Uncategorized

Global Beverage Packaging Market to Reach $204.4 Billion by 2030

Global Beverage Packaging Market to Reach $204.4 Billion by 2030

PR Newswire

NEW YORK, Feb. 10, 2023

NEW YORK, Feb. 10, 2023 /PRNewswire/ — The global economy is at a critical crossroads with a number of interlocking challenges and crises running …

Global Beverage Packaging Market to Reach $204.4 Billion by 2030

PR Newswire

NEW YORK, Feb. 10, 2023

NEW YORK, Feb. 10, 2023 /PRNewswire/ -- The global economy is at a critical crossroads with a number of interlocking challenges and crises running in parallel. The uncertainty around how Russia`s war on Ukraine will play out this year and the war`s role in creating global instability means that the trouble on the inflation front is not over yet. Food and fuel inflation will remain a persistent economic problem. Higher retail inflation will impact consumer confidence and spending. As governments combat inflation by raising interest rates, new job creation will slowdown and impact economic activity and growth. Lower capital expenditure is in the offing as companies go slow on investments, held back by inflation worries and weaker demand. With slower growth and high inflation, developed markets seem primed to enter into a recession. Fears of new COVID outbreaks and China's already uncertain post-pandemic path poses a real risk of the world experiencing more acute supply chain pain and manufacturing disruptions this year. Volatile financial markets, growing trade tensions, stricter regulatory environment and pressure to mainstream climate change into economic decisions will compound the complexity of challenges faced. Year 2023 is expected to be tough year for most markets, investors and consumers. Nevertheless, there is always opportunity for businesses and their leaders who can chart a path forward with resilience and adaptability.

Read the full report: https://www.reportlinker.com/p0552757/?utm_source=PRN

Global Beverage Packaging Market to Reach $204.4 Billion by 2030

In the changed post COVID-19 business landscape, the global market for Beverage Packaging estimated at US$143.7 Billion in the year 2022, is projected to reach a revised size of US$204.4 Billion by 2030, growing at a CAGR of 4.5% over the analysis period 2022-2030. Plastic, one of the segments analyzed in the report, is projected to record a 5.4% CAGR and reach US$77.4 Billion by the end of the analysis period. Taking into account the ongoing post pandemic recovery, growth in the Glass segment is readjusted to a revised 3.5% CAGR for the next 8-year period.

The U.S. Market is Estimated at $39.1 Billion, While China is Forecast to Grow at 7.7% CAGR

The Beverage Packaging market in the U.S. is estimated at US$39.1 Billion in the year 2022. China, the world`s second largest economy, is forecast to reach a projected market size of US$43.7 Billion by the year 2030 trailing a CAGR of 7.7% over the analysis period 2022 to 2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 2.3% and 3.7% respectively over the 2022-2030 period. Within Europe, Germany is forecast to grow at approximately 3% CAGR. Led by countries such as Australia, India, and South Korea, the market in Asia-Pacific is forecast to reach US$27.4 Billion by the year 2030.

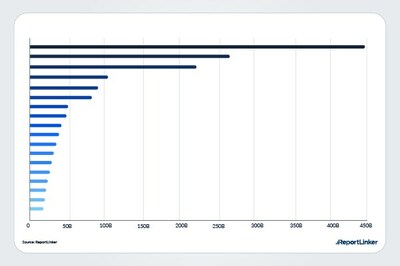

Select Competitors (Total 78 Featured)

- Amcor Ltd.

- American Packaging Corporation

- Anchor Glass Container Corporation

- Anheuser-Busch Companies, LLC

- Ardagh Group S.A.

- Ball Corporation

- Can-Pack S. A.

- Constantia Flexibles GmbH

- Coveris Holdings S.A.

- CPMC Holdings Limited

- Crown Holdings, Inc.

- Daiwa Can Company

- Gerresheimer AG

- Graham Packaging Company Inc.

- HUBER Packaging Group GmbH

- Kingcan Holdings Limited

- Metal Container Corp.

- Mondi plc

- Orora Limited

- SIG Combibloc Group AG

- Silgan Holdings Inc.

- Tecnocap S.p.A

- Verallia SA

- Vetropack Holding AG

- Wiegand-Glas GmbH

Read the full report: https://www.reportlinker.com/p0552757/?utm_source=PRN

I. METHODOLOGY

II. EXECUTIVE SUMMARY

1. MARKET OVERVIEW

Influencer Market Insights

World Market Trajectories

Beverage Packaging: Preserving Quality & Taste; Combining

Convenience & Value, and Providing Portability & Safety

Recent Market Activity

Packaging as a Critical Requirement for Success in the Fiercely

Competitive Beverage Market: The Fundamental Growth Driver

Packaging Innovation and Route to Market

Major Trends in Beverage Packaging Summarized

Major Beverage Industry Trends that are Influencing Packaging

Options

Recent Design Trends in Beverage Packaging Summarized

Global Market Outlook

Emerging Markets Offer Lucrative Growth Opportunities for

Beverage Packaging

Beverage Packaging - Global Key Competitors Percentage Market

Share in 2022 (E)

Beverage Packaging Competitor Market Share Scenario Worldwide

(in %): 2020 & 2025

Competitive Market Presence - Strong/Active/Niche/Trivial for

Players Worldwide in 2022 (E)

Beverage Packaging Competitor Market Share Scenario Worldwide

(in %): 2020 & 2029

Impact of Covid-19 and a Looming Global Recession

2. FOCUS ON SELECT PLAYERS

Amcor Ltd. (Australia)

Bemis Company, Inc. (USA)

American Packaging Corporation (USA)

Anchor Glass Container Corporation (USA)

Anheuser-Busch Companies, LLC (USA)

Metal Container Corp. (USA)

ArcelorMittal S.A. (Luxembourg)

Ardagh Group S.A. (Luxembourg)

Ball Corporation (USA)

Rocky Mountain Metal Container, LLC (USA)

Berry Global, Inc. (USA)

Can-Pack S. A. (Poland)

CCL Industries, Inc. (Canada)

Clondalkin Group Holdings B.V. (The Netherlands)

Consol Speciality Glass (Pty) Ltd. (South Africa)

Constantia Flexibles GmbH (Austria)

Coveris Holdings S.A. (Luxembourg)

CPMC Holdings Limited (China)

Crown Holdings, Inc. (USA)

Daiwa Can Company (Japan)

Ecolean AB (Sweden)

EXAL Corporation (USA)

Fabri-Kal Corporation (USA)

Gerresheimer AG (Germany)

Graham Packaging Company Inc. (USA)

HUBER Packaging Group GmbH (Germany)

Kian Joo Can Factory Berhad (Malaysia)

Kingcan Holdings Limited (China)

Mondi plc (UK)

Orora Limited (Australia)

Owens-Illinois, Inc. (USA)

Pirlo GmbH & Co KG (Austria)

Printpack Inc. (USA)

ProAmpac LLC (USA)

RPC Group Plc (UK)

RPC Astrapak Ltd. (South Africa)

SIG Combibloc Group AG (Switzerland)

Silgan Holdings Inc. (USA)

Sonoco Products Company (USA)

Tecnocap S.p.A (Italy)

TUBETTIFICIO EUROPEO Spa (Italy)

Tetra Laval International S.A. (Switzerland)

The Envases Universales Group (Mexico)

Toyo Seikan Group Holdings, Ltd. (Japan)

Türkiye Sise Ve Cam Fabrikalari A.S. (Turkey)

Anadolu Cam Sanayii A.S. (Turkey)

Verallia SA (France)

Vetropack Holding AG (Switzerland)

Vidrala S.A. (Spain)

WestRock Company (USA)

Wiegand-Glas GmbH (Germany)

ZIGNAGO VETRO S.p.A. (Italy)

3. MARKET TRENDS & DRIVERS

Growing Prominence of Smart and Active Beverage Packaging Drive

Healthy Market Growth

SmarterSeal: A Smart Can Topper

CrownSmart?

OpenSense

Smart Wine Bottle

Smart Milk

Packaging Solutions with Image Recognition and Color Changing

Features

Smart Packaging for Beer

Augment Reality (AR), NFC, QR Codes in Beverage Packaging

Provide a Highly Interactive and Superior Digital Experience

Increasing Consumption of Various Beverages Worldwide:

Foundation for Market Growth

Healthy Beverages and Packaged Water Witness Spiraling Consumption

Driven by the Surging Popularity of PET, Plastic Packaging

Dominates Beverage Packaging Cannibalizing Glass and Metal

Packaging

Enhancing Sustainability of PET Bottles through Re-Use

Sustainable, Green, and Purity Attributes Sustain Demand for

Glass Beverage Packaging

BPA Risks Benefit Market Prospects for Glass in Beverage Packaging

Environmental Concerns Contribute to Glass Packaging Popularity

How Glass Packaging Fares Compared with Alternative Packaging

Materials?

Growing Demand for Beverage Cans Drive Healthy Market Growth

for Metal Beverage Packaging

Metal Packaging?s Superiority over Other Packaging Materials

Complete Recyclability Provides the Critical Advantage

Robust Demand for Safe and Convenient Beverages Spurs Demand

for Beverage Cans

Proliferation of Aluminum Cans in Beverage Market Benefits Can

Filling, Seaming Solution Providers

Rising Sales of Alcoholic Beverages Provides the Perfect

Platform for Market Growth

Effective Packaging Trends and Strategies in the Wine Industry

Increasing Alcohol Consumption Worldwide: An Important

Opportunity Indicator

Glass: The Dominant Beverage Packaging Material for Beer

Glass: The Preferred Packaging Material for Retail Wine

Packaging Too

Super Premium Spirits Brings Back Glass Packaging into Focus

Increasing Beer Production Spells Opportunities for Metal Cans

Aluminum Cans: Replacing Glass in Beer and Soft Drink Segments

Need to Accentuate Display and Branding Drive Significant

Interest in Secondary Packaging for Beverages

?Light Weighting?: Enabling Lower Raw Material Consumption and

Reduced CO2 Emissions

Lightweight Glass: Popular Choice for Sustainable Wine Packaging

The ?Lightweighting? Trend Spurs Efforts to Improve Packaging

Efficiencies

Sustainability Revolution Drives Adoption of Eco-Friendly

Beverage Packaging

Eco-Friendly and Cost-Efficient Beverage Packaging Systems

Renewable Packaging

Green Packaging

Bio-Plastics

Stick Packs and Plastic Canister

Sustainable Aseptic Pouches

Plain and Biodegradable Beverage Packaging

Key Challenges with Marking and Coding of New, Sustainable

Packaging Material for Beverages

Flexible Packaging Continue to Displace Rigid Packaging in

Beverages

Flexible Packaging Options for Food & Beverage Packaging on the

Rise

Demand for Stand-Up Pouches to Benefit from On-the-Go Consumer

Lifestyles

Changing Trends in Tea Packaging Augurs Well for the Market

Paperboard Beverage Cartons: The Cost-Effective Attribute Drive

Demand

Need for Brand Protection Drives Demand for Anti-counterfeit

Packaging

Surging Demand for Healthy Functional Beverages Offer Lucrative

Opportunities for Packaging Solutions

Emerging Culture of Daily Dose Functional Drinks Bodes Well for

Functional Beverage Packaging

Booming Demand for Energy Drinks Expands Addressable Market

Favorable Demographic and Economic Trends Strengthen Market

Prospects

Growing Consumption of Wine among Young Adults

Shrinking Family Size

Emergence of Women as a Major Consumer Cluster

Rapid Urbanization

Burgeoning Middle Class Population

Key Growth Restraining Factors

Changes in Legislation & Regulations

Volatility in Raw Materials Prices

Supply of Contaminated or Faulty Products

Concerns over Safety of Content

Self-Powering Smart Packaging Devices

Edible Water Bottle of the Future

Innovative and Attractive Packaging for Sparkling Waters

New and Innovative Packaging for ?Tea of a Kind?

Novel uShape Technology for Aluminum Beverage Bottles

Compressible Cartons for Beverage Packaging

eSolarMark: New Coding Technology for Beverage Packaging

Innovative Clasper Bottle Technology for Alcoholic Beverage

Packaging

Meypack VP 600: New Machine for Case Packing

Innovative Multi-Packing Canning Solution

TWINCAP Infusion Cap System

Advanced Packaging Solution using Datalase Inline Digital

Printing (IDP) System

Promotional Labels with In-Built NFC Tags

KarmaCap for Shelf-STable Probiotic Beverages

Innovative Packaging Solution for Tom?s Teas

MyPour Container for Precise Pouring of Beer

Unique Bottle Design for Kolibri Drinks

New Lightweight Sustainable Bottle

Select Novel Packaging Formats for Beverages

Bottle in Bottle, U-Boot

Innovative Plastic Packaging with Preservative Properties

Bag-in-a-Box Innovations Elevate Opportunities for Paperboard

Innovative Glass Closure for Whiskey Bottles

Liquid Food Packaging Sector: Innovations despite Adversities

Other Noteworthy Beverage Packaging Innovations and Advancements

The Flip-Bottle

Ultra-thin Packaging Steel

Metal Embossing

DrinkStack

The Vini

4. GLOBAL MARKET PERSPECTIVE

Table 1: World Recent Past, Current & Future Analysis for

Beverage Packaging by Geographic Region - USA, Canada, Japan,

China, Europe, Asia-Pacific, Latin America, Middle East and

Africa Markets - Independent Analysis of Annual Sales in US$

Million for Years 2022 through 2030 and % CAGR

Table 2: World Historic Review for Beverage Packaging by

Geographic Region - USA, Canada, Japan, China, Europe,

Asia-Pacific, Latin America, Middle East and Africa Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 3: World 18-Year Perspective for Beverage Packaging by

Geographic Region - Percentage Breakdown of Value Sales for

USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America,

Middle East and Africa Markets for Years 2012, 2023 & 2030

Table 4: World Recent Past, Current & Future Analysis for

Plastic by Geographic Region - USA, Canada, Japan, China,

Europe, Asia-Pacific, Latin America, Middle East and Africa

Markets - Independent Analysis of Annual Sales in US$ Million

for Years 2022 through 2030 and % CAGR

Table 5: World Historic Review for Plastic by Geographic Region -

USA, Canada, Japan, China, Europe, Asia-Pacific, Latin

America, Middle East and Africa Markets - Independent Analysis

of Annual Sales in US$ Million for Years 2012 through 2021 and

% CAGR

Table 6: World 18-Year Perspective for Plastic by Geographic

Region - Percentage Breakdown of Value Sales for USA, Canada,

Japan, China, Europe, Asia-Pacific, Latin America, Middle East

and Africa for Years 2012, 2023 & 2030

Table 7: World Recent Past, Current & Future Analysis for Glass

by Geographic Region - USA, Canada, Japan, China, Europe,

Asia-Pacific, Latin America, Middle East and Africa Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2022 through 2030 and % CAGR

Table 8: World Historic Review for Glass by Geographic Region -

USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America,

Middle East and Africa Markets - Independent Analysis of Annual

Sales in US$ Million for Years 2012 through 2021 and % CAGR

Table 9: World 18-Year Perspective for Glass by Geographic

Region - Percentage Breakdown of Value Sales for USA, Canada,

Japan, China, Europe, Asia-Pacific, Latin America, Middle East

and Africa for Years 2012, 2023 & 2030

Table 10: World Recent Past, Current & Future Analysis for

Metal by Geographic Region - USA, Canada, Japan, China, Europe,

Asia-Pacific, Latin America, Middle East and Africa Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2022 through 2030 and % CAGR

Table 11: World Historic Review for Metal by Geographic Region -

USA, Canada, Japan, China, Europe, Asia-Pacific, Latin

America, Middle East and Africa Markets - Independent Analysis

of Annual Sales in US$ Million for Years 2012 through 2021 and

% CAGR

Table 12: World 18-Year Perspective for Metal by Geographic

Region - Percentage Breakdown of Value Sales for USA, Canada,

Japan, China, Europe, Asia-Pacific, Latin America, Middle East

and Africa for Years 2012, 2023 & 2030

Table 13: World Recent Past, Current & Future Analysis for

Other Segments by Geographic Region - USA, Canada, Japan,

China, Europe, Asia-Pacific, Latin America, Middle East and

Africa Markets - Independent Analysis of Annual Sales in US$

Million for Years 2022 through 2030 and % CAGR

Table 14: World Historic Review for Other Segments by

Geographic Region - USA, Canada, Japan, China, Europe,

Asia-Pacific, Latin America, Middle East and Africa Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 15: World 18-Year Perspective for Other Segments by

Geographic Region - Percentage Breakdown of Value Sales for

USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America,

Middle East and Africa for Years 2012, 2023 & 2030

Table 16: World Recent Past, Current & Future Analysis for

Alcoholic by Geographic Region - USA, Canada, Japan, China,

Europe, Asia-Pacific, Latin America, Middle East and Africa

Markets - Independent Analysis of Annual Sales in US$ Million

for Years 2022 through 2030 and % CAGR

Table 17: World Historic Review for Alcoholic by Geographic

Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin

America, Middle East and Africa Markets - Independent Analysis

of Annual Sales in US$ Million for Years 2012 through 2021 and

% CAGR

Table 18: World 18-Year Perspective for Alcoholic by Geographic

Region - Percentage Breakdown of Value Sales for USA, Canada,

Japan, China, Europe, Asia-Pacific, Latin America, Middle East

and Africa for Years 2012, 2023 & 2030

Table 19: World Recent Past, Current & Future Analysis for

Non-Alcoholic by Geographic Region - USA, Canada, Japan, China,

Europe, Asia-Pacific, Latin America, Middle East and Africa

Markets - Independent Analysis of Annual Sales in US$ Million

for Years 2022 through 2030 and % CAGR

Table 20: World Historic Review for Non-Alcoholic by Geographic

Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin

America, Middle East and Africa Markets - Independent Analysis

of Annual Sales in US$ Million for Years 2012 through 2021 and

% CAGR

Table 21: World 18-Year Perspective for Non-Alcoholic by

Geographic Region - Percentage Breakdown of Value Sales for

USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America,

Middle East and Africa for Years 2012, 2023 & 2030

Table 22: World Beverage Packaging Market Analysis of Annual

Sales in US$ Million for Years 2012 through 2030

III. MARKET ANALYSIS

UNITED STATES

Beverage Packaging Market Presence - Strong/Active/Niche/

Trivial - Key Competitors in the United States for 2023 (E)

Table 23: USA Recent Past, Current & Future Analysis for

Beverage Packaging by Material - Plastic, Glass, Metal and

Other Segments - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 24: USA Historic Review for Beverage Packaging by

Material - Plastic, Glass, Metal and Other Segments Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 25: USA 18-Year Perspective for Beverage Packaging by

Material - Percentage Breakdown of Value Sales for Plastic,

Glass, Metal and Other Segments for the Years 2012, 2023 & 2030

Table 26: USA Recent Past, Current & Future Analysis for

Beverage Packaging by Beverage Type - Alcoholic and

Non-Alcoholic - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 27: USA Historic Review for Beverage Packaging by

Beverage Type - Alcoholic and Non-Alcoholic Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 28: USA 18-Year Perspective for Beverage Packaging by

Beverage Type - Percentage Breakdown of Value Sales for

Alcoholic and Non-Alcoholic for the Years 2012, 2023 & 2030

CANADA

Table 29: Canada Recent Past, Current & Future Analysis for

Beverage Packaging by Material - Plastic, Glass, Metal and

Other Segments - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 30: Canada Historic Review for Beverage Packaging by

Material - Plastic, Glass, Metal and Other Segments Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 31: Canada 18-Year Perspective for Beverage Packaging by

Material - Percentage Breakdown of Value Sales for Plastic,

Glass, Metal and Other Segments for the Years 2012, 2023 & 2030

Table 32: Canada Recent Past, Current & Future Analysis for

Beverage Packaging by Beverage Type - Alcoholic and

Non-Alcoholic - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 33: Canada Historic Review for Beverage Packaging by

Beverage Type - Alcoholic and Non-Alcoholic Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 34: Canada 18-Year Perspective for Beverage Packaging by

Beverage Type - Percentage Breakdown of Value Sales for

Alcoholic and Non-Alcoholic for the Years 2012, 2023 & 2030

JAPAN

Beverage Packaging Market Presence - Strong/Active/Niche/

Trivial - Key Competitors in Japan for 2023 (E)

Table 35: Japan Recent Past, Current & Future Analysis for

Beverage Packaging by Material - Plastic, Glass, Metal and

Other Segments - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 36: Japan Historic Review for Beverage Packaging by

Material - Plastic, Glass, Metal and Other Segments Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 37: Japan 18-Year Perspective for Beverage Packaging by

Material - Percentage Breakdown of Value Sales for Plastic,

Glass, Metal and Other Segments for the Years 2012, 2023 & 2030

Table 38: Japan Recent Past, Current & Future Analysis for

Beverage Packaging by Beverage Type - Alcoholic and

Non-Alcoholic - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 39: Japan Historic Review for Beverage Packaging by

Beverage Type - Alcoholic and Non-Alcoholic Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 40: Japan 18-Year Perspective for Beverage Packaging by

Beverage Type - Percentage Breakdown of Value Sales for

Alcoholic and Non-Alcoholic for the Years 2012, 2023 & 2030

CHINA

Beverage Packaging Market Presence - Strong/Active/Niche/

Trivial - Key Competitors in China for 2023 (E)

Table 41: China Recent Past, Current & Future Analysis for

Beverage Packaging by Material - Plastic, Glass, Metal and

Other Segments - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 42: China Historic Review for Beverage Packaging by

Material - Plastic, Glass, Metal and Other Segments Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 43: China 18-Year Perspective for Beverage Packaging by

Material - Percentage Breakdown of Value Sales for Plastic,

Glass, Metal and Other Segments for the Years 2012, 2023 & 2030

Table 44: China Recent Past, Current & Future Analysis for

Beverage Packaging by Beverage Type - Alcoholic and

Non-Alcoholic - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 45: China Historic Review for Beverage Packaging by

Beverage Type - Alcoholic and Non-Alcoholic Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 46: China 18-Year Perspective for Beverage Packaging by

Beverage Type - Percentage Breakdown of Value Sales for

Alcoholic and Non-Alcoholic for the Years 2012, 2023 & 2030

EUROPE

Beverage Packaging Market Presence - Strong/Active/Niche/

Trivial - Key Competitors in Europe for 2023 (E)

Table 47: Europe Recent Past, Current & Future Analysis for

Beverage Packaging by Geographic Region - France, Germany,

Italy, UK, Spain, Russia and Rest of Europe Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2022 through 2030 and % CAGR

Table 48: Europe Historic Review for Beverage Packaging by

Geographic Region - France, Germany, Italy, UK, Spain, Russia

and Rest of Europe Markets - Independent Analysis of Annual

Sales in US$ Million for Years 2012 through 2021 and % CAGR

Table 49: Europe 18-Year Perspective for Beverage Packaging by

Geographic Region - Percentage Breakdown of Value Sales for

France, Germany, Italy, UK, Spain, Russia and Rest of Europe

Markets for Years 2012, 2023 & 2030

Table 50: Europe Recent Past, Current & Future Analysis for

Beverage Packaging by Material - Plastic, Glass, Metal and

Other Segments - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 51: Europe Historic Review for Beverage Packaging by

Material - Plastic, Glass, Metal and Other Segments Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 52: Europe 18-Year Perspective for Beverage Packaging by

Material - Percentage Breakdown of Value Sales for Plastic,

Glass, Metal and Other Segments for the Years 2012, 2023 & 2030

Table 53: Europe Recent Past, Current & Future Analysis for

Beverage Packaging by Beverage Type - Alcoholic and

Non-Alcoholic - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 54: Europe Historic Review for Beverage Packaging by

Beverage Type - Alcoholic and Non-Alcoholic Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 55: Europe 18-Year Perspective for Beverage Packaging by

Beverage Type - Percentage Breakdown of Value Sales for

Alcoholic and Non-Alcoholic for the Years 2012, 2023 & 2030

FRANCE

Beverage Packaging Market Presence - Strong/Active/Niche/

Trivial - Key Competitors in France for 2023 (E)

Table 56: France Recent Past, Current & Future Analysis for

Beverage Packaging by Material - Plastic, Glass, Metal and

Other Segments - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 57: France Historic Review for Beverage Packaging by

Material - Plastic, Glass, Metal and Other Segments Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 58: France 18-Year Perspective for Beverage Packaging by

Material - Percentage Breakdown of Value Sales for Plastic,

Glass, Metal and Other Segments for the Years 2012, 2023 & 2030

Table 59: France Recent Past, Current & Future Analysis for

Beverage Packaging by Beverage Type - Alcoholic and

Non-Alcoholic - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 60: France Historic Review for Beverage Packaging by

Beverage Type - Alcoholic and Non-Alcoholic Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 61: France 18-Year Perspective for Beverage Packaging by

Beverage Type - Percentage Breakdown of Value Sales for

Alcoholic and Non-Alcoholic for the Years 2012, 2023 & 2030

GERMANY

Beverage Packaging Market Presence - Strong/Active/Niche/

Trivial - Key Competitors in Germany for 2023 (E)

Table 62: Germany Recent Past, Current & Future Analysis for

Beverage Packaging by Material - Plastic, Glass, Metal and

Other Segments - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 63: Germany Historic Review for Beverage Packaging by

Material - Plastic, Glass, Metal and Other Segments Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 64: Germany 18-Year Perspective for Beverage Packaging by

Material - Percentage Breakdown of Value Sales for Plastic,

Glass, Metal and Other Segments for the Years 2012, 2023 & 2030

Table 65: Germany Recent Past, Current & Future Analysis for

Beverage Packaging by Beverage Type - Alcoholic and

Non-Alcoholic - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 66: Germany Historic Review for Beverage Packaging by

Beverage Type - Alcoholic and Non-Alcoholic Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 67: Germany 18-Year Perspective for Beverage Packaging by

Beverage Type - Percentage Breakdown of Value Sales for

Alcoholic and Non-Alcoholic for the Years 2012, 2023 & 2030

ITALY

Table 68: Italy Recent Past, Current & Future Analysis for

Beverage Packaging by Material - Plastic, Glass, Metal and

Other Segments - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 69: Italy Historic Review for Beverage Packaging by

Material - Plastic, Glass, Metal and Other Segments Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 70: Italy 18-Year Perspective for Beverage Packaging by

Material - Percentage Breakdown of Value Sales for Plastic,

Glass, Metal and Other Segments for the Years 2012, 2023 & 2030

Table 71: Italy Recent Past, Current & Future Analysis for

Beverage Packaging by Beverage Type - Alcoholic and

Non-Alcoholic - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 72: Italy Historic Review for Beverage Packaging by

Beverage Type - Alcoholic and Non-Alcoholic Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 73: Italy 18-Year Perspective for Beverage Packaging by

Beverage Type - Percentage Breakdown of Value Sales for

Alcoholic and Non-Alcoholic for the Years 2012, 2023 & 2030

UNITED KINGDOM

Beverage Packaging Market Presence - Strong/Active/Niche/

Trivial - Key Competitors in the United Kingdom for 2023 (E)

Table 74: UK Recent Past, Current & Future Analysis for

Beverage Packaging by Material - Plastic, Glass, Metal and

Other Segments - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 75: UK Historic Review for Beverage Packaging by Material -

Plastic, Glass, Metal and Other Segments Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 76: UK 18-Year Perspective for Beverage Packaging by

Material - Percentage Breakdown of Value Sales for Plastic,

Glass, Metal and Other Segments for the Years 2012, 2023 & 2030

Table 77: UK Recent Past, Current & Future Analysis for

Beverage Packaging by Beverage Type - Alcoholic and

Non-Alcoholic - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 78: UK Historic Review for Beverage Packaging by Beverage

Type - Alcoholic and Non-Alcoholic Markets - Independent

Analysis of Annual Sales in US$ Million for Years 2012 through

2021 and % CAGR

Table 79: UK 18-Year Perspective for Beverage Packaging by

Beverage Type - Percentage Breakdown of Value Sales for

Alcoholic and Non-Alcoholic for the Years 2012, 2023 & 2030

SPAIN

Table 80: Spain Recent Past, Current & Future Analysis for

Beverage Packaging by Material - Plastic, Glass, Metal and

Other Segments - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 81: Spain Historic Review for Beverage Packaging by

Material - Plastic, Glass, Metal and Other Segments Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 82: Spain 18-Year Perspective for Beverage Packaging by

Material - Percentage Breakdown of Value Sales for Plastic,

Glass, Metal and Other Segments for the Years 2012, 2023 & 2030

Table 83: Spain Recent Past, Current & Future Analysis for

Beverage Packaging by Beverage Type - Alcoholic and

Non-Alcoholic - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 84: Spain Historic Review for Beverage Packaging by

Beverage Type - Alcoholic and Non-Alcoholic Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 85: Spain 18-Year Perspective for Beverage Packaging by

Beverage Type - Percentage Breakdown of Value Sales for

Alcoholic and Non-Alcoholic for the Years 2012, 2023 & 2030

RUSSIA

Table 86: Russia Recent Past, Current & Future Analysis for

Beverage Packaging by Material - Plastic, Glass, Metal and

Other Segments - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 87: Russia Historic Review for Beverage Packaging by

Material - Plastic, Glass, Metal and Other Segments Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 88: Russia 18-Year Perspective for Beverage Packaging by

Material - Percentage Breakdown of Value Sales for Plastic,

Glass, Metal and Other Segments for the Years 2012, 2023 & 2030

Table 89: Russia Recent Past, Current & Future Analysis for

Beverage Packaging by Beverage Type - Alcoholic and

Non-Alcoholic - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 90: Russia Historic Review for Beverage Packaging by

Beverage Type - Alcoholic and Non-Alcoholic Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 91: Russia 18-Year Perspective for Beverage Packaging by

Beverage Type - Percentage Breakdown of Value Sales for

Alcoholic and Non-Alcoholic for the Years 2012, 2023 & 2030

REST OF EUROPE

Table 92: Rest of Europe Recent Past, Current & Future Analysis

for Beverage Packaging by Material - Plastic, Glass, Metal and

Other Segments - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 93: Rest of Europe Historic Review for Beverage Packaging

by Material - Plastic, Glass, Metal and Other Segments Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 94: Rest of Europe 18-Year Perspective for Beverage

Packaging by Material - Percentage Breakdown of Value Sales for

Plastic, Glass, Metal and Other Segments for the Years 2012,

2023 & 2030

Table 95: Rest of Europe Recent Past, Current & Future Analysis

for Beverage Packaging by Beverage Type - Alcoholic and

Non-Alcoholic - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 96: Rest of Europe Historic Review for Beverage Packaging

by Beverage Type - Alcoholic and Non-Alcoholic Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 97: Rest of Europe 18-Year Perspective for Beverage

Packaging by Beverage Type - Percentage Breakdown of Value

Sales for Alcoholic and Non-Alcoholic for the Years 2012, 2023 &

2030

ASIA-PACIFIC

Beverage Packaging Market Presence - Strong/Active/Niche/

Trivial - Key Competitors in Asia-Pacific for 2023 (E)

Table 98: Asia-Pacific Recent Past, Current & Future Analysis

for Beverage Packaging by Geographic Region - Australia, India,

South Korea and Rest of Asia-Pacific Markets - Independent

Analysis of Annual Sales in US$ Million for Years 2022 through

2030 and % CAGR

Table 99: Asia-Pacific Historic Review for Beverage Packaging

by Geographic Region - Australia, India, South Korea and Rest

of Asia-Pacific Markets - Independent Analysis of Annual Sales

in US$ Million for Years 2012 through 2021 and % CAGR

Table 100: Asia-Pacific 18-Year Perspective for Beverage

Packaging by Geographic Region - Percentage Breakdown of Value

Sales for Australia, India, South Korea and Rest of

Asia-Pacific Markets for Years 2012, 2023 & 2030

Table 101: Asia-Pacific Recent Past, Current & Future Analysis

for Beverage Packaging by Material - Plastic, Glass, Metal and

Other Segments - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 102: Asia-Pacific Historic Review for Beverage Packaging

by Material - Plastic, Glass, Metal and Other Segments Markets -

Independent Analysis of Annual Sales in US$ Million for Years

2012 through 2021 and % CAGR

Table 103: Asia-Pacific 18-Year Perspective for Beverage

Packaging by Material - Percentage Breakdown of Value Sales for

Plastic, Glass, Metal and Other Segments for the Years 2012,

2023 & 2030

Table 104: Asia-Pacific Recent Past, Current & Future Analysis

for Beverage Packaging by Beverage Type - Alcoholic and

Non-Alcoholic - Independent Analysis of Annual Sales in US$

Million for the Years 2022 through 2030 and % CAGR

Table 105: Asia-Pacific Historic Review for Beverage Packaging

Please contact our Customer Support Center to get the complete Table of Contents

Read the full report: https://www.reportlinker.com/p0552757/?utm_source=PRN

About Reportlinker

ReportLinker is an award-winning market research solution. Reportlinker finds and organizes the latest industry data so you get all the market research you need - instantly, in one place.

Contact Clare: clare@reportlinker.com

US: (339)-368-6001

Intl: +1 339-368-6001

View original content to download multimedia:https://www.prnewswire.com/news-releases/global-beverage-packaging-market-to-reach-204-4-billion-by-2030--301743318.html

SOURCE Reportlinker

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex