- A new type of versatile economical photocatalyst that harnesses the visible portion of the sunlight spectrum has been developed by researchers from the University of Johannesburg. It is simple to manufacture.

- Currently, economical photocatalysts only ‘use’ the UV spectrum of sunlight.

- The new photocatalyst harnesses about a third of the visible light spectrum.

- The extremely stable, powder-form three-component photocatalyst is built from graphitic carbon (89% of mass), a modified calixarene (10%) and a niobium-containing MXene (1%).

Researchers at the University of Johannesburg have developed a new type of photocatalyst that harnesses the visible portion of the sunlight spectrum. Currently, economical and environmentally-friendly photocatalysts only ‘use’ the UV spectrum of sunlight, example the commonly-used titanium dioxide and other close equivalents.

The research is published in Journal of Science: Advanced Materials and Devices.

The photocatalyst is the first three-component photocatalyst with these specific photocatalytic properties. It is almost 90% comprised of economical off-the-shelf ingredients, and simple enough to produce at scale in resource-constrained laboratories.

In other research studies, a photocatalyst containing the noble metal palladium (Pd) has been described, which ‘uses’ the visible spectrum of sunlight also.

In contrast, the photocatalyst in this study uses small amounts of the minor transitional metal carbide, niobium to prepare the third component, a nanomaterial known as a MXene.

Niobium carbide MXene has been used in a wide array of photocatalytic applications such as hydrogen generation and carbon dioxide conversion to valuable products.

In powder form, the photocatalyst is also extremely stable under high temperatures, humidity, and chemical variations.

The catch with photocatalysts

Reducing energy use in bulk industrial processes can be tricky. But what if a major portion of the electrical energy consumed, can be ‘clawed back’ by the sun instead?

Photocatalysts can be ‘switched on’ by sunlight and other forms of light. These can then facilitate chemical processes by orders of magnitude. These catalysts exhibit potentials to be used in a variety of energy generation and environmental detoxification industries.

But there is a catch. Currently, highly effective photocatalysts tend to be very expensive. Also difficult and even dangerous to make.

A major component of the cost of photocatalysts can be metals such as platinum, palladium or gold. Using metals in photocatalysts is not desirable from an environmental point of view either.

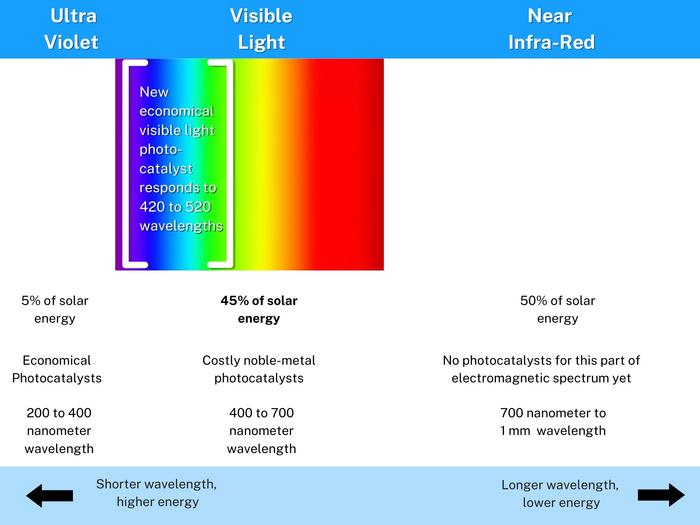

Another catch is that most current photocatalysts tend to ‘switch on’ mostly upon UV light exposure, which only constitutes 5% of sunlight energy reaching the surface of the Earth.

Meanwhile, visible light constitutes 45% of the available solar light energy, and near-infrared the remaining 50%.

Adding a third of visible light spectrum

The photocatalyst the researchers designed and tested harnesses about a third of the visible light spectrum, says Prof Langelihle (Nsika) Dlamini. Dlamini is a researcher at the UJ Department of Chemical Science.

To put numbers on this, the ultraviolet spectrum (UV) has shorter wavelengths (high energy), ranging from 200 to 400 nanometers. Visible sunlight has longer wavelengths (low energy) from 400 to 700 nanometers.

The violet-blue-cyan-green portion of visible sunlight right next to UV light, is what the UJ researchers’ photocatalyst responds to. This low-energy portion of visible light also ‘switches on’ the photocatalyst to initiate chemical reactions.

“The photocatalyst is excited and has a low rate of undesirable electron and holes recombination in the 420 to 520 nanometer wavelength range. This is owing to the unique structural design of the integrated materials,” says Dlamini.

“This means that the photocatalyst should be able to respond to an additional 15% of the available solar energy to initiate chemical processes, depending on its efficiency,” he says.

First economical and stable visible spectrum photocatalyst

This study is a first for a non-noble metal, economical photocatalyst, says PhD candidate Mr Collen Makola.

“The performance of any photocatalyst can be measured by evaluating its ability to convert solar and/or light energy into chemical energy. This is known as the photo-to-chemical conversation efficiency, represented as mu.

“Our photocatalyst (mu= 4.86%) surpasses a three-component photocatalyst (mu = 1.81%), which appeared in a journal article in 2017. That photocatalyst was composed of silver, cadmium sulfide, and zinc oxide,” says Makola.

In temperature tests, the researchers found that the photocatalyst is extremely stable up to 500 degrees Celsius. Also, the stability in water of different pH levels was confirmed ranging from pH 1 to pH 14.

Additionally, the prepared photocatalyst disperses uniformly in water—an added advantage for photocatalytic applications.

Three-ingredient, almost metal-free

To get a photocatalyst with this performance, the researchers combined three ‘ingredients’ for the final design of the photocatalyst.

First, about 89% of the bulk mass of the powder-form photocatalyst is graphitic carbon, says Dlamini.

“Graphitic carbon is ‘excited by’ or ‘switched on’ by UV light in the 200 to 400 nanometer wavelength range. It produces free electrons that can then initiate a variety of chemical processes,” adds Dlamini.

The researchers produced this ingredient at one of the UJ laboratories.

The second ingredient is about 10% of the final mass. This is the calixarene, in this case a cup-shaped molecule.

“We included the calixarene so the photocatalyst can ‘catch’ and break down unwanted organic molecules, such as personal products, pharmaceutical drugs and their metabolites and other substances in municipal wastewater. Calixarenes have been used for decades in pharmaceutical drugs,” adds Dlamini.

The researchers purchased the calixarene off-the-shelf and then modified it.

The third ingredient is the MXene.

“The main function of the MXene is to prevent the photo-generated electrons from the graphitic carbon nitride to recombine or ‘cancel out’ with the positively charged species (known as holes) under visible light exposure,” says Makola.

The MXene they selected is about 1% of the final mass. It contains carbon and a tiny amount of niobium, a relatively low-cost metal.

“Both the calixarene and the MXene contributed to shifting of the light absorption into the visible region of the solar spectrum,” says Makola.

Versatile, multiple applications

By its very nature, the economical photocatalyst has significant potential for multiple industrial applications where sunlight or electrical light is available to facilitate chemical processes, says Dlamini. This varies from bulk water treatment to sterilisation of grow rooms or medical facilities and more.

Currently, the researchers are testing the photocatalyst’s ability to break down organic pollutants and pharmaceutical residues in real wastewater samples at laboratory scale.

###

Funding

The researchers thank the University of Johannesburg (URC) and Faculty of Science (FRC), National Research Foundation – CSUR (Grant SRUG210223587616), National Research Foundation and the German Academic Exchange Service (NRF-DAAD) for research and study financial support.

Notes to Editors:

Media Pack

For high resolution images, go to

https://drive.google.com/drive/folders/1puls0BJhlKIYIjLB8HoNJfEcmVrD_5hv?usp=sharing

No registration or login necessary from a computer.

For more information, or to speak to the researchers involved, please contact:

Ms Therese van Wyk, Research Media Liaison, University of Johannesburg, +27 71 139 8407 (Mobile and Whatsapp), theresevw@uj.ac.za.

Journal

Journal of Science Advanced Materials and Devices

DOI

10.1016/j.jsamd.2023.100593

Method of Research

Experimental study

Subject of Research

Not applicable

Article Title

An insight into a novel calixarene-sensitized Calix@Nb2CTx/g-C3N4 MXene-based photocatalytic heterostructure: Fabrication, physicochemical, optoelectronic, and photoelectrochemical properties

Article Publication Date

9-Jun-2023

COI Statement

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.