Uncategorized

Futures Rise, Yields Drop Amid Escalating Israel Violence

Futures Rise, Yields Drop Amid Escalating Israel Violence

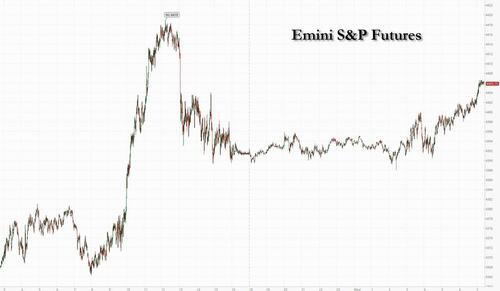

US equity-index futures gained for a 4th day, rising above 4,400 and benefiting…

US equity-index futures gained for a 4th day, rising above 4,400 and benefiting from a fall in Treasury yields which slipped as much as 10bps to 4.54%, the lowest since Sept 29, in a flight to safety move following a report that missiles were fired from Lebanon toward Israel; sentiment was also on edge ahead of the latest US PPI data that could show if investors are right to dial back bets on further policy tightening. As of 7:30am, S&P 500 futures rose 0.3% to 4,405 while Nasdaq futures rose 0.4%. The escalating conflict in Israel meant Treasuries held gains even after Federal Reserve Governor Michelle Bowman said higher rates may be needed to curb inflation. Germany’s 10-year yield dropped six basis points. The Bloomberg dollar index was little changed after five straight days of declines. Luxury giant LVMH dragged European luxury stocks lower.

In premarket trading, energy giant dropped 2% after the company confirmed earlier reports that it will acquire shale giant Pioneer Natural Resources in an all-stock transaction valued at $59.5 billion, or $253 per share, based on ExxonMobil’s closing price on October 5. Pioneer holders will get 2.3234 shares of Exxon for each Pioneer share at closing. Total enterprise value of the transaction, including net debt, is about $64.5 billion. The Premium about 18% to Pioneer’s undisturbed closing price on October 5. Some other notable premarket movers:

- Cava Group gained 4.5% after Morgan Stanley upgraded the fast-casual Mediterranean restaurant chain to overweight from equal-weight, expressing confidence in the company’s catalysts and near-term estimates.

- Shares in dialysis providers DaVita and Baxter International slide, after Novo Nordisk said a kidney-outcomes trial of its blockbuster Ozempic medication is being stopped early after the drug showed surprisingly early effectiveness in a kidney-failure study, sending shares of the world’s biggest dialysis providers tumbling.

- Fresenius Medical Care AG & Co. KGaA both plunged more than 20% on the Novo Nordisk news. Novo shares rose as much as 4.4% in Copenhagen, its biggest one-day move in two months.

Israel said an anti-tank missile fired from Lebanon hit one of its military posts near the border, news that saw investors seek haven assets like US Treasuries. Hezbollah, the Iran-funded group that operates from Lebanon, has expressed solidarity with Hamas and fired several rockets at Israel. Some say a ground invasion of Gaza by Israel is all but inevitable after Prime Minister Benjamin Netanyahu promised that “what we will do to our enemies in the coming days will reverberate with them for generations.” But a ground invasion would be complicated by Gaza’s dense population, its complex underground network of tunnels and the danger it would pose to hostages.

Investors are wary of an escalation of the conflict which would create ripple effects through the Middle East, endangering Israel’s fragile rapprochement with its Arab neighbors and increasing the risks that hostilities spiral into a broader regional war with implications for crude oil supplies.

“A rallying bond market when faced with higher political risk is a kind of positive development,” said Sunil Krishnan, head of multi asset funds at Aviva Investors. “One thing investors have been trying to call this year without much success is when bonds go back to their traditional role of hedging against decline in risk appetite."

Separately, ahead of the release of the September FOMC Minutes later today, San Francisco Fed President Mary Daly said tighter financial conditions may mean the central bank “doesn’t have to do as much,” the latest in a string of softer commentary that raised hopes interest-rate hikes may be done for now. Investors will be watching for any hints in the Fed minutes that the central bank may not follow through with the last hike indicated in its economic projections. Producer inflation data later Wednesday will add to the picture.

“Policymakers have begun to acknowledge a lesser need for further policy action given financial conditions have tightened considerably after the recent surge in Treasury yields,” said Ben Jeffery at BMO Capital Markets. “This acknowledgment may have reduced angst around the need for additional rate increases.”

Meanwhile, a rally in European stocks stalled as disappointing corporate news tempered optimism about the outlook for interest rates and economic stimulus from China. The Stoxx Europe 600 index fluctuated after clocking its biggest gain of the year on Tuesday. The French CAC was the worst performer, down 0.5% with LVMH slumping as much as 8.5% after reporting softening sales, a signal that the post-pandemic luxury boom is waning. That weighed on the luxury-goods sector, with losses for peers including Richemont, Christian Dior SE and Burberry Group Plc. Here are the biggest European movers:

- GSK shares rise as much as 2.5% after the British pharmaceutical company settled another US lawsuit over its blockbuster heartburn drug Zantac

- LVMH shares dropped as much as 8.5%, erasing their gains for the year, after the French luxury group published disappointing third-quarter sales in fashion and leather goods as well as beverages

- Fresenius Medical Care, an operator kidney-dialysis clinics, tumbled as much as 24% after Novo Nordisk said a kidney-outcomes trial of its blockbuster Ozempic drug showed effectiveness surprisingly early

- Hexpol shares rise as much as 4.2% in Stockholm after DNB Markets upgraded the Swedish plastics and polymers firm to buy from hold

- Siltronic shares soar as much as 10%, the most since March 2022, after Citi upgrades its rating on the German silicon wafer manufacturer to buy from neutral, saying it is at an inflection point

- Befesa shares rise as much as 7.7%, the most intraday since March 2022, as Jefferies initiates coverage of the recycling-services group with a buy rating

- FirstGroup shares rise as much as 5.7%, posting their biggest gain since June, after the UK bus and rail operator said it sees FY profit coming in ahead of previous expectations

- ADES gains 21% in Riyadh debut after raising $1.2 billion in Saudi Arabia’s largest initial public offering this year

- SBB, the landlord at the center of Sweden’s property crisis, fell as much as 10% in Stockholm after analysts at Goldman Sachs slashed their target price on the company

- Pagegroup drops as much as 7.9% to the lowest in a year after the recruitment firm’s net fee growth came in slightly light of analysts’ expectations in the third quarter

- Komax shares fall as much as 5.5%, touching the lowest level since January 2021, after ZKB cut its recommendation on the Swiss machinery manufacturer to underperform

- U-Blox shares fall as much as 3.7% after the Swiss semiconductor company’s 9M revenue slipped more than 8% from a year earlier to CHF436 million, while the firm said its expectations for 2023 remain unchanged

Asian stocks rose, heading for a fifth day of gains, as expectations of further China stimulus add to hopes for a rate hike pause by the Federal Reserve to drive sentiment. The MSCI Asia Pacific Index advanced as much as 1%, with Samsung Electronics among the biggest boosts as its better-than-feared results fueled expectations for a chip recovery. South Korea’s Kospi gained more than 2% after nearly entering a correction Tuesday, while benchmarks in Hong Kong and Taiwan also posted notable gains.

- China mainland stocks advanced after Bloomberg reported that Beijing is planning additional sovereign debt for spending on infrastructure in a bid to shore up economic growth. Chinese stocks have declined and dragged on regional and global equity gauges this year on concerns over its flagging recovery.

- Australia's ASX 200 was led by outperformance in tech and mining-related industries, while the index was unfazed by comments from RBA's Kent who reiterated some further policy tightening may be required.

- Japan's Nikkei 225 advanced and briefly breached the 32,000 level to the upside.

- KOSPI was the biggest gainer as shares in index heavyweight Samsung Electronics were boosted after its preliminary Q3 results which showed oper. profit topped forecasts despite declining by 78% Y/Y.

In FX, the Bloomberg Dollar index was little changed after a fifth straight session of declines. Asia’s emerging market currencies gained, with the Korean won and Thai baht leading the advance. The Swiss franc is the best performer among the G-10’s, rising 0.2% versus the greenback.

In rates, Treasuries held earlier gains amassed during the London session on report missiles were fired from Lebanon toward Israel in latest act of war against the state. US yields are richer by 1bp-11bp across the curve in bull-flattening move that’s narrowed 2s10s, 5s30s spreads by ~8bp and ~5bp on the day; 10-year yields around 4.56% are lower by 9bp, adding to Tuesday’s rally; bunds lag by 3.5bp in the sector while gilts keep pace. Similar bull-flattening moves occured in core European rates, where 30-year gilts trade richer by almost 13bp on the day. The US Treasury auction cycle resumes with $35b 10-year reopening at 1pm; 30-year reopening Thursday concludes this week’s cycle. WI 10-year yield around 4.555% is ~26.5bp cheaper than result of September auction, which stopped on the screws; Tuesday’s 3-year note sale was soft, tailing the WI by 1.7bp. US session includes PPI data, 10-year note auction and several Fed speakers.

In commodities, oil declined following a surge earlier this week as Saudi Arabia pledged to help ensure market stability. WTI falling 0.6% to trade near $85.50. Spot gold rises 0.5%. Gold rose to the the highest this month.

Bitcoin remain pressured after briefly dipping under USD 27,000 in APAC hours before reclaiming the handle.

To the day ahead, and data releases include US PPI inflation for September. From central banks, we’ll get the minutes from the FOMC’s September meeting, and remarks from the Fed’s Bowman, Waller, Bostic and Collins. From the ECB, we’ll get their Consumer Expectation Survey for August, and hear from the ECB’s Knot, de Cos and Villeroy.

Market Snapshot

- S&P 500 futures little changed at 4,391.75

- MXAP up 0.8% to 158.02

- MXAPJ up 1.2% to 495.61

- Nikkei up 0.6% to 31,936.51

- Topix down 0.2% to 2,307.84

- Hang Seng Index up 1.3% to 17,893.10

- Shanghai Composite up 0.1% to 3,078.96

- Sensex up 0.5% to 66,415.50

- Australia S&P/ASX 200 up 0.7% to 7,088.41

- Kospi up 2.0% to 2,450.08

- Brent Futures little changed at $87.66/bbl

- STOXX Europe 600 down 0.1% to 451.93

- German 10Y yield little changed at 2.73%

- Euro little changed at $1.0601

- Brent Futures little changed at $87.66/bbl

- Gold spot up 0.4% to $1,868.39

- U.S. Dollar Index little changed at 105.83

Top Overnight News

Asia-Pacific stocks were higher after the positive momentum rolled over from global peers owing to the latest bout of dovish Fed rhetoric and amid China stimulus hopes. ASX 200 was led by outperformance in tech and mining-related industries, while the index was unfazed by comments from RBA's Kent who reiterated some further policy tightening may be required. Nikkei 225 advanced and briefly breached the 32,000 level to the upside. KOSPI was the biggest gainer as shares in index heavyweight Samsung Electronics were boosted after its preliminary Q3 results which showed oper. profit topped forecasts despite declining by 78% Y/Y. Hang Seng and Shanghai Comp. conformed to the broad constructive mood amid stimulus hopes with China to boost financial assistance to expand consumption and is weighing new stimulus, as well as a higher budget deficit this year to meet its growth target.

Asian News

- China will hold the Belt and Road Forum on October 17th-18th with President Xi to attend the opening ceremony and will deliver a keynote speech, according to Reuters citing state media.

- RBA Assistant Governor Kent said monetary policy is slowing the growth of demand and inflation, while he added that policy lags mean some further effects of past rate hikes are still to be felt through the economy and repeated that some further policy tightening may be required.

- PBoC set USD/CNY mid-point at 7.1779 vs exp. 7.2842 (prev. 7.1781)

European bourses have held onto the mixed theme seen at the cash open with underperformance seen in the CAC 40 and Euro Stoxx 50 on the back of disappointing earnings from heavyweight LVMH. Sectors in Europe are mixed with Utilities, Energy and Healthcare towards the top of the pile, while the Luxury sector drags Consumer Products and Services, which resides as the marked laggard. US futures are flat with a mild upward tilt and confined to tight ranges, with the ES still under the 4,400 mark.

European News

- ECB's Centeno said overtightening is not desirable and risk of overtightening must be monitored, via CNBC.

- ECB's Knot said the effects of inflation shocks are waning; inflation is still too high and a slowdown clearly spilling over into services. He added the economy cooling is desirable to tame inflation, and said the ECB has a long road ahead on disinflation. He added restrictive policies will be needed for some time and policy is in a good place now, and stand ready to adjust rates further if disinflation falls, according to Reuters.

- ECB Consumer Inflation Expectations survey (Aug): 12-month ahead 3.5% (prev. 3.4%); 3-year ahead 2.5% (prev. 2.4%). Economic growth expectations for the next 12 months -0.8% (prev. -0.7%).

FX

- DXY grounded ahead of US PPI data as DXY hovers above a minor new October low within 105.600-890 range.

- The Pound probes 1.2300 vs Buck before fading amidst a deeper retreat in UK yields.

- Euro and Yen firmer vs Dollar, but contained around 1.0600 and between 149.00-148.50 respectively.

- Franc outperforms as bonds soar and the Middle East conflict underpins the safe haven; USD/CHF sub-0.9050.

Fixed Income

- Bonds are back in vogue as duration and safe haven demand propel prices higher amidst long end outperformance.

- Bunds up to 129.95 from 129.03, Gilts over 100 ticks above low within 93.95-95.08 range and T-note towards top of 108-11/107-21 band, at the time of writing.

- UK supply snapped up, German issuance meets mixed reception and 10 year US offering due post-PPI data.

- UK sells GBP 3.75bln vs exp. GBP 3.75bln 4.625% 2034 Gilt: 3.12x b/c, 4.444% average yield & tail 0.5bps

- Germany sells EUR 0.806mln vs exp. EUR 1bln 1.25% 2048 and EUR 1.226bln vs exp. EUR 1.5bln 0.00% 2052 Bund.

Commodities

- Crude front-month futures are now softer intraday after trading with mild gains throughout APAC hours.

- Dutch TTF is taking a breather and trades softer around 4% at EUR 47.50/MWh at the time of writing, after rising some 12% yesterday to levels a whisker away from EUR 50/MWh.

- Spot gold and silver are marching higher, potentially amid haven flows as the Israeli war rages on with Lebanon and Syria also said to be involved.

- Russian Deputy PM Novak said he discussed the oil market and OPEC+ cooperation with the Saudi delegation, according to Ifx. Deputy PM Novak said Russia is ready to raise oil product shipment to Saudi Arabia, via Tass.

- Russian Deputy PM Novak said the government not planning to raise taxes for oil companies, via Ria. He added that the Israeli-Palestinian conflict could affect the oil market.

- India government approved royalty rates for lithium, niobium and rare earths; sets lithium royalty at 3% of LME price, according to Reuters.

- QatarEnergy signed a 27-year LNG supply deal with France; to supply up to 3.5 MTPA to France from Qatar, via Bloomberg.

- The US is reportedly mulling dropping sanctions against an Israeli mining magnate accused of corruption in a bid for American firms to receive EV metals, according to WSJ sources.

Geopolitics

- NATO Secretary General Stoltenberg said if it is proven there was an attack on the Baltic Sea gas pipeline, it will be met by a united and determined response from NATO, according to Reuters.

- US Defence Secretary Austin spoke to his Israeli counterpart and reaffirmed US' commitment to expedite air defence capabilities, according to the Pentagon.

US Event Calendar

- 07:00: Oct. MBA Mortgage Applications, prior -6.0%

- 08:30: Sept. PPI Final Demand MoM, est. 0.3%, prior 0.7%

- Sept. PPI Final Demand YoY, est. 1.6%, prior 1.6%

- Sept. PPI Ex Food and Energy MoM, est. 0.2%, prior 0.2%

- Sept. PPI Ex Food and Energy YoY, est. 2.3%, prior 2.2%

- 14:00: Sept. FOMC Meeting Minutes

Central Bank Speakers

- 04:15: Fed’s Bowman Speaks in Morocco

- 10:15: Fed’s Waller Holds Fireside Chat

- 12:15: Fed’s Bostic Speaks to the Metro Atlanta Chamber

- 14:00: Sept. FOMC Meeting Minutes

- 16:30: Fed’s Collins Speaks at Wellesley College

DB's Jim Reid concludes the overnight wrap

Despite the ongoing geopolitical turmoil, markets have surged so far this week with European stocks having their best day of 2023 yesterday, and with the S&P 500 (+0.52%) now 3.29% above where it was at the lows early on Friday, around 90 minutes after payrolls came out. The fact that 10yr US yields are -23bps lower than their peak early on Friday (-14.9bps yesterday) is undoubtedly helping. There is a 10yr Treasury auction today so that will be a good test of the lower yield environment. Another positive driver was a Bloomberg report that China was considering a higher deficit for 2023, suggesting that there could be more stimulus in the pipeline. Meanwhile, Brent Crude oil prices (-0.57%) pared back some of their gains from Monday with the lack of upward price momentum after the weekend's events a positive for risk.

Going through things in a little more detail let’s start with bonds. The -14.9bps decline in 10yr US yields to 4.65% was their biggest daily decline since March at the height of the banking turmoil. The move was entirely driven by real yields, which fell -15.7bps. That direction of travel was cemented by various Fed speakers as well. That included Atlanta Fed President Bostic, who said “I actually don’t think we need to increase rates anymore .” Minneapolis Fed President Kashkari, one of the more hawkish FOMC members, struck a more ambivalent tone, saying that it’s “possible that higher yields may do some of the work” in bringing inflation down but that the Fed may still need to hike further if the economy is resilient. Later on, San Francisco Fed President Daly reiterated her recent comment that recent tightening in financial conditions “could be equivalent to another rate hike”. 10yr USTs have edged down a further -1.2bps overnight, trading at around 4.64% as we go to print. 2yr yields are +2.7bps at a whisker under 5% leaving the curve at around -36bps, off last week's near 12-month intra-day highs of -25.7bps .

Just as Treasuries were rallying, there was also a strong performance for equities on both sides of the Atlantic. In Europe, the STOXX 600 (+1.96%) posted its best performance of 2023 so far, with gains across every sector group. There was a smaller advance in the US, but the S&P 500 still ended the day up +0.52% (despite falling by 0.6% from intra-day highs). Utilities (+1.36%) and banks (+1.41%) were outperformers within the S&P 500, while the NASDAQ gained +0.58%. Small-cap stocks were a particular outperformer as well, with the Russell 2000 (+1.14%) posting a 5th consecutive advance.

One area of concern came from European natural gas prices, which posted another +14.9% gain yesterday that leaves them at a 6-month high of €49.40/MWh. In part, that follows the shutdown of the Tamar gas field due to the situation in Israel, but there’ve also been separate supply concerns, and prices moved higher after Bloomberg reported yesterday that Finland suspected a gas pipeline leak in the Baltic sea was down to sabotage. Fortunately for Europe, natural gas prices are still less than half their levels from this time a year ago, and gas storage is above its levels at this point in 2021 and 2022. Nevertheless, the upward movement will be concerning for policymakers as they approach the winter months.

Elsewhere, sovereign bonds in Europe had a more mixed performance, with yields on 2yr (+3.1bps) and 10yr (+0.3bps) German debt both rising on the day. 10yr yields in other countries did fall back, however, including for French OATs (-3.0bps) and UK gilts (-5.0bps). 10yr BTPs led the way though, falling -11.4bps and came in from 9-month spread highs to bunds .

This morning in Asia equity markets are extending a global markets rally on easing US rate worries and stability in crude oil prices. The KOSPI (+2.35%) is trading sharply higher, hitting a two-week high and is leading gains across the region after the index heavyweight, Samsung Electronics, surged over +3.0% as it reported a more modest decline in quarterly profit than expected. Meanwhile, the Hang Seng (+1.50%), the Nikkei (+0.54%), the CSI (+0.38%) and the Shanghai Composite (+0.19%) are also trading higher as China’s fiscal stimulus speculation improved risk appetite. US stock futures are fairly flat.

The risk on yesterday did help Israeli assets recover some of the recent losses. For instance, the TA-35 equity index was up +1.20%, and now 'only' down -4.45% since the attacks. We also saw the Israeli shekel (+0.03%) remain steady against the US Dollar, having weakened by -2.70% since the attacks.

In other news, the IMF published their latest World Economic Outlook yesterday, which showed a very modest downgrade for global growth relative to July. They kept their expectations for 2023 at 3.0%, but lowered the 2024 projection a tenth to 2.9%. There were some regional divergences within that, however, and the US forecast for next year was upgraded half a point to 1.5%, whereas Germany’s growth was downgraded four-tenths to 0.9%.

Looking at yesterday’s other data, the US NFIB’s small business optimism index fell to a 4-month low of 90.8 in September (vs. 91.0 expected). There were also fresh signs that the rise in borrowing costs was filtering through to the real economy, with the actual interest rate paid on short-term loans by borrowers up to 9.8%, which is its highest since December 2006. Elsewhere, the New York Fed released their latest Survey of Consumer Expectations, which showed a modest uptick in near-term inflation expectations. At the 1yr horizon, median expectations were up a tenth to 3.7%, and at the 3yr horizon they were up two-tenths to 3.0% .

To the day ahead, and data releases include US PPI inflation for September. From central banks, we’ll get the minutes from the FOMC’s September meeting, and remarks from the Fed’s Bowman, Waller, Bostic and Collins. From the ECB, we’ll get their Consumer Expectation Survey for August, and hear from the ECB’s Knot, de Cos and Villeroy.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 day ago

International1 day agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges