Hawkish Powell Hits Stocks; Bitcoin Flat As Breakevens, Bond Yields & Bullion Bounce

Hawkish Powell Hits Stocks; Bitcoin Flat As Breakevens, Bond Yields & Bullion Bounce

A very mixed week across the asset-classes.

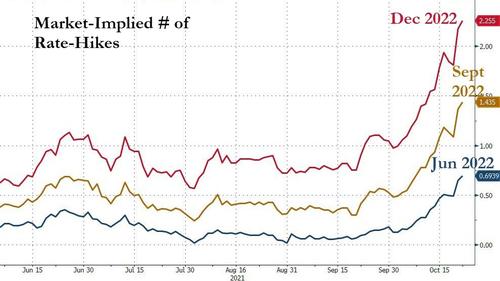

Hawkish Powell: rate-hike expectations surged higher but stocks gained, crude rallied but copper tumbled..

A very mixed week across the asset-classes.

Hawkish Powell: rate-hike expectations surged higher but stocks gained, crude rallied but copper tumbled. Growth and Value stocks basically ended the week up around the same amount (while Cyclicals modestly outperformed Defensives). Perhaps most notably, rates vol and stock vol expectations are dramatically decoupled from one another.

Inflation: Breakevens soared to record highs... globally, bullion bounced but bitcoin ended the week unchanged and bonds only modestly higher in yield.

Source: Bloomberg

We do not that the long-end of the curve notably outperformed today (flattening the curve significantly) after Powell's comments, in a clear signal from the market that it's expecting a Policy error...

Source: Bloomberg

Arguably, as Goldman details below, the market could be morphing back from a 'stagflation' narrative to a 'reflation' narrative...

Heading into the week, the ‘stagflation’ narrative was continuing despite the fact that the S&P 500 had already bounced off of its late-September bottom and was heading back towards an all-time high. And as we exit the week, the inflation debate seems to be evolving into a ‘the Fed will hike earlier’ narrative, with yields on 2-year Notes spiking to 0.50% — a level last seen in the first days of the pandemic way back on March 18, 2020. Praveen Korapaty writes in last Friday’s note, “Front-end pressures mount,” that markets appear to have returned to a paradigm of simultaneously bringing forward and/or accelerating hike pricing and taking down terminal rate assumptions. Bond investors appear to be increasingly thinking that the rise in inflation that we have been observing will translate into an earlier Fed funds rate hike.

And yields on 10-year Treasuries also briefly touched 1.70% this week, suggesting that bond investors are actually also feeling fine about longer-term growth. And this better feeling is also being reflected in stock prices with the S&P 500 breaking up above 4500 and hitting a new all-time high this week. So, the ‘stagflation’ narrative seems to be morphing back into a ‘reflation’ narrative — something similar to what we were experiencing when the economy first ‘reopened’ last spring.

Digging into each asset class, stocks ended the week higher overall (despite today's Powell-driven dip that sent Nasdaq down around 1% today)...

The S&P and Dow closed at record weekly closing highs...

In Canada, the S&P/TSX Composite is up 13 straight days to a new record high - the longest winning streak since 1985...

Source: Bloomberg

Rather interestingly, this week saw "get out and party" recovery stocks underperform the "stay at home and sulk" stocks...

Source: Bloomberg

Cyclicals modestly outperformed Defensives on the week...

Source: Bloomberg

Growth barely outperformed Value on the week...

Source: Bloomberg

TSLA topped FB in terms of market cap again today (to become the 5th biggest company in the S&P) as Musk's carmaker surged to new record highs above $900...

Source: Bloomberg

But the week's biggest gainer was Trump's "TRUTH" SPAC which ended up over 800% (though at one point it was up over 1600%)...

Source: Bloomberg

VIX traded down to a 14 handle this morning - the lowest since before the pandemic lockdowns began...

Treasury yields ended the week higher, but the long-end notably outperformed...

Source: Bloomberg

The yield curve ended the week notably flatter (after a wild ride midweek back to last week's highs)...

Source: Bloomberg

Policy Error? The flattening started with the June taper chatter...

Source: Bloomberg

Inflation Breakevens soared to record highs today (US 5Y topped 3.0%) across the globe today...

Source: Bloomberg

The dollar ended the week lower, chopping around at one-month-lows...

Source: Bloomberg

Cryptos had a wild ride for the week with Bitcoin reaching new record highs after BITO's launch before fading back to unchanged on the week today (Ethereum modestly outperformed on the week)...

Source: Bloomberg

Bitcoin ended the week just above $60k, well off the $67k record high...

Source: Bloomberg

The newly launched Bitcoin (futures) ETF (BITO) ended below its opening level...

Bitcoin Futures were well bid as BITO launched but the premium over spot has faded since...

Source: Bloomberg

Commodities were very mixed with copper clubbed and silver soaring (gold and crude also rallied)...

Source: Bloomberg

Rather interestingly, the huge divergence between copper and silver occurred at a key resistance level (around 20 ounces of silver to buy copper)

Source: Bloomberg

Finally, we note Mizuho's warning of the impact of today's more hawkish speech from Fed chair Powell. Our view that the divergence of equity implied vol (at pre-pandemic lows) from rates implied vol (rising to the highs of the year in most markets) is unsustainable, is showing tentative signs of turning.

Source: Bloomberg

The sharp move lower in Nasdaq futures and widening of CDS indices is a warning shot, we feel, of how risk assets would break down if the Fed was to try to stamp out inflation at such an early point in the cycle as mid 2022.

Commodities relative to stocks are starting to flash some red alerts...

Regime Change

— The Bear Traps Report (@BearTrapsReport) October 5, 2021

The recent commodity outperformance vs. the Nasdaq (9% in 8 days) is one of the most significant stretches in twelve years. On par with readings in 2008 and the dot-com bubble. pic.twitter.com/nNm1rUsuNT

And if one needed an excuse to buy some protection against that whiplash reality check for stocks, VIX is at a critically cheap level relative to VXV...

Source: Bloomberg

That has not tended to end well for stocks.

International

Japanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns

Japanese Preprint Calls For mRNA VaccinesTo Be Suspended Over Blood Bank Contamination Concerns

Authored by Naveen Athrappully via The Epoch…

Authored by Naveen Athrappully via The Epoch Times (emphasis ours),

Receiving blood transfusion from COVID-19-vaccinated individuals could pose a medical risk to unvaccinated recipients since numerous adverse events are being reported among vaccinated people worldwide, according to a recent study from Japan.

The preprint review, published on March 15, examined whether receiving blood from COVID-19-vaccinated individuals is safe or poses a health risk. Many nations have reported that mRNA vaccine usage has resulted in “post-vaccination thrombosis and subsequent cardiovascular damage, as well as a wide variety of diseases involving all organs and systems, including the nervous system,” it said.

Repeated vaccinations can make people more vulnerable to COVID-19, it said. If the blood contains spike proteins, it becomes necessary to remove these proteins prior to administration, and there is no such technology currently available, the authors wrote.

Contrary to earlier expectations, genes and proteins from genetic vaccines have been found to persist in the blood of vaccine recipients for “prolonged periods of time.”

In addition, “a variety of adverse events resulting from genetic vaccines are now being reported worldwide.” This includes a wide range of diseases related to blood and blood vessels.

Some studies have reported that the spike protein in the mRNA vaccines is neurotoxic and capable of crossing the blood-brain barrier, the review stated. “Thus, there is no longer any doubt that the spike protein used as an antigen in genetic vaccines is itself toxic.”

Moreover, people who have taken multiple shots of mRNA vaccines can have several exposures to the same antigen within a small time frame, which may lead to them being “imprinted with a preferential immune response to that antigen.”

This has resulted in COVID-19 vaccine recipients becoming “more susceptible to contracting COVID-19.”

Given such concerns, medical professionals should be aware of the “various risks associated with blood transfusions using blood products derived from people who have suffered from long COVID and from genetic vaccine recipients, including those who have received mRNA vaccines.”

The impact of such genetic vaccines on blood products as well as the actual damage caused by them are currently unknown, the authors wrote.

“In order to avoid these risks and prevent further expansion of blood contamination and complication of the situation, we strongly request that the vaccination campaign using genetic vaccines be suspended and that a harm–benefit assessment be carried out as early as possible.”

Repeated vaccination of genetic vaccines can also end up causing “alterations in immune function” among recipients. This raises the risk of serious illnesses due to opportunistic infections or pathogenic viruses, which would not have been an issue if the immune system were normal, the review said.

“Therefore, from the perspective of traditional containment of infectious diseases, greater caution is required in the collection of blood from genetic vaccine recipients and the subsequent handling of blood products, as well as during solid organ transplantation and even surgical procedures in order to avoid the risk of accidental blood-borne infection,” it stated.

The review was funded by members of the Japanese Society for Vaccine-related Complications and the Volunteer Medical Association. Authors did not declare any conflict of interest.

Dangers With Blood Transfusions

The review pointed out that the genetic vaccination status of blood donors is not collected by organizations even though the use of such blood may pose risks to patients. As such, authors recommended that when blood products are derived from such people, “it is necessary to confirm the presence or absence of spike protein or modified mRNA as in other tests for pathogens.”

“If the blood product is found to contain the spike protein or a modified gene derived from the genetic vaccine, it is essential to remove them,” it stated. “However, there is currently no reliable way to do so.”

Since “there is no way to reliably remove the pathogenic protein or mRNA, we suggest that all such blood products be discarded until a definitive solution is found.”

The authors pointed out that cases of encephalitis among people who received blood from dengue vaccine recipients were reported as recently as last year. This suggests that the present system of tracking and managing blood products “is not adequate.”

Since genetic vaccines were implemented on a global scale for a massive population, “it is expected that the situation will already be complicated” compared to previous drug disasters.

As such, there is an “urgent need” for legislation and international treaties related to the management of blood products, the authors wrote.

The issue of blood transfusion from COVID-19 vaccine recipients has been highly controversial. In 2022, a court in New Zealand ruled against the parents of a sick infant son after they refused blood transfusions from vaccinated people.

The parents had asked the health system to allow blood transfusion from unvaccinated individuals, with donors who were already prepared to contribute. In its ruling, the court stripped the parents of medical custody of their son.

In Canada, doctors have also reported the trend of people’s resistance to vaccinated blood transfusions. Speaking to CBC in 2022, Dr. Dave Sidhu, the southern Alberta medical lead for transfusion and transplant medicine, said that parents of sick children were requesting unvaccinated blood.

“We’re seeing it about once or twice a month, at this stage. And the worry is of course that these requests might increase,” he said at the time.

In Wyoming, Rep. Sarah Penn (R-Wyo.) has sponsored a bill mandating that blood donated by people who have taken COVID-19 shots be labeled. Doing so will allow recipients who do not wish to accept such blood to reject them.

In an interview with Cowboy State Daily, Ms. Penn said, “For various reasons, many people have purposefully strived to keep the mRNA therapies out of their bodies, even to the point that some lost their livelihoods … Their concerns are warranted.”

Uncategorized

Major healthcare company defaults and files Chapter 11 bankruptcy

50-year-old nursing home operator files Chapter 11 bankruptcy after defaulting on over $50 million in loans.

Operators of nursing homes and senior living facilities were severely impacted during the Covid-19 pandemic in 2020 as about 40% of residents had or likely had Covid-19 that year. More than 1,300 nursing homes had infection rates of 75% or higher during surge periods, the U.S. Department of Health and Human Services Office of the Inspector General reported.

The high infection rates led to severe staffing challenges, including significant loss of staff and substantial difficulties in hiring, training and retraining new staff, according to a February 2024 report.

Those staffing challenges, however, continue today, as rising inflation makes it more expensive to compensate these essential workers.

Related: Another discount retailer makes checkout change to fight theft

In addition to staffing challenges, operators have also faced a number of economic issues that have driven some of these companies to file for bankruptcy or, in some cases, shut down facilities. Rising inflation, which affects products, supplies and employee wages, and higher interest rates over the past couple years have severely impacted operators' budgets. On top of those economic issues, operators are battling inadequate Medicare, Medicaid and insurance reimbursements that can lead to capital shortfalls.

Senior care facility bankruptcies rise

Financial hardship has led dozens of operators of senior facilities to file for bankruptcy over the past three years, with 13 companies filing petitions in 2021, 12 debtors filing in 2022 and 15 more in 2023, according to advisory firm Gibbins Advisors.

Notable Chapter 11 filings over the past year have included Evangelical Retirement Homes of Greater Chicago, which filed Chapter 11 in the U.S. Bankruptcy Court for the Northern District of Illinois in June 2023 to sell its assets at auction. Also, Windsor Terrace Health, an operator of 32 nursing homes in California and three in Arizona, filed its petition in the U.S. Bankruptcy Court for the Central District of California in August 2023 listing $1 million to $10 million in assets and liabilities and unable to pay its debts.

More recently, Magnolia Senior Living, an operator of four facilities in Georgia, filed for Chapter 11 protection on March. 19 in the U.S. Bankruptcy Court for the Northern District of Georgia.

Shutterstock

Loan defaults, ransomware attack force Petersen into bankruptcy

Finally, Petersen Health Care, operator of about 100 nursing homes, assisted-living and long-term care facilities in Illinois, Iowa and Missouri, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court in Delaware on March 20.

The company, which had revenue of $340 million in 2023, was suffering financial distress from increased overhead, low reimbursements and a ransomware attack in October 2023 that interrupted the company's efforts to bill patients and insurance companies.

The company's financial problems worsened as it defaulted on payments on more than $50 million in loans that led to 19 of the company's facilities being placed into receivership.

Petersen asserted in a March 21 statement that it will continue to operate its business as normal, as it is seeking court approval of a $45 million debtor-in-possession financing commitment from lenders to fund post-petition operating expenses and working capital.

“Petersen will operate as usual, and our team remains committed to continuing to provide first-rate care for our residents,” CEO David Campbell said in a statement. “We will emerge from restructuring as a stronger company with a more flexible capital structure. This will enable us to continue as a first-choice care provider and a reliable employer for our staff.”

The Peoria, Ill.,-based company, founded in 1974, operates skilled-nursing facilities, assisted/independent living communities, memory care services and homes for the developmentally disabled.

bankruptcy bankruptcies pandemic covid-19 interest ratesUncategorized

Key healthcare firm files Chapter 11 bankruptcy after defaulting

50-year-old nursing home operator files Chapter 11 bankruptcy after defaulting on over $50 million in loans.

Operators of nursing homes and senior living facilities were severely impacted during the Covid-19 pandemic in 2020 as about 40% of residents had or likely had Covid-19 that year and over 1,300 nursing homes had infection rates of 75% or higher during surge periods, the U.S. Department of Health and Human Services Office of the Inspector General reported.

The high infection rates led to severe staffing challenges, including significant loss of staff and substantial difficulties in hiring, training and retraining new staff, according to a February 2024 report. Those staffing challenges, however, continue today, as rising inflation makes it more expensive to compensate these essential workers.

Related: Another discount retailer makes checkout change to fight theft

In addition to staffing challenges, operators have also faced a number of economic issues that have driven some of these companies to file for bankruptcy or, in some cases, shut down facilities. Rising inflation, which affects products, supplies and employee wages, and higher interest rates over the past couple years have severely impacted operators' budgets. On top of those economic issues, operators are battling inadequate Medicare, Medicaid and insurance reimbursements that can lead to capital shortfalls.

Senior care facility bankruptcies rise

Financial hardship has led dozens of operators of senior facilities to file for bankruptcy over the past three years, with 13 companies filing petitions in 2021, 12 debtors filing in 2022 and 15 more in 2023, according to advisory firm Gibbins Advisors.

Notable Chapter 11 filings over the past year have included Evangelical Retirement Homes of Greater Chicago, which filed Chapter 11 in the U.S. Bankruptcy Court for the Northern District of Illinois in June 2023 to sell its assets at auction. Also, Windsor Terrace Health, an operator of 32 nursing homes in California and three in Arizona, filed its petition in the U.S. Bankruptcy Court for the Central District of California in August 2023 listing $1 million to $10 million in assets and liabilities and unable to pay its debts.

More recently, Magnolia Senior Living, an operator of four facilities in Georgia, filed for Chapter 11 protection on March. 19 in the U.S. Bankruptcy Court for the Northern District of Georgia.

Shutterstock

Loan defaults, ransomware attack force Petersen into bankruptcy

Finally, Petersen Health Care, operator of about 100 nursing homes, assisted-living and long-term care facilities in Illinois, Iowa and Missouri, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the District of Delaware on March 20, suffering financial distress from increased overhead, low reimbursements and a ransomware attack in October 2023 that interrupted the company's efforts to bill patients and insurance companies.

The company's financial problems worsened as it defaulted on payments on over $50 million in loans that led to 19 of the company's facilities to be placed into receivership.

Petersen asserted in a March 21 statement that it will continue to operate its business as normal, as it is seeking court approval of a $45 million debtor-in-possession financing commitment from lenders to fund post-petition operating expenses and working capital.

“Petersen will operate as usual, and our team remains committed to continuing to provide first-rate care for our residents,” CEO David Campbell said in a statement. “We will emerge from restructuring as a stronger company with a more flexible capital structure. This will enable us to continue as a first-choice care provider and a reliable employer for our staff.”

The Peoria, Ill.,-based company, which was founded in 1974, operates skilled-nursing facilities, assisted/independent living communities, memory care services and homes for the developmentally disabled.

bankruptcy bankruptcies pandemic covid-19 interest rates-

Spread & Containment2 weeks ago

Spread & Containment2 weeks agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized1 month ago

Uncategorized1 month agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

International2 days ago

International2 days agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoKey Events This Week: All Eyes On Core PCE Amid Deluge Of Fed Speakers