“[…] our findings suggest that diminished brain volume and functional connectivity may be linked to menopause-related symptoms caused by the lower sex hormone levels.”

BUFFALO, NY- April 1, 2024 – A new research paper was published on the cover of Aging (listed by MEDLINE/PubMed as “Aging (Albany NY)” and “Aging-US” by Web of Science) Volume 16, Issue 6, entitled, “Altered brain morphology and functional connectivity in postmenopausal women: automatic segmentation of whole-brain and thalamic subnuclei and resting-state fMRI.”

The transition to menopause is associated with various physiological changes, including alterations in brain structure and function. However, menopause-related structural and functional changes are poorly understood. In this new study, researchers Gwang-Won Kim, Kwangsung Park, Yun-Hyeon Kim, and Gwang-Woo Jeong from Chonnam National University not only compared the brain volume changes between premenopausal and postmenopausal women, but also evaluated the functional connectivity between the targeted brain regions associated with structural atrophy in postmenopausal women.

“To the best of our knowledge, no comparative neuroimaging study on alterations in the brain volume and functional connectivity, especially focusing on the thalamic subnuclei in premenopausal vs. postmenopausal women has been reported.”

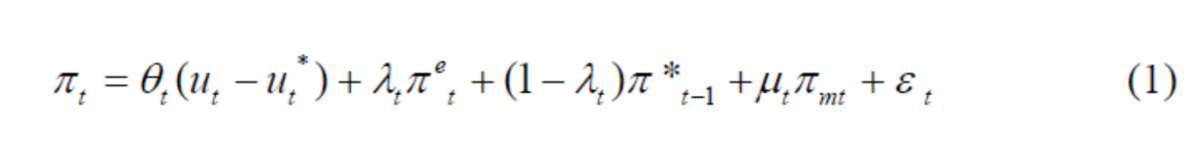

Each of the 21 premenopausal and postmenopausal women underwent magnetic resonance imaging (MRI). T1-weighted MRI and resting-state functional MRI data were used to compare the brain volume and seed-based functional connectivity, respectively. In statistical analysis, multivariate analysis of variance, with age and whole brain volume as covariates, was used to evaluate surface areas and subcortical volumes between the two groups.

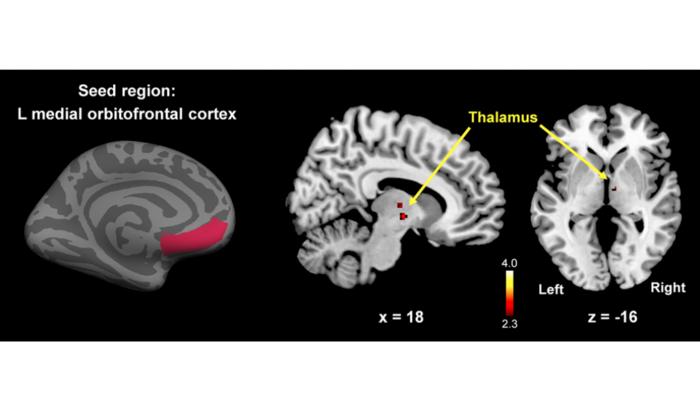

Postmenopausal women showed significantly smaller cortical surface, especially in the left medial orbitofrontal cortex (mOFC), right superior temporal cortex, and right lateral orbitofrontal cortex, compared to premenopausal women (p

“Postmenopausal women showed significantly lower left mOFC, right lOFC, and right STC surface areas, reduced right PuA volume, and decreased left mOFC-right thalamus functional connectivity compared to premenopausal women. If replicated in an independent sample, these findings will be helpful for understanding the effects of menopause on the altered brain volume and functional connectivity in postmenopausal women.”

Read the full study: DOI: https://doi.org/10.18632/aging.205662

Corresponding Author: Gwang-Woo Jeong – gwjeong@jnu.ac.kr

Keywords: brain morphology, functional connectivity, sex hormones, thalamic subnuclei

Click here to sign up for free Altmetric alerts about this article.

About Aging:

Aging publishes research papers in all fields of aging research including but not limited, aging from yeast to mammals, cellular senescence, age-related diseases such as cancer and Alzheimer’s diseases and their prevention and treatment, anti-aging strategies and drug development and especially the role of signal transduction pathways such as mTOR in aging and potential approaches to modulate these signaling pathways to extend lifespan. The journal aims to promote treatment of age-related diseases by slowing down aging, validation of anti-aging drugs by treating age-related diseases, prevention of cancer by inhibiting aging. Cancer and COVID-19 are age-related diseases.

Aging is indexed by PubMed/Medline (abbreviated as “Aging (Albany NY)”), PubMed Central, Web of Science: Science Citation Index Expanded (abbreviated as “Aging‐US” and listed in the Cell Biology and Geriatrics & Gerontology categories), Scopus (abbreviated as “Aging” and listed in the Cell Biology and Aging categories), Biological Abstracts, BIOSIS Previews, EMBASE, META (Chan Zuckerberg Initiative) (2018-2022), and Dimensions (Digital Science).

Please visit our website at www.Aging-US.com and connect with us:

- X, formerly Twitter

- YouTube

- Spotify, and available wherever you listen to podcasts

Click here to subscribe to Aging publication updates.

For media inquiries, please contact media@impactjournals.com.

Aging (Aging-US) Journal Office

6666 E. Quaker Str., Suite 1B

Orchard Park, NY 14127

Phone: 1-800-922-0957, option 1

###

Journal

Aging-US

DOI

10.18632/aging.205662

Method of Research

Observational study

Subject of Research

People

Article Title

Altered brain morphology and functional connectivity in postmenopausal women: automatic segmentation of whole-brain and thalamic subnuclei and resting-state fMRI

Article Publication Date

23-Mar-2024