Access Community Capital serves as the fiscal agent for the 2022 Nevada SBA Award Luncheon

Access Community Capital serves as the fiscal agent for the 2022 Nevada SBA Award Luncheon

PR Newswire

LAS VEGAS, May 13, 2022

LAS VEGAS, May 13, 2022 /PRNewswire/ — Access Community Capital is proud to be a sponsor and fiscal agent of the 2022 Ne…

Access Community Capital serves as the fiscal agent for the 2022 Nevada SBA Award Luncheon

PR Newswire

LAS VEGAS, May 13, 2022

LAS VEGAS, May 13, 2022 /PRNewswire/ -- Access Community Capital is proud to be a sponsor and fiscal agent of the 2022 Nevada SBA Awards luncheon. This year saw an impressive array of businesses that managed to thrive despite a challenging business environment due to the COVID-19 pandemic.

The luncheon, held on May 5, 2022, at The Smith Center in Las Vegas, NV was a sold-out event with well over 260 attendees. Nic Steele, Executive Director of Access Community Capital said "This year's luncheon was an amazing celebration of the resilience in Nevada's Small Business ecosystem. All the winners are a testament to the entrepreneurial spirit that is continuing to drive Nevada's economic growth."

Special thanks to Saul Ramos, the Nevada SBA District Director and the other organizers. Notable support was also provided by Nevada Department of Business and Industry, Nevada Governor's Office of Economic Development, Congresswoman Susie Lee, and Congressman Steven Horsford.

Congratulations to the 2020 and 2022 SBA Award Winners !

Minority Owned Business of the Year:

2022 Winner - Don Tortaco

2020 Winner – Edwin Suarez Physical Therapy, LLC

Woman Owned Business of the Year:

2022 Winner - Live Electric Inc

2020 Winner - Free Brands Inc.

Family Owned Business of the Year:

2022 Winner - See Us Now Staffing, Inc.

Microenterprise Business of the Year:

2022 Winner - PHamily Hair Care

2020 Winner - Bio Logical, LLC

Veteran Owned Business of the Year:

2022 Winner - Heritage Mortuary Inc.

Northern Nevada Legacy Award of the Year:

2022 Winner - Huck Salt

2020 Winner - Full Tilt Logistics

Southern Nevada Legacy Award of the Year:

2022 Winner - Ferraro's Italian Restaurant & Wine Bar

2020 Winner - Michael E. Minden Diamond Jewelers , Michael Minden

Rural Owned Business of the Year:

2022 Winner - McAdoo's Restaurant

Entrepreneurial Spirit Award of the Year:

2022 Winner - Scott Muelrath, Henderson Chamber of Commerce

2020 Winner - David Eclips

Exporter of the Year:

2022 Winner - Ganesha Enterprises

8(a) Graduate of the Year:

2022 Winner - HSG

Lenders of the Year:

2022 Winners

SBA Nevada National Lender of the year (Total # of loans) - U.S. Bank (1st) , Wells Fargo (2nd)

SBA Nevada Lender of the year - Nevada State Bank (1st) , American First Credit Union (2nd) , Meadows Bank (3rd)

Cosponsorship Authorization # 22-10-C. SBA's participation in this Cosponsored Activity is not an endorsement of the views, opinions, products or services of any Cosponsor or other person or entity. All SBA programs and services are extended to the public on a nondiscriminatory basis.

About the Small Business Administration:

Since 1953, the SBA has worked to ignite change and spark action so small businesses can confidently start, grow, expand, or recover. The Nevada District Office has a collective team of resources to help your business prosper.

About Access Community Capital:

Access Community Capital ("ACCESS") is a minority-led mission-driven organization founded by entrepreneurs who understand the plight of business ownership and remain committed to addressing the inequities present in the lending landscape. ACCESS provides loans, grants, and investments to assist small businesses and promote economic development in low-moderate income communities. ACCESS complements traditional financial institutions by increasing access to affordable capital in communities often underserved, including minority-, women-, and veteran-owned businesses. In addition to providing commercial and micro loans, ACCESS also provides mission-related program services such as capacity-building technical assistance and grant making. For more information, please visit http://accesscdfi.org/

View original content to download multimedia:https://www.prnewswire.com/news-releases/access-community-capital-serves-as-the-fiscal-agent-for-the-2022-nevada-sba-award-luncheon-301547212.html

SOURCE Access Community Capital

International

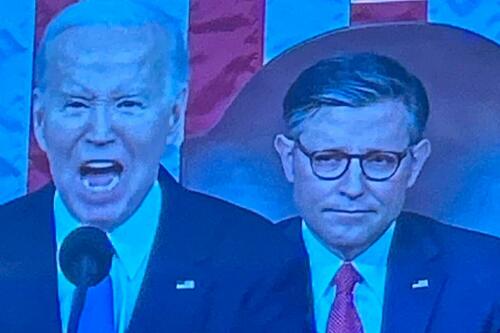

Angry Shouting Aside, Here’s What Biden Is Running On

Angry Shouting Aside, Here’s What Biden Is Running On

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union…

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union address - in which he insisted that the American economy is doing better than ever, blamed inflation on 'corporate greed,' and warned that Donald Trump poses an existential threat to the republic.

But in between the angry rhetoric, he also laid out his 2024 election platform - for which additional details will be released on March 11, when the White House sends its proposed budget to Congress.

To that end, Goldman Sachs' Alec Phillips and Tim Krupa have summarized the key points:

Taxes

While railing against billionaires (nothing new there), Biden repeated the claim that anyone making under $400,000 per year won't see an increase in their taxes. He also proposed a 21% corporate minimum tax, up from 15% on book income outlined in the Inflation Reduction Act (IRA), as well as raising the corporate tax rate from 21% to 28% (which would promptly be passed along to consumers in the form of more inflation). Goldman notes that "Congress is unlikely to consider any of these proposals this year, they would only come into play in a second Biden term, if Democrats also won House and Senate majorities."

Biden once again tells the complete lie that "nobody earning less than $400,000/year will pay additional penny in federal taxes."

— RNC Research (@RNCResearch) March 8, 2024

FACT: Biden has *already* raised the tax burden on Americans making as little as $20,000 per year. pic.twitter.com/VrZ1m0rzG3

Biden also called on Congress to restore the pandemic-era child tax credit.

Immigration

Instead of simply passing a slew of border security Executive Orders like the Trump ones he shredded on day one, Biden repeated the lie that Congress 'needs to act' before he can (translation: send money to Ukraine or the US border will continue to be a sieve).

As immigration comes into even greater focus heading into the election, we continue to expect the Administration to tighten policy (e.g., immigration has surged 20pp the last 7 months to first place with 28% in Gallup’s “most important problem” survey). As such, we estimate the foreign-born contribution to monthly labor force growth will moderate from 110k/month in 2023 to around 70-90k/month in 2024. -GS

SEE IT: Biden gets boo-ed while talking about his immigration bill. WATCH pic.twitter.com/O5FmkYx3xM

— Simon Ateba (@simonateba) March 8, 2024

Ukraine

Biden, with House Speaker Mike Johnson doing his best impression of a bobble-head, urged Congress to pass additional assistance for Ukraine based entirely on the premise that Russia 'won't stop' there (and would what, trigger article 5 and WW3 no matter what?), despite the fact that Putin explicitly told Tucker Carlson he has no further ambitions, and in fact seeks a settlement.

‼️ Breaking: Putin wants a negotiated settlement to what’s happening in Ukraine.

— Ed (@EdMagari) February 9, 2024

In a surprising turn of events, Tucker Carlson could be the key to peace, potentially playing a crucial role in ending the current conflict????️ pic.twitter.com/IKN8ajlEUX

As Goldman estimates, "While there is still a clear chance that such a deal could come together, for now there is no clear path forward for Ukraine aid in Congress."

China

Biden, forgetting about all the aggressive tariffs, suggested that Trump had been soft on China, and that he will stand up "against China's unfair economic practices" and "for peace and stability across the Taiwan Strait."

SOTU FACT CHECK:

— Wesley Hunt (@WesleyHuntTX) March 8, 2024

Biden claims we’re in a strong position to take on China.

No president in our lifetime has been WEAKER on China than Biden. pic.twitter.com/Y73JsIzmM3

Healthcare

Lastly, Biden proposed to expand drug price negotiations to 50 additional drugs each year (an increase from 20 outlined in the IRA), which Goldman said would likely require bipartisan support "even if Democrats controlled Congress and the White House," as such policies would likely be ineligible for the budget "reconciliation" process which has been used in previous years to pass the IRA and other major fiscal party when Congressional margins are just too thin.

So there you have it. With no actual accomplishments to speak of, Biden can only attack Trump, lie, and make empty promises.

Government

Jack Smith Says Trump Retention Of Documents “Starkly Different” From Biden

Jack Smith Says Trump Retention Of Documents "Starkly Different" From Biden

Authored by Catherine Yang via The Epoch Times (emphasis ours),

Special…

Authored by Catherine Yang via The Epoch Times (emphasis ours),

Special counsel Jack Smith has argued the case he is prosecuting against former President Donald Trump for allegedly mishandling classified information is “starkly different” from the case the Department of Justice declined to bring against President Joe Biden over retention of classified documents.

Prosecutors, in responding to a motion President Trump filed to dismiss the case based on selective and vindictive prosecution, said on Thursday this is not the case of “two men ‘commit[ting] the same basic crime in substantially the same manner.”

They argue the similarities are only “superficial,” and that there are two main differences: that President Trump allegedly “engaged in extensive and repeated efforts to obstruct justice and thwart the return of documents” and the “evidence concerning the two men’s intent.”

Special counsel Robert Hur’s report found that there was evidence that President Biden “willfully” retained classified Afghanistan documents, but that evidence “fell short” of concluding guilt of willful retention beyond reasonable doubt.

Prosecutors argue the “strength of the evidence” is a crucial element showing these cases are not “similarly situated.”

“Trump may dispute the Hur Report’s conclusions but he should not be allowed to misrepresent them,” prosecutors wrote, arguing that the defense’s argument to dismiss the case fell short of legal standards.

They point to volume as another distinction: President Biden had 88 classified documents and President Trump had 337. Prosecutors also argued that while President Biden’s Delaware garage “was plainly an unsecured location ... whatever risks are posed by storing documents in a private garage” were “dwarfed” by President Trump storing documents at an “active social club” with 150 staff members and hundreds of visitors.

Defense attorneys had also cited a New York Times report where President Biden was reported to have held the view that President Trump should be prosecuted, expressing concern about his retention of documents at Mar-a-lago.

Prosecutors argued that this case was not “foisted” upon the special counsel, who had not been appointed at the time of these comments.

“Trump appears to contend that it was President Biden who actually made the decision to seek the charges in this case; that Biden did so solely for unconstitutional reasons,” the filing reads. “He presents no evidence whatsoever to show that Biden’s comments about him had any bearing on the Special Counsel’s decision to seek charges, much less that the Special Counsel is a ’stalking horse.'”

8 Other Cases

President Trump has argued he is being subjected to selective and vindictive prosecution, warranting dismissal of the case, but prosecutors argue that the defense has not “identified anyone who has engaged in a remotely similar battery of criminal conduct and not been prosecuted as a result.”

In addition to President Biden, defense attorneys offered eight other examples.

Former Vice President Mike Pence had, after 2023 reports about President Biden retaining classified documents surfaced, retained legal counsel to search his home for classified documents. Some documents were found, and he sent them to the National Archives and Records Administration (NARA).

Prosecutors say this was different from President Trump’s situation, as Vice President Pence returned the documents out of his own initiative and had fewer than 15 classified documents.

Former President Bill Clinton had retained a historian to put together “The Clinton Tapes” project, and it was later reported that NARA did not have those tapes years after his presidency. A court had ruled it could not compel NARA to try to recover the records, and NARA had defined the tapes as personal records.

Prosecutors argue those were tape diaries and the situation was “far different” from President Trump’s.

Former Secretary of State Hillary Clinton had “used private email servers ... to conduct official State Department business,” the DOJ found, and the FBI opened a criminal investigation.

Prosecutors argued this was a different situation where the secretary’s emails showed no “classified” markings and the deletion of more than 31,000 emails was done by an employee and not the secretary.

Former FBI Director James Comey had retained four memos “believing that they contained no classified information.” These memos were part of seven he authored addressing interactions he had with President Trump.

Prosecutors argued there was no obstructive behavior here.

Former CIA Director David Petraeus kept bound notebooks that contained classified and unclassified notes, which he allowed a biographer to review. The FBI later seized the notebooks and Mr. Petraeus took a guilty plea.

Prosecutors argued there was prosecution in Mr. Petraeus’s case, and so President Trump’s case is not selective.

Former national security adviser Sandy Berger removed five copies of a classified document and kept them at his personal office, later shredding three of the copies. When confronted by NARA, he returned the remaining two copies and took a guilty plea.

Former CIA director John Deutch kept a journal with classified information on an unclassified computer, and also took a guilty plea.

Prosecutors argued both Mr. Berger and Mr. Deutch’s behavior was “vastly less egregious than Trump’s” and they had been prosecuted.

Former White House coronavirus response coordinator Deborah Birx had possession of classified materials according to documents retrieved by NARA.

Prosecutors argued that there was no indication she knew she had classified information or “attempted to obstruct justice.”

Uncategorized

Economic Earthquake Ahead? The Cracks Are Spreading Fast

Economic Earthquake Ahead? The Cracks Are Spreading Fast

Authored by Brandon Smith via Alt-Market.us,

One of my favorite false narratives…

Authored by Brandon Smith via Alt-Market.us,

One of my favorite false narratives floating around corporate media platforms has been the argument that the American people “just don’t seem to understand how good the economy really is right now.” If only they would look at the stats, they would realize that we are in the middle of a financial renaissance, right? It must be that people have been brainwashed by negative press from conservative sources…

I have to laugh at this notion because it’s a very common one throughout history – it’s an assertion made by almost every single political regime right before a major collapse. These people always say the same things, and when you study economics as long as I have you can’t help but throw up your hands and marvel at their dedication to the propaganda.

One example that comes to mind immediately is the delusional optimism of the “roaring” 1920s and the lead up to the Great Depression. At the time around 60% of the U.S. population was living in poverty conditions (according to the metrics of the decade) earning less than $2000 a year. However, in the years after WWI ravaged Europe, America’s economic power was considered unrivaled.

The 1920s was an era of mass production and rampant consumerism but it was all fueled by easy access to debt, a condition which had not really existed before in America. It was this illusion of prosperity created by the unchecked application of credit that eventually led to the massive stock market bubble and the crash of 1929. This implosion, along with the Federal Reserve’s policy of raising interest rates into economic weakness, created a black hole in the U.S. financial system for over a decade.

There are two primary tools that various failing regimes will often use to distort the true conditions of the economy: Debt and inflation. In the case of America today, we are experiencing BOTH problems simultaneously and this has made certain economic indicators appear healthy when they are, in fact, highly unstable. The average American knows this is the case because they see the effects everyday. They see the damage to their wallets, to their buying power, in the jobs market and in their quality of life. This is why public faith in the economy has been stuck in the dregs since 2021.

The establishment can flash out-of-context stats in people’s faces, but they can’t force the populace to see a recovery that simply does not exist. Let’s go through a short list of the most faulty indicators and the real reasons why the fiscal picture is not a rosy as the media would like us to believe…

The “miracle” labor market recovery

In the case of the U.S. labor market, we have a clear example of distortion through inflation. The $8 trillion+ dropped on the economy in the first 18 months of the pandemic response sent the system over the edge into stagflation land. Helicopter money has a habit of doing two things very well: Blowing up a bubble in stock markets and blowing up a bubble in retail. Hence, the massive rush by Americans to go out and buy, followed by the sudden labor shortage and the race to hire (mostly for low wage part-time jobs).

The problem with this “miracle” is that inflation leads to price explosions, which we have already experienced. The average American is spending around 30% more for goods, services and housing compared to what they were spending in 2020. This is what happens when you have too much money chasing too few goods and limited production.

The jobs market looks great on paper, but the majority of jobs generated in the past few years are jobs that returned after the covid lockdowns ended. The rest are jobs created through monetary stimulus and the artificial retail rush. Part time low wage service sector jobs are not going to keep the country rolling for very long in a stagflation environment. The question is, what happens now that the stimulus punch bowl has been removed?

Just as we witnessed in the 1920s, Americans have turned to debt to make up for higher prices and stagnant wages by maxing out their credit cards. With the central bank keeping interest rates high, the credit safety net will soon falter. This condition also goes for businesses; the same businesses that will jump headlong into mass layoffs when they realize the party is over. It happened during the Great Depression and it will happen again today.

Cracks in the foundation

We saw cracks in the narrative of the financial structure in 2023 with the banking crisis, and without the Federal Reserve backstop policy many more small and medium banks would have dropped dead. The weakness of U.S. banks is offset by the relative strength of the U.S. dollar, which lures in foreign investors hoping to protect their wealth using dollar denominated assets.

But something is amiss. Gold and bitcoin have rocketed higher along with economically sensitive assets and the dollar. This is the opposite of what’s supposed to happen. Gold and BTC are supposed to be hedges against a weak dollar and a weak economy, right? If global faith in the dollar and in the U.S. economy is so high, why are investors diving into protective assets like gold?

Again, as noted above, inflation distorts everything.

Tens of trillions of extra dollars printed by the Fed are floating around and it’s no surprise that much of that cash is flooding into the economy which simply pushes higher right along with prices on the shelf. But, gold and bitcoin are telling us a more honest story about what’s really happening.

Right now, the U.S. government is adding around $600 billion per month to the national debt as the Fed holds rates higher to fight inflation. This debt is going to crush America’s financial standing for global investors who will eventually ask HOW the U.S. is going to handle that growing millstone? As I predicted years ago, the Fed has created a perfect Catch-22 scenario in which the U.S. must either return to rampant inflation, or, face a debt crisis. In either case, U.S. dollar-denominated assets will lose their appeal and their prices will plummet.

“Healthy” GDP is a complete farce

GDP is the most common out-of-context stat used by governments to convince the citizenry that all is well. It is yet another stat that is entirely manipulated by inflation. It is also manipulated by the way in which modern governments define “economic activity.”

GDP is primarily driven by spending. Meaning, the higher inflation goes, the higher prices go, and the higher GDP climbs (to a point). Eventually prices go too high, credit cards tap out and spending ceases. But, for a short time inflation makes GDP (as well as retail sales) look good.

Another factor that creates a bubble is the fact that government spending is actually included in the calculation of GDP. That’s right, every dollar of your tax money that the government wastes helps the establishment by propping up GDP numbers. This is why government spending increases will never stop – It’s too valuable for them to spend as a way to make the economy appear healthier than it is.

The REAL economy is eclipsing the fake economy

The bottom line is that Americans used to be able to ignore the warning signs because their bank accounts were not being directly affected. This is over. Now, every person in the country is dealing with a massive decline in buying power and higher prices across the board on everything – from food and fuel to housing and financial assets alike. Even the wealthy are seeing a compression to their profit and many are struggling to keep their businesses in the black.

The unfortunate truth is that the elections of 2024 will probably be the turning point at which the whole edifice comes tumbling down. Even if the public votes for change, the system is already broken and cannot be repaired without a complete overhaul.

We have consistently avoided taking our medicine and our disease has gotten worse and worse.

People have lost faith in the economy because they have not faced this kind of uncertainty since the 1930s. Even the stagflation crisis of the 1970s will likely pale in comparison to what is about to happen. On the bright side, at least a large number of Americans are aware of the threat, as opposed to the 1920s when the vast majority of people were utterly conned by the government, the banks and the media into thinking all was well. Knowing is the first step to preparing.

The second step is securing your own financial future – that’s where physical precious metals can play a role. Diversifying your savings with inflation-resistant, uninflatable assets whose intrinsic value doesn’t rely on a counterparty’s promise to pay adds resilience to your savings. That’s the main reason physical gold and silver have been the safe haven store-of-value assets of choice for centuries (among both the elite and the everyday citizen).

* * *

As the world moves away from dollars and toward Central Bank Digital Currencies (CBDCs), is your 401(k) or IRA really safe? A smart and conservative move is to diversify into a physical gold IRA. That way your savings will be in something solid and enduring. Get your FREE info kit on Gold IRAs from Birch Gold Group. No strings attached, just peace of mind. Click here to secure your future today.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International9 hours ago

International9 hours agoWalmart launches clever answer to Target’s new membership program

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex