Government

Futures Rollercoaster As Virus Resurgence Spooks Traders

Futures Rollercoaster As Virus Resurgence Spooks Traders

In a rollercoaster overnight session, futures dropped as much as 1% in early trading, before paring all losses only to slide once again while Nasdaq 100 contracts swung between modest losses and gains. At last check, the Emini was down 0.4% to 3,555 as coronavirus infections surged and investors weighed the timeline of the roll-out of an effective vaccine, while technology stocks headed higher for the second straight day.

"Defensive", work-from-home stocks such as Amazon.com, Apple and Microsoft rose about 0.5% each in premarket trading, while futures for the Nasdaq 100 were up 0.4%. Meanwhile, American Airlines, United and Royal Caribbean Cruises fell between 1.0% and 2.3%.

Fears that an intensifying pandemic will curb the economic rebound threaten this month’s almost 10% surge in global equities, while the value-to-growth rotation reversed after new coronavirus cases in the United States surged above 100,000 for an eighth consecutive day, and global deaths jumping by more than 12,000 with the situation expected to worsen as winter sets in. New York became the latest state to re-introduce social distancing restrictions on Wednesday: New York City ordered bars and restaurants with liquor licenses to close at 10 p.m. as officials. New infections may be steadying or easing in some of Europe’s virus hot spots.

"In the near term, the resurgence of the virus is beginning to make new worries,” Torsten Slok, chief economist at Apollo said on Bloomberg TV. "It looks like this will end up being a W-shaped recovery."

The same dour mood echoed around the world, with global shares on course on Thursday to end their longest winning streak in over a year, one that has lifted them more than 10%, as the post-U.S. election and coronavirus vaccine bull run paused.

European stocks headed toward their first drop of the week on disappointing earnings reports tied to the pandemic. Tech shares outperformed, as some investors perceive them to be defensive. Europe's Stoxx 600 index traded down 0.7% as investors returned to safe-haven government bonds. Siemens AG fell after issuing a cautious 2021 outlook and proposed cutting its dividend.

"What we don’t really agree with is that you need to rotate out of tech into value stocks," said Willem Sels, chief market strategist at HSBC Private Bank, referring to stocks that do well in normal circumstances when economies are open. "We don’t think either that a recovery (helped by a vaccine) would lead to a sustained sell-off in U.S. Treasuries. The Fed has signalled it is on hold," he added.

Earlier in the session, Asian stocks were little changed with communications rising and finance retreating. The MSCI Asia Pacific Index added 0.1% while Japan's Topix index closed 0.2% lower, with Toyota and Tokio Marine contributing the most to the move. The Shanghai Composite Index retreated 0.1%, driven by China Life and ICBC.

"The vaccine-related rotation has quickly faded as investors have realized that the pandemic won’t disappear as fast as it arrived,” said Hussein Sayed, chief market strategist at FXTM. “While the vaccine remains the best news received since the virus spread, life won’t return to normal in a matter of days or weeks."

In FX, the Bloomberg Dollar Spot Index swung from a gain to a loss as equities pared declines, and the dollar traded mixed versus its Group-of-10 peers. Haven currencies still led G-10 as rising global coronavirus cases spurred demand for safety, though the yen gave up most of its earlier advance. Turkey’s lira took a breather after President Tayyip Erdogan’s promise to overhaul unconventional monetary policy and the replacement of his son-in-law as finance minister caused it to rise 10%; the euro was near $1.18, in the middle of the $1.16-$1.20 range it’s been in since late July. Sterling was down 0.5% amid more Brexit uncertainty and as data showed the UK economy losing speed again. The pound fell for a second day, as market focus remains on developments in U.K.-EU trade negotiations; Sweden’s krona hovered near an almost 2-year high versus the euro after inflation came in largely in line with estimates.

Australia and New Zealand dollars gave up an Asia-session gain as U.S. stock futures slid. AUD/NZD was little changed after it earlier touched the its lowest level since April amid growing expectations that the RBNZ won’t impose a negative cash rate following comments by Assistant Governor Christian Hawkesby. The kiwi got an added boost after Reserve Bank of New Zealand Assistant Governor Christian Hawkesby said the economy required less stimulus than it did in August.

"The weakness in broad USD (dollar) and reflationary momentum in equities, which we saw on the back of the U.S. election and improvements in the vaccine situation, seem to be fading across FX and equities," said Christin Tuxen, Head of FX Research at Danske Bank.

In rates, Treasury yields dropped by more than 3bps to 0.9374% at long end after some aggressive buying during Asia session following Tuesday's Veteran's Day holiday, although they were off session highs. Yields, little changed at front end and 2bp-3bp richer further out, are flattening curve spreads that remain near YTD highs reached in anticipation of a reflationary supply surge: 2s10s by more than 3bp, 5s30s by ~1bp; 10-year yields around 0.94% outperform bunds and gilts by 1bp-2bp. Aside from October CPI, supply is the main focus ahead of $27b 30-year bond auction and an expected rebound in IG credit issuance following Wednesday’s U.S. holiday.

Oil was flat after the International Energy Agency on Thursday joined OPEC in cutting forecasts for global oil demand amid new lockdown measures and cautioned that the vaccine breakthrough won’t quickly revive markets. WTI and Brent front-month futures traded flat intraday with WTI Dec meandering around USD 41.50/bbl and Brent Jan sub-44/oz as the complex fails to take its cue from the overall indecisive risk sentiment across markets, and as participants continue to balance supply and demand dynamics ahead of blockbuster OPEC+ meeting.

Looking at the day ahead now, attention will fall on central bankers at the ECB’s forum, where ECB President Lagarde, Fed Chair Powell and Bank of England Governor Bailey will all be appearing on a policy panel. We’ll also hear from ECB Vice President de Guindos and the Fed’s Evans, while the ECB will publish their Economic Bulletin. In terms of data releases, we’ll get the October CPI data, weekly initial jobless claims and the October monthly budget statement. Finally, earnings releases include Walt Disney and Cisco Systems.

Market Snapshot

- S&P 500 futures down 0.2% to 3,562.25

- STOXX Europe 600 down 0.5% to 386.66

- MXAP up 0.08% to 184.62

- MXAPJ down 0.01% to 609.02

- Nikkei up 0.7% to 25,520.88

- Topix down 0.2% to 1,726.23

- Hang Seng Index down 0.2% to 26,169.38

- Shanghai Composite down 0.1% to 3,338.68

- Sensex down 0.6% to 43,316.81

- Australia S&P/ASX 200 down 0.5% to 6,418.22

- Kospi down 0.4% to 2,475.62

- Brent futures down 0.4% to $43.62/bbl

- Gold spot up 0.3% to $1,870.77

- U.S. Dollar Index down 0.2% to 92.88

- German 10Y yield unchanged at -0.507%

- Euro up 0.3% to $1.1809

- Italian 10Y yield fell 2.3 bps to 0.627%

- Spanish 10Y yield fell 0.2 bps to 0.155%

- Top Overnight News from Bloomberg

Top Overnight News from Bloomberg

- New cases may be steadying or easing in some of Europe’s virus hot spots, offering glimmers of hope to some of the worst-hit countries. Meanwhile, the global death toll jumped by more than 12,000, a daily record, according to data from Johns Hopkins University

- President-elect Joe Biden has stocked his transition team with policy experts, academics and former Obama administration officials, a contrast with the industry-friendly figures President Donald Trump sent into the government upon winning office

- Brexit talks are going down to the wire, and the European Union’s chief negotiator Michel Barnier is threatening British access to the continent’s single energy market as a way of extracting concessions on fishing rights

- Talks between OPEC and its allies are zeroing in on a delay to next year’s planned oil-output increase of three to six months, according to several delegates; the International Energy Agency cut forecasts for global oil demand amid new lockdown measures and cautioned that the vaccine breakthrough won’t quickly revive markets. Fuel prices won’t experience any “significant” boost from vaccines until the second half of next year, the agency said and reduced oil-demand projections for this quarter sharply, by 1.2 million barrels a day

- Russia is locking in lower borrowing costs in the wake of Joe Biden’s U.S. election win, kicking off its first dual-tranche sale of euro-denominated bonds

- The U.K. economy expanded 15.5%, the most on record, in the third quarter, a rebound that still leaves Britain’s recovery trailing behind the world’s major industrialized nations

- Sweden’s economy has been harder hit by the Covid crisis than is reflected in the latest official forecasts, according to the governor of the Riksbank, Stefan Ingves

A quick look at global markets courtesy of NewsSquawk:

Asian equity markets traded mostly lower as sentiment gradually deteriorated from the mixed performance stateside where conditions were quieter owing to the Veterans Day quasi-holiday, although a pause in the recent growth-to-value rotation aided a tech rebound. Nonetheless, ASX 200 (-0.5%) was dragged lower by underperformance in cyclicals but with losses in the index stemmed by strength in tech and telecoms as Telstra shares were underpinned by restructuring plans and retailers kept afloat after Wesfarmers reported sales growth. Nikkei 225 (+0.7%) extended on its best levels in nearly 3 decades although the gains were briefly wiped out as risk appetite waned and amid mixed data including Machinery Orders which suffered its longest period of contraction since 2009. Elsewhere, Hang Seng (-0.2%) and Shanghai Comp. (-0.1%) were subdued after mixed lending and financing data, as well as the ongoing tensions, with the US warning of further sanctions against China for its freedom violations in Hong Kong. Finally, 10yr JGBs gained as they tracked the rebound in T-notes and as risk appetite gradually deteriorated but with upside capped by resistance at 152.00 and after mixed results at today’s 5yr auction.

Top Asian News

- Hedge Fund Alleges Vedanta Unit ‘Siphoned Off’ Funds to Parent

- RBNZ Says Negative Rate Less Likely if Banks Use Cheap Loans

- China Says Australia’s ‘Words and Deeds’ to Blame for Disputes

- Nissan Operating Losses Shrink as Restructuring Takes Hold

Major European bourses have recouped earlier lost ground and now trade mixed (Euro Stoxx 50 -0.6%) following a downbeat cash open and after a similar APAC handover, as the growth to value rotation continues to lose steam ahead of Tier 1 US data and the second central bank Sintra sitting, whilst participants continue to question the timeframe of a rollout of an effective vaccine (contingent on regulatory approval), as some doubts remain over manufacturing, storage, and swift distribution. The European sectoral breakdown reflects this as Oil & Gas, Banks and Auto remain the laggards whilst Tech and Healthcare reside at the top of the pile. The rotational pause is also indicated in the US equity futures, with NQ (+0.5%) somewhat front-running the ES (-0.1%) and RTY (-0.3%). Back to Europe, the flow into Healthcare has cushioned losses in the SMI (+0.1%) which outperforms regional peers on the back of Pharma giants Roche (+0.6%) and Novartis (+0.5%) keeps the index somewhat supported. Elsewhere, Travel & Leisure treads water around the unchanged mark ahead of an anticipated Moderna vaccine efficacy update which is expected in the coming days. Individual European movers this morning largely consist of earnings, with Deutsche Telekom (+0.5%) benefitting from better-than-expected metrics whilst noting that T-Mobile’s (+0.7% pre-market) integration of Sprint. Elsewhere, the broader tech sector also saw commentary from Taiwanese chip-maker Foxconn, who expects strong demand in consumer electronics next year, whilst adding Apple’s (+0.4%) iPhone 12 will remain in hot demand.

Top European News

- Johnson’s Senior Aide Quits Amid Tensions in U.K. Government

- Deutsche Telekom Raises Outlook on Growth After Sprint Deal

- Credit Suisse’s Pozsar Pushes Back on Year-End Funding Worries

- AstraZeneca Cancer Drug Fails to Help Patients With Covid-19

In FX, the Buck is softer against most major currency rivals, but retaining an underlying bid due to more pronounced outperformance vs high beta, cyclical and activity counterparts compared to declines relative to safer or pseudo safe-havens. Indeed, the index is straddling 93.000 within tighter confines and remains close enough to stage another attempt at breaching decent chart resistance at 93.210 after matching the Fib retracement level exactly on Wednesday. Turning to fundamentals, US CPI and claims data may provide some impetus beyond fading risk sentiment and before Fed speakers including Chair Powell.

- CHF/EUR/JPY - As noted above, renewed risk aversion, albeit not particularly pronounced, has underpinned the Franc, Euro and Yen to varying degrees as the former pivots 0.9150 vs the Dollar, single currency reclaims 1.1800+ status and latter rebounds from sub-105.50 lows irrespective of considerably weaker than forecast Eurozone ip and Japanese machinery orders. However, decent option expiry interest could cap Eur/Usd and keep Usd/Jpy propped given 1.3 bn rolling off between 1.1795-1.1805 and 1.4 bn residing at 105.40-50 respectively.

- GBP - Sterling has slipped to the bottom of the G10 ranks, with Cable back below 1.3200 and Eur/Gbp around 100 pips off yesterday’s lows amidst the ongoing Brexit trade deal impasse and UK data in the form of GDP and IP falling a little short of consensus. For the record, not much in the way of reaction to latest comments from BoE Governor Bailey sticking to a reserved view on negative rates and also downplaying the prospect of the MPC using yield curve control ala the BoJ and RBA as a policy tool.

- AUD/CAD/NZD - All consolidating off recent peaks relative to their US peer, as the Aussie pulls back from 0.7300, Kiwi 0.6900 and Loonie loses a bit more traction from oil having tested offers into 1.2900 on Monday amidst the height of anti-coronavirus optimism. Usd/Cad has pared some gains from 1.3106 towards 1.3050 awaiting remarks from BoC’s Wilkins before Friday’s Q3 Senior Loan Officer Survey, while Nzd/Usd is hovering around 0.6880 in advance of October’s manufacturing PMI and FPI that may provide independent impetus in wake of the RBNZ.

- SCANDI/EM - The Nok has also retreated alongside crude prices, but the Sek seems unfazed by mixed Swedish inflation prints or relatively downbeat/dovish rhetoric from Riksbank’s Bremen. Meanwhile, the Try has reclaimed another chink of its heavy and unprecedented losses perhaps in delayed response to Turkey’s Defence Minister declaring that he is ready to allay US concerns over Russia’s S-400 missile system and F-35s. Elsewhere, the Zar has absorbed conflicting SA data and Mxn is eyeing Banxico’s rate verdict for direction beyond gyrations in oil.

In commodities, WTI and Brent front-month futures trade flat intraday with WTI Dec meandering around USD 41.50/bbl and Brent Jan sub-44/oz as the complex fails to take its cue from the overall indecisive risk sentiment across markets, and as participants continue to balance supply and demand dynamics ahead of blockbuster OPEC+ meeting. On that note, sources overnight suggested that OPEC+ talks are reportedly to focus on delaying oil output hikes by 3-6 months. However, one delegate said the idea has not garnered widespread support so far among other producers. It’s worth bearing in mind that unanimous consent for a revised accord. Elsewhere the IEA Monthly Oil Market report downgraded its 2020 global oil demand growth forecast by 400k BPD whilst noting it is vaccine unlikely to significantly boost demand until well into 2021. No immediate move was seen on the release, but some fleeting downside was experience as Japan, the number 4 top oil importer in 2019, announced record high new COVID-19 cases whilst the Chinese Vice Foreign Minister has advised Chinese nationals not to travel overseas due to the pandemic – thus jet fuel demand prospects. Elsewhere, spot gold and silver remain somewhat contained ahead of US CPI and Sintra Day 2, whilst LME copper gleans impetus from the softer Buck.

US Event Calendar

- 8:30am: US CPI MoM, est. 0.1%, prior 0.2%; CPI YoY, est. 1.3%, prior 1.4%

- 8:30am: US CPI Ex Food and Energy MoM, est. 0.2%, prior 0.2%; CPI Ex Food and Energy YoY, est. 1.7%, prior 1.7%

- 8:30am: Real Avg Hourly Earning YoY, prior 3.3%; Real Avg Weekly Earnings YoY, prior 4.1%

- 8:30am: Initial Jobless Claims, est. 731,000, prior 751,000; Continuing Claims, est. 6.83m, prior 7.29m

- 9:45am: Bloomberg Consumer Comfort, prior 47.5

- 2pm: Monthly Budget Statement, est. $275.0b deficit, prior $124.6b deficit

DB's Jim Reid concludes the overnight wrap

48 hours after going into self-isolation and getting a test done, the twins are completely over all covid symptoms, unless trying to gouge each other’s eyes out is one. So my wife is stuck at home with them, my daughter and bored dog until we get what we hope will be a negative test result. I took an hour off work yesterday to make them lunch while my wife could get a break. The fury I had to endure when I peeled off the top of a soft boiled egg rather than let one of my three year olds do it scared me a bit. Let’s hope we’re back to relative normality tomorrow. If not I may order a takeaway for lunch and winch it through my upstairs study window to avoid having to endure the madness downstairs.

In contrast there was relative calm in markets yesterday in a quieter session due to various Remembrance Day holidays. Positive sentiment returned to US markets though with Europe continuing to march on. Futures have reversed some these gains overnight but the S&P 500 climbed +0.77% yesterday to recover from the previous day’s losses and close in on its all-time closing high again. In a reversal of the post Pfizer/BioNTech trend, technology stocks led the advance as the NASDAQ rebounded +2.01% with support from Amazon (+3.37%), Microsoft (+2.63%) and Apple (+3.04%). European equities also continued to move higher, with the STOXX 600 up +1.08% to reach a fresh post-pandemic high, as tech (+1.97%) was also one of the leading sectors In Europe. The VIX fell -1.4pts to 23.45pts, its lowest level since the end of August, having now fallen in 7 of the last 8 sessions.

There seemed to be profit-taking in the reopening vs stay-at-home trades yesterday in the US. Airlines (-4.06%) were the worst performing US industry followed by Energy Equipment (-2.21%) and Consumer Finance (-3.12%), while pandemic winners such as Semiconductors (+3.72%), Internet Retail (+3.13%) and Tech hardware (+2.85%) led the S&P. Europe saw more of a broad based rally with 17 of 20 sectors higher, led by Utilities (+2.61%) and Real Estate (+2.42%) alongside the aforementioned Tech sector.

With risk assets benefiting from the news of a potential vaccine and hopes of a return to normality, oil prices continued to advance as well yesterday, and both Brent crude (+0.44%) and WTI (+0.22%) reached a 2-month high of $43.80/bbl and $41.45/bbl respectively though both measures were up near 2% earlier in the day. Elsewhere in the commodities sphere however, safe havens have unsurprisingly struggled in recent days, and gold fell another -0.62% yesterday as the precious metal almost hit a 3-month low at $1,866/oz.

Overnight Asian markets are trading largely lower outside of the Nikkei (+0.08%) which is broadly flat. The Hang Seng (-0.16%), Shanghai Comp (-0.25%), Kospi (-0.29%) and Asx (-0.49%) are all down. Futures on the S&P 500 are also down -0.63% this morning as are European futures (DAX futures -0.79%). Meanwhile, yields on 10y USTs are down -4.4bps to 0.934% having reopened post the holiday. Elsewhere, Bloomberg reported that OPEC+ talks are zeroing in on a three to six month delay to next year’s planned oil-output increase.

Though the Pfizer vaccine news has brought relief to markets, it is unlikely to come soon enough to prevent the continued second wave of the virus in numerous countries, and we saw a further deterioration in the global picture yesterday. In Italy, the total number of virus cases since the pandemic began climbed above 1m yesterday, as the country reported a further 32,961 cases. The number of deaths in the country also stood at 623, which was the most since early April. Similarly, Germany reported its most daily fatalities since mid-April at 261. Here in the UK, a further 595 deaths were reported, which took the total number since the pandemic began above 50,000. However there are continued signs of a levelling off in case numbers in much of Europe. In New York City though, the positivity rate reached 2.52%, almost at the 3% threshold that forces the closure of in-class teaching. The State of New York has responded to the spike with an order closing bars and restaurants at 10pm. Governor Cuomo indicated that more restrictions will come if the virus is not brought under control but that he is resistant to a full lockdown.

On potential vaccines, Moderna is expected to give an early look at some point soon on the efficacy of its vaccine candidate. The initial interim analysis is supposed to be triggered after 53 volunteers of the roughly 40,000 participant study are infected. A secondary analysis will take place once this doubles to 106 infections. The company announced yesterday that it reached the threshold of 53 infected participants and likely surpassed it given a statement from the company said that there was “a significant increase in the rate of case identification across sites in the last week.” They do not know how long the analysis will take as the company is blinded to the data. Meanwhile the Phase 3 trial of Sinovac’s vaccine candidate have restarted in Brazil after the country faced criticism that the decision to stop it was political. Elsewhere, The International Olympic Committee has said that it is “more and more confident” that there will be “reasonable amount of spectators” at the Tokyo Olympics next year. The IOC president said that more virus countermeasures are being added, and the potential availability of a vaccine and rapid testing should also help the Tokyo games.

Back to yesterday and focus was also on the ECB at the start of their forum on central banking yesterday, in particular on President Lagarde’s keynote speech. A notable line from her remarks was that although “all options are on the table, the PEPP and TLTROs have proven their effectiveness in the current environment and can be dynamically adjusted to react to how the pandemic evolves. They are therefore likely to remain the main tools for adjusting our monetary policy.” Furthermore, Lagarde also said in the speech that “when thinking about favourable financing conditions, what matters is not only the level of financing conditions but the duration of policy support, too.” As our chief European economist Mark Wall writes in his blog (link here), these remarks hint at the extension of PEPP net purchases and the TLTRO3 discount beyond June 2021 as likely components of a package of easing measures in December.

Against this backdrop, European sovereign bonds made gains yesterday, with yields on 10yr bunds (-2.2bps), OATs (-2.7bps) and BTPs (-2.4bps) all moving lower. Meanwhile the spread of Spanish 10yr yields over bunds fell -0.7bps to 0.66%, their tightest level since late February. Gilts were the exception to these moves, with 10yr yields up +1.2bps to a 7-month high, and US Treasury markets were closed for a holiday.

Elsewhere in Europe, sterling lost ground (-0.38% against USD) as a Reuters report said that sources from both sides in the Brexit talks had told them that the discussions were set to go past the end of this week. The report said that the middle of next week was when EU sources now expected an agreed text, assuming that there wasn’t a breakthrough earlier than that or a collapse in the negotiations. If they reach that new deadline, that would be just in time for a scheduled video conference of EU leaders on Thursday 19, when leaders would have the chance to discuss any agreement.

Elsewhere in politics and returning to the US, yesterday there was confirmation that Republicans will have at least 50 seats in the US Senate. Democrats are now relying on flipping the two Georgia seats at the January 5th runoff, in order to have a 50-50 Senate composition with Vice President-elect Kamala Harris being the tie-breaker. Staying with Georgia, yesterday the state’s Secretary of State announced that there would be a hand audit of the election which is likely to take a couple of weeks to complete. The results of the election must be certified in the state by November 20.

To the day ahead now, and attention will be on central bankers at the ECB’s forum, where ECB President Lagarde, Fed Chair Powell and Bank of England Governor Bailey will all be appearing on a policy panel. Otherwise, we’ll also hear from ECB Vice President de Guindos and the Fed’s Evans, while the ECB will publish their Economic Bulletin. In terms of data releases, we’ll get UK GDP data for Q3, Euro Area industrial production for September, and from the US there’s the October CPI data, weekly initial jobless claims and the October monthly budget statement. Finally, earnings releases include Walt Disney and Cisco Systems.

International

United Airlines adds new flights to faraway destinations

The airline said that it has been working hard to "find hidden gem destinations."

Since countries started opening up after the pandemic in 2021 and 2022, airlines have been seeing demand soar not just for major global cities and popular routes but also for farther-away destinations.

Numerous reports, including a recent TripAdvisor survey of trending destinations, showed that there has been a rise in U.S. traveler interest in Asian countries such as Japan, South Korea and Vietnam as well as growing tourism traction in off-the-beaten-path European countries such as Slovenia, Estonia and Montenegro.

Related: 'No more flying for you': Travel agency sounds alarm over risk of 'carbon passports'

As a result, airlines have been looking at their networks to include more faraway destinations as well as smaller cities that are growing increasingly popular with tourists and may not be served by their competitors.

Shutterstock

United brings back more routes, says it is committed to 'finding hidden gems'

This week, United Airlines (UAL) announced that it will be launching a new route from Newark Liberty International Airport (EWR) to Morocco's Marrakesh. While it is only the country's fourth-largest city, Marrakesh is a particularly popular place for tourists to seek out the sights and experiences that many associate with the country — colorful souks, gardens with ornate architecture and mosques from the Moorish period.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

"We have consistently been ahead of the curve in finding hidden gem destinations for our customers to explore and remain committed to providing the most unique slate of travel options for their adventures abroad," United's SVP of Global Network Planning Patrick Quayle, said in a press statement.

The new route will launch on Oct. 24 and take place three times a week on a Boeing 767-300ER (BA) plane that is equipped with 46 Polaris business class and 22 Premium Plus seats. The plane choice was a way to reach a luxury customer customer looking to start their holiday in Marrakesh in the plane.

Along with the new Morocco route, United is also launching a flight between Houston (IAH) and Colombia's Medellín on Oct. 27 as well as a route between Tokyo and Cebu in the Philippines on July 31 — the latter is known as a "fifth freedom" flight in which the airline flies to the larger hub from the mainland U.S. and then goes on to smaller Asian city popular with tourists after some travelers get off (and others get on) in Tokyo.

United's network expansion includes new 'fifth freedom' flight

In the fall of 2023, United became the first U.S. airline to fly to the Philippines with a new Manila-San Francisco flight. It has expanded its service to Asia from different U.S. cities earlier last year. Cebu has been on its radar amid growing tourist interest in the region known for marine parks, rainforests and Spanish-style architecture.

With the summer coming up, United also announced that it plans to run its current flights to Hong Kong, Seoul, and Portugal's Porto more frequently at different points of the week and reach four weekly flights between Los Angeles and Shanghai by August 29.

"This is your normal, exciting network planning team back in action," Quayle told travel website The Points Guy of the airline's plans for the new routes.

stocks pandemic south korea japan hong kong europeanInternational

Walmart launches clever answer to Target’s new membership program

The retail superstore is adding a new feature to its Walmart+ plan — and customers will be happy.

It's just been a few days since Target (TGT) launched its new Target Circle 360 paid membership plan.

The plan offers free and fast shipping on many products to customers, initially for $49 a year and then $99 after the initial promotional signup period. It promises to be a success, since many Target customers are loyal to the brand and will go out of their way to shop at one instead of at its two larger peers, Walmart and Amazon.

Related: Walmart makes a major price cut that will delight customers

And stop us if this sounds familiar: Target will rely on its more than 2,000 stores to act as fulfillment hubs.

This model is a proven winner; Walmart also uses its more than 4,600 stores as fulfillment and shipping locations to get orders to customers as soon as possible.

Sometimes, this means shipping goods from the nearest warehouse. But if a desired product is in-store and closer to a customer, it reduces miles on the road and delivery time. It's a kind of logistical magic that makes any efficiency lover's (or retail nerd's) heart go pitter patter.

Walmart rolls out answer to Target's new membership tier

Walmart has certainly had more time than Target to develop and work out the kinks in Walmart+. It first launched the paid membership in 2020 during the height of the pandemic, when many shoppers sheltered at home but still required many staples they might ordinarily pick up at a Walmart, like cleaning supplies, personal-care products, pantry goods and, of course, toilet paper.

It also undercut Amazon (AMZN) Prime, which costs customers $139 a year for free and fast shipping (plus several other benefits including access to its streaming service, Amazon Prime Video).

Walmart+ costs $98 a year, which also gets you free and speedy delivery, plus access to a Paramount+ streaming subscription, fuel savings, and more.

If that's not enough to tempt you, however, Walmart+ just added a new benefit to its membership program, ostensibly to compete directly with something Target now has: ultrafast delivery.

Target Circle 360 particularly attracts customers with free same-day delivery for select orders over $35 and as little as one-hour delivery on select items. Target executes this through its Shipt subsidiary.

We've seen this lightning-fast delivery speed only in snippets from Amazon, the king of delivery efficiency. Who better to take on Target, though, than Walmart, which is using a similar store-as-fulfillment-center model?

"Walmart is stepping up to save our customers even more time with our latest delivery offering: Express On-Demand Early Morning Delivery," Walmart said in a statement, just a day after Target Circle 360 launched. "Starting at 6 a.m., earlier than ever before, customers can enjoy the convenience of On-Demand delivery."

Walmart (WMT) clearly sees consumers' desire for near-instant delivery, which obviously saves time and trips to the store. Rather than waiting a day for your order to show up, it might be on your doorstep when you wake up.

Consumers also tend to spend more money when they shop online, and they remain stickier as paying annual members. So, to a growing number of retail giants, almost instant gratification like this seems like something worth striving for.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic mexicoGovernment

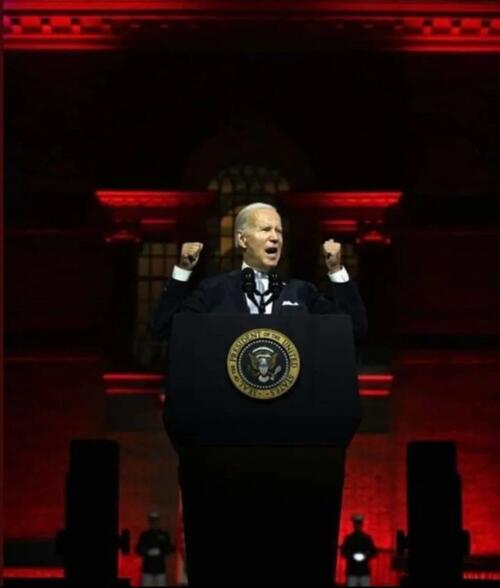

President Biden Delivers The “Darkest, Most Un-American Speech Given By A President”

President Biden Delivers The "Darkest, Most Un-American Speech Given By A President"

Having successfully raged, ranted, lied, and yelled through…

Having successfully raged, ranted, lied, and yelled through the State of The Union, President Biden can go back to his crypt now.

Whatever 'they' gave Biden, every American man, woman, and the other should be allowed to take it - though it seems the cocktail brings out 'dark Brandon'?

Tl;dw: Biden's Speech tonight ...

-

Fund Ukraine.

-

Trump is threat to democracy and America itself.

-

Abortion is good.

-

American Economy is stronger than ever.

-

Inflation wasn't Biden's fault.

-

Illegals are Americans too.

-

Republicans are responsible for the border crisis.

-

Trump is bad.

-

Biden stands with trans-children.

-

J6 was the worst insurrection since the Civil War.

(h/t @TCDMS99)

Tucker Carlson's response sums it all up perfectly:

"that was possibly the darkest, most un-American speech given by an American president. It wasn't a speech, it was a rant..."

Carlson continued: "The true measure of a nation's greatness lies within its capacity to control borders, yet Bid refuses to do it."

"In a fair election, Joe Biden cannot win"

And concluded:

“There was not a meaningful word for the entire duration about the things that actually matter to people who live here.”

Victor Davis Hanson added some excellent color, but this was probably the best line on Biden:

"he doesn't care... he lives in an alternative reality."

— Tucker Carlson (@TuckerCarlson) March 8, 2024

* * *

Watch SOTU Live here...

* * *

Mises' Connor O'Keeffe, warns: "Be on the Lookout for These Lies in Biden's State of the Union Address."

On Thursday evening, President Joe Biden is set to give his third State of the Union address. The political press has been buzzing with speculation over what the president will say. That speculation, however, is focused more on how Biden will perform, and which issues he will prioritize. Much of the speech is expected to be familiar.

The story Biden will tell about what he has done as president and where the country finds itself as a result will be the same dishonest story he's been telling since at least the summer.

He'll cite government statistics to say the economy is growing, unemployment is low, and inflation is down.

Something that has been frustrating Biden, his team, and his allies in the media is that the American people do not feel as economically well off as the official data says they are. Despite what the White House and establishment-friendly journalists say, the problem lies with the data, not the American people's ability to perceive their own well-being.

As I wrote back in January, the reason for the discrepancy is the lack of distinction made between private economic activity and government spending in the most frequently cited economic indicators. There is an important difference between the two:

-

Government, unlike any other entity in the economy, can simply take money and resources from others to spend on things and hire people. Whether or not the spending brings people value is irrelevant

-

It's the private sector that's responsible for producing goods and services that actually meet people's needs and wants. So, the private components of the economy have the most significant effect on people's economic well-being.

Recently, government spending and hiring has accounted for a larger than normal share of both economic activity and employment. This means the government is propping up these traditional measures, making the economy appear better than it actually is. Also, many of the jobs Biden and his allies take credit for creating will quickly go away once it becomes clear that consumers don't actually want whatever the government encouraged these companies to produce.

On top of all that, the administration is dealing with the consequences of their chosen inflation rhetoric.

Since its peak in the summer of 2022, the president's team has talked about inflation "coming back down," which can easily give the impression that it's prices that will eventually come back down.

But that's not what that phrase means. It would be more honest to say that price increases are slowing down.

Americans are finally waking up to the fact that the cost of living will not return to prepandemic levels, and they're not happy about it.

The president has made some clumsy attempts at damage control, such as a Super Bowl Sunday video attacking food companies for "shrinkflation"—selling smaller portions at the same price instead of simply raising prices.

In his speech Thursday, Biden is expected to play up his desire to crack down on the "corporate greed" he's blaming for high prices.

In the name of "bringing down costs for Americans," the administration wants to implement targeted price ceilings - something anyone who has taken even a single economics class could tell you does more harm than good. Biden would never place the blame for the dramatic price increases we've experienced during his term where it actually belongs—on all the government spending that he and President Donald Trump oversaw during the pandemic, funded by the creation of $6 trillion out of thin air - because that kind of spending is precisely what he hopes to kick back up in a second term.

If reelected, the president wants to "revive" parts of his so-called Build Back Better agenda, which he tried and failed to pass in his first year. That would bring a significant expansion of domestic spending. And Biden remains committed to the idea that Americans must be forced to continue funding the war in Ukraine. That's another topic Biden is expected to highlight in the State of the Union, likely accompanied by the lie that Ukraine spending is good for the American economy. It isn't.

It's not possible to predict all the ways President Biden will exaggerate, mislead, and outright lie in his speech on Thursday. But we can be sure of two things. The "state of the Union" is not as strong as Biden will say it is. And his policy ambitions risk making it much worse.

* * *

The American people will be tuning in on their smartphones, laptops, and televisions on Thursday evening to see if 'sloppy joe' 81-year-old President Joe Biden can coherently put together more than two sentences (even with a teleprompter) as he gives his third State of the Union in front of a divided Congress.

President Biden will speak on various topics to convince voters why he shouldn't be sent to a retirement home.

The state of our union under President Biden: three years of decline. pic.twitter.com/Da1KOIb3eR

— Speaker Mike Johnson (@SpeakerJohnson) March 7, 2024

According to CNN sources, here are some of the topics Biden will discuss tonight:

Economic issues: Biden and his team have been drafting a speech heavy on economic populism, aides said, with calls for higher taxes on corporations and the wealthy – an attempt to draw a sharp contrast with Republicans and their likely presidential nominee, Donald Trump.

Health care expenses: Biden will also push for lowering health care costs and discuss his efforts to go after drug manufacturers to lower the cost of prescription medications — all issues his advisers believe can help buoy what have been sagging economic approval ratings.

Israel's war with Hamas: Also looming large over Biden's primetime address is the ongoing Israel-Hamas war, which has consumed much of the president's time and attention over the past few months. The president's top national security advisers have been working around the clock to try to finalize a ceasefire-hostages release deal by Ramadan, the Muslim holy month that begins next week.

An argument for reelection: Aides view Thursday's speech as a critical opportunity for the president to tout his accomplishments in office and lay out his plans for another four years in the nation's top job. Even though viewership has declined over the years, the yearly speech reliably draws tens of millions of households.

Sources provided more color on Biden's SOTU address:

The speech is expected to be heavy on economic populism. The president will talk about raising taxes on corporations and the wealthy. He'll highlight efforts to cut costs for the American people, including pushing Congress to help make prescription drugs more affordable.

Biden will talk about the need to preserve democracy and freedom, a cornerstone of his re-election bid. That includes protecting and bolstering reproductive rights, an issue Democrats believe will energize voters in November. Biden is also expected to promote his unity agenda, a key feature of each of his addresses to Congress while in office.

Biden is also expected to give remarks on border security while the invasion of illegals has become one of the most heated topics among American voters. A majority of voters are frustrated with radical progressives in the White House facilitating the illegal migrant invasion.

It is probable that the president will attribute the failure of the Senate border bill to the Republicans, a claim many voters view as unfounded. This is because the White House has the option to issue an executive order to restore border security, yet opts not to do so

Maybe this is why?

Most Americans are still unaware that the census counts ALL people, including illegal immigrants, for deciding how many House seats each state gets!

— Elon Musk (@elonmusk) March 7, 2024

This results in Dem states getting roughly 20 more House seats, which is another strong incentive for them not to deport illegals.

While Biden addresses the nation, the Biden administration will be armed with a social media team to pump propaganda to at least 100 million Americans.

"The White House hosted about 70 creators, digital publishers, and influencers across three separate events" on Wednesday and Thursday, a White House official told CNN.

Not a very capable social media team...

The State of Confusion https://t.co/C31mHc5ABJ

— zerohedge (@zerohedge) March 7, 2024

The administration's move to ramp up social media operations comes as users on X are mostly free from government censorship with Elon Musk at the helm. This infuriates Democrats, who can no longer censor their political enemies on X.

Meanwhile, Democratic lawmakers tell Axios that the president's SOTU performance will be critical as he tries to dispel voter concerns about his elderly age. The address reached as many as 27 million people in 2023.

"We are all nervous," said one House Democrat, citing concerns about the president's "ability to speak without blowing things."

The SOTU address comes as Biden's polling data is in the dumps.

BetOnline has created several money-making opportunities for gamblers tonight, such as betting on what word Biden mentions the most.

As well as...

We will update you when Tucker Carlson's live feed of SOTU is published.

Fuck it. We’ll do it live! Thursday night, March 7, our live response to Joe Biden’s State of the Union speech. pic.twitter.com/V0UwOrgKvz

— Tucker Carlson (@TuckerCarlson) March 6, 2024

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International6 hours ago

International6 hours agoWalmart launches clever answer to Target’s new membership program

-

International1 month ago

International1 month agoWar Delirium

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex