Fully Automated Luxury Drug Discovery

Fully Automated Luxury Drug Discovery

One day, machines will do all our work for us—even our drug discovery work. What’s more, the machines will do our work better than we ever could. In drug discovery, the machines will eliminate the human inconsistencies and errors that limit the quantity and quality of our drug candidates. They will perceive and exploit efficiencies beyond our understanding. And they will help us develop drug candidates so economically that even the rarest diseases will attract drug discovery investments.

For such a drug discovery utopia to occur, a great change will be needed. Of course, it will happen gradually. Indeed, it has already begun, now that enabling technologies are maturing and becoming more widely available. These technologies include quantum-inspired molecular optimization, target deconvolution via protein painting and advanced mass spectrometry, and end-to-end automation of drug discovery workflows. When these technologies are implemented, small molecule design and lead optimization are accelerated, shortening the drug discovery process by years and saving untold millions of dollars.

Exploring vast chemical libraries

“We want to create as many small molecule drug leads as possible,” says Shahar Keinan, PhD, CEO and co-founder, Polaris Quantum Biotech (PQB), “[by] combining quantum computing, artificial intelligence (AI), and precision medicine.” The company expects to produce up to 100 “drug blueprints” per year while lowering drug development costs and bringing successful leads to market more quickly.

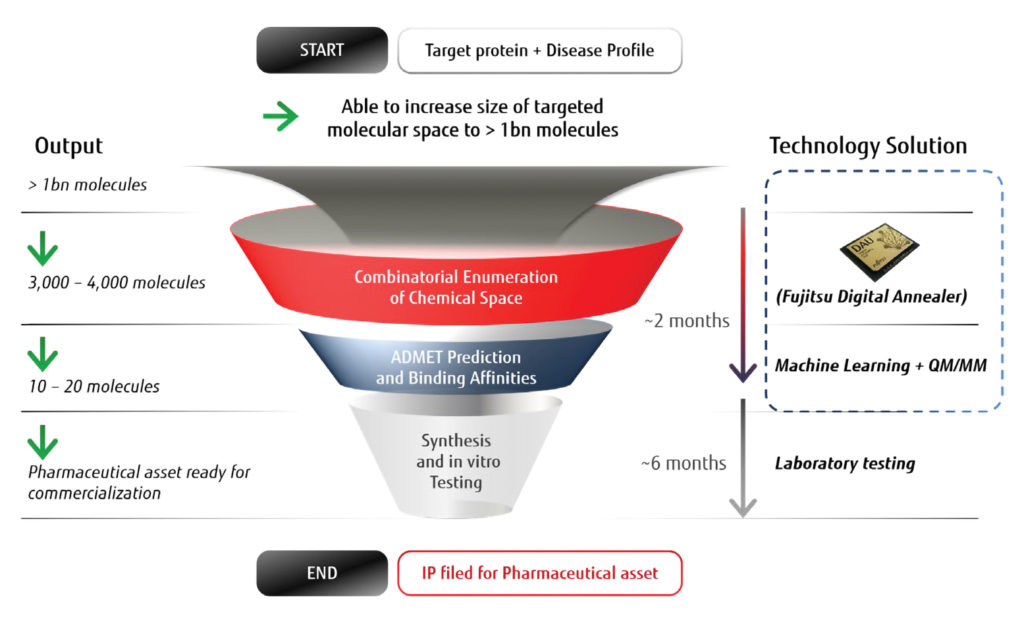

PQB plans to sift through large chemical libraries to identify small molecules that exhibit the properties a drug would need to change the course of disease. This approach poses an optimization problem. To solve it, PQB partnered with Fujitsu to develop a molecular optimization platform that significantly improves the speed and chemical diversity in small molecule lead discovery.

Fujitsu’s quantum-inspired Digital Annealer solves combinatorial optimization problems 10,000 times faster than other currently available alternatives. In less than five minutes, the Digital Annealer can search a virtual library of a billion molecules that are relevant to a protein-binding pocket associated with a particular disease.

“The library is combinatorial and grows very fast,” notes Keinan. “The problem was searching it. If you can take a three- to four-year process and reduce it to eight months, then addressing smaller patient groups becomes financially feasible.”

After the molecules are searched using the quantum-inspired technology to identify a couple of thousand molecules that satisfy basic design criteria, the next set of candidates goes through more elaborate quantum mechanics and molecular mechanics calculations to define the 10–20 best options. These leads are synthesized and tested to identify the optimal candidate.

Since the platform is fast, it needn’t be confined to investigations of known diseases, such as dengue fever. It can also be used to tackle emerging diseases, such as COVID-19, as well as diseases that have exploited mutations to become nonresponsive to current drugs.

“We are open to collaborations with organizations focused on specific diseases to pursue small molecule therapeutics for their area of interest,” Keinan stresses. “We are faster and less expensive, and we are in this business to find a solution for diseases that are currently overlooked.”

Identifying protein-protein interfaces

Using conventional technologies to identify targetable protein-protein interfaces can be difficult and time consuming. One of these conventional technologies is protein crystallography. It provides unparalleled resolution of protein structures, but it confronts users with crystal structures that can take many years to solve. Another conventional technology, hydrogen deuterium exchange mass spectrometry (HDX-MS), poses experimental challenges, such as low pH digestion, as well as interpretive problems that may be impossible to solve without specialized software.

An alternative technology is protein painting. Developed in 2014 by Alessandra Luchini, PhD, Lance A. Liotta, PhD, and Virginia Espina, PhD, as an outgrowth of their dye chemistry work, protein painting uses noncovalent dyes to selectively label solvent-accessible regions of protein complexes—that is, regions other than the solvent-inaccessible protein-protein interface—in native protein conditions.

The dyes block trypsin cleavage, essentially making the solvent-accessible regions “invisible” to mass spectrometry, thus allowing selective identification of the undyed regions. Protein painting uses recombinant proteins similar to crystallography and HDX but takes only a few days to complete.

“We had some experience using dyes as ‘bait’ for proteins in other applications, and we decided to see if we could directly label proteins,” explains Amanda Haymond, PhD, research assistant professor, School of System Biology, Center for Applied Proteomics and Molecular Medicine (CAPMM), George Mason University. “One of the biggest challenges was identifying appropriate dyes or combinations for the reactions.”

To develop a technique that would be accessible, the investigators had to show that it worked with dyes that were either commercially available or simple to synthesize. A dye that Haymond and colleagues described recently interacted primarily with lysine and tyrosine residues, bound nonspecifically to a range of proteins, bound in high numbers to a range of proteins, and protected bound regions of the protein from urea denaturation.1

“We probed the interface between cytokine IL-1B, its receptor IL-1R1, and accessory protein IL-1RAcP,” Haymond reports. “The protein-painting data allowed design of an interfering peptide that disrupted IL-1B signaling, which has therapeutic applications for osteoarthritis. Most recently, we identified a key residue in the PD-1/PD-L1 interface.1 We designed a peptide that mimicked this region and disrupted PD-1/PD-L1 complex formation.”

“We are working on analogs as potential oncology immunotherapeutic agents,” she continues. “We are excited that other groups have adopted protein painting.”2,3

Deconvoluting target strategies

Accurate target deconvolution and understanding on- and off-target effects is of vital importance to the drug discovery process. According to Diarmuid Kenny, PhD, group leader, Integrated Biology, Charles River Laboratories, mass spectrometry–based proteomics stands at the forefront of most unbiased target deconvolution strategies.

The company has developed Capture Compound mass spectrometry (CCMS), a technology that utilizes a photoaffinity label (PAL) to capture and subsequently identify proteins interacting with a small molecule. The PAL generates a covalent bond between the small molecule and the protein of interest, allowing very stringent washing and identification of weak but specific binding proteins. Using a combination of different PALs maximizes the probability of identifying specific binding partners.

Other strategies include the proteome integral solubility alteration (PISA) assay, which incorporates the principles behind thermal proteome profiling to identify specific protein binding partners with an altered temperature stability profile after treatment with a small molecule.

“CCMS is ideal when working with compounds that have good structure-activity relationship (SAR) data,” says Kenny. “We need to modify the compound to incorporate a PAL without abolishing the compound’s activity.

“The PISA assay, which does not rely on modifying the parent compound, is more suitable for in-cell target deconvolution as it can also be used to potentially identify downstream treatment effects. Both CCMS and PISA are functionally agonist, and therefore they can identify both primary and off-target proteins bound by a compound.”

Shotgun proteomics, or data-dependent acquisition, is the traditional methodology for unbiased proteomics workflows. Although robust and widely suitable, this methodology may miss data values. More recently, there has been a movement toward an alternative methodology, namely, sequential window acquisition of all theoretical mass spectra (SWATH-MS), or data-independent acquisition. It is suited to projects that process many samples and need to quantify many proteins in each sample.

Other advanced mass spectrometry technologies include ion mobility–mass spectrometry (IM-MS). It allows for the discrimination of isomers based on differences in their mobility through a gas-filled region while subjected to an electric field. Such technologies can overcome the limitations of conventional technologies to distinguish analytes of the same mass.

Harnessing automation

When transitioning from clinical work to laboratory research, Martin-Immanuel Bittner, MD, PhD, co-founder and CEO, Arctoris, was surprised to learn how much time was spent on highly repetitive manual experimentation. Simultaneously, he realized that the low productivity in drug discovery could be attributed mainly to low data quality, which also led to research failures and, consequently, additional costs. Reports showed that less than 25% of published results were reproducible.4,5

“Scientific protocols are highly ambiguous, which impacts reproducibility and makes pooling data from different sources near impossible,” Bittner states. But protocols could be more definite. To illustrate this point, Bittner suggests that a protocol that says “mix the sample” could add details, such as the settings used on an automated mixer, where mixing is “clearly defined as x minutes at x speed at x temperature for a fully compliant, highly rigorous, standardized approach. If each protocol step is clearly defined and automated, it brings data to new quality levels.”

Typically, automation is thought of as a tool that accomplishes high-throughput screening by enabling a very small number of assays to be run over and over again. At Arctoris, however, automation is something that can be more versatile, provided it is implemented throughout discovery. Full automation, the company asserts, can run assays down to single-plate experiments, resulting in better quality data and shorter cycle times.

Arctoris uses its automation approach to help biotech companies manage projects more efficiently. Also, the company can perform a range of experiments, including experiments that might be inaccessible to some researchers. Both standardized assays and customized assays (for example, target-based assays) are available.

The fully automated Arctoris research facility can perform a selection of cell biology, molecular biology, and biochemistry experiments in a nonbiased, reproducible way, and it can run concurrent experiments around the clock seven days a week. The facility, which is modular and incorporates large robotic work cells within sterile enclosures, interconnects scientific instruments via a network of conveyor belts and robotic arms.

“There is no lengthy onboarding process,” Bittner asserts. “Instead, [there is] complete transparency about the entire process. Access to raw data is in real time. Price is per experiment and depends on reagent cost as well as degree of customization.”

“In the move toward AI-driven drug discovery,” he continues, “the quality of data becomes even more important because with machine learning, the ‘garbage in, garbage out’ mantra applies. Our automated platform produces high-quality, consistent, and structured data, resulting in quality inputs for the next generation of drug discovery efforts.”

Histological analysis of 3D cultures

Three-dimensional (3D) cell culture techniques are becoming more important as model platforms for drug discovery and biology. To facilitate handling of 3D spheroids and organoids for high-throughput histological analysis, a Purdue University team, consisting of engineering professors Thomas Siegmund, PhD, Bumsoo Han, PhD, and George T.C. Chiu, PhD, has developed a new technology, the collapsible basket array (CBA).

According to Siegmund, in the CBA, the 3D cultures reside in fluid-permeable baskets attached to a flexible grid that is submerged in microplate wells containing the culture media. After culture, the CBA is removed from the well plate and released from the carrier structure. The CBA then collapses, allowing the array to be fitted to a standard histology cassette for microscopy analysis of the 3D cultures. The grid can conform to a microplate of any size. The histology cassette is the limiting factor.

A U.S. patent application has been filed. Now that the technology is attracting interest, the Purdue Office of Technology Commercialization and the inventors hope to license it to an industry partner.

Making the CBA compatible with automated pipetting and robotics systems for end-to-end automation is a top priority, says Siegmund. The Purdue team believes the CBA will address obstacles with laborious, mostly manual, and low-throughput handling and analysis of 3D cultures, thereby streamlining the process of drug development and reducing errors occurring during transfer. Currently, 3D printed, larger scale manufacturing is under development.

References

1. Haymond A, Dey D, Carter R, et al. Protein painting, an optimized MS-based technique, reveals functionally relevant interfaces of the PD-1/PD-L1 complex and the YAP2/ZO-1 complex. J. Biol. Chem. 2019; 294(29): 11180–11198. DOI: 10.1074/jbc.RA118.007310.

2. Lin X, Ammosova T, Choy MS, et al. Targeting the Non-catalytic RVxF Site of Protein Phosphatase-1 With Small Molecules for Ebola Virus Inhibition. Front. Microbiol. 2019; 10: 2145. DOI: 10.3389/fmicb.2019.02145.

3. Rosa B, Marchetti M, Paredi G, et al. Combination of SAXS and Protein Painting Discloses the Three-Dimensional Organization of the Bacterial Cysteine Synthase Complex, a Potential Target for Enhancers of Antibiotic Action. Int. J. Mol. Sci. 2019; 20(20): 5219. DOI: 10.3390/ijms20205219.

4. Prinz F, Schlange T, Asadullah K. Believe it or not: How much can we rely on published data on potential drug targets? Nat. Rev. Drug Discov. 2011; 10: 712. DOI: 10.1038/nrd3439-c1.

5. Begley, C, Ellis L. Raise standards for preclinical cancer research. Nature 2012; 483: 531–533. DOI: 10.1038/483531a.

Treating Cancer at a Personal Level

The promise of single-cell proteomics

By Khatereh Motamedchaboki, PhD

“Omics” analysis marks a critical breakthrough in our understanding of human biology and disease. Rather than adopting a reductionist, deconstructed view of a biological system, omics disciplines seek a holistic understanding of how systems interact, and they begin their investigations by characterizing the entire set of molecules present within a cell, organ, or organism.

The value of this approach is well demonstrated by genomics, which has become a key element of disease research and drug discovery. However, proteins provide necessary detail about a cell’s current activity that nucleic acids cannot. Analyzing specific proteins gives a more direct view of cell content and behavior than does evaluating by inference based on other biomolecules—an approach that can fail to account for mechanisms such as post-translational modifications and gene silencing. Proteomics is, therefore, necessary to fully understand the biological systems that drive disease, and to turn biological insights into personalized treatments.

Tackling cancer heterogeneity

Omics analysis enables researchers to explore human biology at an individual level. Every disease, from autoimmune disorders to mental health conditions to cancers, has its own vulnerabilities and patterns, and every patient responds differently. Omics tools can help create tailored medical treatments specific to a patient’s molecular profile, removing the need for “trial and error” periods1 and creating opportunities for both early diagnosis and precision treatment.

As analytical techniques improve, life sciences research is moving from bulk sample analysis toward single-cell omics analysis,2 which explores everything occurring at the molecular level within a single cell. This is crucial in exploring cell heterogeneity, a defining issue in oncology3: tumors comprise many cell types acting in concert, and various cell types and differentiation stages define a system’s health or malignancy. As a result, bulk analysis cannot accurately capture tumor heterogeneity.

Advanced methods of proteomic analysis

Using single-cell proteomics, researchers can examine cellular heterogeneity at the protein level. Single-cell proteomic analysis methods rely upon antibodies, cytometry, or—the gold standard—mass spectrometry (MS). Antibody- and cytometry-based methods use fluorescence-activated cell sorting and antibodies to tag proteins of interest and are, therefore, limited by antibody availability. Single-cell MS-based methods, however, have shown wider applicability in identifying and quantifying thousands of proteins in an unbiased way.4

Proteomics researchers can struggle to increase throughput due to limited sample size5: proteins cannot be amplified, and only small amounts of protein exist within a single cell. Advanced technologies are helping to overcome this hurdle. MS-based tools, such as the Thermo Scientific Orbitrap Eclipse Tribrid mass spectrometer with FAIMS Pro Interface, increase sensitivity and selectivity while conserving limited samples. Field asymmetric waveform ion mobility spectrometry (FAIMS) uses differential ion mobility to spatially separate ion species and directs only target species into the MS for sequencing. When used in combination, FAIMS and MS can offer easy selection and accumulation of multiply charged peptides ions only, as well as increased coverage.

Additionally, innovative methods of sample preparation, such as nanoPOTs (nanodroplet processing in one pot for trace samples), can preserve trace samples.4 Isobaric tandem mass tagging has proven able to “boost” low peptide signals,5 whereas targeted quantitation approaches, such as the Thermo Scientific SureQuant Targeted Mass Spec Assay, are designed to characterize many low-level protein targets, while accounting for proteoforms and post-translation modifications.

Toward a fuller understanding of cellular activity

Single-cell proteomics is a promising tool for modern drug discovery, especially for the development of novel disease treatment methods in the form of personalized medicines. The technology summarized here enables a fuller understanding of cellular activity, by shifting from simple profiling and abundance measurements to dynamic examinations of cells as systems that change over time.

Khatereh Motamedchaboki, PhD, is a senior vertical marketing specialist, proteomics, at Thermo Fisher Scientific.

References

1. Lopez-Ferrer D, Motamedchaboki K. Challenges and emerging directions in single-cell proteomics: Will it go mainstream like genomics? Thermo Fisher Scientific. 2020; White Paper: 65730.

2. Schoof EM, Nicolas Rapin N, Savickas S, et al. A Quantitative Single-Cell Proteomics Approach to Characterize an Acute Myeloid Leukemia Hierarchy. bioRxiv 2019.

3. Bateman, NW Conrads TP. Recent advances and opportunities in proteomic analyses of tumour heterogeneity. J. Pathol. 2018; 255(5): 628–637.

4. Motamedchaboki K, Dou M, Cong Y, et al. High-throughput single-cell proteomics analysis with nanodroplet sample processing, multiplex TMT labeling, and ultra-sensitive LC-MS. Thermo Fisher Scientific. 2020; Application Note: 65714.

5. Yi L, Tsai C-F, Dirice E, et al. Boosting to Amplify Signal with Isobaric Labeling (BASIL) Strategy for Comprehensive Quantitative Phosphoproteomic Characterization of Small Populations of Cells. Anal Chem. 2019; 91(9): 5794–5801.

The post Fully Automated Luxury Drug Discovery appeared first on GEN - Genetic Engineering and Biotechnology News.

Uncategorized

Economic Earthquake Ahead? The Cracks Are Spreading Fast

Economic Earthquake Ahead? The Cracks Are Spreading Fast

Authored by Brandon Smith via Alt-Market.us,

One of my favorite false narratives…

Authored by Brandon Smith via Alt-Market.us,

One of my favorite false narratives floating around corporate media platforms has been the argument that the American people “just don’t seem to understand how good the economy really is right now.” If only they would look at the stats, they would realize that we are in the middle of a financial renaissance, right? It must be that people have been brainwashed by negative press from conservative sources…

I have to laugh at this notion because it’s a very common one throughout history – it’s an assertion made by almost every single political regime right before a major collapse. These people always say the same things, and when you study economics as long as I have you can’t help but throw up your hands and marvel at their dedication to the propaganda.

One example that comes to mind immediately is the delusional optimism of the “roaring” 1920s and the lead up to the Great Depression. At the time around 60% of the U.S. population was living in poverty conditions (according to the metrics of the decade) earning less than $2000 a year. However, in the years after WWI ravaged Europe, America’s economic power was considered unrivaled.

The 1920s was an era of mass production and rampant consumerism but it was all fueled by easy access to debt, a condition which had not really existed before in America. It was this illusion of prosperity created by the unchecked application of credit that eventually led to the massive stock market bubble and the crash of 1929. This implosion, along with the Federal Reserve’s policy of raising interest rates into economic weakness, created a black hole in the U.S. financial system for over a decade.

There are two primary tools that various failing regimes will often use to distort the true conditions of the economy: Debt and inflation. In the case of America today, we are experiencing BOTH problems simultaneously and this has made certain economic indicators appear healthy when they are, in fact, highly unstable. The average American knows this is the case because they see the effects everyday. They see the damage to their wallets, to their buying power, in the jobs market and in their quality of life. This is why public faith in the economy has been stuck in the dregs since 2021.

The establishment can flash out-of-context stats in people’s faces, but they can’t force the populace to see a recovery that simply does not exist. Let’s go through a short list of the most faulty indicators and the real reasons why the fiscal picture is not a rosy as the media would like us to believe…

The “miracle” labor market recovery

In the case of the U.S. labor market, we have a clear example of distortion through inflation. The $8 trillion+ dropped on the economy in the first 18 months of the pandemic response sent the system over the edge into stagflation land. Helicopter money has a habit of doing two things very well: Blowing up a bubble in stock markets and blowing up a bubble in retail. Hence, the massive rush by Americans to go out and buy, followed by the sudden labor shortage and the race to hire (mostly for low wage part-time jobs).

The problem with this “miracle” is that inflation leads to price explosions, which we have already experienced. The average American is spending around 30% more for goods, services and housing compared to what they were spending in 2020. This is what happens when you have too much money chasing too few goods and limited production.

The jobs market looks great on paper, but the majority of jobs generated in the past few years are jobs that returned after the covid lockdowns ended. The rest are jobs created through monetary stimulus and the artificial retail rush. Part time low wage service sector jobs are not going to keep the country rolling for very long in a stagflation environment. The question is, what happens now that the stimulus punch bowl has been removed?

Just as we witnessed in the 1920s, Americans have turned to debt to make up for higher prices and stagnant wages by maxing out their credit cards. With the central bank keeping interest rates high, the credit safety net will soon falter. This condition also goes for businesses; the same businesses that will jump headlong into mass layoffs when they realize the party is over. It happened during the Great Depression and it will happen again today.

Cracks in the foundation

We saw cracks in the narrative of the financial structure in 2023 with the banking crisis, and without the Federal Reserve backstop policy many more small and medium banks would have dropped dead. The weakness of U.S. banks is offset by the relative strength of the U.S. dollar, which lures in foreign investors hoping to protect their wealth using dollar denominated assets.

But something is amiss. Gold and bitcoin have rocketed higher along with economically sensitive assets and the dollar. This is the opposite of what’s supposed to happen. Gold and BTC are supposed to be hedges against a weak dollar and a weak economy, right? If global faith in the dollar and in the U.S. economy is so high, why are investors diving into protective assets like gold?

Again, as noted above, inflation distorts everything.

Tens of trillions of extra dollars printed by the Fed are floating around and it’s no surprise that much of that cash is flooding into the economy which simply pushes higher right along with prices on the shelf. But, gold and bitcoin are telling us a more honest story about what’s really happening.

Right now, the U.S. government is adding around $600 billion per month to the national debt as the Fed holds rates higher to fight inflation. This debt is going to crush America’s financial standing for global investors who will eventually ask HOW the U.S. is going to handle that growing millstone? As I predicted years ago, the Fed has created a perfect Catch-22 scenario in which the U.S. must either return to rampant inflation, or, face a debt crisis. In either case, U.S. dollar-denominated assets will lose their appeal and their prices will plummet.

“Healthy” GDP is a complete farce

GDP is the most common out-of-context stat used by governments to convince the citizenry that all is well. It is yet another stat that is entirely manipulated by inflation. It is also manipulated by the way in which modern governments define “economic activity.”

GDP is primarily driven by spending. Meaning, the higher inflation goes, the higher prices go, and the higher GDP climbs (to a point). Eventually prices go too high, credit cards tap out and spending ceases. But, for a short time inflation makes GDP (as well as retail sales) look good.

Another factor that creates a bubble is the fact that government spending is actually included in the calculation of GDP. That’s right, every dollar of your tax money that the government wastes helps the establishment by propping up GDP numbers. This is why government spending increases will never stop – It’s too valuable for them to spend as a way to make the economy appear healthier than it is.

The REAL economy is eclipsing the fake economy

The bottom line is that Americans used to be able to ignore the warning signs because their bank accounts were not being directly affected. This is over. Now, every person in the country is dealing with a massive decline in buying power and higher prices across the board on everything – from food and fuel to housing and financial assets alike. Even the wealthy are seeing a compression to their profit and many are struggling to keep their businesses in the black.

The unfortunate truth is that the elections of 2024 will probably be the turning point at which the whole edifice comes tumbling down. Even if the public votes for change, the system is already broken and cannot be repaired without a complete overhaul.

We have consistently avoided taking our medicine and our disease has gotten worse and worse.

People have lost faith in the economy because they have not faced this kind of uncertainty since the 1930s. Even the stagflation crisis of the 1970s will likely pale in comparison to what is about to happen. On the bright side, at least a large number of Americans are aware of the threat, as opposed to the 1920s when the vast majority of people were utterly conned by the government, the banks and the media into thinking all was well. Knowing is the first step to preparing.

The second step is securing your own financial future – that’s where physical precious metals can play a role. Diversifying your savings with inflation-resistant, uninflatable assets whose intrinsic value doesn’t rely on a counterparty’s promise to pay adds resilience to your savings. That’s the main reason physical gold and silver have been the safe haven store-of-value assets of choice for centuries (among both the elite and the everyday citizen).

* * *

As the world moves away from dollars and toward Central Bank Digital Currencies (CBDCs), is your 401(k) or IRA really safe? A smart and conservative move is to diversify into a physical gold IRA. That way your savings will be in something solid and enduring. Get your FREE info kit on Gold IRAs from Birch Gold Group. No strings attached, just peace of mind. Click here to secure your future today.

Uncategorized

Wendy’s teases new $3 offer for upcoming holiday

The Daylight Savings Time promotion slashes prices on breakfast.

Daylight Savings Time, or the practice of advancing clocks an hour in the spring to maximize natural daylight, is a controversial practice because of the way it leaves many feeling off-sync and tired on the second Sunday in March when the change is made and one has one less hour to sleep in.

Despite annual "Abolish Daylight Savings Time" think pieces and online arguments that crop up with unwavering regularity, Daylight Savings in North America begins on March 10 this year.

Related: Coca-Cola has a new soda for Diet Coke fans

Tapping into some people's very vocal dislike of Daylight Savings Time, fast-food chain Wendy's (WEN) is launching a daylight savings promotion that is jokingly designed to make losing an hour of sleep less painful and encourage fans to order breakfast anyway.

Image source: Wendy's.

Promotion wants you to compensate for lost sleep with cheaper breakfast

As it is also meant to drive traffic to the Wendy's app, the promotion allows anyone who makes a purchase of $3 or more through the platform to get a free hot coffee, cold coffee or Frosty Cream Cold Brew.

More Food + Dining:

- Taco Bell menu tries new take on an American classic

- McDonald's menu goes big, brings back fan favorites (with a catch)

- The 10 best food stocks to buy now

Available during the Wendy's breakfast hours of 6 a.m. and 10:30 a.m. (which, naturally, will feel even earlier due to Daylight Savings), the deal also allows customers to buy any of its breakfast sandwiches for $3. Items like the Sausage, Egg and Cheese Biscuit, Breakfast Baconator and Maple Bacon Chicken Croissant normally range in price between $4.50 and $7.

The choice of the latter is quite wide since, in the years following the pandemic, Wendy's has made a concerted effort to expand its breakfast menu with a range of new sandwiches with egg in them and sweet items such as the French Toast Sticks. The goal was both to stand out from competitors with a wider breakfast menu and increase traffic to its stores during early-morning hours.

Wendy's deal comes after controversy over 'dynamic pricing'

But last month, the chain known for the square shape of its burger patties ignited controversy after saying that it wanted to introduce "dynamic pricing" in which the cost of many of the items on its menu will vary depending on the time of day. In an earnings call, chief executive Kirk Tanner said that electronic billboards would allow restaurants to display various deals and promotions during slower times in the early morning and late at night.

Outcry was swift and Wendy's ended up walking back its plans with words that they were "misconstrued" as an intent to surge prices during its most popular periods.

While the company issued a statement saying that any changes were meant as "discounts and value offers" during quiet periods rather than raised prices during busy ones, the reputational damage was already done since many saw the clarification as another way to obfuscate its pricing model.

"We said these menuboards would give us more flexibility to change the display of featured items," Wendy's said in its statement. "This was misconstrued in some media reports as an intent to raise prices when demand is highest at our restaurants."

The Daylight Savings Time promotion, in turn, is also a way to demonstrate the kinds of deals Wendy's wants to promote in its stores without putting up full-sized advertising or posters for what is only relevant for a few days.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemicUncategorized

Inside The Most Ridiculous Jobs Report In Recent History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In Recent History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 hours ago

International7 hours agoWalmart launches clever answer to Target’s new membership program

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex