Uncategorized

The March CPI, the Inflation Picture, and the Fed

The higher than expected March CPI released on Wednesday freaked everyone out and got the markets convinced we will see fewer, if any, interest rate cuts…

The higher than expected March CPI released on Wednesday freaked everyone out and got the markets convinced we will see fewer, if any, interest rate cuts this year. I have never been a Fed tea leaf reader, and am not about to change professions now, but it will be bad news if the Fed puts off rate cuts that can revitalize the housing market.

The big concern posed by the CPI, following higher-than-expected inflation numbers in January and February, is whether inflation is reaccelerating. We know that rental inflation is still high as an outcome of the surge in working from home at the start of the pandemic.

But we can be very confident that it will slow sharply over the course of the year due to the much slower inflation rate shown in indexes (including the BLS index) measuring rents in units that change hands. This means that rental inflation will not be an ongoing problem that the Fed has to worry about.

However, the recent data have shown an uptick in inflation, even pulling out rent. This is ostensibly the cause for concern.

There are two important points to be made about this uptick. First, it is not unusual to see large jumps, and falls, in CPI inflation excluding rent. Rent is a huge factor in the index, and since the pace of rental inflation changes slowly, it anchors the overall rate. Inflation is much more erratic when rent is excluded as shown below.

Note that there were many points at which inflation in the non-shelter CPI crossed 2.0 percent even in the low-inflation decade preceding the pandemic. In fact, year-over-year inflation in this index hit 2.1 percent in January of 2020, just before the pandemic started. It was at 2.5 percent in July of 2018. So a somewhat above-target reading for the non-shelter CPI should not be a major cause for concern by itself.

However, there is the question of whether the recent uptick reflects underlying trends. Here the story points in the opposite direction.

The day after the CPI report came out, we got a much more benign reading on the Producer Price Index (PPI). The overall figure for the month was 0.2 percent (0.154 to be more precise), with the core also at 0.2 percent. There are differences in coverage and methodology between the CPI and PPI, but inflation in the indexes still track each other closely.

The figure below shows the PPI for services, the PPI for goods, and the CPI.

What is perhaps most striking is how closely the CPI follows the PPI for services. That probably shouldn’t be surprising, since services account for almost two-thirds of the CPI. (It is important to note that the PPI does not include rent, so these are services minus rent.)

When the CPI goes substantially above or below the service component of the PPI is following movements in the goods component. As can be seen the CPI has been well above the service component in the PPI since May of 2022. The cause here is the supply chain problems that sent goods inflation sky-rocketing a bit more than a year earlier.

The good news in this picture is that the goods component of the PPI has been far below the service CPI for a bit over a year, and for part of this period was even negative. This is just another way of showing the widely noted fact that the prices of supply chain goods have stabilized and in many cases are even falling. This looks likely to continue for the near-term future, especially if we don’t have a policy of blocking cheaper imports with higher tariffs as some presidential candidates are advocating.

The Wage Story

There is another part of the longer-term inflation picture that needs to be included, the slowing of wage growth. Our various wage indices show somewhat different figures for wage growth, but they tell basically the same story. Wage growth accelerated sharply as the economy reopened in the second half of 2020 and especially 2021 and 2022, as employers had to compete to hire and retain workers.

We saw record rates of quits, as workers left jobs that didn’t pay enough, offer advancement opportunities, had unsafe workplaces, or where the boss was a jerk. This is a great story, as workers saw gains in wages that outpaced inflation and workplace satisfaction hit a record high. The gains in wages were especially large for those at the bottom of the wage distribution.

While that is a very bright picture, we could not sustain nominal wage gains of the sort we were seeing in 2021 and the first half of 2022, and still hit the Fed’s 2.0 percent inflation target. Wage growth peaked at roughly 6.0 percent, 2.5 percentage points higher than the rates we were seeing before the pandemic.

To be clear, wages were not driving inflation. There was a shift from wages to profits at the start of the pandemic. It doesn’t make sense to say that wages are the cause of inflation when the profit share is increasing. But it is true that given current rates of productivity growth, we cannot have 6.0 percent wage growth and sustain anything close to a 2.0 percent rate of inflation. (FWIW, I am not a fan of the Fed’s 2.0 percent inflation target, but the Fed is.)

However, wage growth has slowed sharply over the last two years, getting close to its pre-pandemic pace. Again, there are differences by indices, but the pace of wage growth has fallen by roughly 2.0 percentage points, leaving it 0.5 percentage points above its pre-pandemic pace.

One index, the Indeed Wage Tracker, has fallen back to its 2019 rate of wage growth. This index is noteworthy because it measures wages in job postings for new hires. In this sense it can be thought of as being analogous to the new tenant rent indexes that measure the rents of units that turn over.

Just as most people don’t move every month, most people don’t change jobs every month, but we expect the rents of units that don’t turn over to roughly follow the rents of units that do change hands. In the same way, it is reasonable to think that wage patterns of workers who stay in their jobs will roughly follow wage patterns for newly hired workers. The Indeed Wage Tracker is telling us that wage growth has fallen back to a non-inflationary pace. This may take some time to show up in the other wage series, but we can be pretty confident of the direction of change.

Profit Shares and Productivity

There are two other reasons we can be reasonably confident inflation is now under control. The first is that the rise in profit shares at the start of the pandemic has not gone away. In fact, profit shares increased somewhat in the fourth quarter, indicating we are going in the wrong direction.

It is not clear why profit shares continue to rise, and not fall back towards pre-pandemic levels. (Yeah, corporations are greedy, but they have always been greedy.) The increase during the supply-chain crisis was understandable, companies have much more market power when supply is constrained. But unless conditions of competition were permanently altered by the pandemic, it’s hard to see why they would stay elevated, and we certainly should not expect them to continue to rise.

In any case, the rise in the profit share in the fourth quarter, suggests that a lower pace of inflation would be consistent with the wage growth we are now seeing, if the profit share were to remain stable. If the profit share were to fall back towards its pre-pandemic level (which was already well above its level at the start of the century), we could sustain considerably lower inflation with the current pace of wage growth.

In other words, there seems little basis for believing that the current rate of wage growth is inconsistent with the Fed’s 2.0 percent inflation target. In this respect, the Biden administration is on exactly the right track in going after abuses of market power that allow for higher margins, such as attempting to block the merger of the nation’s two largest supermarket chains, Albertson’s and Safeway. Similarly, cracking down on drug companies abusing their government-granted patent monopolies will also have the effect of reducing profit margins.

The other big wildcard in this story is productivity growth. Productivity growth soared in the last three quarters of 2023, averaging 3.7 percent over this period. Productivity growth is notoriously erratic and the data are subject to large revisions. We also have to note that growth was horrible in 2022, actually falling for the year. So, it is far too early to claim we are on a faster growth path. Nonetheless, the recent data are encouraging and it looks like we will have respectable numbers again for the first quarter, although not above 3.0 percent.

Given advances in AI and other technologies, it hardly seems absurd to think we may be seeing a productivity uptick. We are clearly at the very beginning of the uses of many of these technologies, so there will be many gains that we will see down the road.

If we can sustain a faster pace of productivity growth, then we can have faster nominal wage growth and still hit the Fed’s 2.0 percent inflation target. To be clear, I am not talking about a wildly rapid pace of growth, if we can just sustain a 2.0 percent rate, well below the rates we saw in the upturn from 1995 to 2005 and the long Golden Age from 1947 to 1973, then 4.0 percent wage growth would be consistent with 2.0 percent inflation, even after a period in which profit margins shrank somewhat.

Time to Declare Victory and Lower Rates

The long and short here is that it is really time for the Fed to declare victory in its war inflation and start lowering interest rates. One problem that seems to be delaying rate cuts is that the economy remains strong, leaving Chair Powell and other Fed officials to talk about the situation as a one-sided choice. They see a risk of inflation if they lower rates too much or too soon, but there is little basis for concern about a recession or rising unemployment.

However, that leaves other negative effects of high interest rates out of the equation, most notably their impact on the housing market. The number of existing homes being sold in the last year is down by almost a third from its 2020-21 pace. This means that millions of people who would otherwise be looking to move are being kept in place by the Fed’s high interest rate policy.

Higher interest rates are also a drain on people’s budgets insofar as they have credit card debt or other forms of short-term debt. And it makes it more expensive to buy new or used cars. The rise in interest rates also creates stress on the financial system. This stress led to the failure of Silicon Valley Bank last year, along with several other smaller banks. With luck we won’t see another major round of bank failures this year, but higher rates unambiguously increase the risk.

In short, even if the economy does not need lower rates to sustain a healthy growth path right now, there is a real cost to keeping rates high. It’s time for Fed to change course.

The post The March CPI, the Inflation Picture, and the Fed appeared first on Center for Economic and Policy Research.

recession unemployment pandemic fed housing market recession tariffs interest ratesUncategorized

Let’s Be Honest: The Economy Is NOT Doing Well

Let’s Be Honest: The Economy Is NOT Doing Well

Authored by Connor O’Keeffe via The Epoch Times (emphasis ours),

The American economy is…

Authored by Connor O'Keeffe via The Epoch Times (emphasis ours),

The American economy is not all right. But to see why, you need to look beyond the dramatic numbers we keep seeing in the headlines and establishment talking points.

Take, for instance, the latest jobs report. For the third month in a row, the American economy added significantly more jobs than most economists had been expecting—a total of 303,000 for March. On its face, that’s a good number.

But as Ryan McMaken laid out over the weekend, things don’t look as strong when you dig into the data. For instance, virtually all the jobs added are part-time jobs. Full-time jobs have actually been disappearing since December of last year. In fact, as McMaken highlighted, “The year-over-year measure of full-time jobs has fallen into recession territory.”

Also, most of these new part-time jobs are going to immigrants, many of whom are in the country illegally. There has been zero job creation for native-born Americans since mid-2018. While immigrants are not harming the economy by working, the scale of new foreign-born workers has papered over the employment struggles of the native-born population.

Further, government jobs accounted for almost a quarter of those added—way above the standard ten to twelve percent. Just like with government spending and economic growth, government hiring boosts the official jobs number while draining the actual, value-producing economy.

Some economists, like Daniel Lacalle, argue that the U.S. economy is already experiencing a private-sector recession but that government spending and hiring are propping up the official data enough to hide it.

A recession is inevitable, thanks to the last decade of interest rate manipulation by the Federal Reserve—and especially to its dramatic actions during the pandemic. The recession-like conditions in full-time jobs is further evidence that Lacalle is right.

But jobs numbers are only part of the story. The stock market has been fluctuating a lot recently, not because of changing consumer needs or the adoption of some new technology, but based on what Federal Reserve officials are saying about what the central bank will do this year.

At the same time, prices are still high. And they continue to rise at a rate that frustrates even some of President Joe Biden’s biggest economic cheerleaders. Our dollars are worth about 20 percent less than they were four years ago, with no prospect of that trend reversing. That hurts.

But instead of addressing this economic pain, much less their role in creating it, members of the political class are still pretending everything is great. They’re even gearing up to make things worse by, for example, sending even more of our money to the Ukrainian government. All to prolong a war it’s losing, not because of a lack of money, but because of a lack of soldiers.

And at home, President Biden is scrambling to put the brakes on energy production and to transfer money from the working class to his base of college graduates, all before he’s up for reelection in November.

Predictably and appropriately, the establishment’s head-in-the-sand economic strategy is coinciding with a notable decrease in support for the Democrats—the establishment’s preferred party these days. President Biden is behind in the polls in six of the seven swing states and is losing support from working-class and nonwhite voters.

The political establishment and its preferred candidates deserve to lose support, not only for failing to acknowledge America’s economic problems but for causing them in the first place.

From Mises.org

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Uncategorized

Popular media company files for bankruptcy, plans to liquidate

It has become a very difficult market for companies that produce television shows as media consolidates.

For a few years before the Covid pandemic, it seemed like there was an endless amount of money being put into streaming services. Disney, Comcast, Apple, Netflix, and a number of outliers like Verizon and Quibi, were throwing money at seemingly every decent show idea.

That was a golden period for viewers as services including Disney+ and Apple TV+ had seemingly endless budgets. Instead of parceling out good content and big-name shows, Disney's streaming service offered a new Star Wars or Marvel show on a seemingly weekly basis.

Related: Failed Chapter 11 bankruptcy puts fast food chain in final days

Apple's streaming service and Comcast's Peacock, along with a handful of others, seemed to have an unlimited budget as they fought for subscribers. It was a good period to be a television watcher, but the economics made no sense.

Companies were spending more money than they were bringing in and that was not a sustainable model. At some point during the Covid days, it seemed like every streaming player came to the same realization. They had to get smarter about what shows they produced and cut their budgets.

That left a lot of media companies, actors, and television industry workers hurting. The overall amount of work went from an all-time high to an industry that quickly contracted. It's a situation that has forced one seemingly successful company into bankruptcy and liquidation.

Image source: TheStreet

Nickelodeon partner files for bankruptcy

Having an award-winning show or even multiple award-winning shows, does not guarantee financial success. Factory Transmedia won a 2024 Emmy for its Nickelodeon Jr. show, "The Tiny Chef Show." It also was nominated for an Emmy for its preschool animated series "Slumberkins."

That level of success was not enough to sustain the company and keep it financially viable.

"Indie British animation studio Factory Transmedia, which produced the animation for Nick Jr.’s 'The Tiny Chef Show,' is shutting down after being placed into a creditor’s voluntary liquidation. In the U.K., that means that the company is insolvent and no longer has the funds to pay its liabilities," Cartoon Brew reported.

The company blamed market conditions for its demise in a media statement.

"Over the last 12 months the number of projects being green-lit by broadcasters around the world has been severely cut as the global economy and audience behaviors have changed markedly; these challenging market conditions were a significant factor in the insolvency of the business.

Factory Transmedia being sold off

Factory Transmedia has a long history as it has been a player in the United Kingdom animation space for over 20 years. It was involved in a high-profile reboot of "The Clangers," a popular show that launched in 1969 which the company helped bring back in 2015.

"The company was considered to be an animation success story for the Greater Manchester area and had opened a new studio facility as recently as 2017 to accommodate its growing production slate. During peak periods of production, it employed over a hundred people, and its clients included Disney, Nick Jr., CBBC, and CBeebies," according to Cartoon Brew.

Its demise was sudden and the company won't be making a comeback.

JPS Chartered Surveyors has been appointed to help sell off the company's assets through an online auction. That's a somewhat morbid affair which will include selling the company puppets used for the Newzoids satirical sketch show which ran on ITV in 2015 and 2016, as well as its studio equipment, according to a BBC report.

No news has been shared about what will happen to the shows that Factory Transmedia has that are currently in production.

bankruptcy pandemicUncategorized

The Beauty Parlor’s Full Of Sailors And The Circus Is In Town

The Beauty Parlor’s Full Of Sailors And The Circus Is In Town

Authored by James Howard Kunstler via Kunstler.com,

“They have tried to…

Authored by James Howard Kunstler via Kunstler.com,

“They have tried to solve a wide range of insoluble problems, from the weather to poverty to viruses, and now they will attempt to solve us.”

- Eugyppius

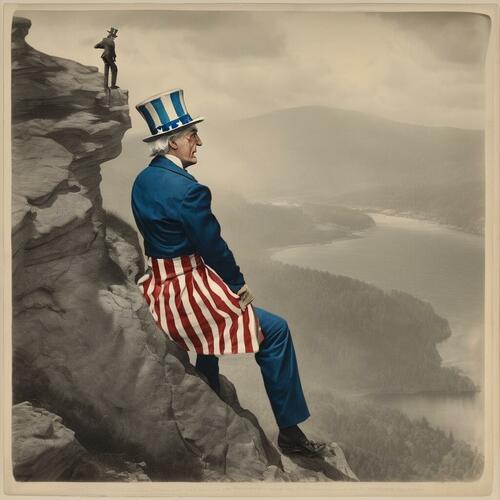

This is that part of the movie where the hero — you — tumbles off the cliff on Kong Island in a lightning storm with a canyon full of tarantulas down below where you’ll soon be landing. I know, not a pretty picture.

The cliff is our country’s financial quandary; the lightning is us getting sucked directly into war; and the tarantula pit below is the emerging peril of Covid vaccine injury and death coming on hard, like your landing.

Gold and silver are vaulting up suddenly like nobody’s business (literally). This may be fun to see if you are sitting on a pile, even a small pile of the stuff. But to everybody else it’s a signal that something is messed up in the complex engine of the economy. You know, of course, that our money is debt. So, debt is the fuel that drives that engine. Debt is a promise to pay back money with interest to take advantage of the time-value of money. The time-value of money means it’s better to have the money now (to keep the engine running) than to wait until your work produces money (if it even can).

The trouble is, debt loses its credibility if there is no plausible way of paying it back, or even just to keep paying the interest. That’s exactly what is happening now. Everybody can see that the US government can’t pay the interest on its debt, which is Treasury bonds, notes, and bills (from long duration to short). That debt is running at well over $1-trillion a year. That’s a thousand billion, which is a thousand million, altogether a million million. See, it’s impossible to grok how more than a trillion dollars gets produced in an economy based on selling fried chicken nuggets and streamed movies to people with no jobs.

When the Treasury holds an auction on a new issue of bonds (needed to pay off the interest on old bonds) and nobody shows up to buy because they doubt its ability to pay interest on the new paper, our country’s debt becomes worthless. As a last resort, the Federal Reserve swoops in and buys that worthless paper by creating “money” on its computer. That “money” goes out into the economy. The Fed pretends to get paid interest. It’s all fakery, a swindle. It’s like putting water in the gas tank of your engine. You know that the engine is going to throw a rod. When it does, it’ll be such a shock that the vehicle it’s running in is liable to hit a bridge abutment or something else hard.

That’s what tumbling off the cliff is like.

The dopes running US foreign policy are so foolishly obsessed with taunting Russia (“poking the bear”), that they can’t give up their sponsorship of the war in Ukraine, which Ukraine is losing because they never had the mojo for the fight. That should have been obvious, but for some reason our “best-and-brightest” overlooked that. No amount of free weaponry and ammo can make up for the fact that Ukraine has run out of young men to pointlessly get shredded by Russian artillery. Russia is unwilling to get rolled by NATO and the US in a part of the world Russia has controlled for centuries. Yet, “Joe Biden” keeps hinting about sending America’s tranny army there, and even gearing up the military draft for the nose-ring and blue hair generation. Good luck with that.

Nor does “JB” exercise any control over what Israel does over in the Bible Lands. Bibi gonna do what Bibi gonna do. Israel can’t be persuaded that the current war is not a struggle for its existence. As Scott Adams points out, Israel has decided to pawn off its Holocaust cred in order to treat its enemies as harshly as possible, so as not to get wiped off the map. Israel has treated the Palestinians very harshly. (The October 7 Hamas raid was pretty darn harsh, too.) In any case, world opinion went all rancid on Israel. That hasn’t stopped them. Now Israel faces its ultimate foe, Persia, a.k.a. Iran, these days. Persia has a big army and a lot of weapons, and all sorts of wing-men in the neighborhood. . . as a practical matter, most of Islam right now. This week, Persia made noises about an imminent attack on Israel. Didn’t happen so far.

Let’s get real on Islam. Its core principle is to exterminate the humans on this planet who are not of Islam. Islam has been pissed-off at Western Civ since the Crusades, its animus renewed in 1683, when Islam’s advance into Europe was halted at the gates of Vienna, and then again in modern times when Islam got pushed around because Western Civ wanted its oil. Islam is overrunning Europe again and penetrating the USA through our southern border. Islam means business. It wants to wreck us, kill us, and take our stuff. And it dearly, sorely, wants to deep-six Israel, which Islam contemptuously refer to as “the Zionist entity,” as if it were some crypto-insectile space alien.

America (and Europe, too) wants to play this both ways: to grudgingly help Israel survive while at the same time pretending not to notice Islam’s true aims. Looks like Israel has decided to go for broke on this one whether we ride to rescue or not. Israel may have to go “Mad Dog” in its neighborhood. They may lose this thing anyway. The rest of the world will affect to hate them for it no matter how it ends. Meanwhile, all over Europe the Islamic birth-rate way outpaces the Euro peoples’ birth rate. And how many angry, determined “sleepers” has Islam snuck into the USA the past several years across “Joe Biden’s” open border. It’s a bit disturbing to contemplate. Also, never under-estimate the damage that can be wreaked with small arms against “a pitiful, helpless, giant,” as Dick Nixon once described our country in an earlier time of distress. There’s your lightning storm.

At the bottom of the cliff is the vaxxed-up population of the world waiting for their spike protein infested bodies and dysregulated immune systems to enter fatal break down. Many already have injured organs, hearts, brains, blood, ovaries, etc. Many others will get in trouble when a more efficient Covid-19 mutation goes lethal on them. The public health authorities are desperately trying to conceal the damage. Some organized groups of people are clamoring for the data on vaccine injury and death from places like the CDC, only to discover that the public health agencies not only won’t disclose it but probably avoided even collecting it over fear of what it would show. Horror creeps on little tarantula feet.

This is how the movie is going as of April. Spring is hardly fledged. Portent looms at every compass point. You’re in a tight spot. (We all are.) In modern times — and I mean going back to the first twinges of the Enlightenment — faith in the people running things has never been lower. It’s still an election year, har har! It makes you wonder if this movie is actually a comedy.

* * *

Support his blog by visiting Jim’s Patreon Page or Substack

-

International3 weeks ago

International3 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment1 month ago

Spread & Containment1 month agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Spread & Containment7 days ago

Spread & Containment7 days agoClimate-Con & The Media-Censorship Complex – Part 1

-

Spread & Containment5 days ago

Spread & Containment5 days agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized1 week ago

Uncategorized1 week agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized6 days ago

Uncategorized6 days agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?

-

International3 weeks ago

International3 weeks agoJapanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns