Government

Clearinghouse Certificates during the Great Depression: A Non-example of “Unaccounted Money”

Abstract: This article examines the non-issue of bank clearinghouse certificates during the Great Depression of the 1930s. Instead of a market failure, this non-issue is found to have been the result of an intervention. At the time, the issue of clearingh

Abstract: This article examines the non-issue of bank clearinghouse certificates during the Great Depression of the 1930s. Instead of a market failure, this non-issue is found to have been the result of an intervention. At the time, the issue of clearinghouse certificates to temporarily meet the need of the economy for a medium of exchange following a financial panic was a well-established practice. To make a long story short: in 1933, plans were underway by bankers to resort to this expedient. Merchants and the public at large were anxious to get their hands on the money substitute. But federal authorities said no. Instead of a short-term fix, following which the economy would return to its former ways, federal authorities had other plans. This paper examines both the specifics of the issue of emergency money during the Great Depression and the general principles involved in such issues.

JEL Classification: B53, E14, E51, N12

Clifford F. Thies (cthies@su.edu) is Eldon R. Lindsey Chair of Free Enterprise Professor of Economics and Finance at Shenandoah University. He thanks two anonymous referees for their constructive criticism and absolves them of any fault for remaining errors and shortcomings.

1. INTRODUCTION

According to Paul Krugman (1999, 8–11), a contributing cause to a depression is hoarding. Because of hoarding, the government should issue massive amounts of money to prevent recessions from turning into depressions. But, why must the government do this? Why can’t the private sector issue money during an emergency? At one level, the answer is easy: the government has monopolized money and prohibits the private sector from issuing money during an emergency. At another level, the answer is complicated.

Relying on numismatic sources, Richard Timberlake (1981, 860) demonstrated that the private sector repeatedly issued massive amounts of money during the hard times of the early to mid-nineteenth century. While there appears to have been some number of issues throughout the period, private, non-bank issues of money mostly appeared during certain times (1814–17, 1837–40, 1857–58, and 1862–64). Timberlake describes this money as “unaccounted.” Subsequent research has documented other instances of unaccounted money including Michigan when the state was nearly without banks (Baily, Hossain and Pecquet 2018), and New Orleans when it was occupied by northern troops during the Civil War (Pecquet and Thies 2010). During the National Bank Era, clearinghouse associations took the lead in issuing money during financial crises (Dwyer and Gilbert 1989, Gorton 1985). So why was there no clearinghouse money during the Great Depression of the 1930s?

In 1999, when Krugman wrote The Return of Depression Economics, it was received strangely. It was a thin book, written in large type, short on economics and long on story-telling. Supposedly, it was about Japan’s “lost decade,” when—according to Krugman—they had not increased their national debt enough. Yet, Japan’s national debt had grown to 200 percent of GDP. Krugman updated the book, The Return of Depression Economics and the Crisis of 2008 (2008). In the update, his concern was that the U.S., with a budget deficit of 12 percent of GDP, was not adding to its national debt fast enough.

To illustrate the problem of hoarding, Krugman used the example of the Capitol Hill Baby-Sitting Co-op of Washington, D.C., of the 1970s. As Krugman describes this co-op, it consisted of lawyers and other such well-heeled persons who decided that, instead of hiring baby-sitters, they would take turns baby-sitting each others’ children. The co-op required that its members only obtain baby-sitting services from each other, and use chits distributed by the co-op for the service. But, the members of the co-op hoarded the chits they had (in order to have them available when they really needed baby-sitting services), rather than use them freely in order to go out. And, since few people were purchasing baby-sitting services, nobody could be sure of acquiring chits through the offer of baby-sitting services, which only served to reinforce the urge to hoard chits.

After trying various New Deal-type “solutions” to the hoarding problem, such as requiring members to go out at least twice a month, the Co-op happened upon the idea of distributing more chits. The additional chits allayed members’ concerns that had led to the hoarding problem, and the market in baby-sitting services picked up.

What does Krugman’s story of the hoarding of baby-sitting chits have to do with depressions? During depressions, people lose confidence in their ability to earn money by offering their labor and other productive services. They therefore seek to build up cash reserves, i.e., to “hoard money.” But, the Keynesian story goes, the hoarding of money lowers the demand for labor and other productive services, resulting in a further loss of confidence, and intensifying the urge to hoard.

Other examples of hoarding come readily to mind. During the coronavirus panic of 2020, there was a run on toilet paper. Because people were not confident in future supplies of the item, they rushed to buy it, and emptied the shelves. Voila! stores ran out of toilet paper, just as panicked shoppers feared. But the shortage was only temporary, and the supply chain quickly restored retail inventories.

Throughout most of the world, replacement kidneys are in short supply as most people “hoard” their extra kidney not being confident of being able to obtain a replacement kidney if the need should arise. But not in Iran, where the authorities allow an internal market in kidneys. In that country, replacement kidneys are in good supply (Fry-Revere 2014).

In 1834, in conjunction with the failure of one bank (the Bank of Maryland) and rumors about others, there was a run on the banks of Baltimore. People lined up at banks to demand their specie (Niles’ Reporter, March 29, 1834). But, as the day wore on, those in line saw others leaving their banks with their bags and wheelbarrows heavy with coins, and—their fears allayed—people began leaving the line. Later in the day, some who had earlier gotten their specie were returning their coins to their banks. Accordingly, there was no general suspension.

Each of these examples indicates that a government intervention is not always needed to solve a hoarding problem (interpreting allowing a market in Iran as reduced involvement by government). Even the example cited by Krugman was resolved by the Baby-Sitting Co-op without a government intervention.

There is more to what is called the “hoarding” of money than the impact of income uncertainty on what the Keynesians call aggregate demand.1 Historically, times of hoarding were times of bank suspensions and of runs on the bank, and sometimes they were also times of uncertainty regarding the gold standard and runs on the dollar.2

The impact of hoarding can be particularly severe with a fractional reserve banking system. In a fractional reserve banking system, every dollar removed from banks forces a multiple reduction of the money supply. Furthermore, a “run on the bank” might result in banks being forced into suspension, immobilizing the funds still in them. The run of the bank can force a suspension even if the bank has positive net worth and reserves sufficient to meet the run because maintaining a certain amount of reserves is required by law or regulation.

In the past, when banks suspended, a great deal of the money people had in their banks became illiquid, meaning that it was unavailable as a medium of exchange. The combination of reduced consumer confidence, job insecurity, a reduced money supply, money tied up in banks in suspension, concerns for additional bank failures, and speculation on gold caused people to cut back on their spending either for lack of income or in order to build-up a cash reserve, and deprived the economy of a portion of its medium of exchange.

To be sure, hoarding might not have been a primary cause of a recession. Hoarding might have only broken out when the public became concerned for the soundness of money and/or of the banking system, and thus may have been a secondary cause making a recession worse. In the monetary history of the United States, money generally disappeared only after banks were forced into suspension.

The great champion of the gold standard Ludwig von Mises recognized the usefulness of money substitutes to deal with bank panics. “[I]t has repeatedly happened in times of crisis that confidence has been destroyed,” he said (Mises 1953, 371). This loss of confidence in bank deposits would result in “a collapse of a part of the national business organization” if allowed to run its course. In England, the Bank of England emitted additional bank notes; and, in the United States, which had no central bank, clearing house certificates were emitted (372). Even though such actions seemed to violate the “rules of the game” of the gold standard, Bordo and Kydland (1996, 85) say these actions may have supported the commitment to the gold standard in the long run.

F.A. Hayek (1967, 109), in an often-misunderstood passage, described the phenomenon as a “secondary depression.” Walter Bagehot’s dictum, that central bankers should lend freely on good collateral to solvent banks at high interest rates during panics, would seem to obviate the effects of hoarding; but, what if there is no central bank (as during the National Bank era); and, what if the central bank does not follow his rule?

2. CLEARINGHOUSE ASSOCIATIONS

During the National Bank Era, and with some acquiescence by law and regulation,3 the market developed an effective method to deal with the problems of bank suspension and hoarding through the issue of scrip, or emergency money, by banks and their clearinghouse associations. Originally, this emergency money was used only among banks. But, over time, at first in the South and then elsewhere, this clearinghouse money came to have a more general circulation. To be sure, clearinghouse money was not the only measure employed by the market to deal with the bank suspension and hoarding problems. But clearinghouse money became, by far, the most significant measure during the National Bank Era. According to A. Piatt Andrew (1908), following the Panic of 1907, when $238 million of clearing house certificates were issued, $96 million of other forms of scrip were also issued. The largest component of these other forms of scrip were payroll checks written by employers.

As A.D. Noyes (1909) details, following the Panic of 1893, the New York Clearing House issued $38.3 million in clearinghouse certificates, and other clearinghouses across the country issued a total of $69 million. These certificates circulated for about 19 weeks, at which time, the panic having ended, they were withdrawn from circulation, and normal operations resumed. Following the Panic of 1907, the New York Clearing House issued $85.4 million in clearinghouse certificates. Including clearinghouses across the country, a total of $238 million was issued. These certificates circulated for about 22 weeks.

Clearinghouse certificates had been issued following prior panics, in 1873, 1884 and 1890. Table 1 gives the amounts issued by the New York Clearing House from 1873 to 1907. An antecedent of clearinghouse certificates was utilized as early as 1857. That year, a form of clearinghouse certificate “backed” by securities issued by New York State and the U.S. Treasury was used for inter-bank settlements (Gibbons 1968, p. 364). This expedient was subsequently utilized several times during the 1860s.4

It was in 1873 that certified checks payable through clearinghouses were first issued as hand-to-hand currency. For example, soon following the decision of the New York Clearing House to adopt the Clearing House Certificate method for inter-bank clearings, the Louisville Clearing House suspended payments in legal tender currency (“greenbacks”) and paid out, instead, small checks based on the pledge of securities with the clearinghouse ([Memphis] Public Ledger, September 29, 1873, p. 2).

In 1893, clearinghouse certificates were first issued as a hand-to-hand currency (Cannon 1910, 3). These retail-level certificates were mostly issued by clearinghouse associations in the South. In addition, checks issued by banks, manufacturers and others, suitable for use as a hand-to-hand currency, became commonplace. The Richmond Dispatch (August 12, 1893, p. 2) reports that these expedients worked well. Thousands of workers were paid in the scrip, which was in turn freely accepted by merchants.5 A numismatic catalogue details dozens of specimens of certified checks issued by banks, clearinghouse certificates and manufacturer’s payroll checks that were issued during this financial panic (Shafer and Shaheen 2013).

In 1907, small-denomination clearinghouse certificates were issued by clearinghouse associations in several regions of the country. As discussed above, the dollar amount of clearinghouse certificates issued approximately doubled the amount issued in conjunction with the financial panic of 1893. Hundreds of specimens of scrip issued by clearinghouses, banks, manufacturers and others are described in Shafer and Shaheen’s (2013) catalogue.

In 1914, to offset financial tightness upon the outbreak of World War I, clearinghouse associations issued $200 million of inter-bank clearinghouse certificates (see Table 2), and “currency associations” organized by national banks issued $400 million in (emergency) National Bank notes under the Aldrich-Vreeland Act of 1907 (“The 1914 issue of …” 1915, 509). These banknotes were not backed by U.S. Treasury bonds, but rather by qualifying securities such as state and municipal bonds and commercial paper; and, the issue was subject to a penalty interest rate. Because of the penalty interest rate on these issues of National Bank notes, they were quickly retired from circulation when the period of financial stringency passed, as were the clearinghouse certificates. Shafer and Shaheen’s (2013) catalogue contains only a few specimens of scrip for this period.

3. HOW DID CLEARINGHOUSE CERTIFICATES WORK?

Initially and in the case of the New York Clearing House until its aborted issue of 1933, clearinghouse certificates were issued by clearinghouses in the making of loans to member banks in large denominations, secured by “good funds” attested to by the clearinghouse association, for the purpose of inter-bank settlements. As demonstrated by Gorton and Tallisman (2018), soon after the issue of these clearinghouse certificates by the New York Clearing House, the premium on currency relative to certified checks fell from about 5 to about 1 percent, restoring liquidity to the nation’s financial center. Bank and stock market suspensions were minimized or avoided altogether.

Outside of New York, financial panics often had lingering effects, including (1) partial or full suspension of cash withdrawals from banks, (2) difficulties in meeting payrolls, (3) dislocation of domestic exchange, (4) hoarding, (5) a currency premium, and (6) the issue of hand-to-hand money substitutes (Wicker 2000; James et al 2013). Banks and clearinghouse associations issued scrip to the public, variously described as cashier’s checks, certified checks and clearinghouse certificates, in small denominations suitable for a hand-to-hand currency. The clearinghouse certificates were typically “backed” by identified assets of clearinghouse member banks, and mutually guaranteed by the clearinghouse member banks. In addition, manufacturers and other businesses issued payroll checks in the manner of due bills, payable upon resumption of normal banking or by a certain date; and, merchants issued scrip redeemable in merchandise.

The bank and clearinghouse scrip were typically lent to an employer, who used them to meet a payroll, or else issued to depositors looking to make withdrawals during a time of suspension. Workers and depositors who received the bank and clearinghouse scrip then tendered them, like money, to various merchants (which is not to say that the merchants had to accept them, since they were not legal tender). Receivers of the scrip might use them to repay their loans from banks, or to make deposits in accounts at banks. Otherwise, they might themselves use the scrip as money. As long as the supply of bank scrip and clearinghouse certificates is small compared to the need of debtors to banks for money with which to make their loan payments, the bank scrip and clearinghouse certificates would pass at or near par.

Thus, among the ways the bank scrip and clearinghouse certificates worked is that they were created in the process of making loans, and destroyed in the process of paying off loans. Also, they were issued to depositors during the time banks were in suspension, and destroyed when used to pay off loans or when re-deposited. During the brief time of their existence, they circulated as money for a temporary period of time under emergency conditions.

4. SCRIP DURING THE GREAT DEPRESSION

If bank scrip and clearinghouse certificates moderated the effects of financial panics during the National Bank Era, why were they not issued during the Great Depression? The reason bankers did not, during the Great Depression, rescue the country from the worst series of bank panics in U.S. monetary history, is, first, the job of lender of last resort had been transferred from clearinghouse associations to the Federal Reserve; and, second, the government stopped the banks from issuing clearinghouse certificates. The clearinghouse associations, spontaneously and motivated by self-interest, developed the expedient of clearinghouse certificates to deal with financial crisis. The newly formed Federal Reserve, contrariwise, was to act with discretion and in the public interest. In hindsight, it is clear that clearinghouses acted dependably and even reflexively as a lender of last resort; while the Federal Reserve during its formative years thrashed about.

During March 1933, following the suspensions of many banks, several state bank holidays, and a looming national bank holiday, the bankers of the country, joined by merchants and others, were ready to issue hundreds of millions of dollars in clearinghouse certificates. But the government intervened and prevented it.

Prior to 1933, bankers had mostly resisted the call for scrip. Nevertheless, a number of localities had availed themselves of the same. According to the New York Times (January 15, 1933, IV:8), by early 1933, about 500,000 people were using some form of scrip. Some municipalities issued scrip in the payment of salaries to their workers and for other purposes. For example, Atlantic City, New Jersey, issued scrip during 1932, receivable by the city for payment of back taxes. Again according to the New York Times (March 3, 1933, p. 36), “The scrip [of Atlantic City] has had a wide circulation and much of it has reached the office of Tax Collector Lewis L. Mathis for delinquent bills.”

In other cases, voluntary associations issued scrip in conjunction with work relief efforts. In Freeport, New York, for example, the Freeport Committee for Unemployment, with the support of “virtually all stores” in the town, issued $50,000 in “stamp scrip.” This emergency money was to be issued to persons in payment for work on make-work projects, and was then to be spent in the stores of the town that would accept it. It was to re-circulate within the town for the next year. A fund for the redemption of the scrip was to accumulate through the purchase of stamps for affixing on the scrip, at the rate of 2 percent of its face value per transaction or per week. While the stamp scrip idea was one of the more inventive schemes that arose during the Great Depression of the 1930s, it should be considered that such difficult times often give rise to panaceas that, somehow, “solve the underlying problem” of a market economy (Myers 1940).

The private issue of scrip during the 1930s was given some impetus by the issue of wooden currency in 1931 by the chamber of commerce of Tenino, Washington (Brown 1941, 22–25; Preston 1933).6 This scrip ranged in denomination from 25¢ to $10, was printed on a thin slice of wood composite material, and was backed by the frozen assets of the suspended local bank. The scheme, born out of the need of the town for a medium of exchange when its one and only bank suspended, caught the fancy of the nation, and became something of a novelty item for tourists. Many subsequent issues by chambers of commerce and similar business groups, individual merchants and other community-based associations featured elements of both novelty and need. Table 3 describes some of the characteristics of the scrip outstanding in 1933.

Notice, in Table 3, how dramatically different were the issues of scrip outstanding in 1933 from those of the prior two major financial crises. During the prior two financial crises, banks and their clearinghouse associations made the majority of issues of scrip; and, together with manufacturers and others in the private, for-profit sector, dominated the issue of scrip. In contrast, in 1933, there was no clear locus. Issuers of scrip were simply diverse. Also during the prior two financial crises, almost all scrip was in denominations of at least $1. In contrast, in 1933, a lot of scrip was fractional currency. The changed composition of scrip reflects the more deranged financial conditions of the 1930s. Bankers, with their ability to recognize value in loan-making and, hence, to enhance the liquidity of the assets and earning power securing those loans, were being replaced by amateurs.

By March 1933, the problems with bank suspension, bank holidays and hoarding had become unbearable. Following the election of Franklin D. Roosevelt, and the possibility of radical legislation or even rule by decree, people throughout the country rushed to withdraw their money from banks. Banks were failing in droves, and, in one state after another, bank holidays were being declared or else withdrawals of deposits were being restricted to 5 percent of balances. In some places, moratoria were being declared on debt payments, and there was a growing suspicion that gold would be embargoed.

Instead of allaying the fears of the public, these bank holidays and other interventions only made things worse. Money started disappearing, including in particular coins and small-denomination paper currency. There was a run on the change-making machines at laundromats, and retailers stopped accepting high-denomination bills for small purchases.

On March 4, when New York Governor Herbert H. Lehman declared a two-day bank holiday, banker sentiment shifted sharply in favor of scrip. That day, the New York Clearing House announced a rush plan to issue clearinghouse certificates upon the re-opening of the banks. At the printing facilities of the American Bank Note Company in the Bronx, crews started working round the clock to deliver up to $200 million in scrip to the New York Clearing House, in denominations from $1 to $50, with additional orders by bankers in Baltimore, Boston, Chicago, Detroit, Philadelphia and elsewhere.

Throughout New York City, merchants and other vendors started announcing their readiness to accept the scrip, as well as bank checks, and their willingness to extend store credit to regular customers. According to the New York Times (March 7, 1933, p. 5), “There was something naïve in the anxiety of the public to get its hands on the promised new medium of exchange.” But representatives of the New York, Philadelphia, Baltimore and Richmond clearinghouse associations were then called to Washington, D.C., by the Secretary of the Treasury. After a few days of negotiation, including an apparent approval of the bankers’ plans, authority to proceed with the issue of clearinghouse certificates was denied. Instead of allowing clearinghouse certificates, the administration pushed the Emergency Banking Act of 1933 through Congress. Among other things, this act gave the Federal Reserve enormous new power to issue currency. This was soon followed by executive orders and other legislation fundamentally changing the character of money and banking in the country.

5. PROBLEMS WITH SCRIP

From time to time during the National Bank Era, bank scrip and clearinghouse certificates served a useful function. They ameliorated the problem of deflation characteristic of a fractional reserve banking system during and immediately subsequent to a bank panic. Being illegal, bank scrip and clearinghouse certificates depended on forbearance by authorities, and quickly disappeared after the emergency was over. They did not permanently add to the money stock. With a gold standard, there was a meaningful link between the money supply and gold, although an elastic one because of fractional reserve banking. During normal times, there was a tendency for the money multiplier and therefore the money supply to increase. During banks panics, the money multiplier and therefore the money supply fell precipitously, with macroeconomic consequences. There were problems attendant to returning to the gold standard after a wartime suspension, and to the periodic discoveries of gold and improvements in the technology of gold mining. Still, the gold standard provided an anchor to the price level. If bank scrip and clearinghouse certificates were permanent additions to the money stock, the price level would become indeterminate. This only happened during the 1920s, when the Federal Reserve became enamored with the Real Bills Doctrine (Humphrey and Timberlake 2019).

Bank scrip and clearinghouse certificates were an inferior form of money to legal tender currency and demand liabilities issued by banks; and, the menagerie of local currencies issued during the 1930s were even more inferior. These emergency forms of money circulated only locally and, because of their small scale, subject to a significant discount by brokers even when received at par within their locality, where brokers made markets in them. Brown (1941, 40–42) gives the example of Detroit’s municipal scrip, that exchanged for legal tender currency at a discount of 5 percent. To some extent, appeals to community-mindedness overcame the inferiority of these various forms of emergency money. But, for the most part, the emergency money was only put into circulation through the payment of wages by state and municipal governments and private sector employers during a time of high unemployment. While there are only a few known cases of counterfeit scrip (again, Detroit’s municipal scrip is an example [Brown 1941, 40–42]), this might simply be due to the fleeting existence of most issues of scrip.

6. STATE PREROGATIVE OVER MONEY

The market has exhibited tremendous ability to identify goods useful as media of exchange, from cattle and grain in the ancient world, to cowrie shells and wampum, to beaver pelts and deer skins, and from tobacco in colonial Virginia and cigarettes in WWII prison camps, to giant rocks on the island of Yap. George Selgin (2008) describes the private issue of coins during the industrial revolution in Great Britain. Nevertheless, the assertion of a monopoly over the medium of exchange by the government—what is called its prerogative over money—has frequently cut short the private issue of money; in some cases, with devastating consequences. Sometimes, there have been rather transparent attempts to evade restrictions on privately issued currency. For example, some money substitutes during the nineteenth century were declared redeemable in train fares or in merchandise so as to look like coupons and not a general medium of exchange (Timberlake 1981, 861–62). With the shortage of coins during the U.S. Civil War, some privately issued tokens in the form of copper pennies were inscribed “NOT ONE CENT”, as in “Millions for defense, but NOT ONE CENT for tribute.”

During the 1870s, the use as money of payroll checks and due bills issued by the mining companies of Michigan’s northern peninsula was abruptly ended when these money substitutes were declared subject to the federal government’s prohibitory tax on private banknotes (Thies 2019). In 2009, the issuer of the “Ron Paul dollar” was convicted of violating the federal government’s law against issuing anything designed to circulate as a medium of exchange (Ramsey 2008). In contrast, the issuers of the Ithaca dollar and other “community currency” (Collom 2005, Kim, Lough and Wu 2016) have not been prosecuted, possibly because they did not threaten the system. From 1933 to 1977, the federal government not only banned the private ownership of gold and abrogated the gold clause in bonds, it banned all forms of indexation (McCulloch 1980).

The failure of banks to issue scrip during the Great Depression of the 1930s was not a market failure, but the result of an intervention. Instead of resorting to the proven expedient of clearinghouse certificates to meet an emergency need for a medium of exchange, the incoming administration had much bigger plans. It would be like a babysitting co-op deciding that the way to deal with the hoarding of babysitting chits is to take children away from their parents and put them into orphanages run by the co-op, instead of simply issuing enough additional chits to bring liquidity to the babysitting market.

Table 1. Clearinghouse Certificates Issued by the New York Clearing House Association from 1873 to 1907

Source: Sprague (1910, 432–23)

Table 2. Clearinghouse Certificates Issued by the Clearinghouse Associations during 1914Source: William B. Dana Co. (1915, 510)

Table 3. Scrip Issued during Selected Financial Panics from 1893 to 1933[1] includes merchants, mining companies, railroads and other transportation companies, chambers of commerce and other business associations, and community-based associations

[2] includes voucher-like chits distributed by work relief efforts; and, exchange certificates issued by labor cooperatives

[3] double-counts certain issues by governments, chambers of commerce and other business and community-based organizations

Sources: Mitchell and Shafer (1984), Shafer and Sheehan (2013)

- 1. The connotation that hoarding is anti-social can be said to be at least as old as Jesus’ parable of the talents, in which the master scolds the servant who had buried the money entrusted with him, instead of depositing it with a banker so that the master, upon his return, could have received his capital with interest (Matthew 25: 14–28). But it is difficult to distinguish the socially-useful purposes of such things as the buffer stocks of business, strategic reserves of a country, and the liquidity services of cash balances, from anti-social behavior, and easy to blame the public for the loss of confidence in banks.

- 2. There clearly was a run on the dollar in conjunction with the Panic of 1893. This run on the dollar was only ended by the dramatic repeal of the Sherman Silver Purchase Act of 1890 during an extraordinary session of Congress called by President Grover Cleveland (Timberlake 1993, 166–82; see also Calomiris 1993, Thies 2005).

- 3. Hepburn (1924, 351–52) mentions the prohibitory federal tax on privately issued banknotes that was not enforced during financial panics, because of the emergency conditions. There were also state and federal laws directly prohibiting the issue of banknotes, or treating them as counterfeits of U.S. currency.

- 4. Swanson (1908) describes the first issue of clearing house certificates during the 1860s. Camp (1892) sketches the early history of the New York Clearing House, including its periodic issue of clearing house certificates.

- 5. To be sure, the next day, even while reporting that the certified check system continued to work well, the newspaper reported that some mercantile houses refused the scrip.

- 6. Brown’s (1941) master’s thesis provided a panoramic view of scrip during the Great Depression. Contemporary works include Elvins (2005, 2010) and Gatch (2008, 2012).

International

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong europeanInternational

Walmart launches clever answer to Target’s new membership program

The retail superstore is adding a new feature to its Walmart+ plan — and customers will be happy.

It's just been a few days since Target (TGT) launched its new Target Circle 360 paid membership plan.

The plan offers free and fast shipping on many products to customers, initially for $49 a year and then $99 after the initial promotional signup period. It promises to be a success, since many Target customers are loyal to the brand and will go out of their way to shop at one instead of at its two larger peers, Walmart and Amazon.

Related: Walmart makes a major price cut that will delight customers

And stop us if this sounds familiar: Target will rely on its more than 2,000 stores to act as fulfillment hubs.

This model is a proven winner; Walmart also uses its more than 4,600 stores as fulfillment and shipping locations to get orders to customers as soon as possible.

Sometimes, this means shipping goods from the nearest warehouse. But if a desired product is in-store and closer to a customer, it reduces miles on the road and delivery time. It's a kind of logistical magic that makes any efficiency lover's (or retail nerd's) heart go pitter patter.

Walmart rolls out answer to Target's new membership tier

Walmart has certainly had more time than Target to develop and work out the kinks in Walmart+. It first launched the paid membership in 2020 during the height of the pandemic, when many shoppers sheltered at home but still required many staples they might ordinarily pick up at a Walmart, like cleaning supplies, personal-care products, pantry goods and, of course, toilet paper.

It also undercut Amazon (AMZN) Prime, which costs customers $139 a year for free and fast shipping (plus several other benefits including access to its streaming service, Amazon Prime Video).

Walmart+ costs $98 a year, which also gets you free and speedy delivery, plus access to a Paramount+ streaming subscription, fuel savings, and more.

If that's not enough to tempt you, however, Walmart+ just added a new benefit to its membership program, ostensibly to compete directly with something Target now has: ultrafast delivery.

Target Circle 360 particularly attracts customers with free same-day delivery for select orders over $35 and as little as one-hour delivery on select items. Target executes this through its Shipt subsidiary.

We've seen this lightning-fast delivery speed only in snippets from Amazon, the king of delivery efficiency. Who better to take on Target, though, than Walmart, which is using a similar store-as-fulfillment-center model?

"Walmart is stepping up to save our customers even more time with our latest delivery offering: Express On-Demand Early Morning Delivery," Walmart said in a statement, just a day after Target Circle 360 launched. "Starting at 6 a.m., earlier than ever before, customers can enjoy the convenience of On-Demand delivery."

Walmart (WMT) clearly sees consumers' desire for near-instant delivery, which obviously saves time and trips to the store. Rather than waiting a day for your order to show up, it might be on your doorstep when you wake up.

Consumers also tend to spend more money when they shop online, and they remain stickier as paying annual members. So, to a growing number of retail giants, almost instant gratification like this seems like something worth striving for.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic mexicoInternational

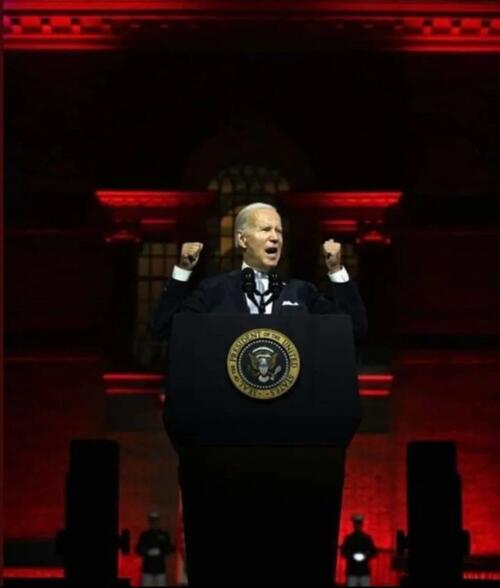

President Biden Delivers The “Darkest, Most Un-American Speech Given By A President”

President Biden Delivers The "Darkest, Most Un-American Speech Given By A President"

Having successfully raged, ranted, lied, and yelled through…

Having successfully raged, ranted, lied, and yelled through the State of The Union, President Biden can go back to his crypt now.

Whatever 'they' gave Biden, every American man, woman, and the other should be allowed to take it - though it seems the cocktail brings out 'dark Brandon'?

Tl;dw: Biden's Speech tonight ...

-

Fund Ukraine.

-

Trump is threat to democracy and America itself.

-

Abortion is good.

-

American Economy is stronger than ever.

-

Inflation wasn't Biden's fault.

-

Illegals are Americans too.

-

Republicans are responsible for the border crisis.

-

Trump is bad.

-

Biden stands with trans-children.

-

J6 was the worst insurrection since the Civil War.

(h/t @TCDMS99)

Tucker Carlson's response sums it all up perfectly:

"that was possibly the darkest, most un-American speech given by an American president. It wasn't a speech, it was a rant..."

Carlson continued: "The true measure of a nation's greatness lies within its capacity to control borders, yet Bid refuses to do it."

"In a fair election, Joe Biden cannot win"

And concluded:

“There was not a meaningful word for the entire duration about the things that actually matter to people who live here.”

Victor Davis Hanson added some excellent color, but this was probably the best line on Biden:

"he doesn't care... he lives in an alternative reality."

— Tucker Carlson (@TuckerCarlson) March 8, 2024

* * *

Watch SOTU Live here...

* * *

Mises' Connor O'Keeffe, warns: "Be on the Lookout for These Lies in Biden's State of the Union Address."

On Thursday evening, President Joe Biden is set to give his third State of the Union address. The political press has been buzzing with speculation over what the president will say. That speculation, however, is focused more on how Biden will perform, and which issues he will prioritize. Much of the speech is expected to be familiar.

The story Biden will tell about what he has done as president and where the country finds itself as a result will be the same dishonest story he's been telling since at least the summer.

He'll cite government statistics to say the economy is growing, unemployment is low, and inflation is down.

Something that has been frustrating Biden, his team, and his allies in the media is that the American people do not feel as economically well off as the official data says they are. Despite what the White House and establishment-friendly journalists say, the problem lies with the data, not the American people's ability to perceive their own well-being.

As I wrote back in January, the reason for the discrepancy is the lack of distinction made between private economic activity and government spending in the most frequently cited economic indicators. There is an important difference between the two:

-

Government, unlike any other entity in the economy, can simply take money and resources from others to spend on things and hire people. Whether or not the spending brings people value is irrelevant

-

It's the private sector that's responsible for producing goods and services that actually meet people's needs and wants. So, the private components of the economy have the most significant effect on people's economic well-being.

Recently, government spending and hiring has accounted for a larger than normal share of both economic activity and employment. This means the government is propping up these traditional measures, making the economy appear better than it actually is. Also, many of the jobs Biden and his allies take credit for creating will quickly go away once it becomes clear that consumers don't actually want whatever the government encouraged these companies to produce.

On top of all that, the administration is dealing with the consequences of their chosen inflation rhetoric.

Since its peak in the summer of 2022, the president's team has talked about inflation "coming back down," which can easily give the impression that it's prices that will eventually come back down.

But that's not what that phrase means. It would be more honest to say that price increases are slowing down.

Americans are finally waking up to the fact that the cost of living will not return to prepandemic levels, and they're not happy about it.

The president has made some clumsy attempts at damage control, such as a Super Bowl Sunday video attacking food companies for "shrinkflation"—selling smaller portions at the same price instead of simply raising prices.

In his speech Thursday, Biden is expected to play up his desire to crack down on the "corporate greed" he's blaming for high prices.

In the name of "bringing down costs for Americans," the administration wants to implement targeted price ceilings - something anyone who has taken even a single economics class could tell you does more harm than good. Biden would never place the blame for the dramatic price increases we've experienced during his term where it actually belongs—on all the government spending that he and President Donald Trump oversaw during the pandemic, funded by the creation of $6 trillion out of thin air - because that kind of spending is precisely what he hopes to kick back up in a second term.

If reelected, the president wants to "revive" parts of his so-called Build Back Better agenda, which he tried and failed to pass in his first year. That would bring a significant expansion of domestic spending. And Biden remains committed to the idea that Americans must be forced to continue funding the war in Ukraine. That's another topic Biden is expected to highlight in the State of the Union, likely accompanied by the lie that Ukraine spending is good for the American economy. It isn't.

It's not possible to predict all the ways President Biden will exaggerate, mislead, and outright lie in his speech on Thursday. But we can be sure of two things. The "state of the Union" is not as strong as Biden will say it is. And his policy ambitions risk making it much worse.

* * *

The American people will be tuning in on their smartphones, laptops, and televisions on Thursday evening to see if 'sloppy joe' 81-year-old President Joe Biden can coherently put together more than two sentences (even with a teleprompter) as he gives his third State of the Union in front of a divided Congress.

President Biden will speak on various topics to convince voters why he shouldn't be sent to a retirement home.

The state of our union under President Biden: three years of decline. pic.twitter.com/Da1KOIb3eR

— Speaker Mike Johnson (@SpeakerJohnson) March 7, 2024

According to CNN sources, here are some of the topics Biden will discuss tonight:

Economic issues: Biden and his team have been drafting a speech heavy on economic populism, aides said, with calls for higher taxes on corporations and the wealthy – an attempt to draw a sharp contrast with Republicans and their likely presidential nominee, Donald Trump.

Health care expenses: Biden will also push for lowering health care costs and discuss his efforts to go after drug manufacturers to lower the cost of prescription medications — all issues his advisers believe can help buoy what have been sagging economic approval ratings.

Israel's war with Hamas: Also looming large over Biden's primetime address is the ongoing Israel-Hamas war, which has consumed much of the president's time and attention over the past few months. The president's top national security advisers have been working around the clock to try to finalize a ceasefire-hostages release deal by Ramadan, the Muslim holy month that begins next week.

An argument for reelection: Aides view Thursday's speech as a critical opportunity for the president to tout his accomplishments in office and lay out his plans for another four years in the nation's top job. Even though viewership has declined over the years, the yearly speech reliably draws tens of millions of households.

Sources provided more color on Biden's SOTU address:

The speech is expected to be heavy on economic populism. The president will talk about raising taxes on corporations and the wealthy. He'll highlight efforts to cut costs for the American people, including pushing Congress to help make prescription drugs more affordable.

Biden will talk about the need to preserve democracy and freedom, a cornerstone of his re-election bid. That includes protecting and bolstering reproductive rights, an issue Democrats believe will energize voters in November. Biden is also expected to promote his unity agenda, a key feature of each of his addresses to Congress while in office.

Biden is also expected to give remarks on border security while the invasion of illegals has become one of the most heated topics among American voters. A majority of voters are frustrated with radical progressives in the White House facilitating the illegal migrant invasion.

It is probable that the president will attribute the failure of the Senate border bill to the Republicans, a claim many voters view as unfounded. This is because the White House has the option to issue an executive order to restore border security, yet opts not to do so

Maybe this is why?

Most Americans are still unaware that the census counts ALL people, including illegal immigrants, for deciding how many House seats each state gets!

— Elon Musk (@elonmusk) March 7, 2024

This results in Dem states getting roughly 20 more House seats, which is another strong incentive for them not to deport illegals.

While Biden addresses the nation, the Biden administration will be armed with a social media team to pump propaganda to at least 100 million Americans.

"The White House hosted about 70 creators, digital publishers, and influencers across three separate events" on Wednesday and Thursday, a White House official told CNN.

Not a very capable social media team...

The State of Confusion https://t.co/C31mHc5ABJ

— zerohedge (@zerohedge) March 7, 2024

The administration's move to ramp up social media operations comes as users on X are mostly free from government censorship with Elon Musk at the helm. This infuriates Democrats, who can no longer censor their political enemies on X.

Meanwhile, Democratic lawmakers tell Axios that the president's SOTU performance will be critical as he tries to dispel voter concerns about his elderly age. The address reached as many as 27 million people in 2023.

"We are all nervous," said one House Democrat, citing concerns about the president's "ability to speak without blowing things."

The SOTU address comes as Biden's polling data is in the dumps.

BetOnline has created several money-making opportunities for gamblers tonight, such as betting on what word Biden mentions the most.

As well as...

We will update you when Tucker Carlson's live feed of SOTU is published.

Fuck it. We’ll do it live! Thursday night, March 7, our live response to Joe Biden’s State of the Union speech. pic.twitter.com/V0UwOrgKvz

— Tucker Carlson (@TuckerCarlson) March 6, 2024

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International4 hours ago

International4 hours agoWalmart launches clever answer to Target’s new membership program

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex