Goldman Sachs Pulls the Trigger on These 2 Stocks

It’s a new year, and a good time to choose new stock to line the portfolio. Investment banking giant Goldman Sachs has been watching the markets with an eye toward

Read More…

The post Goldman Sachs Pulls the Trigger on These 2 Stocks appeared first…

It’s a new year, and a good time to choose new stock to line the portfolio. Investment banking giant Goldman Sachs has been watching the markets with an eye toward the long term – and a finger on pulse of the present. The firm is bullish following the passage of the COVID relief bill last month, seeing the direct income assistance of $600 per person – or $1200 for married couples – as a positive for consumers’ disposable income in the here-and-now.

And with consumer spending making up some two-thirds of the US economy, and boost to that metric is seen as good for the whole. Taking the COVID relief checks into account, Goldman Sachs' chief economist, Jan Hatzius, raised his expectations for US economic growth in 1Q21 – bumping his GDP forecast from 3% to 5%.

“While the income effects of the fiscal package will be very front-loaded, we expect the impact on consumer spending to be more evenly distributed throughout the year,” Hatzius noted.

The economist sees current conditions – with lockdowns in place, as putting something of a damper on immediate spending, but leading to pent-up demand later in the year. With that in mind, Hatzius is predicting sequential gains in Q2 and Q3, and full-year GDP growth of 5.8%, up 9% from his previous estimate.

The stock analysts at Goldman are keen to follow Hatzius’ lead, and they’ve been combing the market for stocks that are likely to gain as the markets take a long-term rising trajectory. The firm's analysts are pulling the trigger on two stocks in particular, noting that each has the potential to deliver double-digit gains in the year ahead.

We ran the two through TipRanks’ database to see what other Wall Street's analysts have to say about them.

17 Education & Technology (YQ)

The worldwide pandemic had one effect that could never have been predicted in advance: the sudden shift of schools to mass online classes. Remote office work has been around for a long time, and at the secondary and college levels, schools have had long experience with correspondence courses – but mass online learning, even down to the primary level, had never been attempted. Companies like 17 Education, however, take up the challenge of online learning.

17 Education is a Chinese company, dedicated to joining technology with high-quality educational content to create more effective and efficient tutoring services for K-12. The program includes both online and in-classroom solutions – 17 Education bills itself as a full-service educational technology provider.

It is also a new company to the financial markets. YQ stock went public just this past December, when trading commenced on the 4th of the month. The IPO opened flat, with shares priced at $10.50, the midpoint of the pre-IPO range. By December 9, the share price had nearly doubled. Since then, however, the stock is down 34% from its peak.

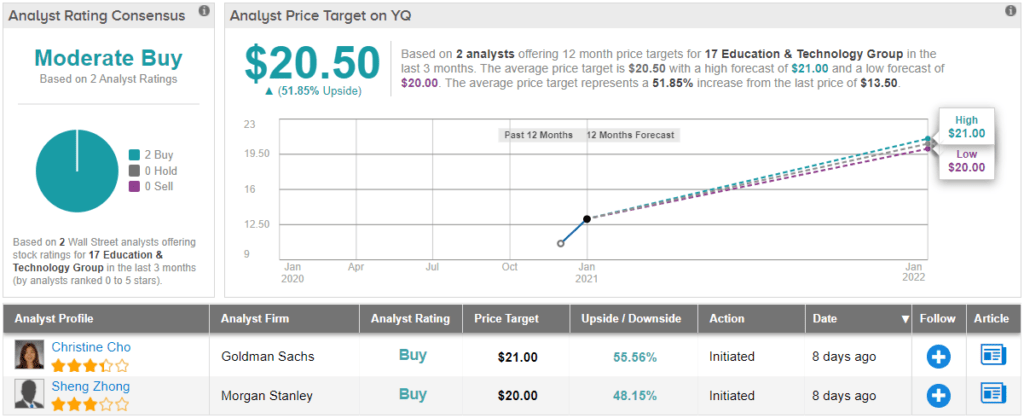

Among the bulls is Goldman analyst Christine Cho, who initiated her coverage of YQ with a Buy rating and a $21 price target. This figure indicates a 55% upside for the next 12 months. (To watch Cho’s track record, click here)

Cho is bullish on the company’s application of big data systems to analyze and streamline classroom solutions, and sees its unique ‘hybrid’ model of combining in-school and online courses as a net plus.

“We see [YQ] translating into two potential advantages for its AST [after school tutoring] business: (1) proprietary school-level insights enabling YQ to develop more localized/customized content, and (2) ability to grow paid enrollments rapidly at a low student acquisition cost — a key challenge in the online AST industry — through penetration of organic in-school MAUs…”

The Goldman review is one of two on record for 17 Education; the other is also a Buy, making the consensus view a Moderate Buy. The stock is priced at $13.5, and the $20.50 average price target gives an upside potential of ~52%. (See YQ stock analysis on TipRanks)

ChampionX Corporation (CHX)

17 Education wasn’t the only new ticker to hit the markets at the height of the pandemic, rather, it was one of many. ChampionX is an oilfield technology company that conducted a major change in 1H20. It’s namesake, ChampionX Holdings, merged with Apergy Corp, with the combined company attaching the ChampionX name to the new partner’s trading history. CHX started trading in June 2020, and in December, the company moved its ticker from the NYSE to the NASDAQ.

CHX offers a range of oilfield tech solutions, including such specialized applications as drilling fluid and mud additives, fracturing fluid systems, and well cementing, in addition to drilling technologies. These tech services are essential for the oil producers – that own the wells – to get the product to the surface. The essential nature of the service, plus the generally improving economic conditions, led to a Q3 sequential gain in revenues of 112%. The top line came in at $633 million.

Analyst Angie Sedita, who covers this stock for Goldman, sees the company in an advantageous position.

“We view ChampionX as a strong oilfield service and equipment provider with a global footprint and favorable product mix. Its primary businesses, chemicals and artificial lift, are exposed to the production phase of the life of a well, thus producing lower earnings cyclicality and stronger through-cycle EBITDA. The recent merger of the two companies completed in Q2-20 (Apergy and ChampionX) should drive market share growth and cross-selling opportunities both in the international and U.S. markets,” Sedita wrote.

To this end, Sedita initiated coverage on CHX with a Buy rating and a $21 price target. Her target implies a 20% upside for the next 12 months. (To watch Sedita’s track record, click here)

All in all, six of Wall Street’s analysts have reviews CHX shares, and 5 said to Buy against 1 who rated it a Hold. This puts the analyst consensus at a Strong Buy. However, the recent share appreciation has pushed the stock price above the average price target of $17.10. (See CHX stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

The post Goldman Sachs Pulls the Trigger on These 2 Stocks appeared first on TipRanks Financial Blog.

economic growth pandemic nasdaq stocks gdp consumer spending oilUncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentSpread & Containment

Another beloved brewery files Chapter 11 bankruptcy

The beer industry has been devastated by covid, changing tastes, and maybe fallout from the Bud Light scandal.

Before the covid pandemic, craft beer was having a moment. Most cities had multiple breweries and taprooms with some having so many that people put together the brewery version of a pub crawl.

It was a period where beer snobbery ruled the day and it was not uncommon to hear bar patrons discuss the makeup of the beer the beer they were drinking. This boom period always seemed destined for failure, or at least a retraction as many markets seemed to have more craft breweries than they could support.

Related: Fast-food chain closes more stores after Chapter 11 bankruptcy

The pandemic, however, hastened that downfall. Many of these local and regional craft breweries counted on in-person sales to drive their business.

And while many had local and regional distribution, selling through a third party comes with much lower margins. Direct sales drove their business and the pandemic forced many breweries to shut down their taprooms during the period where social distancing rules were in effect.

During those months the breweries still had rent and employees to pay while little money was coming in. That led to a number of popular beermakers including San Francisco's nationally-known Anchor Brewing as well as many regional favorites including Chicago’s Metropolitan Brewing, New Jersey’s Flying Fish, Denver’s Joyride Brewing, Tampa’s Zydeco Brew Werks, and Cleveland’s Terrestrial Brewing filing bankruptcy.

Some of these brands hope to survive, but others, including Anchor Brewing, fell into Chapter 7 liquidation. Now, another domino has fallen as a popular regional brewery has filed for Chapter 11 bankruptcy protection.

Image source: Shutterstock

Covid is not the only reason for brewery bankruptcies

While covid deserves some of the blame for brewery failures, it's not the only reason why so many have filed for bankruptcy protection. Overall beer sales have fallen driven by younger people embracing non-alcoholic cocktails, and the rise in popularity of non-beer alcoholic offerings,

Beer sales have fallen to their lowest levels since 1999 and some industry analysts

"Sales declined by more than 5% in the first nine months of the year, dragged down not only by the backlash and boycotts against Anheuser-Busch-owned Bud Light but the changing habits of younger drinkers," according to data from Beer Marketer’s Insights published by the New York Post.

Bud Light parent Anheuser Busch InBev (BUD) faced massive boycotts after it partnered with transgender social media influencer Dylan Mulvaney. It was a very small partnership but it led to a right-wing backlash spurred on by Kid Rock, who posted a video on social media where he chastised the company before shooting up cases of Bud Light with an automatic weapon.

Another brewery files Chapter 11 bankruptcy

Gizmo Brew Works, which does business under the name Roth Brewing Company LLC, filed for Chapter 11 bankruptcy protection on March 8. In its filing, the company checked the box that indicates that its debts are less than $7.5 million and it chooses to proceed under Subchapter V of Chapter 11.

"Both small business and subchapter V cases are treated differently than a traditional chapter 11 case primarily due to accelerated deadlines and the speed with which the plan is confirmed," USCourts.gov explained.

Roth Brewing/Gizmo Brew Works shared that it has 50-99 creditors and assets $100,000 and $500,000. The filing noted that the company does expect to have funds available for unsecured creditors.

The popular brewery operates three taprooms and sells its beer to go at those locations.

"Join us at Gizmo Brew Works Craft Brewery and Taprooms located in Raleigh, Durham, and Chapel Hill, North Carolina. Find us for entertainment, live music, food trucks, beer specials, and most importantly, great-tasting craft beer by Gizmo Brew Works," the company shared on its website.

The company estimates that it has between $1 and $10 million in liabilities (a broad range as the bankruptcy form does not provide a space to be more specific).

Gizmo Brew Works/Roth Brewing did not share a reorganization or funding plan in its bankruptcy filing. An email request for comment sent through the company's contact page was not immediately returned.

bankruptcy pandemic social distancing

Government

Walmart joins Costco in sharing key pricing news

The massive retailers have both shared information that some retailers keep very close to the vest.

As we head toward a presidential election, the presumed candidates for both parties will look for issues that rally undecided voters.

The economy will be a key issue, with Democrats pointing to job creation and lowering prices while Republicans will cite the layoffs at Big Tech companies, high housing prices, and of course, sticky inflation.

The covid pandemic created a perfect storm for inflation and higher prices. It became harder to get many items because people getting sick slowed down, or even stopped, production at some factories.

Related: Popular mall retailer shuts down abruptly after bankruptcy filing

It was also a period where demand increased while shipping, trucking and delivery systems were all strained or thrown out of whack. The combination led to product shortages and higher prices.

You might have gone to the grocery store and not been able to buy your favorite paper towel brand or find toilet paper at all. That happened partly because of the supply chain and partly due to increased demand, but at the end of the day, it led to higher prices, which some consumers blamed on President Joe Biden's administration.

Biden, of course, was blamed for the price increases, but as inflation has dropped and grocery prices have fallen, few companies have been up front about it. That's probably not a political choice in most cases. Instead, some companies have chosen to lower prices more slowly than they raised them.

However, two major retailers, Walmart (WMT) and Costco, have been very honest about inflation. Walmart Chief Executive Doug McMillon's most recent comments validate what Biden's administration has been saying about the state of the economy. And they contrast with the economic picture being painted by Republicans who support their presumptive nominee, Donald Trump.

Image source: Joe Raedle/Getty Images

Walmart sees lower prices

McMillon does not talk about lower prices to make a political statement. He's communicating with customers and potential customers through the analysts who cover the company's quarterly-earnings calls.

During Walmart's fiscal-fourth-quarter-earnings call, McMillon was clear that prices are going down.

"I'm excited about the omnichannel net promoter score trends the team is driving. Across countries, we continue to see a customer that's resilient but looking for value. As always, we're working hard to deliver that for them, including through our rollbacks on food pricing in Walmart U.S. Those were up significantly in Q4 versus last year, following a big increase in Q3," he said.

He was specific about where the chain has seen prices go down.

"Our general merchandise prices are lower than a year ago and even two years ago in some categories, which means our customers are finding value in areas like apparel and hard lines," he said. "In food, prices are lower than a year ago in places like eggs, apples, and deli snacks, but higher in other places like asparagus and blackberries."

McMillon said that in other areas prices were still up but have been falling.

"Dry grocery and consumables categories like paper goods and cleaning supplies are up mid-single digits versus last year and high teens versus two years ago. Private-brand penetration is up in many of the countries where we operate, including the United States," he said.

Costco sees almost no inflation impact

McMillon avoided the word inflation in his comments. Costco (COST) Chief Financial Officer Richard Galanti, who steps down on March 15, has been very transparent on the topic.

The CFO commented on inflation during his company's fiscal-first-quarter-earnings call.

"Most recently, in the last fourth-quarter discussion, we had estimated that year-over-year inflation was in the 1% to 2% range. Our estimate for the quarter just ended, that inflation was in the 0% to 1% range," he said.

Galanti made clear that inflation (and even deflation) varied by category.

"A bigger deflation in some big and bulky items like furniture sets due to lower freight costs year over year, as well as on things like domestics, bulky lower-priced items, again, where the freight cost is significant. Some deflationary items were as much as 20% to 30% and, again, mostly freight-related," he added.

bankruptcy pandemic trump-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 day ago

International1 day agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges