Uncategorized

Troubled wireless technology pioneer files Chapter 11 bankruptcy

The Boca Raton, Fla., telecommunications company files for Chapter 11 bankruptcy after several telecom firms filed in 2023.

The telecommunications industry faced a significant amount of distress in 2023, with several firms filing for bankruptcy.

Cyxtera Technologies, a provider of data center colocation, interconnection services and digital infrastructure, filed for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the District of New Jersey in June 2023 and sold its assets to Brookfield Infrastructure Partners in November 2023.

Related: Movie theater chain seeks sale after recovering from bankruptcy

QualTek Services, a provider of infrastructure services to 5G wireless, telecom, power grid modernization and renewable energy solutions, filed Chapter 11 bankruptcy in May 24, 2023, in the U.S. Bankruptcy Court for the Southern District of Texas to restructure debt and emerged from bankruptcy on June 30, 2023, after reducing its debt by $307 million.

Cloud-based data center provider Internap Holding filed for Chapter 11 bankruptcy on April 28, 2023 in the District of Delaware, with over $198 million in debt and emerged on Aug. 1, 2023, after a restructuring.

Starry Group, a licensed fixed wireless technology developer and internet service provider, filed for a prepackaged Chapter 11 in the District of Delaware on Feb. 20, 2023, seeking to reduce its debt and emerged from bankruptcy in August 2023.

Airspan files bankruptcy to hand majority ownership to Fortress

The bankruptcy trend has continued on from 2023 into 2024, as pioneering telecom company Airspan Networks Holdings (MIMO) on March 31, 2024, filed for a prepackaged Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the District of Delaware that calls for handing majority ownership to funds managed by its senior secured prepetition lender Fortress Investment Group.

Under the debtor's restructuring support agreement, Fortress and certain key stakeholders will provide up to $95 million in new equity financing and eliminate all of the company's existing funded debt. Fortress affiliates have also committed to providing $53 million in debtor-in-possession financing, which, along with cash on hand, will fund the company's operations during restructuring.

The Boca Raton, Fla.-based company had about $205.1 million in total funded debt obligations on the petition date, according to a declaration by CEO Glenn Laxdal. The firm in recent years had incurred sizeable operating losses in part because of a commitment of significant resources to research and development as well as competitive pressures. The company relied on funded indebtedness to cover the shortfall in its cash flow from operations.

Airspan during the Covid pandemic in 2020 suffered from supply chain disruptions, significant price increases for silicon-based components, increased transportation costs, inflation and stagnant growth, the declaration said.

Beginning in 2021, the company retained an investment banker to pursue strategic alternatives and engaged in talks for a potential sale of its assets or a restructuring transaction. In 2022, the company focused on reducing operating costs by reducing its workforce from 800 employees to 494 workers. Since then, the number of employees has decreased to about 370, the declaration said.

In March 2023, Airspan sold an affiliate Mimosa Networks to Radisys for about $60 million. It used $45 million to pay obligations and prepetition senior secured debt, allocated about $5 million for costs and fees and netted about $10 million for fund operations.

Airspan and its prepetition lenders in May 2023 amended senior secured debt, which provided the company with $25 million in delay-draw term loan commitments and granted the company waivers on existing defaults and events of default. The company continued seeking a sale of all its assets until mid-December 2023, when it realized a sale would not happen.

Seeking comprehensive restructuring with senior creditors

It instead sought a comprehensive restructuring with its senior secured lenders and subordinated creditors. The company entered a restructuring support agreement with its lenders and creditors on March 29.

As part of the agreement, existing common stockholders have the option of receiving their pro rata share of $450,000 or, at their election, warrants in lieu of cash. If more than 150 shareholders elect for warrants, no warrants will be provided.

Founded in 1998, Airspan began its business in proprietary digital wireless access technology, primarily broadband wireless solutions.

Airspan provides a broad range of software defined radios, broadband access products and network management software to enable cost-effective deployment and efficient management of mobile, fixed and hybrid wireless networks. Its customers include leading mobile communications service providers, large enterprises, infrastructure operators, military communications integrators and internet service providers.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy default pandemic stocksUncategorized

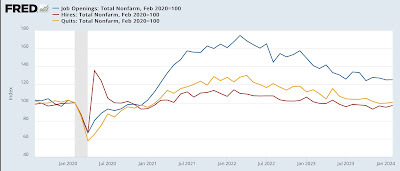

February JOLTS report: soft landing-ish? – except for a noisy jump in layoffs

– by New Deal democratThe JOLTS report for February showed stabilization or slight improvement to all but one of its components, generally suggesting,…

- by New Deal democrat

Uncategorized

FDA’s Anti-Ivermectin “You Are Not A Horse” Post Remains Up As Court Order Deadline Looms

FDA’s Anti-Ivermectin "You Are Not A Horse" Post Remains Up As Court Order Deadline Looms

Authored by Matthew Lysak via The Epoch Times,

Eleven…

Authored by Matthew Lysak via The Epoch Times,

Eleven days after a court-ordered settlement required the U.S. Food and Drug Administration (FDA) to remove all social media and directives regarding ivermectin, a webpage and its most infamous post remains online, advising people against the use of the popular drug.

After years of controversy over using ivermectin to fight COVID-19, the FDA agreed to remove its social media posts urging people to stop using the drug, according to a settlement filed with federal court in southern Texas dated March 21.

The agency has already removed a page that said: “Should I take ivermectin to prevent or treat COVID-19? No.”

However, its Aug. 21, 2021, post on X (formerly Twitter)—in which the FDA wrote:

“You are not a horse. You are not a cow. Seriously y’all. Stop it”—continues to remain live on the social media platform.

At the time of publication, the post had been reposted more than 67,000 times.

Further, a page on the agency’s website titled “Why You Should Not Use Ivermectin to Treat or Prevent COVID-19” also remains live, in which the agency states that the “FDA has not authorized or approved ivermectin for use in preventing or treating COVID-19 in humans or animals.” The page also says no data exist showing ivermectin to be effective against COVID-19, despite studies that show the drug to be effective against the disease.

Dr. Mary Talley Bowden, a practitioner in Texas and founder of the Coalition of Health Freedom, told The Epoch Times that she believes the agency is delaying the inevitable to avoid further public ridicule.

“My guess is they’re hoping all the negative publicity over the case will die down, and they can quietly remove them without as many people noticing,” said Dr. Bowden, who was among a group of doctors who initially filed a lawsuit against the FDA.

“We have three years of false propaganda to overcome regarding ivermectin,” she added.

According to the terms outlined in the settlement, the agency has 21 days to “delete and not republish” web pages and several media posts, including an April 26, 2022, social media post that reads: “Hold your horses y’all. Ivermectin may be trending, but it still isn’t authorized or approved to treat COVID-19.”

In exchange for removing the posts and webpages, doctors who sued the agency are dismissing their claims, the filing states.

An FDA spokesperson was not immediately available for comment but had previously told The Epoch Times in an email that the agency “has chosen to resolve this lawsuit rather than continuing to litigate over statements that are between two and nearly four years old.”

Ivermectin has been around for decades but became the center of controversy in 2020 after medical opinion became divided over its effectiveness as a treatment for COVID-19. In the aftermath, many pharmacists refused to fill prescriptions for the medication.

By 2023, the issue had made its way into a courtroom in a case brought by Dr. Bowden and other medical professionals when, on Aug. 8, a lawyer representing the FDA confirmed that doctors were free to prescribe ivermectin to treat COVID-19.

“FDA explicitly recognizes that doctors do have the authority to prescribe ivermectin to treat COVID,” Ashley Cheung Honold, a Department of Justice lawyer representing the FDA, told the U.S. Court of Appeals for the 5th Circuit.

Despite statements from the FDA affirming that right to doctors, many pharmacists nationwide continue to refuse to fill prescriptions for ivermectin issued to patients for the treatment of COVID-19, according to Dr. Bowden.

In most cases, according to Dr. Bowden, individual pharmacists aren’t to blame and often only carry out orders from corporate leadership. However, she claims to have also seen examples where pharmacists prevented her patients from getting their medication because of their own “personal agenda.”

Further, the longer the FDA posts remain up, the more difficult it is for physicians to ensure that patients receive the care needed, according to Dr. Bowden, who added that a pharmacist refused to fill an ivermectin prescription she had written last week.

“I’ve treated over 6,000 COVID patients using a combination of medications, including ivermectin,” said Dr. Bowden. “All of my patients who received early treatment are alive and well.

“The sooner they remove the posts, the better, but we have a lot of work to do to reeducate the public,” she added.

The FDA has until April 11 to delete the remaining posts, according to the settlement.

Uncategorized

Humana tumbles, UnitedHealth and CVS slide on Medicare Advantage hit

The health insurance sector took yet another blow Tuesday as investors see narrowing near-term profits.

Humana (HUM) shares fell sharply in early Tuesday trading, while rivals UnitedHealth UNH and CVS Health (CVS) traded firmly in the red, as the health insurance industry received yet another blow to its 2024 profit forecasts.

All three major health insurance groups have trailed the broader market this year, with Humana down nearly 25%, amid concern that profit margins will be hit by a surge in medical costs tied to a rise in elective procedures. Those procedures had been delayed by the covid pandemic.

UnitedHealth's medical-cost ratio, a key industry metric, rose nearly 3 percentage points, to 85%, over the final three months of last year, suggesting that a larger portion of its collected premiums were paid out on insurance claims.

Humana said its benefit-expense ratio rose more than 3 percentage points, to 90.7% over the 2023 fourth quarter compared with the year-earlier period. It also was up more than 3 percentage points from third-quarter 2023 levels.

The group noted "elevated Medicare Advantage utilization trends," which it said "further increased in 4Q23, driven by higher-than-anticipated inpatient utilization, primarily for the months of November and December, as well as a further increase in noninpatient trends, predominantly in the categories of physician, outpatient surgeries and supplemental benefits."

Humana health cost warning

Humana in fact sought to mitigate those pressures late last year when it unveiled merger talks with Cigna Group (CI) , noting that the group "continued to experience an increase in covid admissions in the third quarter."

The talks were ultimately scrapped, however, amid concern that the Federal Trade Commission, which has taken a far more active role in challenging megamergers under the leadership of Chairwoman Lina Khan, would block the proposed $120-plus billion tie-up.

Related: UnitedHealth hit by antitrust probe and ransomware hacker report

The FTC is also continuing its probe into the three largest pharmacy-benefit managers – CVS's Caremark, Cigna's Express Scripts and UnitedHealth's OptumRx – and has warned the group of likely changes to the industry's broader regulation.

Medicare Advantage payouts flat

Further pressure was added to profit margins Tuesday when the U.S. Centers for Medicare & Medicaid Services said Medicare Advantage payments would rise only by an average of 3.7% next year.

Analysts were looking for an increase of around 4.7%, based on the CMS's January proposal of 3.7% following increases of around 1.22% each year between 2019 and 2024 to preliminary CMS figures.

The payments, which reimburse insurers for treatment of U.S. patients over age 65, will be effectively lower than current levels when adjusted for costs and inflation.

More Health Care:

- Johnson & Johnson updates 2024 forecast after solid Q4 report

- Health-insurer stocks pay price as more people seek elective care

- Top health scientist warns of the major risks facing shift workers

"We see Humana as most-exposed both from its 84% revenue exposure to Medicare Advantage, and on sentiment given its challenging turnaround of the Medicare book," said Cantor Fitzgerald analyst Sarah James.

"We would also flag CVS as more exposed on sentiment than the 17% revenue exposure would imply, particularly given the outsized investor focus on 2024 Medicare Advantage margins and 2025 bid strategy for the company," she added.

Humana shares were marked 9.2% lower in premarket trading to indicate an opening bell price of $318.70 each. CVS shares slumped 5% to $75.56 each while UnitedHealth was marked 4% lower at $469.95 each.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic treatment-

International2 weeks ago

International2 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment3 weeks ago

Spread & Containment3 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International4 weeks ago

International4 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International4 weeks ago

International4 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoEvidence And Insights About Gold’s Long-Term Uptrend

-

Uncategorized1 month ago

Uncategorized1 month agoA Global, Digital Coup d’État

-

Spread & Containment1 week ago

Spread & Containment1 week agoJapanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns

-

Spread & Containment19 hours ago

Spread & Containment19 hours ago“They Will Surely Try To Run The ‘Disease X’ Ruse” Ahead Of 2024 Elections