Government

“The US Economy Is Inverted”: How The Flood Of Illegal Immigration Is Delaying The Official US Recession

"The US Economy Is Inverted": How The Flood Of Illegal Immigration Is Delaying The Official US Recession

By Dhaval Joshi, Chief Strategist…

By Dhaval Joshi, Chief Strategist at BCA Research

Summary

-

The US economy is highly unusually ‘inverted’. The constraint on the economy is not labor demand, it is labor supply.

-

Hence, the US economy has highly unusually entered a labor demand recession without entering a GDP recession.

-

Nevertheless, for the stock market, a labour demand recession implies a profits headwind, because it is only when profits come under pressure that labour demand goes into recession.

-

Against this, wage disinflation would allow long-duration bond yields to fall, which would provide a countervailing valuation tailwind.

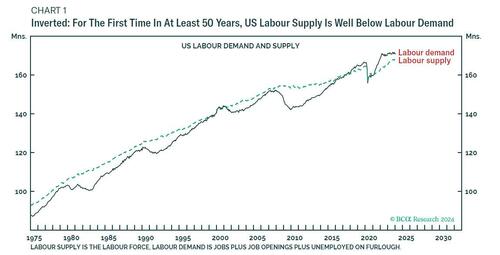

The pandemic might seem like a distant memory, but for the US economy the pandemic’s legacy is still the big story. For the first time in at least fifty years, US labor supply is running well below labor demand. The big story is that the US economy is ‘inverted.’

Therefore, we must analyze the post-pandemic inverted economy very differently to the pre-pandemic economy. Normally, labor demand – being less than labor supply – is the constraint on economic output and thereby drives the cycle. But in an inverted economy, labor supply – being less than labor demand – is the constraint on output and thereby drives the cycle.

Before the pandemic, all downswings caused labor demand to fall well below labour supply. In the subsequent upswings, labor demand gradually caught up with supply…until the next downswing caused a fresh slump in labor demand. And the cycle repeated. Importantly though, all pre-pandemic cycles were driven by the demand side.

Then came the pandemic, and the longstanding pattern inverted. Labor supply suffered the more protracted slump, from which it has gradually caught up with labor demand. Meaning that in the last couple of years, the cycle is being driven not by what is happening to labor demand, but by what is happening to labor supply.

Interest rate hikes work by choking demand, which is exactly what has happened recently. US labor demand is tipping into recession. Jobs plus job openings today are less than they were a year ago. Whenever this happened pre-pandemic, the economy tipped into recession too. But for the first time in at least fifty years, the economy is entering a labor demand recession without entering a GDP recession.

This is because in an inverted economy the constraint on the economy is not labor demand, it is labor supply. Despite weaking

labor demand, labor supply has played catch up to demand and thereby driven economic growth.

As labor supply has caught up with labor demand, it has narrowed the gap between demand and supply. This has created the perfect macro backdrop of robust economic growth with wage disinflation, a Goldilocks setup for financial assets. The pressing question for the coming 6-12 months is, what happens next to labor supply, labor demand, and their interplay?

Why The US Economy Inverted

But first, let’s tackle the obvious question. Why is US labor supply running well below labor demand?

There are two reasons: after the pandemic, prime aged (25-54) workers left the labor force; and older aged (55+) workers retired early, generating millions of so-called ‘excess retirements.’

The economically inactive make no contribution to labor supply. Yet they still consume the goods and services that generate labor demand. This they do by using savings or, in the case of early retirees, by tapping into their retirement assets and income early. Thereby, the plunge in prime-aged labor participation combined with excess retirements caused labor supply to fall well below labor demand.

Subsequently, the plunge in prime-aged labour participation has fully reversed, causing labor supply to recover strongly. But the excess retirements have not reversed and are unlikely to reverse

This means that the strong recovery in labor supply is now exhausted, with labor supply still several million people below labor demand. The economy is still inverted.

US Labour Demand Is Already In Recession, But GDP May Dodge The Bullet

To repeat, US labor demand has already tipped into recession. But in the inverted economy – where labor supply is the constraint on output – labor supply is driving the GDP cycle.

It follows that a GDP recession would require one of two things:

- Labor supply must outright contract. However, with the recent surge in illegal migration – most of which does eventually get counted in the survey-calculated labor supply – a sustained contraction in labor supply seems unlikely. Of course, this could change under a new Trump administration, or...

- Labor demand must contract so sharply – by about 3.5 million jobs – that the economy would ‘un-invert’. Once un-inverted, contracting labor demand would once again drive GDP into recession, as in all pre-pandemic cycles.

But if labor demand contracts more gently – as now – then the US economy could experience a sustained labor demand recession without a GDP recession, making it difficult for the National Bureau of Economic Research (NBER) to designate it an official recession.

This ‘halfway house’ in which GDP is not in recession, but labor demand is in recession and gently ‘catching down’ with labor supply is a distinct possibility – because it is the least painful way for the Federal Reserve to steer wage inflation back down to the 3 percent rate that is needed for price inflation to stabilise at 2 percent (Chart 5 and Chart 6).

Yet though the economy could dodge the ‘NBER official recession’ bullet, a labor demand recession combined with stagnant per capita real incomes would very much feel like a recession.

For the stock market, a labor demand recession implies lower profits because it is only when profits come under pressure that labor demand goes into recession. Against this, wage disinflation would allow long-duration bond yields to fall, which would provide some countervailing support to stock valuations. In combination this would imply the stock market was rangebound while high-quality bonds rallied.

But there is another factor to consider. The euphoric pricing of anything AI-related is a separate and independent risk to the stock market. Absent this risk the macro backdrop would imply a neutral allocation to stocks versus cash. But this additional risk ratchets down my 6-12-month allocation to mildly underweight.

For those who can time this, go underweight stocks when the ‘Joshi rule’ is triggered. Or, when the rally reaches a collapsed complexity that presages an imminent reversal.

More in the full note available to pro subscribers.

Government

Pandemic Whiskey Boom Turns To Hangover

Pandemic Whiskey Boom Turns To Hangover

Authored by Douglas French via The Mises Institute,

Yeah, the other night I laid sleeping

And…

Authored by Douglas French via The Mises Institute,

Yeah, the other night I laid sleeping

And I woke from a terrible dream

So I caught up my pal Jack Daniel's

And his partner Jimmy Beam

And we drank alone, yeah

With nobody else

Yeah, you know when I drink alone

I prefer to be by myself

~George Thorogood

I poured hundreds of “Jack and Cokes” when I tended bar from the late 70’s to mid 80’s. It was beyond me how anyone could tell the difference between Jack Daniels Old No. 7 and anything else when mixed with coke or whatever carbonated cola was coming out of the gun.

Turns out Dr. Fauci and the Center for Disease Control did Brown-Forman, the makers of Jack, a solid by shutting down America and cooping everyone up. More than some whiled away the hours with their old pal Jack Daniels. People may have had to work from home, but without the boss breathing down their necks plenty figured “why not have snoot-full and have fun.” It’ll make the day go by faster. Besides, no customers would be banging on the door. No one will know the difference.

“The phenomenal sales growth we saw during the pandemic was unprecedented and unpredictable but also unsustainable, and now, the spirits market is recalibrating,” Chris Swonger, the president of the Distilled Spirits Council of the United States, said last month. Those stimulus checks could buy a lot of Jack Daniels, or cause the more frugal drinker to pay more for Jack, instead of cheaper brands.

Jennifer Maloney writes for the Wall Street Journal, “Some drinkers of Jack Daniel’s Old No. 7 - often used to make the cocktail Jack and Coke - are trading down to cheaper alternatives while others are trading up.”

Price inflation affects consumers differently. For those drinking their whiskey with Coke, just about any will probably do, but for those imbibing theirs neat or on the rocks may spend a few more cheaper bucks for smoothness.

Even Jack and Coke drinker Brian Moran, a tile-setter who lives in the Chicago suburbs, told the WSJ that a client paid him to tile a kitchen backsplash with five pricier bottles of bourbon, including Stagg, Eagle Rare and E.H. Taylor. “From his first sips, Moran was enthralled,” writes Maloney.

“I don’t know anyone who even drinks it anymore,” he said of Jack Daniel’s Old No. 7, which has a national average price of about $22. “You spend an extra $10 and you get something that’s so much better.”

Brown-Forman reported dismal sales over the winter holiday season and the hangover has lasted into 2024. “Christmas stunk,” Chief Executive Lawson Whiting said on a call with analysts in early March.

Brown-Forman is trying to entice younger legal-age drinkers to Jack Daniel’s Old No. 7 with a TV commercial set to the AC/DC song “Back in Black.” However, that song was a hit more than 40 years ago. Also the company is selling Jack and Coke in a can, attempting to appeal to young drinkers and females. The canned cocktail contains about 5% alcohol depending on the market. Reportedly there is a no sugar version. Which hardly seems possible.

Chairman Campbell Brown, a great-great-grandson of founder George Garvin Brown, told investors that the company has weathered Prohibition and the Great Depression, steadily building the Jack Daniel’s brand since acquiring it nearly 70 years ago.

It was not reported whether he has thanked Dr. Fauci.

International

How Much Do Food Stamps, Social Security, And Medicare Support The Economy?

How Much Do Food Stamps, Social Security, And Medicare Support The Economy?

Authored by Mike Shedlock via MishTalk.com,

Inquiring minds might…

Authored by Mike Shedlock via MishTalk.com,

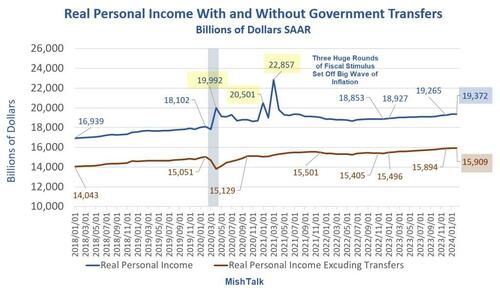

Inquiring minds might be interested in a discussion of government transfer payments as a percentage of real income. I can help, but prepare to be disgusted.

Data from BEA’s personal Income and outlays report. Real means inflation adjusted. Chart by Mish.

What Are Transfer Receipts?

Transfer receipts are government payments for which no services were performed.

Transfer receipts include food stamps, subsidized housing, Social Security, Medicare, Medicaid, child tax credits, and other government assistance.

Three rounds of massive fiscal stimulus during the Covid pandemic set off a huge wave of inflation that the Fed never saw coming.

The numbers are worse than they look above as the following chart shows.

Transfer Receipts as Percentage of Real Personal Income

With every recession, transfer receipts as a percentage of real personal income declines.

The three massive rounds of fiscal stimulus is unprecedented. A friend asked me today why the Fed could not see this coming.

I explained: These guys are not wizards; they have never called a recession in real time. Bernanke denied there was a recession even after it started. He denied there was a housing bubble. They all believe in models that don’t work. And history suggests they always err on the side of being too loose. They will make the same mistakes over and over.

The Fed never saw the uptick in inflation because their models said otherwise. Their models now say inflation will return to normal.

I can see things models don’t: Global wage arbitrage is over. Just in time manufacturing is over. Both Trump and Biden will increase tariffs. The energy needed for AI will soar. The energy needed for EVs will grow even if transition slows. Demographic changes are huge.

Four Reasons Transfer Receipts Poised to Surge

-

Influx of illegal immigrants

-

Republicans just agreed to expand Child Tax Credits

-

Medicaid Expansion

-

Boomer Retirements

Influx of Immigrants

Please note: Denver Health at “Critical Point” as 8,000 Migrants Make 20,000 Emergency Visits

Much of that you will pay for directly with higher premiums. But the Federal government will pick up some of it via Medicaid Expansion.

Child Tax Credits

We have a new number on the deal the House Republicans agreed to. It’s $1.5 trillion over ten years.

For discussion, please see How Much Will That GOP Deal on Child Tax Credits Really Cost?

The reported numbers do not include an Affordable Housing giveaway, or aid to Ukraine and Israel, or expanded defense spending. More money and bigger deficits means more inflation.

The tax credits add directly to transfer payments.

Medicaid Expansion

On March 9, I noted Medicaid Expansion Was Supposed to Pay for Itself, Instead Hospitals Are Closing

10 states did not fall for the Medicaid expansion trap under Obamacare. The rest are suffering. Private payers (you, one way or another) make up the loss.

Boomer Retirements

Due to age demographics, I expect employment in age groups 60 and over to decline by about 12.5 million.

Population stats are from the BLS. Expected Employment Loss is a Mish calculation based on the Employment Population Ratio (the percentage of people working in each age group).

In terms of expanding transfer payments this is the biggest of the four by far.

Boomers health care need and retirements will have a huge impact expanded Social Security payments and Medicare payments.

And there is a shortage of 6 million workers to replace retiring boomers. This is another set of things the Fed has not properly modeled.

As a result of demographics, transfer receipts as a percentage of real personal income will surge. And due to a replacement worker shortage, wages will likely rise and productivity decline.

For discussion, please see In the Next 5 years, Employment in Age Groups 60+ Will Drop by ~12.5 Million

I go over the demographic math, point-by-point. Click on the link for details.

Conclusion: The decline in the rate of inflation is transitory. The Fed does not see this coming.

International

My Weekly Reading for March 31, 2024

FDA Aims To Stifle Medical Innovation Again

By Ronald Bailey, Reason, April 2024.

Excerpt:

The Food and Drug Administration (FDA) that massively screwed…

FDA Aims To Stifle Medical Innovation Again

By Ronald Bailey, Reason, April 2024.

Excerpt:

The Food and Drug Administration (FDA) that massively screwed up COVID-19 testing now wants to apply its vast bureaucratic acumen to all other laboratory developed tests (LDTs). By insisting on its recondite approval procedures, the FDA at the beginning of the pandemic stymied the rollout of COVID-19 tests developed by numerous academic and private laboratories. In contrast, public health authorities in South Korea greenlighted an effective COVID-19 test just one week (and many more in the weeks following) after asking representatives from 20 private medical companies to produce such tests.

LDTs are diagnostic in vitro tests for clinical use that are designed, manufactured, and performed by individual laboratories. They can diagnose illnesses and guide treatments by detecting relevant biomarkers in saliva, blood, or tissues; the tests can identify small molecules, proteins, RNA, DNA, cells, and pathogens. For example, some assess the risks of developing Alzheimer’s disease or guide the treatment of breast cancer.

The FDA now wants to regulate these tests as medical devices that must undergo premarket agency vetting before clinicians and patients are allowed to use them. The FDA estimates that between 600 and 2,400 laboratories currently offer as many as 40,000 to 160,000 tests. Overall, some 3.3 billion in vitro tests are administered to patients annually.

Wow! The FDA plans to be even more detructive of human health than it has been.

How Capitalism Beat Communism in Vietnam

by Rainer Zitelmann, Reason, May 2024.

Excerpts:

The reforms adopted in the next couple of years included permission for private manufacturers to employ up to 10 workers (later increased), abolition of internal customs checkpoints, elimination of the state foreign-trade monopoly, reduced restrictions on private enterprise, elimination of virtually all direct subsidies and price controls, separation of central banking from commercial banking, dismantling major elements of the central planning and price bureaucracies, the return of businesses in the South that had been nationalized in 1975 to their former owners or their relatives, and the return of land seized in the ’70s collectivization campaign if it was “illegally or arbitrarily appropriated.”

And:

Vietnam’s gross domestic product grew by 7.9 percent a year from 1990 to 1996, faster than any other Asian country but China. Poverty fell sharply. By the World Bank’s standard for extreme poverty—living on less than $1.90 a day—52.3 percent of the Vietnamese population was living in extreme poverty in 1993. By 2008, the figure had fallen to 14.1 percent. By 2020, it was only 1 percent. That indicator was developed for “low-income economies,” though, and Vietnam has now moved to the “lower-middle-income” category, where poverty is defined as living on less than $3.20 a day. By that measure, the poverty rate dropped from 79.7 percent to just 5 percent.

Israel announces largest West Bank land seizure since 1993 during Blinken visit

by Cate Brown, Washington Post, March 22, 2024.

Palestinians have little ability to stop the land transfers. After the 1967 war, Israel issued a military order that stopped the process of land registration across the West Bank. Now families lack the paperwork to prove that they have private ownership over their land. And tax records, the only other evidence of West Bank property rights, are not accepted by Israeli authorities.

In June, the Knesset waived a long-standing legal precedent that required the prime minister and the defense minister to sign off on West Bank settlement construction at every phase. Smotrich enjoys near-total control over construction planning and approvals in the West Bank, and approved a record number of settlements in 2023.

“Israel has reached the conclusion that they could get away with this huge land grab because of the lack of international action,” said Sarit Michaeli, international advocacy lead at B’Tselem. “There have been individual economic U.S. sanctions placed on violent settlers, but the greater violence of the occupation is this colossal land theft.”

Steven Pinker: What Went Wrong at Harvard

by Nick Gillespie, Reason, March 27. 2024.

Excerpts:

Pinker: The first of the five-point plan was just consistent commitment to academic freedom. Because another reason that Claudine Gay got into such trouble is that when she was given what admittedly was a kind of a trap that she walked into—that is, if students called for genocide against Jews, would that be prohibited by Harvard’s code of conduct—she made a pretty hardcore [American Civil Liberties Union]-style free speech argument, which came across as hollow or worse, because we’ve had a lecturer who was driven out of Harvard for saying there are two sexes.

There was another professor whose course was canceled because he wanted to explore how counterinsurgency techniques could be used against gang warfare. We had a professor in the School of Public Health who had cosigned an amicus brief for the Obergefell Supreme Court case against a national policy allowing gay marriage. There were calls for his tenure to be revoked, for his classes to be boycotted. He had to undergo struggle sessions and restorative justice sessions and basically grovel in front of a mob. Given Harvard’s history of those cases and others, to all of a sudden say, “Well genocide, it’s just a matter of I disagree with what you say, but I defend it to the death your right to say it,” came off as a little bit hollow and hypocritical.

Pinker: I have nothing against diversity, equity, and inclusion. But as Voltaire said about the Holy Roman Empire: it was neither holy, nor Roman, nor an empire. Diversity, equity, and inclusion imposes an intellectual monoculture. It favors certain groups over others. It has a long list of offenses that mean you can be excluded. But it is a strange bureaucracy. It’s a culture that is kind of an independent stratum from the hierarchy of the universities themselves. The officers get hired or poached to move laterally from university to university. It’s with their own culture, their own mores, their own best practices. It’s just not clear who they report to, or who supervises them, or who allows them to implement policy.

Pinker: Yes. Not at Harvard, but at many universities. No one knew that we had this requirement. No one knew who implemented it. The faculty never voted on it. The president never said this is our policy going forward. A dean of arts and sciences must have signed off on it, but no one can remember who or when. But we just live with it. Likewise, freshman orientation consists of indoctrination sessions.

This is emblematic of a trend in universities, that this nomenklatura just got empowered and no one knows exactly how. What often happens is a dean gets into trouble because of some racial incident. They hire a bunch of staff, and that’s their way of getting out of the trouble. Then they’re there forever. And there is only one way that they’ve been changing and that’s upward.

I love the line “it was neither holy, nor Roman, nor an empire.” Aside from that, Mrs. Lincoln, how was the play?

(0 COMMENTS) subsidies pandemic covid-19 treatment testing fda rna dna gross domestic product south korea china-

Spread & Containment3 weeks ago

Spread & Containment3 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 week ago

International1 week agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

International3 weeks ago

International3 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 weeks ago

International3 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoKey Events This Week: All Eyes On Core PCE Amid Deluge Of Fed Speakers

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoEvidence And Insights About Gold’s Long-Term Uptrend

-

Uncategorized1 month ago

Uncategorized1 month agoA Global, Digital Coup d’État

-

Spread & Containment1 week ago

Spread & Containment1 week agoJapanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns