How Bitcoin Rectifies Easy Money’s Destruction of Growth And Prosperity

Central bank interventions in the monetary system – from lowering interest rates to printing money – do not change peoples’ saving and spending behavior: They only redirect it.

Central bank interventions in the monetary system - from lowering interest rates to printing money - do not change peoples’ saving and spending behavior: They only redirect it.

We live in a highly politicized world today - we spite our neighbors, refuse to watch certain news channels, and increasingly ignore any information which counters our own preconceived views. Our wealth gap in the developed world is rising, and calamities like the pandemic are highlighting and exacerbating those divides.

What brought our society to this point? With technological advancements and scientific progress seemingly unstoppable, why are we not living in a world where we are content, stress levels are low, food is healthy, agriculture is sustainable, and housing is affordable?

Every day, we lean on our elected officials and brilliant minds to help us navigate these waters as a society and lead us to an ideal world which seems so close, yet so far. Unfortunately, our leaders are armed with an incorrect map to reach that world. The theories they rely on to make decisions that affect our jobs, businesses, and livelihoods suffer several fatal flaws - one of which we will explore here.

Central Banks And Consumer Behavior

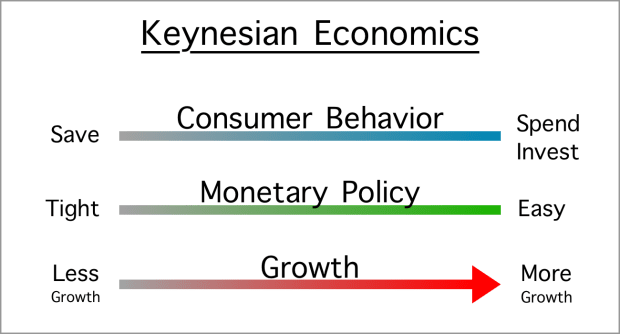

Traditional Keynesian economic theory, popular among all the leading economists in academia and government today, espouses a certain relationship between consumer behavior and central bank policy.

Keynesian theory dictates that easy money policies drive people and businesses to spend and invest, which drives growth and takes up the slack in a waning economy. Tight policies drive saving, as higher yields attract consumers and businesses to purchase financial assets earning those yields.

Almost all major central banks and governments for the past 50 years have favored easy monetary policy, believing it spurs growth across the economy and raises living standards. Easy monetary policy means lower interest rates as well as more aggressive tactics to “provide liquidity” in currency, like quantitative easing and cooperating with governments to increase their spending using newly-created cash.

This relationship between monetary policy, growth, and consumer behavior is an accepted fact today within any respected economics institution. We continue to teach these relationships to our best and brightest at top universities from the 101 level up, and it forms the basis of policy actions by modern central banks.

This is the map our policymakers are holding today.

The Meaning Of Saving And Investment

We need to pause for a moment - in Keynesian economic theory, investment is placed opposite from saving. Easy monetary policy supposedly drives investment and thereby economic growth, while tight monetary policy drives saving.

However, I bet when you think of investing today you think about saving. That extra income you make each month gets saved by way of an investment, like a stock, 401k, or some other financial instrument. Why then does Keynesian theory place these two on opposite ends of a spectrum?

Clearly we need a more nuanced understanding of the relationship between consumer behavior and monetary policy than Keynesian theory gives us.

Introducing Time Preference

The foundational economic concept of time preference gives us a tool for understanding consumer behavior independent of monetary policy. Time preference simply describes an individual's propensity to delay gratification in order to satisfy future needs more fully. Lower time preference means more willingness to delay gratification and treat your future self well, while high time preference indicates a desire for instant gratification over future needs.

Intending to store your purchasing power over time, also known as saving money, is on the lower end of the time preference spectrum. Spending money for consumable pleasures is on the higher end. This is not to say either end is better or worse - both have their time and place - but just to set up how this spectrum can chart our behaviors.

Through the lens of time preference, investment is a low time preference activity which the investor undertakes to carry and grow their money over time. Saving cash is similarly a low-time-preference activity, delaying gratification so that cash can be used to satisfy future needs. Saving cash and making investments are both low time preference activities.

How does this understanding mesh with Keynesian theory, which tries to tie investment and saving to opposite ends of the behavioral and monetary policy spectrum?

Time Preference And Monetary Policy

We need to look at time preference as a separate axis from monetary policy. Individuals with a low time preference can still desire to store their purchasing power over time regardless of central bank monetary policy.

Mainstream Keynesian economic theory misses the fact that central bank monetary policies likely have little effect on peoples’ actual time preferences, but they do have a massive effect on the assets people use to express those preferences.

Research on the empirical reality of the relationship between saving behavior and the main tool of monetary policy until recently - interest rate manipulation - backs this up. The Federal Reserve in this 1996 paper admits that mountains of research on the impact of monetary policy on savings is inconclusive.

“First, economists' understanding of the response of saving to changes in interest rates is quite limited, despite a large volume of research on the topic. Different models of consumer behavior imply different magnitudes for the interest elasticity of saving, and even different signs. Each model probably describes the behavior of some people, and it is not clear which model best characterizes the behavior of the "average saver." Thus, it is simply not possible to provide a precise estimate of the interest elasticity of saving with any confidence.”

Individuals echo this lack of relationship as well - stating that low interest rates are not spurring spending in their circumstances. Only one’s confidence in their own income and the strength of the economy can do that.

This leads us to a new understanding of the relationship between consumer behavior and monetary policy. Both are independent, but changes in monetary policy can change the assets in which savers put their savings.

Central banks are only capable of manipulating the supply of cash - a very powerful commodity given its use in trade and economic calculation. They do not create food, homes, or other productive capital which we use to produce the goods and services we desire. However, their impact on cash gives central banks a massive influence on all prices, for goods and assets alike.

When central banks ease by making cash and credit more available, they lower the returns from holding cash and other low-risk savings options, making them less attractive as a vehicle for saving. The availability of more cash absent real economic growth leads to upward pressure on prices. Again, the central bank does not provide real economic growth - it only pushes cash into the economy.

Individuals with a low time preference who desire to store their savings and transport them to the future must now beat rising prices. Said more simply, their return on investment must beat inflation. This drives investment into progressively riskier projects and strategies with higher potential returns.

The more cash is printed, the higher prices go, and the more risk must be taken on just to stay afloat over time.

For very risk-averse investors, another effect takes hold. These investors simply desire to lose less than inflation. If cash loses value against goods and services at 6% per year, investors are happy to buy anything with an expected return of more than negative 6%. Investing in a business that loses 5% per annum is worthwhile in this environment! This environment makes for a terrible time for savers.

Easing or tightening monetary policy does not change time preferences directly, it only alters the asset classes and strategies individuals can use to most effectively express their preferences.

The Real Impact Of Easy Money On Economic Growth

Central banks, using their Keynesian map of the world, believe easy monetary policy drives economic growth by spurring spending and investment. However, given our understanding of time preference and the different vehicles for storing value over time, we see a different map coming into view.

Civilization-building investments: solid education, clean water, sustainable agriculture, high quality infrastructure, durable tools and the like tend to have “low and slow” returns. They cost a lot to build and take a long time to pay off.

Easy money and resulting inflation make civilization-building investment opportunities negative yielding in real terms, because returns on these investments fail to meet the pace of inflation. Even the lowest time preference investor will need to look for higher yielding investments just to break even with their purchasing power over time.

While some risk-averse investors may still choose these civilization-building investments, many investors will increase their risk level in the hope of keeping up with inflation.

This leads investors - including you and me - to end up knowingly or unknowingly driving devastating real economic effects when we attempt to save our money over time through investments.

Let’s make the effects of easy money on economic growth more tangible with three current examples:

The Wealth Gap

As monetary easing increases the supply of cash, pushing investors to buy riskier assets, the existing wealthy class benefit disproportionately due to their larger exposure to assets and business interests. The majority of people have a low level of assets and mostly live off of cash via fixed wage contracts, i.e. salaries, which are slow to adjust to inflation and often track indices that vastly underestimate inflation. Central banks practicing easy monetary policy directly debase cash. The result is a widening wealth gap.

Piggy Bank Housing

Monetary easing pushes more types of assets to take on the role of transporting value over time for low-time-preference people. Homes are one of these assets, leading cities like Vancouver to become hotbeds for investors who want to protect their savings - both from debasement and government overreach. In 2016, British Columbia even added a tax on foreigners buying homes without using them as their primary residence.

Due to this monetary environment, homes are bought as assets to preserve value over time, sometimes not even as places to live or rent out. Homeowners who value their home as a key asset in their portfolio also have a strong incentive to keep housing prices rising, countering the goal of affordable housing. Housing prices thus continue to float to unaffordable levels.

Stock Buybacks

For a corporation, easy monetary policy means cheaper credit is available for expansion of operations. However, a corporation is like an individual in that the company simply wants to grow, or at least preserve, its value over time. When a company finds itself with more credit on hand, it chooses from many different capital allocation options, just like you and I do.

What central banks believe monetary easing does is primarily drive productive capital investment: meaning companies buy new machinery or hire employees such that their business grows and increases in value, at the same time providing more value to society. Think of the equivalent for you and I as purchasing an education, like an online course to teach ourselves a new skill and make our labor more valuable. These are civilization-building investments.

An “easy money” environment makes those low-and-slow business investments less profitable, or even negative-yielding. Businesses, like us - want to outpace inflation in order to grow their business value. The recently hot method of choice? Stock buybacks, which pump the value of the company on the market. This buyback activity displaces productive capital investment, and is often further fueled by credit. Companies are taking out loans to gamble on their own stock prices.

Importantly, this is not the fault of stupidity or greed - it is a natural reaction by corporations to today’s monetary environment. Without forced monetary easing from central banks, corporations would have no need to chase persistent inflation with riskier investments, and could instead focus on long-term, productive capital investment.

In all of these examples, numbers are going up - which makes economists in their towering office buildings pat themselves on the back. We have growth! The reality for the vast majority of people, however, looks darker.

Unfortunately, when our policymakers notice these problems, they often misdiagnose the disease and respond to it with regulations, taxation, and other controls. Instead of solving the underlying problem of a manipulated monetary system, they treat the symptoms of it with more controls and burdens for the public. Like giving Tylenol to a brain tumor patient, we feel a false sense of progress while allowing the underlying problem to quietly grow in severity.

Opting Out Of An Easy Money System

Knowing that our leaders are looking at an incorrect map of the relationships between our behavior, monetary policy, and economic growth - how can we chart a new course to avoid sailing into the rocks?

Central banks, governments, and powerful economic entities built a strong edifice around their easy money system. Every asset today is influenced by monetary policy, and most assets are held by custodians where they can be easily frozen or snatched in calamitous times. Policymakers are even pushing to have our bank balances held directly by central banks in the name of convenience and monetary stability.

Opting out of this system, however, can be accomplished in small, completely peaceful steps. Investors are already leaving easy money by buying assets: homes, stocks, bonds and more. However, these assets all suffer from supply shocks, risk of seizure, and powerful entities rewriting the rules when they lose.

What we need is an asset that’s impossible to inflate in supply which an individual can self-custody, transfer instantly, and hide from oppressive governments. This asset should be easy to transport physically and over time, without losing value. What asset wins on all these marks today? Bitcoin.

Enough of us opting out of easy money into hard money - like bitcoin - will force our leaders out of their monetary easing stupor and press them to reckon with reality. The “easy money show” can only go on as long as we all act in it.

This is a guest post by Captain Sidd. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.

bonds pandemic stocks bitcoin btcGovernment

Low Iron Levels In Blood Could Trigger Long COVID: Study

Low Iron Levels In Blood Could Trigger Long COVID: Study

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate…

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate iron levels in their blood due to a COVID-19 infection could be at greater risk of long COVID.

A new study indicates that problems with iron levels in the bloodstream likely trigger chronic inflammation and other conditions associated with the post-COVID phenomenon. The findings, published on March 1 in Nature Immunology, could offer new ways to treat or prevent the condition.

Long COVID Patients Have Low Iron Levels

Researchers at the University of Cambridge pinpointed low iron as a potential link to long-COVID symptoms thanks to a study they initiated shortly after the start of the pandemic. They recruited people who tested positive for the virus to provide blood samples for analysis over a year, which allowed the researchers to look for post-infection changes in the blood. The researchers looked at 214 samples and found that 45 percent of patients reported symptoms of long COVID that lasted between three and 10 months.

In analyzing the blood samples, the research team noticed that people experiencing long COVID had low iron levels, contributing to anemia and low red blood cell production, just two weeks after they were diagnosed with COVID-19. This was true for patients regardless of age, sex, or the initial severity of their infection.

According to one of the study co-authors, the removal of iron from the bloodstream is a natural process and defense mechanism of the body.

But it can jeopardize a person’s recovery.

“When the body has an infection, it responds by removing iron from the bloodstream. This protects us from potentially lethal bacteria that capture the iron in the bloodstream and grow rapidly. It’s an evolutionary response that redistributes iron in the body, and the blood plasma becomes an iron desert,” University of Oxford professor Hal Drakesmith said in a press release. “However, if this goes on for a long time, there is less iron for red blood cells, so oxygen is transported less efficiently affecting metabolism and energy production, and for white blood cells, which need iron to work properly. The protective mechanism ends up becoming a problem.”

The research team believes that consistently low iron levels could explain why individuals with long COVID continue to experience fatigue and difficulty exercising. As such, the researchers suggested iron supplementation to help regulate and prevent the often debilitating symptoms associated with long COVID.

“It isn’t necessarily the case that individuals don’t have enough iron in their body, it’s just that it’s trapped in the wrong place,” Aimee Hanson, a postdoctoral researcher at the University of Cambridge who worked on the study, said in the press release. “What we need is a way to remobilize the iron and pull it back into the bloodstream, where it becomes more useful to the red blood cells.”

The research team pointed out that iron supplementation isn’t always straightforward. Achieving the right level of iron varies from person to person. Too much iron can cause stomach issues, ranging from constipation, nausea, and abdominal pain to gastritis and gastric lesions.

1 in 5 Still Affected by Long COVID

COVID-19 has affected nearly 40 percent of Americans, with one in five of those still suffering from symptoms of long COVID, according to the U.S. Centers for Disease Control and Prevention (CDC). Long COVID is marked by health issues that continue at least four weeks after an individual was initially diagnosed with COVID-19. Symptoms can last for days, weeks, months, or years and may include fatigue, cough or chest pain, headache, brain fog, depression or anxiety, digestive issues, and joint or muscle pain.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentSpread & Containment

Another beloved brewery files Chapter 11 bankruptcy

The beer industry has been devastated by covid, changing tastes, and maybe fallout from the Bud Light scandal.

Before the covid pandemic, craft beer was having a moment. Most cities had multiple breweries and taprooms with some having so many that people put together the brewery version of a pub crawl.

It was a period where beer snobbery ruled the day and it was not uncommon to hear bar patrons discuss the makeup of the beer the beer they were drinking. This boom period always seemed destined for failure, or at least a retraction as many markets seemed to have more craft breweries than they could support.

Related: Fast-food chain closes more stores after Chapter 11 bankruptcy

The pandemic, however, hastened that downfall. Many of these local and regional craft breweries counted on in-person sales to drive their business.

And while many had local and regional distribution, selling through a third party comes with much lower margins. Direct sales drove their business and the pandemic forced many breweries to shut down their taprooms during the period where social distancing rules were in effect.

During those months the breweries still had rent and employees to pay while little money was coming in. That led to a number of popular beermakers including San Francisco's nationally-known Anchor Brewing as well as many regional favorites including Chicago’s Metropolitan Brewing, New Jersey’s Flying Fish, Denver’s Joyride Brewing, Tampa’s Zydeco Brew Werks, and Cleveland’s Terrestrial Brewing filing bankruptcy.

Some of these brands hope to survive, but others, including Anchor Brewing, fell into Chapter 7 liquidation. Now, another domino has fallen as a popular regional brewery has filed for Chapter 11 bankruptcy protection.

Image source: Shutterstock

Covid is not the only reason for brewery bankruptcies

While covid deserves some of the blame for brewery failures, it's not the only reason why so many have filed for bankruptcy protection. Overall beer sales have fallen driven by younger people embracing non-alcoholic cocktails, and the rise in popularity of non-beer alcoholic offerings,

Beer sales have fallen to their lowest levels since 1999 and some industry analysts

"Sales declined by more than 5% in the first nine months of the year, dragged down not only by the backlash and boycotts against Anheuser-Busch-owned Bud Light but the changing habits of younger drinkers," according to data from Beer Marketer’s Insights published by the New York Post.

Bud Light parent Anheuser Busch InBev (BUD) faced massive boycotts after it partnered with transgender social media influencer Dylan Mulvaney. It was a very small partnership but it led to a right-wing backlash spurred on by Kid Rock, who posted a video on social media where he chastised the company before shooting up cases of Bud Light with an automatic weapon.

Another brewery files Chapter 11 bankruptcy

Gizmo Brew Works, which does business under the name Roth Brewing Company LLC, filed for Chapter 11 bankruptcy protection on March 8. In its filing, the company checked the box that indicates that its debts are less than $7.5 million and it chooses to proceed under Subchapter V of Chapter 11.

"Both small business and subchapter V cases are treated differently than a traditional chapter 11 case primarily due to accelerated deadlines and the speed with which the plan is confirmed," USCourts.gov explained.

Roth Brewing/Gizmo Brew Works shared that it has 50-99 creditors and assets $100,000 and $500,000. The filing noted that the company does expect to have funds available for unsecured creditors.

The popular brewery operates three taprooms and sells its beer to go at those locations.

"Join us at Gizmo Brew Works Craft Brewery and Taprooms located in Raleigh, Durham, and Chapel Hill, North Carolina. Find us for entertainment, live music, food trucks, beer specials, and most importantly, great-tasting craft beer by Gizmo Brew Works," the company shared on its website.

The company estimates that it has between $1 and $10 million in liabilities (a broad range as the bankruptcy form does not provide a space to be more specific).

Gizmo Brew Works/Roth Brewing did not share a reorganization or funding plan in its bankruptcy filing. An email request for comment sent through the company's contact page was not immediately returned.

bankruptcy pandemic social distancing

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 day ago

International1 day agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges