International

Got stocks? Now what do you do?

Stocks took a beating last week, with a hugely important week ahead for earnings and economic reports.

It was startling this past week to see many of the hottest stocks stagger around and then fall down like drunken sailors in a dodgy street.

This is April, after all, and April has been one of the top months for investors since 1950.

But stagger stocks did. The Standard & Poor's 500 Index finished below 5,000 for the first time since Feb. 21. The Nasdaq Composite dropped 5.5%, its worst weekly loss since its 5.65% fall during the week of Oct. 31, 2022.

The Dow Jones Industrial Average ended flat.

Interest rates moved mostly higher, and so did mortgage rates. There was a terrific scare late Thursday when Israel aircraft attacked Iranian military bases. But the damage was slight, and both Israel and Iran tried to downplay the importance.

And now investors face a big week with some of the most most important earnings reports due from Tesla (TSLA) , Meta Platforms (META) , Microsoft (MSFT) and oil giant Exxon Mobil (XOM) .

Related: Wall Street faces make-or-break week with Tesla, GDP, inflation on deck

Plus there is the first look at the U.S. Gross Domestic Product for the first quarter and the March report of the Federal Reserve's favorite inflation measure, the Personal Consumption Expenditures Index, which is only the Fed's favorite inflation measure.

Sounds like a lot, and it is.

The big market challenges, part 1

The shock professionals and retail investors have been feeling starts with this: The market opened 2024 with traders expecting inflation to fall amid multiple interest-rate cuts from the Federal Reserve.

But inflation hasn't fallen enough to satisfy Fed officials, and this week, Fed Chairman Jerome Powell conceded what market veterans had expected: There may be one rate cut, maybe two in 2024 — if only inflation will cooperate.

The 10-year Treasury yield ended the week at 4.63%, up from 4.53% a week before and up 19% from the 3.88% at the end of 2023.

Mortgage rates had fallen from about 8% in early October to the 6.5% range on a 30-year fixed-rate loan in January, giving hope to home buyers, sellers of existing homes, and small homebuilders. Now, the rate is above 7%. The rising-rate trend hit the recent report on existing home sales.

The big market challenges, part 2

The big tech stocks that led the big rally since the end of October have lost their mojo. Most of the hero stocks turned over after the first quarter.

Nvidia (NVDA) , up nearly 83% in the first quarter, fell 11% last week and is off 15.7% so far in April. Chip designer Arm Holdings (ARM) , up 66.3% in the first quarter, is down 30% just in April.

More on markets

- Netflix’s latest decision frustrates investors

- Crude oil prices whipsaw on Mideast tension after Israel strikes Iran

- Most Day Traders Fail. Here’s Why and What to Do About It

Microsoft, up nearly 12% in the first quarter, is down 5.1% at $399.12 this month. It no longer sports a market capitalization above $3 trillion.

Tesla, up nearly 102% in 2023, has struggled all year with a glutted electric-vehicle market and well-publicized manufacturing problems. It is down 41% year to date.

Not every stock fared so badly.

In fact, the real stress in the market was concentrated in technology, discretionary and communication services stocks. These include Ford (F) , General Motors (GM) , Home Depot (HD) and Starbucks (SBUX) .

Consumer staples, financial and utilities stocks moved higher.

Meanwhile, United Airlines (UAL) was up 22% after a blowout earnings report. Also rising this past week: Goldman Sachs (GS) , up 3.7%, PepsiCo (PEP) , up 3.6%, and Nike (NKE) , 2.8%.

The strength in financial stocks, suggests investors aren't that worried about the economy. They are, however, moving money around, wrote market watcher Jon Markman this week.

How to handle this market

Markets move up and down. A 5%-to-10% rundown is a given once or twice in a normal year, defined for our purposes as not battered by a pandemic or something like the 2008-2009 market crash.

The S&P 500, in fact, fell 10.3% between July 31, 2023 and the market bottom of 4,119.37 on Oct. 27, 2023.

The index still finished the year up 24%.

So the question is how to handle this downturn. And one should start with these questions: Why am I in the market? When do I need the money?

There are at least three options.

- Move investments around to safe havens like bonds you can hold to maturity. The downside is it entails costs and, more importantly, more risk than you expect.

- Do nothing. Market downturns usually turn around if you have the time to wait. The S&P 500 has weathered two serious selloffs starting in late 2007. It's up 657% since the bottom of the 2008-09 crash.

- Buy into the lower prices, a strategy that works with mutual funds and exchange-traded funds. For the same cash, you're getting more shares. And it sets your investments up for a gain when the turn comes.

What's ahead this week

Some 667 public-traded U.S. companies report quarterly reports this week. Of that total, 158 are components of the S&P 500.

The big reports to watch:

Monday: German software giant SAP (SAP) , telecom giant Verizon (VZ) , and grocery giant Albertsons (ACI) .

Tuesday: Visa (V) , Tesla, General Electric Aerospace (GE) (the survivor from breaking the old General Electric into three pieces), Texas Instruments (TXN) and United Parcel Service (UPS) .

Wednesday: Meta Platforms (META) , IBM (IBM) , AT&T (T) and Boeing (BA) .

Thursday: Microsoft, Google parent Alphabet (GOOG) , T-Mobile (TMUS) , Caterpillar (CAT) , Intel (INTC) and Southwest Airlines (LUV) .

Friday: Oil giants Exxon Mobil and Chevron (CVX) , pharmaceutical giant AbbVie (ABBV) , Colgate-Palmolive (CL) and Phillips 66 (PSX) .

Related: Veteran fund manager picks favorite stocks for 2024

bonds pandemic dow jones sp 500 nasdaq stocks rate cut fed federal reserve home sales mortgage rates gross domestic product gdp interest rates oil iranInternational

Project Much? Hillary Clinton Claims Trump Wants To ‘Kill, Imprison His Opposition’

Project Much? Hillary Clinton Claims Trump Wants To ‘Kill, Imprison His Opposition’

Hillary Clinton, who once suggested murdering Julian Assange…

Hillary Clinton, who once suggested murdering Julian Assange and whose party is trying to imprison their chief political rival, suggested that Donald Trump wants to murder and imprison his political opponents.

Appearing on a podcast with Marc Elias, the Democrat super-lawyer who laid the legal groundwork for vote-by-mail in 2020 & was involved in the "Steele Dossier" purchase, Clinton suggested that "Putin does what [Trump] would like to do. Kill his opposition."

[Maybe they just committed suicide like Vince Foster and all those other associates?]

According to Hillary, who helped France murder Gaddafi (after he wanted a mere 5 billion euros / year to stop illegals from flooding into Europe), Trump "really" wants to "imprison his opposition, drive journalists into exile, rule without any check or balance."

"We have to be very conscious of how he sees the world because in that world, he only sees strong men leaders. He sees Putin. He sees Xi. He sees Kim Jong Un in North Korea," the failed presidential candidate continued. "Those are the people he is modelling himself after and we’ve been down this road in our, you know, world history. We sure don’t want to go down that again."

According to Hillary, if Trump "ever gets back near the White House again, it will be like having a dictator. I don’t say that lightly. Go back and read Project 2025. They’re going to fire everybody. The person in the government who knows about the next pandemic? Get rid of him."

Project much?

Watch (h/t Modernity.news):

Hillary Clinton claims that Trump wants to murder his political opponents and become a dictator like Kim Jong Un in North Korea. Report: https://t.co/AeDFUkcCvw pic.twitter.com/jk24sUk0Lm

— m o d e r n i t y (@ModernityNews) April 20, 2024

International

The Regime That Doesn’t Care

The Regime That Doesn’t Care

Authored by Jeffrey Tucker via The Epoch Times,

We’ve all come across warnings against doom scrolling.

This…

Authored by Jeffrey Tucker via The Epoch Times,

We’ve all come across warnings against doom scrolling.

This is the practice of waking up in the morning, scouring headlines, seizing on the bad news, and dwelling on the darkness. You do this during downtimes in the day and in the evening. Your mood worsens, permanently.

It cannot be good for the human spirit.

The term implies that we are somehow looking for doom because it gives us a dopamine rush or something. Testing this idea, I’ve variously tried to avoid doing that. But there is a problem. It is impossible to avoid simply because the bad news is so ubiquitous. In fact, I’ve come to distrust any venues that are not reporting it!

Many people have concluded that if we are looking for something other than doom, we should leave what we called “the news” entirely and focus on culture, religion, philosophy, history, art, poetry, or find something practical and productive to do.

I recently met a wonderful Mennonite family living in Amish country in Pennsylvania. They live a completely unplugged life: no cell phones, no internet, no TV. There are only books, community worship, farming, tending to livestock, shopping at local stores, and visiting with neighbors.

I never could have imagined that there would come a time when I would say to those who have completely seceded from modern life: you might be doing it the right way. There is something truly brilliant about the choices you have made.

Sure, they have created a bubble for themselves, one of their own choosing as an extension of their understanding of their faith tradition. One point I observed: they surely seemed happy. Not in a fake way that we see on social media but authentically happy.

Once you leave that world and dip back into normal life, it’s just undeniable. The headlines are filled with tragedy at home and abroad, much of it an outgrowth of population despair. The list is familiar: learning loss, substance addiction, suicide ideation, public and private violence, massive and well-earned distrust of everything and everyone, raging conflict at all levels of society.

It’s hard consolation that so many predicted this outcome of the pandemic response. We knew from the empirical literature that unemployment is associated with suicide, that isolation is connected with personal despair, that loss of community leads to psychopathology, that dependency on substances produces ill health.

So many warned of this outcome from what governments did. In many ways, the world before lockdowns seemed fixable. Afterwards, too much is broken and ruined to imagine redemption.

A good example for me is mainstream corporate media. There was a time when I could listen to NPR or read the New York Times (NYT) and disagree but think: well, that’s a perspective I reject but still I benefit from knowing it. It seemed like we were all part of the same national conversation.

This is no longer true. What made the difference? Probably the realization that they are not just confused or pushing some biased outlook but rather actively covering up and lying. Realizing that is incredibly disorienting.

There is something about pretending that the lockdowns and all that followed were completely normal that discredits them. They do it constantly. Sometimes the media will report on learning loss or the suicide epidemic or rising ill health in the population. But there seems to be this studious attempt to pretend that no one knows why it is happening.

Or my least favorite tactic: pretending as if the pandemic necessitated all this and that it was not an outgrowth of deliberate decision-making on the part of elites.

This stuff makes me want to scream: they locked us down when it was totally unnecessary!

As my friend Aaron Kheriaty often observes, they believe we are stupid. They actually think we cannot make connections, have no memory, no knowledge of anything serious, and will just eat up their porridge of baloney daily while exercising no critical intelligence over any of it.

This rubs me wrong particularly on the subject of the mRNA shots designed to address the virus. We know for certain that they were oversold and failed in all the ways they were supposed to succeed. We are further flooded with evidence of their harms both from personal experience and the scientific literature.

But do we read or hear about this in the legacy media? Absolutely not. Even when it is overwhelmingly clear that the shot should be considered a possible cause in the sudden rise of heart attacks, sudden death, turbo cancers, and maladies of all sorts, this whole subject is somehow unsayable in the corporate media.

The silence on this topic is so conspicuous and apparent that it discredits everything else. And what is the reason for it? Well, pharma advertising provides a stunning 75 percent of revenue for mainline television. That’s an astounding number. The networks are simply not going to bite the hand that feeds them.

That’s true for TV and probably something similar applies to everything else too.

What does this mean for the rest of us? It means that every time we turn on the TV, we are risking getting propagandized by companies that are seriously in league with the government to generate the highest possible revenue stream for themselves regardless of the consequences.

And why zero focus on vaccine injury? Incredibly, the companies themselves are indemnified against liability for any harms they cause. Just think about the implications of this. Even if you know for sure that you have been harmed by a product you were forced or otherwise manipulated to take, there is almost nothing you can do about it.

That’s an incredible fact, and goes a very long way toward explaining the silent treatment.

The discrediting of major media in this context reveals a deeper and more terrifying truth. Much of the elite class of economic and social managers do not have our best interests in mind. Once you realize this, the color of the world changes for you. Once you gain that insight, there is pretty much no going back from it.

Millions have come to this realization over the last four years. It has changed us as people. We desperately want to live normal happy lives but we are overwhelmed by what we’ve learned. It’s like the curtain was pulled back and we have seen what is really going on. The whole of official culture is screaming at us to ignore that man behind the curtain.

I’ve recently taken my own advice and thrown myself into reading history as a refuge. My choice was probably not the best if my goal was to brighten my spirits. I have been reading “The Vampire Economy” by German economist and financier Gunter Reimann, published in 1939 (and which I scanned and uploaded with the author’s permission).

The book was written as the Nazi Party had gained full control of government (and everything else) and the full war in Europe was about to commence with the German invasion of Poland.

Reimann brilliantly dissects the reality of a regime that cared nothing for the spreading suffering of the people.

“Nazi leaders in Germany do not fear possible national economic ruin in wartime,” he writes.

“They feel that, whatever happens, they will remain on top, that the worse matters become, the more dependent on them will be the propertied classes. And if the worst comes to the worst, they are prepared to sacrifice all other interests to maintain their hold on the State. If they themselves must go, they are ready to pull the temple down with them.”

That’s a bracing analysis and it could apply to many regimes in history, not just the Nazis. Indeed, good government in history has rarely been the norm. Power often benefits from suffering. As Americans we are not used to thinking this way about our elites. But it is probably time to realize that this trajectory is very much in play.

This might be the most striking change among millions of Americans over the last five or so years. We’ve come to realize that our leaders in so many sectors of American life (or global life, for that matter) do not favor our best interests. This is a troubling realization but it explains so much. It’s why the elites did not care about the harms of lockdowns or untested shots and are unconcerned about inflation, mass immigration, the rise of crime, squatting and the insecurity of property, exploding government debt, growing population surveillance, or anything like the normal rules of civilized life.

The regime, in the broadest possible way we can conceive of that term, simply doesn’t care. Even worse, it grows and benefits at our expense. They know it. We know it. They like it this way.

International

The Haven-Volatility Dog Has Not Yet Barked

The Haven-Volatility Dog Has Not Yet Barked

Authored by Simon White, Bloomberg macro strategist,

Implied volatility of traditional havens…

Authored by Simon White, Bloomberg macro strategist,

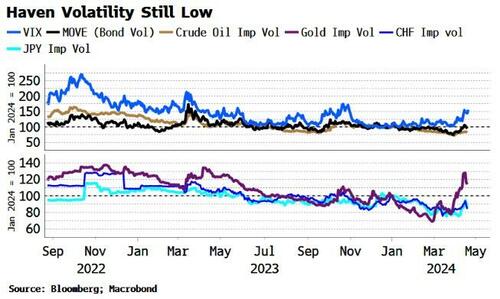

Implied volatility of traditional havens such as the Swiss franc and US Treasuries remains remarkably subdued despite the situation in the Middle East, even as the former has outperformed most other havens, including the dollar. However, vol is beginning to pick up, in a sign risks are beginning to be more fully priced in.

Volatility is typically episodic. Most of the time it is low or falling, but then punctuated by episodes of extreme fear when it spikes, before beginning to trend lower again. It is a good metaphor for human behavior: ignore a potential risk up until the last minute - either believing it’s not really a danger, or pretending it’s not there at all and hoping it will go away, i.e. the ostrich effect – and then panic when said risk does turn out to be major problem (the UK government’s response to the pandemic is a good example).

Recency bias perhaps explains why markets have been surprisingly calm in the face of the ratcheting up of tensions in the Middle East. The geopolitical backdrop across the world has been increasingly quarrelsome, but it has not so far led to a major multi-regional conflagration. With any luck that persists, but the generally still-contained volatility in most markets is perhaps not fully reflective of the underlying risks.

The chart below shows the implied volatility of bonds, the Swiss franc, the yen and crude oil has barely risen this year (all series are normalized to 100 at the start of the 2024).

We are seeing call skew in oil rising showing tail-risk probabilities are rising, even though at-the-money vol remains low.

The Swiss franc has been catching a bid, but that has so far not led to a significant marking up of its vols, while the yen is not acting as the haven it once did.

The VIX (blue line in top panel of chart) and gold volatility (purple line, bottom panel) have started to rise, but that has been more about inflation rather than geopolitical risks.

Generally, though, assets are not at panic stations, and therefore hedging portfolio risks is still cheap.

-

International4 weeks ago

International4 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Government2 weeks ago

Government2 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

International6 days ago

International6 days agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?

-

Uncategorized4 days ago

Uncategorized4 days agoRed States Fight Growing Efforts To Give “Basic Income” Cash To Residents