Uncategorized

Seattle startup using artificial intelligence for mental health screening tech raises $8M

The news: Seattle healthcare startup Aiberry raised $8 million for its AI-powered software that analyzes audio, visual, and language from a short conversation…

The news: Seattle healthcare startup Aiberry raised $8 million for its AI-powered software that analyzes audio, visual, and language from a short conversation to screen for mental health conditions.

How it works: Aiberry’s tool can be used on any digital device with a microphone and camera. It prompts the user over a three- to five-minute conversation with questions such as “how have you been feeling lately?” The tool adapts to a user’s speaking style.

“You can talk to her as you would with a trusted friend or a therapist,” co-CEO Linda Chung told GeekWire.

Aiberry gathers the information and presents it in a dashboard that provides a risk score for mental health conditions including depression, anxiety and suicidal ideation. It also provides insights into mood, concentration and energy levels.

The idea is to give healthcare providers an alternative to conventional clinical screening questionnaires that can require patients to answer the same questions repeatedly and rate their own symptoms. Patients can also track their own symptoms.

Aiberry’s platform is compliant with federal health privacy regulations, according to the company.

AI and healthcare: AI is leveraged by other mental health startups such as Seattle-area Lyssn, which evaluates conversations between providers and patients. Eugene-Ore.-based Ksana Health markets an AI-supported app that measures mental health from smartphone and wearable data.

Academic researchers have also studied how the content of text messages can potentially indicate worsening mental health. Some have developed experimental AI-powered programs to assess mental health through voice patterns and key words, and others have incorporated video.

There are also startups beyond healthcare using AI to analyze conversations, such as Seattle startup Read, which measures engagement and sentiment of participants on video meetings.

Digital health companies generally use standard screening tools to assess mental health status, said co-CEO Johan Bjorkland. Aiberry is meant to be used with a therapist, he added.

“We are giving a risk assessment,” said Bjorklund. “But any real clinical judgment, any diagnosis is not set by an AI, it’s set by a trained professional, a human.”

The people: Aiberry (pronounced “I-berry”) leverages research by co-founder Newton Howard and his colleagues. Howard, a neuroscientist and computer scientist at Oxford University, explores how to use computational methods to assess mental health through analyzing facial expressions and speech content and tone.

Other co-founders include Chung, a former speech language pathologist, and Bjorklund, an electrical engineer and former executive with communications giant Ericsson who also serves as CEO of Bellevue, Wash.-based telecommunications company Betacom. The co-founding team is rounded out by former Ericsson executive Lior Auslander, the startup’s executive vice president of product and technology.

What’s ahead: Aiberry launched a clinical study in September at sites including Georgetown University and the University of Arizona. The study will evaluate its ability to predict self-reported symptoms of depression and anxiety in 800 patients and compare the data to that from standard checklists.

Though the company is currently selling to clinicians, it sees future marketing opportunities in corporate wellness, said Bjorklund. He could also see partnering with other mental health companies such as Talkspace, Headspace Health and Teledoc Health.

“If you’re able to screen people regularly — and this can be at schools, doctor’s offices and workplaces — then we’re helping with early identification, and that leads to early intervention and better outcomes,” said Chung.

Investment: Confluence Capital Group led the seed round with participation from Ascension AI. Aiberry built a prototype tool after launching in 2019 and raised a pre-seed round of $2 million in 2021, riding a wave of funding for mental health startups that reached $5.5 billion globally that year.

depression pandemicUncategorized

Walmart and Target make key self-checkout changes to fight theft

Both chains are making changes customers may not like, but self-checkout isn’t going anywhere, according to one industry expert.

In parts of the world, public bathrooms come with a charge, but people pay on the honor system. The money charged allows for better upkeep of the facilities and most people don't mind dropping a small bill or some coins into a lockbox and many of the people who don't are likely dealing with larger problems.

The honor system, however, requires honor. It's based on the idea that most people are trustworthy and that they will pay their fair share.

Related: Beloved mall retailer files Chapter 7 bankruptcy, will liquidate

In the case of a bathroom, people cheating the system are only stealing a low-value service. In the case of self-checkout, a variation on the honor system, people looking to steal by "forgetting" to scan an item can be a very expensive problem.

That has led retailers including Target, Walmart, and Dollar General to make changes. Target has limited the amount of items you can scan at self-checkout at some stores while Dollar General has literally eliminated it in some locations.

Walmart, like Target, has experimented with item limits and limiting the hours of operation for self-checkout. Now, in some stores, the chain has decided to designate some of its self-checkout stations for Walmart+ members and delivery drivers using the Spark app.

Advantage Solutions General Manager Andy Keenan answered some questions about Walmart, self-checkout, and theft from TheStreet via email.

Image source: John Smith/VIEWpress.

What Walmart's self-checkout changes mean

TheStreet: What are the benefits of reserving self-checkout registers for Spark drivers and Walmart+ customers?

Keenan: The benefits include exclusivity and perks of membership, speed, and convenience when shopping.

TheStreet: If this rolls out more broadly, what do you anticipate being the impact on non-Walmart+ customers?

Keenan: There is the potential for non-Walmart+ customers to become agitated, they are losing convenience because they are not enrolled. Customers who are looking for convenience will have fewer options for speed to check out.

TheStreet: Do lane restrictions like limiting lanes to 10 items or fewer help reduce time spent waiting in lines?

Keenan: Yes, but retailers must have a diverse amount of check lane options including 10 items or fewer to ensure that the speed of checkout actually transpires.

TheStreet: Do you believe self-checkout is leading to partial shrink? If so, do you think that this move to shut off self-checkout lanes will help prevent theft in the future?

Keenan: Yes, self-checkout is leading to partial shrink. We believe this tends to be more due to errors in scanning and intentional theft.

There are already front-end transformation tests going on in stores, reducing the number of self-checkouts and shifting back to cashier checkouts in order to measure the reduction in shrink. Early indicators show that a move back to cashier checkouts combined with other shrink initiatives will help prevent theft.

Self-checkout is not going away

While changes are ongoing, Keenan believes self-checkout is here to stay.

“Self-checkout is not, as one recent article called it, a failed experiment. It’s actually part of the next evolution of the retail customer experience, and evolutions take time,” Keenan said in a web post about the findings of the 2024 Advantage Shopper Outlook survey.

He makes it clear that rising labor costs and struggles to find workers make some for of self-checkout inevitable.

“Since the pandemic, there’s been a revolution on hourly labor,” Keenan said. “Labor in certain markets that would cost you $16 an hour now costs you $19 or $20 an hour, and it’s a gig economy. The people who once stood at a checkout stand in the front of a store are now driving for Instacart or DoorDash because the hours are more flexible. They want to make their own schedule, and it’s varied work. Today, most retailers can’t offer that.”

Basically, while there are kinks to work out, self-checkout simply makes sense for retailers.

“The notion that we’re going to pivot away from technology that helps offset labor needs and will ultimately continue to improve customer experience because of some challenges is far-fetched. We need to continue to embrace the technology and realize that it may always be imperfect, but it will always be evolving. The noise that, ‘Oh, self-checkout might not be working,’ that’s just a moment in time,” he added.

bankruptcy pandemicUncategorized

Good news and bad news Thursday: the bad news is real retail sales

– by New Deal democratThe bad economic news this morning was that after taking into account inflation, retail sales, which rose 0.6% nominally, were…

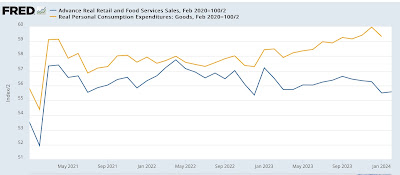

- by New Deal democrat

Uncategorized

Hitting Home: Housing Affordability in the U.S.

The Issue:

Housing is becoming unaffordable to a widening swathe of the American population. This deteriorating affordability directly impacts American…

The Issue:

Housing is becoming unaffordable to a widening swathe of the American population. This deteriorating affordability directly impacts American lives, including where people choose to live and work. It has also been cited as a major contributor to key social problems like rising homelessness and worsening child wellbeing.

The Facts:

- Median house prices are now 6 times the median income, up from a range of between 4 and 5 two decades ago. In cities along the coasts, the numbers are higher, exceeding 10 in San Francisco.

- The ratio of median rents to median income has also crept from 25 percent to 30 percent in two decades.

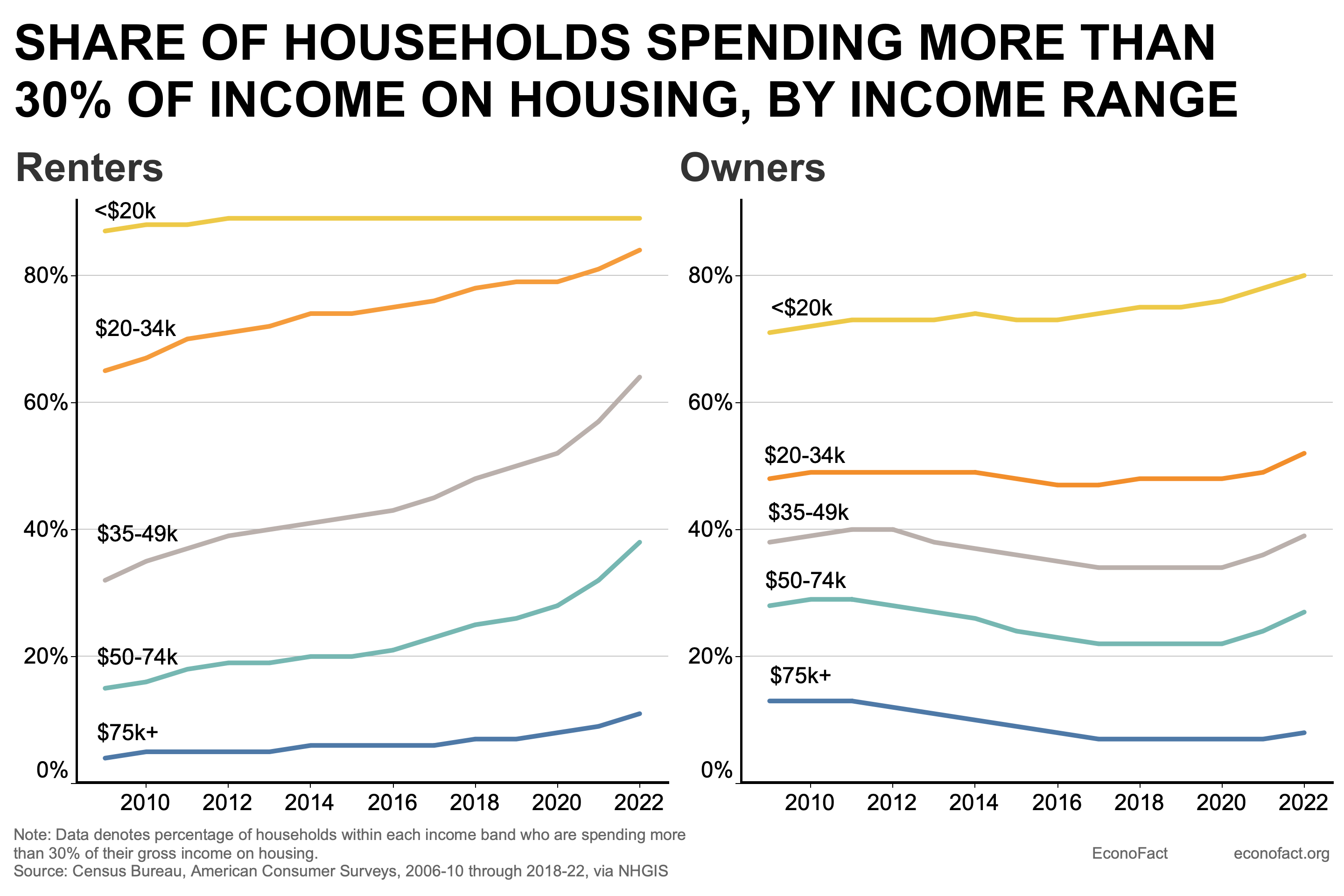

- Households — renters in particular — are increasingly cost-burdened, having to spend more than 30% of their income on rent, mortgage and other housing needs. Among homeowners, about 40 percent of those in the $35-49 income range are cost-burdened. The share of cost-burdened renters in that income range has risen sharply from under 40 percent of households in 2010 to over 60 percent today (see chart).

- Historically, rural and interior areas of the country have been more affordable. But, even prior to the pandemic, migration toward these locations has helped drive faster house price appreciation than in more expensive regions.

- Demographic developments have contributed to the demand-supply imbalance. Supply is crimped by more older Americans opting to age in place. On the demand side, the biggest driver is new household formation. Americans formed about a million new households a year between 2015-2017, but the pace has almost doubled according to the most recent data, largely reflecting a pickup in household formation rates among millennials.

- A long-standing lack of homebuilding, which partly reflects tight regulatory restrictions in many parts of the country, has also contributed to rising home prices.

- More recently, higher interest rates since 2022 have exacerbated these secular trends to make housing even more unaffordable. The mortgage rate on a 30-year home loan soared from 3 ½ percent in early 2022 to nearly 8% in October 2023 as the Fed raised policy interest rates; the mortgage rate had only eased to about 7% in March 2024 as the tightening cycle had peaked. The problem is compounded by mortgage lock-in: higher interest rates have left many homeowners — many of whom bought homes or refinanced at the lows of 2020-21 — with cheaper-than-market mortgages, reluctant to sell their house and reset their mortgage at current, higher rates.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 days ago

International6 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges