Uncategorized

GOLDEN SHIELD DRILLS 13.40M GRADING 12.24 G/T GOLD AND ANOTHER 13.40M GRADING 2.54 G/T GOLD FURTHER EXTENDING MINERALIZATION AT MAZOA HILL

GOLDEN SHIELD DRILLS 13.40M GRADING 12.24 G/T GOLD AND ANOTHER 13.40M GRADING 2.54 G/T GOLD FURTHER EXTENDING MINERALIZATION AT MAZOA HILL

Canada NewsWire

VANCOUVER, BC, Nov. 7, 2022

VANCOUVER, BC, Nov. 7, 2022 /CNW/ – Golden Shield Resources Inc. …

GOLDEN SHIELD DRILLS 13.40M GRADING 12.24 G/T GOLD AND ANOTHER 13.40M GRADING 2.54 G/T GOLD FURTHER EXTENDING MINERALIZATION AT MAZOA HILL

Canada NewsWire

VANCOUVER, BC, Nov. 7, 2022

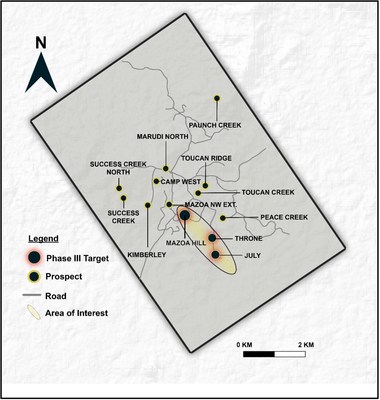

VANCOUVER, BC, Nov. 7, 2022 /CNW/ - Golden Shield Resources Inc. (CSE: GSRI) (FRA: 4LE0) (OTCQB: GSRFF) (the "Company" or "Golden Shield") is pleased to announce assay results from three holes from the Company's ongoing Phase III drill program at its 100% owned flagship, 5,457-hectare Marudi Mountain gold project located southwestern Guyana (the "Marudi Mountain Property"). The Phase III drill program comprises approximately 3,000m, with six holes designed to test the southern and depth extension of the Mazoa Hill Deposit and five drill holes dedicated to testing the July and Throne targets, as discussed in the Company's news release dated September 13, 2022.

- 13.40 m grading 12.24 g/t gold, 4.3 m grading 8.68 g/t gold and another 13.40 metres grading 2.54 g/t gold including 6.0 grading 4.93 g/t gold confirm continuation of high-grade mineralization at depth at Mazoa Hill

- 19.6 m at 1.06 g/t Au encountered in new, upper lens of mineralized host Quartz-Metachert Unit (QMC)

- The intersections in all three holes are outside the currently defined resource at Mazoa Hill and both zones remain open along strike and down-plunge. Results are awaited for three further holes on a further step out section to the SE with host rock QMC identified in all.

- Drilling commenced on the Throne and July Targets with holes targeting anomalous gold values and prospective lithologies identified from surface sampling and trenching programmes.

Hilbert Shields, CEO of Golden Shield commented: "The results of these first three holes at Mazoa Hill continues the extension of the known mineralized zone and finding new lenses of additional mineralization is always a welcome surprise. We eagerly await results from the remaining three holes drilled at Mazoa Hill, and the ongoing initial test drilling of the Throne and July Prospects. Furthermore, we look forward to the outcome of the IP Survey and the comprehensive integration of the multiple layers of historical geological, as well as new data, being gathered by contractors currently on site."

The six recently completed diamond drill holes at Mazoa Hill targeted strike and down-plunge extensions of a high-grade zone or "shoot" identified by Golden Shield's Phase I and II drilling. Historical drilling did not recognize the strike or vertical extent of this shoot. The high-grade shoot is hosted in a broader envelope of "quartzite-metachert" (QMC) which is interpreted as a strongly silicified shear zone along the contact between amphibolite schist and mica schist.

Drill holes MH-22-28, MH-22-29 are approximately 50m apart on section and were drilled to test the down-plunge extension of the high-grade shoot at Mazoa Hill. The two holes stepped out 50m to the southeast of hole MH22-21 which intersected 31m grading 7.58 g/t gold (see the Company's news release dated May 31, 2022).

Hole MH-22-28 intersected three zones:

- 13.40m grading 12.24 g/t gold from 285.00m at the lower contact of the QMC unit.

- 3.00m grading 4.23 g/t gold from 259.80m also at the lower contact of the QMC unit and,

- 19.60m grading 1.06 g/t gold from 194.00m in a newly identified zone above the main QMC unit

Hole MH-22-29 intersected three zones within the main QMC unit:

- 9.00m grading 2.01 g/t gold from 194.00m at the upper QMC contact.

- 13.40m grading 2.54 g/t gold from 315.70m including 6.00m grading 4.93 g/t gold from 315.70m.

- 4.30m grading 8.68 g/t gold from 337.40m at the lower contact of the QMC unit

All intercepted zones remain open at depth and along strike, to the southeast.

MH-22-30 was designed to test the depth extension of mineralization approximately 50 meters vertically below hole MH-22-21, in the central part of the deposit. The hole intersected approximately 50 meters of QMC host lithology, but did not return significant grades from this area, perhaps suggesting a base to, or fault offset, to the high-grade zone, closing off the mineralized lens at depth on this section.

The Mazoa Zone intersected by Holes MH-22-28 and MH-22-29 remain open to depth and along strike to the south and will be a focus of our next drill campaign.

Table 1. Drillhole Intersections.

Hole / Depth | Azimuth and | Interval | From | To | Width | Au |

MH-22-28 / 351m | 240 /-60 | 1 | 194.00 | 213.60 | 19.60 | 1.06 |

Including | 207.40 | 213.50 | 6.10 | 2.89 | ||

2 | 259.80 | 262.80 | 3.00 | 4.23 | ||

3 | 285.00 | 298.40 | 13.40 | 12.24 | ||

MH-22-29/ 354m | 240 /-60 | 1 | 259.40 | 260.50 | 1.10 | 2.03 |

2 | 284.70 | 293.70 | 9.00 | 2.01 | ||

3 | 315.70 | 321.10 | 13.40 | 2.54 | ||

Including | 315.70 | 321.70 | 6.00 | 4.93 | ||

4 | 327.60 | 329.10 | 1.50 | 2.65 | ||

5 | 337.40 | 341.70 | 4.30 | 8.68 | ||

MH-22-30/ 348m | 240 /-60 | 1 | 79.75 | 86.25 | 6.50 | 1.30 |

Including | 79.75 | 81.25 | 1.50 | 4.08 |

*Lengths are drill indicated core length, as insufficient drilling has been undertaken to determine true widths at this time. The highest assay used for weighted average grade is 50.90/t gold and top-cutting is not deemed to be necessary. Average widths are calculated using a 0.50 g/t gold cut-off grade with < 4 m of internal dilution below cut-off grade. Sample lengths are 1m unless reduced below this to respect geological contact. |

With results from the first three of six holes at Mazoa Hill now complete, assays from three remaining holes drilled at Mazoa Hill, MH-22-31, MH-22-32 and MH-22-33 remain to be received. Drilling is currently focused on July and Throne Prospects (see the Company's news release dated September 13, 2022). Both the July and Throne prospects display the same QMC host-rock that hosts gold mineralization at Mazoa Hill and occur along strike to the south of the Mazoa Hill deposit, forming a 1.8 kilometre long trend (see Figure 1).

Property exploration is ongoing at the Marudi Mountain property. Auger sampling work that has been ongoing for months, in, addition to Induced Polarization (IP) Survey is being implemented across approximately 25 square kilometres covering the Mazoa-Throne-July trend. Furthermore, Specialized Geological Mapping has been contracted to assist with geological modelling and generation of additional drill targets with a geologist on site for most of November.

The Company has also received The Depository Trust Company (the "DTC") full-service eligibility in the United States, making the Company's stock more accessible to U.S. retail and institutional investors.

The DTC is the largest securities depository in the world and facilitates electronic settlement of stock certificate transfers in the United States. The shares of the Company, trading under the symbol "GSRFF" in the United States, are now eligible to be electronically cleared and settled through the DTC and are therefore considered "DTC eligible". This electronic method of clearing securities offers a more efficient, lower-cost settlement process for investors and brokers.

All Golden Shield sample assay results have been independently monitored through a quality control / quality assurance ("QA/QC") protocol which includes the insertion of blind standards, blanks as well as pulp and reject duplicate samples. Logging and sampling are completed at Golden Shield's core handling facility located at the Marudi property. Drill core is diamond sawn on site and half drill-core samples are securely transported to Actlabs Guyana Inc ("Actlabs") sample preparation and analysis facility in Georgetown, Guyana. Samples are crushed and pulverised and a 50 gram charge is analysed by Fire Assay with gravimetric finish. Golden Shield is not aware of any drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data referred to herein. ACTLABS Laboratories is independent of Golden Shield.

Leo Hathaway, P. Geo, Executive Chair of Golden Shield, anxd a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed, verified, and approved the scientific and technical information in this news release and has verified the data underlying that scientific and technical information.

Golden Shield Resources was founded by experienced professionals who are convinced that there are many more gold mines yet to be found in Guyana. The Company is well-financed and has three wholly controlled gold projects: Marudi Mountain, Arakaka and Fish Creek. Golden Shield continues to evaluate other gold opportunities in Guyana.

This news release includes certain "Forward–Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward–looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward–looking statements or information. These forward–looking statements or information relate to, among other things: the exploration and development of the Company's mineral projects; and release of drilling results.

Forward–looking statements and forward–looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Golden Shield, future growth potential for Golden Shield and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of gold and other metACTLABS; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Golden Shield's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Golden Shield's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward–looking statements or forward-looking information and Golden Shield has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company's dependence on one mineral project; precious metACTLABS price volatility; risks associated with the conduct of the Company's mineral exploration activities in Guyana; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding mineral resources and reserves; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities and artisanal miners; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified in the Company's public disclosure documents available on www.sedar.com. Readers are cautioned against attributing undue certainty to forward–looking statements or forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated, or intended. The Company does not intend, and does not assume any obligation, to update these forward–looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

SOURCE Golden Shield Resources

Uncategorized

Apartment permits are back to recession lows. Will mortgage rates follow?

If housing leads us into a recession in the near future, that means mortgage rates have stayed too high for too long.

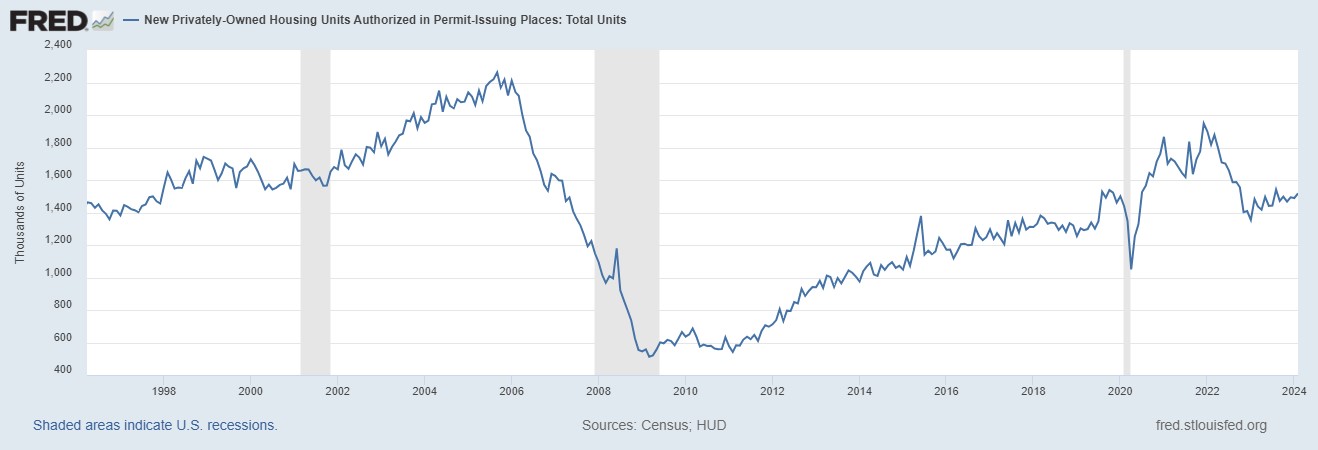

In Tuesday’s report, the 5-unit housing permits data hit the same levels we saw in the COVID-19 recession. Once the backlog of apartments is finished, those jobs will be at risk, which traditionally means mortgage rates would fall soon after, as they have in previous economic cycles.

However, this is happening while single-family permits are still rising as the rate of builder buy-downs and the backlog of single-family homes push single-family permits and starts higher. It is a tale of two markets — something I brought up on CNBC earlier this year to explain why this trend matters with housing starts data because the two marketplaces are heading in opposite directions.

The question is: Will the uptick in single-family permits keep mortgage rates higher than usual? As long as jobless claims stay low, the falling 5-unit apartment permit data might not lead to lower mortgage rates as it has in previous cycles.

From Census: Building Permits: Privately‐owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,518,000. This is 1.9 percent above the revised January rate of 1,489,000 and 2.4 percent above the February 2023 rate of 1,482,000.

When people say housing leads us in and out of a recession, it is a valid premise and that is why people carefully track housing permits. However, this housing cycle has been unique. Unfortunately, many people who have tracked this housing cycle are still stuck on 2008, believing that what happened during COVID-19 was rampant demand speculation that would lead to a massive supply of homes once home sales crashed. This would mean the builders couldn’t sell more new homes or have housing permits rise.

Housing permits, starts and new home sales were falling for a while, and in 2022, the data looked recessionary. However, new home sales were never near the 2005 peak, and the builders found a workable bottom in sales by paying down mortgage rates to boost demand. The first level of job loss recessionary data has been averted for now. Below is the chart of the building permits.

On the other hand, the apartment boom and bust has already happened. Permits are already back to the levels of the COVID-19 recession and have legs to move lower. Traditionally, when this data line gets this negative, a recession isn’t far off. But, as you can see in the chart below, there’s a big gap between the housing permit data for single-family and five units. Looking at this chart, the recession would only happen after single-family and 5-unit permits fall together, not when we have a gap like we see today.

From Census: Housing completions: Privately‐owned housing completions in February were at a seasonally adjusted annual rate of 1,729,000.

As we can see in the chart below, we had a solid month of housing completions. This was driven by 5-unit completions, which have been in the works for a while now. Also, this month’s report show a weather impact as progress in building was held up due to bad weather. However, the good news is that more supply of rental units will mean the fight against rent inflation will be positive as more supply is the best way to deal with inflation. In time, that is also good news for mortgage rates.

Housing Starts: Privately‐owned housing starts in February were at a seasonally adjusted annual rate of 1,521,000. This is 10.7 percent (±14.2 percent)* above the revised January estimate of 1,374,000 and is 5.9 percent (±10.0 percent)* above the February 2023 rate of 1,436,000.

Housing starts data beat to the upside, but the real story is that the marketplace has diverged into two different directions. The apartment boom is over and permits are heading below the COVID-19 recession, but as long as the builders can keep rates low enough to sell more new homes, single-family permits and starts can slowly move forward.

If we lose the single-family marketplace, expect the chart below to look like it always does before a recession — meaning residential construction workers lose their jobs. For now, the apartment construction workers are at the most risk once they finish the backlog of apartments under construction.

Overall, the housing starts beat to the upside. Still, the report’s internals show a marketplace with early recessionary data lines, which traditionally mean mortgage rates should go lower soon. If housing leads us into a recession in the near future, that means mortgage rates have stayed too high for too long and restrictive policy by the Fed created a recession as we have seen in previous economic cycles.

The builders have been paying down rates to keep construction workers employed, but if rates go higher, it will get more and more challenging to do this because not all builders have the capacity to buy down rates. Last year, we saw what 8% mortgage rates did to new home sales; they dropped before rates fell. So, this is something to keep track of, especially with a critical Federal Reserve meeting this week.

recession covid-19 fed federal reserve home sales mortgage rates recessionUncategorized

One more airline cracks down on lounge crowding in a way you won’t like

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemicUncategorized

Star Wars icon gives his support to Disney, Bob Iger

Disney shareholders have a huge decision to make on April 3.

Disney's (DIS) been facing some headwinds up top, but its leadership just got backing from one of the company's more prominent investors.

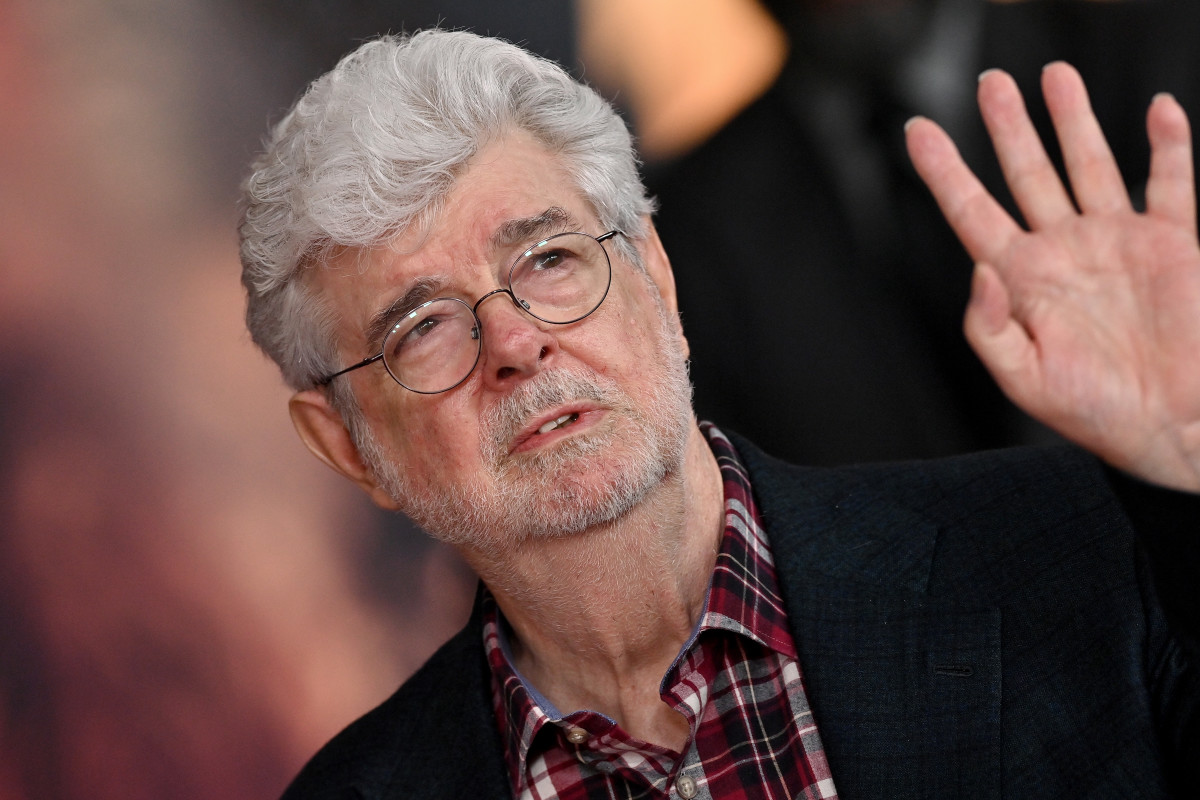

Star Wars creator George Lucas put out of statement in support of the company's current leadership team, led by CEO Bob Iger, ahead of the April 3 shareholders meeting which will see investors vote on the company's 12-member board.

"Creating magic is not for amateurs," Lucas said in a statement. "When I sold Lucasfilm just over a decade ago, I was delighted to become a Disney shareholder because of my long-time admiration for its iconic brand and Bob Iger’s leadership. When Bob recently returned to the company during a difficult time, I was relieved. No one knows Disney better. I remain a significant shareholder because I have full faith and confidence in the power of Disney and Bob’s track record of driving long-term value. I have voted all of my shares for Disney’s 12 directors and urge other shareholders to do the same."

Related: Disney stands against Nelson Peltz as leadership succession plan heats up

Lucasfilm was acquired by Disney for $4 billion in 2012 — notably under the first term of Iger. He received over 37 million in shares of Disney during the acquisition.

Lucas' statement seems to be an attempt to push investors away from the criticism coming from The Trian Partners investment group, led by Nelson Peltz. The group, owns about $3 million in shares of the media giant, is pushing two candidates for positions on the board, which are Peltz and former Disney CFO Jay Rasulo.

Peltz and Co. have called out a pair of Disney directors — Michael Froman and Maria Elena Lagomasino — for their lack of experience in the media space.

Related: Women's basketball is gaining ground, but is March Madness ready to rival the men's game?

Blackwells Capital is also pushing three of its candidates to take seats during the early April shareholder meeting, though Reuters has reported that the firm has been supportive of the company's current direction.

Disney has struggled in recent years amid the changes in media and the effects of the pandemic — which triggered the return of Iger at the helm in late 2022. After going through mass layoffs in the spring of 2023 and focusing on key growth brands, the company has seen a steady recovery with its stock up over 25% year-to-date and around 40% for the last six months.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic recovery-

Spread & Containment7 days ago

Spread & Containment7 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex