Government

Futures, Global Stocks Rise As China Property Rescue Kicks In; US Markets Closed For Labor Day

Futures, Global Stocks Rise As China Property Rescue Kicks In; US Markets Closed For Labor Day

US index futures and global equity markets…

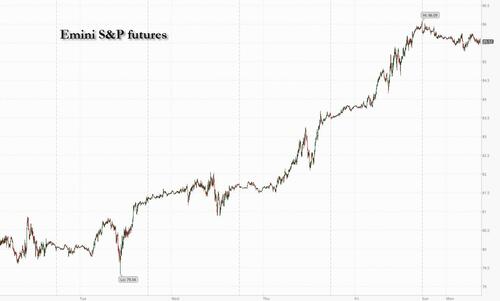

US index futures and global equity markets rose on Monday in razor-thin holiday trading with sentiment boosted by the latest Chinese property stimulus measures coupled by wagers that global interest rates are approaching a peak. As of 8:30am, futures contracts for both S&P 500 and Nasdaq 100 gained about 0.2% as stock markets in Asia and Europe rallied. US cash markets are today closed for the Labor day weekend. Cash bonds are also closed for trading with Treasury futures slightly lower on the session, while the dollar index dipped offsetting a gain in the Chinese yuan. Oil traded at 2023 highs of $85.50.

Stocks rose on Friday after the August jobs report showed a rapidly cooling labor market, offering the Fed room to pause rate increases this month. Markets built on those gains after news of a weekend surge in home sales in two of China’s biggest cities, an early sign that government efforts to cushion a record housing slowdown is helping.

Shanghai and Beijing are seen benefiting the most from authorities’ announcement on Thursday that lowered down-payment thresholds across the nation. The Hang Seng index jumped more than 3% Monday before paring gains, while a Bloomberg gauge of Chinese developers jumped as much as 8.7%.

China’s National Development and Reform Commission will set up a new bureau to oversee the development of the private economy in the latest boost to the sector.

“The incoming data supports our view of a ‘softish’ landing for the US economy, i.e., inflation moving closer to the Federal Reserve’s target without a recession this year,” said UBS Global Wealth Management Chief Investment Officer Mark Haefele. “But remaining uncertainties are likely to keep investors guessing the Fed’s next move and keep market price action choppy.” According to the latest Bloomberg Markets Live Pulse survey, this year’s rally is strong enough to withstand another leg higher for bond yields. Central banks in Australia and Canada are expected to keep interest rates unchanged this week.

Commenting on China, Haefele said that “we have been looking for more significant property rescue measures for some time to shore up sentiment and consumer confidence. This now appears to be materializing in a more convincing way.”

European stocks rose after a broadly positive session in Asia where the latest support measures from the Chinese government underpinned sentiment. Risk assets are also benefiting from a growing expectation that the Fed is done raising rates. The Stoxx 600 is up 0.8%, led by gains in the mining, technology and travel sectors. Here are the most notable European movers:

- CD Projekt shares jump as much as 7.2% after Qontigo index provider added the Polish computer and video game maker to the Stoxx Europe 600 benchmark from Sept. 18

- Novo Nordisk rises as much as 2.3% to another record high on the back of the immense success of its weight-loss drugs, increasing its valuation gap over LVMH as Europe’s most valuable listed firm

- Almirall shares gain as much as 4.8%, the most since February, after the Spanish pharmaceutical company said it has executed acquisition rights for an Alzheimer’s disease product in Spain

- Handelsbanken gains as much as 3%, the most since June, after Swedish business daily Dagens Industri named the Swedish lender its stock of the week, recommending its readers to buy the stock

- Zealand Pharma rises as much 6.5% after Nordea boosted its price target for the pharmaceutical firm, seeing it as a good alternative to benefit from the booming obesity treatment market

- Ashtead Technology gains as much as 6.1% after the subsea equipment rental, advanced technologies and solutions provider delivered what Liberum calls “a typically strong set of results”

- Thales shares gain as much as 2.6% after Jefferies raised to buy from hold, saying the French defense company’s acquisitions will provide momentum for the stock

- Vestas shares dip after BofA cut the wind turbine maker’s PT to reflect lower 2025 offshore expectations, projecting this will put some pressure on margin recovery in the coming years

- Monte dei Paschi declines 3% as Italy’s governing coalition is fighting over plans to sell state-owned assets, including a stake in the lender; Equita sees an overhang risk if the government sells a stake

- Advanced Medical Solutions falls as much as 34%, the most on record, after removing expectations of royalty income from a licensee partner and said de-stocking processes are taking longer than expected

- SynAct Pharma falls as much as 82% after the Swedish biotechnology firm’s rheumatoid arthritis drug resomelagon failed to meet the main goal of a mid-stage clinical trial

Earlier in the session, Asian stocks headed for their best day in a week, boosted by a rally in Hong Kong-listed Chinese shares after authorities rolled out more stimulus measures to revive the property sector. The MSCI Asia Pacific Index rose as much as 1.1%, advancing for a sixth session, aided by gains in Tencent and Alibaba. The Hang Seng China Enterprises Index was the best performing gauge in early trade, lifted by property shares. In Japan, equities already at the highest level since 1990 continued to gain, boosted by Toyota after Mizuho raised its price target of the world’s No. 1 carmaker.

- The Hang Seng and Shanghai Comp were the biggest gainers amid optimism in the property sector after recent reports of measures to support the industry and with shares in developer Country Garden Holdings surging by a double-digit percentage after it made a payment on a ringgit-denominated bond and won approval to extend its onshore private bond maturity by three years, while President Xi had also pledged to widen market access for the service industry and promote cross-border service trade. Lowered mortgage requirements and data over the weekend showed sales jumped, following Friday’s typhoon induced market closure. The CSI 300 Index gained as much as 1.7%.

- Australia's ASX 200 was positive with the resources sector underpinned after Albemarle sweetened its offer for Liontown Resources although further advances in the index were limited by soft data and ahead of tomorrow’s RBA meeting.

- Japan's Nikkei 225 gained as automakers were boosted by higher US sales updates and with Japan’s government to set aside around JPY 20bln to support fishery businesses following China’s import ban on Japanese marine products.

- Indian stocks gained for the second straight session, in-line with regional peers, as technology and metal companies rallied.

- The S&P BSE Sensex rose 0.4% to 65,628.14 in Mumbai, while the NSE Nifty 50 Index advanced 0.5% to 19,528.80. The MSCI Asia Pacific Index rose 1.1% for the day. Metal stocks climbed on optimism that China’s measures to aide its property sector will boost outlook for commodity prices. A sub-gauge of metal stocks on the BSE closed at its highest level since April 2022, rising 2.7%.

In FX, the Bloomberg Dollar Spot Index fell as much as 0.18% after rising for seven straight weeks, its longest such streak since 2018.

In rates, Treasury futures edged lower with no cash trading today due to the Labor Day holiday. Interest-rate swap traders see slightly less than a 50% chance of another hike by November; after that, they’ve fully priced in a quarter-point cut by June. In Europe, bond yields inched higher with rate-setters seemingly divided on whether policy needs to be tightened further this month, given above-forecast inflation and sluggish growth. Investors will also be watching speeches from a raft of Federal Reserve officials including Raphael Bostic and Susan Collins this week, after weaker payroll data prompted traders to price out a final Fed rate hike for this cycle.

In commodities, oil prices steadied at 2023 highs, with WTI crude flat around $85.6 per barrel, after climbing last week on Russia’s announcement that it will extend export curbs. Saudi Arabia is widely expected to follow suit by pushing its voluntary curbs into October.

We will preview the week's main events in more detail shortly, but here is a summary of the top events on deck:

Monday

- ECB President Christine Lagarde makes speech at seminar organized by the European Economics & Financial Center,

Tuesday

- Australia current account, rate decision

- Japan household spending

- China Caixin services PMI

- Eurozone S&P Global Eurozone Services PMI, PPI

- US factory orders

- ECB President Christine Lagarde chairs panel focused on central banks and international sanctions at ECB Legal Conference,

Wednesday

- Australia GDP

- Eurozone retail sales

- Germany factory orders

- US trade

- Canada rate decision, Wednesday

- Bank of England Governor Andrew Bailey testifies to the UK parliament’s Treasury Select Committee

- Federal Reserve issues Beige Book economic survey

- Boston Fed President Susan Collins speaks on the economy at New England Council

Thursday

- China trade, forex reserves

- Eurozone GDP

- US initial jobless claims

- Bank of Canada Governor Tiff Macklem to speak on the Economic Progress Report

- New York Fed President John Williams participates in moderated discussion at the Bloomberg Market Forum

- Atlanta Fed President Raphael Bostic speaks on economic outlook at Broward College

Friday

- Japan GDP

- France industrial production

- Germany CPI

Today's calendar, is empty, with Labor Day holiday in both ths US and Canada.

Top Overnight News from Bloomberg

- European stocks climbed, bolstered by signs China’s stimulus measures are seeping through into the economy and wagers that global interest rates are approaching a peak.

- Turkish inflation accelerated to the fastest this year, underscoring the central bank’s challenge as it raises interest rates to try to end a cost-of-living crisis.

- Chinese stocks jumped after the nation rolled out further property support measures, the latest in an intensifying campaign to rescue the beleaguered sector that’s been dragging down the economy.

- Oil steadied near the highest level since November on expectations that supply cuts by OPEC+ leaders will keep tightening the market.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher led by strength in China’s property sector although the upside was capped for some of the regional bourses amid a thinned start to the week for global markets owing to the US Labor Day holiday. ASX 200 was positive with the resources sector underpinned after Albemarle sweetened its offer for Liontown Resources although further advances in the index were limited by soft data and ahead of tomorrow’s RBA meeting. Nikkei 225 gained as automakers were boosted by higher US sales updates and with Japan’s government to set aside around JPY 20bln to support fishery businesses following China’s import ban on Japanese marine products. Hang Seng and Shanghai Comp were the biggest gainers amid optimism in the property sector after recent reports of measures to support the industry and with shares in developer Country Garden Holdings surging by a double-digit percentage after it made a payment on a ringgit-denominated bond and won approval to extend its onshore private bond maturity by three years, while President Xi had also pledged to widen market access for the service industry and promote cross-border service trade. US equity futures were uneventful and lacked direction after the post-NFP whipsawing. European equity futures are indicative of a higher open with Euro Stoxx 50 futures +0.3% after the cash market closed down 0.3% on Friday.

Asian News

- Chinese President Xi said China will widen market access for the service industry and promote cross-border service trade. Xi also stated that they will promote the integrated development of high-end manufacturing and modern service industries, as well as focus on expanding the domestic market and proactively expanding the import of high-quality services, according to Reuters.

- China state planner vice chairman said the central government approved setting up a special bureau within the NDRC for the development of the private economy, while it was separately reported that China's MIIT is to conduct inspections on reducing business burdens.

- US President Biden said he is disappointed that Chinese President Xi is not attending the G20, according to Reuters.

- Italy’s Foreign Minister said the Belt and Road Initiative deal with China did not bring the results that they had expected, according to Reuters.

- Japan’s government is to set aside around JPY 20bln to support fishery businesses following China’s import ban on Japanese marine products, according to Kyodo.

European stocks rise after a broadly positive session in Asia where the latest support measures from the Chinese government underpinned sentiment. Risk assets are also benefiting from a growing expectation that the Fed is done raising rates. The Stoxx 600 is up 0.8%, led by gains in the mining, technology and travel sectors

European news

- UK Chancellor Hunt said inflation is on track to halve by year-end and pressure on household budgets will ease as inflation cools, according to Reuters.

- EU’s Gentiloni said he was confident an agreement over re-implementing EU budget rules would be reached by year-end and the suspension of the EU Stability and Growth Pact won’t be extended into 2024, according to Reuters.

- German Finance Minister Lindner said in an interview with broadcaster ARD that there won’t be another special budget in Germany during the current legislative term.

- Italy’s Economy Minister Giorgetti confirmed the 2024 GDP growth target of 1% and said the government supports debt reduction policy, while he added that the windfall tax on banks can be improved, according to Reuters.

FX

- DXY was rangebound after last Friday's momentum waned and with US participants away for Labor Day.

- EUR/USD found some slight respite after the recent slump beneath the 1.0800 handle.

- GBP/USD attempted to nurse some of its losses but struggled with resistance at the 1.2600 level, while there were recent comments from UK Chancellor Hunt that inflation is on track to halve by year-end.

- USD/JPY traded sideways and held onto the 146.00 status in the absence of any tier-1 data releases

- Antipodeans mildly benefitted from the positive risk tone, China developer optimism and firmer CNY fixing.

- PBoC set USD/CNY mid-point at 7.1786 vs exp. 7.2795 (prev. 7.1788)

Fixed Income

- 10yr UST futures languished at post-NFP lows after bear steepening on Friday in the wake of hotter-than-expected ISM manufacturing and mixed jobs data, with demand also not helped by the closure of US markets on Monday.

- Bund futures marginally extended on recent declines further beneath the 132.00 level.

- 10yr JGB futures were subdued amid spillover selling from global peers and despite the BoJ’s presence in the market for nearly JPY 1.2tln of JGBs on top of its fixed-rate operations.

Commodities

- Crude futures were uneventful but held on to recent spoils after climbing to the highest in seven months.

- UAE’s Adnoc set October Murban crude OSP at USD 87.28/bbl which is an increase from the September OSP of USD 80.78/bbl, according to Reuters.

- Australia’s Offshore Alliance and Legeneering reached an agreement on decommissioning rates for Thevenard offshore decommissioning work scopes which will see members lock in a 20 dollars per hour uplift in the rates previously offered, while Legeneering agreed to align all offshore maintenance rates and conditions with the union-negotiated EBA for Woodside (WDS AT) FPSO’s.

- Spot gold eked marginal gains as the greenback took a breather following last Friday's advances.

- Copper futures were kept afloat amid the property sector optimism in its largest purchaser China.

Geopolitics

- Ukrainian President Zelensky said he will propose to dismiss Defence Minister Oleksii Reznikov this week and replace him with Rustem Umerov who is the chief of Ukraine’s main privatisation fund. Furthermore, Zelensky said he held talks with French President Macron and struck a deal on training Ukrainian pilots in France, according to Reuters.

- Russia launched drone strikes on Ukraine’s Odesa port region on Sunday ahead of talks on Monday between Turkish President Erdogan and Russian President Putin on restarting grain exports through the Black Sea, according to FT.

- Russian Defence Ministry said it shot down Ukrainian drones over Russia's Kursk region and destroyed four high-speed boats with Ukrainian forces in the Black Sea, according to Reuters.

- Traffic on the Crimean Bridge connecting Russia with the Crimean Peninsula was temporarily suspended on Sunday but has since resumed, while the reason for the suspension was not disclosed, according to Reuters.

- US is to send its first depleted uranium rounds to Ukraine, according to sources cited by Reuters pm Friday.

- South African President Ramaphosa said an inquiry found no evidence to support US claims that a Russian cargo ship transported weapons from South Africa destined for Russia, while he added that no permit was issued for the export of arms and no arms were exported, according to Reuters and FT.

- Chinese gate-crashers at US bases reportedly spark espionage concerns and Washington has tracked about 100 incidents involving Chinese nationals trying to access American military and other installations, according to WSJ.

US Event Calendar

- Labor Day Weekend

DB's Jim Reid concludes the overnight wrap

I thought the most difficult thing over the weekend was going to be hosting a Laser Quest party for 40 screaming kids but that was relatively easy going versus watching "Everything Everywhere All At Once". My wife and I thought it was such utter nonsense that we went to bed halfway through. 7 Oscars including best film perhaps suggest it's us and not the film but unless the second half suddenly comes to life I think an extra hour in bed was more productive. Feel free to tell me I’m wrong about it!

So due to a bad film I'm more rested than expected as we start a new week. Normally on a Monday we preview the week ahead first but it's not really a top tier week for releases (starting with a US holiday today) and last week was a fascinating one, especially on Friday with the payrolls release painting a relatively confusing picture. So we'll review that first.

The headline number came in at +187k (vs +170k expected), a slight upside surprise but with -110k of downward revisions to the prior two months. Indeed payrolls have been downgraded from their initial print for the last 7 months now (every month in 2023 and totalling 355k) and June's print which when released was +209k has been revised down twice to 'only' +105k now. So who knows what August will actually look like in a couple of months' time? Indeed, remember that payrolls went on a run of 13 successive beats until early this summer. So maybe economists weren't as wrong as they continuously appeared in real time. The big surprise in the report was a meaningful increase in the unemployment rate for August, which rose to 3.8% (vs 3.5% expected) as the household survey showed a +514k increase in the number of unemployed alongside a +222k gain in employment, which did though have a positive effect of helping to lift the labour force participation rate 0.2pp to 62.8% – the highest since just before the pandemic (63.3%). There was more confusion as although average hourly earnings growth (+0.2% vs. +0.4%) fell, hours worked ticked up a tenth to 34.4hrs, resulting in our economists' payroll proxy for nominal compensation growth actually increasing to 6.2% annualised for the current quarter and 6.1% compared to a year ago.

We've said this a lot recently but there was something for everyone in the release. The soft landing crowd will be pleased that the labour market is softening without much stress at the moment. However the hard landing argument must be buoyed by the huge downward momentum in recent months and revisions in payrolls. Any path to a hard landing, outside of a shock, has to go via signs of a soft landing first.

Adding to the conflicting data, following payrolls the ISM manufacturing print came in slightly stronger than anticipated at 47.6 (vs 47 expected). However, prices paid came in firmly above expectations at 48.4 (vs 44.0 expected), suggesting that goods disinflation is moderating.

Overall, the mixed data releases on Friday reduced expectations of another hike by the Fed, with markets now seeing the chances of a 25bps rate hike across the next two meetings at 38%, from 48% on Thursday and 63% a week earlier. Meanwhile, the chances of a September hike by the ECB are now priced at 23%, their lowest since early May and down from 55% last Wednesday. The decline mostly came after encouraging details of the euro area inflation print and less hawkish ECB commentary on Thursday.

US Treasuries initially rallied hard (10yr -5bps) off the back of the payrolls release. However, the gains were quickly erased before yields increased a bit more following the ISM print as well as after comments by Cleveland Fed President Mester emphasising that US inflation remains too high despite its recent improvements. There was a lot of chatter about the upcoming Treasury and corporate supply as well.

Oil rising would have contributed following reports of falling Saudi Arabia exports and a suggestion by Russia’s Novak that OPEC+ may announce new oil export limits over the next week. WTI oil futures reached $85.55/bl, after rising +2.30% on Friday, and +7.17% week-on-week. This marked its strongest weekly advance since March, and highest level since November last year. Brent largely followed suit, rising +4.82% week-on-week (and +1.95% on Friday) to $88.55/bbl.

The 10yr Treasury yield finished Friday up +7.1bps (+12bps from the post payroll lows) but closed the week down -5.7bps after softer data releases earlier in the week. 2yr yields rose by a modest +1.6bps on Friday but was down -19.9bps in weekly terms, its largest weekly decline since March. As a result, the 2s10s curve rose by +14.1bps week-on-week in a bull steepening move (and +5.5bps on Friday). European fixed income followed the US on Friday, with 10yr German bunds rising +8.4bps on Friday (and -1.3bps week-on-week).

The S&P 500 managed to eke out a small gain on Friday (+0.18%). This left the index up +2.50% over the week, its strongest weekly performance since mid-June. Megacap stocks underperformed on Friday as the FANG+ index slipped -0.16%, primarily driven by Tesla (-5.06%) after it cut prices in China for a second time in two weeks. In weekly terms, the FANG+ index gained +4.34%, the best weekly performance since May. Similarly, the NASDAQ was -0.02% on Friday but gained +3.25% week-on-week. Turning to Europe, the STOXX 600 climbed +1.49% week-on-week (-0.01% on Friday).

Asian equity markets are higher at the start of the week on prospects of no more interest rate hikes from the Fed coupled with expectations that the latest stimulus measures by Beijing will shore up economic growth. As I check my screens, Chinese markets are outperforming with the Hang Seng (+2.61%) leading gains after being closed on Friday due to a typhoon. They are buoyed by a big rally in Chinese property stocks (c.+8%) while the CSI (+1.48%) and the Shanghai Composite (+1.11%) are also trading sharply higher. Elsewhere, the Nikkei (+0.58%) and the KOSPI (+0.35%) are also trading in positive territory. US stock futures are flat. Meanwhile, there is no trading of USTs due to today’s US holiday.

The next round of US releases this week include factory orders (tomorrow) and more interestingly the ISM services and trade balance on Wednesday. Our US economists expect the ISM gauge to rebound to 53.9 from 52.7 in July. Consumer credit data on Friday will round out the week.

This week will be an interesting one for central banks. The RBA are expected to stay on hold tomorrow following recent softer data (Lowe's final meeting) and then the BoC will now more likely stay on hold on Wednesday following a surprising -0.2% fall in Q2 GDP on Friday against expectations of +1.2%. Later on Wednesday the Fed's Beige Book will show whether the strong start to Q3 US data is corroborated. Over in Europe, highlights include ECB's consumer expectations survey and inflation expectations tomorrow. In addition, we will see the BoE's Decision Maker Panel survey on Thursday as well as a long list of ECB speakers throughout the week, as there are with the Fed. In Asia, two appearances from BoJ officials will also be of interest. Our Chief Japan economist expects markets to be surprised if either emphasises the need for policy normalisation soon.

Back to economic data. Important releases for Germany include the trade balance on Monday and factory orders on Wednesday, followed by industrial production on Thursday. In France, similar indicators will be released, including the trade balance on Thursday and industrial production on Friday. Zooming out to the Eurozone-level data, the July PPI report tomorrow and retail sales on Wednesday will be among the highlights.

Trade data will be among the highlights in China this week, with the release due on Thursday. The Caixin services PMI release tomorrow will round out other PMI reports released last week that showed an improvement in manufacturing but a miss in the official non-manufacturing gauge.

Government

Health Officials: Man Dies From Bubonic Plague In New Mexico

Health Officials: Man Dies From Bubonic Plague In New Mexico

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Officials in…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

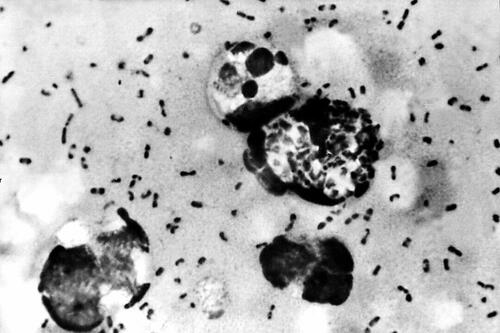

Officials in New Mexico confirmed that a resident died from the plague in the United States’ first fatal case in several years.

The New Mexico Department of Health, in a statement, said that a man in Lincoln County “succumbed to the plague.” The man, who was not identified, was hospitalized before his death, officials said.

They further noted that it is the first human case of plague in New Mexico since 2021 and also the first death since 2020, according to the statement. No other details were provided, including how the disease spread to the man.

The agency is now doing outreach in Lincoln County, while “an environmental assessment will also be conducted in the community to look for ongoing risk,” the statement continued.

“This tragic incident serves as a clear reminder of the threat posed by this ancient disease and emphasizes the need for heightened community awareness and proactive measures to prevent its spread,” the agency said.

A bacterial disease that spreads via rodents, it is generally spread to people through the bites of infected fleas. The plague, known as the black death or the bubonic plague, can spread by contact with infected animals such as rodents, pets, or wildlife.

The New Mexico Health Department statement said that pets such as dogs and cats that roam and hunt can bring infected fleas back into homes and put residents at risk.

Officials warned people in the area to “avoid sick or dead rodents and rabbits, and their nests and burrows” and to “prevent pets from roaming and hunting.”

“Talk to your veterinarian about using an appropriate flea control product on your pets as not all products are safe for cats, dogs or your children” and “have sick pets examined promptly by a veterinarian,” it added.

“See your doctor about any unexplained illness involving a sudden and severe fever, the statement continued, adding that locals should clean areas around their home that could house rodents like wood piles, junk piles, old vehicles, and brush piles.

The plague, which is spread by the bacteria Yersinia pestis, famously caused the deaths of an estimated hundreds of millions of Europeans in the 14th and 15th centuries following the Mongol invasions. In that pandemic, the bacteria spread via fleas on black rats, which historians say was not known by the people at the time.

Other outbreaks of the plague, such as the Plague of Justinian in the 6th century, are also believed to have killed about one-fifth of the population of the Byzantine Empire, according to historical records and accounts. In 2013, researchers said the Justinian plague was also caused by the Yersinia pestis bacteria.

But in the United States, it is considered a rare disease and usually occurs only in several countries worldwide. Generally, according to the Mayo Clinic, the bacteria affects only a few people in U.S. rural areas in Western states.

Recent cases have occurred mainly in Africa, Asia, and Latin America. Countries with frequent plague cases include Madagascar, the Democratic Republic of Congo, and Peru, the clinic says. There were multiple cases of plague reported in Inner Mongolia, China, in recent years, too.

Symptoms

Symptoms of a bubonic plague infection include headache, chills, fever, and weakness. Health officials say it can usually cause a painful swelling of lymph nodes in the groin, armpit, or neck areas. The swelling usually occurs within about two to eight days.

The disease can generally be treated with antibiotics, but it is usually deadly when not treated, the Mayo Clinic website says.

“Plague is considered a potential bioweapon. The U.S. government has plans and treatments in place if the disease is used as a weapon,” the website also says.

According to data from the U.S. Centers for Disease Control and Prevention, the last time that plague deaths were reported in the United States was in 2020 when two people died.

International

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Riley Gaines Explains How Women’s Sports Are Rigged To Promote The Trans Agenda

Is there a light forming when it comes to the long, dark and…

Is there a light forming when it comes to the long, dark and bewildering tunnel of social justice cultism? Global events have been so frenetic that many people might not remember, but only a couple years ago Big Tech companies and numerous governments were openly aligned in favor of mass censorship. Not just to prevent the public from investigating the facts surrounding the pandemic farce, but to silence anyone questioning the validity of woke concepts like trans ideology.

From 2020-2022 was the closest the west has come in a long time to a complete erasure of freedom of speech. Even today there are still countries and Europe and places like Canada or Australia that are charging forward with draconian speech laws. The phrase "radical speech" is starting to circulate within pro-censorship circles in reference to any platform where people are allowed to talk critically. What is radical speech? Basically, it's any discussion that runs contrary to the beliefs of the political left.

Open hatred of moderate or conservative ideals is perfectly acceptable, but don't ever shine a negative light on woke activism, or you might be a terrorist.

Riley Gaines has experienced this double standard first hand. She was even assaulted and taken hostage at an event in 2023 at San Francisco State University when leftists protester tried to trap her in a room and demanded she "pay them to let her go." Campus police allegedly witnessed the incident but charges were never filed and surveillance footage from the college was never released.

It's probably the last thing a champion female swimmer ever expects, but her head-on collision with the trans movement and the institutional conspiracy to push it on the public forced her to become a counter-culture voice of reason rather than just an athlete.

For years the independent media argued that no matter how much we expose the insanity of men posing as women to compete and dominate women's sports, nothing will really change until the real female athletes speak up and fight back. Riley Gaines and those like her represent that necessary rebellion and a desperately needed return to common sense and reason.

In a recent interview on the Joe Rogan Podcast, Gaines related some interesting information on the inner workings of the NCAA and the subversive schemes surrounding trans athletes. Not only were women participants essentially strong-armed by colleges and officials into quietly going along with the program, there was also a concerted propaganda effort. Competition ceremonies were rigged as vehicles for promoting trans athletes over everyone else.

The bottom line? The competitions didn't matter. The real women and their achievements didn't matter. The only thing that mattered to officials were the photo ops; dudes pretending to be chicks posing with awards for the gushing corporate media. The agenda took precedence.

Lia Thomas, formerly known as William Thomas, was more than an activist invading female sports, he was also apparently a science project fostered and protected by the athletic establishment. It's important to understand that the political left does not care about female athletes. They do not care about women's sports. They don't care about the integrity of the environments they co-opt. Their only goal is to identify viable platforms with social impact and take control of them. Women's sports are seen as a vehicle for public indoctrination, nothing more.

The reasons why they covet women's sports are varied, but a primary motive is the desire to assert the fallacy that men and women are "the same" psychologically as well as physically. They want the deconstruction of biological sex and identity as nothing more than "social constructs" subject to personal preference. If they can destroy what it means to be a man or a woman, they can destroy the very foundations of relationships, families and even procreation.

For now it seems as though the trans agenda is hitting a wall with much of the public aware of it and less afraid to criticize it. Social media companies might be able to silence some people, but they can't silence everyone. However, there is still a significant threat as the movement continues to target children through the public education system and women's sports are not out of the woods yet.

The ultimate solution is for women athletes around the world to organize and widely refuse to participate in any competitions in which biological men are allowed. The only way to save women's sports is for women to be willing to end them, at least until institutions that put doctrine ahead of logic are made irrelevant.

Government

Mike Pompeo Doesn’t Rule Out Serving In 2nd Trump Administration

Mike Pompeo Doesn’t Rule Out Serving In 2nd Trump Administration

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former Secretary…

Authored by Jack Phillips via The Epoch Times (emphasis ours),

Former Secretary of State Mike Pompeo said in a new interview that he’s not ruling out accepting a White House position if former President Donald Trump is reelected in November.

“If I get a chance to serve and think that I can make a difference ... I’m almost certainly going to say yes to that opportunity to try and deliver on behalf of the American people,” he told Fox News, when asked during a interview if he would work for President Trump again.

“I’m confident President Trump will be looking for people who will faithfully execute what it is he asked them to do,” Mr. Pompeo said during the interview, which aired on March 8. “I think as a president, you should always want that from everyone.”

He said that as a former secretary of state, “I certainly wanted my team to do what I was asking them to do and was enormously frustrated when I found that I couldn’t get them to do that.”

Mr. Pompeo, a former U.S. representative from Kansas, served as Central Intelligence Agency (CIA) director in the Trump administration from 2017 to 2018 before he was secretary of state from 2018 to 2021. After he left office, there was speculation that he could mount a Republican presidential bid in 2024, but announced that he wouldn’t be running.

President Trump hasn’t publicly commented about Mr. Pompeo’s remarks.

In 2023, amid speculation that he would make a run for the White House, Mr. Pompeo took a swipe at his former boss, telling Fox News at the time that “the Trump administration spent $6 trillion more than it took in, adding to the deficit.”

“That’s never the right direction for the country,” he said.

In a public appearance last year, Mr. Pompeo also appeared to take a shot at the 45th president by criticizing “celebrity leaders” when urging GOP voters to choose ahead of the 2024 election.

2024 Race

Mr. Pompeo’s interview comes as the former president was named the “presumptive nominee” by the Republican National Committee (RNC) last week after his last major Republican challenger, former South Carolina Gov. Nikki Haley, dropped out of the 2024 race after failing to secure enough delegates. President Trump won 14 out of 15 states on Super Tuesday, with only Vermont—which notably has an open primary—going for Ms. Haley, who served as President Trump’s U.S. ambassador to the United Nations.

On March 8, the RNC held a meeting in Houston during which committee members voted in favor of President Trump’s nomination.

“Congratulations to President Donald J. Trump on his huge primary victory!” the organization said in a statement last week. “I’d also like to congratulate Nikki Haley for running a hard-fought campaign and becoming the first woman to win a Republican presidential contest.”

Earlier this year, the former president criticized the idea of being named the presumptive nominee after reports suggested that the RNC would do so before the Super Tuesday contests and while Ms. Haley was still in the race.

Also on March 8, the RNC voted to name Trump-endorsed officials to head the organization. Michael Whatley, a North Carolina Republican, was elected the party’s new national chairman in a vote in Houston, and Lara Trump, the former president’s daughter-in-law, was voted in as co-chair.

“The RNC is going to be the vanguard of a movement that will work tirelessly every single day to elect our nominee, Donald J. Trump, as the 47th President of the United States,” Mr. Whatley told RNC members in a speech after being elected, replacing former chair Ronna McDaniel. Ms. Trump is expected to focus largely on fundraising and media appearances.

President Trump hasn’t signaled whom he would appoint to various federal agencies if he’s reelected in November. He also hasn’t said who his pick for a running mate would be, but has offered several suggestions in recent interviews.

In various interviews, the former president has mentioned Sen. Tim Scott (R-S.C.), Texas Gov. Greg Abbott, Rep. Elise Stefanik (R-N.Y.), Vivek Ramaswamy, Florida Gov. Ron DeSantis, and South Dakota Gov. Kristi Noem, among others.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International6 days ago

International6 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International5 days ago

International5 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges