Uncategorized

Tank trucking market 2023-2027; A descriptive analysis of five forces model, market dynamics, and segmentation- Technavio

Tank trucking market 2023-2027; A descriptive analysis of five forces model, market dynamics, and segmentation- Technavio

PR Newswire

NEW YORK, Jan. 18, 2023

NEW YORK, Jan. 18, 2023 /PRNewswire/ — According to Technavio, the global tank trucking m…

Tank trucking market 2023-2027; A descriptive analysis of five forces model, market dynamics, and segmentation- Technavio

PR Newswire

NEW YORK, Jan. 18, 2023

NEW YORK, Jan. 18, 2023 /PRNewswire/ -- According to Technavio, the global tank trucking market size is estimated to decline by USD 97.06 billion from 2022 to 2027. The market is estimated to decline at a CAGR of 7.29% during the forecast period. However, the growth momentum will decelerate. North America held the largest share of the global market in 2022, and the market in the region is estimated to witness an incremental growth of 30%.

For more Insights on market size Request a sample report

Global tank trucking market - Five forces

The global cloud data warehouse market is fragmented, and the five forces analysis covers–

- Bargaining power of buyers

- The threat of new entrants

- Threat of rivalry

- Bargaining power of suppliers

- Threat of substitutes

- Interpretation of porter's five models helps to strategize the business, for entire details – buy the report!

Global tank trucking market – Customer landscape

The report includes the market's adoption lifecycle, from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global tank trucking market - Segmentation assessment

Technavio has segmented the market based on ownership (for hire and private), and capacity (medium-duty, heavy-duty, and light-duty).

- The for-hire segment will grow at a significant rate during the forecast period. It is essential to hire tank trucks for businesses operating in the global tank trucking market since it enables them to keep their fleet up-to-date and involves lower upfront costs than purchasing them. Although the small-scale and mid-scale vendors are generally unable to spend their limited resources on purchasing tank trucks there is a rise in the sales of this segment. The reason behind this is the increase in demand for tank trucking for short-term transport operations. This is a major factor that is expected to boost the growth of this market segment during the forecast period.

By geography, the global tank trucking market is segmented into North America, Europe, APAC, South America, and Middle East and Africa. The report provides actionable insights and estimates the contribution of all regions to the growth of the global tank trucking market.

- North America is estimated to account for 30% of the growth of the global market during the forecast period. The large-scale investments in infrastructure development and construction activities are the major reasons behind the market's growth in North America. High capital investments have been made in constructing many oil and gas pipelines in the US. As per the US Energy Information Administration (EIA), the natural gas pipeline network in the country is a highly integrated transmission and distribution network that can transport natural gas from and to nearly all the states in the country. In addition, increased oil and gas production due to a surge in unconventional exploration and production (E&P) activities in the region over the last five years has facilitated the availability of cheap feedstock for refineries. Such factors will increase the market growth during the forecast period.

Global tank trucking market – Market dynamics

Key factor driving market growth

- The growing demand for oil and natural gas is notably driving the market growth.

- The global consumption of natural gas over the past decade has increased significantly. The major factor behind the widespread use of natural gas is that it is used as a fuel in heating applications. Growing consumption of fuel in developing countries such as India is also expected to increase the demand for natural gas during the forecast period.

- In addition, the gradual recovery of global crude oil prices will also bring new investments into the oil and gas sector. These factors will boost the global market during the forecast period.

Leading trends influencing the market

- Technological advancements are an emerging trend in the market. The new developments in technology lead to changes in the proportion, size, and structure of tank transport.

- Nowadays, the focus of tanker manufacturers is on lightweight components and parts that are reliable and durable and help improve the performance of their vehicles and also fuel economy. Significant investments are being done by vendors in M&A to expand their product portfolio.

- Lucrative growth opportunities will be created with the integration of artificial intelligence into tankers for vendors in the global oil market.

- Hence, the rapidly growing global oil and gas industry and continuous technological advancements are expected to play a major role in boosting the growth of the global market during the forecast period.

Major challenges hindering the market growth

- Leakage issues during the transportation of oil and gas are major challenges impeding the market growth. The transportation, storage, and distribution activities of the oil and gas industry involve moving oil and gas from oil wells to refineries and ultimately to fuel retail stores for consumption.

- After crude oil is refined, the final products and transported from refineries by tank trucks and by rail to fuel retail stores.

- In general, all modes of transportation used to transport oil and gas are at risk of oil spills. It is during loading and unloading that the oil leaks. Various regulations are in place to ensure effective oil spill prevention.

- Under the FRP rule, facilities that store oil and gas must have an action plan and be prepared to respond to potential oil spill disruptions. Such factors will hinder the global market during the forecast period.

What are the key data covered in this tank trucking market report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the tank trucking market between 2023 and 2027

- Precise estimation of the size of the tank trucking market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the tank trucking market industry across North America, Europe, APAC, South America, and Middle East and Africa

- A thorough analysis of the market's competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of tank trucking market vendors

Gain instant access to 17,000+ market research reports.

Technavio's SUBSCRIPTION platform

The military aerial refueling tanker market is estimated to grow at a CAGR of 8.13% between 2022 and 2027. The size of the market is forecasted to increase by USD 4,709.07 million. This report extensively covers market segmentation by technology (probe-and-drogue and boom-and-receptacle), type (manned and unmanned), and geography (North America, APAC, Europe, Middle East and Africa, and South America).

The tank container shipping market is estimated to grow at a CAGR of 5.06% between 2021 and 2026. The size of the market is forecasted to increase by USD 195.98 million. This report extensively covers market segmentation by end-user (Oil and gas, chemical, and others), and geography (Europe, APAC, North America, MEA, and South America).

Tank Trucking Market Scope | |

Report Coverage | Details |

Page number | 144 |

Base year | 2022 |

Historic period | 2017-2021 |

Forecast period | 2023-2027 |

Growth momentum & CAGR | Decelerate at a CAGR of 7.29% |

Market growth 2023-2027 | USD 97.06 billion |

Market structure | Fragmented |

YoY growth 2022-2023 (%) | 7.18 |

Regional analysis | North America, Europe, APAC, South America, and Middle East and Africa |

Performing market contribution | North America at 30% |

Key countries | US, China, Singapore, UK, and France |

Competitive landscape | Leading Vendors, Market Positioning of Vendors, Competitive Strategies, and Industry Risks |

Key companies profiled | Amthor International, Dupre Logistics LLC, Eagle Transport Corp., Florida Rock and Tank Lines Inc., Groendyke Transport Inc., Kenan Advantage Group Inc., Littlejohn Inc., Mac Trailer Manufacturing Inc., Martin Transport Inc., Miller Transporters Inc., Quest Liner Inc., Ruan Transportation Management Systems, Shiny Shipping and Logistics Pvt. Ltd., Superior Bulk Logistics Inc., Superior Industries Inc., Tankstar USA Inc., TFI International Inc., Trimac Transportation Services Inc., and Burch Tank and Truck |

Market dynamics | Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

Customization purview | If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Customization purview | If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

1 Executive Summary

- 1.1 Market overview

- Exhibit 01: Executive Summary – Chart on Market Overview

- Exhibit 02: Executive Summary – Data Table on Market Overview

- Exhibit 03: Executive Summary – Chart on Global Market Characteristics

- Exhibit 04: Executive Summary – Chart on Market by Geography

- Exhibit 05: Executive Summary – Chart on Market Segmentation by Ownership

- Exhibit 06: Executive Summary – Chart on Market Segmentation by Capacity

- Exhibit 07: Executive Summary – Chart on Incremental Growth

- Exhibit 08: Executive Summary – Data Table on Incremental Growth

- Exhibit 09: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 10: Parent market

- Exhibit 11: Market Characteristics

3 Market Sizing

- 3.1 Market definition

- Exhibit 12: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 13: Market segments

- 3.3 Market size 2022

- 3.4 Market outlook: Forecast for 2022-2027

- Exhibit 14: Chart on Global - Market size and forecast 2022-2027 ($ billion)

- Exhibit 15: Data Table on Global - Market size and forecast 2022-2027 ($ billion)

- Exhibit 16: Chart on Global Market: Year-over-year growth 2022-2027 (%)

- Exhibit 17: Data Table on Global Market: Year-over-year growth 2022-2027 (%)

4 Historic Market Size

- 4.1 Global tank trucking market 2017 - 2021

- Exhibit 18: Historic Market Size – Data Table on Global tank trucking market 2017 - 2021 ($ billion)

- 4.2 Ownership Segment Analysis 2017 - 2021

- Exhibit 19: Historic Market Size – Ownership Segment 2017 - 2021 ($ billion)

- 4.3 Capacity Segment Analysis 2017 - 2021

- Exhibit 20: Historic Market Size – Capacity Segment 2017 - 2021 ($ billion)

- 4.4 Geography Segment Analysis 2017 - 2021

- Exhibit 21: Historic Market Size – Geography Segment 2017 - 2021 ($ billion)

- 4.5 Country Segment Analysis 2017 - 2021

- Exhibit 22: Historic Market Size – Country Segment 2017 - 2021 ($ billion)

5 Five Forces Analysis

- 5.1 Five forces summary

- Exhibit 23: Five forces analysis - Comparison between 2022 and 2027

- 5.2 Bargaining power of buyers

- Exhibit 24: Chart on Bargaining power of buyers – Impact of key factors 2022 and 2027

- 5.3 Bargaining power of suppliers

- Exhibit 25: Bargaining power of suppliers – Impact of key factors in 2022 and 2027

- 5.4 Threat of new entrants

- Exhibit 26: Threat of new entrants – Impact of key factors in 2022 and 2027

- 5.5 Threat of substitutes

- Exhibit 27: Threat of substitutes – Impact of key factors in 2022 and 2027

- 5.6 Threat of rivalry

- Exhibit 28: Threat of rivalry – Impact of key factors in 2022 and 2027

- 5.7 Market condition

- Exhibit 29: Chart on Market condition - Five forces 2022 and 2027

6 Market Segmentation by Ownership

- 6.1 Market segments

- Exhibit 30: Chart on Ownership - Market share 2022-2027 (%)

- Exhibit 31: Data Table on Ownership - Market share 2022-2027 (%)

- 6.2 Comparison by Ownership

- Exhibit 32: Chart on Comparison by Ownership

- Exhibit 33: Data Table on Comparison by Ownership

- 6.3 For hire - Market size and forecast 2022-2027

- Exhibit 34: Chart on For hire - Market size and forecast 2022-2027 ($ billion)

- Exhibit 35: Data Table on For hire - Market size and forecast 2022-2027 ($ billion)

- Exhibit 36: Chart on For hire - Year-over-year growth 2022-2027 (%)

- Exhibit 37: Data Table on For hire - Year-over-year growth 2022-2027 (%)

- 6.4 Private - Market size and forecast 2022-2027

- Exhibit 38: Chart on Private - Market size and forecast 2022-2027 ($ billion)

- Exhibit 39: Data Table on Private - Market size and forecast 2022-2027 ($ billion)

- Exhibit 40: Chart on Private - Year-over-year growth 2022-2027 (%)

- Exhibit 41: Data Table on Private - Year-over-year growth 2022-2027 (%)

- 6.5 Market opportunity by Ownership

- Exhibit 42: Market opportunity by Ownership ($ billion)

7 Market Segmentation by Capacity

- 7.1 Market segments

- Exhibit 43: Chart on Capacity - Market share 2022-2027 (%)

- Exhibit 44: Data Table on Capacity - Market share 2022-2027 (%)

- 7.2 Comparison by Capacity

- Exhibit 45: Chart on Comparison by Capacity

- Exhibit 46: Data Table on Comparison by Capacity

- 7.3 Medium duty - Market size and forecast 2022-2027

- Exhibit 47: Chart on Medium duty - Market size and forecast 2022-2027 ($ billion)

- Exhibit 48: Data Table on Medium duty - Market size and forecast 2022-2027 ($ billion)

- Exhibit 49: Chart on Medium duty - Year-over-year growth 2022-2027 (%)

- Exhibit 50: Data Table on Medium duty - Year-over-year growth 2022-2027 (%)

- 7.4 Heavy duty - Market size and forecast 2022-2027

- Exhibit 51: Chart on Heavy duty - Market size and forecast 2022-2027 ($ billion)

- Exhibit 52: Data Table on Heavy duty - Market size and forecast 2022-2027 ($ billion)

- Exhibit 53: Chart on Heavy duty - Year-over-year growth 2022-2027 (%)

- Exhibit 54: Data Table on Heavy duty - Year-over-year growth 2022-2027 (%)

- 7.5 Light duty - Market size and forecast 2022-2027

- Exhibit 55: Chart on Light duty - Market size and forecast 2022-2027 ($ billion)

- Exhibit 56: Data Table on Light duty - Market size and forecast 2022-2027 ($ billion)

- Exhibit 57: Chart on Light duty - Year-over-year growth 2022-2027 (%)

- Exhibit 58: Data Table on Light duty - Year-over-year growth 2022-2027 (%)

- 7.6 Market opportunity by Capacity

- Exhibit 59: Market opportunity by Capacity ($ billion)

8 Customer Landscape

- 8.1 Customer landscape overview

- Exhibit 60: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

9 Geographic Landscape

- 9.1 Geographic segmentation

- Exhibit 61: Chart on Market share by geography 2022-2027 (%)

- Exhibit 62: Data Table on Market share by geography 2022-2027 (%)

- 9.2 Geographic comparison

- Exhibit 63: Chart on Geographic comparison

- Exhibit 64: Data Table on Geographic comparison

- 9.3 North America - Market size and forecast 2022-2027

- Exhibit 65: Chart on North America - Market size and forecast 2022-2027 ($ billion)

- Exhibit 66: Data Table on North America - Market size and forecast 2022-2027 ($ billion)

- Exhibit 67: Chart on North America - Year-over-year growth 2022-2027 (%)

- Exhibit 68: Data Table on North America - Year-over-year growth 2022-2027 (%)

- 9.4 Europe - Market size and forecast 2022-2027

- Exhibit 69: Chart on Europe - Market size and forecast 2022-2027 ($ billion)

- Exhibit 70: Data Table on Europe - Market size and forecast 2022-2027 ($ billion)

- Exhibit 71: Chart on Europe - Year-over-year growth 2022-2027 (%)

- Exhibit 72: Data Table on Europe - Year-over-year growth 2022-2027 (%)

- 9.5 APAC - Market size and forecast 2022-2027

- Exhibit 73: Chart on APAC - Market size and forecast 2022-2027 ($ billion)

- Exhibit 74: Data Table on APAC - Market size and forecast 2022-2027 ($ billion)

- Exhibit 75: Chart on APAC - Year-over-year growth 2022-2027 (%)

- Exhibit 76: Data Table on APAC - Year-over-year growth 2022-2027 (%)

- 9.6 South America - Market size and forecast 2022-2027

- Exhibit 77: Chart on South America - Market size and forecast 2022-2027 ($ billion)

- Exhibit 78: Data Table on South America - Market size and forecast 2022-2027 ($ billion)

- Exhibit 79: Chart on South America - Year-over-year growth 2022-2027 (%)

- Exhibit 80: Data Table on South America - Year-over-year growth 2022-2027 (%)

- 9.7 Middle East and Africa - Market size and forecast 2022-2027

- Exhibit 81: Chart on Middle East and Africa - Market size and forecast 2022-2027 ($ billion)

- Exhibit 82: Data Table on Middle East and Africa - Market size and forecast 2022-2027 ($ billion)

- Exhibit 83: Chart on Middle East and Africa - Year-over-year growth 2022-2027 (%)

- Exhibit 84: Data Table on Middle East and Africa - Year-over-year growth 2022-2027 (%)

- 9.8 US - Market size and forecast 2022-2027

- Exhibit 85: Chart on US - Market size and forecast 2022-2027 ($ billion)

- Exhibit 86: Data Table on US - Market size and forecast 2022-2027 ($ billion)

- Exhibit 87: Chart on US - Year-over-year growth 2022-2027 (%)

- Exhibit 88: Data Table on US - Year-over-year growth 2022-2027 (%)

- 9.9 China - Market size and forecast 2022-2027

- Exhibit 89: Chart on China - Market size and forecast 2022-2027 ($ billion)

- Exhibit 90: Data Table on China - Market size and forecast 2022-2027 ($ billion)

- Exhibit 91: Chart on China - Year-over-year growth 2022-2027 (%)

- Exhibit 92: Data Table on China - Year-over-year growth 2022-2027 (%)

- 9.10 UK - Market size and forecast 2022-2027

- Exhibit 93: Chart on UK - Market size and forecast 2022-2027 ($ billion)

- Exhibit 94: Data Table on UK - Market size and forecast 2022-2027 ($ billion)

- Exhibit 95: Chart on UK - Year-over-year growth 2022-2027 (%)

- Exhibit 96: Data Table on UK - Year-over-year growth 2022-2027 (%)

- 9.11 Singapore - Market size and forecast 2022-2027

- Exhibit 97: Chart on Singapore - Market size and forecast 2022-2027 ($ billion)

- Exhibit 98: Data Table on Singapore - Market size and forecast 2022-2027 ($ billion)

- Exhibit 99: Chart on Singapore - Year-over-year growth 2022-2027 (%)

- Exhibit 100: Data Table on Singapore - Year-over-year growth 2022-2027 (%)

- 9.12 France - Market size and forecast 2022-2027

- Exhibit 101: Chart on France - Market size and forecast 2022-2027 ($ billion)

- Exhibit 102: Data Table on France - Market size and forecast 2022-2027 ($ billion)

- Exhibit 103: Chart on France - Year-over-year growth 2022-2027 (%)

- Exhibit 104: Data Table on France - Year-over-year growth 2022-2027 (%)

- 9.13 Market opportunity by geography

- Exhibit 105: Market opportunity by geography ($ billion)

10 Drivers, Challenges, and Trends

- 10.1 Market drivers

- 10.2 Market challenges

- 10.3 Impact of drivers and challenges

- Exhibit 106: Impact of drivers and challenges in 2022 and 2027

- 10.4 Market trends

11 Vendor Landscape

- 11.1 Overview

- 11.2 Vendor landscape

- Exhibit 107: Overview on Criticality of inputs and Factors of differentiation

- 11.3 Landscape disruption

- Exhibit 108: Overview on factors of disruption

- 11.4 Industry risks

- Exhibit 109: Impact of key risks on business

12 Vendor Analysis

- 12.1 Vendors covered

- Exhibit 110: Vendors covered

- 12.2 Market positioning of vendors

- Exhibit 111: Matrix on vendor position and classification

- 12.3 Amthor International

- Exhibit 112: Amthor International - Overview

- Exhibit 113: Amthor International - Product / Service

- Exhibit 114: Amthor International - Key offerings

- 12.4 Dupre Logistics LLC

- Exhibit 115: Dupre Logistics LLC - Overview

- Exhibit 116: Dupre Logistics LLC - Product / Service

- Exhibit 117: Dupre Logistics LLC - Key offerings

- 12.5 Eagle Transport Corp.

- Exhibit 118: Eagle Transport Corp. - Overview

- Exhibit 119: Eagle Transport Corp. - Product / Service

- Exhibit 120: Eagle Transport Corp. - Key offerings

- 12.6 Florida Rock and Tank Lines Inc.

- Exhibit 121: Florida Rock and Tank Lines Inc. - Overview

- Exhibit 122: Florida Rock and Tank Lines Inc. - Product / Service

- Exhibit 123: Florida Rock and Tank Lines Inc. - Key offerings

- 12.7 Groendyke Transport Inc.

- Exhibit 124: Groendyke Transport Inc. - Overview

- Exhibit 125: Groendyke Transport Inc. - Product / Service

- Exhibit 126: Groendyke Transport Inc. - Key offerings

- 12.8 Kenan Advantage Group Inc.

- Exhibit 127: Kenan Advantage Group Inc. - Overview

- Exhibit 128: Kenan Advantage Group Inc. - Product / Service

- Exhibit 129: Kenan Advantage Group Inc. - Key offerings

- 12.9 Littlejohn Inc.

- Exhibit 130: Littlejohn Inc. - Overview

- Exhibit 131: Littlejohn Inc. - Product / Service

- Exhibit 132: Littlejohn Inc. - Key offerings

- 12.10 Mac Trailer Manufacturing Inc.

- Exhibit 133: Mac Trailer Manufacturing Inc. - Overview

- Exhibit 134: Mac Trailer Manufacturing Inc. - Product / Service

- Exhibit 135: Mac Trailer Manufacturing Inc. - Key offerings

- 12.11 Martin Transport Inc.

- Exhibit 136: Martin Transport Inc. - Overview

- Exhibit 137: Martin Transport Inc. - Product / Service

- Exhibit 138: Martin Transport Inc. - Key offerings

- 12.12 Miller Transporters Inc.

- Exhibit 139: Miller Transporters Inc. - Overview

- Exhibit 140: Miller Transporters Inc. - Product / Service

- Exhibit 141: Miller Transporters Inc. - Key offerings

- 12.13 Quest Liner Inc.

- Exhibit 142: Quest Liner Inc. - Overview

- Exhibit 143: Quest Liner Inc. - Product / Service

- Exhibit 144: Quest Liner Inc. - Key offerings

- 12.14 Ruan Transportation Management Systems

- Exhibit 145: Ruan Transportation Management Systems - Overview

- Exhibit 146: Ruan Transportation Management Systems - Product / Service

- Exhibit 147: Ruan Transportation Management Systems - Key offerings

- 12.15 Superior Bulk Logistics Inc.

- Exhibit 148: Superior Bulk Logistics Inc. - Overview

- Exhibit 149: Superior Bulk Logistics Inc. - Product / Service

- Exhibit 150: Superior Bulk Logistics Inc. - Key offerings

- 12.16 Tankstar USA Inc.

- Exhibit 151: Tankstar USA Inc. - Overview

- Exhibit 152: Tankstar USA Inc. - Product / Service

- Exhibit 153: Tankstar USA Inc. - Key offerings

- 12.17 Trimac Transportation Services Inc.

- Exhibit 154: Trimac Transportation Services Inc. - Overview

- Exhibit 155: Trimac Transportation Services Inc. - Product / Service

- Exhibit 156: Trimac Transportation Services Inc. - Key offerings

13 Appendix

- 13.1 Scope of the report

- 13.2 Inclusions and exclusions checklist

- Exhibit 157: Inclusions checklist

- Exhibit 158: Exclusions checklist

- 13.3 Currency conversion rates for US$

- Exhibit 159: Currency conversion rates for US$

- 13.4 Research methodology

- Exhibit 160: Research methodology

- Exhibit 161: Validation techniques employed for market sizing

- Exhibit 162: Information sources

- 13.5 List of abbreviations

- Exhibit 163: List of abbreviations

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 focusized analysts, Technavio's repoprovidery consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, exteesearch, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/tank-trucking-market-2023-2027-a-descriptive-analysis-of-five-forces-model-market-dynamics-and-segmentation--technavio-301724342.html

SOURCE Technavio

Uncategorized

Tight inventory and frustrated buyers challenge agents in Virginia

With inventory a little more than half of what it was pre-pandemic, agents are struggling to find homes for clients in Virginia.

No matter where you are in the state, real estate agents in Virginia are facing low inventory conditions that are creating frustrating scenarios for their buyers.

“I think people are getting used to the interest rates where they are now, but there is just a huge lack of inventory,” said Chelsea Newcomb, a RE/MAX Realty Specialists agent based in Charlottesville. “I have buyers that are looking, but to find a house that you love enough to pay a high price for — and to be at over a 6.5% interest rate — it’s just a little bit harder to find something.”

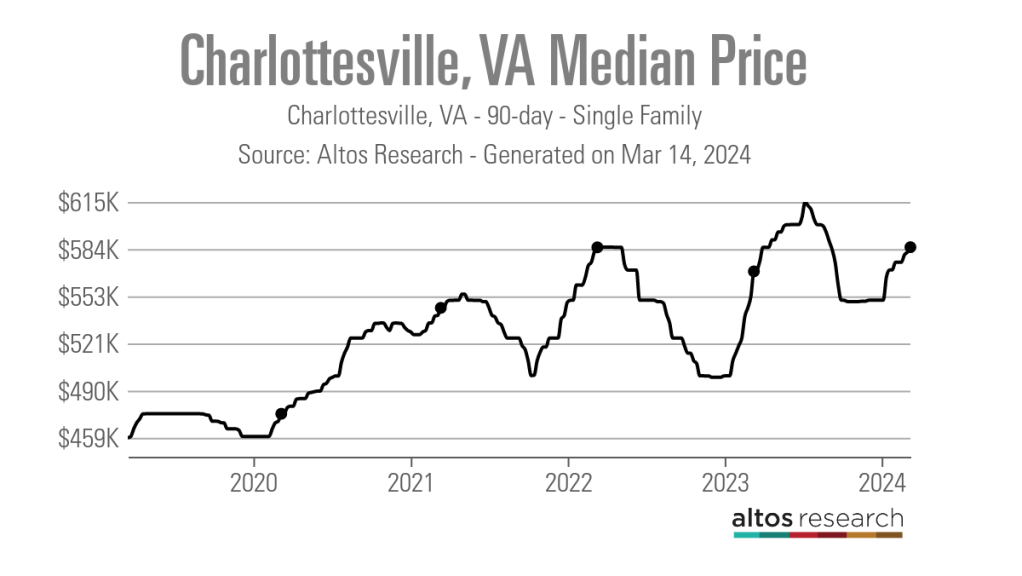

Newcomb said that interest rates and higher prices, which have risen by more than $100,000 since March 2020, according to data from Altos Research, have caused her clients to be pickier when selecting a home.

“When rates and prices were lower, people were more willing to compromise,” Newcomb said.

Out in Wise, Virginia, near the westernmost tip of the state, RE/MAX Cavaliers agent Brett Tiller and his clients are also struggling to find suitable properties.

“The thing that really stands out, especially compared to two years ago, is the lack of quality listings,” Tiller said. “The slightly more upscale single-family listings for move-up buyers with children looking for their forever home just aren’t coming on the market right now, and demand is still very high.”

Statewide, Virginia had a 90-day average of 8,068 active single-family listings as of March 8, 2024, down from 14,471 single-family listings in early March 2020 at the onset of the COVID-19 pandemic, according to Altos Research. That represents a decrease of 44%.

In Newcomb’s base metro area of Charlottesville, there were an average of only 277 active single-family listings during the same recent 90-day period, compared to 892 at the onset of the pandemic. In Wise County, there were only 56 listings.

Due to the demand from move-up buyers in Tiller’s area, the average days on market for homes with a median price of roughly $190,000 was just 17 days as of early March 2024.

“For the right home, which is rare to find right now, we are still seeing multiple offers,” Tiller said. “The demand is the same right now as it was during the heart of the pandemic.”

According to Tiller, the tight inventory has caused homebuyers to spend up to six months searching for their new property, roughly double the time it took prior to the pandemic.

For Matt Salway in the Virginia Beach metro area, the tight inventory conditions are creating a rather hot market.

“Depending on where you are in the area, your listing could have 15 offers in two days,” the agent for Iron Valley Real Estate Hampton Roads | Virginia Beach said. “It has been crazy competition for most of Virginia Beach, and Norfolk is pretty hot too, especially for anything under $400,000.”

According to Altos Research, the Virginia Beach-Norfolk-Newport News housing market had a seven-day average Market Action Index score of 52.44 as of March 14, making it the seventh hottest housing market in the country. Altos considers any Market Action Index score above 30 to be indicative of a seller’s market.

Further up the coastline on the vacation destination of Chincoteague Island, Long & Foster agent Meghan O. Clarkson is also seeing a decent amount of competition despite higher prices and interest rates.

“People are taking their time to actually come see things now instead of buying site unseen, and occasionally we see some seller concessions, but the traffic and the demand is still there; you might just work a little longer with people because we don’t have anything for sale,” Clarkson said.

“I’m busy and constantly have appointments, but the underlying frenzy from the height of the pandemic has gone away, but I think it is because we have just gotten used to it.”

While much of the demand that Clarkson’s market faces is for vacation homes and from retirees looking for a scenic spot to retire, a large portion of the demand in Salway’s market comes from military personnel and civilians working under government contracts.

“We have over a dozen military bases here, plus a bunch of shipyards, so the closer you get to all of those bases, the easier it is to sell a home and the faster the sale happens,” Salway said.

Due to this, Salway said that existing-home inventory typically does not come on the market unless an employment contract ends or the owner is reassigned to a different base, which is currently contributing to the tight inventory situation in his market.

Things are a bit different for Tiller and Newcomb, who are seeing a decent number of buyers from other, more expensive parts of the state.

“One of the crazy things about Louisa and Goochland, which are kind of like suburbs on the western side of Richmond, is that they are growing like crazy,” Newcomb said. “A lot of people are coming in from Northern Virginia because they can work remotely now.”

With a Market Action Index score of 50, it is easy to see why people are leaving the Washington-Arlington-Alexandria market for the Charlottesville market, which has an index score of 41.

In addition, the 90-day average median list price in Charlottesville is $585,000 compared to $729,900 in the D.C. area, which Newcomb said is also luring many Virginia homebuyers to move further south.

“They are very accustomed to higher prices, so they are super impressed with the prices we offer here in the central Virginia area,” Newcomb said.

For local buyers, Newcomb said this means they are frequently being outbid or outpriced.

“A couple who is local to the area and has been here their whole life, they are just now starting to get their mind wrapped around the fact that you can’t get a house for $200,000 anymore,” Newcomb said.

As the year heads closer to spring, triggering the start of the prime homebuying season, agents in Virginia feel optimistic about the market.

“We are seeing seasonal trends like we did up through 2019,” Clarkson said. “The market kind of soft launched around President’s Day and it is still building, but I expect it to pick right back up and be in full swing by Easter like it always used to.”

But while they are confident in demand, questions still remain about whether there will be enough inventory to support even more homebuyers entering the market.

“I have a lot of buyers starting to come off the sidelines, but in my office, I also have a lot of people who are going to list their house in the next two to three weeks now that the weather is starting to break,” Newcomb said. “I think we are going to have a good spring and summer.”

real estate housing market pandemic covid-19 interest ratesUncategorized

These Cities Have The Highest (And Lowest) Share Of Unaffordable Neighborhoods In 2024

These Cities Have The Highest (And Lowest) Share Of Unaffordable Neighborhoods In 2024

Authored by Sam Bourgi via CreditNews.com,

Homeownership…

Authored by Sam Bourgi via CreditNews.com,

Homeownership is one of the key pillars of the American dream. But for many families, the idyllic fantasy of a picket fence and backyard barbecues remains just that—a fantasy.

Thanks to elevated mortgage rates, sky-high house prices, and scarce inventory, millions of American families have been locked out of the opportunity to buy a home in many cities.

To shed light on America’s housing affordability crisis, Creditnews Research ranked the 50 most populous cities by the percentage of neighborhoods within reach for the typical married-couple household to buy a home in.

The study reveals a stark reality, with many cities completely out of reach for the most affluent household type. Not only that, the unaffordability has radically worsened in recent years.

Comparing how affordability has changed since Covid, Creditnews Research discovered an alarming pattern—indicating consistently more unaffordable housing in all but three cities.

Fortunately, there’s still hope for households seeking to put down roots in more affordable cities—especially for those looking beyond Los Angeles, New York, Boston, San Jone, and Miami.

The typical American family has a hard time putting down roots in many parts of the country. In 11 of the top 50 cities, at least 50% of neighborhoods are out of reach for the average married-couple household. The affordability gap has widened significantly since Covid; in fact, no major city has reported an improvement in affordability post-pandemic.

Sam Bourgi, Senior Analyst at Creditnews

Key findings

-

The most unaffordable cities are Los Angeles, Boston, St. Louis, and San Jose; in each city, 100% of neighborhoods are out of reach for for married-couple households earning a median income;

-

The most affordable cities are Cleveland, Hartford, and Memphis—in these cities, the typical family can afford all neighborhoods;

-

None of the top 50 cities by population saw an improvement in affordable neighborhoods post-pandemic;

-

California recorded the biggest spike in unaffordable neighborhoods since pre-Covid;

-

The share of unaffordable neighborhoods has increased the most since pre-Covid in San Jose (70 percentage points), San Diego (from 57.8 percentage points), and Riverside-San Bernardino (51.9 percentage points);

-

Only three cities have seen no change in housing affordability since pre-Covid: Cleveland, Memphis, and Hartford. They’re also the only cities that had 0% of unaffordable neighborhoods before Covid.

Cities with the highest share of unaffordable neighborhoods

With few exceptions, the most unaffordable cities for married-couple households tend to be located in some of the nation’s most expensive housing markets.

Four cities in the ranking have an unaffordability percentage of 100%—indicating that the median married-couple household couldn’t qualify for an average home in any neighborhood.

The following are the cities ranked from the least affordable to the most:

-

Los Angeles, CA: Housing affordability in Los Angeles has deteriorated over the last five years, as average incomes have failed to keep pace with rising property values and elevated mortgage rates. The median household income of married-couple families in LA is $117,056, but even at that rate, 100% of the city’s neighborhoods are unaffordable.

-

St. Louis, MO: It may be surprising to see St. Louis ranking among the most unaffordable housing markets for married-couple households. But a closer look reveals that the Mound City was unaffordable even before Covid. In 2019, 98% of the city’s neighborhoods were unaffordable—way worse than Los Angeles, Boston, or San Jose.

-

Boston, MA: Boston’s housing affordability challenges began long before Covid but accelerated after the pandemic. Before Covid, married couples earning a median income were priced out of 90.7% of Boston’s neighborhoods. But that figure has since jumped to 100%, despite a comfortable median household income of $172,223.

-

San Jose, CA: Nestled in Silicon Valley, San Jose has long been one of the most expensive cities for housing in America. But things have gotten far worse since Covid, as 100% of its neighborhoods are now out of reach for the average family. Perhaps the most shocking part is that the median household income for married-couple families is $188,403—much higher than the national average.

-

San Diego, CA: Another California city, San Diego, is among the most unaffordable places in the country. Despite boasting a median married-couple household income of $136,297, 95.6% of the city’s neighborhoods are unaffordable.

-

San Francisco, CA: San Francisco is another California city with a high married-couple median income ($211,585) but low affordability. The percentage of unaffordable neighborhoods for these homebuyers stands at 89.2%.

-

New York, NY: As one of the most expensive cities in America, New York is a difficult housing market for married couples with dual income. New York City’s share of unaffordable neighborhoods is 85.9%, marking a 33.4% rise from pre-Covid times.

-

Miami, FL: Partly due to a population boom post-Covid, Miami is now one of the most unaffordable cities for homebuyers. Roughly four out of five (79.4%) of Miami’s neighborhoods are out of reach price-wise for married-couple families. That’s a 34.7% increase from 2019.

-

Nashville, TN: With Nashville’s population growth rebounding to pre-pandemic levels, the city has also seen greater affordability challenges. In the Music City, 73.7% of neighborhoods are considered unaffordable for married-couple households—an increase of 11.9% from pre-Covid levels.

-

Richmond, VA: Rounding out the bottom 10 is Richmond, where 55.9% of the city’s 161 neighborhoods are unaffordable for married-couple households. That’s an 11.9% increase from pre-Covid levels.

Cities with the lowest share of unaffordable neighborhoods

All the cities in our top-10 ranking have less than 10% unaffordable neighborhoods—meaning the average family can qualify for a home in at least 90% of the city.

Interestingly, these cities are also outside the top 15 cities by population, and eight are in the bottom half.

The following are the cities ranked from the most affordable to the least:

-

Hartford, CT: Hartford ranks first with the percentage of unaffordable neighborhoods at 0%, unchanged since pre-Covid times. Married couples earning a median income of $135,612 can afford to live in any of the city’s 16 neighborhoods. Interestingly, Hartford is the smallest city to rank in the top 10.

-

Memphis, TN: Like Hartford, Memphis has 0% unaffordable neighborhoods, meaning any married couple earning a median income of $101,734 can afford an average homes in any of the city’s 12 neighborhoods. The percentage of unaffordable neighborhoods also stood at 0% before Covid.

-

Cleveland, OH: The Midwestern city of Cleveland is also tied for first, with the percentage of unaffordable neighborhoods at 0%. That means households with a median-couple income of $89,066 can qualify for an average home in all of the city’s neighborhoods. Cleveland is also among the three cities that have seen no change in unaffordability compared to 2019.

-

Minneapolis, MN: The largest city in the top 10, Minneapolis’ share of unaffordable neighborhoods stood at 2.41%, up slightly from 2019. Married couples earning the median income ($149,214) have access to the vast majority of the city’s 83 neighborhoods.

-

Baltimore, MD: Married-couple households in Baltimore earn a median income of $141,634. At that rate, they can afford to live in 97.3% of the city’s 222 neighborhoods, making only 2.7% of neighborhoods unaffordable. That’s up from 0% pre-Covid.

-

Louisville, KY: Louisville is a highly competitive market for married households. For married-couple households earning a median wage, only 3.6% of neighborhoods are unaffordable, up 11.9% from pre-Covid times.

-

Cincinnati, OH: The second Ohio city in the top 10 ranks close to Cleveland in population but has a much higher median married-couple household income of $129,324. Only 3.6% of the city’s neighborhoods are unaffordable, up slightly from pre-pandemic levels.

-

Indianapolis, IN: Another competitive Midwestern market, only 4.4% of Indianapolis is unaffordable, making the vast majority of the city’s 92 neighborhoods accessible to the average married couple. Still, the percentage of unaffordable neighborhoods before Covid was less than 1%.

-

Oklahoma City, OK: Before Covid, Oklahoma City had 0% neighborhoods unaffordable for married-couple households earning the median wage. It has since increased to 4.69%, which is still tiny compared to the national average.

-

Kansas City, MO: Kansas City has one of the largest numbers of neighborhoods in the top 50 cities. Its married-couple residents can afford to live in nearly 95% of them, making only 5.6% of neighborhoods out of reach. Like Indiana, Kansas City’s share of unaffordable neighborhoods was less than 1% before Covid.

The biggest COVID losers

What's particularly astonishing about the current housing market is just how quickly affordability has declined since Covid.

Even factoring in the market correction after the 2022 peak, the price of existing homes is still nearly one-third higher than before Covid. Mortgage rates have also more than doubled since early 2022.

Combined, the rising home prices and interest rates led to the worst mortgage affordability in more than 40 years.

Against this backdrop, it’s hardly surprising that unaffordability increased in 47 of the 50 cities studied and remained flat in the other three. No city reported improved affordability in 2024 compared to 2019.

The biggest increases are led by San Jose (70 percentage points), San Diego (57.8 percentage points), Riverside-San Bernardino (51.9 percentage points), Sacramento (43 percentage points), Orlando (37.4 percentage points), Miami (34.7 percentage points), and New York City (33.4 percentage points).

The following cities in our study are ranked by the largest percentage point change in unaffordable neighborhoods since pre-Covid:

Uncategorized

Your financial plan may be riskier without bitcoin

It might actually be riskier to not have bitcoin in your portfolio than it is to have a small allocation.

This article originally appeared in the Sound Advisory blog. Sound Advisory provide financial advisory services and are specialize in educating and guiding clients to thrive financially in a bitcoin-powered world. Click here to learn more.

“Belief is a wise wager. Granted that faith cannot be proved, what harm will come to you if you gamble on its truth and it proves false? If you gain, you gain all; if you lose, you lose nothing. Wager, then, without hesitation, that He exists.”

- Blaise Pascal

Blaise Pascal only lived to age 39 but became world-famous for many contributions in the fields of mathematics, physics, and theology. The above quote encapsulates Pascal’s wager—a philosophical argument for the Christian belief in the existence of God.

The argument's conclusion states that a rational person should live as though God exists. Even if the probability is low, the reward is worth the risk.

Pascal’s wager as a justification for bitcoin? Yes, I’m aware of the fallacies: false dichotomy, appeal to emotion, begging the question, etc. That is not the point. The point is that binary outcomes instigate extreme results, and the game theory of money suggests that it’s a winner-take-all game.

The Pascalian investor: A rational approach to bitcoin

Humanity’s adoption of “the best money over time” mimics a series of binary outcomes—A/B tests.

Throughout history, inferior forms of money have faded as better alternatives emerged (see India’s failed transition to a gold standard). And if bitcoin is trying to be the premier money of the future, it will either succeed or it won’t.

“If you ain’t first, you’re last.” -Ricky Bobby, Talladega Nights, on which monies succeed over time.

So, we can look at bitcoin success similarly to Pascal’s wager—let’s call it Satoshi’s wager. The translated points would go something like this:

- If you own bitcoin early and it becomes a globally valuable money, you gain immensely. ????

- If you own bitcoin and it fails, you’ve lost that value. ????

- If you don’t own bitcoin and it goes to zero, no pain and no gain. ????

- If you don’t own bitcoin and it succeeds, you will have missed out on the significant financial revolution of our lifetimes and fall comparatively behind. ????

If bitcoin is successful, it will be worth far more than it is today and have a massive impact on your financial future. If it fails, the losses are only limited to your exposure. The most that you could lose is the money that you invested.

It is hypothetically possible that bitcoin could be worth 100x more than it is today, but it can only possibly lose 1x its value as it goes to zero. The concept we’re discussing here is asymmetric upside - significant gains with relatively limited downside. In other words, the potential rewards of the investment outweigh the potential risks.

Bitcoin offers an asymmetric upside that makes it a wise investment for most portfolios. Even a small allocation provides potential protection against extreme currency debasement.

Salt, gasoline, and insurance

“Don’t over salt your steak, pour too much gas on the fire, or buy too much insurance.”

A little bit goes a long way, and you can easily overdo it. The same applies when looking at bitcoin in the context of a financial plan.

Bitcoin’s asymmetric upside gives it “insurance-like” qualities, and that insurance pays off very well in times of money printing. This was exemplified in 2020 when bitcoin's value increased over 300% in response to pandemic money printing, far outpacing stocks, gold, and bonds.

Bitcoin offers a similar asymmetric upside today. Bitcoin's supply is capped at 21 million coins, making it resistant to inflationary debasement. In contrast, the dollar's purchasing power consistently declines through unrestrained money printing. History has shown that societies prefer money that is hard to inflate.

If recent rampant inflation is uncontainable and the dollar system falters, bitcoin is well-positioned as a successor. This global monetary A/B test is still early, but given their respective sizes, a little bitcoin can go a long way. If it succeeds, early adopters will benefit enormously compared to latecomers. Of course, there are no guarantees, but the potential reward justifies reasonable exposure despite the risks.

Let’s imagine Nervous Nancy, an extremely conservative investor. She wants to invest but also take the least risk possible. She invests 100% of her money in short-term cash equivalents (short-term treasuries, money markets, CDs, maybe some cash in the coffee can). With this investment allocation, she’s nearly certain to get her initial investment back and receive a modest amount of interest as a gain. However, she has no guarantees that the investment returned to her will purchase the same amount as it used to. Inflation and money printing cause each dollar to be able to purchase less and less over time. Depending on the severity of the inflation, it might not buy anything at all. In other words, she didn’t lose any dollars, but the dollar lost purchasing power.

Now, let’s salt her portfolio with bitcoin.

99% short-term treasuries. 1% bitcoin.

With a 1% allocation, if bitcoin goes to zero overnight, she’ll have only lost a penny on the dollar, and her treasury interest will quickly fill the gap. Not at all catastrophic to her financial future.

However, if the hypothetical hyperinflationary scenario from above plays out and bitcoin grows 100x in purchasing power, she’s saved everything. Metaphorically, her entire dollar house burned down, and “bitcoin insurance” made her whole. Powerful. A little bitcoin salt goes a long way.

(When protecting against the existing system, it’s important to remember that you need to get your bitcoin out of the system. Keeping bitcoin on an exchange or with a counterparty will do you no good if that entity fails. If you view bitcoin as insurance, it’s essential to keep your bitcoin in cold storage and hold your keys. Otherwise, it’s someone else’s insurance.)

When all you have a hammer, everything looks like a…

A construction joke:

There are only three rules to construction: 1.) Always use the right tool for the job! 2.) A hammer is always the right tool! 3.) Anything can be a hammer!

Yeah. That’s what I thought, too. Slightly funny and mostly useless.

But if you spend enough time swinging a hammer, you’ll eventually realize it can be more than it first appears. Not everything is a nail. A hammer can tear down walls, break concrete, tap objects into place, and wiggle other things out. A hammer can create and destroy; it builds tall towers and humbles novice fingers. The use cases expand with the skill of the carpenter.

Like hammers, bitcoin is a monetary tool. And a 1-5% allocator to the asset typically sees a “speculative insurance” use case - valid. Bitcoin is speculative insurance, but it is not only speculative insurance. People invest and save in bitcoin for many different reasons.

I’ve seen people use bitcoin to pursue all of the following use cases:

- Hedging against a financial collapse (speculative insurance)

- Saving for family and future (long-term general savings and safety net)

- Growing a downpayment for a house (medium-term specific savings)

- Shooting for the moon in a manner equivalent to winning the lottery (gambling)

- Opting out of government-run, bank-controlled financial systems (financial optionality)

- Making a quick buck (short-term trading)

- Escaping a hostile country (wealth evacuation)

- Locking away wealth that can’t be confiscated (wealth preservation)

- As a means to influence opinions and gain followers (social status)

- Fix the money and fix the world (mission and purpose)

Keep this in mind when taking other people’s financial advice. They are often playing a different game than you. They have different goals, upbringings, worldviews, family dynamics, and circumstances. Even though they might use the same hammer as you, it could be for a completely different job.

Wrapping Up

A massive allocation to bitcoin may seem crazy to some people, yet perfectly reasonable to others. The same goes for having a 1% allocation.

But, given today’s macroeconomic environment and bitcoin’s trajectory, I find very few use cases where 0% bitcoin makes sense. By not owning bitcoin, you implicitly say that you are 100% certain it will fail and go to zero. Given its 14-year history so far, I’d recommend reducing your confidence. Nobody is 100% right forever. A little salt goes a long way. Your financial plan may be riskier without bitcoin. Diversify accordingly.

“We must learn our limits. We are all something, but none of us are everything.” - Blaise Pascal.

bonds pandemic stocks bitcoin link goldContact

Office: (208)-254-0142

Ste. 205

Eagle, ID 83616

Check the background of your financial professional on FINRA's BrokerCheck.The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Some of this material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named representative, broker - dealer, state - or SEC - registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

We take protecting your data and privacy very seriously. As of January 1, 2020 the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information.

Copyright 2024 FMG Suite.

Sound Advisory, LLC (“SA”) is a registered investment advisor offering advisory services in the State of Idaho and in other jurisdictions where exempt. Registration does not imply a certain level of skill or training. The information on this site is not intended as tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This information should not be relied upon as the sole factor in an investment-making decision. Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal any performance noted on this site.

The information on this site is provided “AS IS” and without warranties of any kind, either express or implied. To the fullest extent permissible pursuant to applicable laws, Sound Advisory LLC disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

SA does not warrant that the information on this site will be free from error. Your use of the information is at your sole risk. Under no circumstances shall SA be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided on this site, even if SA or an SA authorized representative has been advised of the possibility of such damages. Information contained on this site should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges