Uncategorized

Manufacturing PMIs Mixed On Growth But Both See Prices Soaring

Manufacturing PMIs Mixed On Growth But Both See Prices Soaring

‘Hard’ data has been soaring since the start of the year – as ‘soft’ data collapses…

'Hard' data has been soaring since the start of the year - as 'soft' data collapses - so all eyes are on this morning's Manufacturing PMIs (surveys) for an end to that trend.

Source: Bloomberg

But, of course, there is normally something for everyone in this data as last month saw ISM's data tumble while S&P Global's soared. Both were expected to improve marginally in March final data today.

ISM's Manufacturing PMI surprised to the upside, rising from 47.8 to 50.3, better than the 48.4 expected (breaking a 15-month streak below 50).

But, S&P Global's US Manufacturing PMI disappointed, falling from its 'flash' print of 52.5 to 51.9 - also down from the final print of 52.2 in February (with prices .

Source: Bloomberg

However, a common theme from both surveys was that of soaring prices!!

S&P Global noted that higher oil and raw material costs, plus increased transportation rates, reportedly added to cost burdens at the end of the first quarter... and the impact of rising labor costs was mentioned as a factor pushing up selling prices at a number of manufacturers.

Employment remains in contraction for the sixth straight month and Prices Paid surged to its highest since July 2022...

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“The final reading of the S&P Global Manufacturing PMI signaled a further encouraging improvement in business conditions in March, adding to signs that the US economy looks to have expanded at a solid pace again in the first quarter.

“A key development in recent months has been the broadening-out of the upturn from services to manufacturing, with reviving demand for goods driving the fastest increase in factory production since May 2022. Jobs growth has also picked up as firms boost capacity to meet demand. Rising capex spending has likewise buoyed orders for machinery and equipment, in a further sign of firms gaining confidence in the outlook.

But the 'improvement' comes at a cost:

“The upturn is, however, being accompanied by some strengthening of pricing power. Average selling prices charged by producers rose at the fastest rate for 11 months in March as factories passed higher costs on to customers, with the rate of inflation running well above the average recorded prior to the pandemic.

Most notable was an especially steep rise in prices charged for consumer goods, which rose at a pace not seen for 16 months, underscoring the likely bumpy path in bringing inflation down to the Fed's 2% target.”

So slower growth and much faster inflation - that does not sound like a recipe for rate-cuts... in fact quite the opposite.

Uncategorized

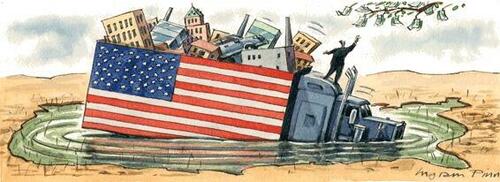

Gross Domestic Income Shows America Is In Stagnation

Gross Domestic Income Shows America Is In Stagnation

Authored by Daniel Lacalle,

In a recent CNN poll, 48% of respondents stated that they…

In a recent CNN poll, 48% of respondents stated that they believe the economy remains in a downturn, and only 35% said that things in the country today are going well. The disparity between somber economic sentiment and a surprisingly strong headline unemployment rate and Gross Domestic Product (GDP) can be easily explained.

The divergence between headline GDP and Gross Domestic Income (GDI) is staggering. While GDP suggests a strong economy, GDI reveals a stagnant economy. Both measures used to follow a similar pattern, but this changed drastically in 2023. While GDP rose 2.5% in 2023, GDI only bounced 0.5%, effectively signaling economic stagnation.

According to the Bureau of Economic Analysis, real GDI increased only 0.5% in 2023, compared with an increase of 2.1% in 2022. If we use the average of real GDP and real GDI, it increased only 1.5% in 2023, compared with an increase of 2.0% in 2022. Not a recession, but certainly a weak economy.

The unemployment figures show weakness as well. Real wage growth in the past four years has been negligible, at 0.7% per year, four times weaker than the previous four years. Furthermore, the labor force participation rate remains below the pre-pandemic level at 62.5%, the same as the employment-population ratio at 60.1%. Poor real average hourly earnings combined with a decrease of 0.6% in the average workweek resulted in an uninspiring 0.5% increase in real average weekly earnings in the year to February 2024.

There is also a weak trend in profits. In 2023, profits from current production (corporate profits with inventory valuation and capital consumption adjustments) increased $49.3 billion, compared with an increase of $285.9 billion in 2022, according to the BEA. Profits of domestic nonfinancial corporations increased $66.6 billion, compared with an increase of $247.6 billion in 2022. This is a very weak trend.

All these figures indicate that the US economy is performing significantly better than the euro area, but it is still far below expectations.

Keynesianism is working against the potential of the United States economy. The accumulated $6.3 trillion deficit of the past four years had a negative impact on the economy. Rising taxes and persistent inflation are eroding the average American quality of life. More citizens need to hold more than one job to make ends meet, and the number of multiple jobholders has reached a multi-decade record.

Gross Domestic Income proves the economy is stagnant, and if we look at GDP and GDI excluding the accumulation of debt, they show the worst year since the 1930s.

How can an economy be stagnant with 2.5% GDP growth? Here is the failure of Keynesianism in all its glory. Headline aggregated figures are optically strong due to the accumulation of debt, and employment figures are bloated by government jobs, disguising a struggling private sector and a weakening purchasing power of the currency.

Cheap money is very expensive in the long run, and discontent rises as Keynesianism focuses on increasing the public sector while the productive economy suffers higher taxes and more challenges to pay the bills.

Inflation is a consequence of the misguided increase in government spending and debt monetization in the middle of a post-pandemic recovery, leading to an aggregate loss of purchasing power of the currency that is close to 24% in the past four years. The government is taking in inflation what it promises in entitlement spending. The result? You are poorer.

It is dangerous to blame Americans’ discontent on a lack of information.

Americans are suffering a prohibitive tax wedge as well as the hidden tax of inflation just because the government decided to play the oldest trick in the book: promise “free stuff” and print new currency through deficit spending, which makes the allegedly free programs more expensive than ever.

The failure of Keynesianism is evident. Sadly, politicians will promise more Keynesianism and present themselves as the solution to the problem they have created.

Uncategorized

Map Reveals ‘Great Migration’ Population Shift Over Last Three Years

Map Reveals ‘Great Migration’ Population Shift Over Last Three Years

The virus pandemic, the rise of remote and hybrid work, and a surge in…

The virus pandemic, the rise of remote and hybrid work, and a surge in violent crime across progressive cities have significantly influenced the migration patterns of Americans over the past several years.

A new report from real estate research firm ResiClub sheds more color on the migration trends, this time on a county-by-county basis. It reveals which counties in the US gained and or lost the most population between April 1, 2020, and July 1, 2023, citing data from the US Census Bureau.

ResiClub founder Lance Lambert wrote on X that the "US Southeast, Mountain West, East/central Texas" had counties with some of the largest population gains over the period. Conversely, the counties based in California, the North and South Great Plains, parts of the Inland Midwest, and the inland Northeast had some of the most significant outflows.

This map shows which counties have gained—and lost—population since 2020

— ResiClub (@ResidentialClub) March 30, 2024

????????

ResiClub PRO | Access to the interactive map + searchable chart for +3,000 counties: https://t.co/BYLDGWN9KW pic.twitter.com/7UjxRdBfWp

Lambert posted a list of the top 40 counties with the largest population shifts over the period.

Top Three Counties With Largest Population Increase:

- Collin, Texas

- Wake County, North Carolina

- Hillsborough, Florida

Top Three Counties With Largest Population Decrease:

- Bronx County, New York

- Kings County, New York

- Queens County, New York

We assume this data has not captured the illegal migration shifts as millions of illegal aliens invade the US via open southern borders and flood progressive cities.

Uncategorized

Costco brings back a food court fan favorite

The warehouse club only makes changes to its food court offerings on very rare occasions.

Costco customers don't like change, at least in certain parts of the retailers' warehouse clubs.

While ever-changing merchandise is actually a popular part of why some people shop at the retailer, there are some sacred cows that never change. Member (and company executives) have been fiercely protective of its $1.50 hot dog and soda combination sold at its food courts while the company literally bought a chicken farm to be able to continue selling its famed $4.99 rotisserie chicken.

Related: Discount retailer faces Chapter 11 bankruptcy or liquidation

Those items are more or less gimmicks. No person, even a Costco loyalist, would flip out if the chain raised the price of the hot dog combo to $2 or if it started charging $5.99 for chicken. Both would remain good deals and while there would be a flood of news stories, the vast majority of members would pay the increased prices without flinching.

Costco (COST) , however, has made those two price points points of pride that it will lose money to protect, Both of those deals likely drive stories traffic and the chain probably still makes money on the hot dog combo while the chicken serves as a loss leader.

In a broad sense, the hot dog combo serves as a sort of symbolic reminder of how protective the company is of its food court. Items rarely change and when the warehouse club does take something off the menu (or adds something new) it reverberates with members.

Image source: Shutterstock

Costco brings a food court fan-favorite back

Costco very rarely changes its food court offerings, but it does happen. It recently dropped its churros and replaced them with chocolate chip cookies. It also has replaced its roast beef sandwich with a cheaper turkey sandwich.

During the pandemic, however, the warehouse club stopped selling a true fan favorite its combo pizza. Essentially an "everything" pizza, the once-popular pie had a variety of meat and vegetable toppings.

The removal of the Combo Pizza even led to a Change.org petition.

"Costco’s Combination Pizza is the most popular pizza variant and overall item at the Costco Food Court. It is a delectable combination of meaty goodness and vegetable crunchiness. Unlike a straight pepperoni or cheese pizza, the combo pizza ignites a party of tremendous flavor in the mouths of millions of Costco membership holders," the petition reads.

Over 18,000 people have signed the document which has a stated goal of 25,000 signatures, The petitioners seem very impassioned about the popular pizza.

"Countless Costco members and membership families have sworn to not renew their membership with Costco due to this travesty. Costco must realize that without its members, there would be no profits for them to be concerned about in the first place," the writeup continued.

Costco appears to have listened

While its a tiny fraction of Costco's membership, the people signing the petition likely represent a larger number of the chain's members who miss the Combo Pizza. The retailer appears to have heard their complaints and is bringing the popular item back, but maybe not in the way members want it.

"According to an alleged employee who took to the popular Costco subreddit, the combo pizza is slated to make its glorious return—but it won't be in the food court. Unfortunately (or fortunately, depending on how you look at it) the pizza will actually be frozen this time around and sold as a take-and-bake option instead," Parade shared.

Members won't be able to eat the pizza at the Costco food court, but they will be able to take it home and bake it in their own ovens. That's a compromise that keeps the food court menu simple and cuts down on waste.

It may not, however, appease the very passionate petitioners.

"The termination of combo pizza from Costco Food Courts nationwide is not only saddening, but total madness, and just straight up WRONG. Costco corporate cites profit and cost concerns, but they could’ve dealt with the issue easily via a price increase. Fans of the combo pizza would have gladly paid the price to continue to enjoy it," the petition filers shared on Change.org.

bankruptcy pandemic

-

Spread & Containment3 weeks ago

Spread & Containment3 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 week ago

International1 week agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

International3 weeks ago

International3 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 weeks ago

International3 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoEvidence And Insights About Gold’s Long-Term Uptrend

-

Uncategorized1 month ago

Uncategorized1 month agoA Global, Digital Coup d’État

-

Spread & Containment1 week ago

Spread & Containment1 week agoJapanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoWhen Complex Systems Collide