biden did so solely for unconstitutional reasons,” the filing reads. “He presents no evidence whatsoever to show that Biden’s comments about him had any bearing on the Special Counsel’s decision to seek charges, much less that the Special Counsel is a ’stalking horse.'”

8 Other Cases

President Trump has argued he is being subjected to selective and vindictive prosecution, warranting dismissal of the case, but prosecutors argue that the defense has not “identified anyone who has engaged in a remotely similar battery of criminal conduct and not been prosecuted as a result.”

In addition to President Biden, defense attorneys offered eight other examples.

Former Vice President Mike Pence had, after 2023 reports about President Biden retaining classified documents surfaced, retained legal counsel to search his home for classified documents. Some documents were found, and he sent them to the National Archives and Records Administration (NARA).

Prosecutors say this was different from President Trump’s situation, as Vice President Pence returned the documents out of his own initiative and had fewer than 15 classified documents.

Former President Bill Clinton had retained a historian to put together “The Clinton Tapes” project, and it was later reported that NARA did not have those tapes years after his presidency. A court had ruled it could not compel NARA to try to recover the records, and NARA had defined the tapes as personal records.

Prosecutors argue those were tape diaries and the situation was “far different” from President Trump’s.

Former Secretary of State Hillary Clinton had “used private email servers ... to conduct official State Department business,” the DOJ found, and the FBI opened a criminal investigation.

Prosecutors argued this was a different situation where the secretary’s emails showed no “classified” markings and the deletion of more than 31,000 emails was done by an employee and not the secretary.

Former FBI Director James Comey had retained four memos “believing that they contained no classified information.” These memos were part of seven he authored addressing interactions he had with President Trump.

Prosecutors argued there was no obstructive behavior here.

Former CIA Director David Petraeus kept bound notebooks that contained classified and unclassified notes, which he allowed a biographer to review. The FBI later seized the notebooks and Mr. Petraeus took a guilty plea.

Prosecutors argued there was prosecution in Mr. Petraeus’s case, and so President Trump’s case is not selective.

Former national security adviser Sandy Berger removed five copies of a classified document and kept them at his personal office, later shredding three of the copies. When confronted by NARA, he returned the remaining two copies and took a guilty plea.

Former CIA director John Deutch kept a journal with classified information on an unclassified computer, and also took a guilty plea.

Prosecutors argued both Mr. Berger and Mr. Deutch’s behavior was “vastly less egregious than Trump’s” and they had been prosecuted.

Former White House coronavirus response coordinator Deborah Birx had possession of classified materials according to documents retrieved by NARA.

Prosecutors argued that there was no indication she knew she had classified information or “attempted to obstruct justice.”

Uncategorized

Economic Earthquake Ahead? The Cracks Are Spreading Fast

Economic Earthquake Ahead? The Cracks Are Spreading Fast

Authored by Brandon Smith via Alt-Market.us,

One of my favorite false narratives…

Authored by Brandon Smith via Alt-Market.us,

One of my favorite false narratives floating around corporate media platforms has been the argument that the American people “just don’t seem to understand how good the economy really is right now.” If only they would look at the stats, they would realize that we are in the middle of a financial renaissance, right? It must be that people have been brainwashed by negative press from conservative sources…

I have to laugh at this notion because it’s a very common one throughout history – it’s an assertion made by almost every single political regime right before a major collapse. These people always say the same things, and when you study economics as long as I have you can’t help but throw up your hands and marvel at their dedication to the propaganda.

One example that comes to mind immediately is the delusional optimism of the “roaring” 1920s and the lead up to the Great Depression. At the time around 60% of the U.S. population was living in poverty conditions (according to the metrics of the decade) earning less than $2000 a year. However, in the years after WWI ravaged Europe, America’s economic power was considered unrivaled.

The 1920s was an era of mass production and rampant consumerism but it was all fueled by easy access to debt, a condition which had not really existed before in America. It was this illusion of prosperity created by the unchecked application of credit that eventually led to the massive stock market bubble and the crash of 1929. This implosion, along with the Federal Reserve’s policy of raising interest rates into economic weakness, created a black hole in the U.S. financial system for over a decade.

There are two primary tools that various failing regimes will often use to distort the true conditions of the economy: Debt and inflation. In the case of America today, we are experiencing BOTH problems simultaneously and this has made certain economic indicators appear healthy when they are, in fact, highly unstable. The average American knows this is the case because they see the effects everyday. They see the damage to their wallets, to their buying power, in the jobs market and in their quality of life. This is why public faith in the economy has been stuck in the dregs since 2021.

The establishment can flash out-of-context stats in people’s faces, but they can’t force the populace to see a recovery that simply does not exist. Let’s go through a short list of the most faulty indicators and the real reasons why the fiscal picture is not a rosy as the media would like us to believe…

The “miracle” labor market recovery

In the case of the U.S. labor market, we have a clear example of distortion through inflation. The $8 trillion+ dropped on the economy in the first 18 months of the pandemic response sent the system over the edge into stagflation land. Helicopter money has a habit of doing two things very well: Blowing up a bubble in stock markets and blowing up a bubble in retail. Hence, the massive rush by Americans to go out and buy, followed by the sudden labor shortage and the race to hire (mostly for low wage part-time jobs).

The problem with this “miracle” is that inflation leads to price explosions, which we have already experienced. The average American is spending around 30% more for goods, services and housing compared to what they were spending in 2020. This is what happens when you have too much money chasing too few goods and limited production.

The jobs market looks great on paper, but the majority of jobs generated in the past few years are jobs that returned after the covid lockdowns ended. The rest are jobs created through monetary stimulus and the artificial retail rush. Part time low wage service sector jobs are not going to keep the country rolling for very long in a stagflation environment. The question is, what happens now that the stimulus punch bowl has been removed?

Just as we witnessed in the 1920s, Americans have turned to debt to make up for higher prices and stagnant wages by maxing out their credit cards. With the central bank keeping interest rates high, the credit safety net will soon falter. This condition also goes for businesses; the same businesses that will jump headlong into mass layoffs when they realize the party is over. It happened during the Great Depression and it will happen again today.

Cracks in the foundation

We saw cracks in the narrative of the financial structure in 2023 with the banking crisis, and without the Federal Reserve backstop policy many more small and medium banks would have dropped dead. The weakness of U.S. banks is offset by the relative strength of the U.S. dollar, which lures in foreign investors hoping to protect their wealth using dollar denominated assets.

But something is amiss. Gold and bitcoin have rocketed higher along with economically sensitive assets and the dollar. This is the opposite of what’s supposed to happen. Gold and BTC are supposed to be hedges against a weak dollar and a weak economy, right? If global faith in the dollar and in the U.S. economy is so high, why are investors diving into protective assets like gold?

Again, as noted above, inflation distorts everything.

Tens of trillions of extra dollars printed by the Fed are floating around and it’s no surprise that much of that cash is flooding into the economy which simply pushes higher right along with prices on the shelf. But, gold and bitcoin are telling us a more honest story about what’s really happening.

Right now, the U.S. government is adding around $600 billion per month to the national debt as the Fed holds rates higher to fight inflation. This debt is going to crush America’s financial standing for global investors who will eventually ask HOW the U.S. is going to handle that growing millstone? As I predicted years ago, the Fed has created a perfect Catch-22 scenario in which the U.S. must either return to rampant inflation, or, face a debt crisis. In either case, U.S. dollar-denominated assets will lose their appeal and their prices will plummet.

“Healthy” GDP is a complete farce

GDP is the most common out-of-context stat used by governments to convince the citizenry that all is well. It is yet another stat that is entirely manipulated by inflation. It is also manipulated by the way in which modern governments define “economic activity.”

GDP is primarily driven by spending. Meaning, the higher inflation goes, the higher prices go, and the higher GDP climbs (to a point). Eventually prices go too high, credit cards tap out and spending ceases. But, for a short time inflation makes GDP (as well as retail sales) look good.

Another factor that creates a bubble is the fact that government spending is actually included in the calculation of GDP. That’s right, every dollar of your tax money that the government wastes helps the establishment by propping up GDP numbers. This is why government spending increases will never stop – It’s too valuable for them to spend as a way to make the economy appear healthier than it is.

The REAL economy is eclipsing the fake economy

The bottom line is that Americans used to be able to ignore the warning signs because their bank accounts were not being directly affected. This is over. Now, every person in the country is dealing with a massive decline in buying power and higher prices across the board on everything – from food and fuel to housing and financial assets alike. Even the wealthy are seeing a compression to their profit and many are struggling to keep their businesses in the black.

The unfortunate truth is that the elections of 2024 will probably be the turning point at which the whole edifice comes tumbling down. Even if the public votes for change, the system is already broken and cannot be repaired without a complete overhaul.

We have consistently avoided taking our medicine and our disease has gotten worse and worse.

People have lost faith in the economy because they have not faced this kind of uncertainty since the 1930s. Even the stagflation crisis of the 1970s will likely pale in comparison to what is about to happen. On the bright side, at least a large number of Americans are aware of the threat, as opposed to the 1920s when the vast majority of people were utterly conned by the government, the banks and the media into thinking all was well. Knowing is the first step to preparing.

The second step is securing your own financial future – that’s where physical precious metals can play a role. Diversifying your savings with inflation-resistant, uninflatable assets whose intrinsic value doesn’t rely on a counterparty’s promise to pay adds resilience to your savings. That’s the main reason physical gold and silver have been the safe haven store-of-value assets of choice for centuries (among both the elite and the everyday citizen).

* * *

As the world moves away from dollars and toward Central Bank Digital Currencies (CBDCs), is your 401(k) or IRA really safe? A smart and conservative move is to diversify into a physical gold IRA. That way your savings will be in something solid and enduring. Get your FREE info kit on Gold IRAs from Birch Gold Group. No strings attached, just peace of mind. Click here to secure your future today.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International8 hours ago

International8 hours agoWalmart launches clever answer to Target’s new membership program

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex