International

Best Stocks To Buy Right Now? 3 E-Commerce Stocks To Know

With consumers still heavily relying on e-commerce across the globe, these companies continue to make moves.

The post Best Stocks To Buy Right Now? 3 E-Commerce Stocks To Know appeared first on Stock Market News, Quotes, Charts and Financial Information..

Do You Have These Top E-Commerce Stocks On Your Watchlist This Week?

While parts of the world continue to battle the coronavirus pandemic, e-commerce would remain a vital service today. As such, it would make sense that investors are eyeing the top e-commerce stocks in the stock market today. From daily necessities and home electronics to even furniture, the e-commerce industry delivers on most fronts. While shopping for all of this used to be an in-person affair, today’s tech significantly simplifies the process. Namely, consumers now have round-the-clock access to countless stores at their fingertips. When you pair this with most people being homebound throughout the pandemic, it is easy to understand the industry’s current momentum.

Even now, as the U.S. is looking towards the tail-end of the pandemic, e-commerce trends remain strong. For instance, we could look at some of the biggest names in the industry now for a sense of this. E-commerce stocks such as Shopify (NYSE: SHOP) and Amazon (NASDAQ: AMZN) appear to be firing on all cylinders now. On one hand, Shopify reported stellar figures across the board in its latest quarter fiscal. In it, the company more than doubled its total revenue and saw a 3,781% jump in earnings per share year-over-year.

On the other hand, Amazon, despite blowing past the $100 billion quarterly revenue mark recently, continues to press on. This appears to be the case as the company’s Prime Day event just passed. Now, the annual mega sale would serve to benefit Amazon and its investors. Even Jefferies (NYSE: JEF) analyst Brent Thill seems to believe so, maintaining a Buy rating on AMZN stock with a price target of $4,200 a share. Given the current focus on the e-commerce space, here are three making waves in the stock market now.

Top E-Commerce Stocks To Buy [Or Sell] Now

- Alibaba Group Holding Ltd. (NYSE: BABA)

- Wayfair Inc. (NYSE: W)

- Mercadolibre Inc. (NASDAQ: MELI)

Alibaba Group Holding Ltd.

Starting us off today is Chinese e-commerce giant, Alibaba Group. For the uninitiated, most would describe Alibaba as the Amazon of China. If anything, the two companies do dabble in similar industries now, e-commerce empires aside. These include booming divisions in the tech world such as cloud computing and autonomous vehicle development. Despite all of this, BABA stock is currently looking at year-to-date losses. Would it be wise for investors to buy the dip here?

Well, investment firm Susquehanna International Group appears to be leaning towards a yes. In its latest coverage of BABA stock, analyst Shyam Patil reiterated a Buy rating with a price target of $350. This would mark a potential upside of over 65% from its price of $211.06 as of Monday’s closing bell. The reason for this, according to Patil, is because Alibaba still has growth opportunities to grab moving forward. After all, as mentioned earlier, the company does have divisions focused on fast-growing tech industries now.

While Alibaba’s portfolio may be diverse and wide, the company continues to apply the best bits towards bolstering its e-commerce services. Earlier this month, Alibaba announced plans to develop self-driving delivery trucks to optimize its logistic division. Speaking of logistics, the company also updated its existing partnership with ZIM Integrated Shipping Services (NYSE: ZIM) yesterday. As of now, the duo will be extending their cooperation agreement for two more years. Given that ZIM is a global container liner shipping company, this is a strategic play by Alibaba. The move will also extend ZIM’s global services to Alibaba buyers as well. Overall, as the company seeks to expand its global reach, would BABA stock be a top buy for you?

[Read More] 3 Growth Stocks That Could Be Better Investments Than AMC Stock Right Now

Wayfair Inc.

Another name to know in the e-commerce space now would be Wayfair Inc. In brief, the Boston-based company markets furniture and home goods on its platform. According to Wayfair, consumers have access to a selection of over 14 million items on this platform from over 11,000 global suppliers. The likes of which, Wayfair delivers via its 56 fulfillment and delivery centers across the U.S., Germany, and the U.K. Now, with the current uptick in home improvement spending, W stock could be on investors’ watchlists. Evidently, the company’s shares have skyrocketed by over 1,000% since its pandemic-era low back in 2020.

Indeed, while the pandemic is responsible for the current momentum in the home-goods industry, Wayfair is not sitting idly by. We can see this as the company recently revealed plans to significantly expand its engineering division. In detail, Wayfair is looking to open three new engineering sites in California, Texas, and Ontario. Over the next year, the company plans to hire 1,000 skilled workers to supplement these expansions, further solidifying its lead in the market. CTO Jim Miller appears optimistic as Wayfair continues to evolve its team “to support the incredible growth of the business”.

On top of all that, Wayfair is also making the most of the hype around Amazon’s Prime Day this year. Through Amazon, Wayfair is currently running its June clearance sale with up to 60% off select wares. Moreover, the company also reported stellar figures in its recent quarter fiscal posted last month. In it, Wayfair saw a 49% year-over-year surge in total revenue for the quarter. This was followed by the company more than doubling its earnings per share and net income over the same time. Given all of this, will you be adding W stock to your portfolio?

Read More

- 4 Top Advertising Stocks To Watch Right Now

- Best Cheap Stocks To Buy Now? 5 Growth Stocks For Your Watchlist

MercadoLibre Inc.

Last but definitely not least, we have MercadoLibre, operator of the largest e-commerce and payments ecosystem in Latin America. For a sense of scale, the company operates in 18 countries including, Brazil, Mexico, and Argentina, among others. In short, MercadoLibre’s online commerce platform offers users a one-stop e-commerce and payments tool experience. The likes of which contribute towards the expansion of the Latin American e-commerce market. With the company’s leading presence in the region, I can understand if MELI stock is in focus now.

For the most part, this appears to be the case as Morgan Stanley (NYSE: MS) recently covered MELI stock. Analysts at the firm appear bullish on MELI stock, reiterating an Overweight rating with a price target of $2,260. Notably, this would indicate a 56% premium on its current price of $1,476.34 as of Monday’s closing bell. In particular, the reason for this upgrade is MercadoLibre’s Pago and Credito fintech operations. MS believes that the company’s focus on mobile wallet engagement and credit growth drivers is a strategic one. Besides, some would argue that digital payment services are the lifeblood of the e-commerce industry, facilitating seamless transactions.

By and large, MercadoLibre continues to dominate the Latin American e-commerce market. This is evident even on the financial front. In its recent quarter fiscal posted in May, the company raked in a whopping $1.38 billion in total revenue for the quarter. To highlight, this marks a 111% year-over-year surge. CFO Pedro Arnt cited strong online consumption and favorable consumer trends as key growth drivers for the quarter. All things considered, would you say that MELI stock is a good investment now?

The post Best Stocks To Buy Right Now? 3 E-Commerce Stocks To Know appeared first on Stock Market News, Quotes, Charts and Financial Information | StockMarket.com.

nasdaq stocks pandemic coronavirus brazil mexico germany ontario chinaInternational

The Realpolitik Grand Divergence

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively…

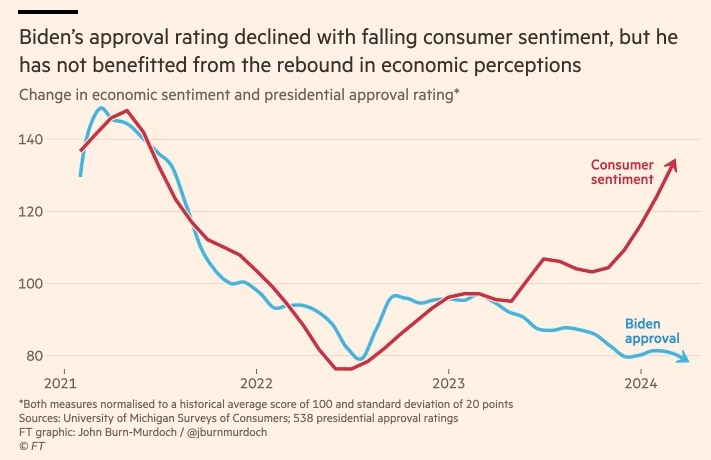

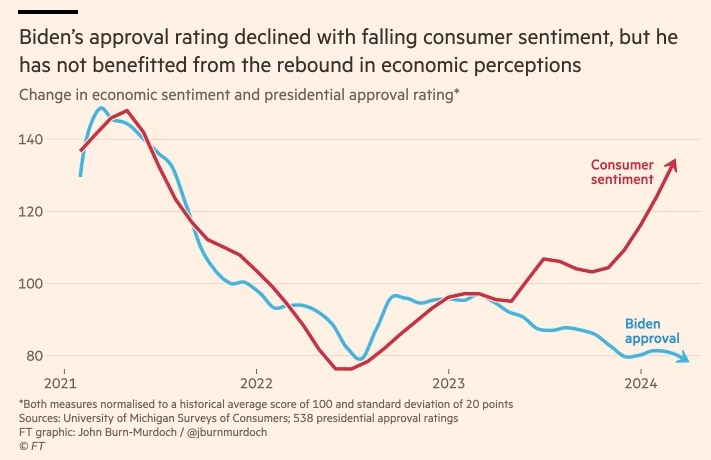

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively impacted incumbent approval ratings. President Biden’s approval ratings remain unaffected despite recent economic improvements, suggesting a decoupling of economic sentiment and political fortunes. This phenomenon, which contrasts with stable economic-political linkages in Europe, is attributed to the U.S.’s heightened partisan divide, where political allegiance increasingly dictates economic perception, challenging the traditional belief that “It’s the economy, stupid” in American politics.

Key Points:

- President Clinton’s political advisor, James Carville, highlighted the economy’s role in political success during 1992 presidential campaign with assertion, “It’s the economy, stupid.”

- Voter sentiment has traditionally linked to economic performance, affecting incumbent party success.

- Recent trends show a disconnect between the U.S. economy’s health and President Biden’s approval ratings.

- The COVID-19 pandemic and inflation crisis may have influenced this anomaly, yet the shift predates these events.

- Research indicates a decoupling of economic sentiment and presidential approval in the U.S. since Obama’s tenure.

- This phenomenon seems unique to the U.S., with European governments’ popularity still tied to economic conditions.

- U.S. political polarization may explain the decoupling, with partisan views influencing economic perceptions.

- Studies suggest that political biases skew individual economic assessments (confirmation bias) impacting presidential approval.

- The current U.S. political climate suggests economic policy impact on electoral decisions is diminishing.

- Contrasts with Europe, where economic sentiment is more uniform across political lines, suggesting a more rational political-economic relationship.

Source: Financial Times

european europe pandemic covid-19International

The Grand Realpolitik Divergence

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively…

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively impacted incumbent approval ratings. President Biden’s approval ratings remain unaffected despite recent economic improvements, suggesting a decoupling of economic sentiment and political fortunes. This phenomenon, which contrasts with stable economic-political linkages in Europe, is attributed to the U.S.’s heightened partisan divide, where political allegiance increasingly dictates economic perception, challenging the traditional belief that “it’s the economy, stupid” in American politics.

Key Points:

- President Clinton’s political advisor, James Carville, highlighted the economy’s role in political success during 1992 presidential campaign with assertion, “It’s the economy, stupid.”

- Voter sentiment has traditionally linked to economic performance, affecting incumbent party success.

- Recent trends show a disconnect between the U.S. economy’s health and President Biden’s approval ratings.

- The COVID-19 pandemic and inflation crisis may have influenced this anomaly, yet the shift predates these events.

- Research indicates a decoupling of economic sentiment and presidential approval in the U.S. since Obama’s tenure.

- This phenomenon seems unique to the U.S., with European governments’ popularity still tied to economic conditions.

- S. political polarization may explain the decoupling, with partisan views influencing economic perceptions.

- Studies suggest that political biases skew individual economic assessments, impacting presidential approval.

- The current U.S. political climate suggests economic policy impact on electoral decisions is diminishing.

- Contrasts with Europe, where economic sentiment is more uniform across political lines, suggesting a more rational political-economic relationship.

Source: Financial Times

european europe pandemic covid-19Spread & Containment

Wake-Up Call

Wake-Up Call

Authored by James Howard Kunstler via Kunstler.com,

“Those who organized the disaster will take advantage of the inevitable…

Authored by James Howard Kunstler via Kunstler.com,

“Those who organized the disaster will take advantage of the inevitable discontent arising from efforts to overcome it, for if there is one thing that they are skilled in, it is demagoguery.”

- Theodore Dalrymple

Can you feel it? The tension rising to the red-line? It runs clear through all of Western Civ. We are ruled by governments of fiends. But now, the sun rides higher in the sky. The sap is rising in the northern forests. The earth heaves. The buds swell and blush. Something is in the air. The animals are waking from their long winter sleep. The natives are restless.

The two traditional political divisions, liberal and conservative died with Covid. Now there are simply the sane versus the insane. The sane have had enough of being pushed around by the insane. The insane don’t register much of what reality tries to tell them. They have a body of insane ideas to comfort and protect them from the reality’s rigors. To call that body of ideas an “ideology” is way too polite.That the insane call themselves “progressive,” is a signature of their insanity.

Progress toward what better state of things? Toward a supremacy of fiends, sadists, degenerates, and morons seizing riches and power by every dishonest means possible outside the rule of law and common decency? It’s not even suitable to call them “communists.” They lack the necessary idealism for that.

They don’t expect to put their shoulders to the wheel with their fellow man. They just want to grab your stuff and then kill you so they don’t have to hear any complaints.

The insane do not believe any of the theoretical bullshit they want to force you to swallow. They don’t care about climate change. It’s just a cudgel they use to beat everyone over the head so they can steal your stuff. They don’t care about “democracy.” It’s just a line of bullshit to cover up their election-stealing. Do you suppose that sane people would keep using electronic vote-tabulating machines that were demonstrably connected to the Internet, and thus hackable, if they cared about election integrity? Of course not. They would arrange p.d.q. to junk them and use paper ballots, and only in person at polling places, with “absentee” exceptions only for people out of the country.

The insane do not care about public health. Everything that is known about the Covid-19 vaccinations tells you that they are unsafe and don’t prevent infection or transmission of a flu-like illness that might not even be what it was officially labeled as. Our public health officials in the FDA, the CDC, and in other corners of the Department of health and Human Services, lie about everything they’re responsible for. This week, the CDC (under Director Mandy Cohen) released a 148-page study on myocarditis reactions to mRNA shots. Every word on every page of the document was redacted. The CDC printed countless copies of the report with 148 utterly blank pages, and then proffered them to the news media. How is that not insane?

The insane do not care about the rule of law. The conduct of “Lawfare” is the subversion of the law by dishonest means. It is a species of racketeering. And that is why Lawfare rogues such Marc Elias, Norm Eisen, Andrew Weissmann, Mary McCord, Lisa Monaco, Matthew Graves, and Merrick Garland, should be charged under the federal RICO statutes for conspiring to deprive sane citizens of their rights and property in the many cases related to the 1/6/21 riot at the US Capitol.

It is, so far, an abiding mystery of contemporary history as to how New York Attorney General Letitia James managed to get away with prosecuting a real estate case against Donald Trump that was no more than victimless business-as-usual between a borrower and his lenders. Ms. James ran for that elected office promising to “get” Mr. Trump on something, anything. That is not how the rule of law works. Under the rule of law, first you determine that there is a crime and then look for who did the crime.

Letitia James must be insane and/or pretty stupid. The short-term gain of stealing Mr. Trump’s property under a false color-of-law and creating impediments to his election campaign, will, sooner or later, blow back at her as a matter of malicious prosecution and, plausibly, racketeering as well. (With whom did she conspire to bring this case? We shall find out.) She will eventually be disgraced publicly as her teammate Fani Willis has already been disgraced in Fulton County, Georgia. I’ll tell you something that all sane people now know but won’t talk about for fear of being crushed by the levers of Lawfare: this looks like a concerted effort by people-of-color to railroad people of non-color. If you think that is a good thing for race relations in our country, then you are insane.

Here are a bunch of other things that are insane: Re-litigating the first amendment is insane. It means what it says, and states it plainly. The open border is insane. No credible sovereign polity would allow it. It would be opposed with force, if necessary. Turning children into transsexuals on a wholesale basis is insane, and fiendishly so. Everybody knows that it is not good for the children or for our society as a whole. But fiends got to fiend, and if you try to deprive them of being fiends then you are guilty of “hate.”

The war in Ukraine is insane. We certainly didn’t ignite it in the service of “democracy.” Our pawn there, Mr. Zelensky, canceled the national elections last year. The war was arguably an effort by our CIA to deprive Russia of its market for natgas in Europe, and thus deprive Russia of a great deal of money, that is, of prosperity. The project failed. Russia overcame NATO’s proxy army and found other markets for its gas. Blowing up the Nord Stream pipelines only served to impoverish and weaken our NATO allies, who no longer have affordable gas to run their industries. The leaders of those allies were too insane to recognize that the Nord Stream op was an act-of-war against them. They were also busy destroying themselves, like the USA, with open borders. They will end up in a new medievalism, ruled by savages. You’d have to be insane to arrange that for yourself.

What’s most obviously insane in our country is that the insane party is pretending to nominate the mentally unfit White House place-keeper, “Joe Biden,” for reelection. You would think that if this party wanted to retain power, they would run a candidate who, though insane, was not also visibly senile. But the rank and file of this party are too insane to see that this dodge is not working. They are pretending with all their might that this is okay, that the growing faction of the sane don’t notice.

Sensing the growing impatience with insanity among the voters, the insane party has reached its point of terminal desperation. What will they try next? Murder? Why not? Nothing else seemed to work. They are too far gone in their insanity to understand that winter is over. We’ve entered the season of rebirth and renewal, starting with a renewed appreciation for being sane and for that indispensable ingredient that makes liberty in a free society possible: good faith. Really, the only question left is: how rough do they intend to play to prevent the return of sanity and good faith?

* * *

Support his blog by visiting Jim’s Patreon Page or Substack

-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoKey Events This Week: All Eyes On Core PCE Amid Deluge Of Fed Speakers

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoA Blue State Exodus: Who Can Afford To Be A Liberal