Futures Slide, Europe Tumbles As Evergrande Contagion Shockwave Goes Global

Futures Slide, Europe Tumbles As Evergrande Contagion Shockwave Goes Global

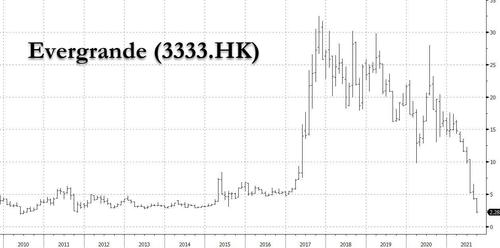

In retrospect, China, Japan, South Korea and Taiwan picked a great day to take a holiday, which as we noted last night hammered Hong Kong stocks more than 3%, slammin

In retrospect, China, Japan, South Korea and Taiwan picked a great day to take a holiday, which as we noted last night hammered Hong Kong stocks more than 3%, slamming the Hong Kong property sector and sending Evergrande - which is expected to default within hours to a bank loan due Monday while crucial interest payment deadline on its offshore bonds looms on Thursday - to its lowest market cap ever (it closed down 10.2% just off the worst levels of the day) before the rout spread to European bourses and US equity futures as Evergrande's escalating liquidity - and now solvency - crisis spread beyond the sector.

At 24,099 points, Hong Kong’s broader Hang Seng index has closed at its lowest level since October 2020.

“Evergrande is just the tip of the iceberg,” said Louis Tse, managing director at Wealthy Securities, a Hong Kong-based brokerage. Chinese developers were under substantial repayment pressure on dollar-denominated bonds, he added, while markets had become nervous that Beijing would push listed real estate groups to cut the costs of housing in mainland China and Hong Kong.

“That affects the banks as well — if you have lower property prices what happens to their mortgages?” Tse said. “It has a chain effect.”

And with Hong Kong becoming the temporary epicenter for the Evergrande meltdown (before it shifts back to China), contagion which had long been absent, finally spilled over across the globe, hitting not only stocks but also FX and commodities, with angst over this week's FOMC meeting where some still think the central bank will announce tapering (spoiler alert: it won't), only deepened on Monday, sending U.S. futures falling more than 1.3% as low as 4,356.25 touching the lowest level since Aug. 19 and far below the 50DMA which has proven to be a remarkable support zone, while European equities were 2% lower and hitting a two-month low. Treasuries gained along with the dollar before Wednesday’s Fed meeting, where policy makers are expected to start laying the groundwork for paring stimulus. Cryptos crumbled, with Bitcoin plunging to $44,000.

The early drop which sent the VIX to 26, its highest reading since May 12, was especially ominous because, as Mohamed El-Erian said, "after three straight weeks of losses, today's trading session will be a notable test for the "buy-the-dip"/"there is no alternative"/FOMO narrative that has impressively powered stocks through prior headwinds." Meanwhile, while we wait to see the dip buyers, the benchmark S&P 500 is on track to snap a seven-month gaining streak.

With a down 1% Futures backdrop for the open of US #markets coming on top of three straight weeks of losses, today's trading session will be a notable test for the "buy-the-dip"/"there is no alternative"/FOMO narrative that has impressively powered #stocks through prior headwinds

— Mohamed A. El-Erian (@elerianm) September 20, 2021

Economically sensitive industrials Boeing Co and Caterpillar Inc slipped 1.7% and 1.9%, respectively. Banking stocks including Morgan Stanley, JPMorgan Chase & Co and Bank of America Corp fell between 1.8% and 2.7% in premarket trading, tracking U.S. Treasury yields. A slate of U.S.-listed Chinese stocks including Weibo Corp, Bilibili Inc, Vipshop Holdings Ltd and Pinduoduo Inc shed between 3.4% and 5.4% amid a widening regulatory crackdown in China. Needless to say, it is a busy morning in the premarket on Monday, and here are some of the biggest movers today:

- Freeport McMoRan (FCX US), Cleveland-Cliffs (CLF US), Alcoa (AA US) and U.S. Steel (X US) down 3%-4% premarket, following the path of global peers as iron-ore and metals prices sink

- Cryptocurrency-exposed stocks sink premarket and in Europe after Bitcoin slipped as it hit a key line of resistance

- Tesla (TSLA US) shares down 2% amid a broad equity selloff. Also hurt by a report that the U.S.’s top crash investigator urged the company to address safety concerns before expanding its cars’ self-driving features

- Chinese stocks listed in the U.S. slump in Monday premarket trading as growing investor angst about China’s real estate crackdown rippled through markets on Monday

- SmileDirect (SDC US) up 16% premarket amid continued touts for the retail-trader favorite, while Meta Materials slips.

- Among other so-called meme stocks: IronNet -7.5%, Offerpad -6.7%, Vinco Ventures -2.7%, AMC -5.5%

- Teradata (TDC US) shares attractive ahead of a likely inflection for its “underappreciated” cloud business, Morgan Stanley writes in note upgrading to overweight

- Wynn Resorts (WYNN US) and Las Vegas Sands (LVS US) slide 2% premarket after their share price targets were lowered at Morgan Stanley, which pushes back its projection of Macau market recovery to mid-2022 from 4Q21 given coronavirus-related concerns in China

- Verastem Oncology (VSTM US) soars 33% premarket after it announced Sunday that a study data in low-grade serous ovarian cancer showed encouraging response rates and progression-free survival

It wasn't just Evergrande: Wall Street’s main indexes have been hurt this month by fears of potentially higher corporate tax rates denting earnings and have shrugged off signs inflation might have peaked. As such, while eagerly waiting to see what Beijing's response will be to the Evergrande contagion, all eyes will also be on the Fed’s policy meeting on Wednesday, where the central bank is expected to lay the groundwork for a tapering, although the consensus is for an actual announcement to be delayed until the November or December meetings.

“Anything pointing to a November tapering decision may support the U.S. dollar further and perhaps extend the latest setback in equities,” said Charalambos Pissouros, head of research at JFD Group. “Market participants may also be eager to find out whether this could also result in earlier rate hikes.”

Aside from Evergrande and the prospect of reduced Fed stimulus, financial markets also face risks from uncertainty over the outlook for President Joe Biden’s $4 trillion economic agenda as well as the need to raise or suspend the U.S. debt ceiling. Investors were already fretting over a slowing global recovery from the pandemic and inflation stoked by commodity prices. On Sunday, Janet Yellen said the U.S. government wrote a WSJ oped in which she said the US will run out of money to pay its bills sometime in October without action on the debt ceiling, warning of “economic catastrophe” unless lawmakers take the necessary steps.

“The edges of the bullish narrative cover are being pulled and the darker underlying reality is coming to the fore,” said Sebastien Galy, a senior macro strategist at Nordea Investment Funds SA. “It is taking the market more time to price in these shocks than I had expected, and the market is far more realistic as the buy-on-dip mentality fades with the fear of inflation.”

European markets were also pounded following the rout in Asian equities earlier. The Stoxx Europe 600 index dropped as much as 2%, on track for the biggest decline since July. Raw materials led the broad-based retreat as iron ore extended a slump below $100 a ton and base metals declined after China stepped up restrictions on industrial activity. Germany’s DAX underperformed as a rebalancing takes effect. The FTSE 100 fares marginally better, declining ~1.6%. Losses spanned all Stoxx 600 sectors with miners, autos and bank the hardest hit. Here are some of the biggest European movers today:

- Lufthansa shares rise as much as 5.1% after the airline announced plans to raise EU2.14b to pay back part of a government bailout received during the pandemic.

- Bawag shares gain as much as 5%, touching a record high, after increasing its targets and raising its dividend payout ratio for FY22.

- AstraZeneca shares increase as much as 3.3%, the most since April 30, after the pharmaceutical group released positive results from trials of its Enhertu breast cancer drug.

- European mining stocks hit the lowest level since February, hit by falling iron ore and base metal prices along with downgrades for heavyweight sector names.

- Prudential shares tumble as much as 8.3% after announcing a share placing which Panmure Gordon said came on the worst day possible, coinciding with a selloff in Asian peers.

- AP Moller-Maersk shares decline as much as 4.4% after Berenberg writes that the risk of container rates peaking and triggering an outsized share price decline “is paramount.”

- Holcim and HeidelbergCement shares slide after they were downgraded at JPMorgan on ESG-related concerns for the building-materials sector and soaring energy costs in Europe.

Earlier in the session, Asian stocks were mauled led by a selloff in Hong Kong amid concerns over a Beijing squeeze on real estate companies and contagion from China Evergrande’s debt crisis. The MSCI Asia Pacific Index slipped as much as 1.3%, with China Evergrande Group and other real estate stocks leading the decliners. Hong Kong shares were the hardest hit, sending the Hang Seng tumbling as much as 4.2% amid the biggest selloff in property stocks in more than a year as traders tracked the risk of contagion from the debt crisis at developer China Evergrande.

Markets in China, Japan, Taiwan and South Korea were closed for holidays. Deepening concerns over Evergrande’s debt woes, along with China’s ongoing corporate crackdowns, have rattled markets. Traders also mentioned that President Xi Jinping’s drive to create “common prosperity” may spill over into the property market.

"We are seeing fears of contagion effect from China Evergrande playing out,” said Jun Rong Yeap, a market strategist at IG Asia. “With China closed today, the limited avenue is bringing the risk-off movement to be focused on the H.K. market, which may aggravate the selloff." The MSCI Asia Pacific Index’s decline extended its 1.6% loss last week. The gauge is up just 0.7% for the year, compared with an 18% climb in the S&P 500 Index.

Shares in Ping An, China’s biggest insurer, fell as much as 8.4 per cent on Monday, after closing down 5 per cent on Friday as it was forced to disclose that it held no exposure to Evergrande debt or equity. Ping An has Rmb63.1bn ($9.8bn) of exposure to the country’s real estate stocks across its Rmb3.8tn of insurance funds.

Metal prices also fell on Monday as concerns grew about the impact on commodity demand of a pullback in the Chinese property market. The property sector accounts for about 20% of the country’s copper consumption and 10 per cent of its nickel demand, according to analysts at Liberum. Copper prices fell by 3% to $9,074 a tonne, while nickel fell by 2% in morning trading on the London Metal Exchange.

Meanwhile, emerging-market stocks headed for their biggest drop in a month, while Russia’s ruble and South Africa’s rand led developing-nation currency declines.

In rates, Treasuries hold gains in early U.S. session following a bout of flight-to-quality that lifted futures during Asia session (with cash market closed for Japan holiday). The 10-year yield dropped 3.4bps to ~1.3277%, with yields richer by 3bp-4bp in long-end of the curve as bunds and gilts lagging slightly; 2s10s flatter by 2.8bp, 5s30s by 1.2bp after breaching 102bp for first time in a year. This week’s events include 20-year auction Tuesday and FOMC policy announcement Wednesday. Bund, Treasury and gilt curves bull flatten. Bund and gilts richen 3-3.5bps across the back end, outperforming USTs by a half basis point or so. Peripheral spreads and swap spreads widen out with the belly of the Italian curve lagging peers.

In FX, the dollar surged with commodity currencies such as the Australian dollar and Norwegian krone plunging as a rout in iron ore and risks from China Evergrande Group’s debt crisis hurt sentiment. Haven FX is well bid with JPY and CHF at the top of the G-10 scoreboard. AUD and NOK are the worst performers with the broad commodity complex trading poorly. RUB and TRY are among the weakest in EM FX.

In commodities, crude futures are in the red as WTI drops 1.75%, snapping below $71 while Brent drops over $1 to trade near $74.30. Ferrous metals were under sharp pressure in Asian hours; base metals are deep in the red with LME copper down as much as 2.8%, LME nickel drops as much as 3.1%. Iron ore prices reached a record this year but slumped 20 per cent last week — their worst weekly performance since the 2008 financial crisis — after markets digested the impact of government curbs on steel production. On Monday, iron ore futures in Singapore fell as much as 11.5 per cent to below $100 a tonne for the first time in more than a year.

“There are fears . . . that the crisis could spill over to other companies in the sector and might directly affect the building and completion of houses,” analysts at Commerzbank said. “The construction sector is one of the biggest consumers of base metals such as copper and aluminium, as well as of steel.”

Spot gold rises off Asia’s lows, trading little changed near $1,755/oz. Crypto cratered with bitcoin trading around $44k.

Luckily, there is little on the calendar today - besides the sheer chaos gripping markets - with just the September NAHB housing market index on deck in the US; We als ohave the Federal election in Canada.

Market Snapshot

- S&P 500 futures down 1.1% to 4,371.00

- STOXX Europe 600 down 1.7% to 453.85

- MXAP down 1.0% to 201.31

- MXAPJ down 1.6% to 639.88

- Nikkei up 0.6% to 30,500.05

- Topix up 0.5% to 2,100.17

- Hang Seng Index down 3.3% to 24,099.14

- Shanghai Composite up 0.2% to 3,613.97

- Sensex down 0.5% to 58,746.01

- Australia S&P/ASX 200 down 2.1% to 7,248.17

- Kospi up 0.3% to 3,140.51

- Brent Futures down 1.3% to $74.37/bbl

- Gold spot up 0.0% to $1,754.52

- U.S. Dollar Index up 0.18% to 93.36

- German 10Y yield rose 12.5 bps to -0.315%

- Euro down 0.1% to $1.1711

Top Overnight News from Bloomberg

- Growing investor angst about China’s real estate crackdown rippled through markets on Monday, adding pressure on Xi Jinping’s government to prevent financial contagion from destabilizing the world’s second-largest economy

- A big week for global markets is off to a shocking start, with risk assets slumping in Asian trading

- Emmanuel Macron is making it clear that French fury isn’t ebbing after Australia canceled a $66 billion submarine order in favor of a new defense pact with the U.S. and Britain.

- The deepening chaos in Europe’s energy markets risks undermining the region’s recovery and complicating policy for officials desperately trying to put the worst economic crisis in a generation behind them

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were spooked at the start of the week amid Evergrande contagion concerns and a continued slump in commodities, while the weakness also followed on from last Friday’s losses on Wall Street and with risk appetite dampened by the key holiday closures, as well the upcoming busy schedule of central bank updates including policy meetings from the FOMC, BoE and BoJ. The ASX 200 (-2.1%) was pressured by underperformance in mining names amid ongoing woes in underlying commodity prices that recently saw a more than 20% weekly decline in iron ore prices for its worst week since the GFC, which dragged prices beneath the USD 100/ton for the first time in 14 months. Conversely, M&A newsflow spurred the stocks at the other end of the spectrum with ALE Property Group boosted after Charter Hall consortium proposed to acquire a 50% stake in the Co. and AusNet Services also saw double-digit percentage gains after it received a AUD 9.8bln takeover proposal from a Brookfield Asset Management affiliate. The Hang Seng (-3.3%) plunged as focus remained on Evergrande which declined by another 17% on default fears, with the concerns not helped by reports that executives redeemed some company investment products in advance earlier this year and are facing severe punishment for securing early redemptions, while banks were also said to be unwilling to provide debt insurance concerning Evergrande and the Co. reportedly began repaying investors in its wealth management products with discounted real estate. The Evergrande woes pressured other real estate names in Hong Kong and resulted in contagion effects for property-exposed insurers, with the mood also dampened following the “patriots only” election in Hong Kong where less than 5.0k electorates voted to choose members of the 1,500-strong Election Committee in which only 1 democracy-leaning candidate won a seat among the candidates which were vetted as loyal to Beijing. The absence of Stock Connect trade further added to the lack of demand as mainland China was closed for the mid-Autumn festival, alongside the holiday closures in Japan, South Korea and Taiwan.

Top Asian News

- Luxury Stocks Plunge on China as Uncertainty Hits Sentiment

- Evergrande Dollar Bonds Slide Further Ahead of Interest Deadline

- Chinese Property Developer Sinic Halts Trading After Sinking 87%

- Thailand to Raise Public Debt Cap to 70% to Fund Covid Recovery

Equities in Europe have extended on the losses seen at the cash open (Euro Stoxx 50 -2.0%; Stoxx 600 -1.8%) as the risk aversion from APAC seeped into the region and intensified, with liquidity overnight also low on account of major market closures including Mainland China (and Stock Connect), Japan and South Korea. China's Evergrande was again the focus overnight as shares plumbed the depths amid the ongoing default woes, with contagion also hitting peers in illiquid trade. The mood could also be dampened by woes surrounding the US debt limit, with Treasury Secretary Yellen warning that the Treasury Department's cash balance will decline to an insufficient level and the government will not be able to pay its bills sometime in October, whilst US Democrat Senator Manchin reportedly thinks that Congress should take a strategic pause until next year before voting on President Biden's USD 3.5tln spending plan. Add to that the newsflow surrounding fears of UK energy suppliers' collapse alongside the geopolitical row between Australia and France, which expands out to the UK, the US and China. Long-story-short, there is not much in terms of good news, with participants also look ahead to Flash PMIs and a raft of Central Bank meetings, including the FOMC, BoE and BoJ. US equity futures have also succumbed to the risk aversion, with the NQ (-1.2%) feeling some modest cushioning from lower yields vs the ES (-1.4%), RTY (-1.9%) and YM (-1.6%). The NQ has fallen under its 50 DMA (around 15,170) whilst the RTY slipped under its 200 DMA (2,200). Back in Europe, bourses see broad-based losses. The expansion of the German bourse also came into effect, but the DAX 40 (-2.0%) nonetheless conforms to losses across the region. The CAC 40 (-2.3%) narrowly underperforms the region amid losses across several heavy-weight. Sectors in Europe are all in the red by hold a defensive bias. Basic Resources underperform, with the European basic materials stock index falling 5% to hit its lowest since February 4th. Healthcare is cushioned by AstraZeneca's (+3.2%) rise amid a couple of positive drug updates: Imfinzi plus chemotherapy tripled patient survival at three in extensive-stage small-cell lung cancer. Separately, Enhertu reduced the risk of disease progression or death by 72% vs trastuzumab emtansine (T-DM1) in patients with HER2-positive metastatic breast cancer. Meanwhile, UK energy suppliers see tailwinds from the defensive nature of the sector, offsetting some concerns surround the collapse of UK energy providers amid the rise of gas prices, with sources via The Telegraph also suggesting the UK price cap is to remain in place to protect consumers. Elsewhere, Deutsche Lufthansa (+2.8%) took a 180 on earlier losses that stemmed from a capital raise. There wasn't anything in terms of news to induce the upside, although last week there were reports of a potential sale or IPO of its MRO unit, whilst commentary from the Co. was also constructive.

Top European News

- Energy Firm Green Warns It May Not Survive Winter: Power Update

- Luxury Stocks Plunge on China as Uncertainty Hits Sentiment

- Lufthansa to Raise $2.5 Billion to Repay State Bailout Funds

- Croatia’s Oil Company INA Mulls Max. HRK2b Bond Sale

In FX, the Dollar has extended its marked recovery from post-US CPI (and NFP) lows to register fresh peaks almost across the board, and with the latest legs up prompted by broad risk aversion rather than bullish fundamentals as such following a somewhat mixed Michigan sentiment survey last Friday. To recap, the index breached 93.000 ahead of the weekend amidst weakness in stock markets on a number of factors including Quad Witching, but the more recent deterioration in sentiment has emanated from steeper declines in crude and other commodities alongside further depreciation in Evergrande’s share price against the backdrop of ongoing concerns about Delta contagion and in thin, illiquid trading conditions due to holidays in mainland China, Japan, South Korea and Taiwan. The DXY recently topped 93.400 before fading, but remains firm ahead of the NAHB housing index and data before this week’s FOMC. However, the Yen is actually outperforming having rebounded from just under 110.00, while the Franc has pared some declines from sub-0.9300 and Gold is trying to find a base around Usd 1750/oz as Treasury yields ease back and the curve reverts to flattening mode.

- NOK/GBP - Brent’s reversal towards Usd 74/brl compared to Usd 76+ at one stage on September 15 has eroded more Norges Bank rate hike premium from the Norwegian Crown, while Sterling is also recoiling as a cyclical currency after displaying relative resilience on hawkish BoE vibes of late. Eur/Nok is now hovering around 10.2600 and Cable is striving to contain losses having run into resistance circa 1.3750 and losing support at 1.3700.

- AUD/CAD/SEK - No respite for the Aussie from an exit plan and route out of lockdown in Melbourne, Victoria, as iron or prices are crushed again and Aud/Usd retreats through 0.7250 awaiting the latest set of RBA minutes, and the Loonie has been undermined by further WTI retracement alongside a degree of political uncertainty given signs that Canada’s election will go right down to the wire, with Usd/Cad just above 1.2800. Elsewhere, risk-off positioning is weighing on the Swedish Krona towards the bottom of an equidistant range around 10.2000 against the Euro on the eve of the Riksbank policy meeting even though the tone might turn more hawkish following much stronger than forecast inflation data in August.

- EUR/NZD - The Euro is embroiled in another tussle, but this time the task is to keep its head over 1.1700 vs the Greenback as it trips stops said to be sitting at 1.1704 (August 20 low), and at this stage decent option expiry interest between 1.1720-30 (1.1 bn) could be capping Eur/Usd rather than exerting any magnetic influence. Similarly, the Kiwi is facing a battle to retain 0.7000+ status as NZ’s services PMI joined the manufacturing index in sub-50.0 territory to counter better news on the COVID-19 front as Auckland’s alert level moves down to level 3 from Tuesday.

- EM - Widespread underperformance vs the Usd on all the factors listed above, though also jitters ahead of a host of Central Bank convenes post-Fed.

In commodities, WTI and Brent front-month futures continue to drift lower, and the complex conforms to the risk-off mood across the market alongside some supply-side developments over the weekend. Firstly, the Iraqi oil minister suggested that OPEC+ is working to maintain a price of USD 70/bbl for Q1 next year and will likely keep the oil deal unchanged during the next meeting in October if prices remain stable. Note – sources via Energy Intel in July suggested a potential pause in the deal amid a lower demand forecast in H1 2022 at the time. Further, the Iranian Foreign Ministry said the nation might hold talks on restoring the 2015 nuclear deal on the sidelines of the United Nations General Assembly next week. That being said, Iran recently reaffirmed the same stance it had during the prior talks earlier this year. WTI Oct has declined back under USD 71.00/bbl (vs high USD 72.08/bbl) whilst Brent Nov moves closer towards USD 74/bbl (vs high USD 75.40/bbl). In terms of bank commentary and amid the ongoing gas crunch, Goldman Sachs noted that tight global gas supplies could create a meaningful bullish catalyst for oil this winter - larger than the downside risk from another COVID wave. The analysts added that a 900k BPD demand uplift from potentially colder winter could lead USD 5/bbl increase on its Q4 2021 USD 80/bbl Brent forecast. It's also worth noting that Chinese Premier Li reiterated that the government would continue its efforts to stabilize commodity prices through a variety of measures. This would be viable for base metals and crude, given that those were the main driving forces in the recent PPI metrics. Base metals have also been hit, with LME copper moving ever closer to USD 9,000/t, having hit a current intraday low of USD 9,053/t. Dalian iron ore prices also saw a slump overnight, with traders citing the ongoing steel curbs dampening demand. Spot gold and silver continue to consolidate following last week's hefty losses ahead of a risk-packed week.

US Event Calendar

- 10am: Sept. NAHB Housing Market Index, est. 74, prior 75

DB's Jim Reid concludes the overnight wrap

It’s a confusion world when equity markets are generally within a couple of percent or so of their record highs whilst we’re seeing the biggest dollar Asian high yield company Evergrande, with $300bn of liabilities, on the brink with no-one really aware of how the work-out will be managed and whether they’ll be contagion. Meanwhile the news wires are full of stories suggesting that this could be a winter of energy blackouts across parts of the world. Having been born in the 1970s I have vivid early memories of our house being stocked full of candles to help out when the numerous power cuts of that period came through. Let’s hope we don’t get a repeat, albeit for different reasons. There are also talks about food shortages in the next few weeks due to the gas situation. C02 is used in a lot of food production in various forms and serious shortages are emerging. So a messy picture of uncertainty and that’s without talking about covid.

On Evergrande, an index of Chinese HY dropped to its lowest level since 2012 on Friday as fears spread locally. To be fair I’ve been worried about the over leveraged Chinese property sector for years without anything much happening so it’s hard to know whether this is finally the big one or not. It’s certainly the biggest test and it’s all down to how much leeway the banks give the company and how much the authorities step in to manage the fall-out. The two are probably linked. There is a domestic bank loan repayment today (with a 24 hour grace period) which is unlikely to be made and a domestic and a dollar bond coupon payment due on Thursday. So things are coming to a head this week even if today and tomorrow are public holidays in China.

Even with the holiday, sentiment is being marred this morning by a Reuters report suggesting that China will target big property developers next in its crackdown over monopolistic behaviours. Interesting timing given the concerns over Evergrande. A combination of this and the escalating Evergrande crisis has sent the Hang Seng Properties Index down as much as -6.64% overnight and to a level which if sustained would be its lowest close since June 2012. Meanwhile, Ping An Insurance, China’s largest insurer by market value and the one most exposed to the real estate sector, is down -7.60% in Hong Kong and Chinese high yield dollar bonds also continue to be under pressure. The broader Hang Seng index is down -3.87%, the Asx -2.21%, while India’s Nifty is -0.41%. The Kospi is up +0.33% though. Japanese and Chinese markets are closed for a holiday. Futures on the S&P 500 are down -0.83% while those on the Stoxx 50 are down a larger -1.23%. In fx, the US dollar index is up +0.15%. So a likely tough start to the week. Will we finally get the correction that’s increasingly become a consensus view?

These stories will continue to reverberate but there’s a lot of other things going on this week with three G7 central bank meetings and two G7 general elections (has that ever happened before?) but the conclusion of the Fed meeting (Wednesday) and German Federal election (Sunday) are the highlights. We also have the Bank of Japan (Wednesday) and Bank of England (Thursday) meetings, alongside the equivalent for a number of EM central banks, including in Turkey, South Africa and Brazil. Elsewhere Canada’s general election takes place today. Data will take a slight back seat but the September flash PMIs (Thursday) will shed further light on the state of the global economy.

The most important event this week will be the Fed’s decision on Wednesday, and this meeting is also significant as we’ll get the FOMC’s latest economic projections (SEP) and the dot plot too. In terms of what to expect, our US economists write in their preview (link here) that they expect the statement to adopt Chair Powell’s language that a reduction in the pace of asset purchases is appropriate “this year” as long as the economy remains on track. Although they see Powell maintaining optionality about the exact timing of that announcement, their view is that the effective message will be that in the absence of any material downside surprises, the bar to pushing the announcement beyond November is relatively high. For the dot plot, they expect there’ll be an upward drift in the dots that raises the number of rate hikes in 2023 to 3, followed by another 3 increases in 2024.

It’s difficult for monetary policy to operate in isolation and the fiscal path may become a little clearer or muddier this week with events in Congress in full swing. In short without a continuing resolution or the Democrats passing through their FY 2022 reconciliation package, the federal government will go into a partial shutdown on October 1st. The Dems plan to hold a vote on the $1.2trn bi-partisan infrastructure package (already passed by the Senate in August) on September 27 and simultaneously hold a vote on a short-term continuing resolution (CR) to fund the government through the October 1 deadline for the start of the new fiscal year. House majority leader Hoyer implied that one of the two planned votes would include legislation to address the debt ceiling, which will most likely need to be dealt with by the second half of October in order to avoid the possibility of a technical default. So a pretty complex picture and one full of brinkmanship on both sides. Senate Minority Leader McConnell has vowed not to vote to suspend the debt ceiling but may accept a short-term one which may force the Democrats to raise the debt ceiling through a party-line vote via their FY 2022 reconciliation package. However, the progressive wing of the Democrat Party in the House might vote against the bi-partisan package if it is not firmly tied to the more expansive reconciliation bill. So a couple of weeks of high intrigue in Washington.

Back to the week ahead and you can preview our economists’ views on the BoJ and BoE meetings here and here. Neither are expected to do too much with the BoE a little more interesting in terms of forward guidance in terms of possible tightening needed next year.

Today’s curiosity will be the Canadian election. Incumbent Prime Minister Justin Trudeau called an early election seeking to regain the majority in the Canadian House of Commons that his party lost in the 2019 election. However, since he did, the polls have narrowed substantially, with CBC News’ polling average putting Trudeau’s Liberals on 31.5%, just narrowly ahead of the opposition Conservatives on 31.0%. According to their model, the Liberals have only a 17% chance of regaining a majority, with the most likely outcome (given a 57% probability) that they’re still the largest party but falling short of the 170 seats needed.

The other main election in focus will be Germany’s, which has important implications for not just domestic but also EU policy. That’s not taking place until Sunday but we’re heading into the last full week of the campaign, with the candidates from the Bundestag parties set to take part in a final TV debate on Thursday. The polls have actually been remarkably stable over the last couple of weeks, having gone through some big shifts over recent months, and Politico’s Poll of Polls puts the centre-left SPD in the lead with 26%, ahead of Chancellor Merkel’s CDU/CSU bloc on 21%, and the Greens trailing on 16%.

Elsewhere on the political scene, there’s an important Quad Summit taking place at the White House on Friday, featuring President Biden along with the Prime Ministers of Australia, India and Japan. The statement from the White House said that the leaders would focus “on deepening our ties and advancing practical cooperation on areas such as combatting COVID-19, addressing the climate crisis, partnering on emerging technologies and cyberspace, and promoting a free and open Indo-Pacific.” That summit follows the announcement this week of a new security partnership between the US, UK and Australia, named AUKUS, which will see Australia obtain a nuclear-powered submarine fleet. On Friday night the implications of this reverberated with France recalling It’s ambassadors from the US and Australia over the Australian cancellation of a submarine contract with the French that was associated with this deal.

Finally on the data front, this Thursday will see the release of the flash PMIs for September, which will offer an indication of how the global economy has fared towards the end of Q3. Back in August, the composite PMIs showed a deterioration from their July levels across the key economies, including the Euro Area, US, UK and Japan, so it’ll be interesting to see if that deceleration in growth momentum continues. Alongside those, the Ifo’s business climate indicator from Germany will be released on Friday.

Back to last week and global equity markets slid for a second consecutive week for the first time since the Spring. The S&P 500 fell -0.57% last week, with a -0.91% decline on Friday leading to the index’s first back-to-back weekly loss since mid-May. The losses were primarily led by growth and technology stocks as the NASDAQ declined -0.47% on the week, while cyclicals such as banks (+1.12%) and energy (+3.20) stocks outperformed. Notably the S&P 500 closed below its 50 day moving average on Friday for the first time since mid-June and only the second time since early-March. European equities similarly fell back, as the STOXX 600 ended the week -0.96% lower after Friday’s -0.88% loss. As with the S&P, the European index traded under its trailing 50 day average - for the first time since mid-July.

Global sovereign bonds continued selling off as yields rose for a fourth straight week. Rising real yields and the expected tapering of central bank purchases weighed on the asset class. US 10yr Treasury yields ended the week up +2.1bps, as Friday’s +2.4bp rise overrode the rest of the week. The rise in yields came after the preliminary University of Michigan survey showed respondents’ inflation expectations in a year rose slightly to 4.7% (4.7% expected), which was 0.1pp higher than last month. 5-10yr expectations remained stable but elevated at 2.9%. Overall the sentiment reading of 71.0 (72.0 expected) was 0.7pts higher than last month but still under expectations. This was the third worst reading in a decade, with only last month and April 2020 having been lower. Buying conditions for household durables, homes and motor vehicles were their worst since 1980 due to complaints of high prices as demand shocks and supply chain issues persist.

Bond yields in Europe moved even higher across much of the continent. Yields on 10yr bunds rose +5.0bps, rising for a fourth straight week to reach its highest levels since early-July. Ahead of this week’s Bank of England meeting, yields on the short end of the curve rose to post-pandemic highs as 2yr and 5yr gilt yields increased +5.6bps and +8.6bps respectively. The short end move came despite Friday’s UK retail data for August unexpectedly falling by -0.9% (vs. +0.8%) and July’s numbers being revised down to -2.8% (from -2.5%). While the recent data may blunt some near-term hawkishness, the market continues to look ahead to rising U.K. rates.

Rounding out the data releases, the final Euro Area CPI reading for August came in unchanged from the preliminary +3.0% y/y and +0.4% m/m. The year-over-year figure increased from +2.2% in July, with clothing costs as the primary driver of the rise.

Government

Low Iron Levels In Blood Could Trigger Long COVID: Study

Low Iron Levels In Blood Could Trigger Long COVID: Study

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate…

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate iron levels in their blood due to a COVID-19 infection could be at greater risk of long COVID.

A new study indicates that problems with iron levels in the bloodstream likely trigger chronic inflammation and other conditions associated with the post-COVID phenomenon. The findings, published on March 1 in Nature Immunology, could offer new ways to treat or prevent the condition.

Long COVID Patients Have Low Iron Levels

Researchers at the University of Cambridge pinpointed low iron as a potential link to long-COVID symptoms thanks to a study they initiated shortly after the start of the pandemic. They recruited people who tested positive for the virus to provide blood samples for analysis over a year, which allowed the researchers to look for post-infection changes in the blood. The researchers looked at 214 samples and found that 45 percent of patients reported symptoms of long COVID that lasted between three and 10 months.

In analyzing the blood samples, the research team noticed that people experiencing long COVID had low iron levels, contributing to anemia and low red blood cell production, just two weeks after they were diagnosed with COVID-19. This was true for patients regardless of age, sex, or the initial severity of their infection.

According to one of the study co-authors, the removal of iron from the bloodstream is a natural process and defense mechanism of the body.

But it can jeopardize a person’s recovery.

“When the body has an infection, it responds by removing iron from the bloodstream. This protects us from potentially lethal bacteria that capture the iron in the bloodstream and grow rapidly. It’s an evolutionary response that redistributes iron in the body, and the blood plasma becomes an iron desert,” University of Oxford professor Hal Drakesmith said in a press release. “However, if this goes on for a long time, there is less iron for red blood cells, so oxygen is transported less efficiently affecting metabolism and energy production, and for white blood cells, which need iron to work properly. The protective mechanism ends up becoming a problem.”

The research team believes that consistently low iron levels could explain why individuals with long COVID continue to experience fatigue and difficulty exercising. As such, the researchers suggested iron supplementation to help regulate and prevent the often debilitating symptoms associated with long COVID.

“It isn’t necessarily the case that individuals don’t have enough iron in their body, it’s just that it’s trapped in the wrong place,” Aimee Hanson, a postdoctoral researcher at the University of Cambridge who worked on the study, said in the press release. “What we need is a way to remobilize the iron and pull it back into the bloodstream, where it becomes more useful to the red blood cells.”

The research team pointed out that iron supplementation isn’t always straightforward. Achieving the right level of iron varies from person to person. Too much iron can cause stomach issues, ranging from constipation, nausea, and abdominal pain to gastritis and gastric lesions.

1 in 5 Still Affected by Long COVID

COVID-19 has affected nearly 40 percent of Americans, with one in five of those still suffering from symptoms of long COVID, according to the U.S. Centers for Disease Control and Prevention (CDC). Long COVID is marked by health issues that continue at least four weeks after an individual was initially diagnosed with COVID-19. Symptoms can last for days, weeks, months, or years and may include fatigue, cough or chest pain, headache, brain fog, depression or anxiety, digestive issues, and joint or muscle pain.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentSpread & Containment

Another beloved brewery files Chapter 11 bankruptcy

The beer industry has been devastated by covid, changing tastes, and maybe fallout from the Bud Light scandal.

Before the covid pandemic, craft beer was having a moment. Most cities had multiple breweries and taprooms with some having so many that people put together the brewery version of a pub crawl.

It was a period where beer snobbery ruled the day and it was not uncommon to hear bar patrons discuss the makeup of the beer the beer they were drinking. This boom period always seemed destined for failure, or at least a retraction as many markets seemed to have more craft breweries than they could support.

Related: Fast-food chain closes more stores after Chapter 11 bankruptcy

The pandemic, however, hastened that downfall. Many of these local and regional craft breweries counted on in-person sales to drive their business.

And while many had local and regional distribution, selling through a third party comes with much lower margins. Direct sales drove their business and the pandemic forced many breweries to shut down their taprooms during the period where social distancing rules were in effect.

During those months the breweries still had rent and employees to pay while little money was coming in. That led to a number of popular beermakers including San Francisco's nationally-known Anchor Brewing as well as many regional favorites including Chicago’s Metropolitan Brewing, New Jersey’s Flying Fish, Denver’s Joyride Brewing, Tampa’s Zydeco Brew Werks, and Cleveland’s Terrestrial Brewing filing bankruptcy.

Some of these brands hope to survive, but others, including Anchor Brewing, fell into Chapter 7 liquidation. Now, another domino has fallen as a popular regional brewery has filed for Chapter 11 bankruptcy protection.

Image source: Shutterstock

Covid is not the only reason for brewery bankruptcies

While covid deserves some of the blame for brewery failures, it's not the only reason why so many have filed for bankruptcy protection. Overall beer sales have fallen driven by younger people embracing non-alcoholic cocktails, and the rise in popularity of non-beer alcoholic offerings,

Beer sales have fallen to their lowest levels since 1999 and some industry analysts

"Sales declined by more than 5% in the first nine months of the year, dragged down not only by the backlash and boycotts against Anheuser-Busch-owned Bud Light but the changing habits of younger drinkers," according to data from Beer Marketer’s Insights published by the New York Post.

Bud Light parent Anheuser Busch InBev (BUD) faced massive boycotts after it partnered with transgender social media influencer Dylan Mulvaney. It was a very small partnership but it led to a right-wing backlash spurred on by Kid Rock, who posted a video on social media where he chastised the company before shooting up cases of Bud Light with an automatic weapon.

Another brewery files Chapter 11 bankruptcy

Gizmo Brew Works, which does business under the name Roth Brewing Company LLC, filed for Chapter 11 bankruptcy protection on March 8. In its filing, the company checked the box that indicates that its debts are less than $7.5 million and it chooses to proceed under Subchapter V of Chapter 11.

"Both small business and subchapter V cases are treated differently than a traditional chapter 11 case primarily due to accelerated deadlines and the speed with which the plan is confirmed," USCourts.gov explained.

Roth Brewing/Gizmo Brew Works shared that it has 50-99 creditors and assets $100,000 and $500,000. The filing noted that the company does expect to have funds available for unsecured creditors.

The popular brewery operates three taprooms and sells its beer to go at those locations.

"Join us at Gizmo Brew Works Craft Brewery and Taprooms located in Raleigh, Durham, and Chapel Hill, North Carolina. Find us for entertainment, live music, food trucks, beer specials, and most importantly, great-tasting craft beer by Gizmo Brew Works," the company shared on its website.

The company estimates that it has between $1 and $10 million in liabilities (a broad range as the bankruptcy form does not provide a space to be more specific).

Gizmo Brew Works/Roth Brewing did not share a reorganization or funding plan in its bankruptcy filing. An email request for comment sent through the company's contact page was not immediately returned.

bankruptcy pandemic social distancing

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 day ago

International1 day agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges