International

Goeasy: Has the Easy Money Already Been Made?

Goeasy (GSY) is a Canadian alternative financial service solution provider that’s been on a magnificent run. The incredible appetite for BNPL (Buy Now, Pay Later) options, and elevated consumer debt

Read More…

The post Goeasy: Has the Easy Money Already

Goeasy (GSY) is a Canadian alternative financial service solution provider that's been on a magnificent run.

The incredible appetite for BNPL (Buy Now, Pay Later) options, and elevated consumer debt levels, have been major contributing factors behind goeasy's rally. After soaring over 114% year-to-date, has the easy money already been made?

It's hard to ignore goeasy's valuation, which still remains modest after yet another incredible year for the record books. As such, I remain bullish.

At writing, shares of goeasy trade at 13.9 times trailing earnings. For a company that's continuing to grow its earnings at a stellar rate, such a multiple seems somewhat too good to be true. (See GSY stock charts on TipRanks)

Incredible top- and bottom-line growth, alongside a low price-to-earnings multiple suggest investors see risks ahead, or that they don't think goeasy's tremendous earnings momentum is sustainable.

Road Ahead

The early stages of an expansionary cycle tend to accompany a spending surge, especially in durable goods like furnishings and other discretionary "nice to have" items. Over the past year and a half, we've witnessed precisely this, as the world economy recovered from the coronavirus recession.

Canadian consumers swiped their credit cards or went to alternative lenders at a higher rate to finance everything from cellphone purchases, to high-end items to furnish a new home.

Goeasy has risen to the occasion, making it easier for cash- and credit-strapped Canadians to finance their purchases.

BNPL firms such as Affirm (AFRM) have become a household name, and as the appetite for consumer loans continues to heat up, alternative financial solution providers like goeasy could continue winning on the back of the BNPL trend.

Still, it's hard to gauge when the BNPL trend will lose traction. Sooner or later, an economic downturn could bring forth a reversal in its momentum. We're likely far off from the next structural economic downturn, although it is worth noting that Canada's GDP did dip slightly into the negatives recently.

As such, goeasy and the broader basket of BNPL firms could continue to post further gains that could be far larger than any losses that'll accompany the next downturn. Given this likelihood, goeasy's stock may still prove to be undervalued here.

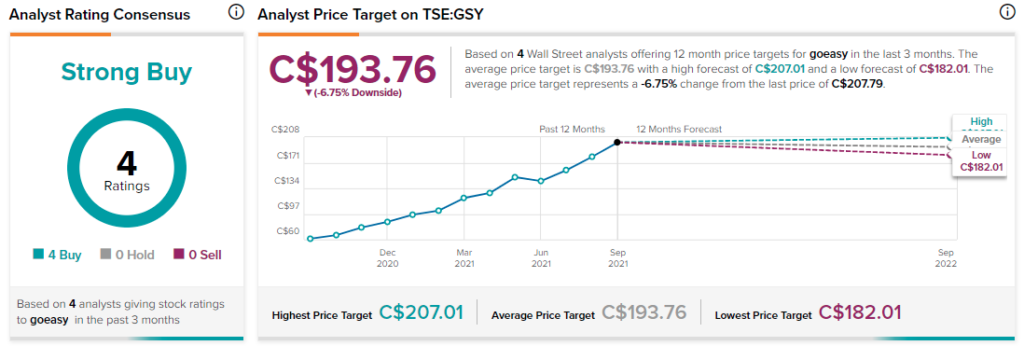

Wall Street's Take

According to TipRanks' analyst consensus rating, GSY stock comes in as a Strong Buy. Out of four analyst ratings, there are four unanimous Buy recommendations.

The average GSY price target is C$193.76. Analyst price targets range from a low of C$182.01 per share, to a high of C$207.01 per share.

Bottom Line

Despite having all Buy ratings on the name, the consensus price target suggests 6.8% downside potential from today's prices.

Indeed, analysts will either need to hike their price targets, or downgrade their ratings. Given recent momentum and no prominent sore spots, I expect the former.

Disclosure: Joey Frenette doesn't own shares of any mentioned companies at the time of publication.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.

The post Goeasy: Has the Easy Money Already Been Made? appeared first on TipRanks Financial Blog.

recession coronavirus link gdp canadaInternational

You can now enter this country without a passport

Singapore has been on a larger push to speed up the flow of tourists with digital immigration clearance.

In the fall of 2023, the city-state of Singapore announced that it was working on end-to-end biometrics that would allow travelers passing through its Changi Airport to check into flights, drop off bags and even leave and exit the country without a passport.

The latter is the most technologically advanced step of them all because not all countries issue passports with the same biometrics while immigration laws leave fewer room for mistakes about who enters the country.

Related: A country just went visa-free for visitors with any passport

That said, Singapore is one step closer to instituting passport-free travel by testing it at its land border with Malaysia. The two countries have two border checkpoints, Woodlands and Tuas, and as of March 20 those entering in Singapore by car are able to show a QR code that they generate through the government’s MyICA app instead of the passport.

Here is who is now able to enter Singapore passport-free

The latter will be available to citizens of Singapore, permanent residents and tourists who have already entered the country once with their current passport. The government app pulls data from one's passport and shows the border officer the conditions of one's entry clearance already recorded in the system.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

While not truly passport-free since tourists still need to link a valid passport to an online system, the move is the first step in Singapore's larger push to get rid of physical passports.

"The QR code initiative allows travellers to enjoy a faster and more convenient experience, with estimated time savings of around 20 seconds for cars with four travellers, to approximately one minute for cars with 10 travellers," Singapore's Immigration and Checkpoints Authority wrote in a press release announcing the new feature. "Overall waiting time can be reduced by more than 30% if most car travellers use QR code for clearance."

More countries are looking at passport-free travel but it will take years to implement

The land crossings between Singapore and Malaysia can get very busy — government numbers show that a new post-pandemic record of 495,000 people crossed Woodlands and Tuas on the weekend of March 8 (the day before Singapore's holiday weekend.)

Even once Singapore implements fully digital clearance at all of its crossings, the change will in no way affect immigration rules since it's only a way of transferring the status afforded by one's nationality into a digital system (those who need a visa to enter Singapore will still need to apply for one at a consulate before the trip.) More countries are in the process of moving toward similar systems but due to the varying availability of necessary technology and the types of passports issued by different countries, the prospect of agent-free crossings is still many years away.

In the U.S., Chicago's O'Hare International Airport was chosen to take part in a pilot program in which low-risk travelers with TSA PreCheck can check into their flight and pass security on domestic flights without showing ID. The UK has also been testing similar digital crossings for British and EU citizens but no similar push for international travelers is currently being planned in the U.S.

stocks pandemic link testing singapore uk euSpread & Containment

This country became first in the world to let in tourists passport-free

Singapore has been on a larger push to speed up the flow of tourists with digital immigration clearance.

In the fall of 2023, the city-state of Singapore announced that it was working on end-to-end biometrics that would allow travelers passing through its Changi Airport to check into flights, drop off bags and even leave and exit the country without a passport.

The latter is the most technologically advanced step of them all because not all countries issue passports with the same biometrics while immigration laws leave fewer room for mistakes about who enters the country.

Related: A country just went visa-free for visitors with any passport

That said, Singapore is one step closer to instituting passport-free travel by testing it at its land border with Malaysia. The two countries have two border checkpoints, Woodlands and Tuas, and as of March 20 those entering in Singapore by car are able to show a QR code that they generate through the government’s MyICA app instead of the passport.

Here is who is now able to enter Singapore passport-free

The latter will be available to citizens of Singapore, permanent residents and tourists who have already entered the country once with their current passport. The government app pulls data from one's passport and shows the border officer the conditions of one's entry clearance already recorded in the system.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

While not truly passport-free since tourists still need to link a valid passport to an online system, the move is the first step in Singapore's larger push to get rid of physical passports.

"The QR code initiative allows travellers to enjoy a faster and more convenient experience, with estimated time savings of around 20 seconds for cars with four travellers, to approximately one minute for cars with 10 travellers," Singapore's Immigration and Checkpoints Authority wrote in a press release announcing the new feature. "Overall waiting time can be reduced by more than 30% if most car travellers use QR code for clearance."

More countries are looking at passport-free travel but it will take years to implement

The land crossings between Singapore and Malaysia can get very busy — government numbers show that a new post-pandemic record of 495,000 people crossed Woodlands and Tuas on the weekend of March 8 (the day before Singapore's holiday weekend.)

Even once Singapore implements fully digital clearance at all of its crossings, the change will in no way affect immigration rules since it's only a way of transferring the status afforded by one's nationality into a digital system (those who need a visa to enter Singapore will still need to apply for one at a consulate before the trip.) More countries are in the process of moving toward similar systems but due to the varying availability of necessary technology and the types of passports issued by different countries, the prospect of agent-free crossings is still many years away.

In the U.S., Chicago's O'Hare International Airport was chosen to take part in a pilot program in which low-risk travelers with TSA PreCheck can check into their flight and pass security on domestic flights without showing ID. The UK has also been testing similar digital crossings for British and EU citizens but no similar push for international travelers is currently being planned in the U.S.

stocks pandemic link testing singapore uk euGovernment

Analysts issue unexpected crude oil price forecast after surge

Here’s what a key investment firm says about the commodity.

Oil is an asset defined by volatility.

U.S. crude prices stood above $60 a barrel in January 2020, just as the covid pandemic began. Three months later, prices briefly went negative, as the pandemic crushed demand.

By June 2022 the price rebounded all the way to $120, as fiscal and monetary stimulus boosted the economy. The price fell back to $80 in September 2022. Since then, it has bounced between about $65 and $90.

Over the past two months, the price has climbed 15% to $82 as of March 20.

Bullish factors for oil prices

The move stems partly from indications that economic growth this year will be stronger than analysts expected.

Related: The Fed rate decision won't surprise markets. What happens next might

Vanguard has just raised its estimate for 2024 U.S. GDP growth to 2% from 0.5%.

Meanwhile, China’s factory output and retail sales exceeded forecasts in January and February. That could boost oil demand in the country, the world's No. 1 oil importer.

Also, drone strokes from Ukraine have knocked out some of Russia’s oil refinery capacity. Ukraine has hit at least nine major refineries this year, erasing an estimated 11% of Russia’s production capacity, according to Bloomberg.

“Russia is a gas station with an army, and we intend on destroying that gas station,” Francisco Serra-Martins, chief executive of drone manufacturer Terminal Autonomy, told the news service. Gasoline, of course, is one of the products made at refineries.

Speaking of gas, the recent surge of oil prices has sent it higher as well. The average national price for regular gas totaled $3.52 per gallon Wednesday, up 7% from a month ago, according to the American Automobile Association. And we’re nearing the peak driving season.

Another bullish factor for oil: Iraq said Monday that it’s cutting oil exports by 130,000 barrels per day in coming months. Iraq produced much more oil in January and February than its OPEC (Organization of Petroleum Exporting Countries) target.

Citigroup’s oil-price forecast

Yet, not everyone is bullish on oil going forward. Citigroup analysts see prices falling through next year, Dow Jones’s Oil Price Information Service (OPIS) reports.

More Economic Analysis:

- Bond markets tell Fed rate story that stocks still ignore

- February inflation surprises with modest uptick, but core pressures ease

- Vanguard unveils bold interest rate forecast ahead of Fed meeting

The analysts note that supply is at risk in Israel, Iran, Iraq, Libya, and Venezuela. But Saudi Arabia, the UAE, Kuwait, and Russia could easily make up any shortfall.

Moreover, output should also rise this year and next in the U.S., Canada, Brazil, and Guyana, the analysts said. Meanwhile, global demand growth will decelerate, amid increased electric vehicle use and economic weakness.

Regarding refineries, the analysts see strong gains in capacity and capacity upgrades this year.

What if Donald Trump is elected president again? That “would likely be bearish for oil and gas," as Trump's policies could boost trade tension, crimping demand, they said.

The analysts made predictions for European oil prices, the world’s benchmark, which sat Wednesday at $86.

They forecast a 9% slide in the second quarter to $78, then a decline to $74 in the third quarter and $70 in the fourth quarter.

Next year should see a descent to $65 in the first quarter, $60 in the second and third, and finally $55 in the fourth, Citi said. That would leave the price 36% below current levels.

U.S. crude prices will trade $4 below European prices from the second quarter this year until the end of 2025, the analysts maintain.

Related: Veteran fund manager picks favorite stocks for 2024

stimulus economic growth pandemic dow jones stocks fed army trump gdp stimulus oil iran brazil canada european russia ukraine china-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges