International

Vertex taps longtime commercial lead to fill two-year COO vacancy; Nancy Thornberry set for different role at Kallyope with an old friend from Merck waiting in the wings

For the first time in two years, Vertex has a COO.

Stuart Arbuckle

The cystic fibrosis drugmaker announced Wednesday that Stuart Arbuckle, who has led the company’s commercial efforts since 2012, has been appointed to run operations as well. In doing…

For the first time in two years, Vertex has a COO.

The cystic fibrosis drugmaker announced Wednesday that Stuart Arbuckle, who has led the company’s commercial efforts since 2012, has been appointed to run operations as well. In doing so, Arbuckle fills a void opened two years ago when, after an investigation, longtime executive Ian Smith was abruptly fired for “personal behavior” that violated Vertex’s code of conduct. Details of the violation, which also cost Smith high-profile board seats at other biotechs, have never been made public.

Analysts and investors will know Arbuckle for his quarterly updates on the state of Vertex’s cystic fibrosis sales. He has presided over a feast-or-famine decade for the commercial arm of a biotech that has seen success with few parallels but substantial pushback over the price of its medicines.

When he joined, the company was still raking in revenue from its hepatitis C drug Incivek, at the time the fastest selling drug in history. But Gilead’s HCV cure Sovaldi soon supplanted it and sales dried up entirely, forcing layoffs and jeopardizing the company.

Since then, Arbuckle has run a branch that Vertex boasts is intentionally slim, so they can direct most of their revenues to R&D. That’s resulted in $6 billion in annual sales for a series of CF drugs that can now treat 90% of patients for a disease that previously left patients with no good options, but also criticism for the roughly $300,000 price tag Vertex attached to those pills.

Prior to Vertex, Arbuckle worked at GlaxoSmithKline and then Amgen, overseeing the biotech’s oncology business group and later heading the company’s expansion into Asia.

“Stuart built out our world-class commercial teams in both the U.S. and International and led the effort to secure the reimbursement of our medicines around the world,” CEO Reshma Kewalramani said in a statement. “He also has played a key role evolving our operating model to ready us for continued expansion into new diseases and geographic areas. In his new role, Stuart will ensure that we are best positioned to maximize the potential of our innovative therapies, secure access for patients and drive continued growth for Vertex.”

— Jason Mast

Nancy Thornberry

Nancy Thornberry→ Gut-brain upstart Kallyope will change CEOs, but it’s not the end of Nancy Thornberry’s story at the New York biotech. Starting Oct. 1, Jay Galeota will take over as Kallyope’s chief executive, while Thornberry will chair R&D and retain her seat on the board of directors. Galeota and Thornberry know each other well from their days at Merck toiling on Type 2 diabetes drug sitagliptin, when Thornberry was franchise head for diabetes and endocrinology and Galeota was SVP and general manager of the diabetes and obesity franchise. (The FDA approved sitagliptin, marketed as Januvia, in 2006). Galeota recently helmed Inheris BioPharma after 28 years at Merck in a plethora of capacities.

Lincoln Germain

Lincoln Germain→ To say that Zymergen is in for an uphill battle would be a gigantic understatement after the revelations this week that its polymer film Hyaline simply doesn’t work and that the company expects no revenue in 2021, followed by “immaterial” 2022 sales. Two new execs — chief commercial officer Lincoln Germain and chief development officer Subodh Deshmukh — are now faced with a monumental challenge as Zymergen picks up the pieces. Germain had been CCO in the advanced materials business at Honeywell, and Deshmukh exits Sandoz, where he was global head of product development. As a result of the grisly details, CEO Josh Hoffman hightailed it out of the company he co-founded and was replaced by ex-Illumina CEO Jay Flatley.

Roger Luo

Roger Luo→ Roger Luo has signed on to be chief development officer at Hillhouse-backed Overland Pharmaceuticals, a US/China play co-founded by Hua Mu and interim CEO Ed Zhang with their sights set on a range of diseases. Luo’s Big Pharma roots run deep: His Janssen days in clinical development from 2010-17 were marked by his work on FGFR inhibitor erdafitinib, which would later earn breakthrough designation for urothelial cancer in 2018. Prior to Janssen, he held leadership roles centered on such drugs as Sprycel (dasatinib) and Erbitux (cetuximab) at Bristol Myers Squibb.

→ LianBio, the Chinese upstart from Perceptive that made a splash last fall with a $310 million financing round and brought in CEO Yizhe Wang in May, has selected Pascal Qian as GM of China. Like Wang, Qian has ties to Eli Lilly, where he recently was Lilly China’s VP, head of oncology business unit. While at Novartis from 2012-18, he led the solid tumor business unit for Novartis Oncology, and earlier he spent seven years at Pfizer in various capacities. LianBio has been unspooling all sorts of deals, from a $70 million partnership with Pfizer in November to an $18 million upfront collaboration in IBD with Xontogeny’s Landos Biopharma.

Janna Hutz

Janna Hutz→ Janna Hutz is entering a new phase in her career at Eisai as president of the Eisai Center for Genetics Guided Dementia Discovery, which also goes by the Star Wars-esque shorthand of G2D2. Formerly an applied human geneticist at Pfizer, Hutz left for Eisai in 2015 and had been G2D2’s head of discovery data science before stepping up in this new post. Her appointment comes at a fascinating time as Eisai and its partner — the much-pilloried Biogen — seek another accelerated approval in Alzheimer’s with BAN2401 (lecanemab) after the Aduhelm OK, which has been a source of sustained uproar and bewilderment in the industry.

Nagesh Mahanthappa

Nagesh Mahanthappa→ Meet the new boss, same as the old boss: Tony Kingsley barely lasted a year at Scholar Rock before stepping down this week as CEO, and the interim successor should know his way around the place. It’s Nagesh Mahanthappa, who founded the company in 2012 and was CEO until Kingsley took over last summer. Scholar Rock has a Phase III trial in the works for its spinal muscular atrophy drug apitegromab and its board of directors is searching for a permanent replacement. Our Nicole DeFeudis has more on Kingsley’s exit.

→ There’s a change at the top to discuss at Armata Pharmaceuticals based in Marina Del Rey, CA, as CEO Todd Patrick retires from the bacteriophage biotech and hands the baton to president and chief development officer Brian Varnum. Before he first showed up at Armata in 2012 when it was C3J Therapeutics, Varnum filled a number of roles at Amgen from 1989 until he was forced into early retirement in 2007 as a result of worldwide downsizing at the pharma giant. Patrick retains his seat on the board of directors and will transition to an advisory role “through at least 2022” for Armata, the product of a merger between C3J and AmpliPhi Biosciences in 2019.

Andrew Perry

Andrew Perry→ GSK vet Andrew Perry has taken on the chief commercial officer post at Research Triangle oncology biotech G1 Therapeutics, led by first-year CEO Jack Bailey, who succeeded Mark Velleca at the top spot. Pfizer vet Soma Gupta had been CCO at G1 since April 2020 and is parting ways “for personal and professional reasons,” according to the release. After 16 years with GSK, Perry shifted to the British pharma’s HIV subsidiary ViiV Healthcare as VP of US marketing.

→ Cambridge, MA-based Foundation Medicine has reeled in Sanket Agrawal as its chief biopharma business officer. Agrawal makes his way to the company after a stint at Amgen in R&D, commercial oncology, and as a general manager. During his time at Amgen, Agrawal helped lead the development from Phase I through launch of Lumakras.

Peggy Sotiropoulou

Peggy Sotiropoulou→ While celebrating another boatload of funding this week — a $110 million Series B on top of its initial round of $78+ million — T cell receptor player T-knife has fleshed out its leadership further with CSO Peggy Sotiropoulou. She hails from Celyad, first arriving as the CAR-T biotech’s R&D manager and rising to head of R&D before her jump to T-knife.

→ Jostling for position in the crowded CD47 field and scoring a nice cash infusion with a $105 million Series C in April, Arch Oncology has made three appointments to try to set themselves apart in the space with Louie Naumovski, CMO; Amit Agarwal, SVP, clinical development; and Steve DeMattos, SVP, clinical operations. To close out the 10 years he just spent at AbbVie, Naumovski was group medical director of oncology early development. Agarwal has Big Pharma experience of his own as Bristol Myers’ multiple myeloma global disease lead. And not to be outdone, DeMattos has been VP, clinical operations at Xencor and has made the rounds at Amgen, J&J and Allergan.

Broes Naeye

Broes Naeye→ Maintaining its Peer Review presence, emactuzumab developer SynOx Therapeutics has tapped Axel Mescheder as CMO and Broes Naeye as chief technology officer. Mescheder, who was with Roche and MorphoSys in his earlier years, rides into the Dublin-based biotech after helming Dutch nanomedicines company Cristal Therapeutics, where he doubled as CMO. Naeye leaves his post as Sanofi’s global product supply lead for Dupixent to slide into this CTO role. It’s a busy time for new execs at SynOx, as Mescheder and Naeye follow the appointments of chairman Ton Logtenberg and CEO Ray Barlow last week.

→ Gennao Bio is giving SynOx a run for its money with rapid-fire Peer Review shoutouts, poaching CSO Dale Ludwig from Actinium to fill the same role. Ludwig was CSO/VP of oncology discovery research — biologics technology for Eli Lilly before moving on to Actinium and spent 11 years at ImClone Systems prior to the 2008 buyout. Ludwig represents the third exec to join Gennao Bio in as many weeks; COO Chris Duke and CFO Claudine Prowse complete the trio.

Jeffrey Staiger

Jeffrey Staiger→ Topping off its initial $13 million funding with a meatier $88 million Series A in January, Aro Biotherapeutics has named Scott Greenberg COO, Jeffrey Staiger SVP of finance and business development, and Michael Tortorici VP of clinical pharmacology and non-clinical development. A 12-year Celgene vet, Greenberg came to Aro in 2019 as VP, business development and alliance management after a year at Roivant, eventually becoming CBO until opportunity knocked with the COO job. Staiger, a Celgene vet in his own right, was recently Bristol Myers’ VP of business development. And Tortorici comes to Aro from a seven-year stay at CSL Behring that saw him get elevated to executive director and head of clinical pharmacology.

Aro, helmed by former J&J R&D exec Sue Dillon, is developing protein drugs based on molecules known as Centyrins and plans to relocate to its new digs in The Curtis area of Philadelphia starting in October.

→ In an abrupt heel turn, Simon Cooper takes over the CMO slot from Claudia Ordonez at Lexington, MA-based Keros Therapeutics, which shrugged off the start of the Covid-19 pandemic with a $96 million upsized IPO in April 2020. Cooper, an ex-staffer at Novartis, Sanofi and AbbVie, appeared in Peer Review a few short months ago when he became CMO at Kadmon after holding the same position at Anokion. Ordonez will remain with Keros in a consulting role until mid-September.

Pamela Cramer

Pamela Cramer→ They got Rhythm: David Meeker, entering year two as CEO of obesity-focused Rhythm Pharmaceuticals, has welcomed chief human resources officer Pamela Cramer and SVP, clinical Linda Shapiro Manning. Cramer had recently been head of people for Foundation Medicine, and she’s the ex-senior director of human resources at Epsilon Data Management and Parexel. After working in clinical development and medical affairs at Novo Nordisk, Merck and Boehringer Ingelheim, Shapiro’s latest tenure as executive clinical research director at Shoshana Shendelman’s Applied Therapeutics was an ephemeral one.

→ Morningside-backed Meissa Vaccines has two candidates in the pipeline for RSV and Covid-19, and the Redwood City, CA biotech now has Robert Walker to oversee clinical development as CMO. Walker pivots from the federal government, where he and his team would lend a hand during Operation Warp Speed while he was CMO and director of the Division of Clinical Development at BARDA.

David Seeberger

David Seeberger→ Merck KGaA oncology spinout iOnctura has tapped Corbin Therapeutics CEO Sean MacDonald as its first CBO and David Seeberger as VP, finance. MacDonald, who remains chairman of Ontario’s Edesa Biotech, has also been head of BD at Cosmo Pharmaceuticals. Seeberger breaks away from bluebird bio after being VP, head of finance, Europe for Nick Leschly’s gang. Swiss-based iOnctura has Phase Ib studies underway with its lead drug IOA-244 for solid and hematological tumors.

→ In late June, Pieris Pharmaceuticals said its idiopathic pulmonary fibrosis drug PRS-220 would also be in development to combat “long Covid.” This week the Boston biotech has chosen two execs, bringing in CMO Tim Demuth and promoting Shane Olwill to chief development officer. Demuth takes his talents to Pieris after serving as Merck KGaA’s VP and head of global clinical development oncology, while Olwill began his run at Pieris 10 years ago as senior director, pharmacology & oncology and was previously head of translational science.

→ PanTher Therapeutics has named Marc Pipas as CMO. Pipas comes to the company with experience from his times at Merrimack Pharmaceuticals — where he was involved in program development of FDA-approved pancreatic cancer drug Onivyde before it was sold to Ipsen for $1 billion — and H3 Biomedicine, a subsidiary of Eisai.

Joseph Gold

Joseph Gold→ Focused on CAR-NK cell therapies, Catamaran Bio is cruising by with Joseph Gold locked into the role of VP, technical operations and manufacturing. Gold, a senior director at Geron from 1996-2012, climbs aboard from his time at City of Hope as senior director of manufacturing for the Center for Biomedicine and Genetics. Catamaran broke its ceremonial bottle of champagne in November 2020, launching with a $42 million Series A.

→ Baltimore-based Personal Genome Diagnostics has enlisted Jamie Platt as COO. Platt makes her way to the company from Inivata, where she most recently served in the same role. Prior to that, Platt served in roles at MPLN and Quest Diagnostics. In addition to Platt’s appointment, PGDx has also pulled in Maggie Rougier-Chapman as SVP, head of marketing and commercial strategy. Rougier-Chapman comes to the company from Invitae, where she served as head, oncology product management & strategy — having made her way there after the company’s acquisition of ArcherDX. While at ArcherDX, Rougier-Chapman was EVP, commercial operations.

Daryn Lewis

Daryn Lewis→ Introducing itself with an $81 million Series A in December, biomolecular condensate outfit Faze Medicines has appointed Daryn Lewis as SVP, head of people & culture. From Ironwood, Lewis proceeded to its spinoff Cyclerion in 2019, where she was VP of people. Backed by Third Rock, Faze pulled in Philip Vickers to grab the CEO reins from interim chief Cary Pfeffer a month after its launch.

→ Randall White has gotten the call to be VP, clinical program management for Pennsylvania’s Windtree Therapeutics, which puts its emphasis on acute cardiovascular and pulmonary diseases. White was previously the global team leader for quizartinib — the tyrosine kinase inhibitor to treat acute myeloid leukemia — at Daiichi Sankyo, and he also filled several roles at Bristol Myers from 2003-17, including head of project management for the early immuno-oncology portfolio.

Amanda Sheldon

Amanda Sheldon→ Frank Watanabe’s Arcutis unpacked positive Phase III data with its roflumilast cream, and the California biotech is adding to the roster as Eric McIntyre leads investor relations and Amanda Sheldon leads corporate communications. McIntyre just put a bow on a decade at Amgen and had been the pharma company’s director of investor relations since 2019. Sheldon makes her way to Arcutis after her time as the FH Foundation’s VP of marketing and communications.

→ Calyx, the eClinical and regulatory solutions and services provider, has brought in Craig Mooney as VP of science and e-tech enabled services. Mooney joins the company after a stint at Bristol Myers, where he served as the director of IRT for most of the past decade.

Reshma Kewalramani

Reshma Kewalramani→ In addition to the Vertex news that batted leadoff today, Reshma Kewalramani has secured a seat on the board of directors at Ginkgo Bioworks, which shook the SPAC atmosphere in May thanks to a $2.5 billion combination with Harry Sloan’s Soaring Eagle Acquisition Corp. Kewalramani will be the eighth board member at Ginkgo, along with Sloan and such names as CEO Jason Kelly, Arie Belldegrun and Pacific Biosciences CEO Christian Henry.

→ Amgen has expanded its board of directors by bringing Omar Ishrak into the fold. Ishrak, the ex-chairman and CEO of Medtronic, is the 12th member of a board that also consists of CEO Bob Bradway, Tyler Jacks and Phillips 66 CEO Greg Garland.

Vicki Sato

Vicki Sato→ David Chang and Arie Belldegrun are bolstering their board of directors at Allogene with the additions of Liz Barrett and Vicki Sato. Barrett, who has helmed UroGen since January 2019, is also on the board at Sage, while Sato — the ex-president of Vertex who’s one of Endpoints News’ 60 over 60 honorees — sits on the boards of Bristol Myers, Vir, and Denali, among others.

→ Yes, Sensei: A $133 million IPO in February almost immediately followed a $30 million financing round for Sensei Biotherapeutics, and Kristian Humer has now been added to the immunotherapy biotech’s board of directors. If it seems like you have the kind of déjà vu that Dionne Warwick would appreciate, you’re not alone: Humer was just in Peer Review last week after he was named CFO and CBO of Viridian.

Yuan Xu

Yuan Xu→ San Diego’s Fate Therapeutics — which registered positive data with its B cell lymphoma program at this year’s ASCO — has elected Yuan Xu to the board of directors. Before she was CEO at Legend, Xu was all over the major pharma map at Merck, Gilead, Novartis and GSK, to name several.

→ Don Santel has succeeded Ali Behbahani as chairman of the board at Princeton, NJ’s Oyster Point Pharma. Behbahani will stay on as a board member. Santel, the ex-CEO of Hyperion who was also interim CEO at Adicet Bio, currently chairs the board at Ocelot Bio as well.

→ Pardes Biosciences, who is chasing a treatment for SARS-CoV-2 infections, has brought on Deborah Autor and Laura Hamill to its board of directors. Autor currently serves as VP, global head of regulatory excellence at AstraZeneca and previously had a 12-year stint at the FDA, most recently serving as deputy commissioner for global regulatory operations and policy. Meanwhile, Hamill most recently served as EVP, worldwide commercial operations at Gilead and previously spent 18 years at Amgen. She currently sits on the boards of Acceleron Pharma, AnaptysBio, and Y-mAbs Therapeutics.

Robert Palay

Robert Palay→ Backed by Khosla Ventures, Cellino — using an AI platform to induced pluripotent stem cells to manufacture autologous iPSCs and tacking on $16 million worth of funding to do it — has made room for Robert Palay on the board of directors. Palay founded and was CEO of Cellular Dynamics International until Fujifilm purchased it in 2015.

→ Cell and gene therapy company Ixaka has pulled in Laurent Audoly as a non-executive director of its board. Audoly is the co-founder, CEO and chairman of Parthenon Therapeutics and has previously served as CEO of Kymera Therapeutics and head of R&D at Pierre Fabre Pharmaceuticals. Earlier in his career, Audoly worked at Pfizer, Merck and Pieris.

→ Theragnostics, focused on the development of molecular radiotherapy for imaging and treating cancers, has recruited Dennis Langer and Ken Herrmann as non-executive directors of its board. Langer previously served as CEO of Neose Technologies, president of Dr. Reddy’s North American business, and SVP of research and development at GSK. On the other hand, Herrmann is the chair of the department of nuclear medicine at the Universitätsklinikum Essen in Germany.

→ Cancer-focused RareCan has tapped Anita Cooper as non-executive director. Currently, Cooper serves as non-executive director for CRO Simbec-Orion and was previously executive officer and SVP of Parexel.

yuan pandemic covid-19 treatment fda genome therapy gold europe germany ontario chinaInternational

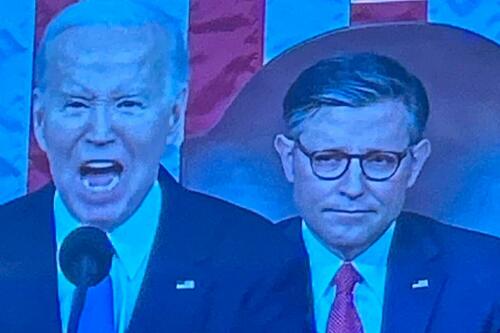

Angry Shouting Aside, Here’s What Biden Is Running On

Angry Shouting Aside, Here’s What Biden Is Running On

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union…

Last night, Joe Biden gave an extremely dark, threatening, angry State of the Union address - in which he insisted that the American economy is doing better than ever, blamed inflation on 'corporate greed,' and warned that Donald Trump poses an existential threat to the republic.

But in between the angry rhetoric, he also laid out his 2024 election platform - for which additional details will be released on March 11, when the White House sends its proposed budget to Congress.

To that end, Goldman Sachs' Alec Phillips and Tim Krupa have summarized the key points:

Taxes

While railing against billionaires (nothing new there), Biden repeated the claim that anyone making under $400,000 per year won't see an increase in their taxes. He also proposed a 21% corporate minimum tax, up from 15% on book income outlined in the Inflation Reduction Act (IRA), as well as raising the corporate tax rate from 21% to 28% (which would promptly be passed along to consumers in the form of more inflation). Goldman notes that "Congress is unlikely to consider any of these proposals this year, they would only come into play in a second Biden term, if Democrats also won House and Senate majorities."

Biden once again tells the complete lie that "nobody earning less than $400,000/year will pay additional penny in federal taxes."

— RNC Research (@RNCResearch) March 8, 2024

FACT: Biden has *already* raised the tax burden on Americans making as little as $20,000 per year. pic.twitter.com/VrZ1m0rzG3

Biden also called on Congress to restore the pandemic-era child tax credit.

Immigration

Instead of simply passing a slew of border security Executive Orders like the Trump ones he shredded on day one, Biden repeated the lie that Congress 'needs to act' before he can (translation: send money to Ukraine or the US border will continue to be a sieve).

As immigration comes into even greater focus heading into the election, we continue to expect the Administration to tighten policy (e.g., immigration has surged 20pp the last 7 months to first place with 28% in Gallup’s “most important problem” survey). As such, we estimate the foreign-born contribution to monthly labor force growth will moderate from 110k/month in 2023 to around 70-90k/month in 2024. -GS

SEE IT: Biden gets boo-ed while talking about his immigration bill. WATCH pic.twitter.com/O5FmkYx3xM

— Simon Ateba (@simonateba) March 8, 2024

Ukraine

Biden, with House Speaker Mike Johnson doing his best impression of a bobble-head, urged Congress to pass additional assistance for Ukraine based entirely on the premise that Russia 'won't stop' there (and would what, trigger article 5 and WW3 no matter what?), despite the fact that Putin explicitly told Tucker Carlson he has no further ambitions, and in fact seeks a settlement.

‼️ Breaking: Putin wants a negotiated settlement to what’s happening in Ukraine.

— Ed (@EdMagari) February 9, 2024

In a surprising turn of events, Tucker Carlson could be the key to peace, potentially playing a crucial role in ending the current conflict????️ pic.twitter.com/IKN8ajlEUX

As Goldman estimates, "While there is still a clear chance that such a deal could come together, for now there is no clear path forward for Ukraine aid in Congress."

China

Biden, forgetting about all the aggressive tariffs, suggested that Trump had been soft on China, and that he will stand up "against China's unfair economic practices" and "for peace and stability across the Taiwan Strait."

SOTU FACT CHECK:

— Wesley Hunt (@WesleyHuntTX) March 8, 2024

Biden claims we’re in a strong position to take on China.

No president in our lifetime has been WEAKER on China than Biden. pic.twitter.com/Y73JsIzmM3

Healthcare

Lastly, Biden proposed to expand drug price negotiations to 50 additional drugs each year (an increase from 20 outlined in the IRA), which Goldman said would likely require bipartisan support "even if Democrats controlled Congress and the White House," as such policies would likely be ineligible for the budget "reconciliation" process which has been used in previous years to pass the IRA and other major fiscal party when Congressional margins are just too thin.

So there you have it. With no actual accomplishments to speak of, Biden can only attack Trump, lie, and make empty promises.

International

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong europeanInternational

Walmart launches clever answer to Target’s new membership program

The retail superstore is adding a new feature to its Walmart+ plan — and customers will be happy.

It's just been a few days since Target (TGT) launched its new Target Circle 360 paid membership plan.

The plan offers free and fast shipping on many products to customers, initially for $49 a year and then $99 after the initial promotional signup period. It promises to be a success, since many Target customers are loyal to the brand and will go out of their way to shop at one instead of at its two larger peers, Walmart and Amazon.

Related: Walmart makes a major price cut that will delight customers

And stop us if this sounds familiar: Target will rely on its more than 2,000 stores to act as fulfillment hubs.

This model is a proven winner; Walmart also uses its more than 4,600 stores as fulfillment and shipping locations to get orders to customers as soon as possible.

Sometimes, this means shipping goods from the nearest warehouse. But if a desired product is in-store and closer to a customer, it reduces miles on the road and delivery time. It's a kind of logistical magic that makes any efficiency lover's (or retail nerd's) heart go pitter patter.

Walmart rolls out answer to Target's new membership tier

Walmart has certainly had more time than Target to develop and work out the kinks in Walmart+. It first launched the paid membership in 2020 during the height of the pandemic, when many shoppers sheltered at home but still required many staples they might ordinarily pick up at a Walmart, like cleaning supplies, personal-care products, pantry goods and, of course, toilet paper.

It also undercut Amazon (AMZN) Prime, which costs customers $139 a year for free and fast shipping (plus several other benefits including access to its streaming service, Amazon Prime Video).

Walmart+ costs $98 a year, which also gets you free and speedy delivery, plus access to a Paramount+ streaming subscription, fuel savings, and more.

If that's not enough to tempt you, however, Walmart+ just added a new benefit to its membership program, ostensibly to compete directly with something Target now has: ultrafast delivery.

Target Circle 360 particularly attracts customers with free same-day delivery for select orders over $35 and as little as one-hour delivery on select items. Target executes this through its Shipt subsidiary.

We've seen this lightning-fast delivery speed only in snippets from Amazon, the king of delivery efficiency. Who better to take on Target, though, than Walmart, which is using a similar store-as-fulfillment-center model?

"Walmart is stepping up to save our customers even more time with our latest delivery offering: Express On-Demand Early Morning Delivery," Walmart said in a statement, just a day after Target Circle 360 launched. "Starting at 6 a.m., earlier than ever before, customers can enjoy the convenience of On-Demand delivery."

Walmart (WMT) clearly sees consumers' desire for near-instant delivery, which obviously saves time and trips to the store. Rather than waiting a day for your order to show up, it might be on your doorstep when you wake up.

Consumers also tend to spend more money when they shop online, and they remain stickier as paying annual members. So, to a growing number of retail giants, almost instant gratification like this seems like something worth striving for.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic mexico-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International11 hours ago

International11 hours agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges