International

How visas for social care workers may be exacerbating exploitation in the sector

An independent report details ‘shocking’ Home Office mishandling of the visas.

The health and social care visa route was introduced in August 2020 as a response to labour shortages after Brexit and the COVID pandemic. Now, the independent chief inspector of borders and immigration has found that the Home Office’s “limited understanding of the sector” has put care workers at risk of exploitation.

An independent report, published in March, details the Home Office’s “shocking” mishandling of the visas. It highlights problems in the way that the system to give social care providers the ability to sponsor workers from abroad operates. In one case, “275 certificates of sponsorship [were] granted to a care home that did not exist”.

The Home Office responded that this incident involved “a licence granted in the name of a real care home without their knowledge … obtained using false information/evidence”. It has accepted the chief inspector’s recommendations to improve the system, and said that many of these improvements were already underway.

The report details how the Home Office system has buckled under unforeseen demand for visas. The number of registered sponsors tripled from 30,730 organisations in 2019 to 94,704 by the end of November 2023, putting considerable pressure on the officials responsible for checking compliance with UK employment law and preventing migrants from working illegally. These issues are particularly acute in the care sector due to low pay and poor working conditions.

According to the inspector’s report, these weaknesses have created a scenario that puts large numbers of care workers at risk of exploitation. And the nature of restrictive visas, where your legal immigration status is tied to your role at a specific employer, means that care workers are discouraged from raising concerns about pay and conditions out of fear of losing their status.

Exploitation in the care sector

Exploitation in the care sector, including forced labour (a type of modern slavery), has been a concern for years. The Joseph Rowntree Foundation highlighted these issues in a report more than a decade ago. But figures have spiked alarmingly in recent years, according to the charity Unseen, which runs the UK’s modern slavery helpline.

In 2022, the year that the new health and care visa was added to the UK’s shortage occupation list, Unseen recorded a year-on-year increase of 606% in cases reported by care workers. Calls from potential victims of modern slavery from the care sector rose from 708 potential victims in 2022 to 918 in 2023.

My own research shows that care worker exploitation usually falls into one of four areas: debt bondage, recruitment, pay and substandard working practices. Live-in care workers are particularly vulnerable. Migrants may seek out live-in care jobs because accommodation is included.

Workers may become indebted to a recruitment agency, loan shark or members of their own family to secure a visa, only to then find that this is almost impossible to pay off from their wages. They may be deceived by the sponsoring organisation into paying extortionate visa costs – illegal recruitment fees of between £2,000 and £18,000 have been reported. And when they arrive in the UK, some find the job they expected fails to materialise. At least one local authority has identified a small number of such cases of organised immigration crime.

There have also been reports of “clawback clauses” in care workers’ contracts. Some of these clauses require care workers to forego their final month’s salary and to pay back training and immigration costs to their employer. While proportionate repayments are legal, there is little guidance on the exact amounts that can be reclaimed. There have been reports of exit penalties amounting to between £1,300 and £11,500.

Transparency in supply chains

The Modern Slavery Act requires large commercial organisations to publish details of how they are preventing exploitation. But this does not currently apply to the majority of smaller providers or the local authorities who commission social care. The government has yet to make good on its 2019 promise to extend the transparency in supply chains duty to public authorities.

An encouraging number of local authorities have participated voluntarily, and have added their statements to a repository run by the Local Government Association.

But the government should be doing more to require transparency, given the level of exploitation still in the sector. The introduction of sanctions on all organisations who fail to publish annually could also encourage compliance and, as in other countries, provide valuable compensation funds for survivors.

At Nottingham University’s Rights Lab, I have worked with three English local authorities and the Local Government Association, to publish a set of guidelines for social care commissioners. These guidelines, which build on the Organisation for Economic Co-operation and Development’s Responsible Business Conduct framework, encourage local authorities to shore up worker protection in their social care contracts.

The UK needs social care workers, and visas for them, but even with planned changes to the sponsorship rules, it seems the risk of exploitation among care workers will remain.

Caroline Emberson works for the University of Nottingham. She has received funding for her research from the University of Nottingham, the UKs Economic and Social Research Council and the charitable foundation Trust for London.

uk pandemicInternational

Fauci To Testify In Public Hearing On COVID-19 Response, Origins

Fauci To Testify In Public Hearing On COVID-19 Response, Origins

Authored by Stephen Katte via The Epoch Times,

Dr. Anthony Fauci is locked…

Authored by Stephen Katte via The Epoch Times,

Dr. Anthony Fauci is locked in to testify before the Select Subcommittee on the Coronavirus Pandemic on June 3, his first public hearing since retiring as the president’s chief medical advisor in 2022.

Subcommittee Chair Brad Wenstrup (R-Ohio) announced in an April 24 press release that Dr. Fauci agreed to appear late last year.

“Retirement from public service does not excuse Dr. Fauci from accountability to the American people,” Mr. Wenstrup said.

“On June 3, Americans will have an opportunity to hear directly from Dr. Fauci about his role in overseeing our nation’s pandemic response, shaping pandemic-era policies, and promoting singular questionable narratives about the origins of COVID-19.”

Dr. Fauci testified in a closed door hearing in January.

According to Mr. Wenstrup, Dr. Fauci has already admitted “to serious systemic failures in our public health system,” which he says deserves “further investigation.”

Mr. Wenstrup says among other revelations, Dr. Fauci has said the six feet apart social distancing guidance, recommended by federal health officials and used to shut down small businesses across the country, “’sort of just appeared,” and was likely not based on scientific data.

During the two-day January hearing, Dr. Fauci revealed he signed off on every foreign and domestic NIAID grant without personally reviewing the proposals.

He also admitted that America’s vaccine mandates, which he promoted, could increase the public’s vaccine hesitancy in the future.

Lab Leak—Not So Far-Fetched

At the same time, Dr. Fauci said the lab leak hypothesis around COVID-19’s origins might not be a conspiracy theory, despite his previous very public assertions that it was.

The lab leak theory claims that SARS-CoV-2, the virus that causes COVID-19, was developed at the Wuhan Institute of Virology (WIV) and was accidentally leaked. In the years since COVID first appeared, this hypothesis has been gaining steam, with even the former head of the Chinese Center for Disease Control and Prevention (China CDC) saying it can’t be ruled out as an option.

Mr. Wenstrup claimed that during the previous hearing, Dr. Fauci said he “did not recall” specific COVID-19 information and conversations relevant to the Select Subcommittee’s investigations over 100 times.

A full transcript is expected to be released before the public hearing in June.

Mr. Wenstrup believes the testimony shared so far “raises significant concerns about public health officials and the validity of their policy recommendations during the COVID-19 pandemic.”

“We also learned that he believes the lab leak hypothesis he publicly downplayed should not be dismissed as a conspiracy theory,” he said.

“As the face of America’s public health response to the COVID-19 pandemic, these statements raise serious questions that warrant public scrutiny,” Mr. Wenstrup added.

Following Dr. Fauci’s hearing, the select subcommittee will also hold a public hearing with EcoHealth Alliance president Dr. Peter Daszak on May 1.

Mr. Wenstrup said it “will serve as a crucial component of our investigation into the origins of COVID-19 and provide essential background ahead of Dr. Fauci’s public hearing.”

“We look forward to both Dr. Fauci’s and Dr. Daszak’s forthcoming and honest testimonies, and appreciate their willingness to voluntarily appear before the Select Subcommittee for public hearings.”

International

This island is often called the ‘Hawaii of Europe’ – Is it really?

Madeira is very popular among European sun-seekers but exotic for Americans.

If you live anywhere on the European continent, Hawaii can seem very far away and exotic.

Without any direct flights, going to Honolulu from cities like London or Paris will require either flying across an ocean and a continent for a transfer in Los Angeles or going in the other direction with a stopover in Tahiti — in either case, a journey that can take more than 20 hours of travel.

Related: Travelers should really stop doing this annoying thing

As a result, many choose much closer destinations for a weekend away. In the last year, the nickname “Hawaii of Europe” for the Portuguese island of Madeira has increasingly taken off as a popular place to go as Portugal itself has been seeing an explosion in touristic demand post-pandemic.

Every couple of weeks, a travel writer will write about visiting “the Hawaii of Europe” to tap into “where could that be?” reader curiosity among North Americans (the average European will already know Madeira.)

Shutterstock

Why Madeira is so often called the ‘Hawaii of Europe’

While only a 90-minute flight from Lisbon, Madeira sits on the African Tectonic plate and so has multiple similarities with the tropical state in the South Pacific — crystal-blue waters interspersed with verdant hills, volcanic zones and a similar culture of farm workers and tourists coming in for the season (in the 1800s, thousands of Madeiran immigrants found their way to Hawaii for economic opportunity.)

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

“As a large European tourist destination, Madeira welcomes approximately 1.2 million tourists a year,” writes a cross-cultural group. “There are opportunities for Hawaii to learn from Madeira, and vice versa, particularly in the area of eco-tourism and attracting European visitors.” It also touched base on the history of cross-migration and its similar environmental needs as “remote oceanic islands.”

If you’ve been following my writing, you may have read a piece voicing my dislike for calling smaller cities the “Paris of” something or “the Dubai of” something else. It’s simply a matter of geography and, if you live in the UK, you do not need any comparisons to view Madeira as a great place to go (over 330,000 Brits went last year, making up the largest group of international visitors by far) while I grew up on the West Coast of Canada and have been to actual Hawaii enough times to not consider it exotic.

Two places that are beautiful and absolutely worth a visit

“Palermo is not ‘the new Lisbon’ while Curaçao is not a ‘St. Maarten dupe.’ All of these places are beautiful and worth a visit if only funds for frequent travel would allow,” I wrote at the time. “[…] With so much of the travel experience now available on social media for those who cannot go in person to experience, I think we really need to move away from calling smaller cities the ‘something of something else’ and start finding the wonders of different places (the world is large and there are so many out there.)”

Due to the shared history of migration, Madeira is probably closer to Hawaii than most other similar comparisons. But in either case, it looks absolutely stunning. Everyone should visit.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic canada european europe ukInternational

Falling Bond Yields Show It’s Crunch Time In China

Falling Bond Yields Show It’s Crunch Time In China

Authored by Simon Black, Bloomberg macro strategist,

Sovereign yields in China have been…

Authored by Simon Black, Bloomberg macro strategist,

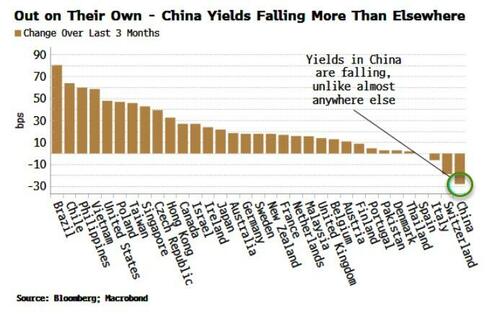

Sovereign yields in China have been falling in recent months, in marked contrast to almost every other major country. This is a key macro variable to watch for signs China is ready to ease policy more comprehensively as its tolerance is tested for an economy that is becoming increasingly deflationary. Further, vigilance should be increased for a yuan devaluation. Though not a base case, the tail-risk of one occurring is rising.

Year of the Dragon in China it may be, but the economy has yet to exhibit the abundance of energy and enthusiasm those born under the symbol are supposed to possess. China failed to exit the pandemic with the resurgence in growth seen in many other countries, and the outlook has been lackluster ever since.

But we are entering the crunch phase, where China needs to respond forcefully, or face the prospect of a protracted debt-deflation. The signal is coming from falling government yields. They have been steadily falling all year, at a faster pace than any other major EM or DM country. Indeed yields have been rising in almost every other country.

That’s a problem for the yuan. The drop in China’s yields is adding pressure on the currency. Widening real-yield differentials show that there remains a strong pull higher on the dollar-yuan pair.

The question is: will this prompt a devaluation in the yuan? The short answer is less likely than not, but it can’t be discounted, and the risks are rising as long as capital outflows continue to climb.

We can’t measure those directly in China as the capital account is nominally closed. But we can proxy for them by looking at the trade surplus, official reserves held at the PBOC, and foreign currency held in bank deposits. The trade surplus is a capital inflow, and whatever portion of it that does not end up either at the PBOC or in foreign-currency bank accounts we can infer is capital outflow.

This measure is rising again, as more capital typically tries to leave the country when growth is sub-par, as it is today.

So far, China appears to be managing the decline in the yuan versus the dollar. USD/CNY has been bumping up against the 2% upper band above the official fix for the pair. But China is stabilizing the yuan’s descent through the state-banking sector. As Brad Setser noted in a recent blog, the PBOC has stated that it has more or less exited from the FX market. Instead, that intervention now takes place unofficially using dollar deposits held at state banks.

China has plenty of foreign-currency reserves to stave off continued yuan weakness (more so than is readily visible, according to Setser), but there is always the possibility policymakers decide to ameliorate the destructive impact on domestic liquidity from capital outflow by allowing a larger, one-time devaluation. There is speculation this is where China is headed, and that it is behind its recent stockpiling of gold, copper and other commodities.

However, there are risks attached to such a move, given it might be detrimental to the more normalized markets that China covets in the name of financial stability, as well potentially prompting a tariff response from the US.

A devaluation is a low, but non-zero, possibility that has risen this year. Either way, the drop in bond yields underscores that China will soon need to do something more dramatic to avert the risk of a debt deflation.

In the past, the current rate of decline in sovereign yields has led to a forthright easing response from China, with a rise in real M1 growth typically seen over the next six-to-nine months.

But M1 growth in China has singularly failed to bounce back so far despite several hints that it was about to. This is likely a deliberate policy choice as rises in narrow money are reflective of broad-based “flood-like” stimulus that policymakers in China have explicitly ruled out as recently as January, in comments from Premier Li Qiang. Policymakers are laser-focused on not re-inflating the shadow-finance sector, which continues to be squeezed.

Shadow finance led to unwanted speculative froth in markets, real estate and investment that China does not want to see reprised. But its curbs have been too successful. Credit remains hard-to-get where it is needed most, typically the non state-owned sectors.

The slowdown this fostered was amplified by China’s response to the pandemic. Rather than supporting household demand, policymakers in China supported the export sector, leading to a surge in outward-bound goods.

Stringent lockdowns prompted households to become exceptionally risk averse, increasing their savings, and being reluctant to spend even after restrictions were lifted, lest the government decided to paralyze the economy again at some future time.

This also caused the real estate sector to implode, prompting multiple piecemeal easing measures to support housing prices and indebted property developers, to little avail so far: leading indicators for real estate such as floor-space started remain muted or weak, while the USD-denominated debt of property companies continues to trade at less than 25 cents in the dollar.

China has a large and growing debt pile that is only set to get worse as its demographics continue to deteriorate. The alarming chart below from the IMF projects public debt (including local government financing vehicles) in China to accelerate way ahead of that in the US in the coming years, to around 150% of GDP by the end of the decade. Total non-financial debt is already closing in on 300% of GDP.

Source: IMF

This raises the risk of a debt-deflation, when the value of assets and the income from them fall in relation to the value of liabilities. Debt becomes increasingly difficult to service and pay back, leading to lower consumption and investment, entrenched deflation and derisory growth that is difficult to escape.

Woody Allen once quipped that mankind is at a crossroads, one road leads to despair and utter hopelessness and the other to total extinction. China’s choices are not yet that stark, but the longer it waits to deliver an emphatic response to its predicament, they may soon become that way.

-

International1 month ago

International1 month agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government3 weeks ago

Government3 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

Spread & Containment6 days ago

Spread & Containment6 days agoJ&J’s AI head jumps to Recursion; Doug Williams resigns as Sana’s R&D chief

-

Government2 days ago

Government2 days agoCOVID-19 Vaccine Emails: Here’s What The CDC Hid Behind Redactions

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.