Uncategorized

Rural Americans aren’t included in inflation figures – and for them, the cost of living may be rising faster

The rising cost of living doesn’t hit all Americans equally. Yet the benchmark figure for charting the rising cost of living excludes people in rural…

When the Federal Reserve convenes at the end of January 2023 to set interest rates, it will be guided by one key bit of data: the U.S. inflation rate. The problem is, that stat ignores a sizable chunk of the country – rural America.

Currently sitting at 6.5%, the rate of inflation is still high, even though it has fallen back slightly from the end of 2022.

The overall inflation rate, along with core inflation – which strips out highly volatile food and energy costs – is seen as key to knowing whether the economy is heating up too fast, and guided the Fed as it imposed several large 0.75 percentage point interest rate increases in 2022. The hope is that raising the benchmark rate, which in turn increases the costs of taking out a bank loan or mortgage, for example, will help reduce inflation back to the Fed target of around 2%.

But the main indicator of inflation, the consumer price index, is compiled by looking at the changes in price specifically urban Americans pay for a set basket of goods. Those living in rural America are not surveyed.

As economists who study rural America, we believe this poses a problem: People living outside America’s cities represent 14% of the U.S. population, or around 46 million people. They are likely to face different financial pressures and have different consumption habits than urbanites.

The fact that the Bureau of Labor Statistics surveys only urban populations for the consumer price index makes assessing rural inflation much more difficult – it may even be masking a rural-urban inflation gap.

To assess if such a gap exists, one needs to turn to other pricing data and qualitative analyses to build a picture of price growth in nonurban areas. We did this by focusing on four critical goods and services in which rural and urban price effects may be significantly different. What we found was rural areas may indeed be suffering more from inflation than urban areas, creating an underappreciated gap.

1. The cost of running a car in the country

Higher costs related to cars and gas can contribute to a urban-rural inflation gap, severely eating into any discretionary income for families outside urban areas, a 2022 report found.

This is likely related to there being considerable differences in vehicle purchases, ownership and lengths of commutes between urban and rural Americans.

Car ownership is integral to rural life, essential for getting from place to place, whereas urban residents can more easily choose cheaper options like public transit, walking or bicycling. This has several implications for expenses in rural areas.

Rural residents spend more on car purchases out of necessity. They are also more likely to own a used car. During the first year of the COVID-19 pandemic, there was a huge increase in used car prices as a result of a lack of new vehicles due to supply chain constraints. These price increases likely affected remote areas disproportionately.

Rural Americans tend to drive farther as part of their day-to-day activities. Because of greater levels of isolation, rural workers are often required to make longer commutes and drive farther for child care, with the proportion of those traveling 50 miles (80 kilometers) or more for work having increased over the past few years. In upper Midwest states as of 2018, nearly 25% of workers in the most remote rural counties commute 50 miles (80 kilometers) or more, compared with just over 10% or workers in urban counties.

Longer journeys mean cars and trucks will wear out more quickly. As a result, rural residents have to devote more money to repairing and replacing cars and trucks – so any jump in automotive inflation will hit them harder.

Though fuel costs can be volatile, periods of high energy prices – such as the one the U.S. experienced through much of 2022 – are likely to disproportionately affect rural residents given the necessity and greater distances of driving. Anecdotal evidence also suggests gas prices can be higher in rural communities than in urban areas.

2. Rising cost of eating at home – and traveling for groceries

As eating away from home becomes more expensive, many households may choose to eat in more often to cut costs. But rural residents already spend a larger amount on eating at home – likely due in part to the slimmer choices available for eating out.

This means they have less flexibility as food costs rise, particularly when it comes to essential grocery items for home preparation. And with the annual inflation of the price of groceries outpacing the cost eating out – 11.8% versus 8.3% – dining at home becomes comparably more expensive.

Rural Americans also do more driving to get groceries – the median rural household travels 3.11 miles (5 kilometers) to go to the nearest grocery store, compared with 0.69 miles (1.1 kilometers) for city dwellers. This creates higher costs to feed a rural family and again more vehicle depreciation.

Rural grocery stores are also dwindling in number, with dollar stores taking their place. As a result, fresh food in particular can be scarce and expensive, which leads to a more limited and unhealthy diet. And with food-at-home prices rising faster than prices at restaurants, the tendency of rural residents to eat more at home will see their costs rising faster.

3. The cost of growing old and ill outside cities

Demographically, rural counties trend older – part of the effect of younger residents migrating to cities and college towns for either work or educational reasons. And older people spend more on health insurance and medical services. Medical services overall have been rising in cost too, so those older populations will be spending more for vital doctors visits.

Again with health, any increase in gas prices will disproportionately hit rural communities more because of the extra travel needed to get even primary care. On average, rural Americans travel 5 more miles (8 kilometers) to get to the nearest hospital than those living in cities. And specialists may be hundreds of miles away.

4. Cheaper home costs, but heating and cooling can be expensive

Rural Americans aren’t always the losers when it comes to the inflation gap. One item in rural areas that favors them is housing.

Outside cities, housing costs are generally lower, because of more limited demand. More rural Americans own their homes than city dwellers. Since owning a home is generally cheaper than renting during a time of rising housing costs, this helps insulate homeowners from inflation, especially as housing prices soared in 2021.

But even renters in rural America spend proportionately less. With housing making up around a third of the consumer price index, these cost advantages work in favor of rural residents.

However, poorer-quality housing leaves rural homeowners and renters vulnerable to rising heating and cooling costs, as well as additional maintenance costs.

Inflation – a disproportionate burden

While there is no conclusive official quantitative data that shows an urban-rural inflation gap, a review of rural life and consumption habits suggests that rural Americans suffer more as the cost of living goes up.

Indeed, rural inflation may be more pernicious than urban inflation, with price increases likely lingering longer than in cities.

Stephan Weiler receives funding from the US Economic Development Administration. He is affiliated with the Regional Economic Development Institute (REDI@CSU).

Tessa Conroy receives funding from the United States Department of Commerce Economic Development Administration in support of Economic Development Authority University Center (Award No. ED21CHI3030029 and CARES Act award no. ED20CHI30700477). Any opinions, findings, conclusions or recommendations expressed in this material are those of the authors and do not necessarily reflect the views of the U.S. Department of Commerce Economic Development Administration.

fed federal reserve pandemic covid-19 interest ratesUncategorized

Pharma industry reputation remains steady at a ‘new normal’ after Covid, Harris Poll finds

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45%…

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45% of US respondents in 2023, according to the latest Harris Poll data. That’s exactly the same as the previous year.

Pharma’s highest point was in February 2021 — as Covid vaccines began to roll out — with a 62% positive US perception, and helping the industry land at an average 55% positive sentiment at the end of the year in Harris’ 2021 annual assessment of industries. The pharma industry’s reputation hit its most recent low at 32% in 2019, but it had hovered around 30% for more than a decade prior.

“Pharma has sustained a lot of the gains, now basically one and half times higher than pre-Covid,” said Harris Poll managing director Rob Jekielek. “There is a question mark around how sustained it will be, but right now it feels like a new normal.”

The Harris survey spans 11 global markets and covers 13 industries. Pharma perception is even better abroad, with an average 58% of respondents notching favorable sentiments in 2023, just a slight slip from 60% in each of the two previous years.

Pharma’s solid global reputation puts it in the middle of the pack among international industries, ranking higher than government at 37% positive, insurance at 48%, financial services at 51% and health insurance at 52%. Pharma ranks just behind automotive (62%), manufacturing (63%) and consumer products (63%), although it lags behind leading industries like tech at 75% positive in the first spot, followed by grocery at 67%.

The bright spotlight on the pharma industry during Covid vaccine and drug development boosted its reputation, but Jekielek said there’s maybe an argument to be made that pharma is continuing to develop innovative drugs outside that spotlight.

“When you look at pharma reputation during Covid, you have clear sense of a very dynamic industry working very quickly and getting therapies and products to market. If you’re looking at things happening now, you could argue that pharma still probably doesn’t get enough credit for its advances, for example, in oncology treatments,” he said.

vaccine pandemic covid-19Uncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

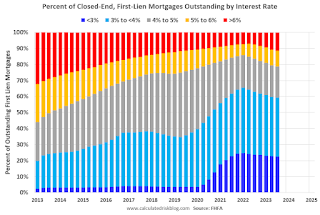

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

Uncategorized

‘Bougie Broke’ – The Financial Reality Behind The Facade

‘Bougie Broke’ – The Financial Reality Behind The Facade

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming…

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Social media users claiming to be Bougie Broke share pictures of their fancy cars, high-fashion clothing, and selfies in exotic locations and expensive restaurants. Yet they complain about living paycheck to paycheck and lacking the means to support their lifestyle.

Bougie broke is like “keeping up with the Joneses,” spending beyond one’s means to impress others.

Bougie Broke gives us a glimpse into the financial condition of a growing number of consumers. Since personal consumption represents about two-thirds of economic activity, it’s worth diving into the Bougie Broke fad to appreciate if a large subset of the population can continue to consume at current rates.

The Wealth Divide Disclaimer

Forecasting personal consumption is always tricky, but it has become even more challenging in the post-pandemic era. To appreciate why we share a joke told by Mike Green.

Bill Gates and I walk into the bar…

Bartender: “Wow… a couple of billionaires on average!”

Bill Gates, Jeff Bezos, Elon Musk, Mark Zuckerberg, and other billionaires make us all much richer, on average. Unfortunately, we can’t use the average to pay our bills.

According to Wikipedia, Bill Gates is one of 756 billionaires living in the United States. Many of these billionaires became much wealthier due to the pandemic as their investment fortunes proliferated.

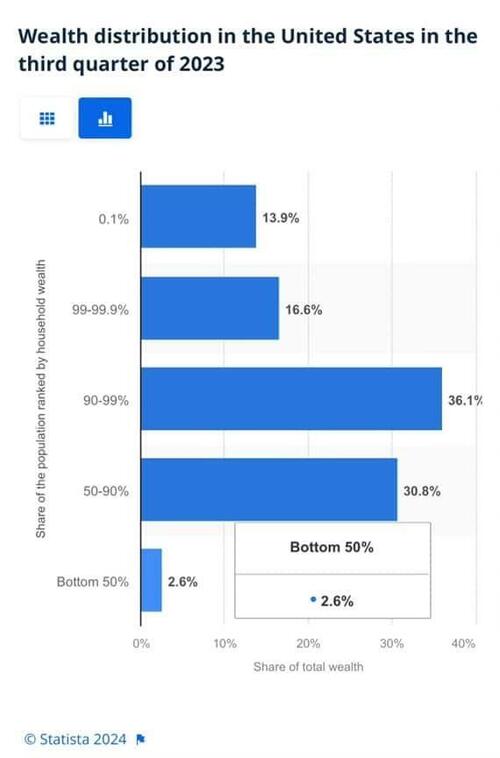

To appreciate the wealth divide, consider the graph below courtesy of Statista. 1% of the U.S. population holds 30% of the wealth. The wealthiest 10% of households have two-thirds of the wealth. The bottom half of the population accounts for less than 3% of the wealth.

The uber-wealthy grossly distorts consumption and savings data. And, with the sharp increase in their wealth over the past few years, the consumption and savings data are more distorted.

Furthermore, and critical to appreciate, the spending by the wealthy doesn’t fluctuate with the economy. Therefore, the spending of the lower wealth classes drives marginal changes in consumption. As such, the condition of the not-so-wealthy is most important for forecasting changes in consumption.

Revenge Spending

Deciphering personal data has also become more difficult because our spending habits have changed due to the pandemic.

A great example is revenge spending. Per the New York Times:

Ola Majekodunmi, the founder of All Things Money, a finance site for young adults, explained revenge spending as expenditures meant to make up for “lost time” after an event like the pandemic.

So, between the growing wealth divide and irregular spending habits, let’s quantify personal savings, debt usage, and real wages to appreciate better if Bougie Broke is a mass movement or a silly meme.

The Means To Consume

Savings, debt, and wages are the three primary sources that give consumers the ability to consume.

Savings

The graph below shows the rollercoaster on which personal savings have been since the pandemic. The savings rate is hovering at the lowest rate since those seen before the 2008 recession. The total amount of personal savings is back to 2017 levels. But, on an inflation-adjusted basis, it’s at 10-year lows. On average, most consumers are drawing down their savings or less. Given that wages are increasing and unemployment is historically low, they must be consuming more.

Now, strip out the savings of the uber-wealthy, and it’s probable that the amount of personal savings for much of the population is negligible. A survey by Payroll.org estimates that 78% of Americans live paycheck to paycheck.

More on Insufficient Savings

The Fed’s latest, albeit old, Report on the Economic Well-Being of U.S. Households from June 2023 claims that over a third of households do not have enough savings to cover an unexpected $400 expense. We venture to guess that number has grown since then. To wit, the number of households with essentially no savings rose 5% from their prior report a year earlier.

Relatively small, unexpected expenses, such as a car repair or a modest medical bill, can be a hardship for many families. When faced with a hypothetical expense of $400, 63 percent of all adults in 2022 said they would have covered it exclusively using cash, savings, or a credit card paid off at the next statement (referred to, altogether, as “cash or its equivalent”). The remainder said they would have paid by borrowing or selling something or said they would not have been able to cover the expense.

Debt

After periods where consumers drained their existing savings and/or devoted less of their paychecks to savings, they either slowed their consumption patterns or borrowed to keep them up. Currently, it seems like many are choosing the latter option. Consumer borrowing is accelerating at a quicker pace than it was before the pandemic.

The first graph below shows outstanding credit card debt fell during the pandemic as the economy cratered. However, after multiple stimulus checks and broad-based economic recovery, consumer confidence rose, and with it, credit card balances surged.

The current trend is steeper than the pre-pandemic trend. Some may be a catch-up, but the current rate is unsustainable. Consequently, borrowing will likely slow down to its pre-pandemic trend or even below it as consumers deal with higher credit card balances and 20+% interest rates on the debt.

The second graph shows that since 2022, credit card balances have grown faster than our incomes. Like the first graph, the credit usage versus income trend is unsustainable, especially with current interest rates.

With many consumers maxing out their credit cards, is it any wonder buy-now-pay-later loans (BNPL) are increasing rapidly?

Insider Intelligence believes that 79 million Americans, or a quarter of those over 18 years old, use BNPL. Lending Tree claims that “nearly 1 in 3 consumers (31%) say they’re at least considering using a buy now, pay later (BNPL) loan this month.”More telling, according to their survey, only 52% of those asked are confident they can pay off their BNPL loan without missing a payment!

Wage Growth

Wages have been growing above trend since the pandemic. Since 2022, the average annual growth in compensation has been 6.28%. Higher incomes support more consumption, but higher prices reduce the amount of goods or services one can buy. Over the same period, real compensation has grown by less than half a percent annually. The average real compensation growth was 2.30% during the three years before the pandemic.

In other words, compensation is just keeping up with inflation instead of outpacing it and providing consumers with the ability to consume, save, or pay down debt.

It’s All About Employment

The unemployment rate is 3.9%, up slightly from recent lows but still among the lowest rates in the last seventy-five years.

The uptick in credit card usage, decline in savings, and the savings rate argue that consumers are slowly running out of room to keep consuming at their current pace.

However, the most significant means by which we consume is income. If the unemployment rate stays low, consumption may moderate. But, if the recent uptick in unemployment continues, a recession is extremely likely, as we have seen every time it turned higher.

It’s not just those losing jobs that consume less. Of greater impact is a loss of confidence by those employed when they see friends or neighbors being laid off.

Accordingly, the labor market is probably the most important leading indicator of consumption and of the ability of the Bougie Broke to continue to be Bougie instead of flat-out broke!

Summary

There are always consumers living above their means. This is often harmless until their means decline or disappear. The Bougie Broke meme and the ability social media gives consumers to flaunt their “wealth” is a new medium for an age-old message.

Diving into the data, it argues that consumption will likely slow in the coming months. Such would allow some consumers to save and whittle down their debt. That situation would be healthy and unlikely to cause a recession.

The potential for the unemployment rate to continue higher is of much greater concern. The combination of a higher unemployment rate and strapped consumers could accentuate a recession.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges