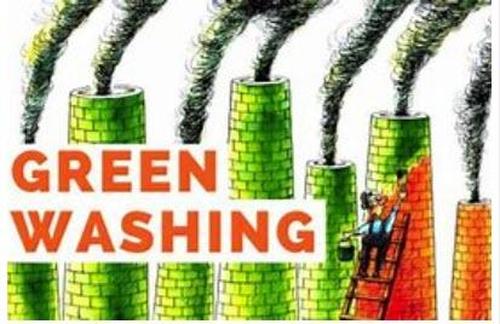

Greenwashing Turns “Ugly” Into Environmentally Friendly

Greenwashing Turns "Ugly" Into Environmentally Friendly

Authored by Bruce Wilds via Advancing Times blog,

Greenwashing is a term you may not be familiar with but may become used more frequently in the future. The combination of limited publi

Authored by Bruce Wilds via Advancing Times blog,

Greenwashing is a term you may not be familiar with but may become used more frequently in the future. The combination of limited public access to information and seemingly unlimited advertising has enabled companies to present themselves as caring environmental stewards, even as they were engaging in environmentally unsustainable practices. This has been going on for years and I expect the effort to portray a company as "caring about the environment" is about to be ramped up to a whole new level.

The idea of greenwashing is not new but has evolved and drastically increased with the news-waves constantly echoing concern over global warming and climate change. Many companies are now working to engage customers in their sustainability efforts, even as their core business model remains environmentally ugly. The many ways companies and people damage the environment are often their "dirty little secrets." Sometimes environmentally damaging behavior is driven by greed, sometimes ignorance, and sometimes a feeling of entitlement or indifference. It is often difficult for people to discover the truth about a company when it is hidden behind well-contrived lies.

In "Many Cites" Buses Have Few Riders

In the same way, government diverts our attention from something that highlights its failures, companies often divert our attention from the bigger picture. Marketers create advertisements that appeal to the sensitive hearts of the consumers by making images and films that are adorable. This is also done by making green claims that are vague and ambiguous. By simply changing the color of the company logo from yellow or red to green can invoke the illusion of environmentally friendly products.

Greenwashing is not reserved for companies, even individuals use it. An example is how John Kerry, President Biden's recently appointed climate czar and envoy for climate change, tried to wash away his sin for taking a private jet to Iceland in 2019 to receive an award. When asked by a local reporter if this was an eco-conscious way to travel, the former secretary of state replied, “it’s the only choice for somebody like me who is traveling the world to win this battle.”

Like many of the global elite, Kerry doesn't see himself as guilty of abusing his position, to him, he is merely exercising his privilege. We see the same crap flowing from many of the self-absorbed global elite that attend conferences such as the World Economic Forum in Davos. For many of these people, a private jet is not the "only" choice, it is a "preferred choice." The hypocrisy of John Kerry, and people like him, should give us pause.

A major issue we now face is that putting a friendly face on ugly presents a real danger. This comes at the same time governments and central banks are rushing to fund a green agenda. Sadly, many of the ideas generated by these so-called environmentalists are akin to putting lipstick on a pig or rooted in the idea a great deal of money can be made by embracing this move. The continuing debate of whether Electric Vehicles are less damaging to the environment and indications they are not underlines the importance of plotting a clear path ahead.

Years ago the answer was ethanol, a renewable domestically produced alcohol fuel made from plant material, today many see this as an expensive boondoggle to benefit big agriculture. The current political atmosphere is ripe for crony capitalism to flourish and boondoggles to sprout up everywhere, especially when it comes to going "green." Another troubling development is the possibility of government overreach removing many of the choices we have come to enjoy. This of course would be carried out under the idea it is being done for "the greater good."

Falling into this category is an agenda being promoted under the Green New Deal moniker, this name is most likely used to give this vision of America a more credible image. The Green New Deal is modeled in part after Franklin D. Roosevelt’s New Deal, a large federal program designed to stabilize the economy and recover from the Great Depression. It should be noted many people give credit to World War II for pulling America out of the Great Depression rather than Roosevelt's economic policies.

Factcheck.org looked into the Green New Deal to see what it includes and doesn’t as well as to why there is confusion over the content. It calls for a massive change in society and the way we live. It focuses on tackling climate change but isn’t concerned just with reducing emissions. This was all wrapped into a resolution listing goals to be accomplished in a 10-year mobilization effort that does not stipulate how the country will reach them. The resolution is also silent on cost and how all this should be funded. Below is a list of the five goals, which the resolution says should be accomplished in a 10-year mobilization effort:

-

Achieve net-zero greenhouse gas emissions through a fair and just transition for all communities and workers

-

Create millions of good, high-wage jobs and ensure prosperity and economic security for all people of the United States

-

Invest in the infrastructure and industry of the United States to sustainably meet the challenges of the 21st century

-

Secure for all people of the United States for generations to come: clean air and water; climate and community resiliency; healthy food; access to nature; and a sustainable environment

-

Promote justice and equity by stopping current, preventing future, and repairing historic oppression of indigenous peoples, communities of color, migrant communities, deindustrialized communities, depopulated rural communities, the poor, low-income workers, women, the elderly, the unhoused, people with disabilities, and youth (“frontline and vulnerable communities”)

With the hard turn towards creating a more green economy, it should come as no surprise that now Jane Yellen as the face of the Treasury Department’s free money initiative recently addressed the G7 telling them, we "should be focused on what more we can do to provide support at this time." She went on to "emphasized the commitment of the Biden Administration to multilateralism to solve global issues, stating that the United States “places a high priority on deepening our international engagement and strengthening our alliances."

The fact Yellen also "expressed strong support for G7 efforts to tackle climate change, highlights how just a small percentage of votes can cause a 180-degree change in a country's policies. Yellen even went further expressing her strong belief that G7 countries "must work to address the challenges facing low-income countries who are struggling to respond to the pandemic." Several Central Banks have already endorsed the green agenda. This all falls into the scenario that it's time to finally fix the world and together we have the ability to create the money to do it. In short, we will spend and you should too.

Enough about the money and the politics behind all this, the reality is, much of the direction the world takes will have less to do with the environment than the image those in charge wish to project. If any of these people really gave a damn about the environment the first word out of their mouth would be "conserve" and then they would be talking about reducing waste.

This is the low-hanging fruit that could be quickly reached and picked at little cost. Both would make a great difference.

The reason nobody talks about this is that conserving and reducing waste would cause the GDP to fall like a stone.

Uncategorized

Key shipping company files for Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Key shipping company files Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Tight inventory and frustrated buyers challenge agents in Virginia

With inventory a little more than half of what it was pre-pandemic, agents are struggling to find homes for clients in Virginia.

No matter where you are in the state, real estate agents in Virginia are facing low inventory conditions that are creating frustrating scenarios for their buyers.

“I think people are getting used to the interest rates where they are now, but there is just a huge lack of inventory,” said Chelsea Newcomb, a RE/MAX Realty Specialists agent based in Charlottesville. “I have buyers that are looking, but to find a house that you love enough to pay a high price for — and to be at over a 6.5% interest rate — it’s just a little bit harder to find something.”

Newcomb said that interest rates and higher prices, which have risen by more than $100,000 since March 2020, according to data from Altos Research, have caused her clients to be pickier when selecting a home.

“When rates and prices were lower, people were more willing to compromise,” Newcomb said.

Out in Wise, Virginia, near the westernmost tip of the state, RE/MAX Cavaliers agent Brett Tiller and his clients are also struggling to find suitable properties.

“The thing that really stands out, especially compared to two years ago, is the lack of quality listings,” Tiller said. “The slightly more upscale single-family listings for move-up buyers with children looking for their forever home just aren’t coming on the market right now, and demand is still very high.”

Statewide, Virginia had a 90-day average of 8,068 active single-family listings as of March 8, 2024, down from 14,471 single-family listings in early March 2020 at the onset of the COVID-19 pandemic, according to Altos Research. That represents a decrease of 44%.

In Newcomb’s base metro area of Charlottesville, there were an average of only 277 active single-family listings during the same recent 90-day period, compared to 892 at the onset of the pandemic. In Wise County, there were only 56 listings.

Due to the demand from move-up buyers in Tiller’s area, the average days on market for homes with a median price of roughly $190,000 was just 17 days as of early March 2024.

“For the right home, which is rare to find right now, we are still seeing multiple offers,” Tiller said. “The demand is the same right now as it was during the heart of the pandemic.”

According to Tiller, the tight inventory has caused homebuyers to spend up to six months searching for their new property, roughly double the time it took prior to the pandemic.

For Matt Salway in the Virginia Beach metro area, the tight inventory conditions are creating a rather hot market.

“Depending on where you are in the area, your listing could have 15 offers in two days,” the agent for Iron Valley Real Estate Hampton Roads | Virginia Beach said. “It has been crazy competition for most of Virginia Beach, and Norfolk is pretty hot too, especially for anything under $400,000.”

According to Altos Research, the Virginia Beach-Norfolk-Newport News housing market had a seven-day average Market Action Index score of 52.44 as of March 14, making it the seventh hottest housing market in the country. Altos considers any Market Action Index score above 30 to be indicative of a seller’s market.

Further up the coastline on the vacation destination of Chincoteague Island, Long & Foster agent Meghan O. Clarkson is also seeing a decent amount of competition despite higher prices and interest rates.

“People are taking their time to actually come see things now instead of buying site unseen, and occasionally we see some seller concessions, but the traffic and the demand is still there; you might just work a little longer with people because we don’t have anything for sale,” Clarkson said.

“I’m busy and constantly have appointments, but the underlying frenzy from the height of the pandemic has gone away, but I think it is because we have just gotten used to it.”

While much of the demand that Clarkson’s market faces is for vacation homes and from retirees looking for a scenic spot to retire, a large portion of the demand in Salway’s market comes from military personnel and civilians working under government contracts.

“We have over a dozen military bases here, plus a bunch of shipyards, so the closer you get to all of those bases, the easier it is to sell a home and the faster the sale happens,” Salway said.

Due to this, Salway said that existing-home inventory typically does not come on the market unless an employment contract ends or the owner is reassigned to a different base, which is currently contributing to the tight inventory situation in his market.

Things are a bit different for Tiller and Newcomb, who are seeing a decent number of buyers from other, more expensive parts of the state.

“One of the crazy things about Louisa and Goochland, which are kind of like suburbs on the western side of Richmond, is that they are growing like crazy,” Newcomb said. “A lot of people are coming in from Northern Virginia because they can work remotely now.”

With a Market Action Index score of 50, it is easy to see why people are leaving the Washington-Arlington-Alexandria market for the Charlottesville market, which has an index score of 41.

In addition, the 90-day average median list price in Charlottesville is $585,000 compared to $729,900 in the D.C. area, which Newcomb said is also luring many Virginia homebuyers to move further south.

“They are very accustomed to higher prices, so they are super impressed with the prices we offer here in the central Virginia area,” Newcomb said.

For local buyers, Newcomb said this means they are frequently being outbid or outpriced.

“A couple who is local to the area and has been here their whole life, they are just now starting to get their mind wrapped around the fact that you can’t get a house for $200,000 anymore,” Newcomb said.

As the year heads closer to spring, triggering the start of the prime homebuying season, agents in Virginia feel optimistic about the market.

“We are seeing seasonal trends like we did up through 2019,” Clarkson said. “The market kind of soft launched around President’s Day and it is still building, but I expect it to pick right back up and be in full swing by Easter like it always used to.”

But while they are confident in demand, questions still remain about whether there will be enough inventory to support even more homebuyers entering the market.

“I have a lot of buyers starting to come off the sidelines, but in my office, I also have a lot of people who are going to list their house in the next two to three weeks now that the weather is starting to break,” Newcomb said. “I think we are going to have a good spring and summer.”

real estate housing market pandemic covid-19 interest rates-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges