Margin Debt Confirms Market Exuberance

Margin Debt Confirms Market Exuberance

Tyler Durden

Tue, 12/08/2020 – 14:00

Authored by Lance Roberts via RealInvestmentAdvice.com,

During the past couple of weeks, I have discussed the rising levels of bullishness in the markets..

Authored by Lance Roberts via RealInvestmentAdvice.com,

During the past couple of weeks, I have discussed the rising levels of bullishness in the markets. We have pointed to indicators like extreme investor positioning, put/call ratios, etc. However, the current surge in margin debt also confirms market exuberance.

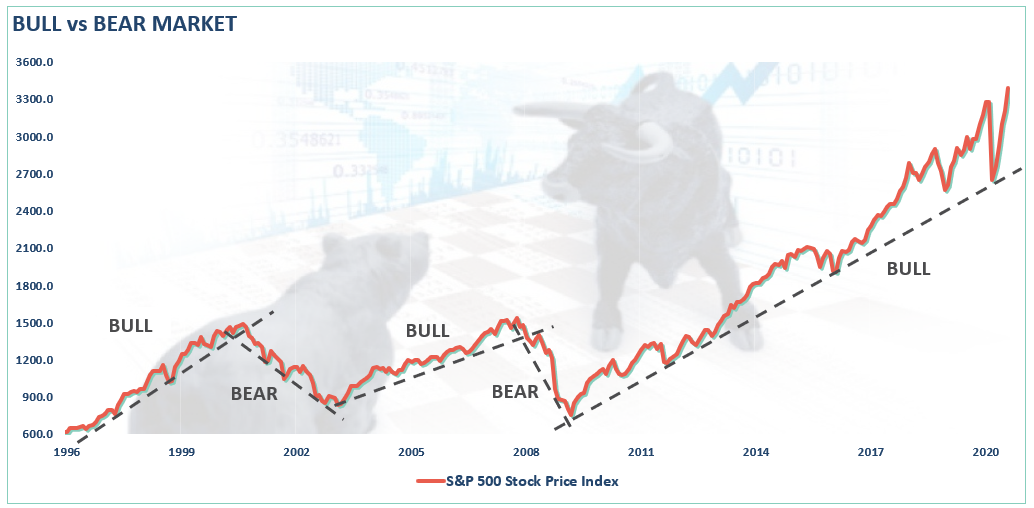

First, we have to step back a bit. We previously discussed why the 35% decline in March was only a “correction” and not a “bear market.” As noted in “March Was Only A Correction,” there is a significant difference.

“The distinction is essential.

‘Corrections’ generally occur over short time frames, do not break the prevailing trend in prices, and are quickly resolved by markets reversing to new highs.

‘Bear Markets’ tend to be long-term affairs where prices grind sideways or lower over several months as valuations are reverted.

Using monthly closing data, the “correction” in March was unusually swift but did not break the long-term bullish trend. Such suggests the bull market that began in 2009 is still intact as long as the monthly trend line holds.

Margin debt also confirms the correction and the recent exuberance.

Everything Is At An All-Time High

Before we dig further into what margin debt tells us, let’s begin with where we are currently. Greg Feirman recently summed it up nicely.

“Friday was an absolute breakout to new ATHs-fest (All-Time Highs). The S&P closed at a new all-time high just below 3,700. The Russell tacked on another 2.37% and closed just below 1900. Junk bonds and regional banks are super strong. Of course, if the indexes are breaking out, so are a lot of individual stocks.”

He is correct. As we discussed in “Sign, Sign, Everywhere A Sign,” investors are now “all in” in terms of portfolio risk.

As Howard Marks noted in a recent Bloomberg interview:

“Fear of missing out has taken over from the fear of losing money. If people are risk-tolerant and afraid of being out of the market, they buy aggressively, in which case you can’t find any bargains. That’s where we are now. That’s what the Fed engineered by putting rates at zero.

“,,,we are back to where we were a year ago—uncertainty, prospective returns that are even lower than they were a year ago, and higher asset prices than a year ago. People are back to having to take on more risk to get return. At Oaktree, we are back to a cautious approach. This is not the kind of environment in which you would be buying with both hands.

The prospective returns are low on everything.”

The Issue Of Margin Debt

This exuberance requires “fuel,” which brings us to margin debt. As I explained previously:

“Margin debt is not a technical indicator for trading markets. What margin debt represents is the amount of speculation that is occurring in the market. In other words, margin debt is the ‘gasoline,’ which drives markets higher as the leverage provides for the additional purchasing power of assets. However, ‘leverage’ also works in reverse as it supplies the accelerant for more significant declines as lenders ‘force’ the sale of assets to cover credit lines without regard to the borrower’s position.”

The last sentence is the most important. The issue with margin debt, in particular, is that the unwinding of leverage is NOT at the investor’s discretion. It is at the discretion of the broker-dealers that extended that leverage in the first place. (In other words, if you don’t sell to cover, the broker-dealer will do it for you.) When lenders fear they may not recoup their credit-lines, they force the borrower to either put in more cash or sell assets to cover the debt. The problem is that “margin calls” generally happen all at once, as falling asset prices impact all lenders simultaneously.

Margin debt is NOT an issue – until it is.

Event Risk

It is when an “event” causes lenders to “panic” that margin becomes problematic.

We have seen margin liquidation events twice in the last 15-years. The first was during the 2008 financial-crisis that forced Lehman into bankruptcy.

The second time was in March of this year.

How do we know that March was a “Margin Call?”

There are two reasons.

-

The Fed rushed to the rescue of the banks (again) as credit risk went parabolic; and,

-

The chart below of “free credit” balances shows the massive liquidation of margin debt as brokerage firms called in credit lines.

Free credit balances are crucial as it is the difference of “unused margin plus cash,” which gets subtracted from “outstanding margin.” In other words, like a credit card with a zero balance, when the lined gets paid off, there is a positive free cash balance; when it is negative, it shows the utilization of the “credit.”

The chart below overlays the two:

-

The actual level of margin debt, and;

-

The level of “free cash” balances.

The sharp reversal of margin debt from the March lows shows the speculation level, which has ensued in the markets due to the Fed’s interventions. (Margin debt lags by 2-months, so I have used the average margin debt growth rate from March to estimate the last 2-months. Given the rapid surge in the market in November, I am probably underestimating current levels.)

Margin Debt Confirms The Exuberance

As noted, when markets are rising and investors are taking on additional leverage to increase buying power, margin debt supports the advance. However, the magnitude of the recent surge in margin debt also confirms the current levels of investor exuberance.

The chart shows the relationship between cash balances and the market. I have inverted free cash balances, so the relationship between increases in margin debt and the market is better represented.

Note that during the 1987 correction, the 2015-2016 “Brexit/Taper Tantrum,” the 2018 “Rate Hike Mistake,” the “COVID Dip,” the market never broke its uptrend, AND cash balances never turned positive.

Both a break of the rising bullish trend and positive free cash balances were the 2000 and 2008 bear markets’ hallmarks. Such is another reason that March was just a “correction.”

Had such occurred, the positive free cash balances, and significantly reduced valuation levels, would have supported the beginning of a longer-term bull market. However, with negative cash balances surging and extreme deviations from long-term means, investors are likely once again set up for another reversion. Such is not even to mention the long-term correlations to valuations.

As noted in “Why This Isn’t 1920,” the highest correlation between stock prices and future returns comes from valuations.

Overbought

Margin data goes back to 1959 to get a long-look at margin debt and its relationship to the market. The chart below is a “stochastic indicator” of margin debt overlaid against the S&P 500.

The stochastic indicator is a momentum indicator developed by George C. Lane in the 1950s. The chart shows the position of the most recent margin debt level relative to its previous high-low range. The indicator measures the momentum of margin debt by comparing the closing level with the range over the past 21-months.

The stochastic indicator represents the speed and momentum of margin debt level changes. Such means the stochastic indicator changes direction before the market. As such, it can be considered a leading indicator.

Currently, the indicator is back to overbought levels, which suggests market risk has risen also. Our stochastic measures of the market itself are confirming much the same.

It’s All Coincident

I want to make a critical point here. Margin debt, like valuations, are “terrible market timing” indicators and should not be used as such.

Rising levels of margin debt are a measure of investor confidence. Investors are more willing to take out debt against investments when shares are rising, and they have more value in their portfolios against which they can borrow. However, the opposite is also true as falling asset prices reduce the amount of credit available, and the liquidation of assets must occur to bring the account back into balance.

I agree and disagree that margin debt levels are simply a function of market activity and have no bearing on the outcome of the market.

As we saw in March, the double-whammy of collapsing oil prices and economic shutdown in response to the coronavirus triggered a sharp sell-off fueled by margin liquidation.

Currently, the majority of investors have forgotten about March. Or worse, assume it can’t happen again for a variety of short-sighted reasons. However, the “gas tank” is full once again as investors are more exuberant now than at the peak of the market in 2000, as noted by Sentiment Trader yesterday.

Excuses Won’t Work

Sure, this time could indeed be different. That has remained the “sirens song” of investors since March. However, as Sentiment Trader summed up the last time we wrote on this topic, such is usually not the case.

“Whenever some of this data fails to lead to the expected outcome for a few weeks or more, we hear the usual chorus of opinions about why it doesn’t work anymore. This has been consistent for 20 years, like…

Decimalization will destroy all breadth figures (2000)

The terror attacks will permanently alter investors’ time preferences (2001)

The pricking of the internet bubble will forever change option skews (2002)

Easy money will render sentiment indicators useless (2007)

The financial crisis means relying on any historical precedents are invalid (2008)

The Fed’s interventions mean any indicators are no longer useful (2010 – present)

All of these sound good, and for a time it seemed like they were accurate. Then markets would revert and the arguments would get swept into the dustbins of history.”

It’s not too late to take action to preserve capital now, so you have the money to invest with later.

A Lot Like Sex

While we remain long-biased in our equity portfolios, we have begun to reduce some of our big winners (take profits) and adding to our more defensive-oriented positions. While we certainly want to participate in the market’s current upside, we will also give up some gains to protect against the eventual reversion.

While it certainly may “feel” like the market “just won’t go down,” it is worth remembering the sage words of Warren Buffett.

“The market is a lot like sex, it feels best at the end.”

In the short-term, holding higher cash levels will indeed provide some drag between our portfolio and the major market index. However, when the first “cold snap” washes across the markets, our preparation should protect us against the “bite.”

We remain “bullish” on the markets currently as momentum is still in play. However, just as any farmer is keenly aware of the signs “Winter” is approaching, we are just taking some precautionary actions.

To spin a bit of Warren’s quote:

“If you engage in the market in an unprotected fashion, you may not want the unexpected surprise.”

Uncategorized

Key shipping company files for Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Key shipping company files Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Tight inventory and frustrated buyers challenge agents in Virginia

With inventory a little more than half of what it was pre-pandemic, agents are struggling to find homes for clients in Virginia.

No matter where you are in the state, real estate agents in Virginia are facing low inventory conditions that are creating frustrating scenarios for their buyers.

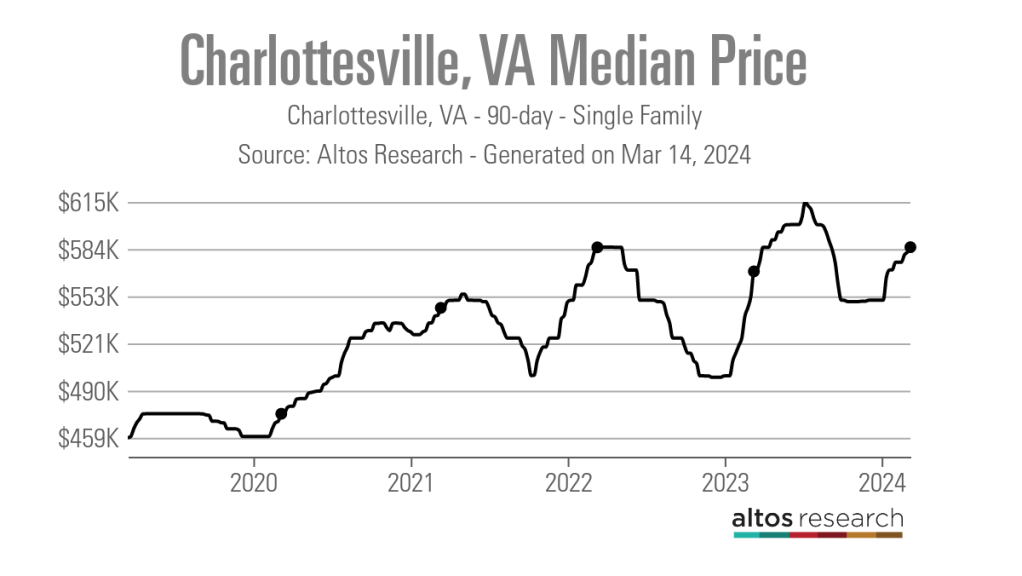

“I think people are getting used to the interest rates where they are now, but there is just a huge lack of inventory,” said Chelsea Newcomb, a RE/MAX Realty Specialists agent based in Charlottesville. “I have buyers that are looking, but to find a house that you love enough to pay a high price for — and to be at over a 6.5% interest rate — it’s just a little bit harder to find something.”

Newcomb said that interest rates and higher prices, which have risen by more than $100,000 since March 2020, according to data from Altos Research, have caused her clients to be pickier when selecting a home.

“When rates and prices were lower, people were more willing to compromise,” Newcomb said.

Out in Wise, Virginia, near the westernmost tip of the state, RE/MAX Cavaliers agent Brett Tiller and his clients are also struggling to find suitable properties.

“The thing that really stands out, especially compared to two years ago, is the lack of quality listings,” Tiller said. “The slightly more upscale single-family listings for move-up buyers with children looking for their forever home just aren’t coming on the market right now, and demand is still very high.”

Statewide, Virginia had a 90-day average of 8,068 active single-family listings as of March 8, 2024, down from 14,471 single-family listings in early March 2020 at the onset of the COVID-19 pandemic, according to Altos Research. That represents a decrease of 44%.

In Newcomb’s base metro area of Charlottesville, there were an average of only 277 active single-family listings during the same recent 90-day period, compared to 892 at the onset of the pandemic. In Wise County, there were only 56 listings.

Due to the demand from move-up buyers in Tiller’s area, the average days on market for homes with a median price of roughly $190,000 was just 17 days as of early March 2024.

“For the right home, which is rare to find right now, we are still seeing multiple offers,” Tiller said. “The demand is the same right now as it was during the heart of the pandemic.”

According to Tiller, the tight inventory has caused homebuyers to spend up to six months searching for their new property, roughly double the time it took prior to the pandemic.

For Matt Salway in the Virginia Beach metro area, the tight inventory conditions are creating a rather hot market.

“Depending on where you are in the area, your listing could have 15 offers in two days,” the agent for Iron Valley Real Estate Hampton Roads | Virginia Beach said. “It has been crazy competition for most of Virginia Beach, and Norfolk is pretty hot too, especially for anything under $400,000.”

According to Altos Research, the Virginia Beach-Norfolk-Newport News housing market had a seven-day average Market Action Index score of 52.44 as of March 14, making it the seventh hottest housing market in the country. Altos considers any Market Action Index score above 30 to be indicative of a seller’s market.

Further up the coastline on the vacation destination of Chincoteague Island, Long & Foster agent Meghan O. Clarkson is also seeing a decent amount of competition despite higher prices and interest rates.

“People are taking their time to actually come see things now instead of buying site unseen, and occasionally we see some seller concessions, but the traffic and the demand is still there; you might just work a little longer with people because we don’t have anything for sale,” Clarkson said.

“I’m busy and constantly have appointments, but the underlying frenzy from the height of the pandemic has gone away, but I think it is because we have just gotten used to it.”

While much of the demand that Clarkson’s market faces is for vacation homes and from retirees looking for a scenic spot to retire, a large portion of the demand in Salway’s market comes from military personnel and civilians working under government contracts.

“We have over a dozen military bases here, plus a bunch of shipyards, so the closer you get to all of those bases, the easier it is to sell a home and the faster the sale happens,” Salway said.

Due to this, Salway said that existing-home inventory typically does not come on the market unless an employment contract ends or the owner is reassigned to a different base, which is currently contributing to the tight inventory situation in his market.

Things are a bit different for Tiller and Newcomb, who are seeing a decent number of buyers from other, more expensive parts of the state.

“One of the crazy things about Louisa and Goochland, which are kind of like suburbs on the western side of Richmond, is that they are growing like crazy,” Newcomb said. “A lot of people are coming in from Northern Virginia because they can work remotely now.”

With a Market Action Index score of 50, it is easy to see why people are leaving the Washington-Arlington-Alexandria market for the Charlottesville market, which has an index score of 41.

In addition, the 90-day average median list price in Charlottesville is $585,000 compared to $729,900 in the D.C. area, which Newcomb said is also luring many Virginia homebuyers to move further south.

“They are very accustomed to higher prices, so they are super impressed with the prices we offer here in the central Virginia area,” Newcomb said.

For local buyers, Newcomb said this means they are frequently being outbid or outpriced.

“A couple who is local to the area and has been here their whole life, they are just now starting to get their mind wrapped around the fact that you can’t get a house for $200,000 anymore,” Newcomb said.

As the year heads closer to spring, triggering the start of the prime homebuying season, agents in Virginia feel optimistic about the market.

“We are seeing seasonal trends like we did up through 2019,” Clarkson said. “The market kind of soft launched around President’s Day and it is still building, but I expect it to pick right back up and be in full swing by Easter like it always used to.”

But while they are confident in demand, questions still remain about whether there will be enough inventory to support even more homebuyers entering the market.

“I have a lot of buyers starting to come off the sidelines, but in my office, I also have a lot of people who are going to list their house in the next two to three weeks now that the weather is starting to break,” Newcomb said. “I think we are going to have a good spring and summer.”

real estate housing market pandemic covid-19 interest rates-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges