Spread & Containment

Quick Note on Lost GDP Due to Shutdowns

Quick Note on Lost GDP Due to Shutdowns

Some folks have complained about the loss of GDP over the last five months and questioned whether the shutdowns have been worth the price. While people often toss around huge numbers in the trillions of dollars as the cost of the shutdown, these big numbers are often both inaccurate and misleading.

Measuring Lost GDP

The first place to start is getting a measure of lost GDP. This is fairly straightforward. We can just apply a 2.0 percent growth projection (approximately the projection from the Congressional Budget Office) and apply it to GDP for the 4th quarter of 2019. The difference between this projection and actual GDP for the first and second quarters gives a reasonable approximation of the cost of the shutdown for the first two quarters. There will be continuing costs going forward, but these are at least as much due to fear of the pandemic, as the impact of ongoing shutdowns. (Air traffic has been running at 25 to 30 percent of year ago levels, even though no restrictions prevent people from flying.)

This simple calculation shows a combined loss of GDP for these quarters of $645 billion measured in 2012 dollars, which would be roughly $745 billion in today’s dollars. That comes to a bit less than $2,300 per person.

If this sounds less than the numbers often tossed around, this is because we generally annualize our GDP numbers. This means that numbers show how much production/spending we would have if the economy kept on the same pace for a full year. As a result, our second quarter GDP showed the economy falling a 32.9 percent annual rate in the second quarter, but it actually only shrank by roughly 8.0 percent. To be clear, this is sill a very large loss of output, but it is probably considerably less than many people had envisioned.

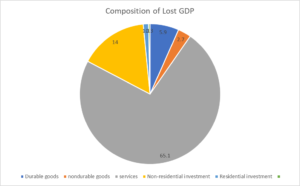

Source: Author’s calculations, see text.

Next, it is worth getting a better handle on where this drop in output came from. The figure above shows the breakdown between consumption, investment, and government expenditures. The striking part of this figure is the extent to which the decline in spending on consumer services accounts for the bulk, almost two-thirds, of lost output. This sector ordinarily accounts for less than 45 percent of GDP.

Before looking at consumer services more closely, it is worth commenting on the relatively smaller declines in other areas. The drop in investment means that we will be somewhat less wealthy in the future because we invested at a slower rate due to the shutdowns. While that is a loss to the economy, any reduction in future productivity due to lost investment is likely to be swamped by the effective gains in productivity associated with increased telecommuting and other changes due to the crisis. So, as a general rule, more investment is better than less investment, but the enduring reduction in work expenses due to changes made during the pandemic will far more than offset the impact of this lost investment on productivity.

There was very little change in residential investment as a result of the shutdowns. While construction did slow when the shutdowns were in place most strongly in March and April, it has been close to normal in the months since then, as demand for housing has remained strong. This means we will not be seeing any shortages of housing due to the pandemic.

It turns out that there has been little net change in government expenditures as a result of the shutdowns. A modest reduction in federal expenditures was mostly offset by an increase in expenditures at the state and local level. It is important to remember that these data refer to actual expenditures on goods and services by the government. While they would include payments for education and hospital care, they exclude transfer payments such as unemployment benefits or the $1,200 per person pandemic checks.

Turning to consumption, there were modest declines in goods consumption, but much of this is likely linked to work-related expenses. In the case of the decline in durable goods consumption, more than half is explained by reduced spending on cars, jewelry and watches, and luggage. These are mostly expenditures that are work-related. The other major drop was in therapeutic appliances and equipment, like eyeglasses. This is an important issue, that I will come back to shortly.

There was a small drop in consumption of nondurable goods, where a large increase in spending on food purchased for home consumption almost offset sharp declines in spending on gasoline and clothes. These drops are clearly due in large part to lower work-related expenses. (It is worth noting that spending on newspapers and periodicals was more than 20 percent higher in the second quarter than it had been in the 4th quarter of 2019.)

The real story of the GDP plunge is in services and it is not hard to guess which ones. The ones involving work-related expenses all saw sharp declines. Spending on “personal care services,” which involves items like hair salons and dry cleaning, was down by 77 percent from the fourth quarter of 2019 to the second quarter of 2020. Transportation services were down by 41.3 percent, with public transportation seeing a falloff of more than 80 percent.

The second major category involves recreation and entertainment spending. Spending on recreation services, which includes things like amusement parks, concerts, and movies, was down 58.8 percent. Spending on restaurants and hotels was down 40.1 percent.

The third major category was health care, with spending down by 25.3 percent. The sharpest decline was in areas like physicians’ offices and dental services.

How should we think about these areas of lost consumption. The first category of work-related expenses is probably not a big loss. (I know everything is this category is not directly work-related, but most of the decline is.) If people spend less money on transportation because they aren’t driving or taking the bus to work, that is not an obvious loss in their well-being.

The second category involves activities that people enjoy doing. For several months they have not been able to go to restaurants and movies, visit with friends and family members, or engage in other normal activities. It is possible to see these things as frivolous, and that might be right compared to dying from the coronavirus, but we are only alive for so long. If we can’t do the things we enjoy, and see people we care about, for six months or a year, that is a big deal.

Finally, we have the category of health care services. Much of this involves things like putting off a checkup or a teeth cleaning. Most of the time, there will not be major consequences from a delay of a couple of months, but in some cases there will be. A person who has to wait another three months to have a cancer detected or to discover they have a heart problem may suffer serious and lasting health damage.

There is also the issue that fear of the pandemic may have discouraged people from getting necessary treatment or tests. For example, would a cancer patient, whose immune system is seriously compromised, feel comfortable going into a doctor’s office or hospital for tests? This is likely less an issue of shutdowns blocking care as opposed to the pandemic itself.

In fact, as we move into a period where most of the legal barriers have been removed or relaxed, this fear is likely to be the greatest issue going forward. People will not return to their former way of life until they can be sure that it is safe, and that means getting the pandemic under control.

I haven’t touched on the issue of schools thus far. This is huge for both the children and the parents. Undoubtedly, the shutdowns and school closings created hardships for many families, especially for mothers of small children. This may have been the largest cost of the shutdowns, as many families found themselves in cramped living spaces for long periods of time. We will likely get a better picture of the full impact some months down the road, when more data are available, but is likely that the shutdowns have been associated with more incidents of domestic violence.

From the standpoint of children, it seems clear that the lack of in-school instruction will further exacerbate the education gap between the children from lower income families and children from the upper middle class. The latter group is likely to have the resources to ensure that their kids receive adequate instruction. That is not the case with children from poorer backgrounds, where parents may be forced to work outside the home and they may not have access to computers or reliable Internet.

This could mean that these children will face lasting consequences in the form of lower graduation rates, lower rates of college completion, and lower incomes during their working careers. There is no easy short-term fix here. We can talk about programs to try to make up the lost ground for students from low- and moderate-income families, but realistically, this is not going to happen. We have failed miserably at trying to equalize educational opportunities over the last sixty years, we are not suddenly going to be able to turn things around in the next decade or so for the children currently in school.

To my view, the more promising route is to try to reduce the huge wage gaps we see now so that it matters much less who got the better education. If we had a minimum wage of $24 an hour and CEOs got paid $2-$3 million a year (with corresponding pay cuts for other top execs), the differences in opportunities would not condemn today’s children to a life of hardship. Unfortunately, few people in high level policy positions want to have this discussion.

Getting the Virus Under Control

While the cost of the shutdowns this spring were substantial, the cost of not shutting down much of the economy would have been enormous. When the country began to shut down in mid-March, the rate of infection was exploding. It was doubling every three or four days, and the reported rate was almost certainly a gross of understatement of the actual rate, since testing was very limited. By early April, the pandemic was causing more than 2,000 deaths a day. The number peaked around 2,300 in mid-April and then began to fall gradually until early July, when it was just over 500 a day. It since has risen again to more than 1,200 a day.

Had it not been for the initial lockdown in mid-March, it is almost certain that the infection would have continued to spread exponentially and the number of deaths would have grown along with the number of infections. There can be little doubt that the shutdowns saved many hundreds of thousands of lives in the United States, and quite possibly well over a million.

It is also important to recognize that many of the people who get the virus, but don’t die, suffer lasting effects. There have been a number of accounts of people who have recovered from the disease but have enduring cognitive and/or physical problems. At this point, we do not have good data on the percentage of the people who get sick who will suffer lasting effects. But it would be wrong to ignore the consequences of the disease for people who get sick but don’t die.

Also, when we consider possible costs for restrictions in the United States going forward, it is important to realize the extent to which we are an outlier. Most other wealthy countries have largely succeeded in bringing the pandemic under control. The European Union (EU), in spite of a recent upsurge, has been averaging less than 7,000 cases a day. That compares to 60,000 in the United States, in spite of the fact that EU’s population is 20 percent larger. The EU has been averaging around 150 deaths a day, compared to well over 1,000 in the United States.

Other wealthy countries generally had stricter shutdowns and smarter re-openings. As a result, the cost to their economies is likely to end up being considerably lower than in the United States. So, even if we decide that the benefits to public health may have been worth the cost to the economy, that doesn’t mean that we could not have had the same or larger benefits at a lower price, with good planning.

The post Quick Note on Lost GDP Due to Shutdowns appeared first on Center for Economic and Policy Research.

Spread & Containment

Harvard Medical School Professor Was Fired Over Not Getting COVID Vaccine

Harvard Medical School Professor Was Fired Over Not Getting COVID Vaccine

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

A…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

A Harvard Medical School professor who refused to get a COVID-19 vaccine has been terminated, according to documents reviewed by The Epoch Times.

Martin Kulldorff, an epidemiologist, was fired by Mass General Brigham in November 2021 over noncompliance with the hospital’s COVID-19 vaccine mandate after his requests for exemptions from the mandate were denied, according to one document. Mr. Kulldorff was also placed on leave by Harvard Medical School (HMS) because his appointment as professor of medicine there “depends upon” holding a position at the hospital, another document stated.

Mr. Kulldorff asked HMS in late 2023 how he could return to his position and was told he was being fired.

“You would need to hold an eligible appointment with a Harvard-affiliated institution for your HMS academic appointment to continue,” Dr. Grace Huang, dean for faculty affairs, told the epidemiologist and biostatistician.

She said the lack of an appointment, combined with college rules that cap leaves of absence at two years, meant he was being terminated.

Mr. Kulldorff disclosed the firing for the first time this month.

“While I can’t comment on the specifics due to employment confidentiality protections that preclude us from doing so, I can confirm that his employment agreement was terminated November 10, 2021,” a spokesperson for Brigham and Women’s Hospital told The Epoch Times via email.

Mass General Brigham granted just 234 exemption requests out of 2,402 received, according to court filings in an ongoing case that alleges discrimination.

The hospital said previously, “We received a number of exemption requests, and each request was carefully considered by a knowledgeable team of reviewers.”

“A lot of other people received exemptions, but I did not,” Mr. Kulldorff told The Epoch Times.

Mr. Kulldorff was originally hired by HMS but switched departments in 2015 to work at the Department of Medicine at Brigham and Women’s Hospital, which is part of Mass General Brigham and affiliated with HMS.

“Harvard Medical School has affiliation agreements with several Boston hospitals which it neither owns nor operationally controls,” an HMS spokesperson told The Epoch Times in an email. “Hospital-based faculty, such as Mr. Kulldorff, are employed by one of the affiliates, not by HMS, and require an active hospital appointment to maintain an academic appointment at Harvard Medical School.”

HMS confirmed that some faculty, who are tenured or on the tenure track, do not require hospital appointments.

Natural Immunity

Before the COVID-19 vaccines became available, Mr. Kulldorff contracted COVID-19. He was hospitalized but eventually recovered.

That gave him a form of protection known as natural immunity. According to a number of studies, including papers from the U.S. Centers for Disease Control and Prevention, natural immunity is better than the protection bestowed by vaccines.

Other studies have found that people with natural immunity face a higher risk of problems after vaccination.

Mr. Kulldorff expressed his concerns about receiving a vaccine in his request for a medical exemption, pointing out a lack of data for vaccinating people who suffer from the same issue he does.

“I already had superior infection-acquired immunity; and it was risky to vaccinate me without proper efficacy and safety studies on patients with my type of immune deficiency,” Mr. Kulldorff wrote in an essay.

In his request for a religious exemption, he highlighted an Israel study that was among the first to compare protection after infection to protection after vaccination. Researchers found that the vaccinated had less protection than the naturally immune.

“Having had COVID disease, I have stronger longer lasting immunity than those vaccinated (Gazit et al). Lacking scientific rationale, vaccine mandates are religious dogma, and I request a religious exemption from COVID vaccination,” he wrote.

Both requests were denied.

Mr. Kulldorff is still unvaccinated.

“I had COVID. I had it badly. So I have infection-acquired immunity. So I don’t need the vaccine,” he told The Epoch Times.

Dissenting Voice

Mr. Kulldorff has been a prominent dissenting voice during the COVID-19 pandemic, countering messaging from the government and many doctors that the COVID-19 vaccines were needed, regardless of prior infection.

He spoke out in an op-ed in April 2021, for instance, against requiring people to provide proof of vaccination to attend shows, go to school, and visit restaurants.

“The idea that everybody needs to be vaccinated is as scientifically baseless as the idea that nobody does. Covid vaccines are essential for older, high-risk people and their caretakers and advisable for many others. But those who’ve been infected are already immune,” he wrote at the time.

Mr. Kulldorff later co-authored the Great Barrington Declaration, which called for focused protection of people at high risk while removing restrictions for younger, healthy people.

Harsh restrictions such as school closures “will cause irreparable damage” if not lifted, the declaration stated.

The declaration drew criticism from Dr. Anthony Fauci, head of the National Institute of Allergy and Infectious Diseases, and Dr. Rochelle Walensky, who became the head of the CDC, among others.

In a competing document, Dr. Walensky and others said that “relying upon immunity from natural infections for COVID-19 is flawed” and that “uncontrolled transmission in younger people risks significant morbidity(3) and mortality across the whole population.”

“Those who are pushing these vaccine mandates and vaccine passports—vaccine fanatics, I would call them—to me they have done much more damage during this one year than the anti-vaxxers have done in two decades,” Mr. Kulldorff later said in an EpochTV interview. “I would even say that these vaccine fanatics, they are the biggest anti-vaxxers that we have right now. They’re doing so much more damage to vaccine confidence than anybody else.”

Surveys indicate that people have less trust now in the CDC and other health institutions than before the pandemic, and data from the CDC and elsewhere show that fewer people are receiving the new COVID-19 vaccines and other shots.

Support

The disclosure that Mr. Kulldorff was fired drew criticism of Harvard and support for Mr. Kulldorff.

The termination “is a massive and incomprehensible injustice,” Dr. Aaron Kheriaty, an ethics expert who was fired from the University of California–Irvine School of Medicine for not getting a COVID-19 vaccine because he had natural immunity, said on X.

“The academy is full of people who declined vaccines—mostly with dubious exemptions—and yet Harvard fires the one professor who happens to speak out against government policies.” Dr. Vinay Prasad, an epidemiologist at the University of California–San Francisco, wrote in a blog post. “It looks like Harvard has weaponized its policies and selectively enforces them.”

A petition to reinstate Mr. Kulldorff has garnered more than 1,800 signatures.

Some other doctors said the decision to let Mr. Kulldorff go was correct.

“Actions have consequence,” Dr. Alastair McAlpine, a Canadian doctor, wrote on X. He said Mr. Kulldorff had “publicly undermine[d] public health.”

International

“Extreme Events”: US Cancer Deaths Spiked In 2021 And 2022 In “Large Excess Over Trend”

"Extreme Events": US Cancer Deaths Spiked In 2021 And 2022 In "Large Excess Over Trend"

Cancer deaths in the United States spiked in 2021…

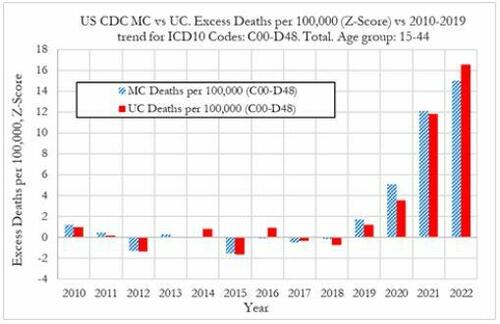

Cancer deaths in the United States spiked in 2021 and 2022 among 15-44 year-olds "in large excess over trend," marking jumps of 5.6% and 7.9% respectively vs. a rise of 1.7% in 2020, according to a new preprint study from deep-dive research firm, Phinance Technologies.

Extreme Events

The report, which relies on data from the CDC, paints a troubling picture.

"We show a rise in excess mortality from neoplasms reported as underlying cause of death, which started in 2020 (1.7%) and accelerated substantially in 2021 (5.6%) and 2022 (7.9%). The increase in excess mortality in both 2021 (Z-score of 11.8) and 2022 (Z-score of 16.5) are highly statistically significant (extreme events)," according to the authors.

That said, co-author, David Wiseman, PhD (who has 86 publications to his name), leaves the cause an open question - suggesting it could either be a "novel phenomenon," Covid-19, or the Covid-19 vaccine.

Cancer deaths in US in 2021 & 2022 in large excess over trend for 15-44 year-olds as extreme events. A novel phenomenon? C19? lockdowns? C19 vaccines? Honored to participate in this work. #CDC where are you? @DowdEdwardhttps://t.co/iUV5oQiWCW pic.twitter.com/uytzaIvvor

— David Wiseman PhD, MRPharmS (@AdhesionsOrg) March 12, 2024

"The results indicate that from 2021 a novel phenomenon leading to increased neoplasm deaths appears to be present in individuals aged 15 to 44 in the US," reads the report.

The authors suggest that the cause may be the result of "an unexpected rise in the incidence of rapidly growing fatal cancers," and/or "a reduction in survival in existing cancer cases."

They also address the possibility that "access to utilization of cancer screening and treatment" may be a factor - the notion that pandemic-era lockdowns resulted in fewer visits to the doctor. Also noted is that "Cancers tend to be slowly-developing diseases with remarkably stable death rates and only small variations over time," which makes "any temporal association between a possible explanatory factor (such as COVID-19, the novel COVID-19 vaccines, or other factor(s)) difficult to establish."

That said, a ZeroHedge review of the CDC data reveals that it does not provide information on duration of illness prior to death - so while it's not mentioned in the preprint, it can't rule out so-called 'turbo cancers' - reportedly rapidly developing cancers, the existence of which has been largely anecdotal (and widely refuted by the usual suspects).

While the Phinance report is extremely careful not to draw conclusions, researcher "Ethical Skeptic" kicked the barn door open in a Thursday post on X - showing a strong correlation between "cancer incidence & mortality" coinciding with the rollout of the Covid mRNA vaccine.

The argument is over.

— Ethical Skeptic ☀ (@EthicalSkeptic) March 14, 2024

The Covid mRNA Vaxx has cause a sizeable 2021 inflection, and now novel-trend elevation in terms of both cancer incidence & mortality.

Now you know who the liars were all along.

????Incidence = 14.8% excess

????UCoD Mortality = 5.3% excess (lags Incidence) pic.twitter.com/uwN9GMrHl1

Phinance principal Ed Dowd commented on the post, noting that "Cancer is suddenly an accelerating growth industry!"

????Indeed it is…Cancer is suddenly an accelerating growth industry! @EthicalSkeptic provides a chart below showing US Cancer treatment in constant dollars with a current growth rate of 14.8% (6.3% New CAGR) versus long term trend of 1.78% CAGR or $33.8 billion in excess cancer… https://t.co/RIn4R2YZZ7

— Edward Dowd (@DowdEdward) March 14, 2024

Continued:

As a former portfolio manager of of a $14 billion Large Cap Growth Equity portfolio I can definitively say Cancer treatments and the Disabilities have become growth industries that both have inflection points coincidental to the mRNA vaccine rollouts in 2021.

— Edward Dowd (@DowdEdward) March 14, 2024

Chart 1 from… pic.twitter.com/TCt4X1plnM

Bottom line - hard data is showing alarming trends, which the CDC and other agencies have a requirement to explore and answer truthfully - and people are asking #WhereIsTheCDC.

We aren't holding our breath.

Experts are sounding the alarm on a spike in cancer diagnosis worldwide. It is still a mystery. @DowdEdward from Phinance Technologies has also been sounding the alarm for months.

— dr.ir. Carla Peeters (@CarlaPeeters3) March 15, 2024

We are facing a dramatic degradation of the human immune system https://t.co/CPnwP3Oj9G

Wiseman, meanwhile, points out that Pfizer and several other companies are making "significant investments in cancer drugs, post COVID."

Pfizer among several companies making significant investments in cancer drugs, post COVID. @DowdEdward @Kevin_McKernan @JesslovesMJK @niki_kyrylenko https://t.co/nefEZYLW1o https://t.co/r505Sbbcq4

— David Wiseman PhD, MRPharmS (@AdhesionsOrg) March 15, 2024

Phinance

We've featured several of Phinance's self-funded deep dives into pandemic data that nobody else is doing. If you'd like to support them, click here.

List of our projects following disturbing tends in deaths, disabilities and absences.

— Edward Dowd (@DowdEdward) March 16, 2024

Link to projects at bottom.

✅ V-Damage Project

✅ Excess Mortality Project

✅ US Disabilities Project

✅ US BLS Absence rates Project

✅ US Cause of Death Project

✅ UK Cause of Death…

Government

“I Can’t Even Save”: Americans Are Getting Absolutely Crushed Under Enormous Debt Load

"I Can’t Even Save": Americans Are Getting Absolutely Crushed Under Enormous Debt Load

While Joe Biden insists that Americans are doing great…

While Joe Biden insists that Americans are doing great - suggesting in his State of the Union Address last week that "our economy is the envy of the world," Americans are being absolutely crushed by inflation (which the Biden admin blames on 'shrinkflation' and 'corporate greed'), and of course - crippling debt.

The signs are obvious. Last week we noted that banks' charge-offs are accelerating, and are now above pre-pandemic levels.

...and leading this increase are credit card loans - with delinquencies that haven't been this high since Q3 2011.

On top of that, while credit cards and nonfarm, nonresidential commercial real estate loans drove the quarterly increase in the noncurrent rate, residential mortgages drove the quarterly increase in the share of loans 30-89 days past due.

And while Biden and crew can spin all they want, an average of polls from RealClear Politics shows that just 40% of people approve of Biden's handling of the economy.

Crushed

On Friday, Bloomberg dug deeper into the effects of Biden's "envious" economy on Americans - specifically, how massive debt loads (credit cards and auto loans especially) are absolutely crushing people.

Two years after the Federal Reserve began hiking interest rates to tame prices, delinquency rates on credit cards and auto loans are the highest in more than a decade. For the first time on record, interest payments on those and other non-mortgage debts are as big a financial burden for US households as mortgage interest payments.

According to the report, this presents a difficult reality for millions of consumers who drive the US economy - "The era of high borrowing costs — however necessary to slow price increases — has a sting of its own that many families may feel for years to come, especially the ones that haven’t locked in cheap home loans."

The Fed, meanwhile, doesn't appear poised to cut rates until later this year.

According to a February paper from IMF and Harvard, the recent high cost of borrowing - something which isn't reflected in inflation figures, is at the heart of lackluster consumer sentiment despite inflation having moderated and a job market which has recovered (thanks to job gains almost entirely enjoyed by immigrants).

In short, the debt burden has made life under President Biden a constant struggle throughout America.

"I’m making the most money I've ever made, and I’m still living paycheck to paycheck," 40-year-old Denver resident Nikki Cimino told Bloomberg. Cimino is carrying a monthly mortgage of $1,650, and has $4,000 in credit card debt following a 2020 divorce.

"There's this wild disconnect between what people are experiencing and what economists are experiencing."

CBS: Do you attribute the inflation crisis to the pandemic or Biden?

— RNC Research (@RNCResearch) March 15, 2024

WISCONSIN VOTER: "It's been YEARS now since the pandemic — I'm not buying that anymore. At first I did; I'm not buying that anymore because yogurt is STILL going up in price!" pic.twitter.com/apahb65scB

What's more, according to Wells Fargo, families have taken on debt at a comparatively fast rate - no doubt to sustain the same lifestyle as low rates and pandemic-era stimmies provided. In fact, it only took four years for households to set a record new debt level after paying down borrowings in 2021 when interest rates were near zero.

Meanwhile, that increased debt load is exacerbated by credit card interest rates that have climbed to a record 22%, according to the Fed.

[P]art of the reason some Americans were able to take on a substantial load of non-mortgage debt is because they’d locked in home loans at ultra-low rates, leaving room on their balance sheets for other types of borrowing. The effective rate of interest on US mortgage debt was just 3.8% at the end of last year.

Yet the loans and interest payments can be a significant strain that shapes families’ spending choices. -Bloomberg

And of course, the highest-interest debt (credit cards) is hurting lower-income households the most, as tends to be the case.

The lowest earners also understandably had the biggest increase in credit card delinquencies.

"Many consumers are levered to the hilt — maxed out on debt and barely keeping their heads above water," Allan Schweitzer, a portfolio manager at credit-focused investment firm Beach Point Capital Management told Bloomberg. "They can dog paddle, if you will, but any uptick in unemployment or worsening of the economy could drive a pretty significant spike in defaults."

"We had more money when Trump was president," said Denise Nierzwicki, 69. She and her 72-year-old husband Paul have around $20,000 in debt spread across multiple cards - all of which have interest rates above 20%.

Photographer: Jon Cherry/Bloomberg

During the pandemic, Denise lost her job and a business deal for a bar they owned in their hometown of Lexington, Kentucky. While they applied for Social Security to ease the pain, Denise is now working 50 hours a week at a restaurant. Despite this, they're barely scraping enough money together to service their debt.

The couple blames Biden for what they see as a gloomy economy and plans to vote for the Republican candidate in November. Denise routinely voted for Democrats up until about 2010, when she grew dissatisfied with Barack Obama’s economic stances, she said. Now, she supports Donald Trump because he lowered taxes and because of his policies on immigration. -Bloomberg

Meanwhile there's student loans - which are not able to be discharged in bankruptcy.

"I can't even save, I don't have a savings account," said 29-year-old in Columbus, Ohio resident Brittany Walling - who has around $80,000 in federal student loans, $20,000 in private debt from her undergraduate and graduate degrees, and $6,000 in credit card debt she accumulated over a six-month stretch in 2022 while she was unemployed.

"I just know that a lot of people are struggling, and things need to change," she told the outlet.

The only silver lining of note, according to Bloomberg, is that broad wage gains resulting in large paychecks has made it easier for people to throw money at credit card bills.

Yet, according to Wells Fargo economist Shannon Grein, "As rates rose in 2023, we avoided a slowdown due to spending that was very much tied to easy access to credit ... Now, credit has become harder to come by and more expensive."

According to Grein, the change has posed "a significant headwind to consumption."

Then there's the election

"Maybe the Fed is done hiking, but as long as rates stay on hold, you still have a passive tightening effect flowing down to the consumer and being exerted on the economy," she continued. "Those household dynamics are going to be a factor in the election this year."

Meanwhile, swing-state voters in a February Bloomberg/Morning Consult poll said they trust Trump more than Biden on interest rates and personal debt.

Reverberations

These 'headwinds' have M3 Partners' Moshin Meghji concerned.

"Any tightening there immediately hits the top line of companies," he said, noting that for heavily indebted companies that took on debt during years of easy borrowing, "there's no easy fix."

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Spread & Containment4 days ago

Spread & Containment4 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex