Futures Flat Ahead Of Another Scorching PPI Print

Futures Flat Ahead Of Another Scorching PPI Print

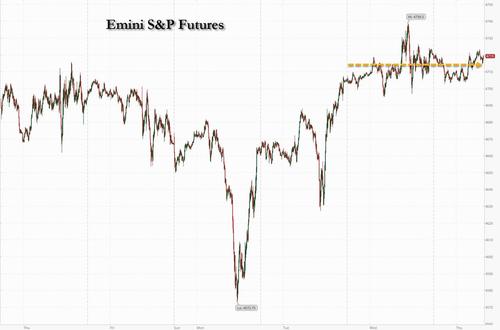

US futures were little changed on Thursday one day after the highest CPI print since 1982 and just minutes before another red hot PPI print is expected (9.8%, up from 9.6%), as investors tried

US futures were little changed on Thursday one day after the highest CPI print since 1982 and just minutes before another red hot PPI print is expected (9.8%, up from 9.6%), as investors tried to gauge the timing and pace of monetary tightening. S&P 500, Dow and Nasdaq 100 futures were up 0.1% as investors waited for the next trading signal. 10Y yields were flat around 1.74%, and the dollar edged lower as a growing tide of investors bet the world’s reserve currency has reached a peak with rate hikes largely priced-in to the market with Fed tightening likely to lead to an economic slowdown.

“Markets in 2022 have been volatile as the reality of inflation set in, and this reaction mainly reflects relief that the print did not exceed already lofty expectations,” Geir Lode, head of global equities at the international business of Federated Hermes, said in an email.

Inflation hitting 7% could force a quicker move by the Federal Reserve, with the market now pricing four rate hikes this year starting no later than March, according to technical analyst Pierre Veyret at ActivTrades in London. “Investors still struggle with one crucial question: how will the Fed manage to tackle rising price pressure without derailing the fragile post-pandemic economic recovery?”

Sure enough, San Francisco Fed President Mary Daly and her Philadelphia peer Patrick Harker added their voices to the chorus in interviews published yesterday evening and this morning, calling for a rate hike as soon as March when odds of a rate hike have hit a new high of 90%. Attention today will be on the confirmation hearing of Lael Brainard in the Senate. The vice-chair nominee, who last publicly commented on the economic outlook in September, said in prepared remarks that tackling inflation is the bank’s “most important task.”

In premarket trading, shares in Delta Air Lines rose more than 2% even though the carrier missed revenue and EPS expectations, after the company said the omicron variant won’t derail its expectation to remain profitable for the rest of the year, as it released fourth-quarter financial results. Here are some of the biggest U.S. movers today:

- U.S. chip stocks are mixed in premarket trading after sector bellwether TSMC gave a 1Q sales outlook that beat estimates and raised its projected annual capex versus last year. Equipment stock Applied Materials (AMAT US) +2% premarket, while TSMC customers are mixed with Apple (AAPL US) -0.1%, Nvidia (NVDA US) +0.7% and AMD (AMD US) +0.6%.

- Puma Biotechnology (PBYI US) shares surge 13% in U.S. premarket trading, after the company said that its Nerlynx treatment was included in the National Comprehensive Cancer Network’s (NCCN) clinical practice guidelines in oncology for the treatment of breast cancer.

- KB Home (KBH US) shares rise 6.2% in premarket trading after the homebuilder’s 4Q EPS beat estimates, with Wells Fargo calling the results and guidance “solid.”

- Planet Labs (PL US) shares rise 1.6% in U.S. premarket trading, after the satellite data provider said that it plans to launch 44 SuperDove satellites on Thursday on SpaceX’s Falcon 9 rocket.

- Adagio Therapeutics (ADGI US) said ADG20 has neutralization activity against omicron and cites recent findings from three publications on ADG20. Shares jumped 30% in post-market trading.

Discussing yesterday's scorching CPI print, DB's Jim Reid writes that "if you did an MRI scan of US inflation yesterday you’d find things to support both sides of the debate which is surprising when it hit 7% YoY and the highest since 1982 when Fed Funds were more than 13% rather than close to zero as they are today. So a slightly different real rate to back then. In fact the real rate is through any level seen in the 1970s and is only comparable to WWII levels. Back to CPI and the YoY number was in line with expectations, but core and MoM figures were all a bit firmer than expected. However, the beats were small enough that the data didn’t significantly change the outlook for monetary policy, with Fed funds futures still pricing in an 89% chance of a March hike, which is roughly around where it’d been over the preceding days."

In Europe, the Stoxx Europe 600 Index paused after a two-day advance, erasing early declines of as much as 0.3% to trade little changed, with technology and automotive shares offsetting losses in consumer products and health care. CAC 40 underperforms, dropping as much as 0.6%. The Stoxx Europe 600 Technology sub-index is up 1.1%, getting a boost from chip stocks which gained after sector bellwether TSMC gave a 1Q sales outlook that beat estimates and raised its projected annual capex versus last year. Geberit dropped as much as 4.5% to a seven-month low after the Swiss producer of sanitary installations reported fourth-quarter sales.

Bloomberg Dollar Spot dips into the red pushing most majors to best levels of the session. NZD, AUD and GBP are the best G-10 performers. Crude futures maintain a relatively narrow range. WTI is flat near $82.70, Brent stalls near $84.84. Spot gold dips before finding support near $1,820/oz. Most base metals are in the red with LME zinc lagging peers.

Asian stocks were little changed after capping their biggest rally in a year, with health-care and software-technology names retreating while financials advanced. The MSCI Asia Pacific Index fluctuated between a drop of 0.3% and a gain of 0.2% on Thursday. Hong Kong’s Hang Seng Tech Index lost 1.8% after rising the most in three months in the previous session. Benchmarks in China and Japan were the day’s worst performers, while the Philippines and Australia outperformed. “The market rose a bit too much yesterday,” said Mamoru Shimode, chief strategist at Resona Asset Management in Tokyo. “Investors keep shifting back and forth from value stocks to growth names and vise versa. It’s because we don’t know yet where U.S. long-term yields will end up settling around.” The Asian stock measure jumped 1.9% Wednesday on views that the Federal Reserve’s anticipated rate hikes will help curb inflation and allow the global recovery to chug along. U.S. inflation readings overnight, at an almost four-decade high, were in line with expectations and helped investors keep previous bets

Japanese stocks fell after Tokyo raised its Covid-19 alert to the second-highest level on a four-tier system. The Topix dropped 0.7% to 2,005.58 at the 3 p.m. close in Tokyo, while the Nikkei 225 declined 1% to 28,489.13. Recruit Holdings Co. contributed the most to the Topix’s decline, decreasing 4%. Out of 2,181 shares in the index, 500 rose and 1,604 fell, while 77 were unchanged. HIS, Japan Airlines and other travel shares fell. Tokyo’s daily cases jumped more than fivefold on Wednesday to 2,198 compared with 390 a week earlier.

India’s benchmark equity index eeked out gains to complete its longest string of advances since mid-October, buoyed by the nation’s top two IT firms after their earnings reports. The S&P BSE Sensex rose for a fifth day, adding 0.1% to close at 61,235.30 in Mumbai, while the NSE Nifty 50 Index climbed 0.3%. Infosys and Tata Consultancy Services were among the biggest boosts to both measures. Of the 30 shares in the Sensex index, 19 rose and 11 fell. Thirteen of the 19 sector sub-indexes compiled by BSE Ltd. advanced, led by a gauge of metal companies. Infosys’ quarterly earnings beat and bellwether Tata Consultancy Services’s better-than-expected sales offer some hope that the rally in India’s technology sector has further room to run, according to analysts. Still, Wipro sank the most in a year after its profit missed estimates

Fixed income is relatively quiet, with changes across major curves limited to less than a basis point so far. The 10-year yield stalled around 1.75%, slightly cheaper on the day, and broadly in line with bunds and gilts. Eurodollar futures bear steepen a touch after a round of hawkish Fedspeak during Asian hours. Treasuries were steady with yields broadly within a basis point of Wednesday’s close. Eurodollars are slightly lower across green- and blue-pack contracts after Fed’s Daly and Harker sounded hawkish tones during Asia hours. Across front-end, eurodollar strip steepens out to blue-pack contracts (Mar25-Dec25), which are lower by up to 4bp. 30-year bond reopening at 1pm ET concludes this week’s coupon auction cycle.$22b 30-year reopening at 1pm ET follows 0.3bp tail in Wednesday’s 10-year auction, and large tails in last two 30-year sales. The WI 30-year yield at ~2.095% is above auction stops since June and ~20bp cheaper than last month’s, which tailed the WI by 3.2bp.

In FX, the pound advanced to its highest level since Oct. 29 amid calls for U.K. Prime Minister Boris Johnson to resign over a “bring your own bottle” party at the height of a lockdown meant to stem the first wave of coronavirus infections in 2020. The Bloomberg Dollar Spot Index held a two-month low as the greenback weakened against all of its Group-of-10 peers, and the euro rallied a third day as it approached the $1.15 handle. Implied volatility in the major currencies over the two- week tenor, that now captures the next Fed meeting, comes in line with the roll yet investors are choosing sides. The Australian dollar extended its overnight gain as the greenback declined following as-expected U.S. inflation. Iron ore supply concern also supported the currency. The yen hovered near a two-week high as long dollar positions were unwound. Japanese government bonds traded in narrow ranges.

In commodities, cude futures maintain a relatively narrow range. WTI is flat near $82.70, Brent stalls near $84.50. Spot gold dips before finding support near $1,820/oz. Most base metals are in the red with LME zinc lagging peers. Bitcoin traded around $44,000 as the inflation numbers rekindled the debate about whether the cryptocurrency is a hedge against rising consumer prices.

Expected data on Thursday include producer prices, an early indicator of inflationary trends, and unemployment claims.

Market Snapshot

- S&P 500 futures little changed at 4,715.50

- STOXX Europe 600 down 0.1% to 485.67

- MXAP little changed at 196.79

- MXAPJ up 0.1% to 643.93

- Nikkei down 1.0% to 28,489.13

- Topix down 0.7% to 2,005.58

- Hang Seng Index up 0.1% to 24,429.77

- Shanghai Composite down 1.2% to 3,555.26

- Sensex up 0.1% to 61,220.38

- Australia S&P/ASX 200 up 0.5% to 7,474.36

- Kospi down 0.3% to 2,962.09

- German 10Y yield little changed at -0.04%

- Euro up 0.2% to $1.1465

- Brent Futures down 0.1% to $84.58/bbl

- Gold spot down 0.3% to $1,820.68

- U.S. Dollar Index little changed at 94.83

Top Overnight News from Bloomberg

- Federal Reserve Bank of San Francisco President Mary Daly and her Philadelphia Fed peer Patrick Harker joined the ranks of officials publicly discussing an interest-rate increase as early as March as the central bank seeks to combat the hottest inflation in a generation

- Global central banks will diverge on the way they respond to inflation this year, creating risks to economies everywhere, Bank of England policy maker Catherine Mann said

- Norway’s race to appoint a new central bank governor is reaching a finale mired in controversy at the prospect of a political ally and friend of Prime Minister Jonas Gahr Store getting the job

- Italy’s government is working on a spending package that won’t require revising its budget to expand the deficit, people familiar with the matter said

- Several of China’s largest banks have become more selective about funding real estate projects by local government financing vehicles, concerned that some are taking on too much risk after they replaced private developers as key buyers of land, people familiar with the matter said

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed following the choppy session in the US where major indices eked mild gains as markets digested CPI data in which headline annual inflation printed at 7.0%. ASX 200 (+0.5%) was underpinned as the energy and mining related sectors continued to benefit from the recent upside in underlying commodity prices, while Crown Resorts shares outperformed after Blackstone raised its cash proposal for Crown Resorts following due diligence inquiries. Nikkei 225 (-1.0%) declined with the index hampered by unfavourable currency flows and with Tokyo raising its COVID-19 alert to the second-highest level. Hang Seng (+0.1%) and Shanghai Comp. (-1.1%) were initially subdued, but did diverge later, after the slight miss on loans and aggregate financing data, while there is a slew of upcoming key releases from China in the days ahead including trade figures tomorrow, as well as GDP and activity data on Monday. In addition, the biggest movers were headline driven including developer Sunac China which dropped by a double-digit percentage after it priced a 452mln-share sale at a 15% discount to repay loans and cruise operator Genting Hong Kong wiped out around half its value on resumption of trade after it warned of defaults due to insolvency of its German shipbuilding business. Finally, 10yr JGBs traded rangebound and were stuck near the 151.00 level following the indecisive mood in T-notes which was not helped by an uninspiring 10yr auction stateside, while the lack of BoJ purchases in the market also added to the humdrum tone.

Top Asian News

- Asia Stocks Steady After Best Rally in a Year; Financials Gain

- Country Garden Selloff Shows Chinese Developer Worries Spreading

- China Banks Curb Property Loans to Local Government Firms

- China’s True Unemployment Pain Masked by Official Data

Bourses in Europe now see a mixed picture with the breadth of the price action also narrow (Euro Stoxx 50 Unch; Stoxx 600 -0.10%). The region initially opened with a modest downside bias following on from a mostly negative APAC handover after Wall Street eked mild gains. US equity futures have since been choppy within a tight range and exhibit a relatively broad-based performance with no real standout performers. Back in Europe, sectors are mixed and lack an overarching theme. Tech remains the outperformer since the morning with some follow-through seen from contract-chip manufacturer TSMC (ADR +4.3% pre-market), who beat on net and revenue whilst upping its 2022 Capex to USD 40bln-44bln from around USD 30bln the prior year, whilst the CEO expects capacity to remain tight throughout 2022. Tech is closely followed by Autos and Parts and Travel & Leisure, whilst the other end of the spectrum sees Healthcare, Oil & Gas, Retail and Personal & Household goods among the straddlers – with Tesco (-1.5%) and Marks & Spencer (-5.3%) weighing on the latter two following trading updates. In terms of other individual movers, BT (+0.5%) trades in the green amid reports DAZN is nearing a deal to buy BT Sport for around USD 800mln, a could be reached as soon as this month but has not been finalized. Turning to analyst commentary: Morgan Stanley’s clients have aligned themselves to the view that European equities will likely perform better than US counterparts. 45% of respondents see Financials as the top-performing sector this year, 14% preferred Tech which would be the lowest score in over six years.

Top European News

- Johnson Buys Time With Apology But U.K. Tory Rage Simmers

- U.K. Retailers Slide as Updates Show Lingering Impact of Virus

- Wood Group Plans Sale of Built Environment Unit Next Quarter

- Just Eat Advisers Pitching Grubhub Sale or Take-Private: Sources

In FX, the Dollar has weakened further in wake of Wednesday’s US inflation data as ‘buy rumour sell fact’ dynamics are compounded by more position paring and increasingly bearish technical impulses to outweigh fundamental factors that seem supportive, on paper or in theory. Indeed, the index only mustered enough recovery momentum to reach 95.022 on the back of hawkish Fed commentary and some short covering before retreating through the psychological level, then yesterday’s 94.903 low and another trough from late 2021 at 94.824 (November 11 base) to 94.710, thus far and leaving little bar the 100 DMA, at 94.675 today, in terms of support ahead of 94.500. However, the flagging Greenback could get a fillip via PPI and/or IJC, if not the next round of Fed speakers and final leg of this week’s auction remit in the form of Usd 22 bn long bonds.

- NZD/AUD - A change in the running order down under where the Kiwi has overtaken the Aussie irrespective of bullish calls on the Aud/Nzd cross from MS, with Nzd/Usd breaching the 50 DMA around 0.6860 on the way to 0.6884 and Aud/Usd scaling the 100 DMA at 0.7288 then 0.7300 before fading at 0.7314.

- GBP/EUR/CHF/CAD/JPY - Also extracting more impetus at the expense of the Buck, but to varying degrees as Sterling continues to shrug aside ongoing Tory party turmoil to attain 1.3700+ status and surpass the 200 DMA that stands at 1.3737, while the Euro has overcome Fib resistance around 1.1440, plus any semi-psychological reticence at 1.1450 to reach 1.1478 and the Franc is now closer to 0.9100 than 0.9150. Elsewhere, crude is still providing the Loonie with an incentive to climb and Usd/Cad has recoiled even further from early 2022 peaks beneath 1.2500 as a result, and the Yen is around 114.50 with scope for a stronger retracement to test the 55 DMA, at 114.22.

- SCANDI/EM - Some signs of fatigue as the Nok stalls on the edge of 9.9000 against the Eur in tandem with Brent just a few cents over Usd 85/brl, but the Czk has recorded fresh decade-plus highs vs the single currency following remarks from CNB chief Rusnok on the need to keep tightening and acknowledging that this may culminate in Koruna appreciation. The Cnh and Cny are firmer vs the Usd pre-Chinese trade and GDP data either side of the weekend, but the Rub is lagging again as the Kremlin concludes that there was no progress in talks between Russia and the West, but the Try is underperforming again with headwinds from elevated oil prices and regardless of a marked pick up in Turkish ip.

In commodities, WTI and Brent front-month contracts have conformed to the indecisive mood across the markets, although the benchmarks received a mild uplift as the Dollar receded in early European hours. As it stands, the WTI Feb and Brent Mar contract both reside within USD 0.80/bbl ranges near USD 82.50/bbl and USD 84.50/bbl respectively. News flow for the complex has been quiet and participants are on the lookout for the next catalyst, potentially in the form of US jobless claims/PPI amid multiple speakers, although the rise in APAC COVID cases remains a continuous headwind on demand for now – particularly in China. On the geopolitical front, Russian-backed troops have reportedly begun pulling out of the 1.6mln BPD Kazakh territory, but Moscow’s tensions with the West do not seem to abate. Russia's Kremlin suggested talks with the West were "unsuccessful" – which comes after NATO’s Secretary-General yesterday suggested there is a real risk of a new armed conflict in Europe. Elsewhere, spot gold has drifted off best levels as the DXY found a floor, for now – with the closest support yesterday’s USD 1,813/oz low ahead of the 50 and 21 DMAs at USD 1,807/oz and USD 1,806.50/oz respectively. LME copper has also pulled back from yesterday’s best levels to levels under USD 10,000/t as the mood remains cautious, although, copper prices in Shanghai rose to over a two-month high as it played catch-up to LME yesterday.

US Event Calendar

- 8:30am: Dec. PPI Final Demand YoY, est. 9.8%, prior 9.6%; MoM, est. 0.4%, prior 0.8%

- 8:30am: Dec. PPI Ex Food and Energy YoY, est. 8.0%, prior 7.7%; MoM, est. 0.5%, prior 0.7%

- 8:30am: Jan. Continuing Claims, est. 1.73m, prior 1.75m

- 8:30am: Jan. Initial Jobless Claims, est. 200,000, prior 207,000

DB's Jim Reid concludes the overnight wrap

Today I have a first. I have two MRI scans. A fresh one on my back and one on my right knee which gave way as I was rehabbing (squats and lunges) the left knee after recent surgery. In my fifth decade of playing sport averagely, but vigorously, it’s all catching up with me very quickly. I’ve exhausted all strengthening exercise routines and injections on my back and the pain gets worse. My surgeon does not want to operate but we will see if he changes his mind after today. If he says play less golf I will walk out mid-meeting even if he may be medically correct. In contrast my knee surgeon is an avid skier and he keeps on doing things to prolong my skiing career even though I’ve said to him that I just really care about golf. So I’ll soon be looking for an avid golfer who just happens to be a back surgeon.

Talking of confirmation bias, if you did an MRI scan of US inflation yesterday you’d find things to support both sides of the debate which is surprising when it hit 7% YoY and the highest since 1982 when Fed Funds were more than 13% rather than close to zero as they are today. So a slightly different real rate to back then. In fact the real rate is through any level seen in the 1970s and is only comparable to WWII levels. Back to CPI and the YoY number was in line with expectations, but core and MoM figures were all a bit firmer than expected. However, the beats were small enough that the data didn’t significantly change the outlook for monetary policy, with Fed funds futures still pricing in an 89% chance of a March hike, which is roughly around where it’d been over the preceding days.

Looking at the details of the release, (our US econ team’s full wrap here) headline month-on-month number came in at +0.5% in December (vs. +0.4% expected), which is the 8thtime in the last 10 months that the print has come in above the consensus expectations on Bloomberg. However, that does still mark a deceleration from the +0.9% and +0.8% monthly growth in October and November respectively. The core CPI reading was also a touch stronger than anticipated, with the monthly print at +0.6% (vs. +0.5% expected), thus sending the annual core CPI measure up to +5.5% (vs. +5.4% expected) and its highest since 1991. Diving into some of the key sub-components, Covid-era favorite used cars and trucks grew +3.5% MoM. More concerning for policymakers, is the continued growth in persistent measures such as shelter, with primary and owners’ equivalent rent both increasing +0.4% MoM. If you were expecting Omicron to slow down American holiday travel, think again, lodging away from home and airfares both posted large increases, +1.2% and +2.7%, respectively. Most forecasters think the peak for inflation is sometime soon, but the pace of the glide path is open to debate. This is a topic we covered in yesterday’s CoTD, found here.

Even though Treasuries had rallied strongly in the immediate aftermath of the report, with the 10yr yield falling back to 1.709% at the intraday low, yields pared back those losses to end the session basically unchanged at 1.74% (+0.7bps). CPI was expected to be bad and therefore the ability to shock was relatively low.

However this tame overall move masked a divergence between a sharp bounceback in the 10yr real yield (+7.5bps) and a decline in inflation breakevens (-7.5bps) as the worst fears from the report weren’t realised. Over in Europe however, there was a more sustained rally, with yields on 10yr bunds down -3.2bps to -0.06%, having come very close in recent days to moving back into positive territory for the first time since May 2019. Furthermore, there was a continued divergence between the two regions at the front end of the curve, with the gap between 2yr yields on Treasuries and bunds widening to 153bps yesterday, which is the biggest since the pandemic began.

Staying with bonds, our US econ and Rates strategy team published a joint piece last night outlining their early expectations for QT, here.

For equities, the lack of an inflation surprise meant that they got a continued reprieve following last week’s selloff, with the S&P 500 (+0.28%) advancing for a 2nd day running for the first time this year, whilst in Europe the STOXX 600 (+0.65%) posted an even stronger advance. Megacap tech stocks were a noticeable outperformer, with the FANG+ index gaining +1.25%, whilst in Europe the STOXX Banks index (+1.22%) hit a fresh 3-year high.

On the topic of inflationary pressures, one asset that continued its upward march was oil yesterday, with Brent Crude (+1.13%), just missing its first close above $85/bbl since October yesterday. Bear in mind it was only 6 weeks earlier that Brent hit its post-Omicron closing low, just beneath $69/bbl, so it’s now up by more than $16/bbl over that period. WTI (+1.75%) saw a similar increase yesterday, which won’t be welcome news to those who’d hoped the recent decline in energy prices late last year would offer some relief on the inflation front. That said, WTI oil is making a great case to be the top-performing major asset for a second year running at the minute, having advanced by over +10% since the start of the year..

This morning, Asian markets are mostly trading lower. The Nikkei (-0.91%) is leading losses in the region, followed by the CSI (-0.55%), Shanghai Composite (-0.31% ) and Kospi (-0.19%). Elsewhere, Hong Kong's Hang Seng index (+0.07%) is swinging between gains and losses. In stock news, Cruise operator Genting Hong Kong Ltd nosedived by a record 56%, after it resumed trading today following last week's suspension as the company indicated the possibility of default. Looking forward, US equity futures are indicating a weak start with the S&P 500 (-0.15%), Nasdaq (-0.26%) and Dow Jones (-0.11%) contracts trading in the red.

On the Covid front, there was further good news from the UK as the latest wave showed further signs of ebbing. For the UK as a whole, the total number of reported cases over the last 7 days is now down -19% compared with the previous 7 day period, whilst in England the number of Covid patients in a mechanical ventilation bed has dropped to its lowest in almost 3 months, before we’d even heard of the Omicron variant.

For those following credit, our colleagues in the European Leveraged Finance Research team have just published their quarterly top trade ideas. You can find the report here.

Looking at yesterday’s other data, Euro Area industrial production grew by +2.3% in November (vs. +0.3% expected), although the October reading was revised down to show a -1.3% contraction.

To the day ahead now, and one of the highlights will be Fed Governor Brainard’s nomination hearing at the Senate Banking committee to become Fed Vice Chair. Other central bank speakers include the Fed’s Barkin and Evans, ECB Vice President de Guindos and the ECB’s Elderson, along with the BoE’s Mann. Separately, data releases from the US include December’s PPI and the weekly initial jobless claims, whilst there’s also Italy’s industrial production for November.

Government

Low Iron Levels In Blood Could Trigger Long COVID: Study

Low Iron Levels In Blood Could Trigger Long COVID: Study

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate…

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate iron levels in their blood due to a COVID-19 infection could be at greater risk of long COVID.

A new study indicates that problems with iron levels in the bloodstream likely trigger chronic inflammation and other conditions associated with the post-COVID phenomenon. The findings, published on March 1 in Nature Immunology, could offer new ways to treat or prevent the condition.

Long COVID Patients Have Low Iron Levels

Researchers at the University of Cambridge pinpointed low iron as a potential link to long-COVID symptoms thanks to a study they initiated shortly after the start of the pandemic. They recruited people who tested positive for the virus to provide blood samples for analysis over a year, which allowed the researchers to look for post-infection changes in the blood. The researchers looked at 214 samples and found that 45 percent of patients reported symptoms of long COVID that lasted between three and 10 months.

In analyzing the blood samples, the research team noticed that people experiencing long COVID had low iron levels, contributing to anemia and low red blood cell production, just two weeks after they were diagnosed with COVID-19. This was true for patients regardless of age, sex, or the initial severity of their infection.

According to one of the study co-authors, the removal of iron from the bloodstream is a natural process and defense mechanism of the body.

But it can jeopardize a person’s recovery.

“When the body has an infection, it responds by removing iron from the bloodstream. This protects us from potentially lethal bacteria that capture the iron in the bloodstream and grow rapidly. It’s an evolutionary response that redistributes iron in the body, and the blood plasma becomes an iron desert,” University of Oxford professor Hal Drakesmith said in a press release. “However, if this goes on for a long time, there is less iron for red blood cells, so oxygen is transported less efficiently affecting metabolism and energy production, and for white blood cells, which need iron to work properly. The protective mechanism ends up becoming a problem.”

The research team believes that consistently low iron levels could explain why individuals with long COVID continue to experience fatigue and difficulty exercising. As such, the researchers suggested iron supplementation to help regulate and prevent the often debilitating symptoms associated with long COVID.

“It isn’t necessarily the case that individuals don’t have enough iron in their body, it’s just that it’s trapped in the wrong place,” Aimee Hanson, a postdoctoral researcher at the University of Cambridge who worked on the study, said in the press release. “What we need is a way to remobilize the iron and pull it back into the bloodstream, where it becomes more useful to the red blood cells.”

The research team pointed out that iron supplementation isn’t always straightforward. Achieving the right level of iron varies from person to person. Too much iron can cause stomach issues, ranging from constipation, nausea, and abdominal pain to gastritis and gastric lesions.

1 in 5 Still Affected by Long COVID

COVID-19 has affected nearly 40 percent of Americans, with one in five of those still suffering from symptoms of long COVID, according to the U.S. Centers for Disease Control and Prevention (CDC). Long COVID is marked by health issues that continue at least four weeks after an individual was initially diagnosed with COVID-19. Symptoms can last for days, weeks, months, or years and may include fatigue, cough or chest pain, headache, brain fog, depression or anxiety, digestive issues, and joint or muscle pain.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentSpread & Containment

Another beloved brewery files Chapter 11 bankruptcy

The beer industry has been devastated by covid, changing tastes, and maybe fallout from the Bud Light scandal.

Before the covid pandemic, craft beer was having a moment. Most cities had multiple breweries and taprooms with some having so many that people put together the brewery version of a pub crawl.

It was a period where beer snobbery ruled the day and it was not uncommon to hear bar patrons discuss the makeup of the beer the beer they were drinking. This boom period always seemed destined for failure, or at least a retraction as many markets seemed to have more craft breweries than they could support.

Related: Fast-food chain closes more stores after Chapter 11 bankruptcy

The pandemic, however, hastened that downfall. Many of these local and regional craft breweries counted on in-person sales to drive their business.

And while many had local and regional distribution, selling through a third party comes with much lower margins. Direct sales drove their business and the pandemic forced many breweries to shut down their taprooms during the period where social distancing rules were in effect.

During those months the breweries still had rent and employees to pay while little money was coming in. That led to a number of popular beermakers including San Francisco's nationally-known Anchor Brewing as well as many regional favorites including Chicago’s Metropolitan Brewing, New Jersey’s Flying Fish, Denver’s Joyride Brewing, Tampa’s Zydeco Brew Werks, and Cleveland’s Terrestrial Brewing filing bankruptcy.

Some of these brands hope to survive, but others, including Anchor Brewing, fell into Chapter 7 liquidation. Now, another domino has fallen as a popular regional brewery has filed for Chapter 11 bankruptcy protection.

Image source: Shutterstock

Covid is not the only reason for brewery bankruptcies

While covid deserves some of the blame for brewery failures, it's not the only reason why so many have filed for bankruptcy protection. Overall beer sales have fallen driven by younger people embracing non-alcoholic cocktails, and the rise in popularity of non-beer alcoholic offerings,

Beer sales have fallen to their lowest levels since 1999 and some industry analysts

"Sales declined by more than 5% in the first nine months of the year, dragged down not only by the backlash and boycotts against Anheuser-Busch-owned Bud Light but the changing habits of younger drinkers," according to data from Beer Marketer’s Insights published by the New York Post.

Bud Light parent Anheuser Busch InBev (BUD) faced massive boycotts after it partnered with transgender social media influencer Dylan Mulvaney. It was a very small partnership but it led to a right-wing backlash spurred on by Kid Rock, who posted a video on social media where he chastised the company before shooting up cases of Bud Light with an automatic weapon.

Another brewery files Chapter 11 bankruptcy

Gizmo Brew Works, which does business under the name Roth Brewing Company LLC, filed for Chapter 11 bankruptcy protection on March 8. In its filing, the company checked the box that indicates that its debts are less than $7.5 million and it chooses to proceed under Subchapter V of Chapter 11.

"Both small business and subchapter V cases are treated differently than a traditional chapter 11 case primarily due to accelerated deadlines and the speed with which the plan is confirmed," USCourts.gov explained.

Roth Brewing/Gizmo Brew Works shared that it has 50-99 creditors and assets $100,000 and $500,000. The filing noted that the company does expect to have funds available for unsecured creditors.

The popular brewery operates three taprooms and sells its beer to go at those locations.

"Join us at Gizmo Brew Works Craft Brewery and Taprooms located in Raleigh, Durham, and Chapel Hill, North Carolina. Find us for entertainment, live music, food trucks, beer specials, and most importantly, great-tasting craft beer by Gizmo Brew Works," the company shared on its website.

The company estimates that it has between $1 and $10 million in liabilities (a broad range as the bankruptcy form does not provide a space to be more specific).

Gizmo Brew Works/Roth Brewing did not share a reorganization or funding plan in its bankruptcy filing. An email request for comment sent through the company's contact page was not immediately returned.

bankruptcy pandemic social distancing

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 day ago

International1 day agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges