Uncategorized

Global B2C e-Commerce Market Analysis Report 2023: Consolidation is Projected to Continue in the Food and Grocery Delivery – Forecasts to 2027

Global B2C e-Commerce Market Analysis Report 2023: Consolidation is Projected to Continue in the Food and Grocery Delivery – Forecasts to 2027

PR Newswire

DUBLIN, March 20, 2023

DUBLIN, March 20, 2023 /PRNewswire/ — The “Global B2C Ecommerce Marke…

Global B2C e-Commerce Market Analysis Report 2023: Consolidation is Projected to Continue in the Food and Grocery Delivery - Forecasts to 2027

PR Newswire

DUBLIN, March 20, 2023

DUBLIN, March 20, 2023 /PRNewswire/ -- The "Global B2C Ecommerce Market Opportunities Databook - 100+ KPIs on Ecommerce Verticals (Shopping, Travel, Food Service, Media & Entertainment, Technology), Market Share by Key Players, Sales Channel Analysis, Payment Instrument, Consumer Demographics - Q1 2023 Update" report has been added to ResearchAndMarkets.com's offering.

Global B2C Ecommerce industry is expected to grow by 7.80% on annual basis to reach US$6,985.5 billion in 2023. The Medium to long-term growth story of global B2C Ecommerce industry promises to be attractive.

The B2C Ecommerce is expected to grow steadily over the forecast period, recording a CAGR of 6.64% during 2023-2027. Globally, B2C Ecommerce Gross Merchandise Value will increase from US$6,479.9 billion in 2022 to reach US$9,034.9 billion by 2027.

Ever since the pandemic outbreak, the global B2C e-commerce industry has recorded strong growth, amid the rapid adoption and acceptance of digitization across all segments. The outbreak has changed the way consumers interact and engages in online shopping and retailers and marketplaces are responding to the shift in consumer behavior with personalized shopping experiences.

Across markets, the industry is projected to record strong growth in order volume and transaction value. Investment in virtual shopping experiences is projected to increase over the next three to four years, as metaverse gains more popularity among shoppers globally. For brands and marketplaces to remain competitive, players must identify new opportunities and constantly evolve with the latest emerging trends in the sector.

Consumer spending is expected to decline further in H1 2023 amid economic uncertainties globally

Rising inflation and surging cost of living dampened consumer spending globally in H2 2022. With consumers spending less on splurging and saving more amid the fears of recession, online order volumes have declined significantly in some regions.

European B2C e-commerce markets are one of the worst affected globally due to economic uncertainties. Even during the year-end holiday shopping season, consumers have reduced their spending on retail purchases, thereby affecting the growth of the market. The trend is projected to further continue in H1 2023, as central banks continue to hike interest rates to bring down inflation.

While Europe has been largely affected, other markets have shown strong momentum in the year-end holiday shopping season. Amazon, for instance, announced that the 2022 Thanksgiving has been the biggest ever for the firm. During the four-day shopping event, independent retailers on the marketplace sold more than US$1 billion on the platform.

Similar trends were visible in the Indian market, wherein e-commerce marketplaces recorded strong growth during the Diwali shopping season. Players such as Meesho have recorded 910 million orders during the 12 months of 2022, with the online shopping trend growing in Tier III and IV cities of the country.

In H1 2023, though, consumers are projected to restrict their spending amid the fears of recession. Furthermore, with their monthly budget impacted significantly due to the rise in product prices, order volume is expected to decline across product categories and the e-commerce segment.

Innovation in the Indian e-commerce segment will shape the future of the global online shopping market

The Indian e-commerce market has been the leading growth of the global industry over the last few years. With millions of more consumers projected to enter the online shopping industry in the country, India is well-positioned to emerge as the global leader in the digital commerce space. To accelerate industry growth, the government has launched an Open Network for Digital Commerce (ONDC) project.

The innovative project aims to democratize the e-commerce market for small and medium-sized businesses. The open-source network will enable buyers and sellers to move from a platform-centric model to an interoperable decentralized network. It means that consumers can discover the product on one platform, order from another, pay for their purchases using different payment providers, and get their product delivered from a cheaper logistic service provider.

The project is projected to reduce the barrier to entry into the e-commerce sector and will threaten the dominance of market leaders such as Amazon and Flipkart. Currently, in the pilot phase, the government is planning a nationwide rollout of the interoperable shopping platform in 2023.

Consolidation is projected to continue in the food and grocery delivery segment globally

During the pandemic outbreak, the food and grocery delivery market recorded strong growth. However, the momentum started to decline in 2022 and the sector entered into a period of consolidation. In 2023, the publisher expects further consolidation in the space amid economic uncertainties faced by players operating in the segment.

Amid the decline in order volume, many good and grocery delivery firms have announced a decline in their valuation. Instacart, for instance, which started 2022 with a valuation of nearly US$40 billion, announced several valuations cut throughout the 12 months. In December 2022, the firm announced another valuation cut to US$10 billion.

Along with the decline in valuation, firms are also entering into mergers and acquisition deals to consolidate their position in the respective markets. In December 2022, Getir announced the acquisition of Gorillas in a US$1.2 billion deal. The agreement will allow Getir to further strengthen its position in the European and the United States market.

In H1 2023, the publisher expects more such merger and acquisition deals to take place in the global e-commerce market, as the food and grocery delivery segment continues to face inflationary and reduced consumer spending pressures.

The report also covers niche trends such as market size by live streaming engagement model and cross-border purchases. It also covers ecommerce spend share by operating systems, devices (mobile vs. desktop) and cities.

This title is a bundled offering, combining 21 reports, covering regional insights along with data-centric analysis at regional and country levels:

- Global B2C Ecommerce Market Opportunities Databook

- Argentina B2C Ecommerce Market Opportunities Databook

- Australia B2C Ecommerce Market Opportunities Databook

- Brazil B2C Ecommerce Market Opportunities Databook

- Canada B2C Ecommerce Market Opportunities Databook

- China B2C Ecommerce Market Opportunities Databook

- France B2C Ecommerce Market Opportunities Databook

- Germany B2C Ecommerce Market Opportunities Databook

- India B2C Ecommerce Market Opportunities Databook

- Indonesia B2C Ecommerce Market Opportunities Databook

- Italy B2C Ecommerce Market Opportunities Databook

- Kenya B2C Ecommerce Market Opportunities Databook

- Mexico B2C Ecommerce Market Opportunities Databook

- Nigeria B2C Ecommerce Market Opportunities Databook

- Pakistan B2C Ecommerce Market Opportunities Databook

- Philippines B2C Ecommerce Market Opportunities Databook

- South Africa B2C Ecommerce Market Opportunities Databook

- United Arab Emirates B2C Ecommerce Market Opportunities Databook

- United Kingdom B2C Ecommerce Market Opportunities Databook

- United States B2C Ecommerce Market Opportunities Databook

- Vietnam B2C Ecommerce Market Opportunities Databook

Scope

B2C Ecommerce Market Size and Future Growth Dynamics

- Gross Merchandise Value Trend Analysis

- Average Value Per Transaction Trend Analysis

- Gross Merchandise Volume Trend Analysis

B2C Ecommerce Market Share by Key Players

- Retail Shopping Ecommerce Market Share by Key Players (40+ Players)

- Travel Ecommerce Market Share by Key Players (40+ Players)

- Food Service Ecommerce Market Share by Key Players (40+ Players)

B2C Ecommerce Market Size and Forecast by B2C Ecommerce Segments (Gross Merchandise Value Trend Analysis, 2018-2027)

- Retail Shopping (breakdown by clothing, footwear & accessories, health, beauty and personal care, food & beverage, appliances and electronics, home improvement, books, music & video, toys & hobby, auto)

- Travel and Hospitality (breakdown by air travel, train & bus, taxi service, hotels & resorts)

- Online Food Service (breakdown by aggregators, direct to consumer)

- Media and Entertainment (breakdown by streaming services, movies & events, theme parks & gaming)

- Healthcare and Wellness

- Technology Products and Services

- Other segments

B2C Ecommerce Market Size and Forecast by Retail Shopping Sales Channel

- Platform to Consumer

- Direct to Consumer

- Consumer to Consumer

B2C Ecommerce Market Share by Travel and Hospitality Sales Channel

- Market Share by Travel and Hospitality Sales Channel

- Aggregator App - Gross Merchandise Value Trend Analysis

- Direct to Consumer - Gross Merchandise Value Trend Analysis

B2C Ecommerce Market Size and Forecast by Online Food Service Sales Channel

- Aggregator App

- Direct to Consumer

B2C Ecommerce Market Size and Forecast by Engagement Model (Gross Merchandise Value Trend Analysis, 2018-2027)

- Website Based

- Live Streaming

B2C Ecommerce Market Size and Forecast by Location (Gross Merchandise Value Trend Analysis, 2018-2027)

- Cross Border

- Domestic

B2C Ecommerce Market Size and Forecast by Device (Gross Merchandise Value Trend Analysis, 2018-2027)

- Mobile

- Desktop

B2C Ecommerce Market Size and Forecast by Operating System

- iOS/macOS

- Android

- Other Operating Systems

B2C Ecommerce Market Size and Forecast by City

- Tier 1

- Tier 2

- Tier 3

B2C Ecommerce Market Size and Forecast by Payment Instrument (Gross Merchandise Value Trend Analysis, 2018-2027)

- Credit Card

- Debit Card

- Bank Transfer

- Prepaid Card

- Digital & Mobile Wallet

- Cash

- Other Digital Payment

Companies Mentioned

- 99Food

- Agoda

- AJ Mobilidade

- Ajio

- Al Rostamani Travels

- Alibaba's 1688

- Almundo

- Amazon

- Americanas

- Argos

- Avechi

- Baemin

- Beat

- Best Buy

- Best Day Travel

- BeTaxi

- BidorBuy

- BlaBlaCar

- Bobobox

- Bolt

- Bolt Food

- Booking.com

- Bukalapak

- Cabify

- Canadian Tire

- Careem

- Carousell

- Carrefour

- Casas Bahia

- Cdiscount

- Cebu Pacific

- Chopnownow

- Coles

- Coppel

- Costco

- CVC Brasil

- Daojia

- daraz

- Decolar Brasil

- Deliveroo

- Despegar

- Didi Chuxing

- DiDi Food

- Domino's

- Doordash

- Dubai Taxi

- Dubizzle

- E.Leclerc Drive

- eBay

- Ele.me

- Etsy

- Expedia

- Faasos

- Flipkart

- FlixBus

- Flytour

- Fnac

- Food Panda

- Fravega

- FREE NOW

- G7 Taxis

- Garbarino

- Gett

- GiDiCab

- Glovo

- GoFood

- Goibibo

- Gousto

- Grab Taxi

- GrabFood

- Grubhub

- Hava Net Limited

- HelloFresh

- Hemingways Travel

- HolidayCheck

- Home Depot

- Homeshopping

- Hopper

- Hot Sale

- iFood

- Infinity Travel

- Instacart

- ItTaxi

- James Delivery

- JD.com

- Jet2holidays

- Jiji

- Jollibee

- Jumia Food

- Just Eat

- Kayak

- Kilimall

- Kmart

- Konga

- Kroger

- Kulina

- Lazada

- Leroy Merlin

- LetaFood

- Lidl

- Little Cab

- Little Caesars

- Lux Group

- Lyft

- Magazine Luiza

- MakeMyTrip

- Maramoja Transport

- Marks & Spencer ( M&S )

- Mc Delivery

- MediaMarkt

- MediaWorld

- Meituan Waimai

- Menulog

- Mercado Libre

- MetroDeal

- MiCab

- Mobile World Group

- Momondo

- Mr D Food

- Mr Price Group

- Musimundo

- MyDawa

- Myer

- Mymenu

- Myntra

- Naheed Super Market

- Namshi

- Noon

- Ola

- OLX

- Omio

- OpenTable

- OrderIn

- OTTO

- PakWheels

- PayPorte

- PegiPegi

- Pickaroo

- Pizza Hut

- Qunar

- Rappi

- Rida

- Ryanair

- Sharaf DG

- Shebah

- Sherpa's

- Shopee

- Shophive

- SinDelantal

- SkipTheDishes

- Skyscanner

- Slot

- Snapdeal

- SNCF Connect

- SoFresh

- Superbalist

- Swiggy

- Takealot

- Talabat

- Taobao

- Target

- Tesco

- Tiket.com

- Tiki

- Tim Hortons

- Tmall

- Tokopedia

- Tongcheng Travel

- Traveloka

- Travelstart

- Tripadvisor

- TripAdvisor.it

- Trivago

- Uber Eats

- Ucook

- Unieuro

- Viva Aerobus

- Volaris

- Wahyoo

- Wakanow

- Walmart

- Wasili

- Webjet

- Woolworths

- Xiaohongshu

- Yidao Yongche

- Yum Deliveries

- Zalando

- Zalora

- Zameen

- Zomato

For more information about this report visit https://www.researchandmarkets.com/r/lv73sl

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Media Contact:

Research and Markets

Laura Wood, Senior Manager

press@researchandmarkets.com

For E.S.T Office Hours Call +1-917-300-0470

For U.S./CAN Toll Free Call +1-800-526-8630

For GMT Office Hours Call +353-1-416-8900

U.S. Fax: 646-607-1907

Fax (outside U.S.): +353-1-481-1716

Logo: https://mma.prnewswire.com/media/539438/Research_and_Markets_Logo.jpg

View original content:https://www.prnewswire.com/news-releases/global-b2c-e-commerce-market-analysis-report-2023-consolidation-is-projected-to-continue-in-the-food-and-grocery-delivery---forecasts-to-2027-301775956.html

SOURCE Research and Markets

Uncategorized

Part 1: Current State of the Housing Market; Overview for mid-March 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt: This 2-part overview for mid-March provides a snapshot of the current housing market.

I always like to star…

A brief excerpt:

This 2-part overview for mid-March provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

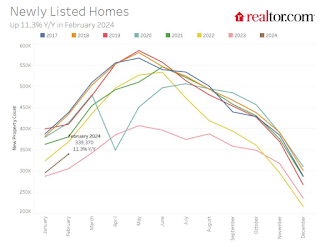

Here is a graph of new listing from Realtor.com’s February 2024 Monthly Housing Market Trends Report showing new listings were up 11.3% year-over-year in February. This is still well below pre-pandemic levels. From Realtor.com:

However, providing a boost to overall inventory, sellers turned out in higher numbers this February as newly listed homes were 11.3% above last year’s levels. This marked the fourth month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but we will have to wait for the March and April data to see how close new listings are to normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be in the 6 1/2% to 7% range.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

Uncategorized

Pharma industry reputation remains steady at a ‘new normal’ after Covid, Harris Poll finds

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45%…

The pharma industry is hanging on to reputation gains notched during the Covid-19 pandemic. Positive perception of the pharma industry is steady at 45% of US respondents in 2023, according to the latest Harris Poll data. That’s exactly the same as the previous year.

Pharma’s highest point was in February 2021 — as Covid vaccines began to roll out — with a 62% positive US perception, and helping the industry land at an average 55% positive sentiment at the end of the year in Harris’ 2021 annual assessment of industries. The pharma industry’s reputation hit its most recent low at 32% in 2019, but it had hovered around 30% for more than a decade prior.

“Pharma has sustained a lot of the gains, now basically one and half times higher than pre-Covid,” said Harris Poll managing director Rob Jekielek. “There is a question mark around how sustained it will be, but right now it feels like a new normal.”

The Harris survey spans 11 global markets and covers 13 industries. Pharma perception is even better abroad, with an average 58% of respondents notching favorable sentiments in 2023, just a slight slip from 60% in each of the two previous years.

Pharma’s solid global reputation puts it in the middle of the pack among international industries, ranking higher than government at 37% positive, insurance at 48%, financial services at 51% and health insurance at 52%. Pharma ranks just behind automotive (62%), manufacturing (63%) and consumer products (63%), although it lags behind leading industries like tech at 75% positive in the first spot, followed by grocery at 67%.

The bright spotlight on the pharma industry during Covid vaccine and drug development boosted its reputation, but Jekielek said there’s maybe an argument to be made that pharma is continuing to develop innovative drugs outside that spotlight.

“When you look at pharma reputation during Covid, you have clear sense of a very dynamic industry working very quickly and getting therapies and products to market. If you’re looking at things happening now, you could argue that pharma still probably doesn’t get enough credit for its advances, for example, in oncology treatments,” he said.

vaccine pandemic covid-19Uncategorized

Q4 Update: Delinquencies, Foreclosures and REO

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO

A brief excerpt: I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened followi…

A brief excerpt:

I’ve argued repeatedly that we would NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble). The two key reasons are mortgage lending has been solid, and most homeowners have substantial equity in their homes..There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ mortgage rates real estate mortgages pandemic interest rates

...

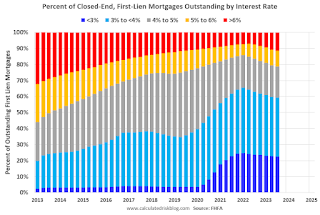

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q3 2023 (Q4 2023 data will be released in a two weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.6% of loans are under 3%, 59.4% are under 4%, and 78.7% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International5 days ago

International5 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges