Government

GSK 2022: A newly focused biopharma company

Targeted business development acquisitions, improvements in R&D and operating performance, and a strengthened post-demerger balance sheet are creating…

Targeted business development acquisitions, improvements in R&D and operating performance, and a strengthened post-demerger balance sheet are creating new capacity and flexibility for GSK to invest in growth and innovation for patients and shareholders.

By Andrew Humphreys • andrew.humphreys@medadnews.com

GSK

980 Great West Road

Brentford, Middlesex TW8 9GS, United Kingdom

+44 (0)20 8047 50000 • gsk.com

| Financial Performance | ||||

| 2021 | 2020 | 1H 2022 | 1H 2021 | |

| Revenue | $46,955 | $46,934 | $19,433 | $15,131 |

| Net income | $7,014 | $8,792 | $4,325 | $3,851 |

| Diluted EPS | $1.19 | $1.57 | $0.89 | $0.84 |

| R&D expense | $7,265 | $7,017 | $3,228 | $3,065 |

| All figures are in millions of dollars except EPS and were translated using the Federal Reserve Board’s average rate of exchange in 2021: £1.3764. | ||||

Best-selling products

All sales are in millions of dollars and were translated using the Federal Reserve Board’s average rate of exchange in 2021: £1.3764.

2021 sales

- Triumeq $2,590

- Shingrix $2,369

- Tivicay $1,901

- Advair/Seretide $1,868

- Trelegy Ellipta $1,675

- Nucala $1,572

- Breo/Relvar Ellipta $1,543

- Xevudy $1,319

- Benlysta $1,203

- Dovato $1,083

- Ventolin $988

- Fluarix, FluLaval $935

- Bexsero $895

- Infanrix, Pediarix $747

- Rotarix $745

- Boostrix $717

- Juluca $712

- Anoro Ellipta $694

- Lamictal $658

- Flovent/Flixotide $611

- Augmentin $586 $

- Zejula $544

1H 2022 sales

- Xevudy $2,440

- Shingrix $1,967

- Triumeq $1,174

- Trelegy Ellipta $1,111

- Tivicay $917

- Nucala $911

- Breo/Relvar Ellipta $804

- Dovato $794

- Advair/Seretide $776

- Benlysta $705

- Ventolin $516

- Bexsero $451

- Infanrix, Pediarix $406

- Juluca $392

- Boostrix $391

- Flovent/Flixotide $372

- Augmentin $356

- Lamictal $340

- Rotarix $326

- Zejula $300

- Anoro Ellipta

Outcomes Creativity Index Score: 13

- Manny Awards — N/A

- Cannes Lions — N/A

- Clio Health — N/A

- Creative Floor Awards — 8

- London International Awards – N/A

- MM+M Awards — 5

- One Show — N/A

GSK separated during 2022 to create two new leading companies, both with the opportunity to impact human health at scale and deliver compelling performance for shareholders. The demerger represents the most significant corporate change for GSK during the past 20 years, according to management. Both new companies have clear targets for growth and the ability to positively impact the health and lives of billions of people. Meanwhile, the pharma giant announced the decision to change its name to GSK from GlaxoSmithKline in the company’s April 27, 2022, earnings release, and officially made the change on May 16.

New GSK is uniting science, talent, and technology to “get ahead of disease together.” Following the demerger, GSK is concentrating purely on biopharmaceuticals, prioritizing investment towards the development of innovative vaccines and specialty medicines, maximizing the increasing opportunities to prevent and treat disease. Step-change in growth includes anticipated sales growth of more than 5 percent and adjusted operating profit growth of more than 10 percent on a compound basis 2021-26; research and development concentrated on the science of the immune system, human genetics and advanced technologies; positively impacting the health of more than 2.5 billion people over 10 years; and maintaining a leading environmental, social and governance (ESG) performance.

Haleon will be a worldwide leader 100 percent focused on consumer health. Management said Haleon will have a clear purpose to deliver better everyday health with humanity, and a focused strategy to deliver sustainable above-market growth and attractive returns to shareholders. Strong prospects for growth include an exceptional portfolio of category-leading brands with an attractive global footprint and competitive capabilities; a compelling strategy to outperform in a growing, £150 billion-plus sector that is “more relevant than ever;” 4-6 percent annual organic sales growth in the medium term, sustainable moderate margin expansion and high cash conversion; and an attractive growth profile with the capacity to invest and deliver shareholder returns.

The July 18, 2022, arrival of the Haleon Group marks a new world leader in consumer healthcare with a clear strategy to outperform and run a responsible business, company executives said. According to management, the balance sheet has been strengthened for GSK, through dividend of more than £7 billion from Haleon. American Depositary Shares representing shares of Haleon plc commenced “regular-way” trading on the New York Stock Exchange on July 22.

Financial & product performance

First-half 2022 sales for the severe asthma medicine Nucala (mepolizumab) amounted to £662 million ($911 million), up 21 percent year-over-year at AER and 18 percent at CER, including U.S. sales of £413 million ($568 million), up 24 percent at AER and 16 percent at CER. The performance reflected continued strong patient demand and the launch of several additional indications.

Total turnover for GSK during 2022’s first half reached £14.12 billion ($19.43 billion), representing a year-over-year increase of 28 percent at AER and 25 percent at CER, reflecting strong performance in all three product groups. Commercial Operations turnover, excluding pandemic sales, rose 15 percent at AER and 12 percent at CER.

Specialty Medicines sales for GSK amounted to £5.84 billion ($8.04 billion), up 69 percent at AER and 63 percent at CER compared to first-half 2021, driven by consistent growth in all therapy areas. Specialty Medicines, excluding sales of the COVID-19 treatment Xevudy, reached £4.07 billion ($5.6 billion), rising 18 percent at AER and 14 percent at CER. HIV sales were reported at £2.59 billion ($3.56 billion) with growth of 14 percent at AER and 10 percent at CER.

Oncology sales for first-half 2022 were £281 million ($387 million), up 23 percent at AER, 19 percent at CER.

Immuno-inflammation, Respiratory and Other sales increased 26 percent at AER and 21 percent at CER to £1.2 billion ($1.65 billion).

Vaccines turnover for GSK during the January–June 2022 period amounted to £3.38 billion ($4.66 billion), up 21 percent at AER, 17 percent at CER. Excluding unrepeated 2021 pandemic adjuvant sales, vaccine sales grew 33 percent at AER and 30 percent at CER. This performance reflects a favorable comparator to first-half 2021, which was adversely impacted by COVID-19 related disruptions in several markets, and the strong commercial execution of the shingles vaccination Shingrix, particularly in the United States and Europe.

GSK’s General Medicines sales in the first half of 2022 totaled £4.9 billion ($6.74 billion), up 3 percent at AER and 2 percent at CER, with the impact of generic competition in United States, Europe, and Japan offset by Trelegy growth in respiratory and the post-pandemic rebound of the antibiotic market since H2 2021 in Other General Medicines. General Medicines includes £76 million ($105 million) of turnover between GSK and Haleon recorded in continuing operations with an offsetting amount accounted for in discontinued operations.

Total operating profit for GSK during the 2022 first half was reported at £3.37 billion ($4.64 billion) versus £2.49 billion ($3.42 billion) during H1 2021. GSK said this included the £0.9 billion upfront income received from the settlement with Gilead Sciences and increased profits on turnover growth of 25 percent at CER, partly offset by higher re-measurement charges for contingent consideration liabilities.

Adjusted operating profit was recorded at £3.95 billion ($5.44 billion), marking 33 percent growth at AER and 26 percent at CER over first-half 2021 on a turnover increase of 25 percent at CER. The Adjusted operating margin of 28.0 percent was 1 percentage point higher at AER and stable at CER compared to the reported January-June 2021 period. Management said this primarily reflected the impact from low-margin COVID-19 solutions sales (Xevudy), which reduced adjusted operating profit growth by 2 percent at AER, 1 percent at CER and reduced the adjusted operating margin by 3.3 percentage points at AER and at CER. This was offset by operating leverage from strong sales growth, beneficial mix, and higher royalty income according to GSK.

Total EPS (adjusted to reflect GSK’s share consolidation on July 18, 2022) from continuing operations was 54.8p (75 cents) during H1 2022 versus 50.3p (69 cents) during the one-year-earlier period. This growth primarily reflected the £0.9 billion upfront income received from the Gilead settlement and increased profits on turnover growth of 25 percent at CER, partly offset by higher re-measurement charges for contingent consideration liabilities as well as an unfavorable comparison due to a credit of £325 million to taxation in Q2 2021.

Following completion of the Consumer Healthcare business demerger on July 18, GSK plc Ordinary shares were consolidated in order to maintain share price comparability before and after the demerger. GSK plc shareholders received 4 new ordinary shares for every 5 existing ordinary shares. GSK reported that earnings per share, diluted EPS, adjusted EPS and dividends per share have been retrospectively adjusted to reflect the share consolidation in all the periods presented.

Adjusted EPS was 67.0p (92 cents) versus 49.3p (68 cents) in H1 2021, an increase of 36 percent at AER and 27 percent at CER, on a 26 percent CER rise in adjusted operating profit. The results included higher COVID-19 solutions sales at low margin with the reduction to growth from COVID-19 solutions being 2 percent at AER and 2 percent at CER. Leverage from growth in sales of Specialty Medicines, beneficial mix, higher royalty income and a lower effective tax rate was partly offset by higher supply chain, freight and distribution costs, lower associate income and higher non-controlling interests.

Cash generated from operations attributable to continuing operations for the first six months of 2022 was £3.94 billion ($5.42 billion) compared to the H1 2021 amount of £1.76 billion ($2.42 billion). The growth primarily reflected a significant increase in operating profit including the upfront income from the Gilead settlement, favorable exchange and favorable timing of collections and profit share payments for Xevudy sales, partly offset by increased contingent consideration payments reflecting the Gilead deal and a higher seasonal increase in inventory.

GSK’s Shingrix posted a record quarter for the shingles vaccine during Q2 2022, with sales more than doubling to £731 million ($1.01 billion). The growth performance was primarily due to demand recovery, strong commercial execution aimed at shifting the shingles vaccination season forward, earlier-than-expected channel inventory build in the United States, and higher demand in Germany.

GSK CEO Emma Walmsley stated, “This is GSK’s first set of results as a newly focused biopharma company, and we have delivered an excellent second-quarter performance, with strong growth in Specialty Medicines, including HIV, and a record quarter for our shingles vaccine Shingrix. With this momentum in sales and operating profit growth, we have raised our full-year guidance and are confident in delivering the long-term growth outlooks we set out for shareholders last year. We continue to strengthen our pipeline, notably with very positive high-level results from our late-stage RSV vaccine candidate, together with targeted business development acquisitions of Sierra Oncology and Affinivax. These improvements in R&D and operating performance, together with a strengthened post-demerger balance sheet, create new capacity and flexibility for GSK to invest in growth and innovation for patients and shareholders.”

According to GSK management, “With the momentum from the business performance to date (through Q2 2022), GSK now expects 2022 sales to increase between 6 to 8 percent and adjusted operating profit to increase between 13 to 15 percent, excluding any contributions from COVID-19 solutions. Adjusted earnings per share is expected to grow around 1 percent lower than operating profit. We have delivered first-half performance ahead of our full-year guidance, slightly better than expected, informed by strong business delivery and the dynamics of prior year comparators.”

According to company management, “Predominantly reflecting a more challenging H2 2021 sales comparator as well as an expected increase in R&D spend, we expect lower reported growth in the second half. Key external factors that will influence the second half of 2022 include the continued risk from COVID-19 dynamics and possible developments in the current uncertain global economic environment.”

Covid-19 Solutions

GSK is collaborating with companies and research groups around the globe to work on promising COVID-19 vaccine candidates through the use of GSK’s innovative vaccine adjuvant technology. GSK said the use of an adjuvant is of particular significance in a pandemic situation since it may reduce the amount of vaccine protein required per dose, enabling more vaccine doses to be produced and therefore contributing to protecting more people.

According to management, GSK’s response to COVID-19 has been one of the broadest in the industry, with potential treatments in addition to the company’s vaccine candidates in development with partner organizations. GSK has been working with Sanofi, Medicago, and SK bioscience to develop adjuvanted, protein-based vaccines.

GSK and Sanofi revealed positive data in June 2022 from the companies’ vaccine study, which assessed an adjuvanted bivalent D614 and Beta (B.1.351) vaccine candidate. Sanofi-GSK’s vaccine is the first candidate to show efficacy in a placebo-controlled study in an environment of high Omicron variant circulation. The vaccine candidate demonstrated a favorable safety and tolerability profile.

Additionally reported in June, Sanofi unveiled positive data from two trials conducted with the company’s new next-generation COVID-19 booster vaccine candidate modeled on the Beta variant antigen and including GSK’s pandemic adjuvant. Taken together, management said these data strongly indicate the potential of Sanofi-GSK’s next-generation Beta-based booster to be a relevant response to public health needs.

GSK Vaccines President Roger Connor stated, “These positive data show efficacy of our protein-based, bivalent adjuvanted vaccine candidate in an environment of high Omicron variant circulation. Our vaccine candidate has the potential to make an important contribution to public health as the pandemic evolves further. We are looking forward to the discussions with regulatory authorities with the aim of making our vaccine candidate available later this year.”

GSK’s oral two-drug regimen Dovato (dolutegravir and lamivudine) generated sales of £577 million ($794 million) during the first half of 2022, with year-over-year growth of more than 70 percent driven by strong patient demand for the HIV medicine.

GSK said these efforts are supported by federal funds from the Biomedical Advanced Research and Development Authority, part of the office of the Assistant Secretary for Preparedness and Response at the U.S. Department of Health and Human Services in collaboration with the U.S. Department of Defense Joint Program Executive Office for Chemical, Biological, Radiological and Nuclear Defense under Contract # W15QKN-16-9-1002 and by the National Institute of Allergy and Infectious Diseases.

Health Canada during February 2022 granted approval for the Medicago COVID-19 vaccine Covifenz (plant-based virus-like particles [VLP], recombinant, adjuvanted). Covifenz is indicated for active immunization to prevent coronavirus disease 2019 caused by severe acute respiratory syndrome coronavirus 2 (SARS‑CoV‑2) in individuals 18 to 64 years of age.

“This first approval is an important milestone in our approach of pairing GSK’s well-established pandemic adjuvant with promising antigens to develop protein-based, refrigerator-stable COVID-19 vaccines to help protect people against COVID-19 disease,” Connor noted. “We look forward to working with Medicago to make the vaccine available in Canada and to progress further regulatory submissions.”

SK bioscience and GSK announced during April 2022 the filing of a biologics license application for SKYCovione, a recombinant protein-based COVID-19 vaccine candidate adjuvanted with GSK’s pandemic adjuvant, to the Korean Ministry of Food and Drug Safety (KMFDS) following positive Phase III data. The self-assembled nanoparticle vaccine candidate targets the receptor binding domain of the SARS-CoV-2 Spike protein for the parental SARS-Cov-2.

SKYCovione is jointly developed with the Institute for Protein Design (IPD) at the University of Washington School of Medicine with combination of GSK’s pandemic adjuvant. The development of the vaccine has been supported by funding from the Coalition for Epidemic Preparedness Innovations (CEPI).

GSK is exploring treatments for COVID-19 patients, collaborating with Vir Biotechnology to evaluate monoclonal antibodies that could be used as therapeutic or preventive options for COVID-19.

GSK and Vir Biotechnology announced in January 2022 a U.S. government deal to purchase additional supply of sotrovimab, authorized for the early treatment of COVID-19. The 600,000 additional doses were supplied to the U.S. government for distribution in first-quarter 2022, allowing additional access to sotrovimab nationwide. The agreement brought the total amount of doses secured through binding agreements to 1.7 million worldwide as of January 2022. The deal included the option for the U.S. government to buy further additional doses during Q2 2022.

The investigational single-dose intravenous (IV) infusion SARS-CoV-2 monoclonal antibody sotrovimab was granted Emergency Use Authorization (EUA) by the FDA during May 2021. Under the EUA, sotrovimab can be used for treating mild-to-moderate COVID-19 in adults and pediatric patients (12 years of age and older weighing at least 40 kg) with positive results of direct SARS-CoV-2 viral testing, and who are at high risk for progression to severe COVID-19, including hospitalization or death.

GSK and Vir anticipated manufacturing 2 million doses worldwide in the 2022 first half and additional doses during the second half of the year.

The European Commission (EC) issued a marketing authorization to Xevudy (sotrovimab) for the early treatment of COVID-19 in December 2021. Sotrovimab is approved in the EU for treating adults and adolescents (aged 12 years and over and weighing at least 40 kg) with COVID-19 who do not require supplemental oxygen and who are at increased risk of progressing to severe COVID-19. Sotrovimab, which incorporates Xencor’s Xtend technology, has been designed to achieve high concentration in the lungs to ensure optimal penetration into airway tissues affected by SARS-CoV-2 and to have an extended half-life.

GSK is additionally working with mRNA specialist CureVac to jointly develop next-generation, optimized mRNA vaccines for COVID-19 with the potential to address multiple emerging variants within one vaccine.

Deals, Collaborations & Partnerships

GSK completed the acquisition of Affinivax during mid-August 2022. A clinical-stage biopharmaceutical company based in Cambridge, Mass., Affinivax has pioneered the development of a novel class of vaccines, the most advanced of which are next-generation pneumococcal vaccines.

Management stated that the acquisition of Affinivax aligns with GSK’s strategy of building a strong portfolio of specialty medicines and vaccines. The acquisition includes the next-generation 24-valent pneumococcal vaccine candidate AFX3772, which is based on the highly innovative Multiple Antigen Presenting System (MAPS) platform technology. A 30-plus valent pneumococcal candidate vaccine is additionally in preclinical development.

The MAPS technology supports higher valency than conventional conjugation technologies, potentially allowing for broader coverage against prevalent pneumococcal serotypes and generating higher antibody responses against many individual serotypes than existing pneumococcal vaccines.

In adult Phase I/II studies, AFX3772 was well tolerated in participants and showed good immune responses versus the current standard of care. The FDA during July 2021 granted Breakthrough Therapy designation for AFX3772 to prevent S. pneumoniae invasive disease and pneumonia in adults 50 years and older. As of August 2022, preparations for the beginning of the Phase III program were under way. Phase II trials began in June 2022 to evaluate the use of the vaccine in the pediatric population.

GSK obtained 100 percent of the outstanding shares of Affinivax. An upfront payment of $2.1 billion was paid upon closing and two potential milestone payments of $0.6 billion are to be paid upon the achievement of certain pediatric clinical development milestones. GSK accounted for the transaction as a business combination.

According to GSK Chief Scientific Officer Tony Wood, “Affinivax’s exciting pneumococcal vaccine candidates, the potentially disruptive MAPs technology and their fantastic scientific talent, further strengthen our pipeline of novel vaccines and presence in the Boston area.”

The acquisition of Sierra Oncology was completed on July 1, 2022. The California-based biopharmaceutical company has concentrated on targeted therapies for treating rare forms of cancer.

With the acquisition came the late-stage potential new medicine momelotinib, which has a unique dual mechanism of action that may address the critical unmet medical needs of myelofibrosis patients with anemia. According to management, momelotinib complements GSK’s Blenrep (belantamab mafodotin). The transaction builds on GSK’s expertise in hematology and aligns with the company’s strategy of building a strong portfolio of specialty medicines and vaccines.

Sierra Oncology submitted a New Drug Application for momelotinib to the FDA in June 2022, and GSK anticipated a regulatory filing in Europe during second-half 2022. If cleared for marketing, momelotinib will contribute to GSK’s growing specialty medicines business, with a U.S. launch anticipated during 2023.

GSK acquired all outstanding shares of Sierra Oncology for $55 per share in cash, representing a total equity value of $1.9 billion (£1.6 billion at current exchange rates). The per-share price represented a premium of 39 percent to Sierra Oncology’s closing stock price on April 12, 2022, and 63 percent to Sierra’s volume-weighted average price (VWAP) during the previous 30 trading days before the acquisition closed.

GSK inked an exclusive license deal in September 2022 for tebipenem pivoxil hydrobromide (tebipenem HBr). The late-stage antibiotic is being developed by Spero Therapeutics as the first oral carbapenem antibiotic to potentially treat complicated urinary tract infections (cUTI), including pyelonephritis, resulting from certain bacteria. Spero will begin a new Phase III clinical study during 2023.

The exclusive license enables GSK to commercialize tebipenem HBr in all regions except for Japan and certain other Asian countries. Spero Therapeutics received $66 million upfront, with the potential for future milestone payments and tiered royalties. GSK will purchase $9 million in shares of Spero common stock.

ViiV Healthcare, the worldwide specialist HIV company majority owned by GSK, with Pfizer and Shionogi as shareholders, and the Medicines Patent Pool (MPP) signed a new voluntary licensing pact in July 2022. The agreement pertains to patents relating to cabotegravir long-acting (LA) for HIV pre-exposure prophylaxis (PrEP) to help enable access in least developed, low-income, lower middle

-income and Sub-Saharan African countries.

Certain generic manufacturers will have the opportunity to develop, manufacture, and supply generic versions of cabotegravir LA for PrEP, the first long-acting HIV prevention product, in 90 countries, subject to required regulatory approvals being obtained. This agreement is anticipated to help to enable at-scale access to generic cabotegravir LA for PrEP. This announcement was made seven months after the first regulatory approval of cabotegravir LA for PrEP in the world, by the FDA, under the trade name Apretude.

A framework contract was signed during July 2022 by GSK with the European Commission’s (EC) Health Emergency Preparedness and Response Authority (HERA) for the reservation of future production and supply of 85 million doses of the company’s pandemic influenza vaccine Adjupanrix [pandemic influenza vaccine (split virion, inactivated, adjuvanted)].

This is one of the first contracts signed by HERA since being established during September 2021. HERA’s core mission is to prevent, detect, and rapidly respond to health emergencies by working closely with other EC and national health agencies, industry and international partners to improve Europe’s readiness for health emergencies.

GSK and the University of Oxford launched the Oxford-GSK Institute during December 2021 to harness advanced technology and unravel mechanisms of disease. According to GSK, the major new collaboration aims to deepen understanding of complex diseases such as Alzheimer’s and Parkinson’s, and increase drug discovery and development success rates. The institute is based at Oxford’s Nuffield Department of Medicine.

With a £30 million investment from GSK, the institute is intended to pioneer further improvements in how new medicines are discovered and developed. The institute will assess and integrate new approaches in genetics, proteomics and digital pathology to understand detailed patterns of disease that vary amongst individuals. The initial research focus will be on neurological diseases, including Alzheimer’s and Parkinson’s disease.

Product Approvals & pipeline updates

ViiV’s Apretude (cabotegravir extended-release injectable suspension) was the recipient of FDA approval in December 2021 as the first long-acting injectable option for HIV prevention. The medicine was approved for use in adults and adolescents weighing at least 35 kg who are at risk of sexually acquiring HIV, including men who have sex with men as well as women and transgender women who have sex with men. Apretude is given as few as six times annually and has demonstrated superior efficacy to a daily oral PrEP option (FTC/TDF tablets) in reducing the risk of HIV acquisition.

Apretude represents the first long-acting injectable pre-exposure prophylaxis (PrEP) option proven superior to daily oral FTC/TDF in reducing HIV acquisition. The product is indicated for HIV PrEP in adults and adolescents at risk of sexually acquiring HIV, weighing at least 35 kg, who have a negative HIV-1 test prior to initiation. The integrase strand transfer inhibitor (INSTI) is administered as a single 600 mg (3-ml) intramuscular (IM) injection of cabotegravir in the buttocks by a healthcare provider every two months after two initiation injections administered one month apart and an optional oral lead-in to assess tolerability.

Triumeq PD won U.S. marketing clearance in late March 2022 as the first dispersible single-tablet regimen containing dolutegravir, a once-daily treatment for children living with HIV. The NDA was approved for a dispersible tablet formulation of the fixed-dose combo of abacavir, dolutegravir and lamivudine for treating pediatric patients weighing 10 kgs to <25 kgs with human immunodeficiency virus type 1 (HIV-1). Also, a supplemental New Drug Application (sNDA) was approved for Triumeq tablet, lowering the minimum weight that a child with HIV-1 can be prescribed this medicine to 25 kgs from 40 kgs.

GSK announced a settlement between ViiV and Gilead in February 2022, resolving global litigation relating to Biktarvy and ViiV’s dolutegravir patents and entry into a patent license deal. Gilead made an upfront payment of $1.25 billion to ViiV during first-quarter 2022. Gilead is also responsible for paying a 3 percent royalty on future U.S. sales of the blockbuster medicine Biktarvy, a triple-combination HIV product containing the HIV integrase inhibitor bictegravir, tenofovir alafenamide and emtricitabine.

ViiV, GSK and Shionogi alleged that Biktarvy infringed certain of their patents relating to dolutegravir. As a result of the settlement deal, patent infringement cases in the United States, UK, France, Ireland, Germany, Japan, Korea, Australia, and Canada were discontinued.

A label update for Cabenuva (cabotegravir and rilpivirine) was cleared by U.S. regulators in March 2022, making the oral lead-in with cabotegravir and rilpivirine tablets optional. Oral cabotegravir and rilpivirine can be taken for a month to evaluate tolerability to the medicines before initiating cabotegravir and rilpivirine injections, a regimen jointly developed as part of a collaboration with Janssen, but this oral lead-in is now optional after clinical study data showed similar safety and efficacy profiles for both initiation methods (with or without the oral lead-in).

Cabenuva is the first complete long-acting HIV treatment regimen and is marketed in the United States as a once-monthly

or every-two-month treatment for HIV-1 in virologically suppressed adults. The medicine contains ViiV’s cabotegravir extended-release injectable suspension in a single-dose vial and rilpivirine extended-release injectable suspension in a single-dose vial, a product of Janssen Sciences Ireland Unlimited Company, one of the Janssen Pharmaceutical Companies of Johnson & Johnson.

During January 2022, the FDA approved Cabenuva for every-

two-month dosing for treating HIV-1 in virologically suppressed adults (HIV-1 RNA less than 50 copies per milliliter [c/ml]) on a stable regimen, with no history of treatment failure, and with no known or suspected resistance to either cabotegravir or rilpivirine.

Priorix (Measles, Mumps and Rubella Vaccine, Live) was the recipient of FDA approval during June 2022 for active immunization for the prevention of measles, mumps and rubella (MMR) in individuals 12 months of age and older. The vaccine is licensed in more than 100 countries, including all European countries, Canada, Australia, and New Zealand, with more than 800 million doses distributed.

The oral hypoxia-inducible factor prolyl hydroxylase inhibitor (HIF-PHI) daprodustat is undergoing regulatory review for the potential treatment of anemia due to chronic kidney disease (CKD) in adult patients on dialysis and not on dialysis. The U.S. FDA’s Cardiovascular and Renal Drugs Advisory Committee was scheduled to review the New Drug Application (NDA) on Oct. 26, 2022.

The daprodustat NDA is based on positive results from the ASCEND Phase III study program, which included five pivotal trials evaluating the efficacy and safety of daprodustat for treating anemia across the spectrum of CKD. Results from the key cardiovascular outcomes trials were published in the New England Journal of Medicine during November 2021 and included non-dialysis (ASCEND-ND) and dialysis (ASCEND-D) CKD patients. These studies showed that daprodustat improved and/or maintained hemoglobin (Hb) within the target level (10-11.5 g/dL), and the primary safety analysis of the intention-to-treat (ITT) populations demonstrated that daprodustat achieved non-inferiority of MACE (major adverse cardiovascular events) versus the standard of care, an erythropoietin stimulating agent (ESA), across non-dialysis and dialysis patient settings.

Daprodustat tablet was approved under the brand name Duvroq during June 2020 by Japan’s Ministry of Health, Labour and Welfare for patients with renal anemia. The European Medicines Agency during March 2022 validated the marketing authorization application for daprodustat, which is undergoing regulatory review. Other regulatory filings were anticipated to continue throughout 2022.

According to GSK, daprodustat was developed based upon the unique Nobel Prize-winning science that showed how cells sense and adapt to oxygen availability.

GSK unveiled long-term data from the Phase III PRIMA (ENGOT-OV26/GOG-3012) trial demonstrating Zejula (niraparib) maintained a sustained and clinically meaningful progression-free survival (PFS) benefit as a maintenance therapy in patients with first-line ovarian cancer following a response to platinum-based chemotherapy. Importantly, this benefit was sustained across all biomarker subgroups according to GSK, including BRCAm, HRd and HRp.

Zejula represents the only once-daily oral monotherapy maintenance treatment approved in the United States and the European Union for patients with first-line platinum-responsive advanced ovarian cancer regardless of biomarker status.

The poly (ADP-ribose) polymerase (PARP) inhibitor niraparib is being investigated in multiple pivotal studies. GSK said the company is building a robust niraparib clinical development program by evaluating activity across multiple tumor types and by assessing several potential combinations of niraparib with other therapeutics. The development program includes several combination studies.

The FDA’s Oncologic Drugs Advisory Committee (ODAC) was scheduled to discuss overall survival (OS) data from the ENGOT-OV16/NOVA Phase III study for Zejula on November 22, 2022. NOVA is a randomized, double-blind, placebo-controlled Phase III study of Zejula for the maintenance treatment of women with platinum-

sensitive recurrent ovarian cancer.

The FDA accepted the NDA in August 2022 for momelotinib, a potential new medicine with a proposed differentiated mechanism of action that may address the significant unmet medical needs of myelofibrosis patients with anemia. The FDA has set a Prescription Drug User Fee Act action date of June 16, 2023. The NDA is based on the results from key Phase III studies, including the pivotal MOMENTUM trial, which met every primary and key secondary endpoint, including Total Symptom Score (TSS), Transfusion Independence (TI) rate and Splenic Response Rate (SRR).

Momelotinib was not approved in any market as of September 2022. Momelotinib has inhibitory ability along three key signaling pathways: Janus kinase (JAK) 1, and JAK2 and activin A receptor, type I (ACVR1). According to research, inhibition of JAK1 and JAK2 may improve constitutional symptoms and splenomegaly. Also, direct inhibition of ACVR1 leads to a decrease in circulating hepcidin, which is elevated in myelofibrosis and contributes to anemia.

Promising Phase IIb interim data were presented by GSK during June 2022 for bepirovirsen, a potential new treatment for chronic hepatitis B. Interim analysis from the B-Clear Phase IIb study demonstrates bepirovirsen’s potential to suppress both the surface antigen and the virus of hepatitis B, resulting in the possibility of functional cure.

The investigational antisense oligonucleotide (ASO) bepirovirsen (product code GSK3228836) is designed to specifically recognize the RNA that the hepatitis B virus uses to replicate itself in infected liver cells (hepatocytes) and make the viral antigens (proteins) which facilitate chronicity of the disease by helping to avoid clearance by the immune system.

Previously known as ISIS 505358 or IONIS-HBVRX, the potential new drug candidate was discovered by and jointly developed with Ionis Pharmaceuticals. Bepirovirsen is one of the ASO HBV program assets in-licensed by GSK from Ionis during August 2019.

GSK said a Phase III monotherapy study for bepirovirsen is anticipated to begin during first-half 2023. The company is exploring potential combination treatments to reduce the global burden of chronic hepatitis B. The clinical trials include a Phase IIb study of bepirovirsen in sequential combination with pegylated interferon treatment and a Phase II trial of bepirovirsen in combination with the company’s chronic hepatitis B targeted immunotherapy.

The World Health Organization (WHO) during September 2022 awarded prequalification to GSK’s groundbreaking malaria vaccine Mosquirix (also known as RTS,S/AS01). The company said this is the first prequalification for a malaria vaccine and is a significant step in rolling out the vaccine in countries with moderate-to -high malaria transmission.

Positive headline results were reported by the company during June 2022 from a pre-specified efficacy interim analysis of the AReSVi 006 Phase III study. The interim analysis was reviewed by an Independent Data Monitoring Committee, and the primary endpoint was exceeded with no unexpected safety concerns observed, according to GSK. The AReSVi 006 study is testing GSK’s respiratory syncytial virus (RSV) vaccine candidate for adults aged 60 years and older.

This marks the first RSV vaccine candidate to demonstrate statistically significant and clinically meaningful efficacy in adults aged 60 years and older. According to GSK, the magnitude of effect observed was consistent across RSV A and B strains, key secondary endpoints and in those aged 70 years and older. As a result, anticipated regulatory filings were expected during first-half 2022.

GSK announced that, further to the voluntary pause shared on February 18, 2022, the company decided to halt enrollment and vaccination in studies assessing the potential RSV maternal vaccine candidate in pregnant women (NCT04605159, NCT04980391, NCT05229068). This decision does not impact the AReSVi 006 study.

Approval in Japan was granted in late May 2022 for Vocabria (cabotegravir injection and tablets), used in combination with Janssen’s Rekambys (rilpivirine long-acting injectable suspension) and Edurant (rilpivirine tablets), as the first complete long-acting treatment for HIV. The approval was granted by Japan’s Ministry of Health, Labour and Welfare (MHLW). Cabotegravir injection used in combination with rilpivirine long-acting is indicated for the treatment of human immunodeficiency virus type 1 (HIV-1) infection in adults who are virologically suppressed, on a stable regimen with no history of treatment failure and with no known or suspected resistance to either cabotegravir or rilpivirine. The long-acting treatment allows people living with HIV to reduce the days they receive treatment from 365 to 12 or 6 per year after initiation.

The integrase strand transfer inhibitor (INSTI) cabotegravir is developed by ViiV Healthcare for treating HIV-1 in virologically suppressed adults. Cabotegravir is approved as a long-acting formulation in combination with injectable rilpivirine.

MHLW during June 2022 accepted the regulatory filing of Shingrix (Zoster Vaccine Recombinant, Adjuvanted) to prevent shingles in at-risk adults aged 18 years and older. Administered intramuscularly in two doses, the non-live, recombinant sub-unit adjuvanted vaccine was originally approved in Japan during March 2018 for adults aged 50 years and older.

The European Commission and the United Kingdom approved Shingrix on August 25, 2020, to prevent shingles and post-herpetic neuralgia (PHN) in adults aged 18 or older at increased risk of shingles. The FDA approved the vaccine on July 26, 2021, to prevent shingles in adults aged 18 years or older at increased risk of shingles due to immunodeficiency or immunosuppression caused by known disease or therapy. The extended indication for preventing shingles and PHN in adults aged 18 years or older at increased risk of developing shingles has additionally been approved in Australia.

Shingrix is recommended in the United States by the Centers for Disease Control and Prevention’s Advisory Committee on Immunization Practices as the preferred vaccine for the prevention of shingles and related complications for immunocompetent adults aged 50 years and older.

In China, a two-dose schedule for GSK’s HPV vaccine Cervarix [Human Papillomavirus bivalent (types 16, 18) Vaccine, Recombinant)] was approved by the National Medical Products Administration (NMPA) for girls aged 9 to 14 years. With this marketing clearance, Cervarix is the first imported two-dose HPV vaccine for this age group in mainland China. The NMPA authorization of the two-dose regimen adds China to two-dose approvals in 100 countries, including the EU, Asia, Africa, and Latin America. GSK said the three-dose schedule remains on the label for girls and women aged 15–45 years in China.

China’s NMPA approved Benlysta (belimumab) during February 2022 for adults with active lupus nephritis. Benlysta is the first biologic approved in China for both systemic lupus erythematosus and lupus nephritis. The B-lymphocyte stimulator (BLyS) specific inhibitor Benlysta is a human monoclonal antibody that binds to soluble BLyS. By binding BLyS, belimumab inhibits the survival of B cells and reduces the differentiation of B cells into immunoglobulin-producing plasma cells.

During the second half of 2022, Phase III data readouts were anticipated for the pentavalent (MenABCWY) meningitis vaccine candidate, otilimab in rheumatoid arthritis, Jemperli in first-line endometrial cancer, and Blenrep in third-line multiple myeloma.

An investment of £1 billion over 10 years was announced by GSK during June 2022 to accelerate research and development dedicated to infectious diseases that disproportionately impact lower-income countries. This research will concentrate on new and disruptive vaccines and medicines to prevent and treat malaria, tuberculosis, HIV (through ViiV Healthcare), neglected tropical diseases, and anti-microbial resistance, which continue to have a devastating toll on the most vulnerable, accounting for more than 60 percent of the disease burden in many lower-income countries.

GSK Global Health R&D hubs are advancing more than 30 potential new vaccines and medicines, targeting 13 high-burden infectious diseases. The company will maintain donations of albendazole until the elimination of lymphatic filariasis, and will double production of GSK’s adjuvant for use in the RTS,S malaria vaccine. The new commitments support management’s ambition to positively impact the health of more than 2.5 billion people during the next 10 years.

federal reserve pandemic coronavirus covid-19 disease control emergency use authorization vaccine treatment testing fda clinical trials preclinical antibodies therapy monoclonal antibodies rna transmission recovery africa japan canada european europe uk france germany eu china world health organizationInternational

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong europeanInternational

Walmart launches clever answer to Target’s new membership program

The retail superstore is adding a new feature to its Walmart+ plan — and customers will be happy.

It's just been a few days since Target (TGT) launched its new Target Circle 360 paid membership plan.

The plan offers free and fast shipping on many products to customers, initially for $49 a year and then $99 after the initial promotional signup period. It promises to be a success, since many Target customers are loyal to the brand and will go out of their way to shop at one instead of at its two larger peers, Walmart and Amazon.

Related: Walmart makes a major price cut that will delight customers

And stop us if this sounds familiar: Target will rely on its more than 2,000 stores to act as fulfillment hubs.

This model is a proven winner; Walmart also uses its more than 4,600 stores as fulfillment and shipping locations to get orders to customers as soon as possible.

Sometimes, this means shipping goods from the nearest warehouse. But if a desired product is in-store and closer to a customer, it reduces miles on the road and delivery time. It's a kind of logistical magic that makes any efficiency lover's (or retail nerd's) heart go pitter patter.

Walmart rolls out answer to Target's new membership tier

Walmart has certainly had more time than Target to develop and work out the kinks in Walmart+. It first launched the paid membership in 2020 during the height of the pandemic, when many shoppers sheltered at home but still required many staples they might ordinarily pick up at a Walmart, like cleaning supplies, personal-care products, pantry goods and, of course, toilet paper.

It also undercut Amazon (AMZN) Prime, which costs customers $139 a year for free and fast shipping (plus several other benefits including access to its streaming service, Amazon Prime Video).

Walmart+ costs $98 a year, which also gets you free and speedy delivery, plus access to a Paramount+ streaming subscription, fuel savings, and more.

If that's not enough to tempt you, however, Walmart+ just added a new benefit to its membership program, ostensibly to compete directly with something Target now has: ultrafast delivery.

Target Circle 360 particularly attracts customers with free same-day delivery for select orders over $35 and as little as one-hour delivery on select items. Target executes this through its Shipt subsidiary.

We've seen this lightning-fast delivery speed only in snippets from Amazon, the king of delivery efficiency. Who better to take on Target, though, than Walmart, which is using a similar store-as-fulfillment-center model?

"Walmart is stepping up to save our customers even more time with our latest delivery offering: Express On-Demand Early Morning Delivery," Walmart said in a statement, just a day after Target Circle 360 launched. "Starting at 6 a.m., earlier than ever before, customers can enjoy the convenience of On-Demand delivery."

Walmart (WMT) clearly sees consumers' desire for near-instant delivery, which obviously saves time and trips to the store. Rather than waiting a day for your order to show up, it might be on your doorstep when you wake up.

Consumers also tend to spend more money when they shop online, and they remain stickier as paying annual members. So, to a growing number of retail giants, almost instant gratification like this seems like something worth striving for.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic mexicoGovernment

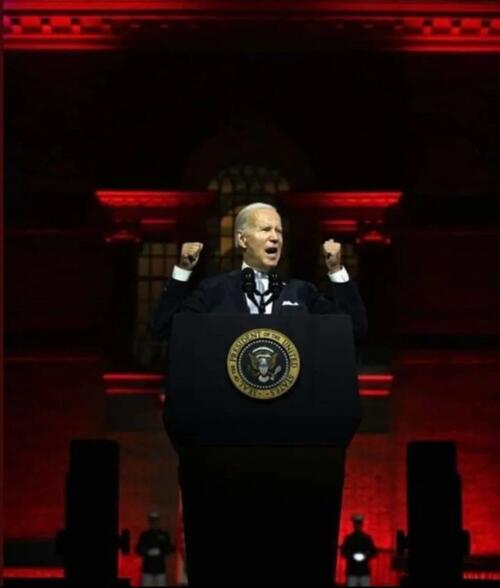

President Biden Delivers The “Darkest, Most Un-American Speech Given By A President”

President Biden Delivers The "Darkest, Most Un-American Speech Given By A President"

Having successfully raged, ranted, lied, and yelled through…

Having successfully raged, ranted, lied, and yelled through the State of The Union, President Biden can go back to his crypt now.

Whatever 'they' gave Biden, every American man, woman, and the other should be allowed to take it - though it seems the cocktail brings out 'dark Brandon'?

Tl;dw: Biden's Speech tonight ...

-

Fund Ukraine.

-

Trump is threat to democracy and America itself.

-

Abortion is good.

-

American Economy is stronger than ever.

-

Inflation wasn't Biden's fault.

-

Illegals are Americans too.

-

Republicans are responsible for the border crisis.

-

Trump is bad.

-

Biden stands with trans-children.

-

J6 was the worst insurrection since the Civil War.

(h/t @TCDMS99)

Tucker Carlson's response sums it all up perfectly:

"that was possibly the darkest, most un-American speech given by an American president. It wasn't a speech, it was a rant..."

Carlson continued: "The true measure of a nation's greatness lies within its capacity to control borders, yet Bid refuses to do it."

"In a fair election, Joe Biden cannot win"

And concluded:

“There was not a meaningful word for the entire duration about the things that actually matter to people who live here.”

Victor Davis Hanson added some excellent color, but this was probably the best line on Biden:

"he doesn't care... he lives in an alternative reality."

— Tucker Carlson (@TuckerCarlson) March 8, 2024

* * *

Watch SOTU Live here...

* * *

Mises' Connor O'Keeffe, warns: "Be on the Lookout for These Lies in Biden's State of the Union Address."

On Thursday evening, President Joe Biden is set to give his third State of the Union address. The political press has been buzzing with speculation over what the president will say. That speculation, however, is focused more on how Biden will perform, and which issues he will prioritize. Much of the speech is expected to be familiar.

The story Biden will tell about what he has done as president and where the country finds itself as a result will be the same dishonest story he's been telling since at least the summer.

He'll cite government statistics to say the economy is growing, unemployment is low, and inflation is down.

Something that has been frustrating Biden, his team, and his allies in the media is that the American people do not feel as economically well off as the official data says they are. Despite what the White House and establishment-friendly journalists say, the problem lies with the data, not the American people's ability to perceive their own well-being.

As I wrote back in January, the reason for the discrepancy is the lack of distinction made between private economic activity and government spending in the most frequently cited economic indicators. There is an important difference between the two:

-

Government, unlike any other entity in the economy, can simply take money and resources from others to spend on things and hire people. Whether or not the spending brings people value is irrelevant

-

It's the private sector that's responsible for producing goods and services that actually meet people's needs and wants. So, the private components of the economy have the most significant effect on people's economic well-being.

Recently, government spending and hiring has accounted for a larger than normal share of both economic activity and employment. This means the government is propping up these traditional measures, making the economy appear better than it actually is. Also, many of the jobs Biden and his allies take credit for creating will quickly go away once it becomes clear that consumers don't actually want whatever the government encouraged these companies to produce.

On top of all that, the administration is dealing with the consequences of their chosen inflation rhetoric.

Since its peak in the summer of 2022, the president's team has talked about inflation "coming back down," which can easily give the impression that it's prices that will eventually come back down.

But that's not what that phrase means. It would be more honest to say that price increases are slowing down.

Americans are finally waking up to the fact that the cost of living will not return to prepandemic levels, and they're not happy about it.

The president has made some clumsy attempts at damage control, such as a Super Bowl Sunday video attacking food companies for "shrinkflation"—selling smaller portions at the same price instead of simply raising prices.

In his speech Thursday, Biden is expected to play up his desire to crack down on the "corporate greed" he's blaming for high prices.

In the name of "bringing down costs for Americans," the administration wants to implement targeted price ceilings - something anyone who has taken even a single economics class could tell you does more harm than good. Biden would never place the blame for the dramatic price increases we've experienced during his term where it actually belongs—on all the government spending that he and President Donald Trump oversaw during the pandemic, funded by the creation of $6 trillion out of thin air - because that kind of spending is precisely what he hopes to kick back up in a second term.

If reelected, the president wants to "revive" parts of his so-called Build Back Better agenda, which he tried and failed to pass in his first year. That would bring a significant expansion of domestic spending. And Biden remains committed to the idea that Americans must be forced to continue funding the war in Ukraine. That's another topic Biden is expected to highlight in the State of the Union, likely accompanied by the lie that Ukraine spending is good for the American economy. It isn't.

It's not possible to predict all the ways President Biden will exaggerate, mislead, and outright lie in his speech on Thursday. But we can be sure of two things. The "state of the Union" is not as strong as Biden will say it is. And his policy ambitions risk making it much worse.

* * *

The American people will be tuning in on their smartphones, laptops, and televisions on Thursday evening to see if 'sloppy joe' 81-year-old President Joe Biden can coherently put together more than two sentences (even with a teleprompter) as he gives his third State of the Union in front of a divided Congress.

President Biden will speak on various topics to convince voters why he shouldn't be sent to a retirement home.

The state of our union under President Biden: three years of decline. pic.twitter.com/Da1KOIb3eR

— Speaker Mike Johnson (@SpeakerJohnson) March 7, 2024

According to CNN sources, here are some of the topics Biden will discuss tonight:

Economic issues: Biden and his team have been drafting a speech heavy on economic populism, aides said, with calls for higher taxes on corporations and the wealthy – an attempt to draw a sharp contrast with Republicans and their likely presidential nominee, Donald Trump.

Health care expenses: Biden will also push for lowering health care costs and discuss his efforts to go after drug manufacturers to lower the cost of prescription medications — all issues his advisers believe can help buoy what have been sagging economic approval ratings.

Israel's war with Hamas: Also looming large over Biden's primetime address is the ongoing Israel-Hamas war, which has consumed much of the president's time and attention over the past few months. The president's top national security advisers have been working around the clock to try to finalize a ceasefire-hostages release deal by Ramadan, the Muslim holy month that begins next week.

An argument for reelection: Aides view Thursday's speech as a critical opportunity for the president to tout his accomplishments in office and lay out his plans for another four years in the nation's top job. Even though viewership has declined over the years, the yearly speech reliably draws tens of millions of households.

Sources provided more color on Biden's SOTU address:

The speech is expected to be heavy on economic populism. The president will talk about raising taxes on corporations and the wealthy. He'll highlight efforts to cut costs for the American people, including pushing Congress to help make prescription drugs more affordable.

Biden will talk about the need to preserve democracy and freedom, a cornerstone of his re-election bid. That includes protecting and bolstering reproductive rights, an issue Democrats believe will energize voters in November. Biden is also expected to promote his unity agenda, a key feature of each of his addresses to Congress while in office.

Biden is also expected to give remarks on border security while the invasion of illegals has become one of the most heated topics among American voters. A majority of voters are frustrated with radical progressives in the White House facilitating the illegal migrant invasion.

It is probable that the president will attribute the failure of the Senate border bill to the Republicans, a claim many voters view as unfounded. This is because the White House has the option to issue an executive order to restore border security, yet opts not to do so

Maybe this is why?

Most Americans are still unaware that the census counts ALL people, including illegal immigrants, for deciding how many House seats each state gets!

— Elon Musk (@elonmusk) March 7, 2024

This results in Dem states getting roughly 20 more House seats, which is another strong incentive for them not to deport illegals.

While Biden addresses the nation, the Biden administration will be armed with a social media team to pump propaganda to at least 100 million Americans.

"The White House hosted about 70 creators, digital publishers, and influencers across three separate events" on Wednesday and Thursday, a White House official told CNN.

Not a very capable social media team...

The State of Confusion https://t.co/C31mHc5ABJ

— zerohedge (@zerohedge) March 7, 2024

The administration's move to ramp up social media operations comes as users on X are mostly free from government censorship with Elon Musk at the helm. This infuriates Democrats, who can no longer censor their political enemies on X.

Meanwhile, Democratic lawmakers tell Axios that the president's SOTU performance will be critical as he tries to dispel voter concerns about his elderly age. The address reached as many as 27 million people in 2023.

"We are all nervous," said one House Democrat, citing concerns about the president's "ability to speak without blowing things."

The SOTU address comes as Biden's polling data is in the dumps.

BetOnline has created several money-making opportunities for gamblers tonight, such as betting on what word Biden mentions the most.

As well as...

We will update you when Tucker Carlson's live feed of SOTU is published.

Fuck it. We’ll do it live! Thursday night, March 7, our live response to Joe Biden’s State of the Union speech. pic.twitter.com/V0UwOrgKvz

— Tucker Carlson (@TuckerCarlson) March 6, 2024

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 hours ago

International2 hours agoWalmart launches clever answer to Target’s new membership program

-

Government1 month ago

Government1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex