Uncategorized

Fall Malaise Sets in; Americans’ Risk of Depression Up 106% With Summer’s End

Fall Malaise Sets in; Americans’ Risk of Depression Up 106% With Summer’s End

PR Newswire

SAN FRANCISCO and WASHINGTON, Nov. 1, 2022

According to the Mental Health Index, cognitive function hi-jacked by increases in depression, stress, and anxiety

…

Fall Malaise Sets in; Americans' Risk of Depression Up 106% With Summer's End

PR Newswire

SAN FRANCISCO and WASHINGTON, Nov. 1, 2022

According to the Mental Health Index, cognitive function hi-jacked by increases in depression, stress, and anxiety

SAN FRANCISCO and WASHINGTON, Nov. 1, 2022 /PRNewswire/ -- According to the Mental Health Index: U.S. Worker Edition, fall malaise is setting in. Americans' risk of depression soared 106% in September when compared to the peak of the sunshine season. Further, data shows that a rise in depression coupled with a 40% increase in anxiety and 16% increase in stress since August is impacting U.S. workers' ability to be decisive and meet complex business goals. In other words, employees' all-important planning capacity dropped a consequential 16% – hi-jacked by the downward mental health spiral.

"Employers take note," warned Matthew Mund, CEO, Total Brain. "Our data shows that a seasonal pattern of mental health improvement in summer months is consistently followed by emotional and cognitive decline during a season marked by the onset of shorter, darker days. Now is the time to increase communications about the availability of employee-sponsored mental health resources and tools and engage workers in robust discussions about emotional wellbeing."

The Mental Health Index: U.S. Worker Edition, powered by Total Brain, a mental health monitoring and support platform, is distributed in partnership with the National Alliance of Healthcare Purchaser Coalitions, One Mind at Work, and the HR Policy Association and its American Health Policy Institute.

"Mental health and stress are not just a product of the pandemic," said Michael Thompson, National Alliance president and CEO. "Employers need to better understand and anticipate the diverse factors that impact the mental wellbeing of their workforce and then try to stay ahead of these trends in their organizational and program strategies."

Margaret Faso, director, Health Care Research and Policy of HR Policy Association said, "Recognizing the seasonal pattern of mental health risk is one of the many ways Total Brain data is so helpful to employers. Planning for the ups and downs allows employers to be prepared with communication about the resources employees need knowing that programs need to be used to be effective."

According to Katy Riddick, One Mind at Work, "We are seeing an important trend among leaders - looking beyond our current environment and the challenges it presents to mental health to a more intentional effort to foster belonging and a sense of purpose in workplaces. We know that this is the long-term strategy that builds more mentally healthy organizations."

The full Q2 2022 Mental Health Index results can be found here. Hear what the experts have to say about the Mental Health Index data.

Methodology: The Mental Health Index: U.S. Worker Edition contains data drawn from a weekly randomized sample of 500 working Americans taken from a larger universe of Total Brain users. The Index is NOT a survey or a poll. Data is culled from neuroscientific brain assessments using standardized digital tasks and questions from the Total Brain platform. Participants include workers from all walks of life and regions, job levels, occupations, industries, and types of organizations (public vs. private). The brain assessments used to compile the Mental Health Index were taken weekly from the first week of February 2020 until the week ending September 25, 2022, inclusive. The two weeks from June 13 to June 26 (inclusive) were compared to the last two weeks of September (from September 12 to 25, inclusive) to evaluate the changes that occurred in data trends in the last three months from June to September 2022. Changes since the pre-pandemic baseline (beginning of February 2020) to September 2022 were also evaluated.

About Total Brain Limited (ASX: TTB): Total Brain Limited is an applied, integrative neuroscience company, based in San Francisco and Sydney, that has developed and offers Total Brain, a mental health monitoring and support platform powered by the world's largest standardized brain database. Its SaaS platform has helped more than one million registered users to-date scientifically measure and optimize their brain capacities while managing the risk of common mental conditions. Benefits for providers include improved patient outcomes, tracking of evidence-based outcomes across the continuum of care, and a reduction in clinician fatigue. Benefits for populations and payers include better mental healthcare access, lower costs, and higher productivity. For more information, please visit www.totalbrain.com and follow on Twitter, LinkedIn, and Facebook.

About the National Alliance: The National Alliance of Healthcare Purchaser Coalitions (National Alliance) is the only nonprofit, purchaser-led organization with a national and regional structure dedicated to driving health and healthcare value across the country. Its members represent private and public sector, nonprofit, and Taft-Hartley organizations, and more than 45 million Americans spending over $300 billion annually on healthcare. nationalalliancehealth.org

About One Mind at Work: Launched in 2017, One Mind at Work is a global coalition of leaders from diverse sectors who have joined together with the goal of transforming approaches to mental health and addiction. One Mind at Work now includes more than 90 global employers and 18 research and content partners. The coalition covers more than 8 million people under its charter. onemindatwork.org

About HR Policy Association: HR Policy Association is the lead organization representing Chief Human Resource Officers at major employers. The Association consists of over 390 of the largest corporations doing business in the United States and globally, and these employers are represented in the organization by their most senior human resource executive. Collectively, their companies employ more than 10 million employees in the United States, over nine percent of the private sector workforce, and 20 million employees worldwide. These senior corporate officers participate in the Association because of their commitment to improving the direction of human resource policy. hrpolicy.org.

About American Health Policy Institute: American Health Policy Institute is a non-partisan non-profit think tank, started by the HR Policy Foundation, which examines the practical implications of health policy changes through the lens of large employers. The Institute examines the challenges employers face in providing health care to their employees and recommends policy solutions to promote the provision of affordable, high-quality, employer-based health care. The Institute serves to provide thought leadership grounded in the practical experience of America's largest employers. Their mission is to develop impactful strategies to ensure that those purchasing health care can not only bend the cost curve, but break it, by keeping health care cost inflation in line with general inflation. americanhealthpolicy.org.

For More Information Contact: | Kelly Faville, Rocket Social Impact |

kelly@rocketsocialimpact.com | |

978-621-6667 |

View original content to download multimedia:https://www.prnewswire.com/news-releases/fall-malaise-sets-in-americans-risk-of-depression-up-106-with-summers-end-301664429.html

SOURCE Total Brain

Uncategorized

Comments on February Employment Report

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the …

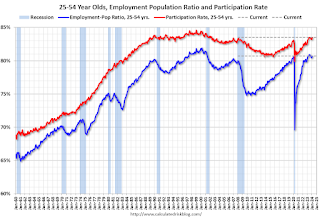

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

Uncategorized

Immune cells can adapt to invading pathogens, deciding whether to fight now or prepare for the next battle

When faced with a threat, T cells have the decision-making flexibility to both clear out the pathogen now and ready themselves for a future encounter.

How does your immune system decide between fighting invading pathogens now or preparing to fight them in the future? Turns out, it can change its mind.

Every person has 10 million to 100 million unique T cells that have a critical job in the immune system: patrolling the body for invading pathogens or cancerous cells to eliminate. Each of these T cells has a unique receptor that allows it to recognize foreign proteins on the surface of infected or cancerous cells. When the right T cell encounters the right protein, it rapidly forms many copies of itself to destroy the offending pathogen.

Importantly, this process of proliferation gives rise to both short-lived effector T cells that shut down the immediate pathogen attack and long-lived memory T cells that provide protection against future attacks. But how do T cells decide whether to form cells that kill pathogens now or protect against future infections?

We are a team of bioengineers studying how immune cells mature. In our recently published research, we found that having multiple pathways to decide whether to kill pathogens now or prepare for future invaders boosts the immune system’s ability to effectively respond to different types of challenges.

Fight or remember?

To understand when and how T cells decide to become effector cells that kill pathogens or memory cells that prepare for future infections, we took movies of T cells dividing in response to a stimulus mimicking an encounter with a pathogen.

Specifically, we tracked the activity of a gene called T cell factor 1, or TCF1. This gene is essential for the longevity of memory cells. We found that stochastic, or probabilistic, silencing of the TCF1 gene when cells confront invading pathogens and inflammation drives an early decision between whether T cells become effector or memory cells. Exposure to higher levels of pathogens or inflammation increases the probability of forming effector cells.

Surprisingly, though, we found that some effector cells that had turned off TCF1 early on were able to turn it back on after clearing the pathogen, later becoming memory cells.

Through mathematical modeling, we determined that this flexibility in decision making among memory T cells is critical to generating the right number of cells that respond immediately and cells that prepare for the future, appropriate to the severity of the infection.

Understanding immune memory

The proper formation of persistent, long-lived T cell memory is critical to a person’s ability to fend off diseases ranging from the common cold to COVID-19 to cancer.

From a social and cognitive science perspective, flexibility allows people to adapt and respond optimally to uncertain and dynamic environments. Similarly, for immune cells responding to a pathogen, flexibility in decision making around whether to become memory cells may enable greater responsiveness to an evolving immune challenge.

Memory cells can be subclassified into different types with distinct features and roles in protective immunity. It’s possible that the pathway where memory cells diverge from effector cells early on and the pathway where memory cells form from effector cells later on give rise to particular subtypes of memory cells.

Our study focuses on T cell memory in the context of acute infections the immune system can successfully clear in days, such as cold, the flu or food poisoning. In contrast, chronic conditions such as HIV and cancer require persistent immune responses; long-lived, memory-like cells are critical for this persistence. Our team is investigating whether flexible memory decision making also applies to chronic conditions and whether we can leverage that flexibility to improve cancer immunotherapy.

Resolving uncertainty surrounding how and when memory cells form could help improve vaccine design and therapies that boost the immune system’s ability to provide long-term protection against diverse infectious diseases.

Kathleen Abadie was funded by a NSF (National Science Foundation) Graduate Research Fellowships. She performed this research in affiliation with the University of Washington Department of Bioengineering.

Elisa Clark performed her research in affiliation with the University of Washington (UW) Department of Bioengineering and was funded by a National Science Foundation Graduate Research Fellowship (NSF-GRFP) and by a predoctoral fellowship through the UW Institute for Stem Cell and Regenerative Medicine (ISCRM).

Hao Yuan Kueh receives funding from the National Institutes of Health.

stimulus covid-19 yuan vaccine stimulusUncategorized

Stock indexes are breaking records and crossing milestones – making many investors feel wealthier

The S&P 500 topped 5,000 on Feb. 9, 2024, for the first time. The Dow Jones Industrial Average will probably hit a new big round number soon t…

The S&P 500 stock index topped 5,000 for the first time on Feb. 9, 2024, exciting some investors and garnering a flurry of media coverage. The Conversation asked Alexander Kurov, a financial markets scholar, to explain what stock indexes are and to say whether this kind of milestone is a big deal or not.

What are stock indexes?

Stock indexes measure the performance of a group of stocks. When prices rise or fall overall for the shares of those companies, so do stock indexes. The number of stocks in those baskets varies, as does the system for how this mix of shares gets updated.

The Dow Jones Industrial Average, also known as the Dow, includes shares in the 30 U.S. companies with the largest market capitalization – meaning the total value of all the stock belonging to shareholders. That list currently spans companies from Apple to Walt Disney Co.

The S&P 500 tracks shares in 500 of the largest U.S. publicly traded companies.

The Nasdaq composite tracks performance of more than 2,500 stocks listed on the Nasdaq stock exchange.

The DJIA, launched on May 26, 1896, is the oldest of these three popular indexes, and it was one of the first established.

Two enterprising journalists, Charles H. Dow and Edward Jones, had created a different index tied to the railroad industry a dozen years earlier. Most of the 12 stocks the DJIA originally included wouldn’t ring many bells today, such as Chicago Gas and National Lead. But one company that only got booted in 2018 had stayed on the list for 120 years: General Electric.

The S&P 500 index was introduced in 1957 because many investors wanted an option that was more representative of the overall U.S. stock market. The Nasdaq composite was launched in 1971.

You can buy shares in an index fund that mirrors a particular index. This approach can diversify your investments and make them less prone to big losses.

Index funds, which have only existed since Vanguard Group founder John Bogle launched the first one in 1976, now hold trillions of dollars .

Why are there so many?

There are hundreds of stock indexes in the world, but only about 50 major ones.

Most of them, including the Nasdaq composite and the S&P 500, are value-weighted. That means stocks with larger market values account for a larger share of the index’s performance.

In addition to these broad-based indexes, there are many less prominent ones. Many of those emphasize a niche by tracking stocks of companies in specific industries like energy or finance.

Do these milestones matter?

Stock prices move constantly in response to corporate, economic and political news, as well as changes in investor psychology. Because company profits will typically grow gradually over time, the market usually fluctuates in the short term, while increasing in value over the long term.

The DJIA first reached 1,000 in November 1972, and it crossed the 10,000 mark on March 29, 1999. On Jan. 22, 2024, it surpassed 38,000 for the first time. Investors and the media will treat the new record set when it gets to another round number – 40,000 – as a milestone.

The S&P 500 index had never hit 5,000 before. But it had already been breaking records for several weeks.

Because there’s a lot of randomness in financial markets, the significance of round-number milestones is mostly psychological. There is no evidence they portend any further gains.

For example, the Nasdaq composite first hit 5,000 on March 10, 2000, at the end of the dot-com bubble.

The index then plunged by almost 80% by October 2002. It took 15 years – until March 3, 2015 – for it return to 5,000.

By mid-February 2024, the Nasdaq composite was nearing its prior record high of 16,057 set on Nov. 19, 2021.

Index milestones matter to the extent they pique investors’ attention and boost market sentiment.

Investors afflicted with a fear of missing out may then invest more in stocks, pushing stock prices to new highs. Chasing after stock trends may destabilize markets by moving prices away from their underlying values.

When a stock index passes a new milestone, investors become more aware of their growing portfolios. Feeling richer can lead them to spend more.

This is called the wealth effect. Many economists believe that the consumption boost that arises in response to a buoyant stock market can make the economy stronger.

Is there a best stock index to follow?

Not really. They all measure somewhat different things and have their own quirks.

For example, the S&P 500 tracks many different industries. However, because it is value-weighted, it’s heavily influenced by only seven stocks with very large market values.

Known as the “Magnificent Seven,” shares in Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia and Tesla now account for over one-fourth of the S&P 500’s value. Nearly all are in the tech sector, and they played a big role in pushing the S&P across the 5,000 mark.

This makes the index more concentrated on a single sector than it appears.

But if you check out several stock indexes rather than just one, you’ll get a good sense of how the market is doing. If they’re all rising quickly or breaking records, that’s a clear sign that the market as a whole is gaining.

Sometimes the smartest thing is to not pay too much attention to any of them.

For example, after hitting record highs on Feb. 19, 2020, the S&P 500 plunged by 34% in just 23 trading days due to concerns about what COVID-19 would do to the economy. But the market rebounded, with stock indexes hitting new milestones and notching new highs by the end of that year.

Panicking in response to short-term market swings would have made investors more likely to sell off their investments in too big a hurry – a move they might have later regretted. This is why I believe advice from the immensely successful investor and fan of stock index funds Warren Buffett is worth heeding.

Buffett, whose stock-selecting prowess has made him one of the world’s 10 richest people, likes to say “Don’t watch the market closely.”

If you’re reading this because stock prices are falling and you’re wondering if you should be worried about that, consider something else Buffett has said: “The light can at any time go from green to red without pausing at yellow.”

And the opposite is true as well.

Alexander Kurov does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

dow jones sp 500 nasdaq stocks covid-19-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges