Fear of the unknown: A tale of the SEC’s crusade against synthetics

DeFi built on blockchain and legacy financial systems is on the verge of clashing in one of the most tumultuous battles in economic history.

On the opening day of Messari Mainnet 2021, New York City’s long-awaited first crypto conferen

DeFi built on blockchain and legacy financial systems is on the verge of clashing in one of the most tumultuous battles in economic history.

On the opening day of Messari Mainnet 2021, New York City’s long-awaited first crypto conference since the start of COVID-19, reports came blazing in via a viral tweet that the United States Securities and Exchange Commission had served a subpoena to an event panelist at the top of an escalator in broad daylight. While it’s still not entirely clear who was served (or why), this isn’t the first time the SEC has encroached upon the crypto industry in full view of the public. Let’s go back a mere two months.

On July 20, 2021, SEC Chair Gary Gensler issued his remarks outlining the SEC’s scope of authority on cryptocurrency:

“It doesn’t matter whether it’s a stock token, a stable value token backed by securities, or any other virtual product that provides synthetic exposure to underlying securities. These platforms — whether in the decentralized or centralized finance space — are implicated by the securities laws and must work within our securities regime.”

Just like the SEC’s bold arrival at Mainnet, Gensler’s remarks definitely did not arise out of the blue. They arose because Gensler — along with his regulatory entourage — finally arrived at the terrifying realization that cryptocurrency’s tokenized, synthetic stocks are just like stocks, but better.

Related: Powers On... Don't worry, Bitcoin's adoption will not be stopped

So, what are synthetics?

Synthetic assets are artificial renditions of existing assets whose prices are pegged to the value of the assets they represent in real-time. For instance, a synthetic share of renewable energy giant Tesla can be purchased and sold at exactly the same price as a real share of Tesla at any given moment.

Consider average stock traders for whom profit margins, accessibility and personal privacy take precedence. To them, the apparent “realness” of TSLA acquired from a broker-dealer will not hold water next to the cryptoverse’s many synthetic renditions, which can be acquired at a fraction of the cost at 8:00 pm on a Sunday evening. What’s more, it’s only a matter of time before traders will be able to stake synthetic TSLA in a decentralized finance protocol to earn interest or take out a collateralized loan.

Related: Crypto synthetic assets, explained

The role of synthetics

Decentralized platforms built on blockchain and legacy financial systems are on the verge of clashing in one of the most tumultuous battles in economic history, and Gensler’s remarks merely constitute a shot across the bow. Make no mistake: decentralized finance (DeFi) and traditional finance (TradFi) have already drawn their battle lines. They will remind powerful incumbents and new entrants alike that, contrary to what contemporary wisdom may suggest, systems of exchange imbue assets with value — not the converse. The ramifications cannot be understated: Synthetic assets establish a level playing field where centralized and decentralized systems can compete for users and capital — a free market for markets.

Typically, digital marketplaces support an assortment of assets that compete by being exchanged against one another. But when the asset side is fixed — that is, when identical assets exist across multiple platforms — it is the marketplaces that compete for the largest share of each asset’s daily trading volume. Ultimately, traders settle the score, determining where assets should live and which systems should die.

On that accord, while Bitcoin (BTC) competes indirectly with fiat currencies as a unique form of money transacted over a decentralized network, it is the array of emergent fiat currency-pegged stablecoins that pose the most pernicious and immediate threat to national governments and their directors in central banking. Unlike Bitcoin, which often proves too volatile and exotic for outsiders, fiat-backed stablecoins cut down the complicated tradeoffs and keep the simple stuff: Around-the-clock access, low-cost international transfers, kick-ass interest rates and 1:1 redemption into fiat.

Related: Stablecoins present new dilemmas for regulators as mass adoption looms

Even to skeptics, stablecoins drive a strong bargain, and the U.S. Congress put forth its own token of acknowledgment with its December 2020 legislative proposal of the STABLE Act, which would require stablecoin issuers to acquire the same bank charters as their centralized counterparts at Chase, Wells Fargo and so on.

Incumbent institutions have a long history of seeking out, acquiring and, at times, even sabotaging their competition. It’s not difficult to see where legacy banking’s aversion to synthetics comes from. As decentralized platforms become more user-friendly and tread further into the mainstream, significant buy-side demand will migrate from legacy platforms and their formerly exclusive assets into digitally native synthetics.

Robinhood saga: The remix

Imagine what might have transpired if Robinhood users had access to synthetic shares of GME and AMC on Jan. 28, 2021.

If even a small minority of the buy-side demand for those stocks — say 10% — migrated from Robinhood to Mirror Protocol’s synthetic stocks, it would have effectively inflated the supply of shares outstanding and consequently suppressed the share price. In turn, GameStop’s C-level executives would have been in for a real tough board call.

Related: GameStop inadvertently paves the way for decentralized finance

And then, consider also the implications of investors staking their synthetic GME and AMC in DeFi protocols to receive mortgage and small business loans at drastically reduced interest rates, definitively cutting banks and other incumbents out of the equation.

Such a scenario would behoove GameStop and AMC to migrate a fraction of their shares to blockchain-based platforms in order to restore robust pricing mechanisms. Meanwhile, investors on the retail side, who only seek a superior user experience and the benefits of interoperability with DeFi protocols, would ultimately win — something you don’t hear too often in modern financial markets.

From stocks to commodities, real estate instruments, bonds, and beyond, the emergence of synthetic assets will disrupt pricing mechanisms, catalyze unprecedented turbulence in financial markets and produce unforetold arbitrage opportunities, unlike anything the world has ever seen. Although the consequences of such a dramatic shift are beyond prediction, centralized incumbents will not voluntarily cannibalize their business models — free markets must be entrusted to select winners.

The future of synthetics

As demand for synthetic assets reaches and exceeds that of their purportedly regulated TradFi counterparts, the capitalists and investors of the world will be forced to contemplate what in fact makes an asset “real” in the first place, and will ultimately determine not only the direction of free markets but their very constitution.

In the heat of an existential crisis, financial institutions and governments will undoubtedly get all hands on deck: The SEC will battle to eradicate synthetic stocks, Congress will commit to subduing stablecoin issuers from challenging the international banking elite, the Commodity Futures Trading Commission (CFTC) will step in to tame platforms dealing in derivatives and Financial Crimes Enforcement Network (FinCEN) will continue to target those aiming to protect user privacy.

Related: The new episode of crypto regulation: The Empire Strikes Back

Rough days lie ahead — and it is already too late to turn back the hands of innovation. Compound’s cTokens, Synthetix’s Synths and Mirror Protocol’s mAssets have already opened Pandora’s box, while Offshift’s fully private zk-Assets are slated to launch in January 2022. Whatever unfolds, the rigid barrier separating the realm of traditional finance from that of emergent decentralized platforms will be permanently dismantled, and a new age of financial freedom will spring forth.

May the best systems win.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

International

Parexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

Peyton Howell

→ Jamie Macdonald will retire as CEO of Parexel on May 15, and the clinical research organization has already named Peyton Howell — the…

→ Jamie Macdonald will retire as CEO of Parexel on May 15, and the clinical research organization has already named Peyton Howell — the current chief operating and growth officer — as his successor. Macdonald replaced co-founder and longtime chief executive Josef von Rickenbach in March 2018, and Howell arrived two months later as chief commercial and strategy officer. Earlier, she handled a series of roles for more than a decade at AmerisourceBergen.

“Jamie guided Parexel through a pivotal time in the company’s evolution, leading it through its successful acquisition by EQT and Goldman Sachs Asset Management in 2021 and achieving industry-leading profit growth across his tenure with the company — outpacing the top-tier CROs during this same period to position Parexel for sustainable growth,” board chair Sheri McCoy said in a statement.

Macdonald will keep his board seat at Parexel until the end of this year.

Matt Britz

Matt Britz→ Chaired by Simone Song, who just announced a $260 million second fund at ORI Capital a month ago, AffyImmune Therapeutics has promoted Matt Britz to CEO. Britz joined AffyImmune as SVP of business development from Minerva Biotechnologies in 2021, and he was quickly elevated to COO. In addition to the new boss, AffyImmune has welcomed bluebird bio alum Pete Gelinas as SVP of CMC. For the past two years, Gelinas led manufacturing and technical operations at David Hallal’s ElevateBio. Song’s crew at ORI forked over $30 million for AffyImmune’s “Series A+” in October 2021, and we’ll see if the CAR-T developer has another fundraising round on the horizon.

Christine Roth

Christine Roth→ Bayer told Nicole DeFeudis this week that it’s “basically halving” the number of execs on its pharmaceutical leadership team as part of the massive restructuring project that’s taking place at the German multinational. It means the end of the road for Anne-Grethe Mortensen, a longtime Bayer staffer who has been chief marketing officer since 2019, but she’s the only one who will part ways. Sebastian Guth, who has been doing double duty as president of Bayer US and president of North America pharmaceuticals, will be COO on April 1 and stay in the US. The head of the oncology strategic business unit, Christine Roth, will lead a new “global commercialization” team on June 1. Meanwhile, R&D chief Christian Rommel and product supply leader Holger Weintritt aren’t going anywhere and neither is CMO Michael Devoy, but Devoy won’t be on the pharma leadership roster.

Annemarie Hanekamp

Annemarie Hanekamp→ Annemarie Hanekamp will replace Sean Marett as BioNTech’s chief commercial officer on July 1. Hanekamp led the radioligand therapy teams at Novartis, which got a jump on an increasingly buzzy field with the approvals of Lutathera (from the Advanced Accelerator Applications buyout) and Pluvicto. Before that, she had numerous roles in 11 years at Bristol Myers Squibb, culminating in her promotion to head of sales, US immunology. BioNTech makes this leadership move as Covid-19 revenue continues its downward slide and as the German company touts an oncology pipeline that contains ADCs and bispecifics.

Noah Berkowitz

Noah Berkowitz→ Several weeks after CFO Sean Cassidy’s departure, Arvinas has made another C-suite change by bringing in Noah Berkowitz as CMO. From 2020-23, Berkowitz was Bristol Myers’ development unit head, hematology, and he also tackled the role of clinical development head for hematology during his tenure at Novartis. Ron Peck, a Bristol Myers vet in his own right who had been medical chief since 2019, is stepping down from the protein degradation player “to pursue other opportunities.”

→ Fulcrum Therapeutics has enlisted Patrick Horn as CMO, while interim medical chief Iain Fraser will become SVP of early development. We last saw Horn in this space when he was named CMO of HemoShear Therapeutics, and he’s held the same position with Tetraphase and Albireo Pharma. Ex-Fulcrum CMO Santiago Arroyo left after five months to take the role of development chief at Bicycle Therapeutics in April 2023. Four months later, the FDA lifted the clinical hold on Fulcrum’s sickle cell therapy FTX-6058.

Simon Cooper

Simon Cooper→ Morphic Therapeutic also has a new medical chief: Simon Cooper spent more than two and a half years with Keros Therapeutics in the same capacity, and he’s also been CMO at Kadmon and Anokion. Cooper has an extensive Big Pharma background with Roche, Novartis and Sanofi, and he was an asset strategy leader for risankizumab (known as the blockbuster Skyrizi) at AbbVie. Last September, Morphic’s stock took a tumble when its inflammatory bowel disease drug MORF-057 did not surpass Takeda’s Entyvio in terms of efficacy.

→ Eye drug developer Clearside Biomedical has picked up Victor Chong as CMO. Chong joins the team in Georgia from J&J Innovative Medicine, where he was VP, global head of retina DAS. Before that, he was global head of medicine, retinal health at Boehringer Ingelheim.

→ Elsewhere, at Ocugen, the company has promoted Huma Qamar to the role of CMO. Qamar has been with the company for over three years. Prior to her role at Ocugen, Qamar was with FSD Pharma as SVP, head of R&D.

Petra Kaufmann

Petra Kaufmann→ Vigil Neuroscience concludes our tour through the latest CMO hires with the exit of Christopher Silber after just five months with the company. In walks Petra Kaufmann, the former CMO of AAV gene therapy biotech Affinia Therapeutics. Kaufmann is also the former SVP, clinical development, translational medicine & analytics for Novartis Gene Therapies. The FDA lifted a partial clinical hold on Vigil’s lead program, a TREM2 antibody now called iluzanebart, almost exactly a year ago.

→ Michael Boretti has taken the CBO job at Solu Therapeutics, the Longwood upstart that’s now run by ex-Faze Medicines CEO Phil Vickers. Boretti previously held the CBO post at Celsius Therapeutics since 2019 and he’s the ex-VP of business development for Epizyme. Santé Ventures, DCVC Bio and the venture arm of Astellas are among the investors that joined Longwood for Solu’s $31 million seed round last summer.

Dan Neil

Dan Neil→ BenevolentAI says that chief technology officer Dan Neil will be ending his seven-year run at the company in April “to relocate to be nearer his family.” James Malone will succeed Neil. He just finished a year-long stint with Logically.ai as VP of engineering; earlier, Malone was BenchSci’s VP, data engineering, machine learning and bioinformatics.

→ Larry Hineline is retiring after 22 years as CFO of Caplyta maker Intra-Cellular Therapies, which has also elevated Michael Halstead to president. Halstead has spent the last decade as Intra-Cellular’s general counsel and was elevated to EVP in 2019.

Jonathan Gillis

Jonathan Gillis→ Through its acquisition of Karuna Therapeutics, Bristol Myers has a Sept. 26 decision date for the schizophrenia drug KarXT. Another contender in this space comes from MapLight Therapeutics, which has selected Vishwas Setia as CFO and shifted his predecessor, Jonathan Gillis, to chief administrative and accounting officer. Setia worked at Bank of America Securities for nearly a decade and served as a managing director in the healthcare investment banking group. MapLight secured a $225 million Series C last October and while ML-007C-MA is a muscarinic 1 and muscarinic 4 agonist like KarXT, the difference is it’s in combination with a peripheral muscarinic antagonist.

→ Syndax Pharmaceuticals, which closed a $230 million public offering in December, has named Steven Closter as CCO. Closter previously worked at Sunovion Pharmaceuticals, culminating in his role as VP, brand strategy and launch excellence. Before that, he spent nearly two decades at Forest Laboratories in senior marketing and commercial roles, including VP, marketing.

Tracey Lodie

Tracey Lodie→ Co-founded by scientific advisory board chair George Church and backed by Bayer, GRO Biosciences has welcomed Tracey Lodie as chief development officer. Lodie comes to GRObio from Quell Therapeutics, where he had been CSO since the summer of 2021. The 14-year Sanofi Genzyme vet also spent two years as Gamida Cell’s science chief and was SVP, translational immunology for BlueRock Therapeutics. In November 2021, GRObio raised $25 million in Series A financing to make protein therapies with artificial amino acids.

→ Lyon, France-based MaaT Pharma, which completed a new microbiome facility in France with Skyepharma last September, has enlisted Jonathan Chriqui as CBO. Chriqui has experience from Ipsen and Servier under his belt and formerly served as chief operating & chief business development officer at Somagenetix.

John Maraganore

John Maraganore→ John Maraganore inundated Peer Review with a barrage of board appointments and advisory gigs after he stepped down from Alnylam, but lately it’s been all quiet on the Maraganore front — until this week. He’s now on the board at Rapport Therapeutics, a neuro biotech that racked up two megarounds in short order last year and is chaired by ex-Karuna chief Steve Paul. Maraganore is also a venture partner at both Atlas Ventures and ARCH Venture Partners.

→ As BeiGene celebrates the long-awaited US approval of its PD-1 drug tislelizumab, which will be branded as Tevimbra, Checkpoint Therapeutics will resubmit a BLA for its PD-1 candidate cosibelimab after the FDA issued a CRL in December. Checkpoint has now elected Amit Sharma to the board of directors. Sharma, the VP of clinical development and therapeutic head for nephrology and hematology at AstraZeneca’s rare disease unit Alexion, was previously a medical affairs exec in Bayer’s cardiovascular and renal division.

→ Maggie Pax has sewn up a spot on the board of directors at Repligen. In the back half of her eight years with Thermo Fisher, Pax was VP, strategy and innovation.

fda therapy covid-19 franceGovernment

Censorship And The Digital Public Square

Censorship And The Digital Public Square

Authored by Adeline Von Drehle via RealClear Wire,

“We don’t want no censorship, we don’t…

Authored by Adeline Von Drehle via RealClear Wire,

“We don’t want no censorship, we don’t need no censorship!” Kevin Nathaniel’s voice boomed from the podium in front of the Supreme Court as he, frontman of the Spirit Drummers, led the crowd in a series of sing-songy, reggae-inspired chants. His audience was small but excitable. Some wore Kennedy ’24 beanies and “Ivermectin saves lives” T-shirts. Others showed off signs reading “Fauci is the tyrant the founding fathers warned us about,” and “Freedom of speech includes views you don’t like,” and “Media literacy = censorship,” as they bopped along to the bongo drums.

Inside, the Supreme Court was gearing up to hear the oral arguments of Murthy v. Missouri, in which Missouri and Louisiana, as well as several individuals, claim that federal officials violated the First Amendment in their efforts to combat misinformation on social media. The parties contend that the Biden administration effectively coerced platforms into silencing the voices of American citizens, particularly those on the right who posted about the COVID-19 lab leak theory, pandemic lockdowns, vaccine side effects, election fraud, and the Hunter Biden laptop story. The plaintiffs have called it a “sprawling Censorship Enterprise.”

People live with different facts than their neighbors. One reason for this is social media algorithms, which use engagement features such as “like” buttons to feed users more of the content they seem to be interested in. Such a system can result in one person’s feed looking completely alien to another person. That we live in parallel universes is not news, but the dilemma it poses raises crucial questions about the responsibility of social media companies to track what is on their platforms and whether the government even has the right – or the responsibility – to counter what it deems misinformation, and when a line has been crossed into unconstitutional censorship.

Plaintiffs in Murthy v. Missouri claim the line was crossed, and then crossed a few hundred more times. The suit names federal officials including President Joe Biden, former White House Press Secretary Jen Psaki, Anthony Fauci, Surgeon General Vivek Murthy, and others – as well as federal agencies such as the Department of Health and Human Services and the Centers for Disease Control and Prevention.

While the lawsuit ostensibly sets out to detail the many ways the federal government violated Americans’ First Amendment rights, it also spent a great deal of its time explaining why the information the mainstream has labeled “misinformation” is actually the truth.

The Missouri and Louisiana attorneys general cite studies, journal articles, and news stories to bolster their assertions about mail-in voter fraud and about the inefficacy of masking, quarantining, and COVID-19 vaccines. “Yesterday’s ‘misinformation’ often becomes today’s viable theory and tomorrow’s established fact,” they wrote in their legal brief.

The plaintiffs go on to the meat of their complaint, which is about 50 pages of what they hope will be viewed as convincing evidence of a well-oiled censorship machine.

In one example, they present transcripts of Jen Psaki linking encouragement for social media companies to “stop amplifying untrustworthy content … especially related to COVID-19, vaccinations, and elections” with comments about anti-trust regulation and privacy protections, insinuating that the federal government would impose undesirable regulations on social media companies if they do not increase censorship of right-wing messaging.

The suit also states that Dr. Fauci “coordinated with social-media firms to police and suppress speech regarding COVID-19 on social media,” particularly about the lab-leak theory – which contends that COVID-19 originated in a lab in Wuhan, China – because Fauci himself signed off on funding the gain-of-function research that may have created the virus. Instead, Fauci and other officials at the National Institutes of Health pushed the narrative that COVID was a zoonotic virus that jumped to humans in a Wuhan seafood market.

Whether these examples and many others constitute threats or nefarious coercion is what the high court is now weighing. A federal district court judge issued a preliminary injunction that prevents much of the federal government from collaborating with various groups about what should and should not be allowed on social media. The Fifth U.S. Circuit Court of Appeals kept it in place, saying the evidence showed the existence of “a coordinated campaign” of unprecedented “magnitude orchestrated by federal officials that jeopardized a fundamental aspect of American life.”

The injunction rang alarm bells as it specifically banned communication between the federal government and the Election Integrity Partnership, which was instrumental in debunking false claims about the 2020 election. The Supreme Court stayed the injunction, suggesting it was less convinced than the lower courts by initial evidence.

One private individual suing alongside the states is Dr. Aaron Kheriaty, who was fired from his job at a University of California school for refusing a COVID-19 vaccine. Author of “The New Abnormal: The Rise of the Biomedical Security State,” Kheriaty describes government censorship as a “leviathan,” a Hobbesian term to describe an entity with utter control over its subjects.

“It’s an interconnected network of public and supposedly private entities that is basically working 24/7 to flag and pressure the social media companies into doing its bidding with censorship,” said Kheriaty. “If these social media companies are not complying, the government can turn the screws and turn up the temperature and basically force them into compliance.”

Some conspiracy theories turn out to be true. But this would be a big one.

It is undeniable that conservative and right-wing voices were censored on social media, mostly beginning in and around March 2020, just as the plaintiffs argue in their suit. Platforms such as Facebook, X (formerly Twitter), and YouTube all made concerted efforts to either outright remove dissenting posts about the COVID-19 pandemic and the 2020 presidential election, or at least to diminish the reach of such posts.

Litigating whether such measures are unconstitutional raises a host of questions, starting with whether platforms such as X or Facebook are solely private sector companies or whether in a highly digital age they have become the de facto public square where censorship is more proscribed. This is not merely an academic concern. The First Amendment protects, in the Supreme Court’s words, a “robust sphere of individual liberty” that allows private actors to make their own decisions about what speech they wish to associate with. Social media companies have been considered private actors under the law and are permitted to moderate user speech and content as they see fit under Section 230 of the Communications Decency Act.

But with social media platforms acting as the present-day town square, it’s no surprise that so many Americans think it unjust that they could be censored for their views. “Modern society is so thoroughly dependent upon social media for communication, news, commerce, education, and entertainment that any restriction of access to it can easily feel like a matter of constitutional significance,” writes legal scholar Mary Anne Franks.

The Murthy v. Missouri suit argues that Section 230 “directly contributed to the rise of a small number of extremely powerful social-media platforms, who have now turned into a ‘censorship cartel.’” In this part of the suit, the case transforms itself into an argument for the overturning of Section 230, which multiple states are considering.

The lawsuit cites numerous examples of censorship that occurred before the Biden administration took office, and claims it was indeed threats from the Biden campaign which coerced social media companies to overly censor. It will be difficult to prove abridgment of free speech on these points, as only a government – not a campaign – is legally bound by the First Amendment.

The plaintiffs cite, “perhaps most notoriously,” the example of the Hunter Biden laptop story. The New York Post ran a story on Oct. 14, 2020, about the computer of then-presidential nominee Joe Biden’s son and the proof it held of corrupt business dealings, but the Post’s Twitter account was blocked until after the election. In fact, no one could share the story (even via Twitter direct message) because, as the Wall Street Journal Editorial Board put it, “nearly all of the media at the time ignored the story or ‘fact-checked’ as false.” The plaintiffs argue the story was censored because social media companies were “parroting the Biden campaign’s false line,” and so treated the story as “disinformation.”

Similar arguments are made about censorship of speech that raised concerns about the security of voting by mail – that the Biden campaign coerced social media companies into censoring such speech because it did not align with their personal interests. Such posts about election fraud spiraled into a narrative that the election was stolen and contributed to the violent Jan. 6 riot at the U.S. Capitol.

In 1783, George Washington warned that if ‘the Freedom of Speech may be taken away,’ then ‘dumb and silent we may be led, like sheep, to the Slaughter.’ Citing this quote, the plaintiffs in Murthy v. Missouri began their quest to unveil the censorship leviathan.

Whether the courts find their evidence compelling enough to reapply the injunction on much of the federal government is the question of the case. The plaintiffs argue that the government has no role at all, insisting that labeling “disfavored speech ‘misinformation’ or ‘disinformation’ does not strip it of First Amendment protection. Some false statements are inevitable if there is to be an open and vigorous expression of views.”

Kheriaty echoed the sentiment. “The constitution is very clear that the government’s role is not to distinguish between true and false information or true and false speech,” he said. “The government’s only role is to distinguish between legal and illegal speech.”

Danger is invited in when people are not exposed to a multitude of viewpoints, they say. Perhaps we are all victims of the certain censorship that comes from our personalized social media feeds, in which we are fed only information we want to hear. Each side thinks the other is brainwashed. This has led to real-world harm, and surely will again in the future. Whose job is it to save us from ourselves?

Uncategorized

Retirement Crisis Faces Government And Corporate Pensions

It is long past the time that we face the fact that "Social Security" is facing a retirement crisis. In June 2022, we touched on this issue, discussing…

It is long past the time that we face the fact that “Social Security” is facing a retirement crisis. In June 2022, we touched on this issue, discussing the stark realities confronting Social Security.

“The program’s payouts have exceeded revenue since 2010, but the recent past is nowhere near as grim as the future. According to the latest annual report by Social Security’s trustees, the gap between promised benefits and future payroll tax revenue has reached a staggering $59.8 trillion. That gap is $6.8 trillion larger than it was just one year earlier. The biggest driver of that move wasn’t Covid-19, but rather a lowering of expected fertility over the coming decades.” – Stark Realities

Note the last sentence.

When President Roosevelt first enacted social security in 1935, the intention was to serve as a safety net for older adults. However, at that time, life expectancy was roughly 60 years. Therefore, the expectation was that participants would not be drawing on social security for very long on an actuarial basis. Furthermore, according to the Social Security Administration, roughly 42 workers contributed to the funding pool for each welfare recipient in 1940.

Of course, given that politicians like to use government coffers to buy votes, additional amendments were added to Social Security to expand participation in the program. This included adding domestic labor in 1950 and widows and orphans in 1956. They lowered the retirement age to 62 in 1961 and increased benefits in 1972. Then politicians added more beneficiaries, from disabled people to immigrants, farmers, railroad workers, firefighters, ministers, federal, state, and local government employees, etc.

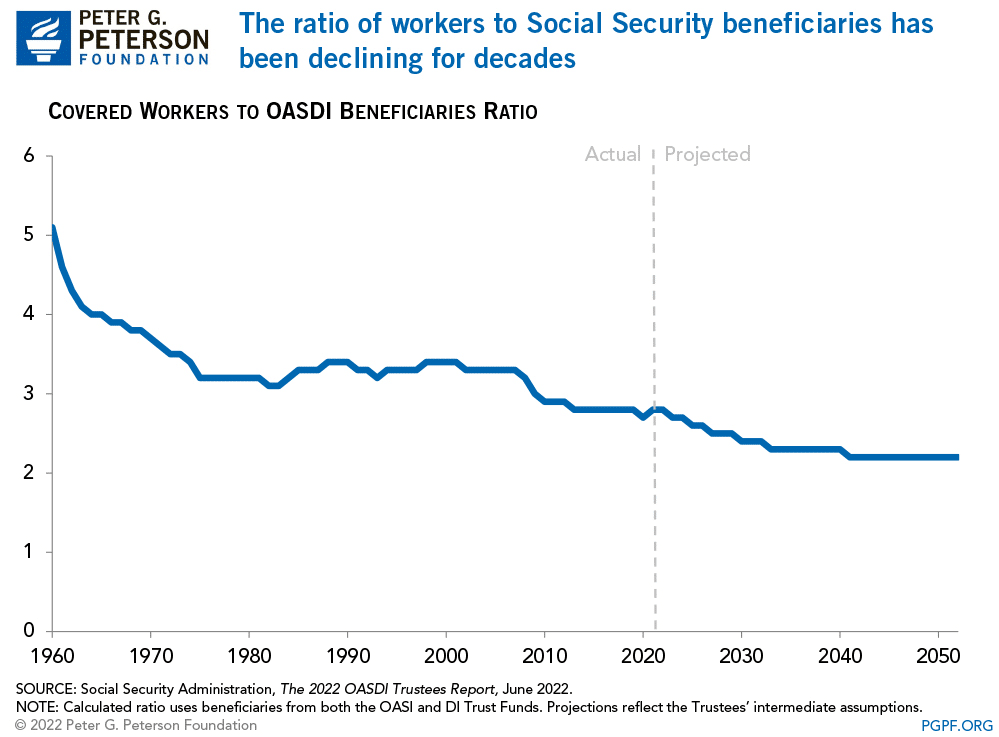

While politicians and voters continued adding more beneficiaries to the welfare program, workers steadily declined. Today, there are barely 2-workers for each beneficiary. As noted by the Peter G. Peterson Foundation:

“Social Security has been a cornerstone of economic security for almost 90 years, but the program is on unsound footing. Social Security’s combined trust funds are projected to be depleted by 2035 — just 13 years from now. A major contributor to the unsustainability of the current Social Security program is that the number of workers contributing to the program is growing more slowly than the number of beneficiaries receiving monthly payments. In 1960, there were 5.1 workers per beneficiary; that ratio has dropped to 2.8 today.”

As we will discuss, the collision of demographics and math is coming to the welfare system.

A Massive Shortfall

The new Financial Report of the United States Government (February 2024) estimates that the financial position of Social Security and Medicare are underfunded by roughly $175 Trillion. Treasury Secretary Janet Yellin signed the report, but the chart below details the problem.

The obvious problem is that the welfare system’s liabilities massively outweigh taxpayers’ ability to fund it. To put this into context, as of Q4-2023, the GDP of the United States was just $22.6 trillion. In that same period, total federal revenues were roughly $4.8 trillion. In other words, if we applied 100% of all federal revenues to Social Security and Medicare, it would take 36.5 years to fill the gap. Of course, that is assuming that nothing changes.

However, therein lies the actuarial problem.

All pension plans, whether corporate or governmental, rely on certain assumptions to plan for future obligations. Corporate pensions, for example, rely on certain portfolio return assumptions to fund planned employee retirements. Most pension plans assume that portfolios will return 7% a year. However, a vast difference exists between “average returns” and “compound returns” as shown.

Social Security, Medicare, and corporate pension plans face a retirement crisis. A shortfall arises if contributions and returns don’t meet expectations or demand increases on the plans.

For example, given real-world return assumptions, pension funds SHOULD lower their return estimates to roughly 3-4% to potentially meet future obligations and maintain some solvency. However, they can’t make such reforms because “plan participants” won’t let them. Why? Because:

- It would require a 30-40% increase in contributions by plan participants they can not afford.

- Given many plan participants will retire LONG before 2060, there isn’t enough time to solve the issues and;

- Any bear market will further impede the pension plan’s ability to meet future obligations without cutting future benefits.

Social Security and Medicare face the same intractable problem. While there is ample warning from the Trustees that there are funding shortfalls to the plans, politicians refuse to make the needed changes and instead keep adding more participants to the rolls.

However, all current actuarial forecasts depend on a steady and predictable pace of age and retirement. But that is not what is currently happening.

A Retirement Crisis In The Making

The single biggest threat that faces all pension plans is demographics. That single issue can not be fixed as it takes roughly 25 years to grow a taxpayer. So, even if we passed laws today that required all women of birthing age to have a minimum of 4 children over the next 5 years, we would not see any impact for nearly 30 years. However, the problem is running in reverse as fertility rates continue to decline.

Interestingly, researchers from the Center For Sexual Health at Indiana University put forth some hypotheses behind the decline in sexual activity:

- Less alcohol consumption (not spending time in bars/restaurants)

- More time on social media and playing video games

- Lower wages lead to lower rates of romantic relationships

- Non-heterosexual identities

The apparent problem with less sex and non-heterosexual identities is fewer births.

No matter how you calculate the numbers, the problem remains the same. Too many obligations and a demographic crisis. As noted by official OECD estimates, the aging of the population relative to the working-age population has already crossed the “point of no return.”

To compound that situation, there has been a surge in retirees significantly higher than estimates. As noted above, actuarial tables depend on an expected rate of retirees drawing from the system. If that number exceeds those estimates, a funding shortfall increases to provide the required benefits.

The decline in economic prosperity discussed previously is caused by excessive debt and declining income growth due to productivity increases. Furthermore, the shift from manufacturing to a service-based society will continue to lead to reduced taxable incomes.

This employment problem is critical.

By 2025, each married couple will pay Social Security retirement benefits for one retiree and their own family’s expenses. Therefore, taxes must rise, and other government services must be cut.

Back in 1966, each employee shouldered $555 of social benefits. Today, each employee has to support more than $18,000 in benefits. The trend is unsustainable unless wages or employment increases dramatically, and based on current trends, such seems unlikely.

The entire social support framework faces an inevitable conclusion where wishful thinking will not change that outcome. The question is whether elected leaders will make needed changes now or later when they are forced upon us.

For now, we continue to “Whistle past the graveyard” of a retirement crisis.

The post Retirement Crisis Faces Government And Corporate Pensions appeared first on RIA.

gdp covid-19-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges