Fear Of Missing Out? Wall Street & Retail Hang On.

The "Fear Of Missing Out," or "F.O.M.O." is a centuries-old behavioral trait that began to get studied in 1996 by marketing strategist Dr. Dan Herman….

The “Fear Of Missing Out,” or “F.O.M.O.” is a centuries-old behavioral trait that began to get studied in 1996 by marketing strategist Dr. Dan Herman.

“Fear of missing out (FOMO) is the feeling of apprehension that one is either not in the know or missing out on information, events, experiences, or life decisions that could make one’s life better. The fear of missing out is also associated with a fear of regret. Such may lead to concerns that one might miss an opportunity. Whether for social interaction, a novel experience, a memorable event, or a profitable investment.” – Wikipedia

Over the last couple of years, the “fear of missing out” went mainstream. Young retail investors armed with a “stimmy check,” the Robinhood app, and membership to WallStreetBets piled into the financial markets. The lure of easy money and lavish lifestyles was too hard to pass up.

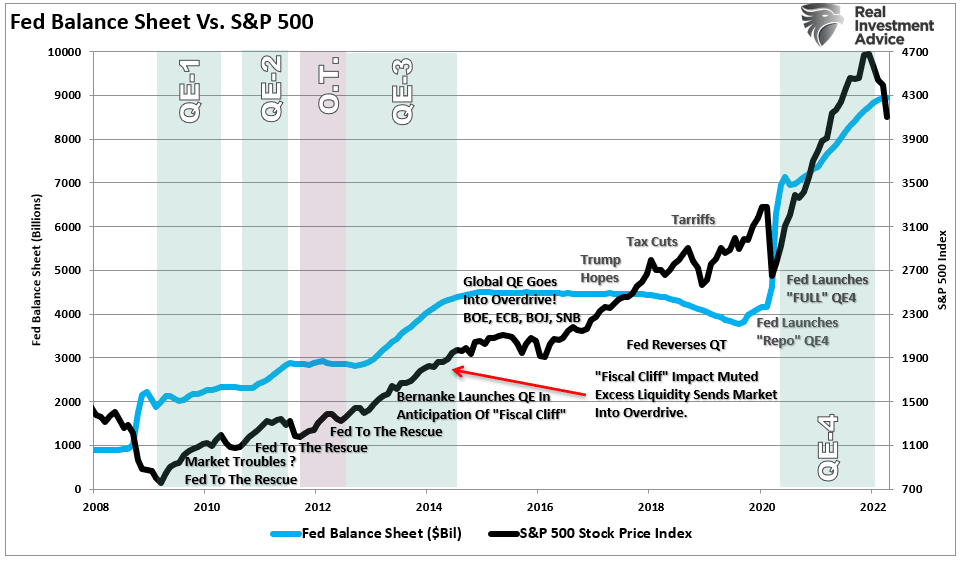

However, recent events are the point where F.O.M.O. became most visible. In reality, the “fear of missing out” has been with us for over a decade. As shown, repeated rounds of monetary interventions created a sense of moral hazard in the financial markets.

What exactly is the definition of “moral hazard.”

Noun – The lack of incentive to guard against risk where one is protected from its consequences, e.g., by insurance.

The massive Federal Reserve interventions provided a perverse incentive to take on extreme forms of risk. From speculative I.P.O.s, S.P.A.C.s, or Cryptocurrencies, investors believed the Fed was protecting them from the consequences of risk. In other words, the Fed effectively “insured them” against potential losses.

The lesson taught to investors was that the Fed would bail out any market decline. Therefore, the “fear of missing out” overrides the “need to get out.”

Such is the case we see currently in the markets.

I’m Terrified, But I’m Not Selling

Not surprisingly, investors are terrified with the market down nearly 20% so far this year. As shown by our composite index of both retail and institutional investors, fear is rampant. The net bullish sentiment is currently at the lowest level since the depths of the financial crisis.

This extreme bearishness would suggest investors are reducing their exposure to equity risk. However, the reality is quite different. As shown below, the A.A.I.I. investor allocation to stocks, bonds, and cash tells the story. Despite A.A.I.I. sentiment at very bearish levels, the allocation to equities remains very high while bonds and cash remain low.

Interestingly, seemingly terrified investors are still unwilling to sell for the “fear of missing out.“ It is worth noting that during previous bear markets, equity allocations fell as investors fled to cash. Such has not been the case in 2022.

Investors seem more afraid of missing the bottom should the Federal Reserve suddenly reverse course on monetary policy. Much like Pavlov’s dogs, after years of being trained to “buy the dip,” investors are awaiting the Fed to “ring the bell.“

However, if a recession is approaching, the question will be how deep of a price declination investors can emotionally withstand.

The Coming Correction Of “E”

As discussed many times, valuations are the most critical determinant of investment returns over long-term periods. As shown below, valuations, as measured by P/E ratios (price divided by earnings), highly correlate to future returns.

While the price (P) of the valuation calculation has fallen in 2022, forward earnings estimates (E) have not. In fact, as shown below, earnings estimates through the end of 2023 increased during the month of June and remain well above the long-term exponential earnings trend.

Currently, as shown below, Wall Street continues to expect earnings to grow through the end of 2024 despite the growing risk of a recession.

However, while estimates, and forward expectations of rising equity prices, history clearly shows that earnings do not survive recessions. Such is because earnings come from economic activity, and therefore recessions result in earnings reversions. Given that earnings expectations are at the top of the long-term growth channel, a reversion below the trendline should be no surprise.

During the previous four recessions and subsequent bear markets, the typical revision to consensus EPS estimates before the onset of a recession ranged from -6% to -18%, with a median of 10%. Coming out of recession, analysts start to increase estimates markedly. Such makes for a great indicator of when to be a buyer of equities.

Notably, while forward P/E ratios have declined, much of that is due to the decline in the “P” and not the “E.” Therefore, if the data suggests that an earnings recession is coming, then the current “bear market” cycle still has more work to do.

The realignment of market prices and valuations is always a brutal process.

This Time Is Likely Not Different

As noted recently by Nick Colas, there are downside risks to equities if the “E” gets reduced.

“The second-order guess might be 3,386 if we assume investors will think other market participants will key off either pre-pandemic highs and/or discount a modest earnings recession.

- Such was the last S&P 500 high before the Pandemic Recession (February 19th, 2020).

- It is also 18x S&P earnings of $188/share, roughly 15% below current earnings of $220/share.

- While earnings typically decline 25% in a recession, perhaps any upcoming economic downturn will be milder than most.

The third-order guess is around 3,000 if investors believe markets must discount a full-blown recession before there is enough general interest in stocks to make for a durable low.

- Assume an average decline of 25% to S&P earnings from a recession, and you get $165/share.

- Put an 18x multiple on that $166/share, and you get an S&P of 2,970.“

There is currently a large contingent of investors who have never seen an actual “bear market.” As noted above, their entire investing experience consists of continual interventions by the Federal Reserve. Therefore, it is not surprising that despite the recent price decline, they aren’t selling out of the market. Wall Street also suffers from the same “fear of missing out.” as they hope the Fed can engineer a soft-landing.

Unfortunately, the risk of disappointment is high as history suggests the Fed will cause a “hard landing” in the economy. If we use history as a guide, a more severe reversion in earnings is logical.

This time is not likely different.

The most significant risk to investors is when the “fear of missing out” changes to the “fear of being in.”

The post Fear Of Missing Out? Wall Street & Retail Hang On. appeared first on RIA.

recession pandemic bonds sp 500 equities stocks monetary policy fed federal reserve recessionGovernment

Problems After COVID-19 Vaccination More Prevalent Among Naturally Immune: Study

Problems After COVID-19 Vaccination More Prevalent Among Naturally Immune: Study

Authored by Zachary Stieber via The Epoch Times (emphasis…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

People who recovered from COVID-19 and received a COVID-19 shot were more likely to suffer adverse reactions, researchers in Europe are reporting.

Participants in the study were more likely to experience an adverse reaction after vaccination regardless of the type of shot, with one exception, the researchers found.

Across all vaccine brands, people with prior COVID-19 were 2.6 times as likely after dose one to suffer an adverse reaction, according to the new study. Such people are commonly known as having a type of protection known as natural immunity after recovery.

People with previous COVID-19 were also 1.25 times as likely after dose 2 to experience an adverse reaction.

The findings held true across all vaccine types following dose one.

Of the female participants who received the Pfizer-BioNTech vaccine, for instance, 82 percent who had COVID-19 previously experienced an adverse reaction after their first dose, compared to 59 percent of females who did not have prior COVID-19.

The only exception to the trend was among males who received a second AstraZeneca dose. The percentage of males who suffered an adverse reaction was higher, 33 percent to 24 percent, among those without a COVID-19 history.

“Participants who had a prior SARS-CoV-2 infection (confirmed with a positive test) experienced at least one adverse reaction more often after the 1st dose compared to participants who did not have prior COVID-19. This pattern was observed in both men and women and across vaccine brands,” Florence van Hunsel, an epidemiologist with the Netherlands Pharmacovigilance Centre Lareb, and her co-authors wrote.

There were only slightly higher odds of the naturally immune suffering an adverse reaction following receipt of a Pfizer or Moderna booster, the researchers also found.

The researchers performed what’s known as a cohort event monitoring study, following 29,387 participants as they received at least one dose of a COVID-19 vaccine. The participants live in a European country such as Belgium, France, or Slovakia.

Overall, three-quarters of the participants reported at least one adverse reaction, although some were minor such as injection site pain.

Adverse reactions described as serious were reported by 0.24 percent of people who received a first or second dose and 0.26 percent for people who received a booster. Different examples of serious reactions were not listed in the study.

Participants were only specifically asked to record a range of minor adverse reactions (ADRs). They could provide details of other reactions in free text form.

“The unsolicited events were manually assessed and coded, and the seriousness was classified based on international criteria,” researchers said.

The free text answers were not provided by researchers in the paper.

“The authors note, ‘In this manuscript, the focus was not on serious ADRs and adverse events of special interest.’” Yet, in their highlights section they state, “The percentage of serious ADRs in the study is low for 1st and 2nd vaccination and booster.”

Dr. Joel Wallskog, co-chair of the group React19, which advocates for people who were injured by vaccines, told The Epoch Times: “It is intellectually dishonest to set out to study minor adverse events after COVID-19 vaccination then make conclusions about the frequency of serious adverse events. They also fail to provide the free text data.” He added that the paper showed “yet another study that is in my opinion, deficient by design.”

Ms. Hunsel did not respond to a request for comment.

She and other researchers listed limitations in the paper, including how they did not provide data broken down by country.

The paper was published by the journal Vaccine on March 6.

The study was funded by the European Medicines Agency and the Dutch government.

No authors declared conflicts of interest.

Some previous papers have also found that people with prior COVID-19 infection had more adverse events following COVID-19 vaccination, including a 2021 paper from French researchers. A U.S. study identified prior COVID-19 as a predictor of the severity of side effects.

Some other studies have determined COVID-19 vaccines confer little or no benefit to people with a history of infection, including those who had received a primary series.

The U.S. Centers for Disease Control and Prevention still recommends people who recovered from COVID-19 receive a COVID-19 vaccine, although a number of other health authorities have stopped recommending the shot for people who have prior COVID-19.

Another New Study

In another new paper, South Korean researchers outlined how they found people were more likely to report certain adverse reactions after COVID-19 vaccination than after receipt of another vaccine.

The reporting of myocarditis, a form of heart inflammation, or pericarditis, a related condition, was nearly 20 times as high among children as the reporting odds following receipt of all other vaccines, the researchers found.

The reporting odds were also much higher for multisystem inflammatory syndrome or Kawasaki disease among adolescent COVID-19 recipients.

Researchers analyzed reports made to VigiBase, which is run by the World Health Organization.

“Based on our results, close monitoring for these rare but serious inflammatory reactions after COVID-19 vaccination among adolescents until definitive causal relationship can be established,” the researchers wrote.

The study was published by the Journal of Korean Medical Science in its March edition.

Limitations include VigiBase receiving reports of problems, with some reports going unconfirmed.

Funding came from the South Korean government. One author reported receiving grants from pharmaceutical companies, including Pfizer.

Uncategorized

Key shipping company files for Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Key shipping company files Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocks-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A