Uncategorized

Luxury sales expected to climb in the second quarter as pent-up demand buoys real estate activity in most major markets across Canada, says RE/MAX® Canada

Luxury sales expected to climb in the second quarter as pent-up demand buoys real estate activity in most major markets across Canada, says RE/MAX® Canada

Canada NewsWire

TORONTO and KELOWNA, BC, April 4, 2023

Spotlight on inventory once again, as …

Luxury sales expected to climb in the second quarter as pent-up demand buoys real estate activity in most major markets across Canada, says RE/MAX® Canada

Canada NewsWire

TORONTO and KELOWNA, BC, April 4, 2023

Spotlight on inventory once again, as available homes listed for sale fall below tight pandemic levels in key markets

TORONTO and KELOWNA, BC, April 4, 2023 /CNW/ -- Growing demand for residential properties has trickled into the upper-end of the Canadian real estate market, with luxury sales posting gains in the first quarter of 2023 over the fourth quarter of 2022 in most major Canadian markets, according to the 2023 Spotlight on Luxury Report released today by RE/MAX Canada.

RE/MAX Canada examined 15 Canadian housing markets from coast to coast -- including Greater Vancouver, Fraser Valley, Kelowna, Calgary, Edmonton, Saskatoon, Winnipeg, Hamilton-Burlington, London-St. Thomas, Greater Toronto Area (GTA), Ottawa, Island of Montreal, Halifax-Dartmouth, Moncton and St. John's – and found rapid depletion in housing stock is placing upward pressure on values at lower price points and sparking an uptick in demand in the luxury segment. While upper-end sales in the first quarter of 2023 have fallen short of peak levels reached in Q1 2022, activity is on par or ahead of Q4 2022 figures in 10 of the 15 markets surveyed. The ascending pattern is expected to continue in the upcoming quarter, as both sales and temperatures heat up. Saskatoon, underpinned by strong economic fundamentals, bucked the national trend, with luxury home sales exceeding Q1 2022 levels in Q1 2023.

"Much of the activity in the market can be attributed to pent-up demand, which has been building since mid-2022," says Christopher Alexander, President of RE/MAX Canada. "Bolstered by lower fixed-term mortgage rates and attractive housing values, buyers are taking advantage of this window of opportunity to secure home ownership. Listings, however, are few and far between in most areas of the country and finding the right home has proved challenging."

Market | Luxury | Q1 2023* | Q4 2022 | % change |

Price Point | Sales | Sales | ||

Greater Vancouver*** | $4,000,000 | 51 | 42 | 21.4 % |

Fraser Valley*** | $3,000,000 | 30 | 25 | 20.0 % |

Kelowna | $1,500,000 | 54 | 65 | -16.9 % |

Calgary (City of) | $1,000,000 | 269 | 201 | 33.8 % |

Edmonton | $1,000,000 | 40 | 57 | -29.8 % |

Saskatoon | $750,000 | 27 | 25 | 8.0 % |

Winnipeg | $700,000 | 51 | 53 | -3.8 % |

Hamilton-Burlington | $2,000,000 | 43 | 31 | 38.7 % |

London-St. Thomas | $1,200,000 | 40 | 44 | -9.1 % |

Greater Toronto Area | $3,000,000 | 261 | 251 | 4.0 % |

Ottawa | $1,250,000 | 91 | 85 | 7.1 % |

Island of Montreal | $1,500,000 | 73 | 72 | 1.4 % |

Halifax-Dartmouth | $1,000,000 | 42 | 37 | 13.5 % |

Moncton** | $700,000 | 13 | 13 | 0.0 % |

St. John's | $600,000 | 18 | 56 | -67.9 % |

Source: Based on local board statistics provided by RE/MAX Brokers and Sales Representatives. Luxury price points, typically 2x local average price plus, are determine by RE/MAX Brokers and Sales Representatives *Preliminary figures as of March 31st. **Five of the 13 total sales are pending. ***Detached home sales only. |

Sidelined buyers jumped back into the market in Q1, as anticipated inventory failed to materialize and housing values stabilized, according to the RE/MAX Canada 2023 Spotlight on Luxury Report. Supply levels are now tighter than they were during the pandemic in some markets. In the Fraser Valley, for example, listings recently hit a 30-year low and, in St. John's, Newfoundland, a property recently listed for sale at the $800,000 price point experienced 15 showings and three offers and sold on its first day on the market.

"Inventory continues to be the lynchpin of the Canadian housing market," explains Alexander. "The pattern of heating and cooling housing markets emerges time and time again, and it is directly linked to our issues with supply and the inability of governments at all three levels to get shovels in the ground across our nation, which is now approaching 40 million people in population. We welcome the news that our country is growing, but with one million new Canadians added in 2022, we also need to be certain that adequate housing, not to mention vital infrastructure, is in place to support the influx of newcomers."

A lack of available homes listed for sale have served to prop-up housing values across the country, despite softer overall demand, explains Alexander. After double-digit declines from peak to trough in the second and third quarters of 2022, prices have held up relatively well in major centres. The year-over-year value of luxury homes in markets such as Calgary and Moncton increased, while the GTA, Hamilton-Burlington, Ottawa and Greater Vancouver have fallen just short of peak Q1 levels.

In an effort to maintain supply and curtail demand from foreign buyers, the government implemented its Prohibition on the Purchase of Residential Property by Non-Canadians Act on January 1, 2023, which had unintentional consequences on the construction of purpose-built residential rentals and mixed-use projects across the country, as well as sports and entertainment figures and corporate transfers throughout the first quarter.

Amendments to the Act, effective March 27, 2023, included:

- Enabling more work permit holders to purchase a home to live in while working in Canada.

- Repealing existing provisions so the prohibition doesn't apply to vacant land; provide an exception for development purposes.

- Increasing the corporation foreign control threshold from three per cent to 10 per cent.

The bulk of purchasers, however, remain local in most Canadian markets, with the exception of some out-of-province activity in the first quarter. Centres such as Kelowna on the west coast and in markets throughout Canada's east coast have seen an influx of buyers driven largely by lifestyle, as strong value for the dollar proved enticing to move-up purchasers.

After a tumultuous 2022, cautious optimism is growing in major centres across the country. The ripple effect is starting to work its way through the housing market, with all segments working in tandem. Competitive offers, once again on the table from St. John's to Greater Vancouver, are becoming increasingly common, especially in areas such as the GTA where nearly 20 per cent of freehold homes over $3 million sold at or above list price in Q1 2023.

Turn-key and renovated properties remain most sought after, as higher building costs have dampened the appetite for new construction to some extent. While softer, due to limited inventory in many markets, the uber-luxe segment is starting to pick up in line with overall activity in the upper end. Inventory, at this level, however, is even more scarce.

"Home-buying activity is expected to ramp up in the months ahead, with stronger demand and upward pressure on price characterizing the second quarter of 2023," says Elton Ash, Executive Vice President, RE/MAX Canada. "Recent stock market volatility and bank failures south of the border that have sent shockwaves throughout the financial markets may provide an additional boost for Canadian housing markets as buyers turn to the security of bricks and mortar yet again. While concerns exist over the possibility of rising overnight rates and recessionary pressures later in the year, the spring market appears to be shifting into full swing."

MARKET-BY-MARKET OVERVIEW

GREATER VANCOUVER

- Buyers at the top end of the market are looking to take advantage of somewhat softer housing values, but many sellers are holding firm on price, even willing to pay vacancy taxes while waiting for market conditions to improve.

- While move-up activity has been occurring as buyers take advantage of discounts at the top end of the market, there has been an uptick in sellers downsizing to smaller pieds-a-terre in the core or selling secondary properties to avoid tax implications.

- Based on the late first quarter burst of homebuying activity, sales in the second quarter of 2023 are expected to ramp up in tandem with the traditional spring market. Buyers who have been sitting on the fence are likely to make their moves in the coming months.

A critical shortage of available housing continues to impact homebuying activity in the Greater Vancouver Area, with demand exceeding supply at almost every price point. New listings in February 2023 were down almost 40 per cent year-over-year, with even tighter inventory of luxury homes for sale. Showings at higher price points have increased in recent weeks as momentum at lower price points spills over into luxury. Buyers at the top end of the market are looking to take advantage of somewhat softer housing values, but many sellers are holding firm on price, and even willing to pay vacancy taxes while waiting for market conditions to improve. While detached sales over $4 million in Greater Vancouver have declined by almost 50 per cent, compared to levels reported in the first quarter of 2022, the number of homes that have changed hands in the first three months of 2023 are more than 20 per cent ahead of Q4 2022. Just 16 sales have taken place over $3 million in the attached segment between January and March of this year– this, despite the sale of a $19 million condominium earlier in the quarter. Sixty-eight attached properties sold in the first quarter of 2022.

While move-up activity has been occurring as buyers take advantage of discounts at the top end of the market, there has been an uptick in sellers downsizing to smaller pieds-a-terre in the core or selling secondary properties to avoid tax implications. Demand is greatest for luxury properties on Vancouver's Westside, from Oak St. west to the university, with neighbourhoods such as Shaughnessy, Point Grey, Kerrisdale and Marine Dr. most sought after. The vast majority of buyers are seeking properties offering a view, gated or well-treed homes offering privacy, as well as the usual bells and whistles including gyms, wine cellars, theatre rooms, pools, and outdoor weather-proofed kitchens. In terms of condominiums in the downtown core, there is growing demand for larger, three-bedroom units although these are exceptionally expensive, and few and far between. Party rooms, rooftop terraces and spacious fitness areas are among the desired amenities. Based on the late first quarter burst of homebuying activity, sales in the second quarter of 2023 are expected to ramp up in tandem with the traditional spring market. Buyers who have been sitting on the fence are likely to make their move in the coming months. An influx of listings, especially at luxury price points, should help keep values stable, but if current conditions persist, the Vancouver housing market is likely to see some upward pressure on pricing.

FRASER VALLEY

- Lower-end price points are already experiencing multiple offers in the double-digits, with homes selling well in excess of listing prices in recent weeks.

- Buyers have adjusted their expectations as sellers hold firm on asking price, while the sales-to-listings ratio signals a strong seller's market.

- Supply remains a crucial component in the housing equation; without an uptick in new listings, values will likely continue to climb.

With inventory levels at a 30-year low and pent-up demand building, the market for residential real estate in the Fraser Valley is tightening. Lower-end price points are already experiencing multiple offers in the double-digits, with homes selling well in excess of listing prices in recent weeks. Open houses held on properties priced from $700,000 to $2 million have been swamped with serious buyers. While detached sales at the top end of the market are down from robust levels reported in the first three months of 2022, the 30 properties priced over $3 million in the first quarter of 2023 were 20 per cent ahead of fourth quarter 2022 levels. Nine strata condominiums have sold over the $1.5 million price point in Q1 2023, up from two in the fourth quarter of 2022. Buyers have adjusted expectations as seller's hold firm in asking price while the sales-to-listings ratio signal a strong seller's market. Trade-up activity, however, is limited due to lack of inventory, which has hampered sales in the top end. April to June will be the test, as they are typically the strongest months on record for an influx of new inventory. The entry point to luxury, between $3 million to $4 million, represents the lion's share of activity in the Fraser Valley. South Surrey and its ocean-view properties remain most coveted by affluent purchasers. Any downward movement in terms of interest rates is expected to spark a new flurry of homebuying activity across all price points. Supply remains a crucial component in the housing equation; without an uptick in new listings, values will continue to climb. While 2023 was expected to be a challenging year for residential real estate, all indicators now point to a solid year of healthy homebuying activity, with consumer confidence climbing and increased demand evident throughout all segments of the Fraser Valley housing market.

KELOWNA

- REALTORS® are reporting renewed interest at the top end of the market in recent weeks, which should translate into more sales in the second and third quarters of 2023.

- Fifty-four homes traded hands over the first three months of the year as concerns over stock performance amidst a flurry of bank failures have shaken the market.

- As Canada's fastest-growing metropolitan area, according to Statistics Canada, the increase in out-of-town and out-of-province buyers should serve to further bolster homebuying activity in the months ahead as temperatures and sales heat up.

The traditional spring market has contributed to an upswing in homebuying activity in Kelowna, but the upward momentum has just begun to spark the city's luxury market. Upper-end REALTORS® are reporting renewed interest at the top end of the market in recent weeks, which should translate into more sales in the second and third quarters of the year. Sales of single-family homes and strata condominiums priced at $1.5 million plus are down more than 50 per cent from Q1 2022, and about 17 per cent short of fourth quarter of 2022 levels. Fifty-four homes traded hands over the first three months of the year as concerns over stock performance amidst a flurry of bank failures have shaken the market. Luxury properties situated on Kelowna's Lake Okanagan, priced from $2 million to $5 million, continue to be most sought after, with inventory levels, particularly tight this year. Lakeview homes, homes with acreage, and properties with a pool round out the most desirable features for today's discriminating buyers. Pockets of luxury can be found throughout Kelowna and include enclaves in Upper Mission, southeast Kelowna, Kettle Valley, Wilden, Lakeview Heights, and Black Mountain. Values in the top end have held up relatively well, especially at uber-luxe price points. Sales are lagging at the luxury segment's entry-level price point to luxury with nearly half of the close to 350 homes currently listed for sale falling into the $1.5 million to $2.2 million price bracket. The luxury segment represents about 15 percent of total single-family sales this year, down from approximately 21 percent in 2023. An influx of new luxury condominiums has hampered sales of resale strata product over the past year. As Canada's fastest growing metropolitan area according to the 2021 Statistics Canada Census, the increase in out-of-town and out-of-province buyers should serve to further bolster homebuying activity in the months ahead as temperatures and sales heat up. Kelowna's luxury segment is expected to remain healthy, with balanced market conditions prevailing for the remainder of the year.

CALGARY (City of)

- Market conditions remain challenging, despite a welcome reprieve from last year's frenzied pace.

- Buyers are exercising caution in the market, and although multiple offers continue to occur, the winning bid is rarely more than $20,000 to $30,000 over asking.

- Values at the top end of the market are ahead of Q1 2022 as a result, with average price up more than $30,000 in the first quarter of 2023 ($1,426,848 vs. $1,405,954).

Although sales of luxury properties over $1 million are heating up throughout the city, low inventory levels continue to hamper homebuying activity. Close to 270 single-detached homes and apartments sold at $1 million plus in the first quarter, an increase of 33.8 per cent over the Q4 2022 performance but well short of record Q1 2022 levels. Market conditions remain challenging, despite a welcome reprieve from last year's frenzied pace. Sellers remain hesitant to list their properties for sale, fearing that they will be unable to find a replacement home. Buyers are exercising caution in the market, and although multiple offers continue to occur, the winning bid is rarely more than $20,000 to $30,000 over asking, unlike some of the frothier bids seen just one year ago. Inventory has dwindled over recent months and few new listings have materialized with the advent of the spring market. Pent-up demand is building as a result. Values at the top end of the market are ahead of Q1 2022 as a result, with the average price up more than $30,000 in the first quarter of 2023 ($1,426,848 vs. $1,405,954). Although single-detached homes make up the majority of sales at the top end, executive condominiums are starting to see greater activity. The renewed vibrancy of the city centre, sparked by the growing number of employees returning to their jobs in the core, has also served to attract more purchasers to downtown condominium properties. Move-up buyers are behind the push for luxury homes and condominium apartments, buoyed by strong equity gains in recent years. Sales over $1 million represent approximately five per cent of the overall market, with most sales occurring between $1.3 million and $1.8 million. Luxury tastes are exceptionally personal, with some buyers attracted to acreage and square footage while others are drawn to inner-city locations in closer proximity to the city core. Some homeowners are downsizing or making lateral moves. While it's unlikely that luxury sales will surpass last year's record pace in the city, supply and demand are expected to remain in sync for the remainder of 2023, which should ensure another solid year of homebuying activity and continued price appreciation at the top end of the market.

EDMONTON

- Despite building pent-up demand and an ongoing influx of buyers from Ontario and British Columbia, listings available for sale have slowed to a trickle, especially at the coveted $1 million to $1.2-million price point.

- Existing stock, including spec properties, is most sought-after, with fewer buyers choosing to build or buy newer homes from plans due to the uncertainty of spiralling construction costs.

- As the spring market takes shape, luxury REALTORS® are fielding more calls from both interested buyers and much-needed sellers but some sort of catalyst is necessary to really kick-start the housing market.

Tight inventory levels continue to challenge luxury buyers in the first three months of 2023, with high-end sales over $1 million hovering at 40, down significantly from year-ago levels during the same period. Despite building pent-up demand and an ongoing influx of buyers from Ontario and British Columbia, listings available for sale have slowed to a trickle, especially at the coveted $1 million to $1.2-million price point. Buyers are squeezed between what they want and what is currently available, and they seldom match up. Close to 260 listings are currently available between $1 million and $14 million. Values, however, are holding up fairly well, with no big dip, given that the cost to build is so much higher. Move-up buyers, usually in their late 30's to late 40s with teenage children, represent the lion's share of high-end purchasers. Most are seeking large homes and substantial lot sizes in mature neighbourhoods, a trend that ticked up during the pandemic. Existing stock, including spec properties, is most sought-after, with fewer buyers choosing to build or buy newer homes from plans due to the uncertainty of spiralling construction costs. The strongest demand is found in west end neighbourhoods such as Crestwood and Laurier overlooking the river valley, while Windsor Park and Belgravia are popular destinations sough of the river by the University of Alberta. Upper-end buyers seeking larger lots typically look to Edmonton's suburban communities such as Windemere with its estate properties on the ravine or in Summerside, where homes backing onto the lake are coveted. Downsizing and lateral moves are also occurring, albeit to a lesser extent, with homeowners in older, established neighbourhoods trading large, tired homes for smaller and newer infill properties within similar areas. The foreign buyer ban has had an unintended consequence in the Edmonton area as corporate transfers and professional sports players get caught up in the net. With no exemptions in sight, many have chosen to rent. As the spring market takes shape, luxury REALTORS® are fielding more calls from both interested buyers and much-needed sellers but some sort of catalyst is necessary to really kick-start the housing market. A decline in interest rates would be the ideal impetus, providing a boost to consumer confidence and mindset. Until then, we expect activity to be somewhat tempered in the months ahead, with the luxury market kicking into high gear by the fall.

SASKATOON

- Sales of luxury properties over $750,000 are on the upswing in Saskatoon, with homebuying activity in the first quarter of the year expected to exceed levels reported during the same period in 2022.

- The supply of homes available for sale continues to tighten across the board.

- Strong economic fundamentals continue to underpin Saskatchewan's economy, providing an ideal backdrop for a robust housing market.

Sales of luxury properties over $750,000 are on the upswing in Saskatoon, with homebuying activity in the first quarter of the year expected to exceed levels reported during the same period in 2022. To date, 27 sales have occurred over the $750,000 threshold, up from 22 sales during the first three months of 2022. The supply of homes available for sale continues to tighten across the board. Concerns over further rate hikes have driven strong move-up activity at lower price points, with multiple offers now occurring in the $400,000 to $700,000 range. Momentum is expected to spill over into the luxury market, where pent-up demand is building. The most active segment is priced between $850,000 and $1 million. Communities such as Westbridge and the Willows in South Saskatoon and Rosewood on the city's east side are experiencing competitive offers on million-dollar homes. Lakefront and acreage properties on the city's periphery are also coveted, but most sought after are properties located on the banks of the South Saskatchewan River. Saskatchewan Ave. and White Swan River Rd. make up the uber-luxe segment of the market, with price tags in excess of $1.5 million. Days on market for upscale product in Saskatoon has declined in recent months, now hovering at 49 days compared to 53 in the fourth quarter of last year, reflecting the uptick in demand. Strong economic fundamentals continue to underpin Saskatchewan's economy, providing an ideal backdrop for a robust housing market. Healthy homebuying activity is expected to continue at luxury price points for the remainder of the year. Values at the top end, however, will depend on inventory. Should the supply shortage continue, there could be upward pressure on pricing.

WINNIPEG

- The pause on rate hikes has provided some slight stimulus in the market, prompting those who were on the fence or waiting for the market to bottom out to re-enter.

- Sales at the top end of the market appear to be better insulated from market pressures, with uber-luxe sales over the $1.5 million price point relatively unaffected.

- While the move-up market has been subdued because of carrying costs, there has been a flurry of downsizing activity in the top end of the market as property owners look to simplify their lifestyles.

The pace of luxury sales has picked up in recent weeks as the number of showings and pending sales over the $700,000 price point increase. While sales in the upper end are almost 55 per cent short of the peak in Q1 2022, the 51 homes that changed hands in the first quarter of 2023 are more in line with the fourth quarter of 2022 levels. The pause on rate hikes has provided some slight stimulus in the market, prompting those who were on the fence or waiting for the market to bottom out to re-enter. Showings/offers are increasing but more time is needed to realize quantifiable effects. Sales at the top end of the market appear to be better insulated from market pressures, with uber-luxe sales over the $1.5 million price point relatively unaffected. A good selection of inventory exists over the $700,000 price point, but supply over the $1.5 million threshold is limited. There has been some pullback by sellers in recent months who were unable to realize their ask price. While the move-up market has been subdued because of carrying costs, there has been a flurry of downsizing activity in the top end of the market as property owners look to simplify their lifestyles. Sales over $700,000 currently represent 4.1 per cent of total residential sales, with the majority occurring in Tuxedo, Waverly West, Linden Woods, East St. Paul/Pritchard Farms, River Heights, Sage Creek, Oak Bluff, Taylor Farms and West St. Paul. Approximately 60 per cent of luxury sales occur in the city and 40 per cent occur outside of Winnipeg. While features most attractive to high-end buyers in Winnipeg typically include greater square footage, larger lot sizes, pools, theatre rooms, and home gyms, there has been a recent increase in demand for joint family and in-law suites trending, with requirements for more square footage and finer finishes.

LONDON

- Balanced market conditions exist at present, but rising sales are depleting the limited supply of homes available for sale in London.

- New construction has faltered over the $1 million price point as the gap between resale and homebuilders' pricing increases.

- Luxury sales are expected to gain traction with the advent of the traditional spring market, but high-end buyers will likely remain somewhat cautious with the threat of further interest rate hikes ever present.

Rising confidence levels, prompted by the Bank of Canada's decision to temporarily pause rate hikes, have translated into greater homebuying activity in the London-St. Thomas market in recent weeks. The uptick, most pronounced for homes in the $400,000 to $600,000 price range, has filtered into every segment of the residential market, including luxury. Demand for properties priced over $1.2 million in the first quarter of the year are comparable to Q4 2022 levels at 40 but are down from the 259 sales reported in the first quarter of 2022. Balanced market conditions exist at present, but rising sales are depleting the limited supply of homes available for sale in London. Average prices at the top end have experienced some softening but remain propped up by low inventory levels. The southwest, northwest, and areas due north of the city are most popular with luxury buyers. Neighbourhoods such as Masonville and High Park have experienced big build up in recent years, sought-after by professionals who work in the hospitals, universities and colleges located in the North End of the city. The southwest has also experienced solid demand from high-end buyers seeking newer homes in close proximity to retail centres. New construction has faltered over the $1 million price point as the gap between resale and builders pricing increases. Several assignments have come to market in recent months as buyers look to recoup some of their losses. Luxury sales are expected to gain traction with the advent of the traditional spring market, but high-end buyers will remain somewhat cautious with the threat of further interest rate hikes ever present.

HAMILTON-BURLINGTON

- February sales showed increased strength at higher price points, with affluent buyers typically seeking newer, high-end product or older homes that have been completely gutted.

- Inventory levels are up over last year in the luxury segment but remain in balanced market territory.

- The uber-luxe segment of the market, priced between $4 million and $5 million, has performed relatively well as it is somewhat insulated from the overall market stressors.

While sales activity at the $2 million price point was down considerably from last year's record levels in Hamilton-Burlington, demand for luxury properties during the first quarter of 2023 show improvement over the previous quarter. Forty-three sales were recorded in the first three months of 2023, down from 171 during the same period one year ago but are well ahead of Q4 sales. The luxury segment now represents less than one per cent of overall sales in the Hamilton-Burlington market. Homebuying activity in the top end bottomed out in early in the year, with February sales showing increased strength at higher price points, with affluent buyers typically seeking newer, high-end product or older homes that have been completely gutted. Demand is greatest in southeast Burlington as luxury buyers move closer to the coveted Oakville area and proximity to the Toronto core. Popular high-end areas also include Ancaster, Dundas, and southwest Hamilton including Kirkendall. Inventory levels are up over last year in the luxury segment but remain in balanced market territory. The Bank of Canada decision to pause interest rate hikes has provided some stability to the marketplace, with both buyers and sellers returning to the market. To that point, there has been a notable uptick in showings of properties over $2 million in Hamilton in recent weeks. The uber-luxe segment of the market, priced between $4 million and $5 million has performed relatively well as it is somewhat insulated from the overall market stressors. Prices have held relatively stable at the top end, down approximately four per cent from year ago levels.

GREATER TORONTO AREA

- Hungry buyers returned to the market, expecting bargains and selection, but finding neither.

- Limited inventory has placed upward pressure on values and prompted a new round of competitive offers on well-priced homes in desirable areas.

- Buyers are feeling frustrated with the lack of selection available, particularly in the $3 million to $5 million prince range. Midtown communities such as Summerhill, Forest Hill, Annex, South Hill/Casa Loma, Bedford Park, and Lytton Park are most popular with this segment of the market.

Pent-up demand for housing in the Greater Toronto Area (GTA) was released with the Bank of Canada's decision to temporarily pause interest rates increases early in the first quarter of 2023. The move provided the impetus for homebuying activity to roar back to life throughout the city and in outlying areas. Hungry buyers returned to the market, expecting bargains and selection, but finding neither. Limited inventory has placed upward pressure on values and prompted a new round of competitive offers on well-priced homes in desirable areas. Momentum has since trickled into the luxury market over the $3 million price point, especially at the entry level. Year to date, more than 260 homes have sold at $3 million plus, down substantially from the peak level of 702 sales reported in the first quarter of 2022 but ahead of Q4 2022 levels. The average price for high-end freehold and condominium properties has remained relatively stable, falling about 2.7 per cent in Q1 2023 from frothy first quarter 2022 levels ($4,056,809 vs. $4,165,593). Of the close to 250 freehold sales reported over $3 million, 48 sold at or above list price, representing almost 20 per cent. Activity started to shift into high gear in late March, with more showings and sales reported, including two sales over $8 million. Buyers are feeling frustrated with the lack of selection available, particularly in the $3 million to $5 million range. Midtown communities such as Summerhill, Forest Hill, Annex, South Hill/Casa Loma, Bedford Park and Lytton Park are the most popular with this segment of the market. While entry and mid-level price points are heating up, the uber-luxe market remains soft, with just two sales occurring over the $10 million benchmark so far this year. Inventory levels are in large part responsible, with only two properties listed for sale in the sought-after Forest Hill and Rosedale neighbourhoods and 22 listed over $10 million throughout the remainder of the 416-area code. The foreign buyer ban has had a minor impact on the GTA thus far, given domestic buyers have dominated most of the movement in the market in recent years. Greater stability in the overall market has been noted with the Bank of Canada holding on interest rate hikes, with consumer confidence improving from last year's levels. As of late in the quarter, as a result of the SVB bank failure there seems to be a new wave of buyers wanting to make bigger purchases to get more of their cash into real estate. If the current trending continues in the high-end, the market will likely experience upward pressure on values once again.

OTTAWA

- Homebuying activity at the entry-level to luxury – between $1.25 million and $1.5 million – is particularly brisk, with more than half of all luxury sales occurring at that price point.

- Momentum is strong heading into the spring market, a direct contrast to Q4 2022, when uncertainties plagued the housing market.

- The stage is set for an active first quarter, with demand for luxury homes expected to gain traction in the coming months.

Rising consumer confidence levels contributed to a notable uptick in demand for housing in Ottawa's residential real estate market in the latter half of the first quarter. More than 90 luxury freehold and condominium properties changed hands over $1.25 million in the first three months of the year, surpassing Q4 levels for 2022 by seven per cent. Values are firming up at the top end of the market, given the limited supply of homes listed or sale. Homebuying activity at the entry-level to luxury – between $1.25 million and $1.5 million – is particularly brisk, with more than half of all luxury sales occurring at that price point. The average price of sales over $1.25 million was $1,593,310 in the first quarter of the year, off just five per cent from year-ago levels. Momentum heading into the spring market is strong, a direct contrast to the fourth quarter of the year when uncertainties plagued the housing market. Both buyers and sellers breathed a collective sigh of relief with the temporary pause in interest rate hikes in January and buyers ventured back into the market in February and March as mortgage rates fell. Luxury buyers in the nation's capital have typically been drawn to turn-key homes in established neighbourhoods, including Rockcliffe, Manor Park, Glebe, Old Ottawa, Golden Triangle, Westboro, Greeley and Manotick. Uber-luxe over the $3 million price point is on the road to recovery, with three sales posted year-to-date, down from five during the same period in 2022. The stage is set for an active second quarter, with demand for luxury homes expected to gain traction in the coming months. An influx of new listings is anticipated as the weather improves, with supply meeting demand.

ISLAND OF MONTREAL

- An ample supply of high-end, single-detached homes and condominiums is currently listed for sale across the city.

- Uber-luxe buyers have been active in the market recently, driving sales at $5 million plus, including a recent sale in Westmount for almost $8 million and Ville-Marie (Westmount adjacent) for $5.6 million.

- As homebuying momentum gains traction in the Island of Montreal heading into the busiest months of the year for the residential market, spillover is expected in the luxury segment.

Demand for luxury property in Montreal has edged up with the advent of the traditional spring market. Buoyed by the positive news delivered by the Bank of Canada in January and reinforced in March, buyers have finally returned to the market, taking advantage of greater selection and softer housing values in the upper end. While the number of homes that have changed hands at luxury price points in excess of $1.5 million remain well off last year's levels with 73 sales year-to-date, compared to 128 during the same period last year, momentum is heading in the right direction. There were 72 sales over $1.5 million in the fourth quarter of 2022. An ample supply of high-end, single-detached homes and condominiums is currently listed for sale across the city. Renovated and unique properties are sparking the greatest interest, especially in the luxurious pockets of Westmount, Outremont, and the Town of Mont-Royal. Most buyers at luxury price points are reluctant to purchase homes that require substantial updating, preferring instead to buy turn-key properties. Uber-luxe buyers have been active in the market recently, driving sales at $5 million plus, including a recent sale in Westmount for almost $8 million and Ville-Marie (Westmount adjacent) for $5.6 million. Most buyers are moving up, although some downsizing is also occurring, albeit at a slower pace, with sellers cashing in on equity gains realized over the past decade or so. Single-detached homes remain most sought-after while a glut of condominium product exists at higher price points. As homebuying momentum gains traction in the Island of Montreal heading into the busiest months of the year for the residential market, spillover is expected in the luxury segment. High-end homes that are well priced and well located will generate the greatest buzz, while tired properties will need to be updated or priced accordingly to sell. Pent-up demand has been building and if interest rates decline, there could be a flurry of activity as buyers, many of whom have been waiting on the fence for at least six to nine months, reinvigorate the housing market.

MONCTON

- The city's luxury space has experienced solid growth since the onset of the pandemic.

- A shortage of listings exists across every price point but are particularly scarce at the $700,000 threshold.

- As demand for properties in Moncton and the surrounding areas soared and pricing matured, instances of sales over the million-dollar benchmark increased.

Homebuying activity in Moncton's upper-end has been relatively solid year-over-year, with the number of sales over the $700,000 price point falling just one short of 2022 first quarter levels. Thirteen properties (including eight closed and five pending) were sold in Q1 2023, down from the 14 sales during the same period in 2022. First quarter sales were up on par with fourth quarter sales. The city's luxury space has experienced solid growth since the onset of the pandemic. Prior to 2020, few sales occurred over the $700,000 price point. As demand for properties in Moncton and the surrounding areas soared and pricing matured, instances of sales over the million-dollar benchmark increased. Average price at the top end of the market hovered at $826,750 in the first quarter (based on the eight sales – no price available for pending), compared to $811,121 in the first quarter of 2022. While the vast majority of sales in the city are occurring at lower price points, the upper tier is attracting both professionals and out of area buyers who are fascinated by the reasonable cost of housing. Shediac is of particular interest with out of province and foreign buyers seeking the coastal lifestyle at a fraction of the cost of housing on the west coast. The most popular areas with affluent local buyers include properties situated on the golf course in Dieppe and more rural areas like Irishtown. A shortage of listings exists across every price point but are particularly scarce at the $700,000 threshold. Many sellers are sitting on their luxury properties, given that there is little product from which to choose, and a reluctance to commit to higher mortgage rates. While the promise of a temporary pause in interest rate hikes has provided some stability in Moncton's residential housing market, the real push for high-end real estate will materialize later this year once interest rates decline. The luxury segment represents approximately eight per cent of overall sales in Moncton and the surrounding area.

HALIFAX

- Pent-up demand is building, yet there are numerous buyers on the fence, despite the pause in interest rate increases.

- Inventory remains sparse at the top end of the market, with limited product available in high-demand areas such as the Peninsula of Halifax, along with Bedford and the Fall River areas.

- Luxury sales in the first quarter of 2023 were slightly ahead of fourth quarter 2022 levels, but it's too soon to tell if the spring market will blossom

While luxury sales have remained relatively steadfast in the first quarter of 2023, there has been a nominal uptick in overall activity in Halifax in recent weeks with the arrival of the spring market. Forty-two homes including freehold and condominiums have sold over the $1 million price point to date, down almost 50 per cent from year-ago levels during the same period. Values, however, have remained consistent year over year, averaging $1.3 million. The luxury segment represents about five per cent of the overall market. Pent-up demand is building, yet there are numerous buyers on the fence, despite the pause in interest rate increases. Uncertainty has played a role in the market, particularly in recent weeks given the banking crisis in the US and its global reverberations. Inventory remains sparse at the top end of the market, with limited product available in high-demand areas such as the Peninsula of Halifax, along with Bedford and the Fall River areas. Approximately 120 active listings are currently available for sale, down from year-ago levels but up proportionately to the overall active listings. Trade-up activity at the top end is still occurring but has slowed somewhat as fewer people are benefitting from the big equity gains that the last two years provided. Square footage and large lots are the foremost features driving the move-up market, while waterfront, harbourfront, and lakefront homes are commanding a premium. Luxury sales in the first quarter of 2023 were slightly ahead of fourth quarter 2022 levels, but it's too soon to tell if the spring market will blossom. Homebuying activity in the year ahead is likely to be slower than in previous years for the luxury segment, given fewer migratory buyers from other provinces and the implementation of the foreign buyers ban.

ST. JOHN'S

- Sellers are hesitant to list their properties due to the dearth of available listings, and builders are reluctant to put a shovel in the ground without a firm commitment given today's higher-interest-rate environment.

- Representing about five per cent of total sales, the luxury segment has taken off in recent years thanks to the province's strong economic base which remains propped up by the province's natural resources.

- The Bank of Canada announcement regarding the temporary pause in interest rates has been welcome news to buyers in the St. John's area. While it has yet to translate into greater sales at the top end of the market, it has provided some stability for the impending spring market.

While demand for luxury properties continues to build in St. John's, existing inventory continues to fall short of buyer expectations. After a brisk fourth quarter of 2022, when close to 60 high-end properties priced in excess of $600,000 changed hands, just 18 properties sold in the first quarter of 2023 (almost on par with year-ago levels for the same period). Sellers are hesitant to list their properties due to the dearth of available listings, and builders are reluctant to put a shovel in the ground without a firm commitment given today's higher-interest-rate environment. Throughout the first three months of the year, buyers braved inclement weather to visit the few new high-end listings that came to market. One property, priced over $800,000, experienced 15 showings and three offers, selling on its first day on market. Representing about five per cent of total sales, the luxury segment has taken off in recent years thanks to Newfoundland/Labrador's strong economic base which remains propped up by the province's natural resources. There has been a slight uptick in recent weeks as the spring market takes hold. Move-up buyers are most active in the upper-end, with most seeking large homes, featuring 9 ft. ceilings, spacious kitchens, and generous lot sizes. While many will gravitate to newer construction in the high-end, the cookie-cutter homes of yesterday will not suffice. Luxury buyers interested in building custom homes are spending $500,000 for lots in established enclaves such as Churchill Square. Those seeking mature areas at a lower sticker price are attracted to Clovelly Trails in the east end where buyers can pick up a lot for $150,000 to $160,000 and build their dream home. Neighbourhoods such as Logy Bay are a popular choice with those seeking existing luxury homes. In the coveted Portugal Cove / St. Philips and Paradise communities, luxury properties in Country Gardens are highly sought-after, but listings are few and far between. While the foreign buyer ban has restricted purchases within St. John's, the neighbouring coastal areas have experienced some activity as they are not subject to the ban. The Bank of Canada announcement regarding the temporary pause in interest rates has been welcome news to buyers in the St. John's area. While it has yet to translate into greater sales at the top end of the market, it has provided some stability for the impending spring market.

About the RE/MAX Network

As one of the leading global real estate franchisors, RE/MAX, LLC is a subsidiary of RE/MAX Holdings (NYSE: RMAX) with more than 140,000 agents in almost 9,000 offices with a presence in more than 110 countries and territories. RE/MAX Canada refers to RE/MAX of Western Canada (1998), LLC, RE/MAX Ontario-Atlantic Canada, Inc., and RE/MAX Promotions, Inc., each of which are affiliates of RE/MAX, LLC. Nobody in the world sells more real estate than RE/MAX, as measured by residential transaction sides.

RE/MAX was founded in 1973 by Dave and Gail Liniger, with an innovative, entrepreneurial culture affording its agents and franchisees the flexibility to operate their businesses with great independence. RE/MAX agents have lived, worked and served in their local communities for decades, raising millions of dollars every year for Children's Miracle Network Hospitals® and other charities. To learn more about RE/MAX, to search home listings or find an agent in your community, please visit remax.ca. For the latest news from RE/MAX Canada, please visit blog.remax.ca.

Forward looking statements

This report includes "forward-looking statements" within the meaning of the "safe harbour" provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as "believe," "intend," "expect," "estimate," "plan," "outlook," "project," and other similar words and expressions that predict or indicate future events or trends that are not statements of historical matters. These forward-looking statements include statements regarding housing market conditions and the Company's results of operations, performance and growth. Forward-looking statements should not be read as guarantees of future performance or results. Forward-looking statements are based on information available at the time those statements are made and/or management's good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. These risks and uncertainties include (1) the global COVID-19 pandemic, which has impacted the Company and continues to pose significant and widespread risks to the Company's business, the Company's ability to successfully close the anticipated reacquisition and to integrate the reacquired regions into its business, (3) changes in the real estate market or interest rates and availability of financing, (4) changes in business and economic activity in general, (5) the Company's ability to attract and retain quality franchisees, (6) the Company's franchisees' ability to recruit and retain real estate agents and mortgage loan originators, (7) changes in laws and regulations, (8) the Company's ability to enhance, market, and protect the RE/MAX and Motto Mortgage brands, (9) the Company's ability to implement its technology initiatives, and (10) fluctuations in foreign currency exchange rates, and those risks and uncertainties described in the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission ("SEC") and similar disclosures in subsequent periodic and current reports filed with the SEC, which are available on the investor relations page of the Company's website at www.remax.com and on the SEC website at www.sec.gov. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Except as required by law, the Company does not intend, and undertakes no duty, to update this information to reflect future events or circumstances.

SOURCE RE/MAX Canada

Uncategorized

Mortgage rates fall as labor market normalizes

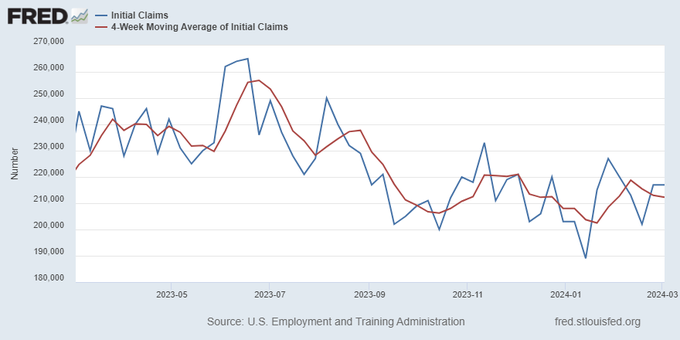

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

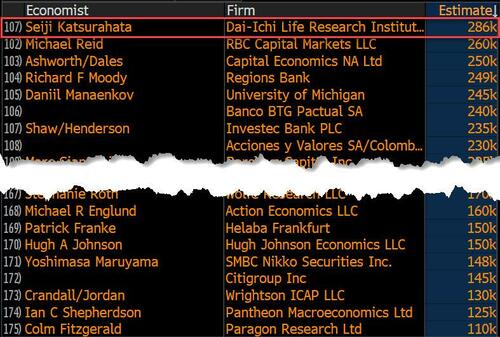

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

Uncategorized

Economic Earthquake Ahead? The Cracks Are Spreading Fast

Economic Earthquake Ahead? The Cracks Are Spreading Fast

Authored by Brandon Smith via Alt-Market.us,

One of my favorite false narratives…

Authored by Brandon Smith via Alt-Market.us,

One of my favorite false narratives floating around corporate media platforms has been the argument that the American people “just don’t seem to understand how good the economy really is right now.” If only they would look at the stats, they would realize that we are in the middle of a financial renaissance, right? It must be that people have been brainwashed by negative press from conservative sources…

I have to laugh at this notion because it’s a very common one throughout history – it’s an assertion made by almost every single political regime right before a major collapse. These people always say the same things, and when you study economics as long as I have you can’t help but throw up your hands and marvel at their dedication to the propaganda.

One example that comes to mind immediately is the delusional optimism of the “roaring” 1920s and the lead up to the Great Depression. At the time around 60% of the U.S. population was living in poverty conditions (according to the metrics of the decade) earning less than $2000 a year. However, in the years after WWI ravaged Europe, America’s economic power was considered unrivaled.

The 1920s was an era of mass production and rampant consumerism but it was all fueled by easy access to debt, a condition which had not really existed before in America. It was this illusion of prosperity created by the unchecked application of credit that eventually led to the massive stock market bubble and the crash of 1929. This implosion, along with the Federal Reserve’s policy of raising interest rates into economic weakness, created a black hole in the U.S. financial system for over a decade.

There are two primary tools that various failing regimes will often use to distort the true conditions of the economy: Debt and inflation. In the case of America today, we are experiencing BOTH problems simultaneously and this has made certain economic indicators appear healthy when they are, in fact, highly unstable. The average American knows this is the case because they see the effects everyday. They see the damage to their wallets, to their buying power, in the jobs market and in their quality of life. This is why public faith in the economy has been stuck in the dregs since 2021.

The establishment can flash out-of-context stats in people’s faces, but they can’t force the populace to see a recovery that simply does not exist. Let’s go through a short list of the most faulty indicators and the real reasons why the fiscal picture is not a rosy as the media would like us to believe…

The “miracle” labor market recovery

In the case of the U.S. labor market, we have a clear example of distortion through inflation. The $8 trillion+ dropped on the economy in the first 18 months of the pandemic response sent the system over the edge into stagflation land. Helicopter money has a habit of doing two things very well: Blowing up a bubble in stock markets and blowing up a bubble in retail. Hence, the massive rush by Americans to go out and buy, followed by the sudden labor shortage and the race to hire (mostly for low wage part-time jobs).

The problem with this “miracle” is that inflation leads to price explosions, which we have already experienced. The average American is spending around 30% more for goods, services and housing compared to what they were spending in 2020. This is what happens when you have too much money chasing too few goods and limited production.

The jobs market looks great on paper, but the majority of jobs generated in the past few years are jobs that returned after the covid lockdowns ended. The rest are jobs created through monetary stimulus and the artificial retail rush. Part time low wage service sector jobs are not going to keep the country rolling for very long in a stagflation environment. The question is, what happens now that the stimulus punch bowl has been removed?

Just as we witnessed in the 1920s, Americans have turned to debt to make up for higher prices and stagnant wages by maxing out their credit cards. With the central bank keeping interest rates high, the credit safety net will soon falter. This condition also goes for businesses; the same businesses that will jump headlong into mass layoffs when they realize the party is over. It happened during the Great Depression and it will happen again today.

Cracks in the foundation

We saw cracks in the narrative of the financial structure in 2023 with the banking crisis, and without the Federal Reserve backstop policy many more small and medium banks would have dropped dead. The weakness of U.S. banks is offset by the relative strength of the U.S. dollar, which lures in foreign investors hoping to protect their wealth using dollar denominated assets.

But something is amiss. Gold and bitcoin have rocketed higher along with economically sensitive assets and the dollar. This is the opposite of what’s supposed to happen. Gold and BTC are supposed to be hedges against a weak dollar and a weak economy, right? If global faith in the dollar and in the U.S. economy is so high, why are investors diving into protective assets like gold?

Again, as noted above, inflation distorts everything.

Tens of trillions of extra dollars printed by the Fed are floating around and it’s no surprise that much of that cash is flooding into the economy which simply pushes higher right along with prices on the shelf. But, gold and bitcoin are telling us a more honest story about what’s really happening.

Right now, the U.S. government is adding around $600 billion per month to the national debt as the Fed holds rates higher to fight inflation. This debt is going to crush America’s financial standing for global investors who will eventually ask HOW the U.S. is going to handle that growing millstone? As I predicted years ago, the Fed has created a perfect Catch-22 scenario in which the U.S. must either return to rampant inflation, or, face a debt crisis. In either case, U.S. dollar-denominated assets will lose their appeal and their prices will plummet.

“Healthy” GDP is a complete farce

GDP is the most common out-of-context stat used by governments to convince the citizenry that all is well. It is yet another stat that is entirely manipulated by inflation. It is also manipulated by the way in which modern governments define “economic activity.”

GDP is primarily driven by spending. Meaning, the higher inflation goes, the higher prices go, and the higher GDP climbs (to a point). Eventually prices go too high, credit cards tap out and spending ceases. But, for a short time inflation makes GDP (as well as retail sales) look good.

Another factor that creates a bubble is the fact that government spending is actually included in the calculation of GDP. That’s right, every dollar of your tax money that the government wastes helps the establishment by propping up GDP numbers. This is why government spending increases will never stop – It’s too valuable for them to spend as a way to make the economy appear healthier than it is.

The REAL economy is eclipsing the fake economy

The bottom line is that Americans used to be able to ignore the warning signs because their bank accounts were not being directly affected. This is over. Now, every person in the country is dealing with a massive decline in buying power and higher prices across the board on everything – from food and fuel to housing and financial assets alike. Even the wealthy are seeing a compression to their profit and many are struggling to keep their businesses in the black.

The unfortunate truth is that the elections of 2024 will probably be the turning point at which the whole edifice comes tumbling down. Even if the public votes for change, the system is already broken and cannot be repaired without a complete overhaul.

We have consistently avoided taking our medicine and our disease has gotten worse and worse.

People have lost faith in the economy because they have not faced this kind of uncertainty since the 1930s. Even the stagflation crisis of the 1970s will likely pale in comparison to what is about to happen. On the bright side, at least a large number of Americans are aware of the threat, as opposed to the 1920s when the vast majority of people were utterly conned by the government, the banks and the media into thinking all was well. Knowing is the first step to preparing.

The second step is securing your own financial future – that’s where physical precious metals can play a role. Diversifying your savings with inflation-resistant, uninflatable assets whose intrinsic value doesn’t rely on a counterparty’s promise to pay adds resilience to your savings. That’s the main reason physical gold and silver have been the safe haven store-of-value assets of choice for centuries (among both the elite and the everyday citizen).

* * *

As the world moves away from dollars and toward Central Bank Digital Currencies (CBDCs), is your 401(k) or IRA really safe? A smart and conservative move is to diversify into a physical gold IRA. That way your savings will be in something solid and enduring. Get your FREE info kit on Gold IRAs from Birch Gold Group. No strings attached, just peace of mind. Click here to secure your future today.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International13 hours ago

International13 hours agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges