Government

Bears Remain In Control as King Dollar Rallies to Record 20-Year High

Last week was particularly tough for investors as all 11 sectors experienced losses of some extent. The S&P fell 4.6% after the Fed telegraphed that…

Last week was particularly tough for investors as all 11 sectors experienced losses of some extent.

The S&P fell 4.6% after the Fed telegraphed that more tightening of short-term rates lies ahead by year’s end, when it was thought that the Fed would “hike and hold,” allowing the three 75-point rate increases of June, July and September to work through the system. It is well understood that any rate increase takes about six months before its full effect is felt in the economy, and the market soured on the notion that the Fed might overshoot.

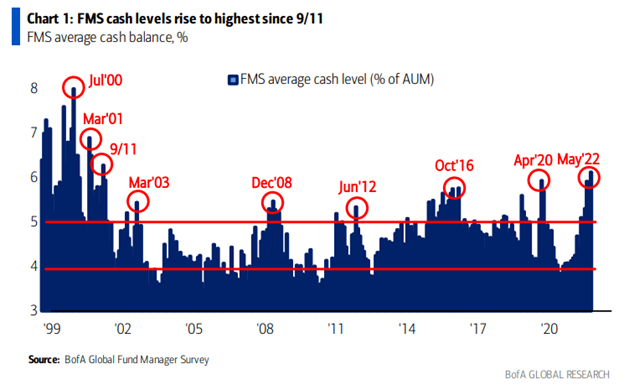

The S&P has now shed 23% year to date and came within 10 points of the June 3,647 low as the third quarter comes to a close. This kind of price action puts pressure on fund managers trying to window dress portfolios to show they have the right blend of risk and cash, which just happens to be at an extreme level that has historically defined a market bottom going back to the dot-com crash.

The S&P 500 ended Friday’s session at 3,693.23, down from last Friday’s closing level of 3,873.33. This follows a 4.8% tumble the previous week ahead of the Federal Open Market Committee (FOMC) meeting last week that pushed the market benchmark’s slide during the last two weeks to 9.2%. With just one week remaining in the month, this puts the S&P 500’s decline for September to date at 6.6%.

The Dow took out its low for 2022 but doesn’t carry the same technical implications as a priced weighted index. The Nasdaq and Russell 2000 also tested their June lows last Friday.

A view of the five-year chart of the S&P shows the long-term uptrend line coming in to play at 3,570 or roughly 3.6% below where the market closed Friday. Looking at the breach of this line in May 2020 was due to panic selling from the Covid-19 outbreak that quickly repaired itself when emergency stimulus was enacted. The previous test in November 2018 was brought on by the market’s “taper tantrum” when the Fed threatened to hike rates back then.

The current Fed Funds rate stands at 3.00%-3.25% with the Fed laying out a dot-plot plan for a year-end target of 4.4% that would take 30-year mortgage rates above 8.0% by some estimates. It now appears that after the Fed has popped the equity balloon, the U.S. central bank now is targeting the housing market to bring down rent inflation as well as the labor market where wage inflation has been very prominent.

Both forces will be harder to conquer than deflating the stock market. Record housing prices could easily give back 10% on a national basis and as much as 25% in some of the hottest and most overpriced markets such as Boise, Idaho; Austin, Texas; Charlotte, North Carolina; Nashville, Tennessee; Phoenix, Arizona; San Diego, California; and Tampa, Florida.

Bringing wages down will be near impossible without widespread layoffs. With the labor market staying tight with net new jobs created each month, inflation may be long lasting.

Other central banks outside the United States raised rates in lock step with the Fed, even after data showed a significant decline in economic activity in Europe that portends of a hard landing for the region. Energy prices pulled back further in reaction to the data.

That drop in energy prices is somewhat counterintuitive to the headline that Russia’s President Vladimir Putin is calling up 300,000 reservists to fortify his forces in Ukraine, sending a clear signal he is digging in and not in willing to negotiate or submit to calls by global leaders to stop the war he started on Feb. 26.

Inflation is clearly coming down across the commodity markets. Everything from crude, natural gas, gasoline, wheat, corn, soybean, sugar, lumber, cotton, copper, cattle, lean hogs and copper prices are pulling back with the CRB Index returning to levels not seen since this past March. These broad price declines will certainly show up in the forthcoming inflation data.

This week, investors will receive key data on the housing market, economic growth and inflation. Tuesday will feature releases of August new home sales, as well as the S&P Case Shiller US home price index for July, followed by the pending home sales index for August on Wednesday.

Thursday, Q2 revised gross domestic product will be released, followed by the Friday release of the Personal Consumption Expenditures, or PCE, price index, a closely watched inflation reading, for August. That price index is the Fed’s preferred inflation barometer.

The market is grasping for any hints of inflation ebbing from the June peak, but much of the current downturn in commodities took place in September. In this regard, the large basket of housing data (FHFA Housing Price Index for July, Case-Schiller Home Price Index for July, New Home Sales for August, MBA Mortgage Applications Index for the week ending Sept. 24 and Pending Home Sales for August) will likely matter the most when weighing the huge influence housing has on gross domestic product (GDP).

Sources: www.bea.gov

The biggest headwind for the market continues to be the powerful rally in the U.S. dollar against all developed and emerging market currencies. Charts of the pound sterling, euro, yen, looney, krona and yuan are in protracted downtrends. The combination of the Fed’s monthly quantitative tightening (QT) of $95 billion coming out of the financial system and the flight to safety is fueling a major upside move in the greenback.

One wonders what sort of headline it will take to turn the tide and bring confidence back to the market. It will take probably several headlines about inflation being on the decline, some better-than-expected earnings from companies of market leading stocks and a change in the makeup of Congress come election time. With stocks in extreme oversold territory, a 7%-10% rally is probably in the cards near term that gets the S&P back up to 4,000 where the 50-day moving average lies overhead. From there, Mr. Market will have a lot of wood to chop to break the dollar and bring back the bulls.

The post Bears Remain In Control as King Dollar Rallies to Record 20-Year High appeared first on Stock Investor.

stimulus economic growth covid-19 sp 500 nasdaq stocks fomc open market committee fed home sales mortgage rates housing market currencies pound euro yuan russell 2000 congress gross domestic product gdp stimulus commodities commodity markets europe russia ukraineGovernment

Low Iron Levels In Blood Could Trigger Long COVID: Study

Low Iron Levels In Blood Could Trigger Long COVID: Study

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate…

Authored by Amie Dahnke via The Epoch Times (emphasis ours),

People with inadequate iron levels in their blood due to a COVID-19 infection could be at greater risk of long COVID.

A new study indicates that problems with iron levels in the bloodstream likely trigger chronic inflammation and other conditions associated with the post-COVID phenomenon. The findings, published on March 1 in Nature Immunology, could offer new ways to treat or prevent the condition.

Long COVID Patients Have Low Iron Levels

Researchers at the University of Cambridge pinpointed low iron as a potential link to long-COVID symptoms thanks to a study they initiated shortly after the start of the pandemic. They recruited people who tested positive for the virus to provide blood samples for analysis over a year, which allowed the researchers to look for post-infection changes in the blood. The researchers looked at 214 samples and found that 45 percent of patients reported symptoms of long COVID that lasted between three and 10 months.

In analyzing the blood samples, the research team noticed that people experiencing long COVID had low iron levels, contributing to anemia and low red blood cell production, just two weeks after they were diagnosed with COVID-19. This was true for patients regardless of age, sex, or the initial severity of their infection.

According to one of the study co-authors, the removal of iron from the bloodstream is a natural process and defense mechanism of the body.

But it can jeopardize a person’s recovery.

“When the body has an infection, it responds by removing iron from the bloodstream. This protects us from potentially lethal bacteria that capture the iron in the bloodstream and grow rapidly. It’s an evolutionary response that redistributes iron in the body, and the blood plasma becomes an iron desert,” University of Oxford professor Hal Drakesmith said in a press release. “However, if this goes on for a long time, there is less iron for red blood cells, so oxygen is transported less efficiently affecting metabolism and energy production, and for white blood cells, which need iron to work properly. The protective mechanism ends up becoming a problem.”

The research team believes that consistently low iron levels could explain why individuals with long COVID continue to experience fatigue and difficulty exercising. As such, the researchers suggested iron supplementation to help regulate and prevent the often debilitating symptoms associated with long COVID.

“It isn’t necessarily the case that individuals don’t have enough iron in their body, it’s just that it’s trapped in the wrong place,” Aimee Hanson, a postdoctoral researcher at the University of Cambridge who worked on the study, said in the press release. “What we need is a way to remobilize the iron and pull it back into the bloodstream, where it becomes more useful to the red blood cells.”

The research team pointed out that iron supplementation isn’t always straightforward. Achieving the right level of iron varies from person to person. Too much iron can cause stomach issues, ranging from constipation, nausea, and abdominal pain to gastritis and gastric lesions.

1 in 5 Still Affected by Long COVID

COVID-19 has affected nearly 40 percent of Americans, with one in five of those still suffering from symptoms of long COVID, according to the U.S. Centers for Disease Control and Prevention (CDC). Long COVID is marked by health issues that continue at least four weeks after an individual was initially diagnosed with COVID-19. Symptoms can last for days, weeks, months, or years and may include fatigue, cough or chest pain, headache, brain fog, depression or anxiety, digestive issues, and joint or muscle pain.

Government

Walmart joins Costco in sharing key pricing news

The massive retailers have both shared information that some retailers keep very close to the vest.

As we head toward a presidential election, the presumed candidates for both parties will look for issues that rally undecided voters.

The economy will be a key issue, with Democrats pointing to job creation and lowering prices while Republicans will cite the layoffs at Big Tech companies, high housing prices, and of course, sticky inflation.

The covid pandemic created a perfect storm for inflation and higher prices. It became harder to get many items because people getting sick slowed down, or even stopped, production at some factories.

Related: Popular mall retailer shuts down abruptly after bankruptcy filing

It was also a period where demand increased while shipping, trucking and delivery systems were all strained or thrown out of whack. The combination led to product shortages and higher prices.

You might have gone to the grocery store and not been able to buy your favorite paper towel brand or find toilet paper at all. That happened partly because of the supply chain and partly due to increased demand, but at the end of the day, it led to higher prices, which some consumers blamed on President Joe Biden's administration.

Biden, of course, was blamed for the price increases, but as inflation has dropped and grocery prices have fallen, few companies have been up front about it. That's probably not a political choice in most cases. Instead, some companies have chosen to lower prices more slowly than they raised them.

However, two major retailers, Walmart (WMT) and Costco, have been very honest about inflation. Walmart Chief Executive Doug McMillon's most recent comments validate what Biden's administration has been saying about the state of the economy. And they contrast with the economic picture being painted by Republicans who support their presumptive nominee, Donald Trump.

Image source: Joe Raedle/Getty Images

Walmart sees lower prices

McMillon does not talk about lower prices to make a political statement. He's communicating with customers and potential customers through the analysts who cover the company's quarterly-earnings calls.

During Walmart's fiscal-fourth-quarter-earnings call, McMillon was clear that prices are going down.

"I'm excited about the omnichannel net promoter score trends the team is driving. Across countries, we continue to see a customer that's resilient but looking for value. As always, we're working hard to deliver that for them, including through our rollbacks on food pricing in Walmart U.S. Those were up significantly in Q4 versus last year, following a big increase in Q3," he said.

He was specific about where the chain has seen prices go down.

"Our general merchandise prices are lower than a year ago and even two years ago in some categories, which means our customers are finding value in areas like apparel and hard lines," he said. "In food, prices are lower than a year ago in places like eggs, apples, and deli snacks, but higher in other places like asparagus and blackberries."

McMillon said that in other areas prices were still up but have been falling.

"Dry grocery and consumables categories like paper goods and cleaning supplies are up mid-single digits versus last year and high teens versus two years ago. Private-brand penetration is up in many of the countries where we operate, including the United States," he said.

Costco sees almost no inflation impact

McMillon avoided the word inflation in his comments. Costco (COST) Chief Financial Officer Richard Galanti, who steps down on March 15, has been very transparent on the topic.

The CFO commented on inflation during his company's fiscal-first-quarter-earnings call.

"Most recently, in the last fourth-quarter discussion, we had estimated that year-over-year inflation was in the 1% to 2% range. Our estimate for the quarter just ended, that inflation was in the 0% to 1% range," he said.

Galanti made clear that inflation (and even deflation) varied by category.

"A bigger deflation in some big and bulky items like furniture sets due to lower freight costs year over year, as well as on things like domestics, bulky lower-priced items, again, where the freight cost is significant. Some deflationary items were as much as 20% to 30% and, again, mostly freight-related," he added.

bankruptcy pandemic trumpGovernment

Walmart has really good news for shoppers (and Joe Biden)

The giant retailer joins Costco in making a statement that has political overtones, even if that’s not the intent.

As we head toward a presidential election, the presumed candidates for both parties will look for issues that rally undecided voters.

The economy will be a key issue, with Democrats pointing to job creation and lowering prices while Republicans will cite the layoffs at Big Tech companies, high housing prices, and of course, sticky inflation.

The covid pandemic created a perfect storm for inflation and higher prices. It became harder to get many items because people getting sick slowed down, or even stopped, production at some factories.

Related: Popular mall retailer shuts down abruptly after bankruptcy filing

It was also a period where demand increased while shipping, trucking and delivery systems were all strained or thrown out of whack. The combination led to product shortages and higher prices.

You might have gone to the grocery store and not been able to buy your favorite paper towel brand or find toilet paper at all. That happened partly because of the supply chain and partly due to increased demand, but at the end of the day, it led to higher prices, which some consumers blamed on President Joe Biden's administration.

Biden, of course, was blamed for the price increases, but as inflation has dropped and grocery prices have fallen, few companies have been up front about it. That's probably not a political choice in most cases. Instead, some companies have chosen to lower prices more slowly than they raised them.

However, two major retailers, Walmart (WMT) and Costco, have been very honest about inflation. Walmart Chief Executive Doug McMillon's most recent comments validate what Biden's administration has been saying about the state of the economy. And they contrast with the economic picture being painted by Republicans who support their presumptive nominee, Donald Trump.

Image source: Joe Raedle/Getty Images

Walmart sees lower prices

McMillon does not talk about lower prices to make a political statement. He's communicating with customers and potential customers through the analysts who cover the company's quarterly-earnings calls.

During Walmart's fiscal-fourth-quarter-earnings call, McMillon was clear that prices are going down.

"I'm excited about the omnichannel net promoter score trends the team is driving. Across countries, we continue to see a customer that's resilient but looking for value. As always, we're working hard to deliver that for them, including through our rollbacks on food pricing in Walmart U.S. Those were up significantly in Q4 versus last year, following a big increase in Q3," he said.

He was specific about where the chain has seen prices go down.

"Our general merchandise prices are lower than a year ago and even two years ago in some categories, which means our customers are finding value in areas like apparel and hard lines," he said. "In food, prices are lower than a year ago in places like eggs, apples, and deli snacks, but higher in other places like asparagus and blackberries."

McMillon said that in other areas prices were still up but have been falling.

"Dry grocery and consumables categories like paper goods and cleaning supplies are up mid-single digits versus last year and high teens versus two years ago. Private-brand penetration is up in many of the countries where we operate, including the United States," he said.

Costco sees almost no inflation impact

McMillon avoided the word inflation in his comments. Costco (COST) Chief Financial Officer Richard Galanti, who steps down on March 15, has been very transparent on the topic.

The CFO commented on inflation during his company's fiscal-first-quarter-earnings call.

"Most recently, in the last fourth-quarter discussion, we had estimated that year-over-year inflation was in the 1% to 2% range. Our estimate for the quarter just ended, that inflation was in the 0% to 1% range," he said.

Galanti made clear that inflation (and even deflation) varied by category.

"A bigger deflation in some big and bulky items like furniture sets due to lower freight costs year over year, as well as on things like domestics, bulky lower-priced items, again, where the freight cost is significant. Some deflationary items were as much as 20% to 30% and, again, mostly freight-related," he added.

bankruptcy pandemic trump-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 day ago

International1 day agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges