International

Sustainable Debt Markets Surge As Social And Transition Financing Take Root

Key Takeaways We expect global issuance in sustainable debt to surpass $700 billion in 2021, driven by an acceleration of green-labeled bond issuance and continued growth of other sustainable debt instruments, including social and sustainability bonds….

Key Takeaways

- We expect global issuance in sustainable debt to surpass $700 billion in 2021, driven by an acceleration of green-labeled bond issuance and continued growth of other sustainable debt instruments, including social and sustainability bonds.

- Innovation within the sustainable debt market will continue as new types of instruments, including sustainability-linked loans and bonds, expand rapidly and diversify the ways issuers and investors contribute to sustainability objectives.

- Net-zero emissions commitments from the largest economies globally will require significant investment and indicate the dominance of green debt will continue.

- We may also see the continued extension of the use-of-proceeds model to transition bonds for companies operating in more carbon-intensive, transition sectors.

- Improved transparency and reporting practices remain key to fostering credibility in the sustainable debt market.

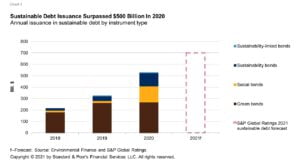

S&P Global Ratings expects issuance of sustainable debt–including green, social, sustainability, and sustainability-linked bonds–will surpass $700 billion in 2021. This would take cumulative issuance past the $2 trillion milestone, from $1.3 trillion as of year-end 2020. Sustainable debt issuance exceeded $530 billion in 2020, according to Environmental Finance, up a staggering 63% from 2019. Social bonds emerged as the fastest growing segment of the market (chart 1), growing about 8x in 2020, catapulted by the COVID-19 pandemic and growing concern about social inequities. As issuer attention shifted toward financing pandemic aid and ensuring recession relief measures, green bond debt slowed in the first half of the 2020. However, it rebounded in the second half, reaching a record annual issuance amount of $270 billion and indicating that issuer and investor appetite for financing climate response and other environmental objectives is strong and accelerating. We believe green-labeled bond issuance could exceed $400 billion in 2021, as global political and regulatory actions grow, serving as a catalyst for increased sovereign and private issuance. We also believe the green use-of-proceeds model will expand to include transition finance, aiding high-carbon-emitting sectors to finance their transition into net-zero emissions business activities.

The COVID-19 pandemic highlighted the need for resilience across societies so they could better withstand high-impact shocks, including those related to health, safety, social fragmentation, and climate change. As this theme becomes more prominent, the connection between social inclusion and the environment will strengthen, and the effect will spill into the capital markets, leading to a rise in instruments targeting broader sustainability objectives. As a result, we believe innovation and diversification within the sustainable debt market will continue in 2021. We expect to see rapid growth of sustainability bonds, which target both social and environmental objectives, as well as greater interest in sustainability-linked instruments. In addition, as the transition to a net-zero economy concept gains traction, we believe new sectors and issuers will enter the market, expanding the pool of investable sustainable financing and allowing investors to diversify their contribution to sustainability objectives.

We Expect The Sustainable Debt Market Will Grow Significantly In 2021

Similar to how the green bond market was spurred by climate policies and the transition to a low-carbon/net-zero economy, we believe greater interest from organizations and investors in social risk factors has had a galvanizing effect on social and sustainability bond issuance. Non-green bond issuance made up almost half of the total sustainable debt market in 2020, up from less than 20% in 2019, according to Environmental Finance. We believe investor appetite for other sustainable debt instruments will complement the continued expansion of the green bond market in 2021. We believe public issuers–including sovereigns, local governments, and government-backed entities–will play a key role in the growth of newer instruments, given their wide social and societal mandate.

Sustainable Debt Instruments Defined

The International Capital Market Assn. defines green bonds as use of proceed bonds that enable capital-raising and investment for projects with environmental benefits including renewable energy, green buildings, and sustainable agriculture. Social bonds raise funds for projects that address or mitigate a specific social issue and/or seek to achieve positive social outcomes, such as improving food security and access to education, health care, and financing, especially but not exclusively for target populations. Sustainability bonds target both environmental and social benefits. Sustainability-linked bonds and loans are a relatively new class of instruments that provide incentives for issuers and borrowers to set and achieve predetermined sustainability performance targets.

We believe green-labeled bond issuance could reach $400 billion in 2021. The COVID-19 pandemic led to a temporary slowdown in green bond issuance in the first half of 2020 as issuers switched their attention to addressing social objectives, namely health and safety, over environmental ones. However, in the third quarter of 2020, green bond issuance rebounded 21% over the second quarter, with $69.4 billion in issuance reported according to the Climate Bonds Initiative (CBI), the highest recorded in any third-quarter period. By year-end 2020, the green bonds market reached a significant milestone, exceeding $1 trillion in issued bonds since the first issuance in 2007. In our view, this growth reflects, in part, a surge in fixed-income issuance globally because of significant liquidity support from central banks and a faster-than-expected rebound in economic activity (see: “Global Financing Conditions: Bond Issuance Is Expected To Finish 2020 Up 16% And Decline In 2021,” published Oct. 26, 2020). It further reflects the continuous acceleration of climate-related policies globally, including as part of countries’ recovery plans. Inaugural sovereign green bond issuances in second-half 2020, including the €6.5 billion bond issued by the German government, the largest ever single green bond to date, as well as Sweden’s $2.3 billion inaugural green bond, were also pivotal for market growth.

Net-zero emissions pledges will spur green-labeled issuance, particularly in the EU. We expect Europe’s share of the green bond market (54% in 2020 according to CBI) will continue to grow, particularly as green bonds are issued to finance technologies that help meet the EU’s transition to net-zero carbon emissions by 2050. European Council President Charles Michel has proposed using 30% of the €750 billion Next Generation EU COVID-19 recovery plan to target climate-friendly projects, translating to a potential €225 billion of additional green financial instruments (see: “The EU Recovery Plan Could Create Its Own Green Safe Asset,” published July 15, 2020). Italy, Spain, and the U.K. are among European nations planning to sell their first sovereign green bonds in 2021. CBI predicts 14 sovereigns could issue inaugural green bonds during the next two years. We believe changes in environmental legislation and regulation will likely increase pressure for action from the private sector and lead to further follow-on green issuance.

However, growth in the green bond market will not come from the EU alone. U.S.-based issuers have been leaders in the green bond market over the past few years, ahead of any other country, composing more than $51 billion or 19% of total issuance in 2020 (chart 4). We expect the U.S. will maintain its dominant position in the market, given the ambitious set of environmental priorities set out by President Joe Biden’s administration, which include achieving a 100% clean energy economy and reaching carbon neutrality by 2050. In addition, Biden’s climate and environmental justice proposal includes federal investment of $1.7 trillion over the next 10 years, which could attract private markets to crowd into the green bond space. The real estate sector has dominated U.S. green bond issuance, but other sectors–including renewables and transport, which are a focus under Biden’s plan–have also seen large-scale issuance, showing “capacity and appetite to fund a more ambitious environmental drive,” according to CBI. We are also likely to see an uptick in green bond issuance in the Asia-Pacific region as China and Japan aim for carbon neutrality by 2060 and 2050, respectively. These commitments will require significant investment and indicate strong green debt market growth will likely continue in 2021 and beyond.

Transition bonds may emerge as a complement to green-labeled financing. Green financing has been almost solely directed at activities that are considered already green, according to CBI. The largest carbon-emitting industries and companies–including those in the materials, oil and gas, chemicals, and transportation sectors–are still largely absent from the market because they do not have sufficient green assets to issue green bonds. Concerns have grown that there are not enough green assets to absorb the amount of capital needed to meet the Paris Agreement’s climate change goals. Transition bonds provide a potential solution by enabling carbon-intensive companies to raise capital and use the proceeds for activities that help them reduce their carbon footprint. Only a few transition bonds have been issued thus far, because no unifying definition of transition exists in the market. However, we believe these bonds may play a much more important role in the sustainable debt market in 2021, particularly as standards for transition instruments become more comprehensive and robust.

After a breakthrough year in social issuance in response to the COVID-19 pandemic, we expect social bonds will maintain a prominent place in the sustainable bond market. The pandemic has heightened issuers’ and investors’ interests in the vast social inequalities and justice issues–including rising unemployment, income inequality, and strains on housing, health care, and education systems–that exist around the world (see “Sustainable Finance Addresses Social Justice As COVID-19 Raises The Stakes,” published Nov. 10, 2020). Massive social bond issuance by the EU under its Support to Mitigate Unemployment Risks in an Emergency (SURE) program was a major indicator of growth in the market. The EU raised €39.5 billion from SURE social bonds in fourth-quarter 2020 alone. In the Asia-Pacific region, social bonds outpaced issuance of green bonds for the first time as banks and sovereigns turned their attention to financing health care, employment programs, and other social development projects in many of the region’s vulnerable communities.

The pandemic’s legacy and implications, particularly as they relate to social justice, will persist. As a result, we believe that even in a post-pandemic world, the calls for equitable, sustainable growth will continue to be heard in the capital markets, leading to further growth in social bond issuance. We have already seen rapid diversification in the types of projects financed by social bonds, and we believe this will continue in the longer term as new financed categories emerge, targeting areas such as economic recovery, diversity and inclusion, and improvement of basic essential services including vaccine manufacturing and distribution.

Sustainability-linked instruments are gaining traction as the sustainable debt market diversifies. Sustainability-linked bonds (SLBs) have historically composed a very small part of the sustainable-debt market; only a few issues are outstanding. However, several factors indicate this category of instruments may experience significant growth in 2021. Unlike green, social, and sustainability bonds, which rely on proceeds being allocated to specific green or social projects, SLBs give companies incentives to advance their sustainability agendas more broadly by directly linking their cost of funding to the achievements of specific sustainability performance targets (SPTs). In June 2020, the International Capital Markets Assn. (ICMA) published the Sustainability-Linked Bond Principles (SLBPs), outlining the five core components of an SLB: key performance indicators (KPIs), SPTs, bond characteristics, reporting, and verification. By providing guidance on best practices for issuance, we believe the SLBPs will promote a sense of legitimacy in the market. Large corporations, including French fashion house Chanel and Brazilian paper and pulp firm Suzano, are some of the recent sustainability-linked bond issuers, and we expect more companies to follow suit as market integrity and transparency efforts grow. In addition, the European Central Bank announced that starting in January 2021, it will accept sustainability-linked bonds as eligible collateral and also start buying them under its asset purchase programs, which should further stimulate growth of the market and help establish best practices for the instrument.

Transparency And Reporting Remain Key

Regulations and principles have played a key role in advancing the best practices for use of proceeds and impact reporting. ICMA’s Green Bond Principles, Social Bond Principles, and Sustainability Bond Guidelines (collectively the Principles), promote the standardization and integrity of the use-of-proceeds market by ensuring that bond proceeds are used exclusively to finance or refinance green and/or social projects and recommending best practices related to transparency, disclosure, and reporting. Furthermore, the EU Taxonomy–a classification system that establishes a list of environmentally sustainable economic activities and requires issuers to report on the environmental objectives of their green bonds–is expected to create a greater sense of credibility in the green bond market. We expect the EU Taxonomy and other similar frameworks will promote the growth of the sustainable debt market as they provide financial market participants with additional resources for assessing the sustainability merits of an investment. While significant progress surrounding transparency and reporting has been made, there is room for improvement, particularly with the newer categories of bonds (i.e., social and transition), for which impact assessment is less standardized. In our opinion, robust disclosure practices, ongoing standardization, and the use of qualified third-party reviews could mitigate some of these risks.

Looking ahead

The sustainable finance landscape is growing and evolving as new financing instruments, including transition and sustainability-linked financing complement green, social, and sustainability bonds. We believe growth in these instruments will be global, accelerated by ambitious environmental commitments and the call for a greater focus on mitigating social risks. In our opinion, improved transparency and reporting practices are key to fostering credibility and propelling future issuance.

Related Research

- Stakeholder Capitalism: Aligning Value Creation With Protection Of Values, Jan. 19, 2021

- Sustainable Finance Addresses Social Justice As COVID-19 Raises The Stakes, Nov. 10, 2020

- A Pandemic-Driven Surge In Social Bond Issuance Shows The Sustainable Debt Market Is Evolving, June 22, 2020

- People Power: COVID-19 Will Redefine Workforce Dynamics In The Post-Pandemic Era, June 4, 2020

- The ESG Lens On COVID-19, Part 2: How Companies Deal With Disruption, April 28, 2020

- The ESG Lens On COVID-19, Part 1, April 20, 2020

The post Sustainable Debt Markets Surge As Social And Transition Financing Take Root appeared first on ValueWalk.

recession unemployment pandemic covid-19 economic recovery bonds real estate vaccine recession recovery unemployment oil japan european europe spain italy sweden eu chinaInternational

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong europeanInternational

Walmart launches clever answer to Target’s new membership program

The retail superstore is adding a new feature to its Walmart+ plan — and customers will be happy.

It's just been a few days since Target (TGT) launched its new Target Circle 360 paid membership plan.

The plan offers free and fast shipping on many products to customers, initially for $49 a year and then $99 after the initial promotional signup period. It promises to be a success, since many Target customers are loyal to the brand and will go out of their way to shop at one instead of at its two larger peers, Walmart and Amazon.

Related: Walmart makes a major price cut that will delight customers

And stop us if this sounds familiar: Target will rely on its more than 2,000 stores to act as fulfillment hubs.

This model is a proven winner; Walmart also uses its more than 4,600 stores as fulfillment and shipping locations to get orders to customers as soon as possible.

Sometimes, this means shipping goods from the nearest warehouse. But if a desired product is in-store and closer to a customer, it reduces miles on the road and delivery time. It's a kind of logistical magic that makes any efficiency lover's (or retail nerd's) heart go pitter patter.

Walmart rolls out answer to Target's new membership tier

Walmart has certainly had more time than Target to develop and work out the kinks in Walmart+. It first launched the paid membership in 2020 during the height of the pandemic, when many shoppers sheltered at home but still required many staples they might ordinarily pick up at a Walmart, like cleaning supplies, personal-care products, pantry goods and, of course, toilet paper.

It also undercut Amazon (AMZN) Prime, which costs customers $139 a year for free and fast shipping (plus several other benefits including access to its streaming service, Amazon Prime Video).

Walmart+ costs $98 a year, which also gets you free and speedy delivery, plus access to a Paramount+ streaming subscription, fuel savings, and more.

If that's not enough to tempt you, however, Walmart+ just added a new benefit to its membership program, ostensibly to compete directly with something Target now has: ultrafast delivery.

Target Circle 360 particularly attracts customers with free same-day delivery for select orders over $35 and as little as one-hour delivery on select items. Target executes this through its Shipt subsidiary.

We've seen this lightning-fast delivery speed only in snippets from Amazon, the king of delivery efficiency. Who better to take on Target, though, than Walmart, which is using a similar store-as-fulfillment-center model?

"Walmart is stepping up to save our customers even more time with our latest delivery offering: Express On-Demand Early Morning Delivery," Walmart said in a statement, just a day after Target Circle 360 launched. "Starting at 6 a.m., earlier than ever before, customers can enjoy the convenience of On-Demand delivery."

Walmart (WMT) clearly sees consumers' desire for near-instant delivery, which obviously saves time and trips to the store. Rather than waiting a day for your order to show up, it might be on your doorstep when you wake up.

Consumers also tend to spend more money when they shop online, and they remain stickier as paying annual members. So, to a growing number of retail giants, almost instant gratification like this seems like something worth striving for.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic mexicoInternational

President Biden Delivers The “Darkest, Most Un-American Speech Given By A President”

President Biden Delivers The "Darkest, Most Un-American Speech Given By A President"

Having successfully raged, ranted, lied, and yelled through…

Having successfully raged, ranted, lied, and yelled through the State of The Union, President Biden can go back to his crypt now.

Whatever 'they' gave Biden, every American man, woman, and the other should be allowed to take it - though it seems the cocktail brings out 'dark Brandon'?

Tl;dw: Biden's Speech tonight ...

-

Fund Ukraine.

-

Trump is threat to democracy and America itself.

-

Abortion is good.

-

American Economy is stronger than ever.

-

Inflation wasn't Biden's fault.

-

Illegals are Americans too.

-

Republicans are responsible for the border crisis.

-

Trump is bad.

-

Biden stands with trans-children.

-

J6 was the worst insurrection since the Civil War.

(h/t @TCDMS99)

Tucker Carlson's response sums it all up perfectly:

"that was possibly the darkest, most un-American speech given by an American president. It wasn't a speech, it was a rant..."

Carlson continued: "The true measure of a nation's greatness lies within its capacity to control borders, yet Bid refuses to do it."

"In a fair election, Joe Biden cannot win"

And concluded:

“There was not a meaningful word for the entire duration about the things that actually matter to people who live here.”

Victor Davis Hanson added some excellent color, but this was probably the best line on Biden:

"he doesn't care... he lives in an alternative reality."

— Tucker Carlson (@TuckerCarlson) March 8, 2024

* * *

Watch SOTU Live here...

* * *

Mises' Connor O'Keeffe, warns: "Be on the Lookout for These Lies in Biden's State of the Union Address."

On Thursday evening, President Joe Biden is set to give his third State of the Union address. The political press has been buzzing with speculation over what the president will say. That speculation, however, is focused more on how Biden will perform, and which issues he will prioritize. Much of the speech is expected to be familiar.

The story Biden will tell about what he has done as president and where the country finds itself as a result will be the same dishonest story he's been telling since at least the summer.

He'll cite government statistics to say the economy is growing, unemployment is low, and inflation is down.

Something that has been frustrating Biden, his team, and his allies in the media is that the American people do not feel as economically well off as the official data says they are. Despite what the White House and establishment-friendly journalists say, the problem lies with the data, not the American people's ability to perceive their own well-being.

As I wrote back in January, the reason for the discrepancy is the lack of distinction made between private economic activity and government spending in the most frequently cited economic indicators. There is an important difference between the two:

-

Government, unlike any other entity in the economy, can simply take money and resources from others to spend on things and hire people. Whether or not the spending brings people value is irrelevant

-

It's the private sector that's responsible for producing goods and services that actually meet people's needs and wants. So, the private components of the economy have the most significant effect on people's economic well-being.

Recently, government spending and hiring has accounted for a larger than normal share of both economic activity and employment. This means the government is propping up these traditional measures, making the economy appear better than it actually is. Also, many of the jobs Biden and his allies take credit for creating will quickly go away once it becomes clear that consumers don't actually want whatever the government encouraged these companies to produce.

On top of all that, the administration is dealing with the consequences of their chosen inflation rhetoric.

Since its peak in the summer of 2022, the president's team has talked about inflation "coming back down," which can easily give the impression that it's prices that will eventually come back down.

But that's not what that phrase means. It would be more honest to say that price increases are slowing down.

Americans are finally waking up to the fact that the cost of living will not return to prepandemic levels, and they're not happy about it.

The president has made some clumsy attempts at damage control, such as a Super Bowl Sunday video attacking food companies for "shrinkflation"—selling smaller portions at the same price instead of simply raising prices.

In his speech Thursday, Biden is expected to play up his desire to crack down on the "corporate greed" he's blaming for high prices.

In the name of "bringing down costs for Americans," the administration wants to implement targeted price ceilings - something anyone who has taken even a single economics class could tell you does more harm than good. Biden would never place the blame for the dramatic price increases we've experienced during his term where it actually belongs—on all the government spending that he and President Donald Trump oversaw during the pandemic, funded by the creation of $6 trillion out of thin air - because that kind of spending is precisely what he hopes to kick back up in a second term.

If reelected, the president wants to "revive" parts of his so-called Build Back Better agenda, which he tried and failed to pass in his first year. That would bring a significant expansion of domestic spending. And Biden remains committed to the idea that Americans must be forced to continue funding the war in Ukraine. That's another topic Biden is expected to highlight in the State of the Union, likely accompanied by the lie that Ukraine spending is good for the American economy. It isn't.

It's not possible to predict all the ways President Biden will exaggerate, mislead, and outright lie in his speech on Thursday. But we can be sure of two things. The "state of the Union" is not as strong as Biden will say it is. And his policy ambitions risk making it much worse.

* * *

The American people will be tuning in on their smartphones, laptops, and televisions on Thursday evening to see if 'sloppy joe' 81-year-old President Joe Biden can coherently put together more than two sentences (even with a teleprompter) as he gives his third State of the Union in front of a divided Congress.

President Biden will speak on various topics to convince voters why he shouldn't be sent to a retirement home.

The state of our union under President Biden: three years of decline. pic.twitter.com/Da1KOIb3eR

— Speaker Mike Johnson (@SpeakerJohnson) March 7, 2024

According to CNN sources, here are some of the topics Biden will discuss tonight:

Economic issues: Biden and his team have been drafting a speech heavy on economic populism, aides said, with calls for higher taxes on corporations and the wealthy – an attempt to draw a sharp contrast with Republicans and their likely presidential nominee, Donald Trump.

Health care expenses: Biden will also push for lowering health care costs and discuss his efforts to go after drug manufacturers to lower the cost of prescription medications — all issues his advisers believe can help buoy what have been sagging economic approval ratings.

Israel's war with Hamas: Also looming large over Biden's primetime address is the ongoing Israel-Hamas war, which has consumed much of the president's time and attention over the past few months. The president's top national security advisers have been working around the clock to try to finalize a ceasefire-hostages release deal by Ramadan, the Muslim holy month that begins next week.

An argument for reelection: Aides view Thursday's speech as a critical opportunity for the president to tout his accomplishments in office and lay out his plans for another four years in the nation's top job. Even though viewership has declined over the years, the yearly speech reliably draws tens of millions of households.

Sources provided more color on Biden's SOTU address:

The speech is expected to be heavy on economic populism. The president will talk about raising taxes on corporations and the wealthy. He'll highlight efforts to cut costs for the American people, including pushing Congress to help make prescription drugs more affordable.

Biden will talk about the need to preserve democracy and freedom, a cornerstone of his re-election bid. That includes protecting and bolstering reproductive rights, an issue Democrats believe will energize voters in November. Biden is also expected to promote his unity agenda, a key feature of each of his addresses to Congress while in office.

Biden is also expected to give remarks on border security while the invasion of illegals has become one of the most heated topics among American voters. A majority of voters are frustrated with radical progressives in the White House facilitating the illegal migrant invasion.

It is probable that the president will attribute the failure of the Senate border bill to the Republicans, a claim many voters view as unfounded. This is because the White House has the option to issue an executive order to restore border security, yet opts not to do so

Maybe this is why?

Most Americans are still unaware that the census counts ALL people, including illegal immigrants, for deciding how many House seats each state gets!

— Elon Musk (@elonmusk) March 7, 2024

This results in Dem states getting roughly 20 more House seats, which is another strong incentive for them not to deport illegals.

While Biden addresses the nation, the Biden administration will be armed with a social media team to pump propaganda to at least 100 million Americans.

"The White House hosted about 70 creators, digital publishers, and influencers across three separate events" on Wednesday and Thursday, a White House official told CNN.

Not a very capable social media team...

The State of Confusion https://t.co/C31mHc5ABJ

— zerohedge (@zerohedge) March 7, 2024

The administration's move to ramp up social media operations comes as users on X are mostly free from government censorship with Elon Musk at the helm. This infuriates Democrats, who can no longer censor their political enemies on X.

Meanwhile, Democratic lawmakers tell Axios that the president's SOTU performance will be critical as he tries to dispel voter concerns about his elderly age. The address reached as many as 27 million people in 2023.

"We are all nervous," said one House Democrat, citing concerns about the president's "ability to speak without blowing things."

The SOTU address comes as Biden's polling data is in the dumps.

BetOnline has created several money-making opportunities for gamblers tonight, such as betting on what word Biden mentions the most.

As well as...

We will update you when Tucker Carlson's live feed of SOTU is published.

Fuck it. We’ll do it live! Thursday night, March 7, our live response to Joe Biden’s State of the Union speech. pic.twitter.com/V0UwOrgKvz

— Tucker Carlson (@TuckerCarlson) March 6, 2024

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 hours ago

International6 hours agoWalmart launches clever answer to Target’s new membership program

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex