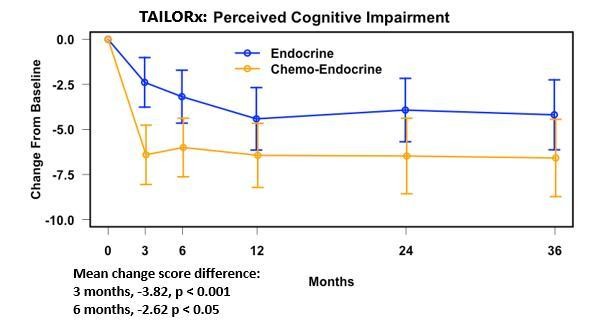

The Journal of Clinical Oncology reports that a subgroup of women on chemotherapy in the landmark TAILORx breast cancer treatment trial had an early and abrupt cognitive decline at three and six months following treatment, which leveled off at 12 and 36 months. The women received chemotherapy plus hormone therapy following surgery, to prevent the disease from returning. The publication also reports the loss of cognition in women who received hormone therapy alone. The ECOG-ACRIN Cancer Research Group (ECOG-ACRIN) conducted the study with funding from the National Cancer Institute, part of the National Institutes of Health.

“We found that chemotherapy produced early cognitive impairment that leveled off by one year and did not get worse over time,” said lead author Lynne I. Wagner, PhD, a professor of social sciences and health policy at Wake Forest University. “This patient-reported information will hopefully reassure women who get diagnosed with early breast cancer in the future and learn they need chemotherapy because they are at high risk of recurrence.”

Cancer-related cognitive impairment is common during chemotherapy treatment. The term ‘chemo-brain’ refers to cognitive impairments assumed to be from chemotherapy. The randomized design of TAILORx allowed Dr. Wagner and colleagues to evaluate the accuracy of this term by quantifying the unique contribution of chemotherapy to acute and long-term changes in cognition.

TAILORx is the first trial to quantify cognitive impairment and health-related quality of life from the patient’s perspective. Dr. Wagner and colleagues compared survey responses from 579 TAILORx women randomized to one of two treatment groups: hormone therapy alone or hormone therapy plus chemotherapy. Their use of questionnaires to capture data directly from patients gives confidence that the results accurately characterize women’s perspectives on their symptoms and functioning.

Before TAILORx, it was impossible to quantify the extent to which chemotherapy contributed to cognitive impairment because everyone received chemotherapy.

Over one-third of the women in the study reported a significant decrease in cognition compared to pre-treatment. Dr. Wagner and colleagues calculated a minimum change score to determine what is likely to be a clinically significant level of change. In the group on hormone therapy alone, 34% of participants had change scores from baseline to 12 months that exceeded the level considered to be clinically relevant. In the chemotherapy and hormone therapy group, 38% of participants had change scores exceeding the benchmark.

Women on Hormone Therapy Also Reported Significant Cognitive Impairment

A comparison of the two groups revealed that the group with chemotherapy lost more cognitive function at three and six months than the group on hormone therapy alone. However, at 12 and 36 months, the impairment was not significantly different between the groups. This was not because the women who had chemotherapy improved, but rather because women on hormone therapy were also reporting cognitive impairment, although the pace of decline was slower and more gradual.

“I think we’ve generally assumed that cognitive impairment is due to chemotherapy,” said Dr. Wagner. “Our findings tell us that hormone therapy may also play a role. Future research is needed to understand better how hormone therapy affects cognition in the context of cancer treatment and also how to treat this symptom.”

Cognitive Function Did Not Return to Pre-Treatment Levels in Either Group

Another key finding from TAILORx is that women’s cognitive function did not return to pre-treatment levels regardless of the treatment they received.

“We were surprised by the finding that women’s cognitive function did not return to pre-treatment levels after finishing chemotherapy, but neither did the group with hormone therapy alone,” said Dr. Wagner. “These results do not suggest that women should skip hormone therapy. Rather, the results should alert women and their doctors to continually discuss cognitive function even if they’ve been on hormone therapy for a few years.”

This patient-reported data validates the experiences of women with breast cancer who noticed a decline in their cognition but questioned if it was related to treatment or due to aging, stress, or another nonspecific cause.

“Finding that long-term cognitive impairments were comparable between groups confirms we can retire the term ‘chemo-brain’ as it does not accurately describe the whole picture,” said Dr. Wagner.

About TAILORx and Genetic Testing

The groundbreaking TAILORx trial found no benefit from chemotherapy for 70% of women with the most common type of breast cancer: hormone receptor (HR)-positive, HER2-negative, axillary lymph node-negative. The first results in 2018, published in the New England Journal of Medicine, give clinicians high-quality data to inform personalized treatment recommendations for women. The trial used the Oncotype DX Recurrence Score, a molecular test that measures a woman’s risk of recurrence by assigning a score (0 – 100) for the presence of 21 tumor genes linked to breast cancer. The higher the score, the more tumor genes present, and thus, the higher the risk of recurrence. The TAILORx results suggest a potential benefit from chemotherapy for women with early breast cancer who are of any age with a recurrence score of 26 – 100 or 50 years old and younger with a recurrence score of 16 – 25.

Before TAILORx, there was uncertainty about the best treatment for women with a mid-range score of 11 – 25. The trial was designed to answer this question. Women with a score of 11 – 25 were randomly assigned to chemotherapy plus hormone therapy or hormone therapy alone.

About the Cognition Study Design

The analysis assessed cognitive impairment among a subgroup of 579 randomized TAILORx women able to be evaluated. It used the 37-item Functional Assessment of Cancer Therapy-Cognitive Function (FACT-Cog) questionnaire, administered at baseline, 3, 6, 12, 24, and 36 months. The FACT-Cog included the 20-item Perceived Cognitive Impairment (PCI) scale, the primary endpoint. Clinically meaningful changes were defined a priori, and linear regression was used to model PCI scores on baseline PCI, treatment, and other factors.

Other Findings

The measure of women who reported improved cognition from baseline to 12 months was 14% in the group on hormone therapy alone and 8% in the group that received chemotherapy plus hormone therapy.

Many have questioned whether cancer-related cognitive impairment is due to aging, menopausal changes, or as a manifestation of anxiety and depression. These findings did not differ based on age. Researchers observed the same magnitude of cognitive changes among women under 50 years of age, 51-64 years, and 65 years and older. They saw the same pattern of results for women who were pre-menopausal as those who were post-menopausal. Neither anxiety nor depression attributed to the results.

Implications

This patient-reported data from TAILORx has important implications for women with early breast cancer and the clinicians who treat them. Finding that women on chemotherapy experienced an early and abrupt decrease in cognition underscores the value of precision-guided treatment to identify women who will not benefit from chemotherapy to spare them this toxicity. The persistent cognitive impairment reported in both groups identifies the need for research to understand this distressing symptom better.

###

About the Publication

Title: Patient-Reported Cognitive Impairment Among Women With Early Breast Cancer Randomly Assigned to Endocrine Therapy Alone Versus Chemoendocrine Therapy

Published at: https:/

DOI: https:/

About ECOG-ACRIN

The ECOG-ACRIN Cancer Research Group (ECOG-ACRIN) is a membership-based scientific organization that designs and conducts cancer research involving adults who have or are at risk of developing cancer. ECOG-ACRIN comprises nearly 1100 member institutions in the United States and around the world. Approximately 12,000 physicians, translational scientists, and associated research professionals from the member institutions are involved in Group research, which is organized into three scientific programs: Cancer Control and Outcomes, Therapeutic Studies, and Biomarker Sciences. ECOG-ACRIN is supported primarily through National Cancer Institute research grant funding, but also receives funding from private sector organizations through philanthropy and collaborations. Its headquarters are in Philadelphia, Pa. For more information, visit http://www.