Earnings to bring normality

It’s been a rollercoaster start to the year and as we head into earnings season, it’s hard to say exactly where investors stand. Blocking out the January noise is one thing but it’s made far more complicated by omicron, inflation, and the rapid…

It’s been a rollercoaster start to the year and as we head into earnings season, it’s hard to say exactly where investors stand.

Blocking out the January noise is one thing but it’s made far more complicated by omicron, inflation, and the rapid evolution of monetary policy. Yesterday’s reaction to the inflation data was a case in point. The data mostly exceeded expectations, albeit marginally, while headline inflation was a near 40-year high of 7%. And yet the response was broadly positive.

I get that traders were perhaps fearing the worst and, as I’ve referenced before, it does feel like markets are at peak fear on US monetary policy which could make relief rallies more likely. But there is also underlying anxiety in the markets that could make for some volatile price action for the foreseeable future.

Perhaps earnings season will bring some welcome normality to the markets after a period of fear, relief, and speculation. The fourth quarter is expected to have been another strong quarter, although the emergence of omicron will likely have had an impact during the critical holiday period for many companies. Of course, as we’ve seen throughout the pandemic, that will likely have been to the benefit of others.

And while earnings season will provide a distraction, it is happening against an uncertain backdrop for interest rates and inflation which will keep investors on their toes. It does seem that investors are on the edge of what they will tolerate and it won’t take much to push them over the edge. Which will be fine if we are near the peak of inflation, as many expect.

The data today looks a mixed bag on the face of it, with jobless claims coming in a little higher than expected, which may be down to seasonal adjustments. The overall trend remains positive and continues to point to a tight labor market. The PPI data on the other hand will be welcomed, with the headline number slipping to 0.2% month on month. Perhaps a sign of supply-side pressures finally starting to abate which will come as a relief after inflation hit a near-40 year high last month.

Sterling solid as pressure mounts on Boris

It seems impossible to ignore the political soap opera currently taking place in the UK, with Prime Minister Boris Johnson once again in the public firing line after finally admitting to attending an office party in May 2020.

In other circumstances, uncertainty around the top job in the country could bring pressure in the markets but the pound is performing very well. Perhaps that’s a reflection of the controversy that forever surrounds Boris, and we’re all therefore numb to it, or a sign of the environment we’re in that the PM being a resignation risk is further down the list when compared with inflation, interest rates, omicron, energy prices etc.

Can bitcoin break key resistance?

Bitcoin is enjoying some relief along with other risk assets and has recaptured USD 44,000, only a few days after briefly dipping below USD 40,000. That swift 10% rebound is nothing by bitcoin standards and if it can break USD 45,500, we could see another sharp move higher as belief starts to grow that the worst of the rout is behind it. It looks like a fragile rebound at the moment but a break of that resistance could change that.

For a look at all of today’s economic events, check out our economic calendar: www.marketpulse.com/economic-events/

bitcoin pandemic poundUncategorized

Key healthcare firm files Chapter 11 bankruptcy after defaulting

50-year-old nursing home operator files Chapter 11 bankruptcy after defaulting on over $50 million in loans.

Operators of nursing homes and senior living facilities were severely impacted during the Covid-19 pandemic in 2020 as about 40% of residents had or likely had Covid-19 that year and over 1,300 nursing homes had infection rates of 75% or higher during surge periods, the U.S. Department of Health and Human Services Office of the Inspector General reported.

The high infection rates led to severe staffing challenges, including significant loss of staff and substantial difficulties in hiring, training and retraining new staff, according to a February 2024 report. Those staffing challenges, however, continue today, as rising inflation makes it more expensive to compensate these essential workers.

Related: Another discount retailer makes checkout change to fight theft

In addition to staffing challenges, operators have also faced a number of economic issues that have driven some of these companies to file for bankruptcy or, in some cases, shut down facilities. Rising inflation, which affects products, supplies and employee wages, and higher interest rates over the past couple years have severely impacted operators' budgets. On top of those economic issues, operators are battling inadequate Medicare, Medicaid and insurance reimbursements that can lead to capital shortfalls.

Senior care facility bankruptcies rise

Financial hardship has led dozens of operators of senior facilities to file for bankruptcy over the past three years, with 13 companies filing petitions in 2021, 12 debtors filing in 2022 and 15 more in 2023, according to advisory firm Gibbins Advisors.

Notable Chapter 11 filings over the past year have included Evangelical Retirement Homes of Greater Chicago, which filed Chapter 11 in the U.S. Bankruptcy Court for the Northern District of Illinois in June 2023 to sell its assets at auction. Also, Windsor Terrace Health, an operator of 32 nursing homes in California and three in Arizona, filed its petition in the U.S. Bankruptcy Court for the Central District of California in August 2023 listing $1 million to $10 million in assets and liabilities and unable to pay its debts.

More recently, Magnolia Senior Living, an operator of four facilities in Georgia, filed for Chapter 11 protection on March. 19 in the U.S. Bankruptcy Court for the Northern District of Georgia.

Shutterstock

Loan defaults, ransomware attack force Petersen into bankruptcy

Finally, Petersen Health Care, operator of about 100 nursing homes, assisted-living and long-term care facilities in Illinois, Iowa and Missouri, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the District of Delaware on March 20, suffering financial distress from increased overhead, low reimbursements and a ransomware attack in October 2023 that interrupted the company's efforts to bill patients and insurance companies.

The company's financial problems worsened as it defaulted on payments on over $50 million in loans that led to 19 of the company's facilities to be placed into receivership.

Petersen asserted in a March 21 statement that it will continue to operate its business as normal, as it is seeking court approval of a $45 million debtor-in-possession financing commitment from lenders to fund post-petition operating expenses and working capital.

“Petersen will operate as usual, and our team remains committed to continuing to provide first-rate care for our residents,” CEO David Campbell said in a statement. “We will emerge from restructuring as a stronger company with a more flexible capital structure. This will enable us to continue as a first-choice care provider and a reliable employer for our staff.”

The Peoria, Ill.,-based company, which was founded in 1974, operates skilled-nursing facilities, assisted/independent living communities, memory care services and homes for the developmentally disabled.

bankruptcy bankruptcies pandemic covid-19 interest ratesUncategorized

Major healthcare facilities operator files Chapter 11 bankruptcy

50-year-old nursing home operator files Chapter 11 bankruptcy after defaulting on over $50 million in loans.

Operators of nursing homes and senior living facilities were severely impacted during the Covid-19 pandemic in 2020 as about 40% of residents had or likely had Covid-19 that year and over 1,300 nursing homes had infection rates of 75% or higher during surge periods, the U.S. Department of Health and Human Services Office of the Inspector General reported.

The high infection rates led to severe staffing challenges, including significant loss of staff and substantial difficulties in hiring, training and retraining new staff, according to a February 2024 report. Those staffing challenges, however, continue today, as rising inflation makes it more expensive to compensate these essential workers.

Related: Another discount retailer makes checkout change to fight theft

In addition to staffing challenges, operators have also faced a number of economic issues that have driven some of these companies to file for bankruptcy or, in some cases, shut down facilities. Rising inflation, which affects products, supplies and employee wages, and higher interest rates over the past couple years have severely impacted operators' budgets. On top of those economic issues, operators are battling inadequate Medicare, Medicaid and insurance reimbursements that can lead to capital shortfalls.

Senior care facility bankruptcies rise

Financial hardship has led dozens of operators of senior facilities to file for bankruptcy over the past three years, with 13 companies filing petitions in 2021, 12 debtors filing in 2022 and 15 more in 2023, according to Gibbins Advisors.

Notable Chapter 11 filings over the past year have included Evangelical Retirement Homes of Greater Chicago, which filed Chapter 11 in the U.S. Bankruptcy Court for the Northern District of Illinois in June 2023 to sell its assets at auction. Also, Windsor Terrace Health, an operator of 32 nursing homes in California and three in Arizona, filed its petition in the U.S. Bankruptcy Court for the Central District of California in August 2023 listing $1 million to $10 million in assets and liabilities and unable to pay its debts.

More recently, Magnolia Senior Living, an operator of four facilities in Georgia, filed for Chapter 11 protection on March. 19 in the U.S. Bankruptcy Court for the Northern District of Georgia.

Shutterstock

Loan defaults, ransomware attack force Petersen into bankruptcy

Finally, Petersen Health Care, operator of about 100 nursing homes, assisted-living and long-term care facilities in Illinois, Iowa and Missouri, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the District of Delaware on March 20, suffering financial distress from increased overhead, low reimbursements and a ransomware attack in October 2023 that interrupted the company's efforts to bill patients and insurance companies.

The company's financial problems worsened as it defaulted in on payments on over $50 million in loans that led to 19 of the company's facilities to be placed into receivership.

Petersen asserted in a March 21 statement that it will continue to operate its business as normal, as it is seeking court approval of a $45 million debtor-in-possession financing commitment from lenders to fund post-petition operating expenses and working capital.

“Petersen will operate as usual, and our team remains committed to continuing to provide first-rate care for our residents,” CEO David Campbell said in a statement. “We will emerge from restructuring as a stronger company with a more flexible capital structure. This will enable us to continue as a first-choice care provider and a reliable employer for our staff.”

The Peoria, Ill.,-based company, which was founded in 1974, operates skilled-nursing facilities, assisted/independent living communities, memory care services and homes for the developmentally disabled.

bankruptcy bankruptcies pandemic covid-19 interest ratesInternational

The Realpolitik Grand Divergence

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively…

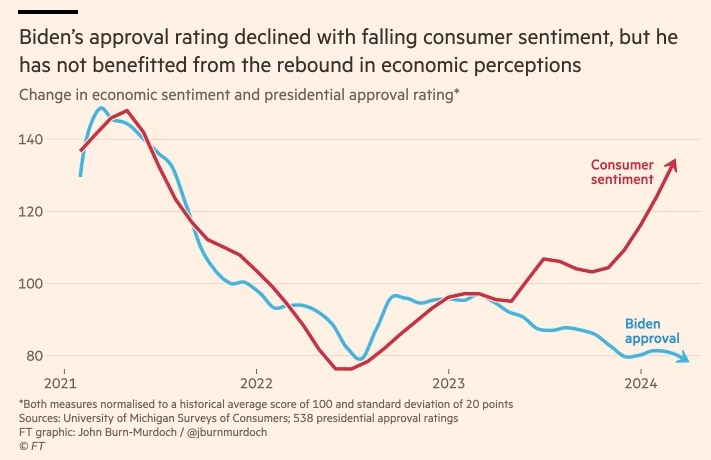

The diverging relationship between economic performance and political success in the U.S. highlights a shift from the past, where a strong economy positively impacted incumbent approval ratings. President Biden’s approval ratings remain unaffected despite recent economic improvements, suggesting a decoupling of economic sentiment and political fortunes. This phenomenon, which contrasts with stable economic-political linkages in Europe, is attributed to the U.S.’s heightened partisan divide, where political allegiance increasingly dictates economic perception, challenging the traditional belief that “It’s the economy, stupid” in American politics.

Key Points:

- President Clinton’s political advisor, James Carville, highlighted the economy’s role in political success during 1992 presidential campaign with assertion, “It’s the economy, stupid.”

- Voter sentiment has traditionally linked to economic performance, affecting incumbent party success.

- Recent trends show a disconnect between the U.S. economy’s health and President Biden’s approval ratings.

- The COVID-19 pandemic and inflation crisis may have influenced this anomaly, yet the shift predates these events.

- Research indicates a decoupling of economic sentiment and presidential approval in the U.S. since Obama’s tenure.

- This phenomenon seems unique to the U.S., with European governments’ popularity still tied to economic conditions.

- U.S. political polarization may explain the decoupling, with partisan views influencing economic perceptions.

- Studies suggest that political biases skew individual economic assessments (confirmation bias) impacting presidential approval.

- The current U.S. political climate suggests economic policy impact on electoral decisions is diminishing.

- Contrasts with Europe, where economic sentiment is more uniform across political lines, suggesting a more rational political-economic relationship.

Source: Financial Times

european europe pandemic covid-19-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoGOP Efforts To Shore Up Election Security In Swing States Face Challenges

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoKey Events This Week: All Eyes On Core PCE Amid Deluge Of Fed Speakers

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoA Blue State Exodus: Who Can Afford To Be A Liberal