Government

No Fooling: Gov. Newsom’s $20 Minimum Wage Hits April 1

No Fooling: Gov. Newsom’s $20 Minimum Wage Hits April 1

Authored by John Seiler via The Epoch Times (emphasis ours),

A sign is posted on the…

Authored by John Seiler via The Epoch Times (emphasis ours),

Commentary

I wish we could call “April fool!” on the $20 minimum wage hitting California fast-food restaurants on April 1. But the wage hike signed into law last September by Gov. Gavin Newsom is really going to hit hard.

Last December, Pizza Hut announced it would lay off more than 1,200 delivery drivers across the state. It switched to independent deliver services for home delivery. On March 25, the Wall Street Journal reported on driver Michael Ojeda, 29, “who previously supported his mother and partner on his Pizza Hut delivery wages.” He told the paper, “Pizza Hut was my career for nearly a decade and with little to no notice it was taken away.”

Round Table Pizza also laid off 73 drivers. And, “In San Jose, Brian Hom, owner of two Vitality Bowls restaurants, now runs his stores with two employees, versus four workers that he typically used in the past. That means it takes longer to make customers’ açaí bowls and other orders, and Hom said he is also raising prices by around 10 percent to help cover the increased labor costs. ”

Mr. Hom said, “I’m definitely not going to hire anymore.”

The $20 wage increase affects only chains with 60 or more restaurants nationwide. One effect might be to discourage national chains from setting up here. If a chain has, for example, 55 restaurants outside California, it would be hesitant to establish five restaurants in the Golden State because that would impact its wage structure everywhere else.

The $7.25 federal minimum wage applies in 20 states with no higher state wage. If a restaurant company operating in those states expanded to California, the disparity between $7.25 and $20 would be a shock to the company.

Another big effect will be on all other California businesses, not just restaurants with fewer than 60 operations nationwide. The state minimum wage overall went up fifty cents to $16 an hour on Jan. 1. The best workers at $16 will gravitate to the $20 jobs, effectively putting pressure on companies to pay more than $16. Companies that can’t do so will go out of business.

We won’t know for a couple of months, but California’s unemployment rate could go much higher. According to the U.S. Bureau of Labor Statistics, the state’s unemployment already has risen from 5.0 percent last September to 5.3 percent in February, the highest in the nation. The next highest is Nevada at 5.2 percent. Rival Texas is 3.9 percent and Florida is 3.1 percent.

Higher unemployment also will raise costs for the state’s troubled Employment Development Department. Due to incompetence by the Newsom administration, massive fraud during COVID-19 left the state $20 billion in debt to the federal government. Worse, reported California Globe on Feb. 29, higher interest rates from the Federal Reserve Board mean “the state can expect to have to make an interest only payment of about $500 million dollars instead of the $330 million that was planned for in Gov. Gavin Newsom’s budget for fiscal 2024-25,” which begins on July 1. It must be paid in September.

Newsom’s Political Future

Mr. Newsom can be a savvy politician. But he has a problem with economic realities. For eight years as lieutenant governor, he sat at the feet of Gov. Jerry Brown, who demonstrated how to prevent a budget from getting out of control. Instead, as governor Mr. Newsom went on spending sprees with the $97 billion surplus, everyone, including him, said couldn’t last. It didn’t.

Now he’s staring down a $38 billion budget deficit, according to his Jan. 10 budget proposal; or $73 billion, according to the Legislative Analyst’s latest projection.

The $20 minimum wage will kill many thousands of jobs, canceling the taxes of those workers while they are unemployed, while increasing unemployment costs. Albeit the $20 wage will bring in higher taxes from the workers still employed.

Employers, commonly in the upper middle-class, will suffer fewer profits, cutting into the income taxes they pay. Many even will call it quits and fold up their businesses, or move to more reasonable states.

All this will hit this summer as Mr. Newsom’s presidential ambitions could still advance should President Joe Biden’s mental faculties decline much further. All that still is a long shot, of course. The PredictIt betting on Mr. Newsom gaining the nomination has been decreasing lately (middle line in the graph below), from 18 cents on Feb. 9 to 6 cents on March 29. Mr. Biden’s (top line) rose from 72 cents to 89 cents. Vice President Kamala Harris finished at 4 cents, below Mr. Newsom.

The point is it’s not impossible Mr. Newsom could get the nomination. If he does, California’s rising unemployment rate, the massive budget deficit, homelessness, high housing costs, and crime will be a target-rich environment for the Republicans’ presumptive nominee: former President Donald Trump.

Mr. Newsom could have avoided the unemployment crisis if he simply had pushed the $20 minimum wage into the future to 2027, when he will be out office. Then it would have been the next governor’s problem.

Conclusion: Expect More Joblessness

A higher minimum wage usually kills jobs, unless it is genuinely in line with an area’s cost of living. The current statewide $16 minimum wage is the second-highest of any state in the country, after Washington state’s $16.28. And Washington, D.C., not a state, is the highest at $17.00. All are areas with high expenses.

The biggest problem for California will be the $20 wage in rural areas. Although not as cheap to live in as Mississippi, it’s cheaper than living in San Francisco or Santa Monica. Which also means a lower minimum wage would be more sensible inland. Instead, the $20 wage will wipe out many more fast food jobs per capita inland than in the coastal areas.

The $20 wage is also going to increase prices for those still going to fast-food places. If inflation continues or gets worse, that will boost prices even more, leading to fewer customers, followed by even more layoffs.

Tinkering with the economy has consequences. Starting on April Fools’ Day, California will be finding out how an excessive minimum wage increase is one of the worst ones.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

International

Did The COVID Psyop Fail?

Did The COVID Psyop Fail?

Authored by Todd Hayen via Off-Guardian.org,

As you all know, I have not been one to believe that the tides are…

Authored by Todd Hayen via Off-Guardian.org,

As you all know, I have not been one to believe that the tides are turning. But lots of people think they are. They cite many victories, in court, in the streets, with family and friends.

The fact that the agenda has not sent out a second wave of horror and fear propaganda is also rather telling to these folks. Where is the next pandemic? What happened to Covid’s diabolic never-ending run of mutations, what happened to Monkey Pox? What happened to Disease X?

Yes, all this could still happen, but it seems there have been more false starts—starts that didn’t go anywhere. But if so, you would think they wouldn’t have put them out there just to not have them continue. It’s been rather weird, like an electrical storm you see on the horizon with its threatening lightning strikes, but it never gets close enough to warrant closing the cellar door.

How about CBDCs? And the Digital IDs? You hear a lot about these, but nothing that is concretely happening to implement them. Is it happening in other places? Australia? Germany? The UK? Of course, a lot is said about it, on YouTube, and in alt media. Lots of talking heads, but how imminent is it? Actually, I won’t dwell on this, I have no doubt all of this is coming, but has the dragon been wounded? Even a little bit? Has this march into oblivion been slowed down?

Maybe there is no wounding of the general juggernaut of world rule by the schmucks who are claiming power. Although even that sacrosanct organization may have suffered from shell damage. Wasn’t DAVOS not all that they expected this past year? Hasn’t there been some pretty obvious whiplash from some leaders in their little club? How about the UN and the “sustainable development” circus? How is that going?

Anyway, I digress. Although the health of the world agenda, including all of these projects I mention, are all part of it, Covid, and pandemics in general, are the specific topics of this article.

I don’t buy any of this talk of victory for a New York minute. This is like cancer, you can’t claim victory until it is ALL gone, every last scrap of it. Remissions are nice, but if you’ve still got cancer in your body somewhere, it is only a time-out. I feel that this is similar. Even if one cell survived, it would start multiplying again and wouldn’t stop until it was big and gnarly and spitting out all the garbage this monster has been known to spit out. So, I don’t buy it…but…

Is it possible that at least one battle was won? Maybe, but just because they have pulled the troops back doesn’t mean they didn’t still take the city and got essentially what they stormed in for. I may still say that is a possibility. I mean, what did they want as a consequence of their Covid campaign? Did they want 100% compliance, with billions of sheep bowing down to them? Did they want everyone locked up in their own little cage, ala 1984, each of us in a squalid apartment with just a giant TV in the middle of it so Big Brother could blab at us all day long? If that is true, then indeed the psyop failed, because they didn’t get that—at least not yet.

But what if they got this: a toxic injection placed in billions of people worldwide that will kill untold millions over the course of about 20 years? Not only that, but the injection will render another untold millions sterile. Do the math here: how many people would need to be sterilized over 20 years to reduce the population worldwide by 1 billion? 2 billion? What other havoc could such a death jab wreak? What untold horrors are yet to overcome us? Your guess is as good as mine. Think zombies here, think soulless ghouls, think humans with no empathy, think lost humanity.

And that’s just the physical consequences. What about the psychological success they have had with the Covid campaign? Sure, many participants have shot them the bird regarding more boosters, and have ignored more threats of losing jobs over vaccine resistance. Sure, the courts have ruled in Canada that the illustrious leader here performed a no-no with his reckless enactment of the Emergency Act, and as a result, lawsuits are flowing into the courts. Does all this mean that no one fell for the psychological operation? That no one was mentally affected by the lockdowns, the masks, the closure of schools, churches, and other institutions? Does it mean that we have all recovered from the trauma of those three years, and mentally and emotionally we are just back to square one—all normal again?

If anyone reading this knows anything about hypnosis, they probably understand what hypnotic suggestion is all about. It is real, folks. What has been altered subliminally in our unconscious minds could be quite formidable. We are being programmed for better performance in future projects the agenda has in store for us. Most of the shrews reading this are safe from this brainwashing (hopefully) because we closed our eyes during the deadly meteor storm perpetrated by the fear-mongering agenda (watch The Day of the Triffids to understand that reference!) But those out there who got caught up in it and drank the delayed-reaction Kool-Aid—are all like sleeper spies from the Cold War, soon to be re-activated at some future date to continue complying with TPTB’s bidding.

Here I go again. I am supposed to be entertaining the possibility that the Covid psyop failed, not suggesting evidence to prove its great success. Sorry. Well, maybe it didn’t go as well as they wanted it to go. It does seem there was a lot more gas in the tank and that they could have pushed it a bit further than they did. They were doing pretty well, but they just fizzled out. Maybe they did expect more people to get vaxxed, maybe that was a disappointment. They sure looked like they were going for the whole enchilada with all their “you’ve GOT to get vaccinated!!” hoopla. Maybe they got too much pushback from us shrews. So many angry shrews showed up pretty quickly. And the shrews that were already on the scene, who were not surprised with all these shenanigans to begin with, just got louder and louder. Sure, not many sheep flipped, but some did. Their booster campaign is floundering (in my opinion, only because they turned the heat down, or off entirely).

So maybe they did get nicked a bit. Maybe a few arrows penetrated the armour, and they backed off a step or two. Maybe we did surprise the bastards with our resolve, tenacity, wit, and refusal to play the game.

But then again, maybe not.

Government

“The US Economy Is Inverted”: How The Flood Of Illegal Immigration Is Delaying The Official US Recession

"The US Economy Is Inverted": How The Flood Of Illegal Immigration Is Delaying The Official US Recession

By Dhaval Joshi, Chief Strategist…

By Dhaval Joshi, Chief Strategist at BCA Research

Summary

-

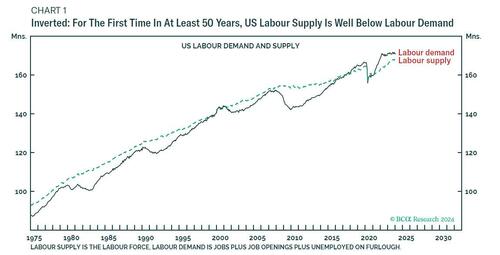

The US economy is highly unusually ‘inverted’. The constraint on the economy is not labor demand, it is labor supply.

-

Hence, the US economy has highly unusually entered a labor demand recession without entering a GDP recession.

-

Nevertheless, for the stock market, a labour demand recession implies a profits headwind, because it is only when profits come under pressure that labour demand goes into recession.

-

Against this, wage disinflation would allow long-duration bond yields to fall, which would provide a countervailing valuation tailwind.

The pandemic might seem like a distant memory, but for the US economy the pandemic’s legacy is still the big story. For the first time in at least fifty years, US labor supply is running well below labor demand. The big story is that the US economy is ‘inverted.’

Therefore, we must analyze the post-pandemic inverted economy very differently to the pre-pandemic economy. Normally, labor demand – being less than labor supply – is the constraint on economic output and thereby drives the cycle. But in an inverted economy, labor supply – being less than labor demand – is the constraint on output and thereby drives the cycle.

Before the pandemic, all downswings caused labor demand to fall well below labour supply. In the subsequent upswings, labor demand gradually caught up with supply…until the next downswing caused a fresh slump in labor demand. And the cycle repeated. Importantly though, all pre-pandemic cycles were driven by the demand side.

Then came the pandemic, and the longstanding pattern inverted. Labor supply suffered the more protracted slump, from which it has gradually caught up with labor demand. Meaning that in the last couple of years, the cycle is being driven not by what is happening to labor demand, but by what is happening to labor supply.

Interest rate hikes work by choking demand, which is exactly what has happened recently. US labor demand is tipping into recession. Jobs plus job openings today are less than they were a year ago. Whenever this happened pre-pandemic, the economy tipped into recession too. But for the first time in at least fifty years, the economy is entering a labor demand recession without entering a GDP recession.

This is because in an inverted economy the constraint on the economy is not labor demand, it is labor supply. Despite weaking

labor demand, labor supply has played catch up to demand and thereby driven economic growth.

As labor supply has caught up with labor demand, it has narrowed the gap between demand and supply. This has created the perfect macro backdrop of robust economic growth with wage disinflation, a Goldilocks setup for financial assets. The pressing question for the coming 6-12 months is, what happens next to labor supply, labor demand, and their interplay?

Why The US Economy Inverted

But first, let’s tackle the obvious question. Why is US labor supply running well below labor demand?

There are two reasons: after the pandemic, prime aged (25-54) workers left the labor force; and older aged (55+) workers retired early, generating millions of so-called ‘excess retirements.’

The economically inactive make no contribution to labor supply. Yet they still consume the goods and services that generate labor demand. This they do by using savings or, in the case of early retirees, by tapping into their retirement assets and income early. Thereby, the plunge in prime-aged labor participation combined with excess retirements caused labor supply to fall well below labor demand.

Subsequently, the plunge in prime-aged labour participation has fully reversed, causing labor supply to recover strongly. But the excess retirements have not reversed and are unlikely to reverse

This means that the strong recovery in labor supply is now exhausted, with labor supply still several million people below labor demand. The economy is still inverted.

US Labour Demand Is Already In Recession, But GDP May Dodge The Bullet

To repeat, US labor demand has already tipped into recession. But in the inverted economy – where labor supply is the constraint on output – labor supply is driving the GDP cycle.

It follows that a GDP recession would require one of two things:

- Labor supply must outright contract. However, with the recent surge in illegal migration – most of which does eventually get counted in the survey-calculated labor supply – a sustained contraction in labor supply seems unlikely. Of course, this could change under a new Trump administration, or...

- Labor demand must contract so sharply – by about 3.5 million jobs – that the economy would ‘un-invert’. Once un-inverted, contracting labor demand would once again drive GDP into recession, as in all pre-pandemic cycles.

But if labor demand contracts more gently – as now – then the US economy could experience a sustained labor demand recession without a GDP recession, making it difficult for the National Bureau of Economic Research (NBER) to designate it an official recession.

This ‘halfway house’ in which GDP is not in recession, but labor demand is in recession and gently ‘catching down’ with labor supply is a distinct possibility – because it is the least painful way for the Federal Reserve to steer wage inflation back down to the 3 percent rate that is needed for price inflation to stabilise at 2 percent (Chart 5 and Chart 6).

Yet though the economy could dodge the ‘NBER official recession’ bullet, a labor demand recession combined with stagnant per capita real incomes would very much feel like a recession.

For the stock market, a labor demand recession implies lower profits because it is only when profits come under pressure that labor demand goes into recession. Against this, wage disinflation would allow long-duration bond yields to fall, which would provide some countervailing support to stock valuations. In combination this would imply the stock market was rangebound while high-quality bonds rallied.

But there is another factor to consider. The euphoric pricing of anything AI-related is a separate and independent risk to the stock market. Absent this risk the macro backdrop would imply a neutral allocation to stocks versus cash. But this additional risk ratchets down my 6-12-month allocation to mildly underweight.

For those who can time this, go underweight stocks when the ‘Joshi rule’ is triggered. Or, when the rally reaches a collapsed complexity that presages an imminent reversal.

More in the full note available to pro subscribers.

Government

Pandemic Whiskey Boom Turns To Hangover

Pandemic Whiskey Boom Turns To Hangover

Authored by Douglas French via The Mises Institute,

Yeah, the other night I laid sleeping

And…

Authored by Douglas French via The Mises Institute,

Yeah, the other night I laid sleeping

And I woke from a terrible dream

So I caught up my pal Jack Daniel's

And his partner Jimmy Beam

And we drank alone, yeah

With nobody else

Yeah, you know when I drink alone

I prefer to be by myself

~George Thorogood

I poured hundreds of “Jack and Cokes” when I tended bar from the late 70’s to mid 80’s. It was beyond me how anyone could tell the difference between Jack Daniels Old No. 7 and anything else when mixed with coke or whatever carbonated cola was coming out of the gun.

Turns out Dr. Fauci and the Center for Disease Control did Brown-Forman, the makers of Jack, a solid by shutting down America and cooping everyone up. More than some whiled away the hours with their old pal Jack Daniels. People may have had to work from home, but without the boss breathing down their necks plenty figured “why not have snoot-full and have fun.” It’ll make the day go by faster. Besides, no customers would be banging on the door. No one will know the difference.

“The phenomenal sales growth we saw during the pandemic was unprecedented and unpredictable but also unsustainable, and now, the spirits market is recalibrating,” Chris Swonger, the president of the Distilled Spirits Council of the United States, said last month. Those stimulus checks could buy a lot of Jack Daniels, or cause the more frugal drinker to pay more for Jack, instead of cheaper brands.

Jennifer Maloney writes for the Wall Street Journal, “Some drinkers of Jack Daniel’s Old No. 7 - often used to make the cocktail Jack and Coke - are trading down to cheaper alternatives while others are trading up.”

Price inflation affects consumers differently. For those drinking their whiskey with Coke, just about any will probably do, but for those imbibing theirs neat or on the rocks may spend a few more cheaper bucks for smoothness.

Even Jack and Coke drinker Brian Moran, a tile-setter who lives in the Chicago suburbs, told the WSJ that a client paid him to tile a kitchen backsplash with five pricier bottles of bourbon, including Stagg, Eagle Rare and E.H. Taylor. “From his first sips, Moran was enthralled,” writes Maloney.

“I don’t know anyone who even drinks it anymore,” he said of Jack Daniel’s Old No. 7, which has a national average price of about $22. “You spend an extra $10 and you get something that’s so much better.”

Brown-Forman reported dismal sales over the winter holiday season and the hangover has lasted into 2024. “Christmas stunk,” Chief Executive Lawson Whiting said on a call with analysts in early March.

Brown-Forman is trying to entice younger legal-age drinkers to Jack Daniel’s Old No. 7 with a TV commercial set to the AC/DC song “Back in Black.” However, that song was a hit more than 40 years ago. Also the company is selling Jack and Coke in a can, attempting to appeal to young drinkers and females. The canned cocktail contains about 5% alcohol depending on the market. Reportedly there is a no sugar version. Which hardly seems possible.

Chairman Campbell Brown, a great-great-grandson of founder George Garvin Brown, told investors that the company has weathered Prohibition and the Great Depression, steadily building the Jack Daniel’s brand since acquiring it nearly 70 years ago.

It was not reported whether he has thanked Dr. Fauci.

-

Spread & Containment3 weeks ago

Spread & Containment3 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 week ago

International1 week agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

International3 weeks ago

International3 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 weeks ago

International3 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoKey Events This Week: All Eyes On Core PCE Amid Deluge Of Fed Speakers

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoEvidence And Insights About Gold’s Long-Term Uptrend

-

Uncategorized1 month ago

Uncategorized1 month agoA Global, Digital Coup d’État

-

Spread & Containment1 week ago

Spread & Containment1 week agoJapanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns