Uncategorized

“A Global Conspiracy Against God” – Archbishop Says Trump Is Only One To Save Humanity From ‘The Great Reset’

"A Global Conspiracy Against God" – Archbishop Says Trump Is Only One To Save Humanity From ‘The Great Reset’

The Italian archbishop best known for confronting Pope Francis over the Vatican's willful blindness to priests who abuse boys has written a letter in which he lashes out at the "global elite", prompting some to accuse him of sympathizing with the "QAnon" movement of conspiracy theorists.

The letter, penned by Archibishop Carlo Maria Vigano, formerly the Vatican's ambassador to the US, attacks a shadowy "global elite", that is plotting a "Great Reset" intended to undermine "God and humanity".

This same group, the archbishop argued, is also responsible for the lockdowns that have restricted movement and freedom around the globe, eliciting protests in many European capitals.

"The fate of the whole world is being threatened by a global conspiracy against God and humanity," Viganò wrote in the letter, which comes just days before the US election, which the archbishop wrote was of "epochal importance."

“No one, up until last February,” Viganò writes, “would ever have thought that, in all of our cities, citizens would be arrested simply for wanting to walk down the street, to breathe, to want to keep their business open, to want to go to church on Sunday. Yet now it is happening all over the world, even in picture-postcard Italy that many Americans consider to be a small enchanted country, with its ancient monuments, its churches, its charming cities, its characteristic villages.” Viganò adds: “And while the politicians are barricaded inside their palaces promulgating decrees like Persian satraps, businesses are failing, shops are closing, and people are prevented from living, traveling, working, and praying."

Working to protect the world from this group of elites seeking to recast society in a secular, totalitarian model, Viganò portrays President Trump as “the final garrison against the world dictatorship". Viganò cast Trump's opponent, Vice President Joe Biden, as "a person who is manipulated by the deep state."

Analysts who monitor "QAnon" conspiracy theories and their spread online warned the mainstream press that the letter had been widely discussed on various QAnon message boards, and had been disseminated in languages including Portuguese, Spanish, French, German and Italian, according to Yahoo News.

Over the summer, Trump tweeted an earlier letter penned by the archbishop, and encouraged his supporters to read it.

So honored by Archbishop Viganò’s incredible letter to me. I hope everyone, religious or not, reads it! https://t.co/fVhkCz89g5

— Donald J. Trump (@realDonaldTrump) June 10, 2020

In the past, Viagnò has accused Pope Francis of sweeping the child abuse crisis under the rug, and moving to protect homosexual priests, part of a "homosexual current" flowing through the Vatican.

Read the full letter below:

* * *

DONALD J. TRUMP

Sunday, October 25, 2020

Solemnity of Christ the King

Mr. President,

Allow me to address you at this hour in which the fate of the whole world is being threatened by a global conspiracy against God and humanity. I write to you as an Archbishop, as a Successor of the Apostles, as the former Apostolic Nuncio to the United States of America. I am writing to you in the midst of the silence of both civil and religious authorities. May you accept these words of mine as the “voice of one crying out in the desert” (Jn 1:23).

As I said when I wrote my letter to you in June, this historical moment sees the forces of Evil aligned in a battle without quarter against the forces of Good; forces of Evil that appear powerful and organized as they oppose the children of Light, who are disoriented and disorganized, abandoned by their temporal and spiritual leaders.

Daily we sense the attacks multiplying of those who want to destroy the very basis of society: the natural family, respect for human life, love of country, freedom of education and business. We see heads of nations and religious leaders pandering to this suicide of Western culture and its Christian soul, while the fundamental rights of citizens and believers are denied in the name of a health emergency that is revealing itself more and more fully as instrumental to the establishment of an inhuman faceless tyranny.

A global plan called the Great Reset is underway. Its architect is a global élite that wants to subdue all of humanity, imposing coercive measures with which to drastically limit individual freedoms and those of entire populations. In several nations this plan has already been approved and financed; in others it is still in an early stage. Behind the world leaders who are the accomplices and executors of this infernal project, there are unscrupulous characters who finance the World Economic Forum and Event 201, promoting their agenda.

The purpose of the Great Reset is the imposition of a health dictatorship aiming at the imposition of liberticidal measures, hidden behind tempting promises of ensuring a universal income and cancelling individual debt. The price of these concessions from the International Monetary Fund will be the renunciation of private property and adherence to a program of vaccination against Covid-19 and Covid-21 promoted by Bill Gates with the collaboration of the main pharmaceutical groups. Beyond the enormous economic interests that motivate the promoters of the Great Reset, the imposition of the vaccination will be accompanied by the requirement of a health passport and a digital ID, with the consequent contact tracing of the population of the entire world. Those who do not accept these measures will be confined in detention camps or placed under house arrest, and all their assets will be confiscated.

Mr. President, I imagine that you are already aware that in some countries the Great Reset will be activated between the end of this year and the first trimester of 2021. For this purpose, further lockdowns are planned, which will be officially justified by a supposed second and third wave of the pandemic. You are well aware of the means that have been deployed to sow panic and legitimize draconian limitations on individual liberties, artfully provoking a world-wide economic crisis. In the intentions of its architects, this crisis will serve to make the recourse of nations to the Great Reset irreversible, thereby giving the final blow to a world whose existence and very memory they want to completely cancel. But this world, Mr. President, includes people, affections, institutions, faith, culture, traditions, and ideals: people and values that do not act like automatons, who do not obey like machines, because they are endowed with a soul and a heart, because they are tied together by a spiritual bond that draws its strength from above, from that God that our adversaries want to challenge, just as Lucifer did at the beginning of time with his “non serviam."

Many people – as we well know – are annoyed by this reference to the clash between Good and Evil and the use of “apocalyptic” overtones, which according to them exasperates spirits and sharpens divisions. It is not surprising that the enemy is angered at being discovered just when he believes he has reached the citadel he seeks to conquer undisturbed. What is surprising, however, is that there is no one to sound the alarm. The reaction of the deep state to those who denounce its plan is broken and incoherent, but understandable. Just when the complicity of the mainstream media had succeeded in making the transition to the New World Order almost painless and unnoticed, all sorts of deceptions, scandals and crimes are coming to light.

Until a few months ago, it was easy to smear as “conspiracy theorists” those who denounced these terrible plans, which we now see being carried out down to the smallest detail. No one, up until last February, would ever have thought that, in all of our cities, citizens would be arrested simply for wanting to walk down the street, to breathe, to want to keep their business open, to want to go to church on Sunday. Yet now it is happening all over the world, even in picture-postcard Italy that many Americans consider to be a small enchanted country, with its ancient monuments, its churches, its charming cities, its characteristic villages. And while the politicians are barricaded inside their palaces promulgating decrees like Persian satraps, businesses are failing, shops are closing, and people are prevented from living, traveling, working, and praying. The disastrous psychological consequences of this operation are already being seen, beginning with the suicides of desperate entrepreneurs and of our children, segregated from friends and classmates, told to follow their classes while sitting at home alone in front of a computer.

In Sacred Scripture, Saint Paul speaks to us of “the one who opposes” the manifestation of the mystery of iniquity, the kathèkon (2 Thess 2:6-7). In the religious sphere, this obstacle to evil is the Church, and in particular the papacy; in the political sphere, it is those who impede the establishment of the New World Order.

As is now clear, the one who occupies the Chair of Peter has betrayed his role from the very beginning in order to defend and promote the globalist ideology, supporting the agenda of the deep church, who chose him from its ranks.

Mr. President, you have clearly stated that you want to defend the nation – One Nation under God, fundamental liberties, and non-negotiable values that are denied and fought against today. It is you, dear President, who are “the one who opposes” the deep state, the final assault of the children of darkness.

For this reason, it is necessary that all people of good will be persuaded of the epochal importance of the imminent election: not so much for the sake of this or that political program, but because of the general inspiration of your action that best embodies – in this particular historical context – that world, our world, which they want to cancel by means of the lockdown. Your adversary is also our adversary: it is the Enemy of the human race, He who is “a murderer from the beginning” (Jn 8:44).

Around you are gathered with faith and courage those who consider you the final garrison against the world dictatorship. The alternative is to vote for a person who is manipulated by the deep state, gravely compromised by scandals and corruption, who will do to the United States what Jorge Mario Bergoglio is doing to the Church, Prime Minister Conte to Italy, President Macron to France, Prime Minster Sanchez to Spain, and so on. The blackmailable nature of Joe Biden – just like that of the prelates of the Vatican’s “magic circle” – will expose him to be used unscrupulously, allowing illegitimate powers to interfere in both domestic politics as well as international balances. It is obvious that those who manipulate him already have someone worse than him ready, with whom they will replace him as soon as the opportunity arises.

And yet, in the midst of this bleak picture, this apparently unstoppable advance of the “Invisible Enemy,” an element of hope emerges. The adversary does not know how to love, and it does not understand that it is not enough to assure a universal income or to cancel mortgages in order to subjugate the masses and convince them to be branded like cattle. This people, which for too long has endured the abuses of a hateful and tyrannical power, is rediscovering that it has a soul; it is understanding that it is not willing to exchange its freedom for the homogenization and cancellation of its identity; it is beginning to understand the value of familial and social ties, of the bonds of faith and culture that unite honest people. This Great Reset is destined to fail because those who planned it do not understand that there are still people ready to take to the streets to defend their rights, to protect their loved ones, to give a future to their children and grandchildren. The leveling inhumanity of the globalist project will shatter miserably in the face of the firm and courageous opposition of the children of Light. The enemy has Satan on its side, He who only knows how to hate. But on our side, we have the Lord Almighty, the God of armies arrayed for battle, and the Most Holy Virgin, who will crush the head of the ancient Serpent. “If God is for us, who can be against us?” (Rom 8:31).

Mr. President, you are well aware that, in this crucial hour, the United States of America is considered the defending wall against which the war declared by the advocates of globalism has been unleashed. Place your trust in the Lord, strengthened by the words of the Apostle Paul: “I can do all things in Him who strengthens me” (Phil 4:13). To be an instrument of Divine Providence is a great responsibility, for which you will certainly receive all the graces of state that you need, since they are being fervently implored for you by the many people who support you with their prayers.

With this heavenly hope and the assurance of my prayer for you, for the First Lady, and for your collaborators, with all my heart I send you my blessing.

God bless the United States of America!

+ Carlo Maria Viganò

Tit. Archbishop of Ulpiana

Former Apostolic Nuncio to the United States of America

Uncategorized

Stock indexes are breaking records and crossing milestones – making many investors feel wealthier

The S&P 500 topped 5,000 on Feb. 9, 2024, for the first time. The Dow Jones Industrial Average will probably hit a new big round number soon t…

The S&P 500 stock index topped 5,000 for the first time on Feb. 9, 2024, exciting some investors and garnering a flurry of media coverage. The Conversation asked Alexander Kurov, a financial markets scholar, to explain what stock indexes are and to say whether this kind of milestone is a big deal or not.

What are stock indexes?

Stock indexes measure the performance of a group of stocks. When prices rise or fall overall for the shares of those companies, so do stock indexes. The number of stocks in those baskets varies, as does the system for how this mix of shares gets updated.

The Dow Jones Industrial Average, also known as the Dow, includes shares in the 30 U.S. companies with the largest market capitalization – meaning the total value of all the stock belonging to shareholders. That list currently spans companies from Apple to Walt Disney Co.

The S&P 500 tracks shares in 500 of the largest U.S. publicly traded companies.

The Nasdaq composite tracks performance of more than 2,500 stocks listed on the Nasdaq stock exchange.

The DJIA, launched on May 26, 1896, is the oldest of these three popular indexes, and it was one of the first established.

Two enterprising journalists, Charles H. Dow and Edward Jones, had created a different index tied to the railroad industry a dozen years earlier. Most of the 12 stocks the DJIA originally included wouldn’t ring many bells today, such as Chicago Gas and National Lead. But one company that only got booted in 2018 had stayed on the list for 120 years: General Electric.

The S&P 500 index was introduced in 1957 because many investors wanted an option that was more representative of the overall U.S. stock market. The Nasdaq composite was launched in 1971.

You can buy shares in an index fund that mirrors a particular index. This approach can diversify your investments and make them less prone to big losses.

Index funds, which have only existed since Vanguard Group founder John Bogle launched the first one in 1976, now hold trillions of dollars .

Why are there so many?

There are hundreds of stock indexes in the world, but only about 50 major ones.

Most of them, including the Nasdaq composite and the S&P 500, are value-weighted. That means stocks with larger market values account for a larger share of the index’s performance.

In addition to these broad-based indexes, there are many less prominent ones. Many of those emphasize a niche by tracking stocks of companies in specific industries like energy or finance.

Do these milestones matter?

Stock prices move constantly in response to corporate, economic and political news, as well as changes in investor psychology. Because company profits will typically grow gradually over time, the market usually fluctuates in the short term, while increasing in value over the long term.

The DJIA first reached 1,000 in November 1972, and it crossed the 10,000 mark on March 29, 1999. On Jan. 22, 2024, it surpassed 38,000 for the first time. Investors and the media will treat the new record set when it gets to another round number – 40,000 – as a milestone.

The S&P 500 index had never hit 5,000 before. But it had already been breaking records for several weeks.

Because there’s a lot of randomness in financial markets, the significance of round-number milestones is mostly psychological. There is no evidence they portend any further gains.

For example, the Nasdaq composite first hit 5,000 on March 10, 2000, at the end of the dot-com bubble.

The index then plunged by almost 80% by October 2002. It took 15 years – until March 3, 2015 – for it return to 5,000.

By mid-February 2024, the Nasdaq composite was nearing its prior record high of 16,057 set on Nov. 19, 2021.

Index milestones matter to the extent they pique investors’ attention and boost market sentiment.

Investors afflicted with a fear of missing out may then invest more in stocks, pushing stock prices to new highs. Chasing after stock trends may destabilize markets by moving prices away from their underlying values.

When a stock index passes a new milestone, investors become more aware of their growing portfolios. Feeling richer can lead them to spend more.

This is called the wealth effect. Many economists believe that the consumption boost that arises in response to a buoyant stock market can make the economy stronger.

Is there a best stock index to follow?

Not really. They all measure somewhat different things and have their own quirks.

For example, the S&P 500 tracks many different industries. However, because it is value-weighted, it’s heavily influenced by only seven stocks with very large market values.

Known as the “Magnificent Seven,” shares in Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia and Tesla now account for over one-fourth of the S&P 500’s value. Nearly all are in the tech sector, and they played a big role in pushing the S&P across the 5,000 mark.

This makes the index more concentrated on a single sector than it appears.

But if you check out several stock indexes rather than just one, you’ll get a good sense of how the market is doing. If they’re all rising quickly or breaking records, that’s a clear sign that the market as a whole is gaining.

Sometimes the smartest thing is to not pay too much attention to any of them.

For example, after hitting record highs on Feb. 19, 2020, the S&P 500 plunged by 34% in just 23 trading days due to concerns about what COVID-19 would do to the economy. But the market rebounded, with stock indexes hitting new milestones and notching new highs by the end of that year.

Panicking in response to short-term market swings would have made investors more likely to sell off their investments in too big a hurry – a move they might have later regretted. This is why I believe advice from the immensely successful investor and fan of stock index funds Warren Buffett is worth heeding.

Buffett, whose stock-selecting prowess has made him one of the world’s 10 richest people, likes to say “Don’t watch the market closely.”

If you’re reading this because stock prices are falling and you’re wondering if you should be worried about that, consider something else Buffett has said: “The light can at any time go from green to red without pausing at yellow.”

And the opposite is true as well.

Alexander Kurov does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

dow jones sp 500 nasdaq stocks covid-19Uncategorized

Marriage is not as effective an anti-poverty strategy as you’ve been led to believe

Marriage on its own won’t do away with child poverty, and in fact it can create even more instability for low-income families.

Brides.com predicts that 2024 will be the “year of the proposal” as engagements tick back up after a pandemic-driven slowdown.

Meanwhile, support for marriage has found new grist in recent books, including sociologist Brad Wilcox’s “Get Married: Why Americans Must Defy the Elites, Forge Strong Families and Save Civilization” and economist Melissa Kearney’s “The Two-Parent Privilege.”

Kearney’s book was hailed by economist Tyler Cowen as possibly “the most important economics and policy book of this year.” This is not because it treads new ground but because, as author Kay Hymowitz writes, it breaks the supposed “taboo about an honest accounting of family decline.”

These developments are good news for the marriage promotion movement, which for decades has claimed that marriage supports children’s well-being and combats poverty. The movement dates back at least to the U.S. Department of Labor’s Moynihan Report of 1965, which argued that family structure aggravated Black poverty.

Forty years after the Moynihan Report, George W. Bush-era programs such as the Healthy Marriage Initiative sought to enlist churches and other community groups in an effort to channel childbearing back into marriage. These initiatives continue today, with the federally subsidized Healthy Marriage and Responsible Fatherhood programs.

Still, nearly 30% of U.S. children live in single-parent homes today, compared with 10% in 1965.

We are law professors who have written extensively about family structure and poverty. We, and others, have found that there is almost no evidence that federal programs that promote marriage have made a difference in encouraging two-parent households. That’s in large part because they forgo effective solutions that directly address poverty for measures that embrace the culture wars.

Marriage and social class

Today’s marriage promoters claim that marriage should not be just for elites. The emergence of marriage as a marker of class, they believe, is a sign of societal dysfunction.

According to census data released in 2021, 9.5% of children living with two parents – and 7.5% with married parents – lived below the poverty level, compared with 31.7% of children living with a single parent.

Kearney’s argument comes down to: 1 + 1 = 2. Two parents have more resources, including money and time to spend with children, than one. She marshals extensive research designed to show that children from married couple families are more likely to graduate from high school, complete college and earn higher incomes as adults than the children of single parents.

It is undoubtedly true that two parents – that is, two nonviolent parents with reliable incomes and cooperative behavior – have more resources for their children than one parent who has to work two jobs to pay the rent. However, this equation does not address causation. In other words, parents who have stable incomes and behaviors are more likely to stay together than parents who don’t.

Ethnographic studies indicate, for example, that the most common reasons unmarried women are no longer with the fathers of their children are the men’s violent behavior, infidelity and substance abuse.

Moreover, income volatility disproportionately affects parents who don’t go to college. So while they may have more money to invest in children together than apart, when one of these parents experiences a substantial drop in income, the other parent may have to decide whether to support the partner or the children on what is often a meager income.

The impact of having single parents also plays out differently by race and class. As sociologist and researcher Christina Cross explains, “Living apart from a biological parent does not carry the same cost for Black youths as for their white peers, and being raised in a two-parent family is not equally beneficial.”

For example, Cross found that living in a single-mother family is less likely to affect high school completion rates for Black children than for white children. Also, Black families tend to be more embedded in extended family than white families, and this additional support system may help protect children from negative outcomes associated with single-parent households.

Making men more ‘marriageable’

Kearney, to her credit, does note that economic insecurity largely explains what is happening to working-class families, and that no parent should have to tolerate violence or substance abuse. But she doubles down on the need to restore a norm of two-parent families.

Many of her policy prescriptions are sensible. She advocates for better opportunities for low-income men – to make them, in the words of sociologist William Julius Wilson, “marriageable.” Such policies would include wage subsidies to improve their job opportunities, investment in community colleges that provide skills training, and the removal of questions about criminal histories from job applications, so that candidates who have previously been incarcerated are not immediately disqualified.

A new marriage model

What marriage promotion efforts overlook, however, are the underlying changes in what marriage has become – both legally and practically.

The new marriage model rests on three premises.

The first is a moral command: Have sex if you want to, but don’t have children until you are ready. While the shotgun marriage once served as the primary response to unplanned pregnancy, such marriages today often derail education and careers and are more likely to result in divorce than other marriages. Research shows that lower-income women’s pregnancies are much more likely to be unplanned.

The second is the ability to pick a partner who will support you and assume joint responsibility for parenting. As women have attained more economic independence, they are less in need of men to raise children, particularly if their partners are insensitive or abusive. With healthy relationships, couples pick partners based on trust, commitment and equal respect. This is more difficult to do in communities with high rates of incarceration and few opportunities for stable employment.

And the third is economic and behavioral stability. Instability undermines even committed unions. Parents who wait until they find the right partner and have stable lives bring a lot more to parenting, whether they marry or not.

We believe that creating opportunities for low-income parents to reach this middle-class model is likely to be the most effective marriage promotion policy.

Economic support is key

In relationships that fall outside of these premises, 1 + 1 often becomes 1 + -1, which equals 0.

Being committed to a partner who can’t pay speeding tickets, runs up credit card bills, comes home drunk or can’t be relied on to pick up the children after school is not a recipe for success.

Economic principles suggest that businesses with more volatile income streams need a stronger capital base to withstand the downturns. Working-class couples who face economic insecurity see commitment as similarly misguided; without a capital base, a downturn for one partner can wipe out the other.

The Biden administration’s child tax credit expansion included in the American Rescue Plan Act of 2021 helped cut the child poverty rate – after accounting for government assistance – to a record low that year. It did more to address child poverty than marriage promotion efforts have ever done.

Researchers have described such income-support policies as the “ultimate multipurpose policy instrument.” They improve the economic circumstances of single-parent families and, in doing so, may also provide greater support for two-parent relationships.

Policymakers know how to solve child poverty – and these measures are far more effective than efforts to put two married parents in every household.

The authors do not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and have disclosed no relevant affiliations beyond their academic appointment.

subsidies pandemicUncategorized

Divergences And Other Technical Warnings

While the bulls remain entirely in control of the market narrative, divergences and other technical warnings suggest becoming more cautious may be prudent….

While the bulls remain entirely in control of the market narrative, divergences and other technical warnings suggest becoming more cautious may be prudent.

In January 2020, we discussed why we were taking profits and reducing risk in our portfolios. At the time, the market was surging, and there was no reason for concern. However, just over a month later, the markets fell sharply as the “pandemic” set in. While there was no evidence at the time that such an event would occur, the markets were so exuberant that only a trigger was needed to spark a correction.

“When you sit down with your portfolio management team, and the first comment made is ‘this is nuts,’ it’s probably time to think about your overall portfolio risk. On Friday, that was how the investment committee both started and ended – ‘this is nuts.'” – January 11th, 2020.

As the S&P 500 index approaches another psychological milestone of 5000, we again see numerous warning signs emerging that suggest the risk of a correction is elevated. Does that mean a correction will ensue tomorrow? Of course not. As the old saying goes, “Markets can remain irrational longer than you can remain solvent.” However, just as in 2020, it took more than a month before the warnings became reality.

While discussing the risk of a correction, it was just last October that we discussed why a rally was likely. The reasons at that time were almost precisely the opposite of what we see today. There was extremely bearish investor sentiment combined with negative divergences of technical indicators, and analysts could not cut year-end price targets fast enough.

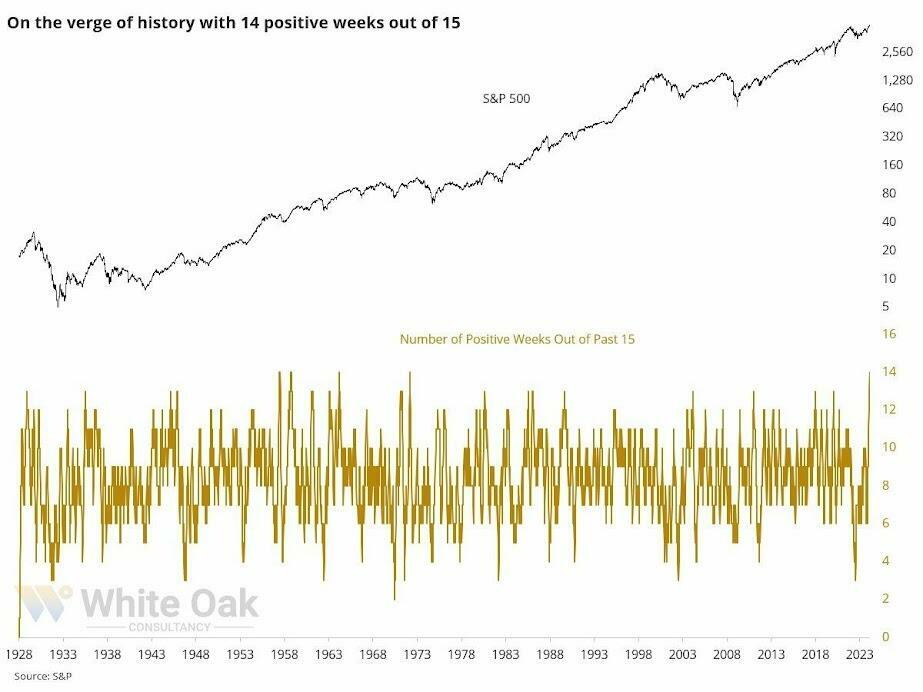

What happened next was the longest win streak in 52 years that pushed the market to new all-time highs.

The last time we saw such a rally was between November 1971 and February 1972. Of course, the “Nifty Fifty” rally preceded the 1973-74 bear market. Then, like today, a handful of stocks were driving the markets higher as interest rates were elevated along with inflation.

While there are many differences today versus then, there are reasons for concern.

The “New Nifty 50”

My colleague Albert Edwards at Societe Generale recently discussed the rising capitalization of the technology market.

“I never thought we would get back to the point where the value of the US tech sector once again comprised an incredible one third of the US equity market. This just pips the previous all-time peak seen on 17 July 2000 at the height of the Nasdaq tech bubble.

What’s more, this high has been reached with only three of the ‘Magnificant-7’ internet stocks actually being in the tech sector (Apple, Microsoft, and Nvidia)! If you add in the market cap of Amazon, Meta, Alphabet (Google) and Tesla, then the IT and ‘internet’ stocks dominate like never before.”

Of course, there are undoubtedly important differences between today and the “Dot.com” era. The most obvious is that, unlike then, technology companies generate enormous revenues and profits. However, this was the same with the “Nifty-50” in the early 70s. The problem is always two-fold: 1) the sustainability of those earnings and growth rates and 2) the valuations paid for them. If something occurs that slows earnings growth, the valuation multiples will get revised lower.

While the economic backdrop has seemingly not caught up with technology companies yet, the divergence of corporate profits between the Technology sector and the rest of the market is likely unsustainable.

That inability to match the pace of expectations is already occurring. That divergence poses a substantial risk to investors.

Again, while the risk is somewhat evident, the “bullishness” of the market can last much longer than logic would predict. Valuations, as always, are a terrible market timing device; however, they tell you a lot about long-term returns from markets. Currently, the valuations paid for technology stocks are alarming and hard to justify.

However, despite valuations, those stocks can keep ramping higher in the short term (6-18 months) as the speculative flows continue.

However, over the next few months, some divergences and indicators suggest caution is advisable.

Technical Divergences Add To The Risk

Each weekend in the BullBearReport, investor sentiment is something that we track closely. The reason is that when investor sentiment is extremely bullish or bearish, such is the point where reversals have occurred. As Sam Stovall, the investment strategist for Standard & Poor’s, once stated:

“If everybody’s optimistic, who is left to buy? If everybody’s pessimistic, who’s left to sell?”

Currently, everyone is very optimistic about the market. Bank of America, one of the world’s largest asset custodians, monitors risk positioning across equities. Currently, “risk love” is in the 83rd percentile and at levels that have generally preceded short-term corrective actions.

At the same time, retail and professional investors are also exuberant, as noted on Tuesday.

“Another measure of bullish sentiment is comparing investor sentiment to the volatility index. Low levels of volatility exist when there is little concern about a market correction. Low volatility and bullish sentiment are often cozy roommates. The chart below compares the VIX/Sentiment ratio to the S&P Index. Once again, this measure suggests that markets are at risk of a short-term price correction.”

However, while everyone is exceedingly bullish on the market, the internal divergence of stocks sends warning signals. Andrei Sota recently showed that market breadth is weakening despite record highs. Note that prior market peaks were accompanied by peaks in the percentage of stocks above their 20, 50, and 200-day moving averages. To further hammer home this point, consider the following Tweet from Jason Goepfert of Sentimentrader:

“Man, this is weird. The S&P 500 is within .35% of a 3-year high. Fewer than 40% of its stocks are above their 10-day avg, fewer than 60% above their 50-day, and fewer than 70% above their 200-day. Since 1928, that’s only happened once before: August 8, 1929.“

That negative divergence between stocks making new highs and the underlying breadth is a good reason to be more cautious with allocations currently.

As I started this commentary, “This is nuts.”

So Why Not Go To Cash

This analysis raises an obvious question.

“Well, if this is nuts, why not go to cash and wait out the correction and then buy back in.”

The best answer to that question came from Albert Edwards this week.

“I cast my mind back to 2000 where the narrative around the then IT bubble was incredibly persuasive, just as it is now. But the problem that skeptical investors have now, as they did in 1999, is that selling, or underweighting US IT, can destroy performance if one exits too early.”

Regarding speculative bull markets, as noted above, the “this is nuts” part can remain “nuts” for much longer than you think. Therefore, given that we have to generate returns for our clients or suffer career risk, we must be careful not to exit the markets too early…or too late.

Therefore, regardless of your personal views, the bull market that started in October remains intact. The speculative frenzy is still present. As such, we are reducing equity exposure modestly and rebalancing risk by following our basic procedures.

- Trim Winning Positions back to their original portfolio weightings. (ie. Take profits)

- Sell Those Positions That Aren’t Working. If they don’t rally with the market during a bounce, they will decline when it sells off again.

- Move Trailing Stop Losses Up to new levels.

- Review Your Portfolio Allocation Relative To Your Risk Tolerance. If you have an aggressive allocation to equities at this point of the market cycle, you may want to try to recall how you felt during 2008. Raise cash levels and increase fixed income accordingly to reduce relative market exposure.

Could I be wrong? Absolutely.

But a host of indicators are sending us an early warning.

What’s worse:

- Missing out temporarily on some additional short-term gains or

- Spending time getting back to even which is not the same as making money.

“Opportunities are made up far easier than lost capital.” – Todd Harrison

The post Divergences And Other Technical Warnings appeared first on RIA.

sp 500 nasdaq equities stocks pandemic interest rates-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges