Uncategorized

Futures Drop As Tech Earnings Disappoint, Payrolls Loom

Futures Drop As Tech Earnings Disappoint, Payrolls Loom

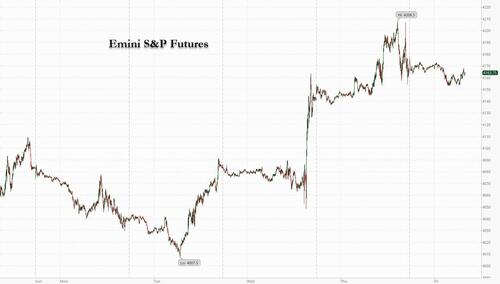

Thursday’s powerful rally reverse and Nasdaq futures slipped on Friday after the "Triple-A"…

Thursday's powerful rally reverse and Nasdaq futures slipped on Friday after the "Triple-A" tech giants Apple, Amazon and Alphabet poured cold water on sentiment after their reported earnings that largely missed expectations and showed an economic slowdown is choking demand for their businesses. APPL missed its 4Q revenue despite holiday season, stock -3.1%; AMZN’s Q1 guidance missed expectation, stock -5.4%; GOOGL signaled declines in searching demand, stock -4.0%. As a result, Nasdaq 100 futures fell 1% as of 7:45am ET after underlying benchmark soared 3.6% on Thursday, taking weekly gains to 5.2%. This would be the index’s fifth week of gains, marking the longest such winning streak since November 2021. S&P 500 futures also dropped, sliding 0.5% and off session lows. The risk off mood helped rates drop with the 10-year yield falling to about 3.38%; the dollar was flat, reversing earlier gains, while oil traded modestly in the red.

Today, the focal point will be the NFP data: consensus sees NFP to print 189k vs 223k prior; Unemployment to print 3.6% vs 3.5% prior. Further, keep an eye on the Hourly Earnings (4.6% survey vs. 4.3% prior) and Labor Force Participation Rate (62.3% survey vs. 62.3% prior) to further gauge the wage inflation.

As noted above, Apple, Amazon and Alphabet, which have a combined market value of almost $5 trillion, produced results that highlighted weaker demand for electronics, e-commerce, cloud computing and digital advertising. All three companies slumped in premarket trading. Together, they comprise about 27% of the Nasdaq 100. Here is a snapshot of their disappointing earnings:

- Apple Inc (AAPL) Q1 2023 (USD): EPS 1.88 (exp. 1.94), Revenue 117.15bln (exp. 121.1bln), Products 96.39bln (exp. 98.98bln), iPhone 65.78bln (exp. 68.3bln), Mac 7.74bln (exp. 9.72bln), iPad 9.40bln (exp. 7.78bln). Co. said Q2 2023 revenue growth will be higher than the previous year and it sees a 5% impact from FX rates in Q2, while it expects iPhone revenue growth to accelerate in Q2 compared to Q1. Shares are lower by 3.3% pre-market.

- Alphabet Inc (GOOGL) Q4 2022 (USD): EPS 1.05 (exp. 1.18), Revenue 76.05bln (exp. 76.53bln). Google advertising 59.04bln (exp. 60.64bln). Significant work underway to improve all aspects of cost structure, in support of investments in highest growth priorities. Shares are lower by 4.1% pre-market.

- Amazon.com Inc (AMZN) Q4 2022 (USD): EPS 0.03 (exp. 0.18), Revenue 149.2bln (exp. 145.42bln).AWS net sales USD 21.38bln (exp. 21.76bln). Co. said in the short-term, it faces an uncertain economy but remain quite optimistic about the long-term opportunities for the Co. Shares are lower by 5.5% pre-market.

Elsewhere in premarket trading, bank stocks were mixed as investors awaited the release of economic data including monthly US payrolls. Here are some other notable premarket movers:

- Nordstrom shares jump as much as 37% on news that meme-stock activist investor Ryan Cohen is building a large stake in the department store operator, a move that analysts said was positive, though they were looking to hear more regarding the activist’s intentions.

- Gilead shares rose 3.9% on low volumes after the company reported 4Q results. Gilead’s core business performed well and complemented strong ongoing sales for the biopharma’s Covid treatment, which should bode well for investor sentiment into 2023, analysts say.

- Qualcomm sank 3.6% after the semiconductor and telecommunication equipment provider gave worse-than-expected forecasts for the second quarter, saying it’s yet to see the benefits of China reopening in smartphone demand.

- Starbucks shares fall 2.1% after the coffee chain delivered results that showed weakness in China that dragged on its overall performance.

- Atlassian shares fall 12% as a second consecutive cloud guidance cut and weaker trends in its customer base are both causes for concern for analysts, though some say expectations for the software company have now been rebased to a beatable level.

- Bill.com shares drop 20% as the back-office software firm’s quarterly results showed surprising levels of macro-driven weakness in its customer base, according to analysts.

- Keep an eye on Boeing after the stock was cut to sector perform from outperform at RBC as the broker sees supply chain and production overhangs weighing on sentiment for the plane manufacturer.

Despite Friday's weakness, US stock soared this week after Fed Chair Powell said the central bank has made progress in its fight to tamp down inflation, with investors brushing off fears of more rate hikes. Aside from further earnings, a slew of labor data will be in focus on Friday. Fed officials have made clear they want to see evidence that supply and demand imbalances in the labor market are starting to improve.

“The resilience of the labor market does appear to suggest that markets are underestimating how much further headroom the Federal Reserve might have when it comes to further rate hikes,” said Michael Hewson, chief market analyst at CMC Markets UK. “There continues to be a sense that the market is extraordinarily complacent about how quickly we might see the Federal Reserve pivot when it comes to interest rates.”

“Risk markets are buoyed by lower implied policy rates and expectations that the Fed will achieve a soft landing,” Alex Rohner, a fixed-income strategist at Bank J Safra Sarasin Ltd. wrote in a note. “This will be very hard to achieve. In fact, substantial tightening cycles such as the current one have historically led to a sharp rise in unemployment, and a recession.”

European stocks retreated after closing within a whisker of a bull market on Thursday. The Stoxx 600 is down 0.2% with real estate, construction and financial services the worst-performing sectors. French drugmaker Sanofi was the biggest decliner in index-points terms after forecasting a slowdown in profit growth this year. Carmakers also weighed on the index, following US peers lower after Ford’s disappointing earnings report. Here are the biggest European movers:

- Sanofi shares drop as much as 5.2%, the most since November, after the French pharma giant reported fourth-quarter results that missed estimates on weak vaccine sales

- IWG shares drop as much as 6.9% after Barclays cut the workspace provider to equalweight from overweight, saying that consensus looks too optimistic

- Coloplast slides as much as 3.6%, before paring losses, after the Danish chronic and continence care firm’s in- line 1Q report was overshadowed by unchanged and somewhat cautious guidance

- Volvo Car -3.4%, Ferrari -3%, Porsche -3.9%, Faurecia -2.3%, VW -1.6%, BMW -1.5%, Stellantis -1.5% after Ford posted fourth-quarter profit that fell short of Wall Street estimates

- Cint falls as much as 41%, the most since its 2021 IPO after the Swedish data-insights firm pre-released weak 4Q results

- Skanska falls as much as 4.2% after a weak performance for the Swedish construction group’s residential development arm proved a weak spot in an otherwise strong 4Q report

- Zur Rose shares jumped as much as 92%, with trading halted multiple times over the course of the morning, after news the online pharmacy had sold its Swiss business to Migros subsidiary Medbase

- CaixaBank shares rose as much as 3.9%, the most since December, after the Spanish lender reported fourth-quarter results that beat estimates and said it will consider additional extraordinary capital distributions

Earlier in the session, Asian stocks declined, with the regional benchmark on course for its first weekly drop of the year, as the rally in Chinese equities paused. The MSCI Asia Pacific Index declined as much as 0.6% on Friday, with declines in heavyweights Alibaba and BHP helping to offset gains in tech stocks in Japan and South Korea. Key gauges for Hong Kong and mainland China were major drags. Hopes for an energizing economic reopening and easing of corporate crackdowns have spurred a blistering rally in Chinese stocks — with the MSCI China Index up more than 50% from an October trough. But investors have started looking more deeply for new catalysts to extend the rally. Valuation of the MSCI measure of Chinese stocks may rise from the current level of around 11 times projected earnings, but to reach 13 times or more, “people need to have a very different view on geopolitical risks,” Wendy Liu, a strategist at JPMorgan Chase, said in an interview with Bloomberg TV. Still, “within that range, I think there are a lot of investment opportunities,” she said.

Japanese equities bucked the Asian trend and rose, as investors digested corporate earnings reports: Sony, Takeda Pharmaceutical and other companies that reported their latest quarterly results gained. The Topix Index rose 0.3% to 1,970.26 as of market close in Tokyo, while the Nikkei advanced 0.4% to 27,509.46. Sony contributed the most to the Topix Index’s gain, increasing 6.2% as the electronics and entertainment provider beat earnings expectations and lifted its outlook. Takeda and Murata also climbed after results. Still, among the 2,164 stocks in the index, decliners outpaced advancers 1,301 to 739, while 124 were unchanged. The latest flow data show foreign investors last week bought the most Japanese stocks and futures in more than four years.

Australian stocks posted a fifth week of gains: the S&P/ASX 200 index rose 0.6% to close at a nine-month high of 7,558.10, boosted by strength in banks and health care shares. The benchmark advanced for a fifth straight week, adding 0.9%. In New Zealand, the S&P/NZX 50 index rose 0.4% to 12,197.15.

India’s benchmark stocks gauge rallied to post its biggest weekly advance in more than six months as investors continued to overlook the selloff in shares of Adani Group, some of which rose on Friday after volatility-curbing measures from exchanges. The S&P BSE Sensex Index rose 1.5% to 60,841.88 in Mumbai, taking its weekly rally to 2.6%, the biggest since July 31. The NSE Nifty 50 Index advanced 1.4%, while its weekly gains trailed the benchmark at 1.4%, dragged by sharp plunge in shares of some Adani companies that are part of the broader index. Shares of Adani conglomerate were mixed as four out of ten companies, including Adani Enterprises, ended higher, led by 7.9% gain in ports and logistics unit while both cement units also advanced. The flagship gained 1.4%, overcoming an intraday plunge of as much as 35%. Local bourses placed six Adani Group companies, four of which also have derivative contracts traded, on a watchlist for additional trading scrutiny, a measure that analysts saw helping curb volatility in these stocks. However, the measure didn’t pacify selling in Adani Transmission and Adani Green Energy, which plunged by daily 10% limit. Excluding for the four gainers, rest six companies related to the group, closed at lower circuit level. “The equity markets witnessed an extremely high level of volatility all through the week, on account of external as well as domestic developments,” said Joseph Thomas, Head of Research, Emkay Wealth Management. “The Fed outcome as well as ECB, and also the selloff in the shares of a major business group added to the selling pressure.” Despite the selloff in Adani shares, investors have been focusing on sectors, such as consumer durables and technology, which have corrected sharply in recent weeks. Consumer durables index was the top gainer among BSE Ltd.’s 20 sector gauges while utilities, which have weight to Adani stocks, were the worst.

In FX, the Dollar Index is down 0.2% ahead of the US jobs report. The Canadian dollar and Australian dollar are the weakest among the G-10’s.

In rates, treasuries are slightly richer across the curve helped by a drop in S&P futures from Thursday’s peak as tech earnings from Apple, Amazon and Alphabet dented post-FOMC optimism. US 10-year yields around 3.39%, marginally richer vs. Thursday close with bunds lagging by 8bp in the sector, gilts by 2bp; US curve spreads slightly steeper, although within a basis point of Thursday close. Three-month dollar Libor +2.80bp at 4.83414%. European bonds also declined, paring some of the sizable gains seen after Thursday’s central bank decisions. German 10-year yields are up 6bps while the UK equivalent adds 2bps.

US economic data slate includes January jobs report (8:30am), S&P services PMI (9:45am) and ISM services index (10am): January jobs report estimate a headline print of 188k, down from prior 223k with whisper number at 197k.

In commodities, oil headed for a second weekly drop as optimism over a recovery in Chinese demand dimmed and US stockpiles kept rising. Crude futures are little changed with WTI trading near $75.85. Russia's Kremlin said the EU embargo on Russian petroleum products will further unbalance energy market, according to Reuters. Base metals are mostly lower whilst copper bucks the trend; LME copper tested levels close to USD 9,050/t (vs high 9,091/t) before finding some support. Spot gold is down 0.1% at $1,910.

Bitcoin trades flat in European hours on either side of USD 23,500 awaitng the US NFP.

To the day ahead now, and the main highlight will be the US jobs report for January. Otherwise, in the US we’ve got the ISM services index for January, there’s the Euro Area PPI reading for December, and the final services and composite PMIs for January from around the world. From central banks, we’ll hear from the Fed’s Daly, the ECB’s Visco and BoE chief economist Pill.

Market Snapshot

- S&P 500 futures down 0.7% to 4,161.00

- STOXX Europe 600 down 0.3% to 457.99

- MXAP down 0.2% to 169.86

- MXAPJ down 0.3% to 555.25

- Nikkei up 0.4% to 27,509.46

- Topix up 0.3% to 1,970.26

- Hang Seng Index down 1.4% to 21,660.47

- Shanghai Composite down 0.7% to 3,263.41

- Sensex up 1.6% to 60,865.73

- Australia S&P/ASX 200 up 0.6% to 7,558.11

- Kospi up 0.5% to 2,480.40

- German 10Y yield little changed at 2.14%

- Euro little changed at $1.0918

- Brent Futures up 0.2% to $82.37/bbl

- Gold spot up 0.1% to $1,914.44

- U.S. Dollar Index little changed at 101.73

Top Overnight News

- Bullish markets are increasingly pricing in a second-half reversal of the global monetary tightening wave, making it tougher for central bankers to vanquish inflation once and for all

- Late to the global interest-rate hiking party, the ECB is trying to convince everyone that it will also be one of the last to leave; ECB Governing Council member Peter Kazimir said next month’s planned hike in borrowing costs probably won’t be the last, while Governing Council member Gediminas Simkus said a rate cut in 2023 is “not very likely”; Professional forecasters surveyed by the ECB expect inflation to average 2.1% in 2025

- Russia will almost triple the amount of foreign currency it plans to sell through early March after a plunge in energy revenue brought it far below the target set in the budget

- The BOJ’s unrealized losses from its bond holdings grew about 10 times last quarter due to the December policy adjustments that drove up yields

- China's policymakers plan to step up support for domestic demand this year but are likely to stop short of splashing out big on direct consumer subsidies, keeping their focus mainly on investment, three sources close to policy discussions said. RTRS

- China said on Friday that cross border travel between the mainland, Hong Kong and Macau would fully resume from Feb. 6, dropping existing quotas and scrapping a mandatory COVID-19 test that was required before travelling. RTRS

- CIA Director William Burns said on Thursday the intelligence agency assesses that China’s President Xi Jinping has been a little sobered by the war in Ukraine, but that it would be a mistake to underestimate Beijing and Moscow’s commitment to partnership. SCMP

- BOE Chief Economist Huw Pill has said policy makers must “enguard against the possibility of doing too much” on interest rates, the latest sign that the quickest tightening cycle in three decades may be near an end. BBG

- The ECB is likely to raise interest rates again in May after an already signalled hike in March, two policymakers said on Friday, with one arguing that the peak or "terminal" rate is at least starting to appear on the horizon.

- The number of Russian troops killed and wounded in Ukraine is approaching 200,000, a stark symbol of just how badly President Vladimir V. Putin’s invasion has gone, according to American and other Western officials. NYT

- The Kremlin on Friday rejected as a "hoax" media reports that U.S. CIA Director William Burns had travelled to Moscow with a secret peace proposal that involved Ukraine ceding a fifth of its territory to Russia. The Swiss newspaper Neue Zürcher Zeitung's report, which said Burns had made a secret trip to Moscow last month to put forward the plan on behalf of the White House, has also been dismissed by Washington. RTRS

- Big 3 Last Night: AAPL missed on EPS and revs on the call said the shortfall was driven by China supply disruptions (which have been resolved) while China demand improves (thanks to reopening) and gross margins were guided above the St (due in part to falling commodity costs); AMZN (worst of the 3) w/ the slowdown/miss in AWS (on the call said AWS is set to slow even more); GOOGL missed on EPS/op. income/revs (Google Search and YouTube advertising both were light). Into prints we saw L/O supply. Last night and pre open HFs buying the weakness. GS Securities

- Turkey’s consumer inflation slowed less than forecast, even as months of deceleration are emboldening policymakers to consider interest- rate cuts ahead of approaching elections. Consumer prices rose an annual 57.7% last month, from 64.3% in December

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed as participants digested the latest bout of central bank rate hikes and a slew of earnings releases, while strong Chinese Caixin Services and Composite PMI data also failed to inspire. ASX 200 was led by healthcare and real estate, while the top-weighted financial sector also benefitted amid reports of early merger talks between regional lenders Bank of Queensland and Bendigo & Adelaide Bank. Nikkei 225 briefly breached the 27,500 level as earnings remained in focus with Sony among the best performers after it reported higher 9-month profits, as well as raised its FY net guidance and PS5 sales target. Hang Seng and Shanghai Comp. weakened despite the easing of border restrictions between mainland China, Hong Kong and Macau, while the rebound in Chinese Caixin PMI data also failed to spur risk appetite after the bout of global central bank policy tightening and with China’s Commerce Ministry warning that the nation’s imports and exports face an extremely severe environment on slowing external demand.

Top Asian News

- Hong Kong Macau Affairs Office said will drop cross-border restrictions between the mainland, Hong Kong and Macau, as well as end pre-arrival PCR testing for some travellers and will resume group tours effective February 6th. Hong Kong Chief Executive Lee also announced that all border points between mainland China and Hong Kong are to resume without quotas on travel, according to Reuters.

- Chinese policymakers are planning on supporting domestic demand in 2023 but are unlikely to "splash out" on direct consumer subsidies, keeping their focus on investment, according to Reuters sources.

- China's Cabinet stated that China's economy still faces difficult and challenges, according to state media, adding that China's economic operations are recovering, and will consolidate and expand economic recovery momentum, via Reuters.

European bourses trade mostly lower, with little in terms of news flow since the cash open as participants look ahead to the US jobs numbers. Sectors are now mixed with Energy, Basic Resources, and Healthcare as the top performers, with the former two aided by gains in underlying commodities, whilst healthcare is driven by gains in Roche (+3.0%) and AstraZeneca (+1.7%) whilst Sanofi (-2.9%) slips after poorly-received earnings. Sticking with sectors, the sectoral laggards comprise of Real Estate, Utilities, Construction and Financial Services. US futures are softer across the board with the NQ the underperformer amid disappointing earnings from highly concentrated mega-cap names (AAPL, AMZN, GOOG).

Top European News

- BoE's Chief Economics Pill said the UK has had some better times as of late, he is confident yesterday's hike was necessary and appropriate, and there is still a lot of policy in the pipeline. Pill said the MPC has changed language quite substantially and the MPC's job is to return inflation to the target and hold it over the medium term. He said he does not want to steer market rates on a day-to-day basis and they have to be prepared for shocks. He said it is important to guard against the possibility of doing too much. He has reasonably high confidence we will see inflation fall this year, focus is on whether inflation declined further ahead, and the notion of whether we are in a recession or not may vary throughout the year, via Times Radio.

- ECB's Simkus said inflation has probably peaked but core has yet to do so; 50bps hike in March may not be the last half-point move. He said a rate hike in May is possible, could be 25bps or 50bps but hardly 75bps. Rate reduction this year is unlikely but possible next year if the situation changes. Inflation trends are positive and approaching the terminal rate, according to Reuters and Bloomberg.

- ECB's Kazimir said March hike will not bring rates to peak. ECB will decide how many hikes take place beyond March, and fears that inflation could stay at levels too high. He said the fight against inflation is far from won.

- ECB's Rehn said the Governing Council intends to raise rates by 50bsp in March, via Twtter.

- ECB's Muller said core inflation is a cause for concern, via Bloomberg.

- ECB's Wunsch said a 25bps or 50bps rate hike is possible; will not go from 50bps in March to zero in May, and adds that 3.5% terminal rate is the minimum. He said core inflation remains persistent. He said Thursday's decision was hawkish, market reaction was surprising.

- ECB Survey of Professional Forecasters: 2023 inflation nudged higher to 5.9%, 2025 seen just above target at 2.1%.

FX

- DXY has given up earlier gains after testing levels close to 102.00 before warning towards 101.50.

- EUR and GBP reside as the current outperformers, with the former lifted by hawkish commentary from several ECB members, whilst both currencies benefit from upward revisions to January PMIs.

- CAD is the lagged as USD/CAD continued its rebound from sub-1.3300 and y-t-d low, while the AUD suffers some contagion from a Yuan retreat.

Fixed Income

- 10yr USTs is nearer 115-13+ than 115-22+ extremes vs 116-00 at best in the previous session as eyes turn to the NFP.

- Bunds have been down to 138.56 for a 137 tick retracement from Thursday peak following hawkish ECB commentary.

- Gilts sub-107.00 at 106.89 having hit 107.78 yesterday, but downside is cushioned by dovishly-received remarks from BoE's Pill.

Commodities

- Crude benchmarks are choppy as the contracts trimmed their earlier modest gains, while complex-specific news flow has been rather light in the European morning.

- Spot gold is flat intraday but with a downside bias despite the dollar waning throughout the European morning.

- Base metals are mostly lower whilst copper bucks the trend; LME copper tested levels close to USD 9,050/t (vs high 9,091/t) before finding some support.

- Russia's Kremlin said the EU embargo on Russian petroleum products will further unbalance energy market, according to Reuters.

Geopolitics

- US is tracking a suspected Chinese spy balloon which entered US airspace a couple of days ago which US military officials recommended to not shoot down because of safety risks, while President Biden was briefed regarding the spy balloon and asked the military to present options, according to a senior administration official cited by Reuters. It was later reported that Canada's Department of National Defence was monitoring a possible 2nd balloon incident.

- Chinese Foreign Ministry, on the US Pentagon suspecting a Chinese spy balloon over US, said speculation and hype are not conducive until the facts are clear, according to Reuters.

- US CIA Director Burns said China is the biggest geopolitical challenge that the US faces and the CIA assessed that Chinese President Xi has been a little sobered by Ukraine but has serious focus and ambition on Taiwan, according to Reuters.

- Chinese Foreign Ministry said there is no news to release at this time on US Secretary of State Blinken's visit to China, according to Reuters.

- Secretaries of Security Councils of Central Asia, Pakistan, India, China are to meet on Afghanistan in Moscow next week, according to Tass.

- Reports of air raid sirens in Kyiv before EU-Ukraine summit started, according to AFP.

- Russia's Kremlin has rejected reports that the US offered Russia a secret peace plan on Ukraine, according to Reuters.

US Event Calendar

- 08:30: Jan. Change in Nonfarm Payrolls, est. 189,000, prior 223,000

- Change in Private Payrolls, est. 190,000, prior 220,000

- Change in Manufact. Payrolls, est. 7,000, prior 8,000

- Unemployment Rate, est. 3.6%, prior 3.5%

- Underemployment Rate, prior 6.5%

- Labor Force Participation Rate, est. 62.3%, prior 62.3%

- Average Hourly Earnings MoM, est. 0.3%, prior 0.3%

- Average Hourly Earnings YoY, est. 4.3%, prior 4.6%

- Average Weekly Hours est. 34.3, prior 34.3

- 09:45: Jan. S&P Global US Services PMI, est. 46.6, prior 46.6

- ISM Services Prices Paid, prior 67.6, revised 68.1

- ISM Services Employment, prior 49.8, revised 49.4

- ISM Services New Orders, prior 45.2

- ISM Services Index, est. 50.5, prior 49.6, revised 49.2

DB's Jim Reid concludes the overnight wrap

After an action packed week, I've been press ganged into attending a fancy dress quiz night at our kids' school this weekend. The theme is "back to the 90s". My wife is going as Geri Halliwell and rather randomly I'm going as the late Keith Flint from the band The Prodigy as my wife found a supposedly good outfit for me. I've not seen it yet but I have a fake green Mohican, some fake nose studs, a studded collar and numerous fake ear piercings. My wife has her make up box ready as well. I can only hope it's the 1990s and not the 1890s as we'll look a bit racy next to Queen Victoria otherwise. For those that voted for us in II last year you'll be spared pictures. For those that didn't, you'll get them when you least expect.

Ahead of that excitement, today we hit another payrolls Friday after an astonishing rally across the board over the last 36 hours. The highlight yesterday was one of the biggest rallies for European sovereigns in a decade as investors grew hopeful that central banks were nearing the end of their hiking cycles. Whilst plenty were questioning how sustainable this rally will prove given the actual decisions and central bank commentary, the results were undeniable. Yields on 10yr bunds (-20.4bps) saw their largest daily decline since November 2011, on the day that Mario Draghi became ECB President. That positivity was evident across the board, with the S&P 500 (+1.47%) hitting a 5-month high, and the NASDAQ (+3.25%) ending the day just shy of entering a bull market (+19.5% from the lows). However, entering that bull market might wait for another day as the big 3 tech earnings after the bell - Apple, Alphabet and Amazon - all disappointed in various ways. Their shares were down -3.2%, -4.6% and -5.1% in after-hours trading. However for some perspective they were up +3.7%, +7.3% and +7.4% respectively in normal trading.

Google’s parent company missed on Q4 revenues, particularly in YouTube ads, which are down year over year. Meanwhile Amazon reported their first annual loss since 2014, posting a net loss of -2.7bn, compared to $33bn in profit over the previous fiscal year. Apple had a poor holiday season that the company blamed in part on supply chain issues due to the Covid policies in China that led to a slower rollout of new products. Against that background, NASDAQ 100 futures are now -1.51% lower, with S&P futures down -0.53%.

The normal hours rally got a big boost from what was at first glance a pretty hawkish ECB announcement before the nuances came through. The hike itself was 50bps as expected, taking the deposit rate up to a post-2008 high of 2.5%. And in a surprise move, they also pre-committed themselves to another 50bps hike in March, which only 2-3 weeks ago had been considered in the balance between 25 and 50. However, markets latched onto several other more dovish signals, in particular that after March they would “then evaluate the subsequent path of its monetary policy.” In addition, President Lagarde acknowledged that inflation risks were now “more balanced”, and that “the recent fall in energy prices, if it persists, may slow inflation more rapidly than expected.” What investors have liked about this week’s central bank commentary is that it will seemingly become more dependent on inflation data after March. The market thinks inflation is tamed and thus central banks will be able to, or will have to, cut rates before year-end. See our European economists' views here, where they explain why they view yesterday’s decision as the ECB preparing for the third and final stage of the tightening cycle. They maintain their view of a 3.25% terminal rate following a 50bp hike in March and a final hike of 25bp in May.

Even as our view of terminal remained unchanged, investors moved to price in a move dovish back end to this year and beyond. For instance, even as investors moved to fully price in a 50bps move next month, the rate priced in for year-end came down by around 20bps. In turn, that triggered a massive rally for European sovereigns, with declines among 10yr bunds (-20.4bps), OATs (-23.7bps) and BTPs (-39.3bps) that we haven’t seen in years. On BTPs, it was the sixth best daily move since our daily data begins in 1993.

This rally initially wasn’t just confined to Europe though, since the ECB’s move added to pre-existing views that central banks are moving away from the forceful hikes of late-2022, and will instead adopt a more data-driven approach that could soon see a pause in the hiking cycle. This initially caused US Treasuries to rally along with Europe. However, in the NY afternoon, rates gave back some of their gains as expectations on the Fed’s terminal rate ultimately remained unchanged, leaving yields on 10yr Treasuries (-2.4bps) just slightly lower at 3.376%. The effects of that could be seen in financial conditions as well, with Bloomberg’s index for the US easing intraday to its most accommodative level since last February before tightening into the close as rates sold off. Regardless financial conditions remain nearly as loose as we have seen in nearly a year.

A major component of the looser financial conditions has been the rally in equities, with the S&P 500 (+1.47%) posting a third consecutive gain of more than +1% for the first time since October. The backdrop of lower rates meant that tech stocks saw a major outperformance, with the NASDAQ up +3.25%, and the FANG+ index seeing its best day since November with a +6.92% gain prior to the after-hours hiccup. It was much the same story in Europe too, with the STOXX 600 (+1.35%) at a 9-month high, along with advances for the DAX (+2.16%) and the CAC 40 (+1.26%) as well.

Asian equity markets are mixed this morning even as US equities closed on a positive note overnight. As I type, the KOSPI (+0.60%) and the Nikkei (+0.35%) are trading in the green. However, Chinese equities, led by the Hang Seng (-1.82%) and followed by the CSI (-1.67%) and the Shanghai Composite (-1.37%) are sharply lower in morning trading, taking some of the steam out of the strong rally since late October. The weak tech earnings from Wall Street overshadowed optimism about China’s economic recovery as the nation’s service sector expanded for the first time in 5 months in January. Data released showed that the services PMI rose to 52.9 from 48 in December as the sector got a boost from the lifting of strict Covid-19 curbs.

Elsewhere, the final estimate of Japan’s au Jibun Bank services PMI edged up to 52.3 in January, a 3-month high against the prior month’s reading of 51.1. The composite PMI advanced to 50.7 in January from 49.7 in December, moving above 50 for the first time in three months. Meanwhile, yields on Japanese 10yr government bonds fell (-0.9bps) to 0.48%, just below the ceiling of the Bank of Japan’s target range.

Looking forward, today’s main highlight will be the US jobs report for January, which will offer a firmer read on the state of the labour market entering 2023. Our US economists are expecting nonfarm payrolls to have grown by +175k, which would be the weakest since the December 2020 contraction, but would be consistent with a pattern that’s seen declines for 5 consecutive months now. If realised, they see the unemployment rate ticking up a tenth to 3.6%, and they think average hourly earnings will be up by +0.3%. Keep an eye out for the work week hours which was disappointing last month. Ahead of that, yesterday’s labour market data continued the theme of very strong readings, with the initial weekly jobless claims for the week ending January 28 at just 183k (vs. 195k expected). That’s their lowest level since last April, and this isn’t just a blip either, since the 4-week moving average fell to an 8-month low of 191.75k as well.

Finally, the other central bank decision yesterday came from the Bank of England, who hiked by 50bps as expected, thus taking Bank Rate up to 4%. The vote split was 7-2, with the minority preferring to leave rates unchanged. But the decision was seen as dovish, in part because the MPC dropped their previous guidance that they would “respond forcefully” if inflationary pressures were more persistent. Instead, there was a milder form of words that said if there were “more persistent pressures, then further tightening in monetary policy would be required.” Against that backdrop, sterling weakened by -1.18% against the US Dollar, and yields on 10yr gilts were down -30.1bps, which was a larger decline than in most other European countries. Our UK economist Sanjay Raja opines on the meeting here and has reduced his terminal forecast from 4.50% to 4.25%, with 25bps in March being the last hike. There are risks of modest rate hikes in H2. See his piece for more.

To the day ahead now, and the main highlight will be the US jobs report for January. Otherwise, in the US we’ve got the ISM services index for January, there’s the Euro Area PPI reading for December, and the final services and composite PMIs for January from around the world. From central banks, we’ll hear from the Fed’s Daly, the ECB’s Visco and BoE chief economist Pill.

Uncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

Uncategorized

Economic Earthquake Ahead? The Cracks Are Spreading Fast

Economic Earthquake Ahead? The Cracks Are Spreading Fast

Authored by Brandon Smith via Alt-Market.us,

One of my favorite false narratives…

Authored by Brandon Smith via Alt-Market.us,

One of my favorite false narratives floating around corporate media platforms has been the argument that the American people “just don’t seem to understand how good the economy really is right now.” If only they would look at the stats, they would realize that we are in the middle of a financial renaissance, right? It must be that people have been brainwashed by negative press from conservative sources…

I have to laugh at this notion because it’s a very common one throughout history – it’s an assertion made by almost every single political regime right before a major collapse. These people always say the same things, and when you study economics as long as I have you can’t help but throw up your hands and marvel at their dedication to the propaganda.

One example that comes to mind immediately is the delusional optimism of the “roaring” 1920s and the lead up to the Great Depression. At the time around 60% of the U.S. population was living in poverty conditions (according to the metrics of the decade) earning less than $2000 a year. However, in the years after WWI ravaged Europe, America’s economic power was considered unrivaled.

The 1920s was an era of mass production and rampant consumerism but it was all fueled by easy access to debt, a condition which had not really existed before in America. It was this illusion of prosperity created by the unchecked application of credit that eventually led to the massive stock market bubble and the crash of 1929. This implosion, along with the Federal Reserve’s policy of raising interest rates into economic weakness, created a black hole in the U.S. financial system for over a decade.

There are two primary tools that various failing regimes will often use to distort the true conditions of the economy: Debt and inflation. In the case of America today, we are experiencing BOTH problems simultaneously and this has made certain economic indicators appear healthy when they are, in fact, highly unstable. The average American knows this is the case because they see the effects everyday. They see the damage to their wallets, to their buying power, in the jobs market and in their quality of life. This is why public faith in the economy has been stuck in the dregs since 2021.

The establishment can flash out-of-context stats in people’s faces, but they can’t force the populace to see a recovery that simply does not exist. Let’s go through a short list of the most faulty indicators and the real reasons why the fiscal picture is not a rosy as the media would like us to believe…

The “miracle” labor market recovery

In the case of the U.S. labor market, we have a clear example of distortion through inflation. The $8 trillion+ dropped on the economy in the first 18 months of the pandemic response sent the system over the edge into stagflation land. Helicopter money has a habit of doing two things very well: Blowing up a bubble in stock markets and blowing up a bubble in retail. Hence, the massive rush by Americans to go out and buy, followed by the sudden labor shortage and the race to hire (mostly for low wage part-time jobs).

The problem with this “miracle” is that inflation leads to price explosions, which we have already experienced. The average American is spending around 30% more for goods, services and housing compared to what they were spending in 2020. This is what happens when you have too much money chasing too few goods and limited production.

The jobs market looks great on paper, but the majority of jobs generated in the past few years are jobs that returned after the covid lockdowns ended. The rest are jobs created through monetary stimulus and the artificial retail rush. Part time low wage service sector jobs are not going to keep the country rolling for very long in a stagflation environment. The question is, what happens now that the stimulus punch bowl has been removed?

Just as we witnessed in the 1920s, Americans have turned to debt to make up for higher prices and stagnant wages by maxing out their credit cards. With the central bank keeping interest rates high, the credit safety net will soon falter. This condition also goes for businesses; the same businesses that will jump headlong into mass layoffs when they realize the party is over. It happened during the Great Depression and it will happen again today.

Cracks in the foundation

We saw cracks in the narrative of the financial structure in 2023 with the banking crisis, and without the Federal Reserve backstop policy many more small and medium banks would have dropped dead. The weakness of U.S. banks is offset by the relative strength of the U.S. dollar, which lures in foreign investors hoping to protect their wealth using dollar denominated assets.

But something is amiss. Gold and bitcoin have rocketed higher along with economically sensitive assets and the dollar. This is the opposite of what’s supposed to happen. Gold and BTC are supposed to be hedges against a weak dollar and a weak economy, right? If global faith in the dollar and in the U.S. economy is so high, why are investors diving into protective assets like gold?

Again, as noted above, inflation distorts everything.

Tens of trillions of extra dollars printed by the Fed are floating around and it’s no surprise that much of that cash is flooding into the economy which simply pushes higher right along with prices on the shelf. But, gold and bitcoin are telling us a more honest story about what’s really happening.

Right now, the U.S. government is adding around $600 billion per month to the national debt as the Fed holds rates higher to fight inflation. This debt is going to crush America’s financial standing for global investors who will eventually ask HOW the U.S. is going to handle that growing millstone? As I predicted years ago, the Fed has created a perfect Catch-22 scenario in which the U.S. must either return to rampant inflation, or, face a debt crisis. In either case, U.S. dollar-denominated assets will lose their appeal and their prices will plummet.

“Healthy” GDP is a complete farce

GDP is the most common out-of-context stat used by governments to convince the citizenry that all is well. It is yet another stat that is entirely manipulated by inflation. It is also manipulated by the way in which modern governments define “economic activity.”

GDP is primarily driven by spending. Meaning, the higher inflation goes, the higher prices go, and the higher GDP climbs (to a point). Eventually prices go too high, credit cards tap out and spending ceases. But, for a short time inflation makes GDP (as well as retail sales) look good.

Another factor that creates a bubble is the fact that government spending is actually included in the calculation of GDP. That’s right, every dollar of your tax money that the government wastes helps the establishment by propping up GDP numbers. This is why government spending increases will never stop – It’s too valuable for them to spend as a way to make the economy appear healthier than it is.

The REAL economy is eclipsing the fake economy

The bottom line is that Americans used to be able to ignore the warning signs because their bank accounts were not being directly affected. This is over. Now, every person in the country is dealing with a massive decline in buying power and higher prices across the board on everything – from food and fuel to housing and financial assets alike. Even the wealthy are seeing a compression to their profit and many are struggling to keep their businesses in the black.

The unfortunate truth is that the elections of 2024 will probably be the turning point at which the whole edifice comes tumbling down. Even if the public votes for change, the system is already broken and cannot be repaired without a complete overhaul.

We have consistently avoided taking our medicine and our disease has gotten worse and worse.

People have lost faith in the economy because they have not faced this kind of uncertainty since the 1930s. Even the stagflation crisis of the 1970s will likely pale in comparison to what is about to happen. On the bright side, at least a large number of Americans are aware of the threat, as opposed to the 1920s when the vast majority of people were utterly conned by the government, the banks and the media into thinking all was well. Knowing is the first step to preparing.

The second step is securing your own financial future – that’s where physical precious metals can play a role. Diversifying your savings with inflation-resistant, uninflatable assets whose intrinsic value doesn’t rely on a counterparty’s promise to pay adds resilience to your savings. That’s the main reason physical gold and silver have been the safe haven store-of-value assets of choice for centuries (among both the elite and the everyday citizen).

* * *

As the world moves away from dollars and toward Central Bank Digital Currencies (CBDCs), is your 401(k) or IRA really safe? A smart and conservative move is to diversify into a physical gold IRA. That way your savings will be in something solid and enduring. Get your FREE info kit on Gold IRAs from Birch Gold Group. No strings attached, just peace of mind. Click here to secure your future today.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International14 hours ago

International14 hours agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges