Uncategorized

StockWatch: Biogen Q1 Results Beat Expectations, for a Change

Biogen finished the first quarter with net income of $393.4 million, up 1.4% from $387.9 million in Q1 2023, despite a 7% drop in revenue to $2.291 billion…

Investors and analysts are so used to bad news from Biogen (BIIB) that they seemingly didn’t know how to react when the biotech giant delivered more upbeat—or at least less downbeat—first-quarter results than expected.

Biogen finished the first quarter with net income of $393.4 million, up 1.4% from $387.9 million in Q1 2023, despite a 7% drop in revenue to $2.291 billion from $2.464 billion a year ago. The company’s GAAP diluted earnings per share (EPS) rose year-over-year, albeit by just 1%, to $2.70 from $2.67 (non-GAAP EPS, which excludes nonrecurring items, rose 8%, from $3.40 to $3.67).

“This is the first time in several years that the underlying business performance of Biogen has allowed us to actually demonstrate earnings per share growth, and that’s a major achievement,” Biogen president and CEO Christopher A. Viehbacher told analysts on the company’s quarterly earnings call. “We’ve clearly still got a lot of work to do, but I think it feels like we’re turning the corner in the company.

Biogen said its cost-cutting efforts carried out last year have begun to bear fruit, though the company’s top-selling multiple sclerosis drugs lost revenue to competition from less expensive generics.

More encouraging, however, was that the sales of three recently approved drugs surpassed analyst forecasts. The Alzheimer’s drug Leqembi® (lecanumab), which Biogen co-developed with Eisai, recorded global in-market sales of approximately $19 million, nearly double the $10 million generated in all of 2023, while the number of patients on therapy increased nearly 2.5 times since the end of 2023, Viehbacher said. While he furnished no figures, Eisai said in February that 2,000 U.S. patients were on Leqembi as of January 26 and about another 8,000 were on a waiting list.

“1Q24 earnings showed the first signs of hope for a change in the slope of Leqembi’s launch curve as physicians and institutions have refined their processes for getting patients from diagnosis to infusion,” Brian P. Skorney, a senior research analyst with Baird, wrote in a research note. “We think this could set up a subsequent strong 2Q as the patient floodgates start opening.”

Biogen’s Skyclarys® (omaveloxolone), a treatment for Friedreich ataxia patients ages 16+, fared even better, racking up $78 million in global revenue. “As of April 19, we now have over 1,100 patients on therapy. With an estimated 4,500 addressable Friedreich’s ataxia patients in the United States, we have achieved 24% market penetration,” Alisha Alaimo, Biogen’s president, head of North America, told analysts.

Another recent approval, Zurzuvae (zuranolone), which won FDA approval for postpartum depression in adults—but not for the larger market of adults with major depressive disorder—generated approximately $12 million. Biogen co-developed Zurzuvae with Sage Therapeutics.

Beating analyst forecasts

Those numbers beat analyst forecasts compiled by FactSet and reported by CNBC of $11 million for Leqembi, $68.8 million for Skyclarys, and $5 million for Zurzuvae.

Analysts following Biogen acknowledged the company’s positive results for Leqembi and Skyclarys. So too, to a lesser degree, did investors, as Biogen shares rose almost 5% Wednesday once it released its Q1 results, from $193.18 to $201.99. Biogen shares inched up another nearly 4% the rest of this past week to $209.79 in Friday afternoon trading as of 3:02 p.m. That still represents a 27% plunge from Biogen’s stock price of $288.04 a year ago on April 26, 2023.

“Sentiment is still low in the big picture, but might not be as bad as investors think and there is nice progress w/ other launches despite Leqmebi being slow,” Jefferies biotech equity analyst Michael J. Yee commented in a research note. “We think [the] stock should recover if these launches pick up in H2/24 on a backdrop of already low expectations.”

Also on the positive side, a quartet of Leerink Partners analysts led by Marc Goodman, senior managing director, neuroscience and a senior research analyst with Leerink Partners, noted that Leqembi and Skyclarys performed about in line with their expectations, while Viehbacher and other Biogen executives expressed optimism that the treatments will continue to see increases in new patient starts and sales.

“Given how low investor expectations have gotten on [Biogen’s] name, 1Q24 was pretty good news,” Goodman and colleagues observed in a research note. “We are not surprised by the stock bump of 5% in a flattish to slightly down biotech environment, as the business has somewhat stabilized, Skyclarys was OK, and Leqembi is seeing an inflection point.”

Awaiting data readouts

Goodman said he is awaiting clinical data readouts on four pipeline candidates expected at mid-year:

- Dapirolizumab pegol (BIIB133)—Phase III data in systemic lupus erythematosus (SLE). Biogen and UCB are partnering to develop the drug, now being assessed in NCT04294667 and extension study NCT04976322.

- BIIB124/SAGE324—Phase IIb data in essential tremor; Biogen and Sage Therapeutics are partnering to develop the drug, now being assessed in NCT05173012 and long-term safety and tolerability study NCT05366751.

- BIIB105—Data from the Phase I/II ALSpire trial (NCT04494256) in participants with the ALS Ataxin-2 (ATXN2) genetic mutation and broad amyotrophic lateral sclerosis (ALS).

- BIIB121—Data from the Phase Ib portion of the Phase I/II HALOS trial (NCT05127226) in Angelman syndrome. Biogen has an option to acquire an exclusive license from Ionis Pharmaceuticals, with which it is partnering to develop the drug.

Also positive on Biogen was Sumant Kulkarni, a managing director covering biotechnology stocks with Canaccord Genuity. “There were no major surprises for us in the quarter, and we are encouraged by signs of solid execution,” Kulkarni wrote in a research note.

Kulkarni raised Canaccord Genuity’s 12-month price target on Biogen shares 1%, from $305 to $308, and reiterated his firm’s “Buy” rating on the stock. “We would not be surprised if eventual 2024E EPS exceeds BIIB‘s current outlook range of $15–16,” he added.

Sales erosion

On the downside, Biogen continued to see erosion in sales of its leading drugs, namely the six treatments that comprise its multiple sclerosis (MS) franchise. Product revenue for the MS franchise slid 4% year-over-year, to $1.076 billion from $1.125 billion in the year-ago quarter.

Nearly half of those sales come from Biogen’s top-selling MS drug Tysabri® (natalizumab), which saw its product revenue fall 9% to $431.3 million from $472.8 million in Q1 2023. Tysabri saw its first biosimilar rival win FDA approval in August 2023—Tyruko® (natalizumab-sztn), marketed by Sandoz, which spun off from Novartis last October.

Outside of MS, another underperformer for Biogen during the first quarter was the spinal muscular atrophy treatment Spinraza® (nusinersen), which saw its net product revenue tumble 23%, to $341.3 million from $443.3 million in the first three months of 2023. The Q1 2024 sales fell 18% short of FactSet’s $415.1 million estimate and 21% below the $430 million estimate of William Blair analysts Myles R. Minter, PhD, and Sarah Schram, PhD.

Minter and Schram noted that Biogen has projected a full-year 2024 decline in revenue vs. 2023 by low- to mid-single digits. That would translate to about $9.4 billion, vs. the William Blair analysts’ current estimate of $9.39 billion and FactSet’s projected $9.47 billion.

“With shares down roughly 25% year-to-date prior to [Wednesday’s] update, we believe even modest signs of growth are enough to swing investor sentiment in the beaten-up name,” Minter and Schram wrote. They added that Biogen still has $4–5 billion available for future mergers and acquisitions (M&A) deals for further inorganic growth, and still generates about $3 billion in earnings before interest taxes, depreciation, and amortization (EBITDA) per year.

Also optimistic on Biogen was Wedbush Securities analyst Laura Chico, who raised her firm’s price target on Biogen 1%, from $213 to $215, while keeping its “Neutral” rating on the stock.

Cutting price targets

Not all analysts share the optimism on Biogen shown by Minter and Schram, Yee, Goodman, and Kulkarni. Three analysts lowered their price targets on Biogen shares, albeit only by single digits:

- Andrew Fein (H.C. Wainwright)—Down 8%, from $325 to $300, but maintaining the firm’s “Buy” rating.

- Carter Gould (Barclays)—Down 7%, from $215 to $200, but maintaining the firm’s “Equal Weight” rating.

- Srikripa Devarakonda (Truist Financial)—Down 1% from $344 to $340, but maintaining the firm’s “Buy” rating.

Kulkarni cautioned that in the near- to mid-term, three factors will be key to how well Biogen shares perform: 1) the Skyclarys and Zurzuvae launches, plus a potential inflection on Leqembi; 2) continued defense of its sales position for the rest of Biogen’s product base, including Spinraza and the MS franchise, “which appear to be holding up well”; and 3) further cost optimization.

Over the past near-year, Biogen has been carrying out cost cutting—including the elimination of approximately 1,000 jobs—through its “Fit for Growth” initiative, which the company had projected will generate approximately $1 billion in gross operating expense savings by 2025.

Biogen said “Fit for Growth” was on track to deliver that $1 billion in savings—and ultimately, approximately $800 million in net operating expense savings by 2025, up from the $700 million net initially projected by the company. That means only about $200 million will be reinvested into product launches and R&D programs, compared with the $300 million projected last year.

Michael McDonnell, Biogen executive vice president and CFO, told analysts on the earnings call that while Spinraza’s U.S. revenue was up 1% year-over-year, the drug was hurt by a 35% decline in revenue outside the United States.

“The majority of this year-over-year decline was due to shipment timing in certain emerging markets,” McDonnell explained. “We continue to generally see stable patient numbers globally, and we would expect the shipping dynamic outside the U.S. to largely normalize throughout the remainder of 2024. We also saw some modest negative impacts from competition and foreign exchange in the quarter.”

As a result, McDonnell said, “We expect global Spinraza revenue to decline by a low-single-digit percentage” for the full year 2024.

Leaders and laggards

- Biodexa Pharmaceuticals (BDRX) shares rocketed 74% from $0.72 to $1.25 Friday, after the company said it signed an exclusive license with Rapamycin Holdings (Emtora Biosciences) for worldwide rights to “develop, manufacture, commercialize, and otherwise advance the clinical potential of” eRapa, a Phase III-ready drug candidate designed to treat familial adenomatous polyposis (FAP). Biodexa’s Phase III FAP program will be funded by a $17 million grant from the Cancer Prevention and Research Institute of Texas (CPRIT), a $6 billion, 20-year initiative approved by Texas voters to fund cancer-related research, product development, and prevention efforts. Biodexa said Phase II results for eRapa in FAP will be presented at two “leading” scientific conferences in Q2.

- Cidara Therapeutics (CDTX)shares tumbled 25% from $13.62 to $10.25 between April 22 and Tuesday, before bouncing back 20% on Wednesday, to $12.29, after reacquiring global rights from Janssen Pharmaceuticals (Johnson & Johnson) to CD388, which is in development for the prevention of all strains of influenza A and B, and completing a $240 million private placement financing led by RA Capital Management with “significant” participation by Bain. Cidara began the week acknowledging receipt of a delinquency notice from Nasdaq because it was late filing its Form 10-K Annual Report for the fiscal year ended December 31, 2023, with the U.S. Securities and Exchange Commission (SEC). Cidara filed the Form 10-K on April 22. Earlier, Cidara said it needed more time to account for indirect taxes, and related interest and penalties, in various ex-U.S. tax jurisdictions based on its supply chain activities in 2023 and prior years.

- Nvidia (NVDA) shares climbed 15% this past week from $762 on April 19 to $877.76 on Friday, capping a week marked by the company’s acquisition of Tel Aviv-based Run:ai, a provider of workload management and orchestration software based on the Kubernetes open-source system, for a price reported by Globes to be between $680 million to $720 million. Nvidia, which is expanding its presence in the life sciences, said Run:ai customers—including “some of the world’s largest enterprises across multiple industries”—use the company’s platform to manage data-center-scale graphic processing unit (GPU) clusters. During the pandemic, Run:ai helped the London Medical Imaging & Artificial Intelligence Centre for Value-Based Healthcare (AI Centre) manage AI resources as it developed a COVID-19 diagnostic tool. “Run:ai has been a close collaborator with NVIDIA since 2020 and we share a passion for helping our customers make the most of their infrastructure,” Omri Geller, Run:ai cofounder and CEO, said in a statement.

The post StockWatch: Biogen Q1 Results Beat Expectations, for a Change appeared first on GEN - Genetic Engineering and Biotechnology News.

depression pandemic covid-19 nasdaq emerging markets stocks treatment fda genetic therapyUncategorized

The Teams Are Set For World War III

The Teams Are Set For World War III

Authored by Toby Rogers via The Brownstone Institute,

I’ve seen some crazy things over the last few…

Authored by Toby Rogers via The Brownstone Institute,

I’ve seen some crazy things over the last few years but this is off-the-charts insane.

Last week, Michael E. Mann spoke at the EcoHeath Alliance: Green Planet One Health Benefit 2024. Just to recap who each of these players are:

-

Michael E. Mann is the creator of the “hockey stick graph” that has driven the global warming debate for the last 25 years.

-

EcoHealth Alliance is the CIA cutout led by Peter Daszak that launders money from the NIH to the Wuhan Institute of Virology to create gain-of-function viruses (including SARS-CoV-2 which killed over 7 million people).

-

“One Health” is the pretext the World Health Organization (WHO) is using to drive the Pandemic Treaty that will vastly expand the powers of the WHO and create economic incentives for every nation on earth to develop new gain-of-function viruses.

So a leader in the global warming movement spoke at an event to raise money for the organization that just murdered 7 million people and the campaign that intends to launch new pandemics in perpetuity to enrich the biowarfare industrial complex.

And then just for good measure, Peter Hotez reposted all of this information on Twitter, I imagine in solidarity with all of the exciting genociding going on.

Mann’s appearance at this event is emblematic of a disturbing shift that has been years in the making. Serious and thoughtful people in the environmental movement tried to address industrial and military pollution for decades. Now their cause has been co-opted by Big Tech and other corporate actors with malevolent intentions — and the rest of the environmental movement has gone along with this, apparently without objection. So we are witnessing a convergence between the global warming movement, the biowarfare industrial complex, and the WHO pandemic treaty grifters.

I wish it wasn’t true but here we are.

Before I go any further I need to make one thing clear: the notion that pandemics are driven by global warming is complete and total bullsh*t. The evidence is overwhelming that pandemics are created by the biowarfare industrial complex including the 13,000 psychopaths who work at over 400 US bioweapons labs (as described in great detail in The Wuhan Cover-Up).

Unfortunately “global warming” has become a cover for the proliferation of the biowarfare industrial economy.

Mann’s appearance at an event to raise money for people who are clearly guilty of genocide (and planning more carnage) made me realize that this really is World War III. They are straight-up telling us who they are and what they intend to do.

The different sides in this war are not nation-states.

Instead, Team Tyranny is a bunch of different business interests pushing what has become a giant multi-trillion dollar grift.

And Team Freedom is ordinary people throughout the world just trying to return to the classical economic and political liberalism that drove human progress from 1776 until 2020.

Here’s how I see the battle lines being drawn:

TEAM TYRANNY

Their base: Elites, billionaires, the ruling class, the biowarfare industrial complex, intelligence agencies, and bougie technocrats.

Institutions they control: WEF, WHO, UN, BMGF, World Bank, IMF, most universities, the mainstream media, and liberal governments throughout the developed world.

Economic philosophy: The billionaires should control all wealth on earth. The peasants should only be allowed to exist to serve the billionaires, grow food, and fix the machines when necessary. Robots and Artificial Intelligence will soon be able to replace most of the peasants.

Political philosophy: Centralized control of everything. Elites know best. The 90% should shut up, pay their taxes, take their vaccines, develop chronic disease, and die. High tech global totalitarianism is the best form of government. Billionaires are God.

Philosophy of medicine: Allopathic. Cut, poison, burn, kill. Corporations create all knowledge. Bodies are machines. Transhumanism is ideal. The billionaires will soon live forever in the digital cloud.

Their currency: For now, inflationary Federal Reserve policies. Soon, Central Bank Digital Currency (CBDC) that will put the peasants in their place once and for all.

Policy vehicles to advance their agenda: One Health; WHO Pandemic Treaty; social credit scores; climate scores; vaccine mandates/passports; lockdowns and quarantine camps; elimination of small farms and livestock; corporate control of all food, land, water, transportation, and the weather; corporate control of social movements; and 15-minute cities for the peasants.

Military strategy: Gain-of-function viruses, propaganda, and vaccines.

TEAM FREEDOM

Our base: The medical freedom movement, Constitutionalists, small “l” libertarians, independent farmers, natural meat and milk producers, pirate parties, natural healers, homeopaths, chiropractors, integrative and functional medicine doctors, and osteopaths.

Aligned institutions: CHD, ICAN, Brownstone Institute, NVIC, SFHF, the RFK, Jr. campaign, the Republican party at the county level…

Economic philosophy: Small “c” capitalism. Competition. Entrepreneurship.

Political philosophy: Classical liberalism. The people, using their own ingenuity, will generally figure out the best way to do things. Decentralize everything including the internet. If the elites would just leave us alone the world would be a much more peaceful, creative, and prosperous place. Human freedom leads to human flourishing.

Philosophy of medicine: Nature is infinite in its wisdom. Listen to the body. Systems have the ability to heal and regenerate.

Our currency: Cash, gold, crypto, and barter. (I don’t love crypto but lots of smart people in our movement do.)

Policy ideas: Exit the WHO. Boycott WEF companies. Repeal the Bayh-Dole Act, NCVIA Act, Patriot Act, and PREP Act. Add medical freedom to the Constitution. Prosecute the Faucistas at Nuremberg 2.0. Overhaul the NIH, FDA, CDC, EPA, USDA, FCC, DoD, and intelligence agencies. Make all publicly-funded scientific data available to the public. Ban insider trading by Congress. Support and protect organic food, farms, and farmers’ markets. Break up monopolies. Cut the size of the federal government in half (or more).

Our preferred tools to create change: Ideas, love for humanity, logic and reason, common sense, art and music, and popular uprising.

What would you add, subtract, or change in each of these lists?

* * *

Republished from the author’s Substack

Uncategorized

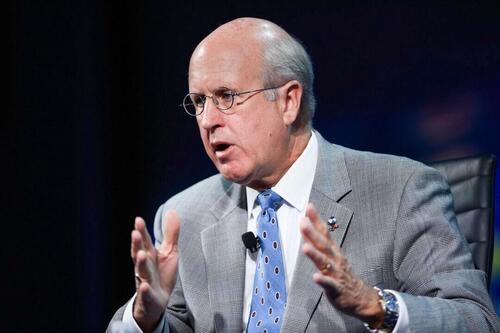

Washington’s Fiscal Mess Is Irresponsible, Unethical, Immoral: Former US Comptroller General

Washington’s Fiscal Mess Is Irresponsible, Unethical, Immoral: Former US Comptroller General

Authored by Andrew Moran via The Epoch Times,

In…

Authored by Andrew Moran via The Epoch Times,

In 2007, the U.S. national debt was below $10 trillion, and the budget deficit was about $160 billion. Federal spending was about $3 trillion, and interest payments were approximately $400 billion.

Then the numbers spiraled out of control.

Washington’s fiscal situation has drastically changed since then; total debt has surpassed $34 trillion, the annual budget shortfall exceeds $1 trillion, and interest costs have topped $1 trillion.

David Walker, the former comptroller general of the United States and a Main Street Economics advisory board member, is unsurprised.

Seventeen years ago, Mr. Walker rang fiscal alarm bells. Like Ross Perot before him, he took his case to the American people and delivered the cold, hard truth: The government’s books are unsustainable, and interest charges on the mounting debt will swallow a significant portion of federal revenues.

During this time, the former head of the Government Accountability Office (GAO) appeared on a widely viewed episode of “60 Minutes,” toured the country to spotlight worrisome trends in the U.S. government’s budget (he did this again in 2012), and attempted to convince lawmakers of the unsustainable fiscal path.

He also penned a 2009 book titled “Comeback America: Turning the Country Around and Restoring Fiscal Responsibility.”

Given the treasure trove of budgetary numbers coming out of the nation’s capital almost daily, such as nearly half of income tax revenues being dedicated to interest payments, Mr. Walker’s warnings have not been heeded nearly two decades later.

According to the Congressional Budget Office’s long-term outlooks, the national debt will eye $50 trillion by 2034, fueled by around $17 trillion in cumulative deficits. As a percentage of GDP, debt held by the public and the deficit will reach 166 percent and 8.5 percent by 2054, respectively, the CBO forecasts.

“Washington has become addicted to spending, deficits, and debt, and they’re charging the credit card and planning to send the bill to younger and future generations of Americans,” Mr. Walker told The Epoch Times.

“That’s irresponsible. It’s unethical, and it’s immoral, and it needs to stop.”

Is the United States past the point of no return?

“Only God knows when the tipping point is going to occur, and God’s not telling us,” he said.

He combs through various metrics to gauge the situation.

One of these is the debt-to-GDP ratio, which is presently at about 122 percent. Outside of the coronavirus pandemic, this is a record high.

Mandatory spending as a percentage of the federal budget is another metric. It currently stands at around 73 percent.

Another one is interest as a percentage of the budget, which is close to 15 percent.

For Mr. Walker, it is not only raw numbers but what the trends are displaying, which requires a deep dive into demographics.

“We have an aging society with longer lifespans, relatively fewer workers, supporting more retirees, and a skills gap,” he noted.

Last year, two notable developments happened: a majority of Baby Boomers were at least 65, and the birth rate tumbled to the lowest in a century.

This will metastasize into a costly burden for the federal government, particularly Social Security.

The Peter G. Peterson Foundation estimates that the current worker-to-beneficiary ratio is 2.8-to-1, down from 5.1-to-1 in 1960. By 2035, the Social Security Administration projects the ratio will further slide to 2.3-to-1.

Republicans and Democrats

President Joe Biden has claimed that he has acted fiscally responsibly, telling a crowd at a North America’s Building Trades Unions event on April 24 that he cut the national debt. President Biden has repeatedly touted this claim over the last 18 months, although he has added close to $7 trillion to the national debt since taking office in 2021.

While Republicans have griped over the current administration’s spending endeavors, experts assert that the GOP has also contributed trillions of dollars to the debt pile. One of the GOP-led expansionist initiatives was Medicare Part D under former President George W. Bush.

This program, which was designed to utilize private health care plans to offer drug coverage to Medicare beneficiaries, added $8 trillion in new unfunded obligations. Mr. Walker accepted that “the politicians were totally out of touch with fiscal reality,” considering that Medicare was already underfunded by $19 trillion.

Former U.S. President George W. Bush speaks at Seminole Golf Club in Juno Beach, Fla., on May 7, 2021. (Cliff Hawkins/Getty Images)

Put simply, both parties have been fiscally irresponsible, and now the bills are coming due.

Mr. Walker purported that politicians suffer from myopia as they are too focused on the next election and, as a result, fearful of making tough decisions. They also experience tunnel vision, he says, meaning they only concentrate on one issue at a time “without understanding the interdependency” and “the collateral effect.”

Self-interest is another malady infecting both sides of the aisle as they aim to keep their jobs and ensure their party stays in power.

“We’ve lost our sense of stewardship,” he said.

“Stewardship is not just generating results today, not just leaving things better off when you leave them when you came, but better positioned for the future,” Mr. Walker explained. “We’ve lost that sense. We need to regain it if we want our future to be better than our past.”

He identified Rep. Jody Arrington (R-Texas), who chairs the House Budget Committee, as one of the few lawmakers to realize the fiscal issues by committing to the Fiscal Commission Act and supporting a constitutional amendment that would limit government growth and stabilize the debt-to-GDP ratio.

“There are others, but there’s not enough,” Mr. Walker said.

Earlier this year, the House Budget Committee advanced the Fiscal Commission Act of 2024 out of committee with bipartisan support.

The bill would establish a 16-member panel featuring six Republicans, six Democrats, and four outside experts without voting power. The group would explore strategies to balance the budget as soon as possible and assess mechanisms to enhance the long-term solvency of various entitlement programs, especially Social Security and Medicare.

Despite some consternation from several Democrats, the bipartisan push received applause, including from the Committee for a Responsible Federal Budget.

“The federal debt is on an unsustainable course, and lawmakers have been unable or unwilling to correct it,” the organization stated. “A fiscal commission would bring Members of both parties and chambers together to facilitate a conversation over how to solve these problems, without pre-prescribing any particular solution (or a solution at all).”

Hope and Change

Whether the United States can improve its fiscal trajectories remains to be seen.

Mr. Walker is hopeful about some of the legislative efforts coming out of the nation’s capital. The country is beginning to face the consequences of years of fiscal mismanagement, making it harder to sell its debt to the rest of the world.

In recent months, many Treasury auctions have led to lackluster demand among domestic and foreign investors. Market watchers have warned that global financial markets might share Fitch and Moody’s concerns about America’s fiscal deterioration.

But when discussing trillions of dollars, percentages, GDP, and servicing costs, how can the average person, worried about paying his mortgage or replacing a broken-down refrigerator, grasp or even be concerned with these trends?

According to Mr. Walker, you tap into their “head and heart.”

“You have to help them understand that we’re already seeing some of the implications of fiscal irresponsibility,” he said, adding that the causes of the Roman Empire’s demise are familiar to what is transpiring in the United States today: fiscal irresponsibility, a decline in moral values, an overextended military, and an inability to control its borders.

However, while it is vital to translate these gigantic numbers into terms the layman can understand, experts also need to “hit their heart.”

“Do they love their country? Do they love their kids, and do they love their grandkids?” he said. “We’re mortgaging their future at record rates.”

Uncategorized

Book Bits: 27 April 2024

● The Algebra of Wealth: A Simple Formula for Financial Security Scott Galloway Q&A with author via New York magazine Q: Over the last ten years…

● The Algebra of Wealth: A Simple Formula for Financial Security

Scott Galloway

Q&A with author via New York magazine

Q: Over the last ten years or so, you had the idea of crypto democratizing finance. Now you have AI democratizing talent, like there’s this hack around wealth and around work.

A: I don’t want to call them get-rich-quick schemes — but the number of people who have made money by buying crypto or buying Nvidia when it was a $10 (now it’s at $800) is small. Even among those few who have managed to do so, a lot give most of it back because they fall under the illusion of thinking it was about skill rather than luck. They double down and start making bigger bets on even riskier assets. The market reminds them in a fairly ugly way that they actually aren’t good. They just got very lucky. I find over the long term, luck is pretty symmetrical. There are people who have made a lot of money in meme stocks; most of them gave it all back because they started conflating luck with talent.

● A Wealth of Well-Being: A Holistic Approach to Behavioral Finance

● A Wealth of Well-Being: A Holistic Approach to Behavioral Finance

Meir Statman

Interview with author via Morningstar

Today on the podcast, we welcome back Meir Statman, the behavioral finance expert and author on the connection between financial well-being and life well-being, the role of social comparisons, and more. Meir is the Glenn Klimek Professor of Finance at Santa Clara University. Meir’s latest book is A Wealth of Well-Being: A Holistic Approach to Behavioral Finance. Other books include Behavioral Finance: The Second Generation, What Investors Really Want, and Finance for Normal People. Meir’s research has also been published in the Journal of Finance, the Financial Analyst Journal, the Journal of Portfolio Management, and many other journals. He received his PhD from Columbia University and his BA and MBA from the Hebrew University of Jerusalem.

-

Government3 weeks ago

Government3 weeks agoClimate-Con & The Media-Censorship Complex – Part 1

-

International1 week ago

International1 week agoJ&J’s AI head jumps to Recursion; Doug Williams resigns as Sana’s R&D chief

-

Government4 days ago

Government4 days agoCOVID-19 Vaccine Emails: Here’s What The CDC Hid Behind Redactions

-

International2 weeks ago

International2 weeks agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment3 weeks ago

Spread & Containment3 weeks agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized1 day ago

Uncategorized1 day agoPopular fast-food restaurant chain files Chapter 11 bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCan language models read the genome? This one decoded mRNA to make better vaccines.