Government

Futures Punch To New Record High After US-China Reaffirm Committment To Trade Deal

Futures Punch To New Record High After US-China Reaffirm Committment To Trade Deal

Three things send the market higher these days: i) optimism that Congress will finally renew the fiscal stimulus which expired on July 31; ii) optimism that a covid vaccine will miraculously fix the global economy, and iii) in a throwback to 2019 optimism on the US-China trade deal. We got a dose of iii) late on Monday when the USTR reported that top U.S. and Chinese trade officials reaffirmed their commitment to a Phase 1 trade deal which has seen China lagging on its obligations to buy American goods, with a call (originally scheduled for Aug 15) in which both sides saw "progress and are committed to taking the steps necessary to ensure the success of the agreement", and demonstrating a willingness to cooperate even as tensions rise over issues ranging from data security to democracy in Hong Kong.

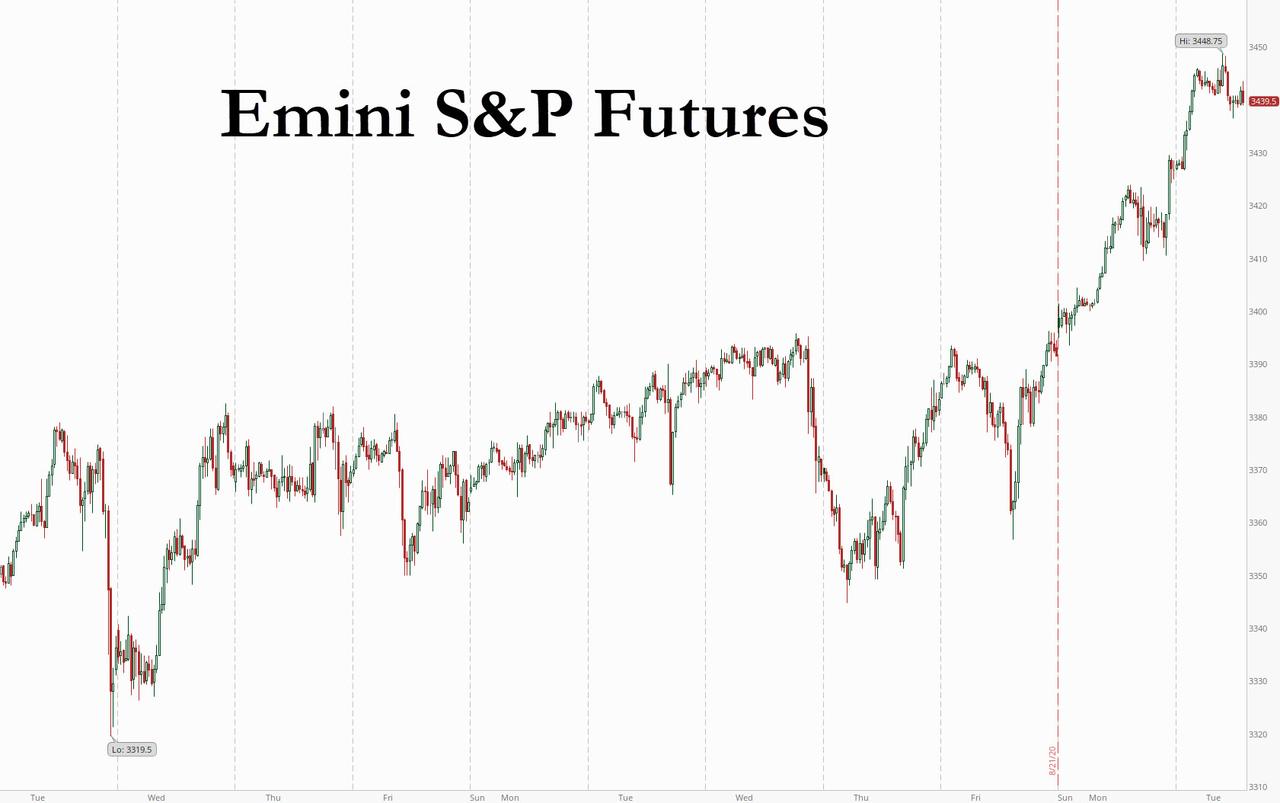

Given the exchanges between the U.S. and China recently "have been negative, any small bit of positivity is seen as a big step forward, even when it isn’t," said David Madden, market analyst at CMC Markets UK. It was certainly enough to push US equity futures higher for a fourth straight session, with the Emini punching to a new all time of 3,448.75 during the Asian session which saw shares rise throughout most of Asia, before trimming gains to around 3,440 after the European open.

The S&P 500 and Nasdaq both clocked new record highs on Monday, with the benchmark index surpassing its pre-pandemic high last week even as recent economic data pointed to a wobbly recovery from the virus-led downturn. However, even as the ES was up some 0.3%, Nasdaq futures were shockingly in the red sparking panic and hysteria among a generation of retail daytraders who have never seen a red open in a centrally-planned market.

Salesforce.com, Amgen and Honeywell climbed between 3.6% and 4% premarket on news they would join the blue-chip Dow Jones Industrial Average index on Aug. 31. This came at the expense of three companies that are getting kicked out of the DJIA including E&P titan and formerly world's most valuable company Exxon Mobil, Pfizer and Raytheon Technologies which were down between 1.5% and 2.4%. Best Buy dropped despite reporting earnings that beat on the top and bottom line; Folgers coffee maker JM Smucker medical device maker Medtronic are also due to report quarterly results before the opening bell.

Investors also remain focused on vaccine progress as global economies reopen. Moderna said it’s near a deal to supply at least 80 million vaccine doses to the European Union.

"A steady flow of progress with Covid-19 treatments/vaccines is delivering the latest boost to risk appetite," said Oanda senior market analyst Edward Moya, but just like Morgan Stanley, he cautioned that "market breadth however does not support the surge to record high territory for U.S. indexes."

European stocks advanced for a second day after the latest IFO surveys showed German companies turning slightly more optimistic on the economic recovery despite missing expectations on, well, expectations:

- Ifo Expectations 97.5 vs. Exp. 98.0 (Prev. 96.7)

- Ifo Current Conditions 87.9 vs. Exp. 87.0 (Prev. 84.5)

- Ifo Business Climate 92.6 vs. Exp. 92.1 (Prev. 90.4)

The current assessment continues to lag expectations about the future, a reversal to pre-covid days.

The Stoxx Europe 600 Index climbed 0.4% as of 10:28 a.m. in London, with travel stocks advancing more than 2% and leading gains among sectors.

In Asia, markets were broadly higher, with Tokyo, Taipei, Seoul and Sydney all in the green while peers in Hong Kong and Shanghai slipped. South Korea's Kospi Index gained 1.6% and Jakarta Composite rising 1.2%, while Shanghai Composite dropped 0.4%. Japan's Topix gained 1.1%, with Globeride and Land Co rising the most. The Shanghai Composite Index retreated 0.4%, with Jiangxi Hongdu Aviation Industry and Dalian Bio-Chem posting the biggest slides.

In rates, treasuries traded heavy into early U.S. session with yields cheaper by 1bp-4bp across the curve in bear-steepening move. Treasury 10-year yields close to cheapest level of the day at 0.684%, highest in several days; long-end-led losses steepen 2s10s, 5s30s by ~2bp. Factors weighing on the curve include IG credit issuance, start of Treasury auction cycle and grind higher in S&P 500 futures. In Europe, Bunds lag Treasuries by 2bp while gilts trade broadly in line. As Bloomberg notes, concession starts to build into front-end also with $50b 2-year note sale at 1pm ET, ahead of $51b 5-year Wednesday and $47b 7-year Thursday.

In FX, the dollar and yen have softened against most currencies, while the euro has been topping the top-performing list as Action Economics recaps. This dynamic has come amid risk-on positioning in global markets. EUR-USD lifted to the mid 1.1800s, posting an intraday peak at 1.1843, which is 60 pips up on Monday's New York closing level. The euro has also rallied against the yen, which is the day's biggest loser, and most other currencies. While a bout of general dollar selling has helped to lift EUR-USD, there have concurrently been a couple of cues to buy euros, including August German Ifo business climate indicator, which beat forecasts in rising to a headline reading of 92.6, and remarks from German finance minister Scholz, who said there are signs that the German economy is developing above forecasts. USD-JPY, meanwhile, posted an eight-day high at 106.38, which is a gain of just over 40 pips on yesterday's closing level. The biggest mover out of the main currency pairings and crosses was EUR-JPY, which was showing over a 0.8% gain. The cross printed a six-day high at 125.97. GBP-JPY was not far behind, while AUD-JPY was showing a near 0.5% upward advance. Cable pegged an intraday high at 1.3126. USD-CAD posted a five-day peak at 1.3240 in pre-London trading, subsequently settling lower.

In commodities, oil was slightly higher as traders kept a watchful eye on Tropical Storm Laura, which is expected to strengthen into a hurricane before making landfall later this week. U.S. gasoline futures rose to the highest level since March on concern over possible fuel shortages. Elsewhere, gold dipped as low as $1,922 an ounce trading in a narrow range.

Looking at today's calendar, we’ll get the FHFA house price index for June, new home sales or July, as well as the Conference Board’s consumer confidence reading and the Richmond Fed manufacturing index for August. The Conference Board is expected to show U.S. consumer confidence improved slightly in August after falling more than expected in July amid a flare up in coronavirus cases. Otherwise, San Francisco Fed President Daly will be speaking, and earnings releases include Salesforce, Medtronic, Intuit and Autodesk. Investors also await Federal Reserve Chairman Jerome Powell’s address on Thursday for hints on the central bank’s next steps to support an economic recovery.

Market Snapshot

- S&P 500 futures up 0.3% to 3,439.25

- STOXX Europe 600 up 0.4% to 372.29

- MXAP up 0.3% to 172.99

- MXAPJ up 0.2% to 572.19

- Nikkei up 1.4% to 23,296.77

- Topix up 1.1% to 1,625.23

- Hang Seng Index down 0.3% to 25,486.22

- Shanghai Composite down 0.4% to 3,373.58

- Sensex up 0.06% to 38,824.20

- Australia S&P/ASX 200 up 0.5% to 6,161.39

- Kospi up 1.6% to 2,366.73

- German 10Y yield rose 2.1 bps to -0.47%

- Euro up 0.3% to $1.1817

- Italian 10Y yield unchanged at 0.819%

- Spanish 10Y yield rose 3.3 bps to 0.36%

- Brent futures up 0.3% to $45.28/bbl

- Gold spot down 0.1% to $1,926.57

- U.S. Dollar Index down 0.3% to 93.06

Top Overnight News from Bloomberg

- The U.S. and China reaffirmed their commitment to the phase-one trade deal in a biannual review, demonstrating a willingness to cooperate even as tensions rise over issues ranging from data security to democracy in Hong Kong

- Germany’s coronavirus daily new cases increased at a pace not seen for almost four months

- Moderna Inc. has announced it is close to a deal with the EU to provide at least 80 million vaccine doses

- Storm Laura is expected to be upgraded to a hurricane when it makes landfall on the American gulf coast in the next few days, leading U.S. gasoline futures to rise to their highest since the start of the pandemic on fears over potential fuel shortages

Courtesy of NewsSquawk, here is a quick recap of global markets:

Asian equity markets were mixed after trading mostly higher as the region initially took impetus from the fresh record highs on Wall St where cyclicals outperformed and with risk appetite also spurred by COVID-19 plasma treatment hopes, as well as reports US and China’s top trade negotiators held a constructive conversation on the Phase 1 agreement. ASX 200 (+0.5%) was led by tech and financials although gains in the benchmark index were capped by resistance at the 6200 level and amid headwinds from a deluge of earnings, while Nikkei 225 (+1.4%) outperformed as exporters cheered recent currency weakness and with the government to ease the ban on foreign residents returning to the country. Hang Seng (-0.3%) and Shanghai Comp. (-0.4%) also began higher after the PBoC boosted its liquidity efforts with a total CNY 300bln of reverse repo operations and following talks between USTR Lighthizer, Treasury Secretary Mnuchin and China’s Vice Premier Liu He in which both sides saw progress and were committed to taking the next steps required to ensure the success of the deal. However, gains later faded given that discussions were not much of a surprise and with the PBoC distancing itself from lowering capital requirements for bank, while Hong Kong was also cautious ahead of Chief Executive Lam’s announcement on social distancing arrangements later today as the current restrictions which limits public gatherings to two people are set to expire. Finally, 10yr JGBs were lacklustre with price action contained below the 152.00 level after weakness in T-notes and demand sapped by the gains in stocks, with the 20yr JGB auction doing little to spur prices despite printing improved results.

Top Asian News

- U.S., China Signal Progress on Trade Deal as Relations Fray

- Hong Kong to Relax Social Distancing Rules as Virus Cases Drop

- Credit Suisse’s Head of Asia Technology to Join Xiaomi as CFO

- Thai Cabinet Approves Extension of Emergency for Another Month

Stocks in Europe trade with modest gains (Euro Stoxx 50 +0.6%) albeit off highs, as sentiment somewhat improved following the mixed APAC lead. Some suggest that the “constructive” US-Sino trade call is spurring risk assets. However, it is worth remembering that there has been no new progress/developments in terms of trade, and in the grand scheme of things, US-Sino relations remain at all-time-lows on a number of fronts – e.g. geopolitics, capital markets and technology. On the data front – the German Ifo survey showed optimism in the country has increased, but economists noted that the German recovery is fragile and stocks were largely unfazed by the release. Sectors are mostly in the green, although the cyclical tilt seen at the open has somewhat faded, but nonetheless, financials and travel & leisure hold their top positions in the region, whilst materials and energy lag amid the price action in their respective complexes. In terms of individual movers, Aveva (+3.9%) holds onto gains after announcing a proposed acquisition of Osisoft for an enterprise value of USD 5bln. Nokia (+0.5%) and Ericsson (+1.2%) remain firm after reports noted that the Indian government is looking to phase out equipment from Chinese companies including Huawei from its telecoms network amid border tensions – with Nokia and Ericsson potentially to gain from this. On the flip side, Swisscom (-1.0%) is subdued after Swiss competition watchdog opened a probe into the Co. amid suspected abuse of market position within the broadband sector.

Top European News

- German Businesses Signal Optimism Recovery Is on Track; Germany Closes In on Agreement to Extend Job-Preserving Aid

- Credit Suisse to Cut Branches, Staff by Merging Swiss Unit

- Vanishing Jobs and Empty Offices Plague Britain’s Retailers

- Italy Clashes With Ex- Monopoly Over Future of Phone Network

In FX, as the DXY hovers just above the 93.000 level within a confined 93.012-351 band, major Dollar counterparts are also sitting close to big figures awaiting firm breaks or clearer direction, like the Euro in wake of an encouraging German Ifo survey on balance. To recap, 2 out of the 3 metrics exceeded expectations, but the more forward looking outlook reading missed consensus remains the institute was reserved in describing the economic recovery as fragile. Hence, Eur/Usd was toppy ahead of yesterday’s peak and hefty option expiry interest close by at 1.1850 in 1 bn. Meanwhile, Cable continues to pivot 1.3100 ahead of CBI trades and amidst the ongoing threat of Britain leaving transition without a Brexit trade deal, and the Franc is still tethered to 0.9100 after a dip in Swiss Q2 payrolls was largely nullified by an upward revision to the previous quarter. However, the Yen has retreated through 106.00 and into a lower range on a loss of safe-haven premium and with US Treasury yields backing up before this week’s auctions amidst curve re-steepening.

- NZD/AUD/CAD - The Kiwi is holding above 0.6500 in advance of NZ trade data and the Aussie has gleaned more indirect support from another firm PBoC CNY fix that in turn has given the CNH fresh impetus to test 6.9000 vs the Greenback. Aud/Usd is meandering between 0.7152-82 following mixed independent impulses overnight via an improvement in ANZ weekly consumer confidence in contrast to labour data revealing a 1% decline in jobs for the month to August 8 and 2.8% drop in the state of Victoria for a national fall of 4.9% relative to mid-March (pre-pandemic or the ‘first’ wave as such). Conversely, the Loonie is licking wounds beneath 1.3200 and detached from choppy oil prices following Canada’s appeal to the WTO against US soft lumber levies.

- SCANDI/EM - Marginal Nok outperformance even though Norwegian GDP was a bit weaker than forecast in Q2, but the Try has not derived much traction on the back of a rise in Turkish manufacturing sentiment and the Rub is not tracking the firm tone in Brent against the backdrop of ongoing geopolitical/diplomatic tensions that are also weighing on the Lira.

In commodities, WTI and Brent front month futures remain relatively flat in early European trade, with the benchmark only some USD 0.2-0.3/bbl off overnight lows. Traders are keeping a keen eye on the developments in the Gulf of Mexico as Tropical Storm Laura is forecast to evolve into a major hurricane before making landfall late-Wednesday, whilst Marco was downgraded to a Tropical Depression. On that front, the latest update from the Search Results Bureau of Safety and Environmental Enforcement (BSEE) estimates around 82.4% of current oil production shuttered – with the next release scheduled for 1400ET/1900BST. WTI Oct resides around USD 42.50/bbl (vs. low ~42.30/bbl), whilst its Brent counterpart trades around USD 45.25/bbl (vs. low USD 45.08/bbl). Traders will now be eyeing the weekly release of the Private Inventories in the absence of macro headlines – albeit price action could be muted as hurricane developments are timelier. Elsewhere, spot gold trades choppy within a tight range on either side of USD 1930/oz whilst spot silver sees similar action around 26.50/oz – both moving in tandem with the Buck ahead of Fed Chair Powell’s speech on Thursday. In terms of base metals, Dalian iron ore prices fell some 3.5% whilst Shanghai steel rebar edged lower as downstream demand recovery missed market forecasts. Conversely, Shanghai nickel prices rose almost 2% at one point amid dwindling Chinese port inventories.

US Event Calendar

- 9am: FHFA House Price Index MoM, est. 0.3%, prior -0.3%; House Price Purchase Index QoQ, prior 1.7%

- 9am: S&P CoreLogic CS 20-City MoM SA, est. 0.1%, prior 0.04%; YoY NSA, est. 3.6%, prior 3.69%

- 10am: Conf. Board Consumer Confidence, est. 93, prior 92.6; Present Situation, prior 94.2; Expectations, prior 91.5

- 10am: New Home Sales, est. 790,000, prior 776,000; MoM, est. 1.8%, prior 13.8%

- 10am: Richmond Fed Manufact. Index, est. 10, prior 10

DB's Jim Reid, freshly back from vacation, concludes the overnight wrap

If you’d have told me at the start of the year that at the end of August I’d be quarantining with my family and not allowed to leave the perimeter of my garden then I’d have been extremely worried and assumed that one of my children had dug up the bubonic plague. Thankfully it’s less worrisome than that and instead because I was on holiday in the French Alps and new travel rules now apply back to the U.K from France. Ironically the French Alps have hardly seen new cases rise even if they have in say Paris and parts of the South of France. So if you’d have got back two days before me from Paris you wouldn’t have to quarantine but I do from the Alps. We still had to cut our holiday short by a week to ensure the children didn’t miss their first days at school next week. Elite athletes are exempt from these rules but after trying to show the customs officer at the Channel Tunnel my golf swing I wasn’t given special dispensation.

So we’ve been looking after three young terrors at home over the last week and it’s been painful with nothing to do or nowhere to go. Bronte also doesn’t understand why she doesn’t get walked. All first world problems admittedly but I really don’t understand those that say the best thing about Covid is that you get to spend more time with your family. I love them all dearly but an hour or two a day is ideal (that doesn’t include my wife by the way).

So I actually mean it when I say it’s good to be back in my home office mentally and physically quarantining from the kids. Over the holiday I’ve been thinking a lot about the virus and the way forward and I continue to scratch my head about the end game. Within the next few weeks we should know much more about the state of play with regards to the leaders in the vaccine race (supportive news yesterday for the AstraZeneca/Oxford Uni version as we’ll see below). That’s probably going to be the most important newsflow of the next month or so. We’re trying to collate as much info as possible on the current state of play with vaccines and will try to put out a piece next week on where we are at. Obviously if a vaccine gets approved in the coming weeks then we’ll likely have a realistic end game within months as I’m sure we’ll go into mass production very quickly.

However without a vaccine it feels like global strategies are very difficult to decipher. When lockdowns started back in March the main rational was to ensure health services did not get overrun. Five months on, the number of Covid cases in hospitals are relatively low in many areas and yet many countries seem to be trying to keep cases as low as possible as a badge of honour and the world has got so scared that such a strategy seems to meet high approval. Countries that are seeing cases rise are looked at with great suspicion even if hospitalisations are still relatively low. However is such suppression a sustainable strategy? Given this is happening in the northern hemisphere summer I can’t help wondering where we’ll be in two or three months time and what the reaction will be from the authorities.

The good news is that there continues to be plenty of evidence that those catching the virus seem to be from younger, less vulnerable cohorts and this seems to be contributing to a lower and lower case fatality rate across the globe alongside better treatment and possibly the virus mutating. To be fair listening to politicians the bar to renewed full lockdowns seems to be high around the world, but equally the bar to getting to anything resembling normality also seems very high. So we are in Covid limbo until a vaccine or a yet unidentified master plan materialises. All ahead of a northern hemisphere autumn and winter when life will naturally move more indoors.

To be fair all of this continues to be a passing curiosity to the US equity market which continues to hit new highs even if the breadth of the winners has narrowed further in recent weeks. Yesterday showed some signs of rotation and catch up from the laggards though, which helped push the S&P 500 up a further +1.00%, having already risen for 7 of the last 8 weeks. The move took the index to another record high and puts it +6.03% on a YTD basis. The airline industry led the S&P yesterday, gaining +8.23% as optimism on a possible vaccine buoyed the beaten down industry higher. In fact American Airlines (+10.53%), Carnival (+10.17%), United (+9.93%), Delta (+9.28%) and Norwegian Cruise Line (+7.58%) were five of the seven best performing stocks in the index. Elsewhere, tech stocks underperformed as there was some rotation out of biotechs (-0.47%) in particular. The Nasdaq closed +0.60% higher yesterday (also to a new record) with the tech-dominated index now standing at an astonishing +26.83% higher YTD.

On the vaccine news, AstraZeneca shares were up +2.06% following the FT report that the Trump administration could bypass normal regulatory standards for the Oxford vaccine. As the election approaches it seems inevitable that Mr Trump will want to encourage as much positivity on the virus as is in his power. So one to watch.

Oil prices were buoyant as well yesterday, with Brent crude up +1.76% to $45.13/bbl in a move that wiped out all of last week’s declines and helped energy stocks lead the equity advance on both sides of the Atlantic. Over in Europe, equities saw even bigger moves higher, with the STOXX 600 up +1.58% and the DAX up +2.36%.

The rotation into risk assets saw sovereign bonds lose ground somewhat yesterday, and yields on 10yr Treasuries were up +2.6bps by the close. With market participants awaiting Fed Chair Powell’s speech at Jackson Hole for any policy hints, our global head of rates research Francis Yared wrote a blog post yesterday (link here) in which he says that a lot of the expected dovishness is already priced into markets. As a result, only a material upsizing in QE should have a material market impact. There was a similar pattern for European rates too yesterday, where yields on 10yr bunds (+1.6bps), OATs (+0.9bps) and gilts (+0.7bps) all rose. And in line with this retreat from safe assets, gold extended its falls from the previous week with a further -0.60% decline. It’s now -6.53% off its highs 3 weeks ago.

Overnight the key news has been that the US and China’s top trade negotiators discussed the Phase 1 trade deal last night and the US concluded that both sides saw progress and are committed to its success. The US statement said that “The parties also discussed the significant increases in purchases of US products by China as well as future actions needed to implement the agreement,” while adding that China has made progress on other commitments like taking steps to ensure greater protection for intellectual property rights and removing impediments to American companies in the areas of financial services.

Asian markets are mostly positive this morning outside of China and HK which are seeing the Hang Seng (-0.53%) and Shanghai Comp (-0.19%) both down. The Nikkei (+1.84%), Kospi (+1.44%) and Asx (+0.42%) are up though alongside futures on the S&P 500 (+0.46%). Elsewhere, gold and silver prices are also up +0.39% and +0.49% and in agriculture commodities, CBT soybeans and corn future prices are up +1.10% and +1.52% respectively.

On the coronavirus and as alluded to at the top, countries around the world continue to re-implement restrictions at the first uptick in cases. Zurich has announced new limits on social gatherings of up to 100 unless masks are worn and have mandated that masks must be worn within shops. This followed news that the Netherlands have issued 10-day quarantine measures on all travelers from Spain, as well as the majority of travelers from France. This comes as Spain posted four month highs in cases last week. In what may be a harbinger for the colder month’s ahead, Germany is planning to stop testing people returning from hotspots, citing a lack of testing capacity for the virus. Those travelers will still have to undergo quarantine measures and will have to get tested themselves in order to exit their quarantine early. These measures weighed on the STOXX 600 Travel and Leisure stocks (-0.09%), which did not see the same performance as their American counterparts on the upbeat vaccine news.

We did get further signs of stabilisation in new cases in the United States though, with Florida reporting the lowest number of new cases since mid-June yesterday, while New York state saw their infection rate fall to 0.66%, the lowest since the beginning of the pandemic. In a sign of further normalization following the recent uptick in cases, Apple announced plans to reopen some of the over 120 stores that they had reclosed during the summer outbreak. This could happen as soon as the end of this month. Across the other side of world, Singapore has identified a total of 58 cases in the country’s largest foreign workers dormitory which houses c. 16,000 people and as a precaution has placed another 4,800 workers from the same dormitory on stay-home notices. Meanwhile, South Korea added a further 280 cases in the past 24 hours up from 266 a day earlier and also ordered kindergarten, elementary, middle and high schools in the greater Seoul area to shift to online classes from partial attendance. Elsewhere, Qantas Airways said overnight that it will cut an additional 2,500 jobs due to the COVID impact on top of the earlier announced plans to eliminate 6,000 jobs or 20% of the workforce.

To the day ahead now, and data highlights from Germany include the Ifo business climate indicator for August along with the final reading of Q2’s GDP. Meanwhile in the US, we’ll get the FHFA house price index for June, new home sales or July, as well as the Conference Board’s consumer confidence reading and the Richmond Fed manufacturing index for August. Otherwise, San Francisco Fed President Daly will be speaking, and earnings releases include Salesforce, Medtronic, Intuit and Autodesk.

International

‘Excess Mortality Skyrocketed’: Tucker Carlson and Dr. Pierre Kory Unpack ‘Criminal’ COVID Response

‘Excess Mortality Skyrocketed’: Tucker Carlson and Dr. Pierre Kory Unpack ‘Criminal’ COVID Response

As the global pandemic unfolded, government-funded…

As the global pandemic unfolded, government-funded experimental vaccines were hastily developed for a virus which primarily killed the old and fat (and those with other obvious comorbidities), and an aggressive, global campaign to coerce billions into injecting them ensued.

Then there were the lockdowns - with some countries (New Zealand, for example) building internment camps for those who tested positive for Covid-19, and others such as China welding entire apartment buildings shut to trap people inside.

It was an egregious and unnecessary response to a virus that, while highly virulent, was survivable by the vast majority of the general population.

Oh, and the vaccines, which governments are still pushing, didn't work as advertised to the point where health officials changed the definition of "vaccine" multiple times.

Tucker Carlson recently sat down with Dr. Pierre Kory, a critical care specialist and vocal critic of vaccines. The two had a wide-ranging discussion, which included vaccine safety and efficacy, excess mortality, demographic impacts of the virus, big pharma, and the professional price Kory has paid for speaking out.

Keep reading below, or if you have roughly 50 minutes, watch it in its entirety for free on X:

Ep. 81 They’re still claiming the Covid vax is safe and effective. Yet somehow Dr. Pierre Kory treats hundreds of patients who’ve been badly injured by it. Why is no one in the public health establishment paying attention? pic.twitter.com/IekW4Brhoy

— Tucker Carlson (@TuckerCarlson) March 13, 2024

"Do we have any real sense of what the cost, the physical cost to the country and world has been of those vaccines?" Carlson asked, kicking off the interview.

"I do think we have some understanding of the cost. I mean, I think, you know, you're aware of the work of of Ed Dowd, who's put together a team and looked, analytically at a lot of the epidemiologic data," Kory replied. "I mean, time with that vaccination rollout is when all of the numbers started going sideways, the excess mortality started to skyrocket."

When asked "what kind of death toll are we looking at?", Kory responded "...in 2023 alone, in the first nine months, we had what's called an excess mortality of 158,000 Americans," adding "But this is in 2023. I mean, we've had Omicron now for two years, which is a mild variant. Not that many go to the hospital."

'Safe and Effective'

Tucker also asked Kory why the people who claimed the vaccine were "safe and effective" aren't being held criminally liable for abetting the "killing of all these Americans," to which Kory replied: "It’s my kind of belief, looking back, that [safe and effective] was a predetermined conclusion. There was no data to support that, but it was agreed upon that it would be presented as safe and effective."

Tucker Carlson Asks the Forbidden Question

— The Vigilant Fox ???? (@VigilantFox) March 14, 2024

He wants to know why the people who made the claim “safe and effective” aren’t being held to criminal liability for abetting the “killing of all these Americans.”

DR. PIERRE KORY: “It’s my kind of belief, looking back, that [safe and… pic.twitter.com/Icnge18Rtz

Carlson and Kory then discussed the different segments of the population that experienced vaccine side effects, with Kory noting an "explosion in dying in the youngest and healthiest sectors of society," adding "And why did the employed fare far worse than those that weren't? And this particularly white collar, white collar, more than gray collar, more than blue collar."

Kory also said that Big Pharma is 'terrified' of Vitamin D because it "threatens the disease model." As journalist The Vigilant Fox notes on X, "Vitamin D showed about a 60% effectiveness against the incidence of COVID-19 in randomized control trials," and "showed about 40-50% effectiveness in reducing the incidence of COVID-19 in observational studies."

Dr. Pierre Kory: Big Pharma is ‘TERRIFIED’ of Vitamin D

— The Vigilant Fox ???? (@VigilantFox) March 14, 2024

Why?

Because “It threatens the DISEASE MODEL.”

A new meta-analysis out of Italy, published in the journal, Nutrients, has unearthed some shocking data about Vitamin D.

Looking at data from 16 different studies and 1.26… pic.twitter.com/q5CsMqgVju

Professional costs

Kory - while risking professional suicide by speaking out, has undoubtedly helped save countless lives by advocating for alternate treatments such as Ivermectin.

Kory shared his own experiences of job loss and censorship, highlighting the challenges of advocating for a more nuanced understanding of vaccine safety in an environment often resistant to dissenting voices.

"I wrote a book called The War on Ivermectin and the the genesis of that book," he said, adding "Not only is my expertise on Ivermectin and my vast clinical experience, but and I tell the story before, but I got an email, during this journey from a guy named William B Grant, who's a professor out in California, and he wrote to me this email just one day, my life was going totally sideways because our protocols focused on Ivermectin. I was using a lot in my practice, as were tens of thousands of doctors around the world, to really good benefits. And I was getting attacked, hit jobs in the media, and he wrote me this email on and he said, Dear Dr. Kory, what they're doing to Ivermectin, they've been doing to vitamin D for decades..."

"And it's got five tactics. And these are the five tactics that all industries employ when science emerges, that's inconvenient to their interests. And so I'm just going to give you an example. Ivermectin science was extremely inconvenient to the interests of the pharmaceutical industrial complex. I mean, it threatened the vaccine campaign. It threatened vaccine hesitancy, which was public enemy number one. We know that, that everything, all the propaganda censorship was literally going after something called vaccine hesitancy."

Money makes the world go 'round

Carlson then hit on perhaps the most devious aspect of the relationship between drug companies and the medical establishment, and how special interests completely taint science to the point where public distrust of institutions has spiked in recent years.

"I think all of it starts at the level the medical journals," said Kory. "Because once you have something established in the medical journals as a, let's say, a proven fact or a generally accepted consensus, consensus comes out of the journals."

"I have dozens of rejection letters from investigators around the world who did good trials on ivermectin, tried to publish it. No thank you, no thank you, no thank you. And then the ones that do get in all purportedly prove that ivermectin didn't work," Kory continued.

"So and then when you look at the ones that actually got in and this is where like probably my biggest estrangement and why I don't recognize science and don't trust it anymore, is the trials that flew to publication in the top journals in the world were so brazenly manipulated and corrupted in the design and conduct in, many of us wrote about it. But they flew to publication, and then every time they were published, you saw these huge PR campaigns in the media. New York Times, Boston Globe, L.A. times, ivermectin doesn't work. Latest high quality, rigorous study says. I'm sitting here in my office watching these lies just ripple throughout the media sphere based on fraudulent studies published in the top journals. And that's that's that has changed. Now that's why I say I'm estranged and I don't know what to trust anymore."

Vaccine Injuries

Carlson asked Kory about his clinical experience with vaccine injuries.

"So how this is how I divide, this is just kind of my perception of vaccine injury is that when I use the term vaccine injury, I'm usually referring to what I call a single organ problem, like pericarditis, myocarditis, stroke, something like that. An autoimmune disease," he replied.

"What I specialize in my practice, is I treat patients with what we call a long Covid long vaxx. It's the same disease, just different triggers, right? One is triggered by Covid, the other one is triggered by the spike protein from the vaccine. Much more common is long vax. The only real differences between the two conditions is that the vaccinated are, on average, sicker and more disabled than the long Covids, with some pretty prominent exceptions to that."

Watch the entire interview above, and you can support Tucker Carlson's endeavors by joining the Tucker Carlson Network here...

International

Shakira’s net worth

After 12 albums, a tax evasion case, and now a towering bronze idol sculpted in her image, how much is Shakira worth more than 4 decades into her care…

Shakira’s considerable net worth is no surprise, given her massive popularity in Latin America, the U.S., and elsewhere.

In fact, the belly-dancing contralto queen is the second-wealthiest Latin-America-born pop singer of all time after Gloria Estefan. (Interestingly, Estefan actually helped a young Shakira translate her breakout album “Laundry Service” into English, hugely propelling her stateside success.)

Since releasing her first record at age 13, Shakira has spent decades recording albums in both Spanish and English and performing all over the world. Over the course of her 40+ year career, she helped thrust Latin pop music into the American mainstream, paving the way for the subsequent success of massively popular modern acts like Karol G and Bad Bunny.

In December 2023, a 21-foot-tall beachside bronze statue of the “Hips Don’t Lie” singer was unveiled in her Colombian hometown of Barranquilla, making her a permanent fixture in the city’s skyline and cementing her legacy as one of Latin America’s most influential entertainers.

After 12 albums, a plethora of film and television appearances, a highly publicized tax evasion case, and now a towering bronze idol sculpted in her image, how much is Shakira worth? What does her income look like? And how does she spend her money?

How much is Shakira worth?

In late 2023, Spanish sports and lifestyle publication Marca reported Shakira’s net worth at $400 million, citing Forbes as the figure’s source (although Forbes’ profile page for Shakira does not list a net worth — and didn’t when that article was published).

Most other sources list the singer’s wealth at an estimated $300 million, and almost all of these point to Celebrity Net Worth — a popular but dubious celebrity wealth estimation site — as the source for the figure.

A $300 million net worth would make Shakira the third-richest Latina pop star after Gloria Estefan ($500 million) and Jennifer Lopez ($400 million), and the second-richest Latin-America-born pop singer after Estefan (JLo is Puerto Rican but was born in New York).

Shakira’s income: How much does she make annually?

Entertainers like Shakira don’t have predictable paychecks like ordinary salaried professionals. Instead, annual take-home earnings vary quite a bit depending on each year’s album sales, royalties, film and television appearances, streaming revenue, and other sources of income. As one might expect, Shakira’s earnings have fluctuated quite a bit over the years.

From June 2018 to June 2019, for instance, Shakira was the 10th highest-earning female musician, grossing $35 million, according to Forbes. This wasn’t her first time gracing the top 10, though — back in 2012, she also landed the #10 spot, bringing in $20 million, according to Billboard.

In 2023, Billboard listed Shakira as the 16th-highest-grossing Latin artist of all time.

How much does Shakira make from her concerts and tours?

A large part of Shakira’s wealth comes from her world tours, during which she sometimes sells out massive stadiums and arenas full of passionate fans eager to see her dance and sing live.

According to a 2020 report by Pollstar, she sold over 2.7 million tickets across 190 shows that grossed over $189 million between 2000 and 2020. This landed her the 19th spot on a list of female musicians ranked by touring revenue during that period. In 2023, Billboard reported a more modest touring revenue figure of $108.1 million across 120 shows.

In 2003, Shakira reportedly generated over $4 million from a single show on Valentine’s Day at Foro Sol in Mexico City. 15 years later, in 2018, Shakira grossed around $76.5 million from her El Dorado World Tour, according to Touring Data.

Related: RuPaul's net worth: Everything to know about the cultural icon and force behind 'Drag Race'

How much has Shakira made from her album sales?

According to a 2023 profile in Variety, Shakira has sold over 100 million records throughout her career. “Laundry Service,” the pop icon’s fifth studio album, was her most successful, selling over 13 million copies worldwide, according to TheRichest.

Exactly how much money Shakira has taken home from her album sales is unclear, but in 2008, it was widely reported that she signed a 10-year contract with LiveNation to the tune of between $70 and $100 million to release her subsequent albums and manage her tours.

How much did Shakira make from her Super Bowl and World Cup performances?

Shakira co-wrote one of her biggest hits, “Waka Waka (This Time for Africa),” after FIFA selected her to create the official anthem for the 2010 World Cup in South Africa. She performed the song, along with several of her existing fan-favorite tracks, during the event’s opening ceremonies. TheThings reported in 2023 that the song generated $1.4 million in revenue, citing Popnable for the figure.

A decade later, 2020’s Superbowl halftime show featured Shakira and Jennifer Lopez as co-headliners with guest performances by Bad Bunny and J Balvin. The 14-minute performance was widely praised as a high-energy celebration of Latin music and dance, but as is typical for Super Bowl shows, neither Shakira nor JLo was compensated beyond expenses and production costs.

The exposure value that comes with performing in the Super Bowl Halftime Show, though, is significant. It is typically the most-watched television event in the U.S. each year, and in 2020, a 30-second Super Bowl ad spot cost between $5 and $6 million.

How much did Shakira make as a coach on “The Voice?”

Shakira served as a team coach on the popular singing competition program “The Voice” during the show’s fourth and sixth seasons. On the show, celebrity musicians coach up-and-coming amateurs in a team-based competition that eventually results in a single winner. In 2012, The Hollywood Reporter wrote that Shakira’s salary as a coach on “The Voice” was $12 million.

Related: John Cena's net worth: The wrestler-turned-actor's investments, businesses, and more

How does Shakira spend her money?

Shakira doesn’t just make a lot of money — she spends it, too. Like many wealthy entertainers, she’s purchased her share of luxuries, but Barranquilla’s barefoot belly dancer is also a prolific philanthropist, having donated tens of millions to charitable causes throughout her career.

Private island

Back in 2006, she teamed up with Roger Waters of Pink Floyd fame and Spanish singer Alejandro Sanz to purchase Bonds Cay, a 550-acre island in the Bahamas, which was listed for $16 million at the time.

Along with her two partners in the purchase, Shakira planned to develop the island to feature housing, hotels, and an artists’ retreat designed to host a revolving cast of artists-in-residence. This plan didn’t come to fruition, though, and as of this article’s last update, the island was once again for sale on Vladi Private Islands.

Real estate and vehicles

Like most wealthy celebs, Shakira’s portfolio of high-end playthings also features an array of luxury properties and vehicles, including a home in Barcelona, a villa in Cyprus, a Miami mansion, and a rotating cast of Mercedes-Benz vehicles.

Philanthropy and charity

Shakira doesn’t just spend her massive wealth on herself; the “Queen of Latin Music” is also a dedicated philanthropist and regularly donates portions of her earnings to the Fundación Pies Descalzos, or “Barefoot Foundation,” a charity she founded in 1997 to “improve the education and social development of children in Colombia, which has suffered decades of conflict.” The foundation focuses on providing meals for children and building and improving educational infrastructure in Shakira’s hometown of Barranquilla as well as four other Colombian communities.

In addition to her efforts with the Fundación Pies Descalzos, Shakira has made a number of other notable donations over the years. In 2007, she diverted a whopping $40 million of her wealth to help rebuild community infrastructure in Peru and Nicaragua in the wake of a devastating 8.0 magnitude earthquake. Later, during the COVID-19 pandemic in 2020, Shakira donated a large supply of N95 masks for healthcare workers and ventilators for hospital patients to her hometown of Barranquilla.

Back in 2010, the UN honored Shakira with a medal to recognize her dedication to social justice, at which time the Director General of the International Labour Organization described her as a “true ambassador for children and young people.”

Shakira’s tax fraud scandal: How much did she pay?

In 2018, prosecutors in Spain initiated a tax evasion case against Shakira, alleging she lived primarily in Spain from 2012 to 2014 and therefore failed to pay around $14.4 million in taxes to the Spanish government. Spanish law requires anyone who is “domiciled” (i.e., living primarily) in Spain for more than half of the year to pay income taxes.

During the period in question, Shakira listed the Bahamas as her primary residence but did spend some time in Spain, as she was dating Gerard Piqué, a professional footballer and Spanish citizen. The couple’s first son, Milan, was also born in Barcelona during this period.

Shakira maintained that she spent far fewer than 183 days per year in Spain during each of the years in question. In an interview with Elle Magazine, the pop star opined that “Spanish tax authorities saw that I was dating a Spanish citizen and started to salivate. It's clear they wanted to go after that money no matter what."

Prosecutors in the case sought a fine of almost $26 million and a possible eight-year prison stint, but in November of 2023, Shakira took a deal to close the case, accepting a fine of around $8 million and a three-year suspended sentence to avoid going to trial. In reference to her decision to take the deal, Shakira stated, "While I was determined to defend my innocence in a trial that my lawyers were confident would have ruled in my favour [had the trial proceeded], I have made the decision to finally resolve this matter with the best interest of my kids at heart who do not want to see their mom sacrifice her personal well-being in this fight."

How much did the Shakira statue in Barranquilla cost?

In late 2023, a 21-foot-tall bronze likeness of Shakira was unveiled on a waterfront promenade in Barranquilla. The city’s then-mayor, Jaime Pumarejo, commissioned Colombian sculptor Yino Márquez to create the statue of the city’s treasured pop icon, along with a sculpture of the city’s coat of arms.

According to the New York Times, the two sculptures cost the city the equivalent of around $180,000. A plaque at the statue’s base reads, “A heart that composes, hips that don’t lie, an unmatched talent, a voice that moves the masses and bare feet that march for the good of children and humanity.”

Related: Taylor Swift net worth: The most successful entertainer joins the billionaire's club

bonds pandemic covid-19 real estate africa mexico spainInternational

Delta Air Lines adds a new route travelers have been asking for

The new Delta seasonal flight to the popular destination will run daily on a Boeing 767-300.

Those who have tried to book a flight from North America to Europe in the summer of 2023 know just how high travel demand to the continent has spiked.

At 2.93 billion, visitors to the countries making up the European Union had finally reached pre-pandemic levels last year while North Americans in particular were booking trips to both large metropolises such as Paris and Milan as well as smaller cities growing increasingly popular among tourists.

Related: A popular European city is introducing the highest 'tourist tax' yet

As a result, U.S.-based airlines have been re-evaluating their networks to add more direct routes to smaller European destinations that most travelers would have previously needed to reach by train or transfer flight with a local airline.

Shutterstock

Delta Air Lines: ‘Glad to offer customers increased choice…’

By the end of March, Delta Air Lines (DAL) will be restarting its route between New York’s JFK and Marco Polo International Airport in Venice as well as launching two new flights to Venice from Atlanta. One will start running this month while the other will be added during peak demand in the summer.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

“As one of the most beautiful cities in the world, Venice is hugely popular with U.S. travelers, and our flights bring valuable tourism and trade opportunities to the city and the region as well as unrivalled opportunities for Venetians looking to explore destinations across the Americas,” Delta’s SVP for Europe Matteo Curcio said in a statement. “We’re glad to offer customers increased choice this summer with flights from New York and additional service from Atlanta.”

The JFK-Venice flight will run on a Boeing 767-300 (BA) and have 216 seats including higher classes such as Delta One, Delta Premium Select and Delta Comfort Plus.

Delta offers these features on the new flight

Both the New York and Atlanta flights are seasonal routes that will be pulled out of service in October. Both will run daily while the first route will depart New York at 8:55 p.m. and arrive in Venice at 10:15 a.m. local time on the way there, while leaving Venice at 12:15 p.m. to arrive at JFK at 5:05 p.m. on the way back.

According to Delta, this will bring its service to 17 flights from different U.S. cities to Venice during the peak summer period. As with most Delta flights at this point, passengers in all fare classes will have access to free Wi-Fi during the flight.

Those flying in Delta’s highest class or with access through airline status or a credit card will also be able to use the new Delta lounge that is part of the airline’s $12 billion terminal renovation and is slated to open to travelers in the coming months. The space will take up more than 40,000 square feet and have an outdoor terrace.

“Delta One customers can stretch out in a lie-flat seat and enjoy premium amenities like plush bedding made from recycled plastic bottles, more beverage options, and a seasonal chef-curated four-course meal,” Delta said of the new route. “[…] All customers can enjoy a wide selection of in-flight entertainment options and stay connected with Wi-Fi and enjoy free mobile messaging.”

stocks pandemic european europe-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges