Uncategorized

“Recession Is Coming” As Fed “Is Going Too Crazy” – Dallas Fed Respondents Slam US Economic Outlook

"Recession Is Coming" As Fed "Is Going Too Crazy" – Dallas Fed Respondents Slam US Economic Outlook

While the headline Dallas Fed Manufacturing…

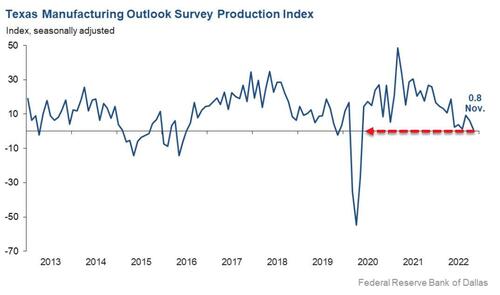

While the headline Dallas Fed Manufacturing survey did not weaken as much as expected, the production index, a key measure of state manufacturing conditions, fell five points to near zero - its weakest level since the COVID lockdowns in 2020...

Under the hood, several other measures of manufacturing activity indicated contraction this month. The new orders index plummeted to -20.9 - its sixth month in a row in negative territory and lowest reading since May 2020. The growth rate of orders index dropped seven points to -19.9. The capacity utilization index turned negative, falling from 9.1 to -3.4, and the shipments index posted a second consecutive negative reading at -7.5, down from -1.6 in October.

Additionally, perceptions of broader business conditions continued to worsen in November. The general business activity index posted a seventh consecutive negative reading but moved up five points to -14.4. The company outlook index pushed down further, from -9.1 to -15.2.

However, it was the comments from respondents that offer the most prescient insight into US economic conditions:

-

Customers are illiquid. Demand is there; there is just no cash to buy food. There is increased tension in terms of demand for skilled workers and retaining them. [Food Manufacturing]

-

Business is slow and slowing. Our outlook for January is hopeful. [Paper Manufacturing]

-

There is less panic buying going on. Inventories are beginning to go down. Lead times we are able to give to our customers are beginning to decrease as input of new orders slows. The slowdown is consistent with normal seasonal factors but way below last year’s very high fourth-quarter order level. We are beginning to see the end of the dislocations caused by the pandemic. [Printing and Related Support Activities]

-

Recession is coming! We are just waiting for the backlog to evaporate. Then layoffs start. [Primary Metal Manufacturing]

-

We are very concerned about the volume of future business activity. We see our customers pulling back their plans for expansion but still planning for the future. This has put us in a position to be very competitive to win every order possible to ensure our cash flow and ability to pay our employees and bills. [Machinery Manufacturing]

-

We are still running strong; however, we believe that it is inevitable that the economy will contract within the next six months. [Machinery Manufacturing]

-

[The Federal Reserve] is going too crazy—that is really affecting the industrial equipment industry and stalling infrastructure spending as I have never seen before. Millions of jobs are at risk in manufacturing. [Computer and Electronic Product Manufacturing]

-

The cost of capital is unbearable for small businesses and will delay or reduce expenditures or hiring unless business drives change. [Computer and Electronic Product Manufacturing]

-

The outlook is troubling and unsettling. Caution is the strategy. The Federal Reserve is too aggressive. Let what’s been done materialize in the economy before piling on. [Transportation Equipment Manufacturing]

Does any of that sound like an economy that is "strong as hell"?

Uncategorized

Part 1: Current State of the Housing Market; Overview for mid-March 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt: This 2-part overview for mid-March provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-March provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

Here is a graph of new listing from Realtor.com’s February 2024 Monthly Housing Market Trends Report showing new listings were up 11.3% year-over-year in February. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this February as newly listed homes were 11.3% above last year’s levels. This marked the fourth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but we will have to wait for the March and April data to see how close new listings are to normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

Uncategorized

Pharma industry reputation remains steady at a ‘new normal’ after Covid, Harris Poll finds

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45%…

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45% of US respondents in 2023, according to the latest Harris Poll data. That’s exactly the same as the previous year.

Pharma’s highest point was in February 2021 — as Covid vaccines began to roll out — with a 62% positive US perception, and helping the industry land at an average 55% positive sentiment at the end of the year in Harris’ 2021 annual assessment of industries. The pharma industry’s reputation hit its most recent low at 32% in 2019, but it had hovered around 30% for more than a decade prior.

“Pharma has sustained a lot of the gains, now basically one and half times higher than pre-Covid,” said Harris Poll managing director Rob Jekielek. “There is a question mark around how sustained it will be, but right now it feels like a new normal.”

The Harris survey spans 11 global markets and covers 13 industries. Pharma perception is even better abroad, with an average 58% of respondents notching favorable sentiments in 2023, just a slight slip from 60% in each of the two previous years.

Pharma’s solid global reputation puts it in the middle of the pack among international industries, ranking higher than government at 37% positive, insurance at 48%, financial services at 51% and health insurance at 52%. Pharma ranks just behind automotive (62%), manufacturing (63%) and consumer products (63%), although it lags behind leading industries like tech at 75% positive in the first spot, followed by grocery at 67%.

The bright spotlight on the pharma industry during Covid vaccine and drug development boosted its reputation, but Jekielek said there’s maybe an argument to be made that pharma is continuing to develop innovative drugs outside that spotlight.

“When you look at pharma reputation during Covid, you have clear sense of a very dynamic industry working very quickly and getting therapies and products to market. If you’re looking at things happening now, you could argue that pharma still probably doesn’t get enough credit for its advances, for example, in oncology treatments,” he said.

vaccine pandemic covid-19Uncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges