The Debt Ceiling Is A Cliff — And We Keep Raising It

Fiat money extends the debt cycle and traps citizens in ever-increasing inflation — but bitcoin forces a reckoning.

Fiat money extends the debt cycle and traps citizens in ever-increasing inflation — but bitcoin forces a reckoning.

The Longer We Wait, The Harder We Fall

On Friday, October 15, 2021, U.S. President Joe Biden signed legislation raising the government’s borrowing limit to $28.9 trillion. Many Americans are now accustomed to this recurring bureaucratic process and don’t think much of it or its consequences. Two sides fight, they get close to a deadline (and sometimes pass it!) and eventually raise the “debt ceiling” so they can fight over it again some months later.

We Americans, as a collective and a government, are deciding to delay paying our bills. At an individual level, we understand what happens when we don’t pay our own bills. But what happens when the most powerful nation today stops paying bills? To understand the effects of this — and how we got here in the first place — we need to study history. Let’s start with a simple short-term debt cycle.

Lending And The Short-Term Debt Cycle

The short-term debt cycle arises from lending. Entrepreneurs need capital to bring their ideas to fruition, and savers want a way to increase the value of their savings. Traditionally, banks sat in the middle, facilitating transactions between entrepreneurs and savers by aggregating savings (in the form of bank deposits) and making loans to entrepreneurs.

However, this act creates two claims on one asset: The depositor has a claim on the money they deposited, but so does the entrepreneur who receives a loan from the bank. This leads to fractional reserve banking; the bank doesn’t hold 100% of the assets that savers have deposited with it, they hold a fraction.

This system enabled lending, which is a useful tool for all parties — entrepreneurs with ideas, savers with capital, and banks coordinating the two and keeping ledgers.

When Times Are Good

When entrepreneurs successfully create new business ventures, loans are repaid and debts are cancelled, meaning there are no longer two claims on one asset. Everyone is happy. Savers and banks earn a return, and we have new businesses providing services to people thanks to the sweat and ingenuity of the entrepreneurs and staff.

The debt cycle in this case ends with debts being paid back.

When Times Are Bad

When Alice the entrepreneur fails at her business venture, she is unable to repay her loan. The bank now has too many claims against the assets that they have, because they were counting on Alice repaying her loan. As a result, if all depositors rush down to the bank at once to withdraw (a “run on the bank”) then some depositor(s) won’t get all of their money back.

If enough entrepreneurs fail at once, say because of an “Act of God” calamity, this can cause quite an uproar and a lot of bank runs. However, the debts are still settled, either through repayment to depositors or default, leaving depositors without their money.

The debt cycle in this case ends with some portion of debts defaulting.

The debt cycle either ends with payment or default — there is no other option. When borrowing overextends, there must be a crash. These crashes are painful but short and contained.

The Mini Depression Of 1920

The year 1920 was the single most deflationary year in American history, with wholesale prices declining almost 40%. However, all measures of a recession (not just stock prices!) rebounded by 1922, making the crash severe but short. Production declined almost 30% but returned to peak levels by October 1922.

This depression also followed the 1918–1920 Spanish Flu pandemic and came one year after the conclusion of the First World War. Despite these massive economic dislocations, the crash was short and now relegated to a footnote in history.

Finance writer and historian James Grant, founder of Grant’s Interest Rate Observer, noted about the 1920 Depression in his 2014 book “The Forgotten Depression, 1921”:

"The essential point about the long ago downturn of 1920–1921 is that it was kind of the last demonstration of how a price mechanism works and the last governmentally unmediated business cycle downturn.”

The Free Market And Hard Money Curtail Debt Cycles

When an economy runs on a hard money system, free market forces rein in excessive borrowing and thus keep the debt cycle short.

What Is Hard Money?

Hard money is a form of money that is expensive for anyone to produce. This ensures a level playing field: Everyone has to work equally hard to gain money. Nobody can create money and spend it into the economy without incurring a cost almost equal to the value of the money itself. Gold and bitcoin are two examples of hard money, mining them requires so much time and energy that it’s almost not worth it to do so.

How Do Free Markets Rein In Borrowing?

Free market forces are crucial to limiting speculative manias. On one side, you have lenders and savers who hope to make a return on their capital, while on the other, you have borrowers hoping to take borrowed money and turn it into more money.

In a free market that utilizes hard money, there are two options to conclude the extension of credit: Debts are repaid, or debts are defaulted on. The greed of lenders wanting more return on their capital by making more loans is kept in check by the risk of default. The greed of borrowers wanting more capital is kept in check by the burden on their future self or business from increased debt.

This applies at an individual level as well: As any borrower increases their debt pile, they become riskier and riskier to lend to. That risk means lenders will demand to be paid a higher interest rate on their loan. That higher rate makes it harder for the borrower to borrow more, leading them to either turn toward paying down some of their existing debts or default outright.

These forces keep lending in balance, cutting down speculative manias before they go too far.

The Lengthening Of The Debt Cycle

Powerful entities — like governments — can use their sheer power to make them a less risky borrower.

Over the past century or so, we’ve seen many governments take on debt so that they can lend to individuals and businesses, especially during hard economic times. Those loans help individuals and businesses pay their bills and debts, easing the pain of a crash. However, this lending by governments does not resolve debts; it simply transfers debt from private individuals to the government, putting it in a large pile of public debt.

Governments can build such a huge pile of debt because lenders know that a government has special tools for paying back that debt. You and I may not be able to seize the property of others in order to pay our debts, but a government can. Even the bastion of the free world, the United States, seized the privately held gold of its citizens in order to keep itself afloat in 1933.

This government debt issuance leads to a lengthening of the debt cycle. The depth of each drop is tempered, but the unwinding of debts is not completed — it is only delayed. Frequent short and sharp downturns are transformed into longer cycles with infrequent but devastating collapses.

This brings us back to the debt ceiling: The reason our politicians keep having this debate is thanks to ongoing debt issuance by our government in order to fund bailouts during downturns as well as government outlays that exceed government revenues. All this debt climbs on top of that massive $28+ trillion pile of public debt.

However, at some point, even powerful governments feel the heat from angsty lenders and need a new set of tools. Throughout history, governments in a corner have employed another tool to service their debt and continue to prolong the debt cycle: debt monetization. The U.S. government opened this toolbox in 1971 by disconnecting the U.S. dollar — and all global currencies — from gold thus creating the fiat currency system we still live with today.

Fiat Currency And The Third Tool for Ending Debt Cycles

Fiat currency, like that friend who only calls when he needs something, shows up often in history but never stays for long. “Fiat” roughly translates from Latin as “by decree.” Fiat currency is thus money which derives its use — and value — by decree from a governing body. Fiat currency is not hard money; the governing body often (solely) reserves the right to create the currency and distribute it through some mechanism.

In a fiat currency system where depositors are placing fiat currency into banks, we have a new trick for unwinding debts.

Monetization: A New Tool For Ending Debt Cycles

Remember how bad times in the debt cycle led to the bank having more claims against their assets than assets on their books? Within a fiat currency system, the governing body can now solve this little ledger problem by just creating more currency. Poof, everyone gets paid.

We call this tool for ending debt cycles monetization, because we “monetize” the debts by paying them with newly created currency.

Today, we often call these governing bodies that create currency “central banks,” and together with their partners in government we believe these entities are capable of “softening” the frequent crashes endemic to an economy with any kind of lending. We like lending, because when it goes well, everyone benefits, so this fiat currency system appears to be a decent way of easing the pain of downturns.

The Effect Of Monetizing Debt

We already know that paying down debts costs the borrower, whereas defaulting on them costs the lender. Many central bankers and politicians would like to drown you in jargon at this point, leaving you with the impression that monetization solves the painful dilemma of pay or default, even if they can’t articulate just how.

So who foots the bill when we monetize debts?

When debts are monetized, new currency enters circulation, diluting the value of all the existing currency in circulation. This dilution of value of new currency is felt through inflation, which we’re hearing a lot about lately.

Those citizens who work on a fixed salary or wage and keep most of their net worth in the currency suffer from inflation the most, while those closest to the government and banking system with most of their net worth in non-cash assets benefit. It is those former citizens, the ones furthest away from the currency “spigot” and least aware of the effects of inflation, who pay for debt monetization.

The endgame of debt monetization is hyperinflation, which occurs when the central bank decides to go bananas and print, print, print to pay down every debt. Zimbabwe, Venezuela, and pre-WWII Germany come to mind. This is not a pretty event for anyone involved. Unlike defaulting or paying down debt, where effects are contained to the lenders and borrowers involved, monetization leads down a road ending in not just economic collapse but societal collapse.

Monetizing debt has serious costs, so operators of fiat currency systems must act cautiously. However, monetizing debt throughout history has often been more politically favorable than paying or defaulting, likely owing to the fact that it’s harder for people to understand who is footing the bill.

Governments And The Never-Ending Debt Cycle

Now that we understand how fiat currency enables debt monetization, let’s jump back to governments and their giant debt piles.

As a government’s pile of debt grows, it becomes ever more difficult and painful to pay it down, default on it or monetize it. Nobody from the politician to the politically connected elite to the welfare recipient wants budget cuts in their area, especially in the name of paying down the public debt. Defaulting would mean lenders would lose confidence in the government, demanding higher interest rates in order to make further loans thus forcing budget cuts. Debt monetization, taken too far, rips apart the fabric of society.

This results in an increasing desperation by the government to keep the status quo intact. Just keep the debt growing and push the problem onto the next generation.

The free market can bring an end to this debt cycle by simply “shorting” (selling) government bonds (loan contracts), making it more expensive for the government to borrow. However, a fiat currency system makes this difficult, because the central bank can print unlimited fiat currency and use it to buy bonds. Since the central bank incurs no cost to print currency, they are the ultimate player in the market. An investor who sells government bonds is destined to lose to a central bank that will never stop buying, so most investors go along with the game. This destroys the free market’s ability to bring an end to overborrowing.

Central banks for the past 50 years have proven to us, unequivocally, that they will support their governments’ borrowing habits and fight off the free market that would keep the debt cycle in check.

When central banks buy government bonds, they pay for them with newly printed currency. This is what I mean by monetizing debt. Too much of this, and we get the hyperinflation scenario we all want to avoid.

As debts climb, all options — from paying and defaulting to monetizing — become more and more painful. So what is a government to do in order to continue lengthening the debt cycle?

We’re Doing This For Your Own Good

Continuing the borrowing bonanza without an unwinding force by the free market requires governments to employ tools of a more authoritarian or subversive variety. The United States has a long and well-hidden history of these tactics, from seizing the gold of its citizens in the 1930s to partnering with oil-rich despots in the 1970s to issuing jargon-clad explanations for quantitative easing during the Global Financial Crisis of 2008.

Monetary debasement is the powerful government’s tool of choice to forego the inevitable, but sustaining that tool’s power requires preventing free individuals from forcing a return to rationality. As public debt rises, governments will consider new measures to kick the can such as:

- Raising revenue through increased taxation like unrealized capital gains.

- More intense financial surveillance and controls to stabilize the currency’s value.

- Legal workarounds to mint trillion dollar coins to further dilute the currency supply and “monetize” the problem of excessive government spending.

As long as governments like the United States continue to overspend, bailing out every short-term debt cycle, they will simply delay paying the bills and either increase the severity of an eventual unwinding — via payments or default — or trigger a collapse of society through debt monetization. We will all pay for a century of foregone debts through some combination of increased taxation, inflation and loss of freedom.

Waking Up

When will we wake up and see this system for what it is? Unfortunately, most probably never will. They will blame immigrants or billionaires, depending on their political bent, for the ills of our time. They will continue to defend the system, even as the tightness of its controls and severity of its punishments increase.

This knowledge is your power. Now that you see the trajectory of the long-term debt cycle, what steps will you take to bring a better future?

The realizations I’ve written here are the reasons I buy, hold and support Bitcoin — an accessible form of hard money that can support a modern, digital and global economy. Bitcoin is a lifeline extending to a world where debt cycles are kept short and crashes are contained, where governments are robbed of a critical tool for lengthening the end of the debt cycle into a societal collapse. Supporting Bitcoin forces governments to be rational yet again, to balance their budgets and pay down debts, to avoid monetization.

Will you be part of the solution or part of the perpetuation?

This is a guest post by Captain Sidd. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.

bonds government bonds pandemic bitcoin btc currencies gold oilInternational

Red Candle In The Wind

Red Candle In The Wind

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by…

By Benjamin PIcton of Rabobank

February non-farm payrolls superficially exceeded market expectations on Friday by printing at 275,000 against a consensus call of 200,000. We say superficially, because the downward revisions to prior months totalled 167,000 for December and January, taking the total change in employed persons well below the implied forecast, and helping the unemployment rate to pop two-ticks to 3.9%. The U6 underemployment rate also rose from 7.2% to 7.3%, while average hourly earnings growth fell to 0.2% m-o-m and average weekly hours worked languished at 34.3, equalling pre-pandemic lows.

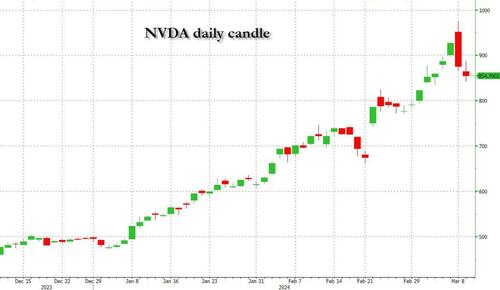

Undeterred by the devil in the detail, the algos sprang into action once exchanges opened. Market darling NVIDIA hit a new intraday high of $974 before (presumably) the humans took over and sold the stock down more than 10% to close at $875.28. If our suspicions are correct that it was the AIs buying before the humans started selling (no doubt triggering trailing stops on the way down), the irony is not lost on us.

The 1-day chart for NVIDIA now makes for interesting viewing, because the red candle posted on Friday presents quite a strong bearish engulfing signal. Volume traded on the day was almost double the 15-day simple moving average, and similar price action is observable on the 1-day charts for both Intel and AMD. Regular readers will be aware that we have expressed incredulity in the past about the durability the AI thematic melt-up, so it will be interesting to see whether Friday’s sell off is just a profit-taking blip, or a genuine trend reversal.

AI equities aside, this week ought to be important for markets because the BTFP program expires today. That means that the Fed will no longer be loaning cash to the banking system in exchange for collateral pledged at-par. The KBW Regional Banking index has so far taken this in its stride and is trading 30% above the lows established during the mini banking crisis of this time last year, but the Fed’s liquidity facility was effectively an exercise in can-kicking that makes regional banks a sector of the market worth paying attention to in the weeks ahead. Even here in Sydney, regulators are warning of external risks posed to the banking sector from scheduled refinancing of commercial real estate loans following sharp falls in valuations.

Markets are sending signals in other sectors, too. Gold closed at a new record-high of $2178/oz on Friday after trading above $2200/oz briefly. Gold has been going ballistic since the Friday before last, posting gains even on days where 2-year Treasury yields have risen. Gold bugs are buying as real yields fall from the October highs and inflation breakevens creep higher. This is particularly interesting as gold ETFs have been recording net outflows; suggesting that price gains aren’t being driven by a retail pile-in. Are gold buyers now betting on a stagflationary outcome where the Fed cuts without inflation being anchored at the 2% target? The price action around the US CPI release tomorrow ought to be illuminating.

Leaving the day-to-day movements to one side, we are also seeing further signs of structural change at the macro level. The UK budget last week included a provision for the creation of a British ISA. That is, an Individual Savings Account that provides tax breaks to savers who invest their money in the stock of British companies. This follows moves last year to encourage pension funds to head up the risk curve by allocating 5% of their capital to unlisted investments.

As a Hail Mary option for a government cruising toward an electoral drubbing it’s a curious choice, but it’s worth highlighting as cash-strapped governments increasingly see private savings pools as a funding solution for their spending priorities.

Of course, the UK is not alone in making creeping moves towards financial repression. In contrast to announcements today of increased trade liberalisation, Australian Treasurer Jim Chalmers has in the recent past flagged his interest in tapping private pension savings to fund state spending priorities, including defence, public housing and renewable energy projects. Both the UK and Australia appear intent on finding ways to open up the lungs of their economies, but government wants more say in directing private capital flows for state goals.

So, how far is the blurring of the lines between free markets and state planning likely to go? Given the immense and varied budgetary (and security) pressures that governments are facing, could we see a re-up of WWII-era Victory bonds, where private investors are encouraged to do their patriotic duty by directly financing government at negative real rates?

That would really light a fire under the gold market.

Spread & Containment

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Fauci Deputy Warned Him Against Vaccine Mandates: Email

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Mandating COVID-19 vaccination was a mistake due to ethical and other concerns, a top government doctor warned Dr. Anthony Fauci after Dr. Fauci promoted mass vaccination.

“Coercing or forcing people to take a vaccine can have negative consequences from a biological, sociological, psychological, economical, and ethical standpoint and is not worth the cost even if the vaccine is 100% safe,” Dr. Matthew Memoli, director of the Laboratory of Infectious Diseases clinical studies unit at the U.S. National Institute of Allergy and Infectious Diseases (NIAID), told Dr. Fauci in an email.

“A more prudent approach that considers these issues would be to focus our efforts on those at high risk of severe disease and death, such as the elderly and obese, and do not push vaccination on the young and healthy any further.”

Employing that strategy would help prevent loss of public trust and political capital, Dr. Memoli said.

The email was sent on July 30, 2021, after Dr. Fauci, director of the NIAID, claimed that communities would be safer if more people received one of the COVID-19 vaccines and that mass vaccination would lead to the end of the COVID-19 pandemic.

“We’re on a really good track now to really crush this outbreak, and the more people we get vaccinated, the more assuredness that we’re going to have that we’re going to be able to do that,” Dr. Fauci said on CNN the month prior.

Dr. Memoli, who has studied influenza vaccination for years, disagreed, telling Dr. Fauci that research in the field has indicated yearly shots sometimes drive the evolution of influenza.

Vaccinating people who have not been infected with COVID-19, he said, could potentially impact the evolution of the virus that causes COVID-19 in unexpected ways.

“At best what we are doing with mandated mass vaccination does nothing and the variants emerge evading immunity anyway as they would have without the vaccine,” Dr. Memoli wrote. “At worst it drives evolution of the virus in a way that is different from nature and possibly detrimental, prolonging the pandemic or causing more morbidity and mortality than it should.”

The vaccination strategy was flawed because it relied on a single antigen, introducing immunity that only lasted for a certain period of time, Dr. Memoli said. When the immunity weakened, the virus was given an opportunity to evolve.

Some other experts, including virologist Geert Vanden Bossche, have offered similar views. Others in the scientific community, such as U.S. Centers for Disease Control and Prevention scientists, say vaccination prevents virus evolution, though the agency has acknowledged it doesn’t have records supporting its position.

Other Messages

Dr. Memoli sent the email to Dr. Fauci and two other top NIAID officials, Drs. Hugh Auchincloss and Clifford Lane. The message was first reported by the Wall Street Journal, though the publication did not publish the message. The Epoch Times obtained the email and 199 other pages of Dr. Memoli’s emails through a Freedom of Information Act request. There were no indications that Dr. Fauci ever responded to Dr. Memoli.

Later in 2021, the NIAID’s parent agency, the U.S. National Institutes of Health (NIH), and all other federal government agencies began requiring COVID-19 vaccination, under direction from President Joe Biden.

In other messages, Dr. Memoli said the mandates were unethical and that he was hopeful legal cases brought against the mandates would ultimately let people “make their own healthcare decisions.”

“I am certainly doing everything in my power to influence that,” he wrote on Nov. 2, 2021, to an unknown recipient. Dr. Memoli also disclosed that both he and his wife had applied for exemptions from the mandates imposed by the NIH and his wife’s employer. While her request had been granted, his had not as of yet, Dr. Memoli said. It’s not clear if it ever was.

According to Dr. Memoli, officials had not gone over the bioethics of the mandates. He wrote to the NIH’s Department of Bioethics, pointing out that the protection from the vaccines waned over time, that the shots can cause serious health issues such as myocarditis, or heart inflammation, and that vaccinated people were just as likely to spread COVID-19 as unvaccinated people.

He cited multiple studies in his emails, including one that found a resurgence of COVID-19 cases in a California health care system despite a high rate of vaccination and another that showed transmission rates were similar among the vaccinated and unvaccinated.

Dr. Memoli said he was “particularly interested in the bioethics of a mandate when the vaccine doesn’t have the ability to stop spread of the disease, which is the purpose of the mandate.”

The message led to Dr. Memoli speaking during an NIH event in December 2021, several weeks after he went public with his concerns about mandating vaccines.

“Vaccine mandates should be rare and considered only with a strong justification,” Dr. Memoli said in the debate. He suggested that the justification was not there for COVID-19 vaccines, given their fleeting effectiveness.

Julie Ledgerwood, another NIAID official who also spoke at the event, said that the vaccines were highly effective and that the side effects that had been detected were not significant. She did acknowledge that vaccinated people needed boosters after a period of time.

The NIH, and many other government agencies, removed their mandates in 2023 with the end of the COVID-19 public health emergency.

A request for comment from Dr. Fauci was not returned. Dr. Memoli told The Epoch Times in an email he was “happy to answer any questions you have” but that he needed clearance from the NIAID’s media office. That office then refused to give clearance.

Dr. Jay Bhattacharya, a professor of health policy at Stanford University, said that Dr. Memoli showed bravery when he warned Dr. Fauci against mandates.

“Those mandates have done more to demolish public trust in public health than any single action by public health officials in my professional career, including diminishing public trust in all vaccines.” Dr. Bhattacharya, a frequent critic of the U.S. response to COVID-19, told The Epoch Times via email. “It was risky for Dr. Memoli to speak publicly since he works at the NIH, and the culture of the NIH punishes those who cross powerful scientific bureaucrats like Dr. Fauci or his former boss, Dr. Francis Collins.”

Government

Trump “Clearly Hasn’t Learned From His COVID-Era Mistakes”, RFK Jr. Says

Trump "Clearly Hasn’t Learned From His COVID-Era Mistakes", RFK Jr. Says

Authored by Jeff Louderback via The Epoch Times (emphasis ours),

President…

Authored by Jeff Louderback via The Epoch Times (emphasis ours),

President Joe Biden claimed that COVID vaccines are now helping cancer patients during his State of the Union address on March 7, but it was a response on Truth Social from former President Donald Trump that drew the ire of independent presidential candidate Robert F. Kennedy Jr.

During the address, President Biden said: “The pandemic no longer controls our lives. The vaccines that saved us from COVID are now being used to help beat cancer, turning setback into comeback. That’s what America does.”

President Trump wrote: “The Pandemic no longer controls our lives. The VACCINES that saved us from COVID are now being used to help beat cancer—turning setback into comeback. YOU’RE WELCOME JOE. NINE-MONTH APPROVAL TIME VS. 12 YEARS THAT IT WOULD HAVE TAKEN YOU.”

An outspoken critic of President Trump’s COVID response, and the Operation Warp Speed program that escalated the availability of COVID vaccines, Mr. Kennedy said on X, formerly known as Twitter, that “Donald Trump clearly hasn’t learned from his COVID-era mistakes.”

“He fails to recognize how ineffective his warp speed vaccine is as the ninth shot is being recommended to seniors. Even more troubling is the documented harm being caused by the shot to so many innocent children and adults who are suffering myocarditis, pericarditis, and brain inflammation,” Mr. Kennedy remarked.

“This has been confirmed by a CDC-funded study of 99 million people. Instead of bragging about its speedy approval, we should be honestly and transparently debating the abundant evidence that this vaccine may have caused more harm than good.

“I look forward to debating both Trump and Biden on Sept. 16 in San Marcos, Texas.”

Mr. Kennedy announced in April 2023 that he would challenge President Biden for the 2024 Democratic Party presidential nomination before declaring his run as an independent last October, claiming that the Democrat National Committee was “rigging the primary.”

Since the early stages of his campaign, Mr. Kennedy has generated more support than pundits expected from conservatives, moderates, and independents resulting in speculation that he could take votes away from President Trump.

Many Republicans continue to seek a reckoning over the government-imposed pandemic lockdowns and vaccine mandates.

President Trump’s defense of Operation Warp Speed, the program he rolled out in May 2020 to spur the development and distribution of COVID-19 vaccines amid the pandemic, remains a sticking point for some of his supporters.

Operation Warp Speed featured a partnership between the government, the military, and the private sector, with the government paying for millions of vaccine doses to be produced.

President Trump released a statement in March 2021 saying: “I hope everyone remembers when they’re getting the COVID-19 Vaccine, that if I wasn’t President, you wouldn’t be getting that beautiful ‘shot’ for 5 years, at best, and probably wouldn’t be getting it at all. I hope everyone remembers!”

President Trump said about the COVID-19 vaccine in an interview on Fox News in March 2021: “It works incredibly well. Ninety-five percent, maybe even more than that. I would recommend it, and I would recommend it to a lot of people that don’t want to get it and a lot of those people voted for me, frankly.

“But again, we have our freedoms and we have to live by that and I agree with that also. But it’s a great vaccine, it’s a safe vaccine, and it’s something that works.”

On many occasions, President Trump has said that he is not in favor of vaccine mandates.

An environmental attorney, Mr. Kennedy founded Children’s Health Defense, a nonprofit that aims to end childhood health epidemics by promoting vaccine safeguards, among other initiatives.

Last year, Mr. Kennedy told podcaster Joe Rogan that ivermectin was suppressed by the FDA so that the COVID-19 vaccines could be granted emergency use authorization.

He has criticized Big Pharma, vaccine safety, and government mandates for years.

Since launching his presidential campaign, Mr. Kennedy has made his stances on the COVID-19 vaccines, and vaccines in general, a frequent talking point.

“I would argue that the science is very clear right now that they [vaccines] caused a lot more problems than they averted,” Mr. Kennedy said on Piers Morgan Uncensored last April.

“And if you look at the countries that did not vaccinate, they had the lowest death rates, they had the lowest COVID and infection rates.”

Additional data show a “direct correlation” between excess deaths and high vaccination rates in developed countries, he said.

President Trump and Mr. Kennedy have similar views on topics like protecting the U.S.-Mexico border and ending the Russia-Ukraine war.

COVID-19 is the topic where Mr. Kennedy and President Trump seem to differ the most.

Former President Donald Trump intended to “drain the swamp” when he took office in 2017, but he was “intimidated by bureaucrats” at federal agencies and did not accomplish that objective, Mr. Kennedy said on Feb. 5.

Speaking at a voter rally in Tucson, where he collected signatures to get on the Arizona ballot, the independent presidential candidate said President Trump was “earnest” when he vowed to “drain the swamp,” but it was “business as usual” during his term.

John Bolton, who President Trump appointed as a national security adviser, is “the template for a swamp creature,” Mr. Kennedy said.

Scott Gottlieb, who President Trump named to run the FDA, “was Pfizer’s business partner” and eventually returned to Pfizer, Mr. Kennedy said.

Mr. Kennedy said that President Trump had more lobbyists running federal agencies than any president in U.S. history.

“You can’t reform them when you’ve got the swamp creatures running them, and I’m not going to do that. I’m going to do something different,” Mr. Kennedy said.

During the COVID-19 pandemic, President Trump “did not ask the questions that he should have,” he believes.

President Trump “knew that lockdowns were wrong” and then “agreed to lockdowns,” Mr. Kennedy said.

He also “knew that hydroxychloroquine worked, he said it,” Mr. Kennedy explained, adding that he was eventually “rolled over” by Dr. Anthony Fauci and his advisers.

MaryJo Perry, a longtime advocate for vaccine choice and a Trump supporter, thinks votes will be at a premium come Election Day, particularly because the independent and third-party field is becoming more competitive.

Ms. Perry, president of Mississippi Parents for Vaccine Rights, believes advocates for medical freedom could determine who is ultimately president.

She believes that Mr. Kennedy is “pulling votes from Trump” because of the former president’s stance on the vaccines.

“People care about medical freedom. It’s an important issue here in Mississippi, and across the country,” Ms. Perry told The Epoch Times.

“Trump should admit he was wrong about Operation Warp Speed and that COVID vaccines have been dangerous. That would make a difference among people he has offended.”

President Trump won’t lose enough votes to Mr. Kennedy about Operation Warp Speed and COVID vaccines to have a significant impact on the election, Ohio Republican strategist Wes Farno told The Epoch Times.

President Trump won in Ohio by eight percentage points in both 2016 and 2020. The Ohio Republican Party endorsed President Trump for the nomination in 2024.

“The positives of a Trump presidency far outweigh the negatives,” Mr. Farno said. “People are more concerned about their wallet and the economy.

“They are asking themselves if they were better off during President Trump’s term compared to since President Biden took office. The answer to that question is obvious because many Americans are struggling to afford groceries, gas, mortgages, and rent payments.

“America needs President Trump.”

Multiple national polls back Mr. Farno’s view.

As of March 6, the RealClearPolitics average of polls indicates that President Trump has 41.8 percent support in a five-way race that includes President Biden (38.4 percent), Mr. Kennedy (12.7 percent), independent Cornel West (2.6 percent), and Green Party nominee Jill Stein (1.7 percent).

A Pew Research Center study conducted among 10,133 U.S. adults from Feb. 7 to Feb. 11 showed that Democrats and Democrat-leaning independents (42 percent) are more likely than Republicans and GOP-leaning independents (15 percent) to say they have received an updated COVID vaccine.

The poll also reported that just 28 percent of adults say they have received the updated COVID inoculation.

The peer-reviewed multinational study of more than 99 million vaccinated people that Mr. Kennedy referenced in his X post on March 7 was published in the Vaccine journal on Feb. 12.

It aimed to evaluate the risk of 13 adverse events of special interest (AESI) following COVID-19 vaccination. The AESIs spanned three categories—neurological, hematologic (blood), and cardiovascular.

The study reviewed data collected from more than 99 million vaccinated people from eight nations—Argentina, Australia, Canada, Denmark, Finland, France, New Zealand, and Scotland—looking at risks up to 42 days after getting the shots.

Three vaccines—Pfizer and Moderna’s mRNA vaccines as well as AstraZeneca’s viral vector jab—were examined in the study.

Researchers found higher-than-expected cases that they deemed met the threshold to be potential safety signals for multiple AESIs, including for Guillain-Barre syndrome (GBS), cerebral venous sinus thrombosis (CVST), myocarditis, and pericarditis.

A safety signal refers to information that could suggest a potential risk or harm that may be associated with a medical product.

The study identified higher incidences of neurological, cardiovascular, and blood disorder complications than what the researchers expected.

President Trump’s role in Operation Warp Speed, and his continued praise of the COVID vaccine, remains a concern for some voters, including those who still support him.

Krista Cobb is a 40-year-old mother in western Ohio. She voted for President Trump in 2020 and said she would cast her vote for him this November, but she was stunned when she saw his response to President Biden about the COVID-19 vaccine during the State of the Union address.

“I love President Trump and support his policies, but at this point, he has to know they [advisers and health officials] lied about the shot,” Ms. Cobb told The Epoch Times.

“If he continues to promote it, especially after all of the hearings they’ve had about it in Congress, the side effects, and cover-ups on Capitol Hill, at what point does he become the same as the people who have lied?” Ms. Cobb added.

“I think he should distance himself from talk about Operation Warp Speed and even admit that he was wrong—that the vaccines have not had the impact he was told they would have. If he did that, people would respect him even more.”

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges